The economic crisis triggered by the Covid-19 pandemic and the ensuing lockdowns could accelerate consolidation in favour of organised players and formalisation of jobs, and provide a stronger push to ‘Make in India', according to BofA Securities.

The cash crunch faced by the government and businesses alike could lead to six structural changes in the Indian economy, BofA Securities said in a report. These are:

- Second wave of consolidation in favour of organised players across a variety of sectors.

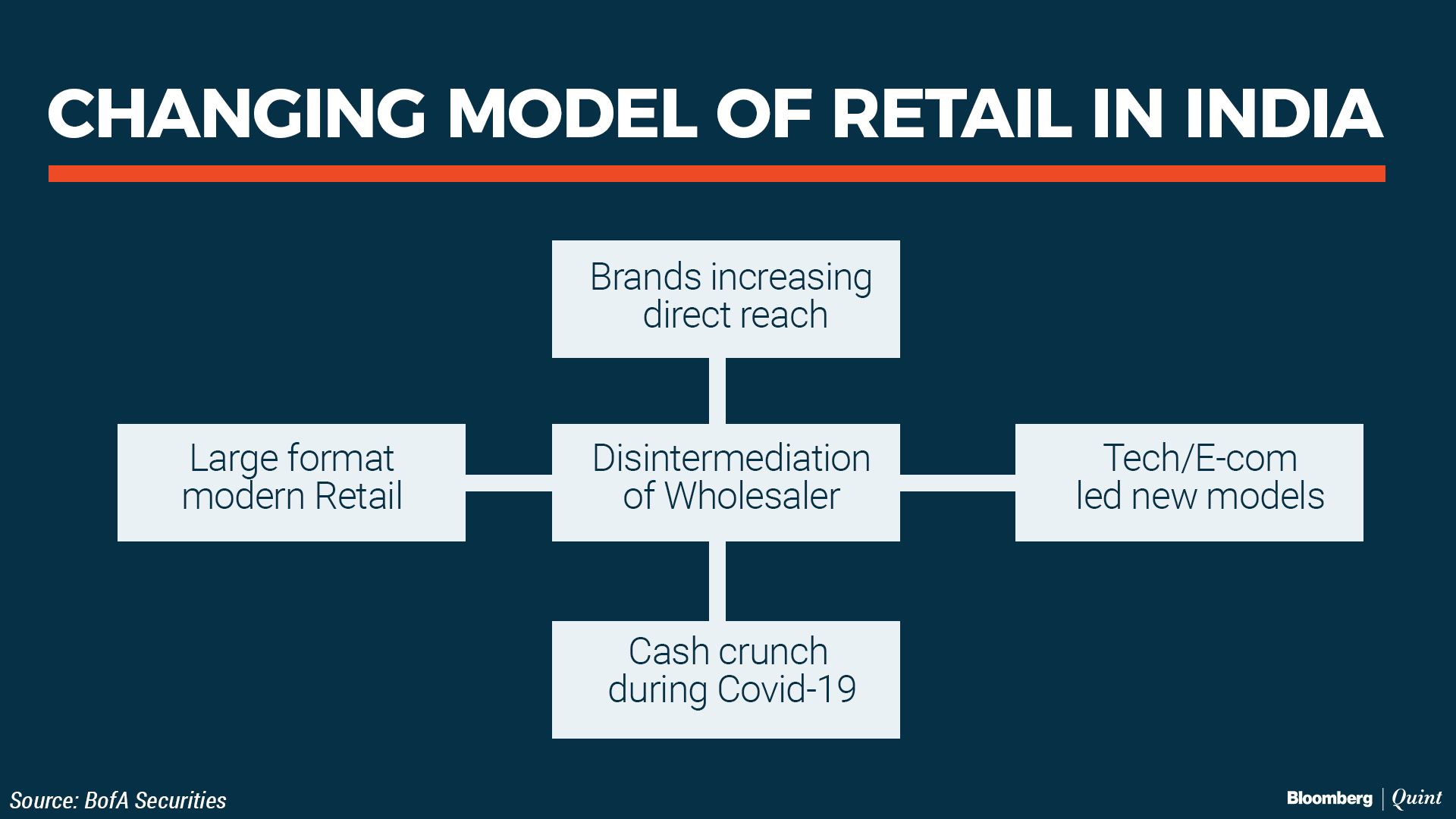

- Dis-intermediation within the value chain could be accelerated, especially with a faster shift to e-commerce.

- Change in asset ownership in the real estate and infrastructure sectors.

- Formalisation of jobs that would help target government subsidy distribution.

- Another push for 'Make in India'.

- Change in consumer behaviour—preference for online platforms and an aversion to crowds.

Prime Minister Narendra Modi has been promoting ‘Make in India' since his first term in office. But this time, in addition to the pull factor from the promised land, labour and power reforms, there is a push factor with global firms looking to diversify out of China, Amish Shah, India equity strategist at BofA Securities, said in an interview.

