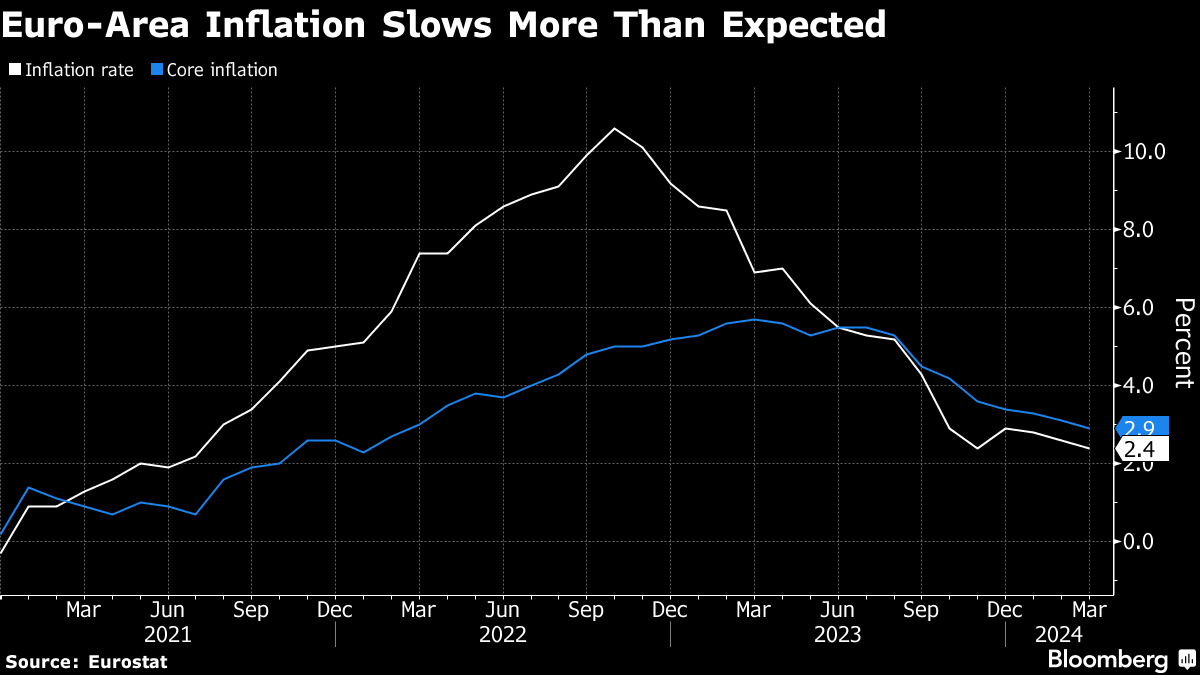

(Bloomberg) -- Euro-area inflation slowed more than expected, cementing prospects for an interest-rate cut by the European Central Bank in June.

Consumer prices rose an annual 2.4% last month, down from 2.6% in February, in line with a Bloomberg Economics Nowcast model. Analysts predicted an increase of 2.5%. A measure excluding volatile items such as food and energy also eased more than anticipated, to 2.9%.

The report adds to evidence that policymakers are on track to return inflation to the 2% target, allowing them to soon dial back some of the restriction needed after price gains surged into double digits. President Christine Lagarde has signaled a first cut in June — informed by fresh forecasts and an update on wage growth in the early months of the year.

Most of the Governing Council — including officials from Germany, France and Spain — have signed up to that timeline, with few clinging to hopes of an earlier move. Economists and money markets are equally aligned, suggesting it would take a big shock to change course.

Traders held wagers on the scope for rate cuts this year after the report, pricing three quarter-point reductions starting in June with the chance of a fourth at around 60%. That compares to as many as four cuts priced ahead of last month's monetary-policy decision.

What Bloomberg Economics Says...

“Our forecasts point to better news ahead. Favorable base effects will help push services price gains lower in April, while disinflation in core goods is likely to proceed apace. That will push down on core price pressure over the next few months, though not necessarily on the headline measure, which will hover around current levels, as favorable energy base effects fully dissipate.”

—Ana Andrade and Jamie Rush. For full react, click here

Bloomberg Economics' Nowcast for April points to a reading of 2.1%.

While shipping disruptions in the Middle East haven't affected inflation in Europe much and last week's collapse of a bridge in Baltimore — a key port for carmakers and other manufacturers — is also unlikely to do so, rising pay within the 20-nation euro zone may yet stoke prices.

