Economic growth in India is estimated to slow down as rural and urban consumption demand moderates, according to Nomura.

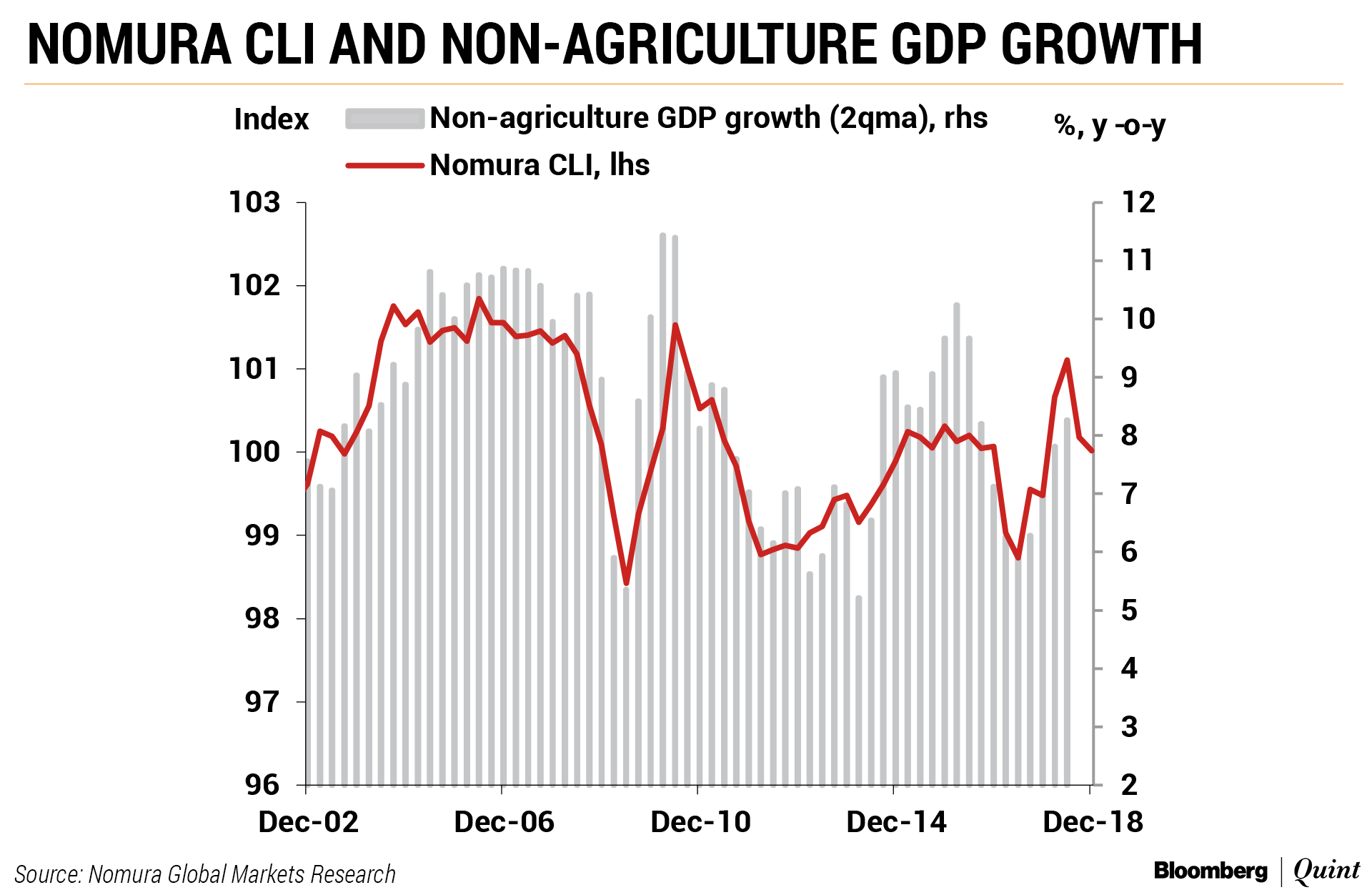

The brokerage's Composite Leading Index, which maps high frequency data, is estimated to come in at 100.1 in the fourth quarter of the current financial year, down from a three-year high of 101.1 in the September ended quarter. The index has a one-quarter lead over non-agricultural GDP growth.

In its research note dated Oct. 30, Nomura stated that GDP growth peaked at 8.2 percent in the second quarter and would drop to 6.9 percent by the first quarter of the the next financial year.

Nomura said that growth will moderate from globally weaker demand, higher oil prices, tighter financial conditions and a negative fiscal pulse.

The Japanese financial firm's indices also predict higher possibilities of negative data surprises and a policy pause by the Reserve Bank of India in the near term because of lower inflation and concerns of a global slowdown.

Sales of two-wheelers and tractors—bellwethers of rural consumption—have moderated to about five percent in September from 11 percent in August. Rising fuel prices are also taking a toll on urban demand, as seen by contracting passenger vehicle sales. The three-month moving average of passenger vehicle sales on an annual basis contracted by 3.6 percent in September.

The ongoing liquidity crunch in non-banking financial companies is likely to further slow down commercial vehicle demand though the economy can expect to see higher incremental bank credit, according to the report.

Government capex and capital goods output were other indicators that declined in August, dragging down investment demand. On the upside, the economy saw a sharper moderation in imports, excluding oil and gold, in comparison with exports. Supply side indicators, including industrial production and services, continue to buoy the economy.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.