- RBI Governor delayed GDP and CPI projections due to base year changes for 2026-27

- GDP base year shifts to 2022-23 and CPI base year updates to 2024 by MoSPI

- CPI 2024 series expands basket to 358 items, adding online markets and digital services

RBI Governor Sanjay Malhotra has held back on Gross Domestic Product (GDP) and Consumer Price Index (CPI) projections for the fiscal year spanning 2026-27, due to a change in the base year for both the indices. The base for GDP will move to 2022–23 and CPI will move to 2024.

The Ministry of Statistics and Program Implementation (MoSPI) had earlier stated that India will change the base years for calculating GDP and CPI later this month. The new series of CPI (base year 2024) is to be released on Feb. 12, 2026. The new series of GDP (base year 2022-23) is slated for release on Feb 27, 2026.

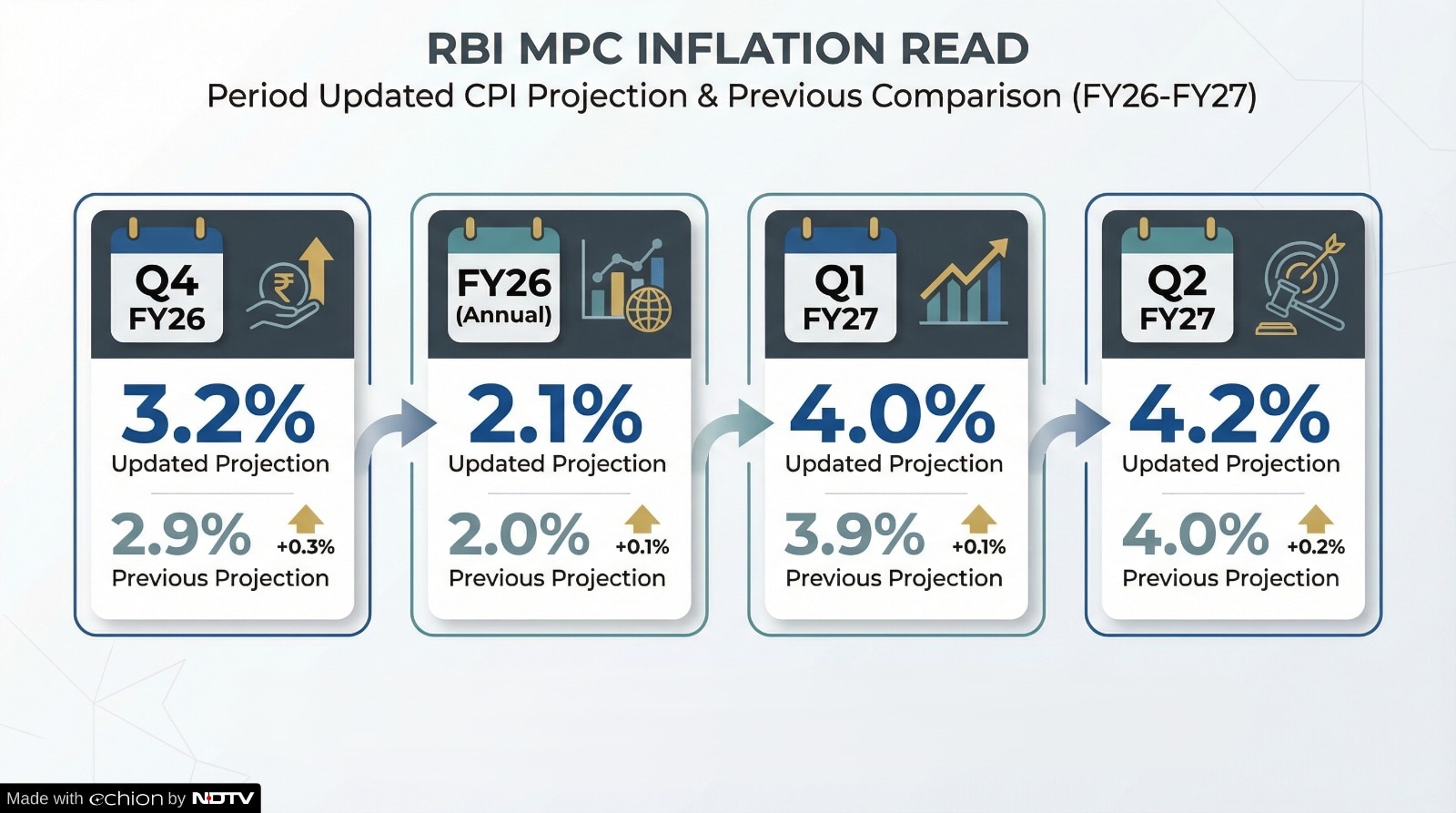

The Reserve Bank of India's Monetary Policy Committee (MPC) has decided to keep the policy repo rate unchanged at 5.25%, in line with the street's expectations.

Photo Credit: NDTV Profit

What Is a Base Year?

A base year, as defined by MoSPI, serves as the benchmark period used to assess how economic indicators change over time. For GDP calculations, it reflects the pricing and production patterns used to measure real economic growth. It also determines the weighting of goods and services in the consumption basket, which forms the basis for computing CPI inflation.

India currently uses 2011–12 as the base year for GDP and 2012 for CPI. However, MoSPI has indicated that these years no longer accurately represent the present structure of the economy and therefore need updating.

What's Changing in the New Series?

The upcoming CPI 2024 series introduces a significantly updated consumption basket, expanding it from 299 to 358 items, with widened market coverage and the inclusion of 12 online markets to capture prices from e‑commerce platforms and digital services such as airfares and OTT subscriptions.

These updates reflect modern consumer behaviour, including the rising share of online purchases, and incorporate advanced price‑collection methods using digital and administrative data.

The revised index also adopts the latest Classification of Individual Consumption According to Purpose (COICOP) 2018 classification, updates item weights using the 2023–24 Household Consumption Expenditure Survey, and formalises new procedures such as collecting airfare quotes 21 days in advance for domestic travel and 60 days for international routes.

ALSO READ: RBI Monetary Policy: MPC Keeps Repo Rate Unchanged At 5.25%; Maintains Neutral Stance

Weightage Changes

Food and beverage weight drops sharply—from about 45.9% to ~36.8%—while housing, transport, health, and other essential services gain prominence, making the CPI more representative of today's spending patterns.

The framework also modernises rent measurement, includes standardized gold and silver jewellery items rather than customised pieces, and expands coverage to 1,465 rural and 1,395 urban markets across 434 towns.

Impact on Inflation and Growth Data

MoSPI has indicated that updating the base years will lead to CPI inflation being calculated using new spending patterns that better reflect how households allocate their money today. As a result, the headline inflation figures under the revised series may differ from the numbers currently reported.

The ministry emphasized that these revisions arise from methodological improvements in measurement. They do not imply any real change in the underlying economic performance of the country.

ALSO READ: RBI Holds Rates, Lifts Inflation Estimates And Expands MSME Support: Key Takeaways

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.