Chief Economist Philip Lane insists wage increases must continue to retreat for him to consider reversing some of the ECB's past hikes.

While a key compensation gauge showed some moderation at the end of 2023, salaries continue to expand by more than 4%. That's sustaining price pressures in services, where labor has an outsized impact on final costs.

Inflation in that sector remained at 4% in March, while the rate for non-energy industrial goods fell to 1.1%.

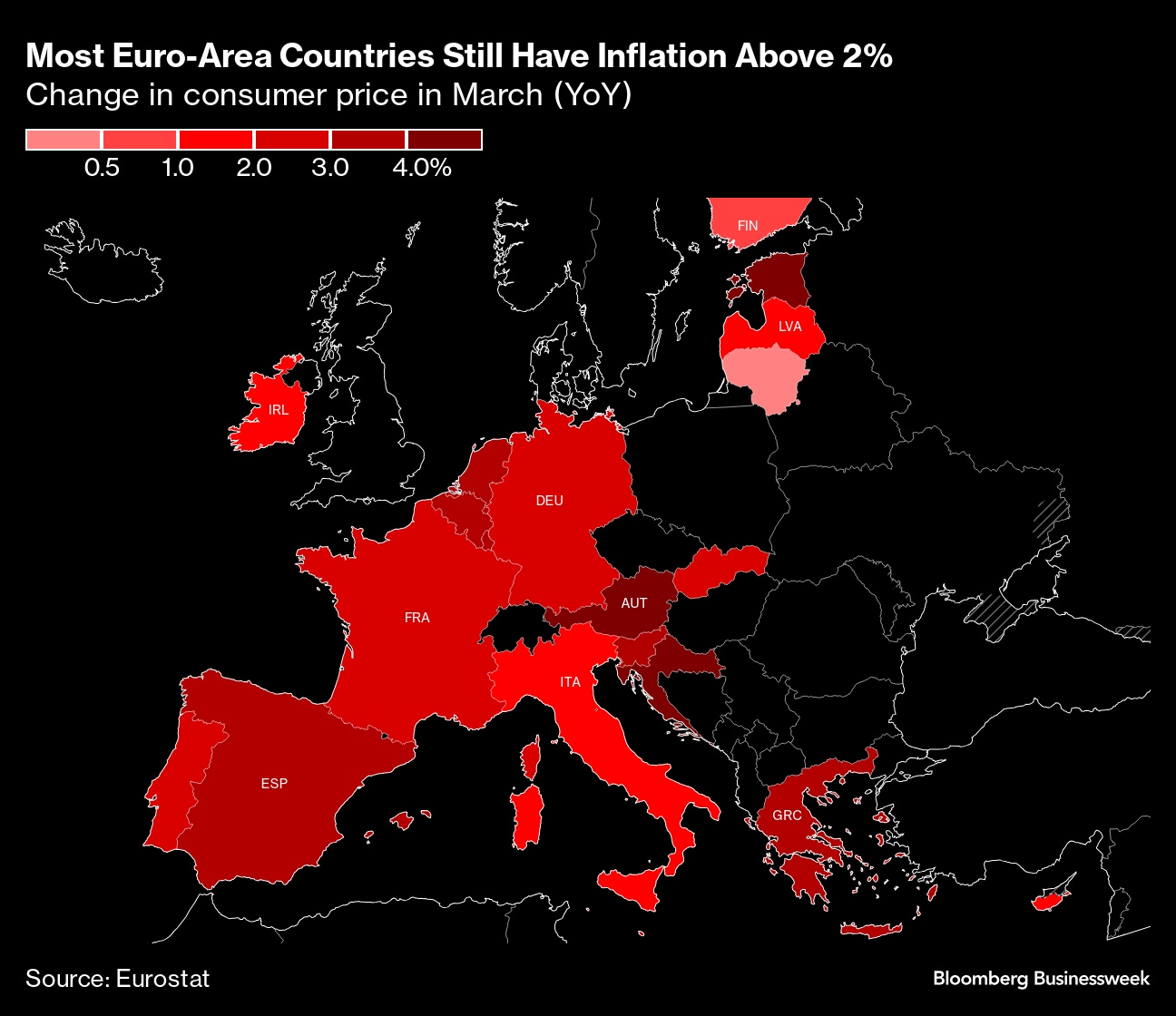

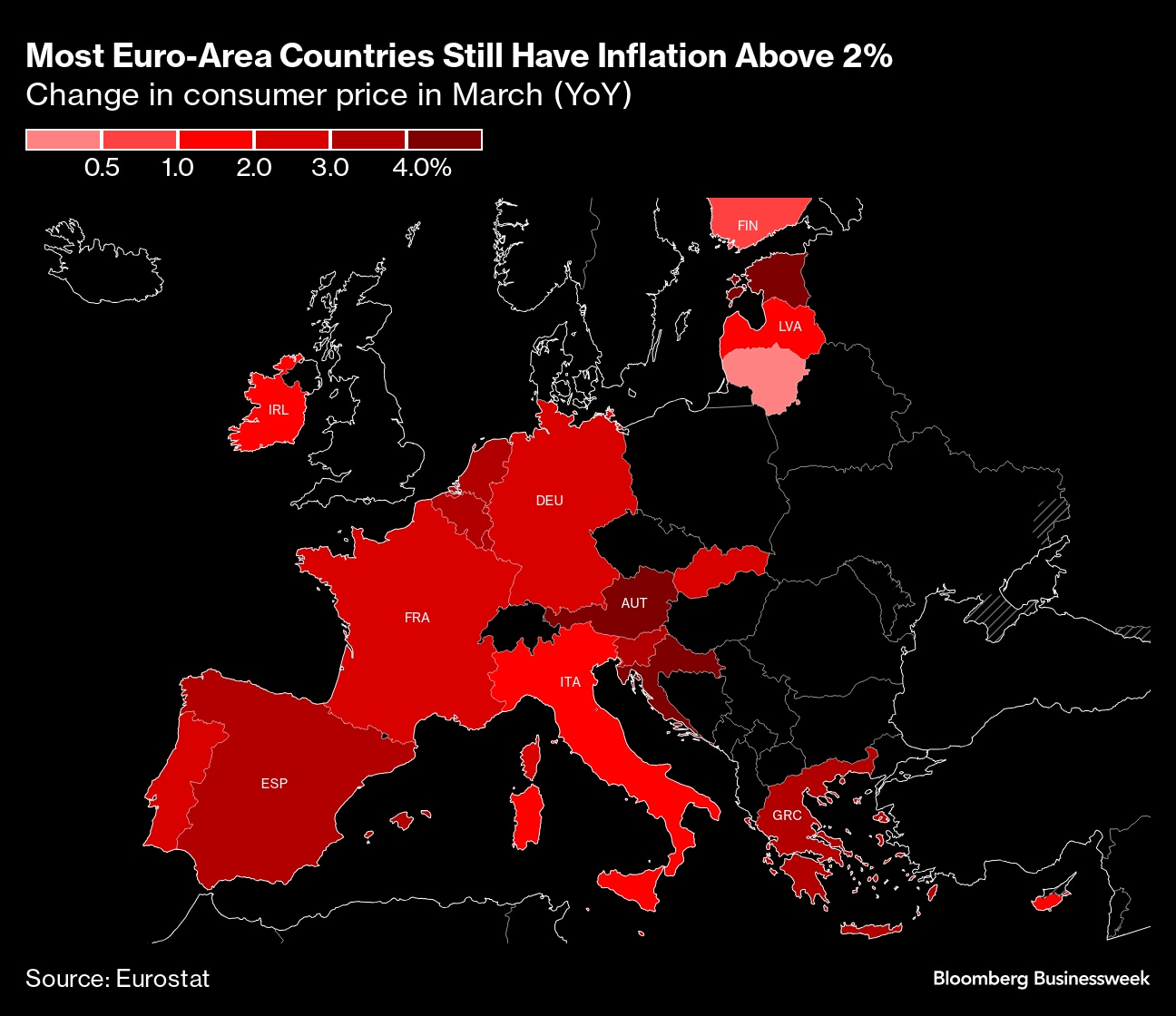

Across the region, trends also diverge. Spanish inflation accelerated after the government removed some of the support put in place to keep a lid on energy costs, and Italy also saw an uptick. Meanwhile, German and French readings both showed that inflation eased for a third month.

Such trends make it harder to determine the optimal path following the ECB's initial cut. Policymakers have already shifted some attention to discussing the pace of later steps, though insist that ultimately economic data will decide.

Lagarde, too, says the ECB will respond to new information as it comes in. “This implies,” she said last month, “that, even after the first rate cut, we cannot pre-commit to a particular rate path.”

--With assistance from Joel Rinneby, Barbara Sladkowska, James Hirai, Alice Gledhill and Andrej Sokol (Economist).

(Updates with Bloomberg Economics in after fifth paragraph, Nowcast in sixth)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.