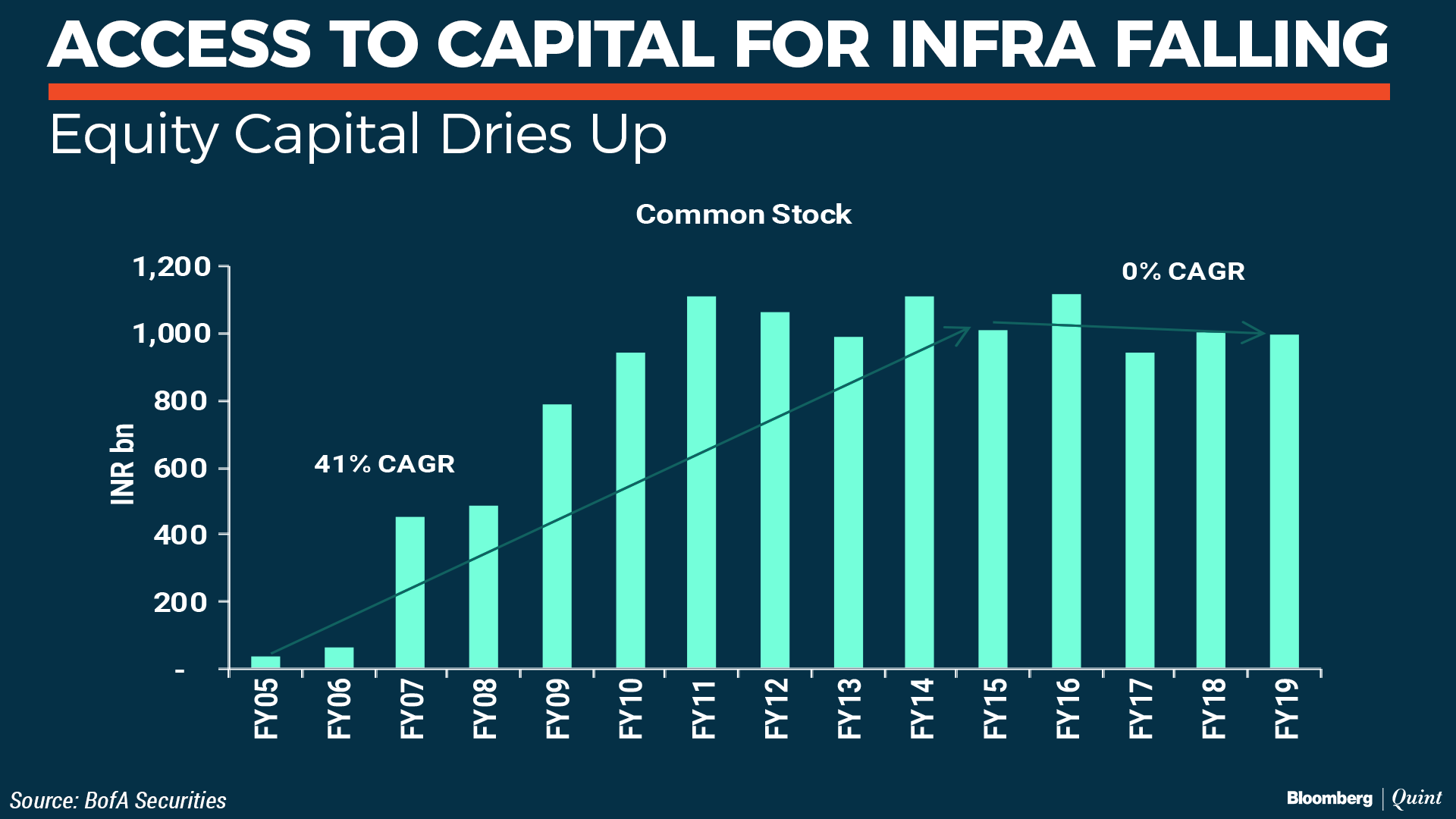

The economic distress caused by the nationwide lockdowns will force consolidation in various industries, but will be especially widespread in real estate and infrastructure, Shah said.

Most capital-hungry sectors like real estate and infrastructure will turn capital-starved. These players will have no option but to sell their assets, or their entire businesses, perhaps.Amish Shah, India Equity Strategist, BofA Securities

BofA Securities expects sovereign funds, pension funds and private equity funds to invest in these real estate and infrastructure assets, as they make for good long-term, low-risk, high-yield investments that these funds are known to chase.

The Covid-19 cash crunch could also accelerate dis-intermediation of the wholesale channel that was already underway due to the rising number of large-format modern retail stores and e-commerce driven models, the report said. Companies will have more incentive to side-step the middleman, it said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.