11_07_24 (1).jpg?downsize=773:435)

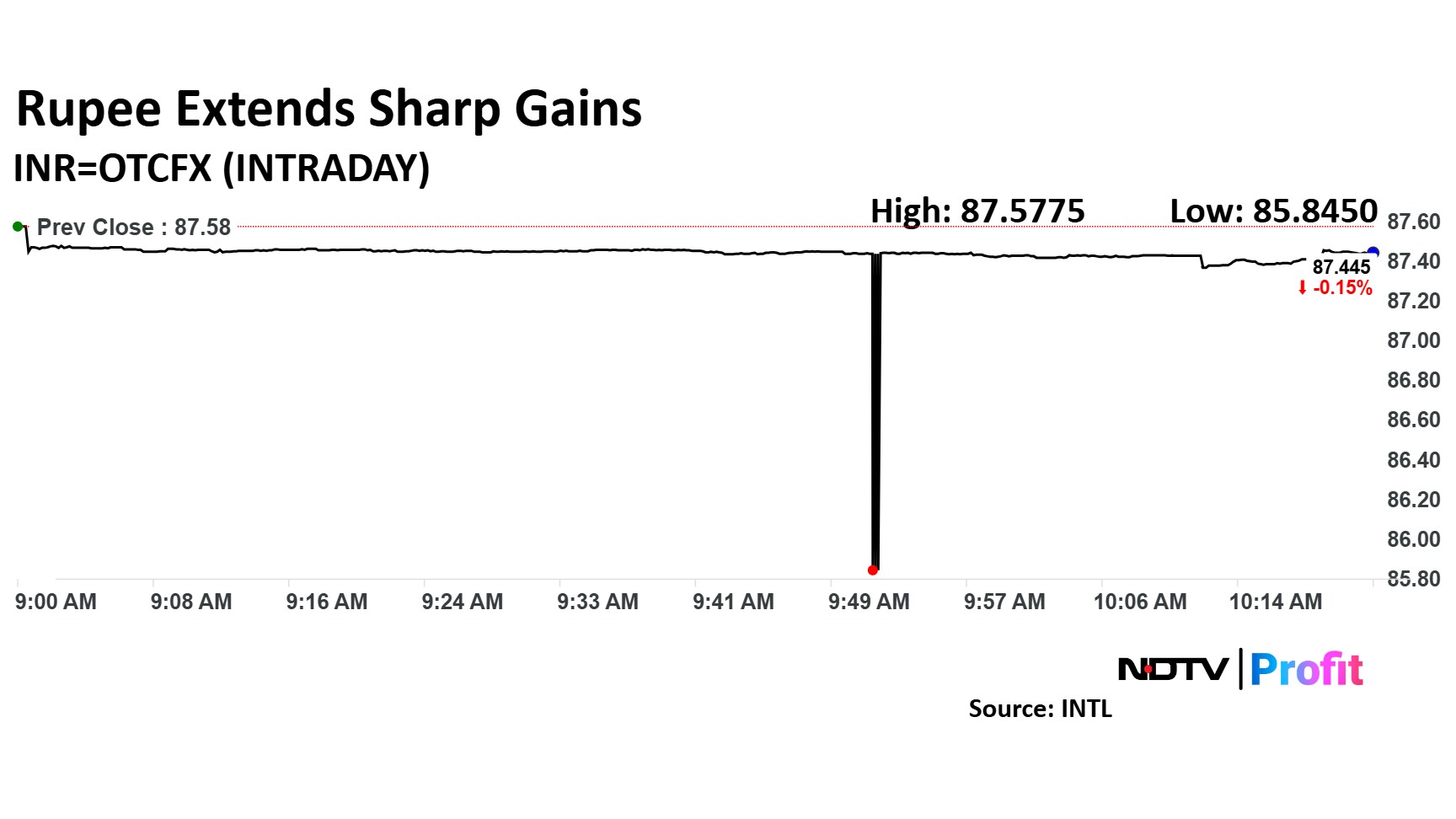

The Indian Rupee rose 25 paise to 87.33 against US Dollar after it opened 11 paise higher at 87.48 a dollar, on Friday. It closed at 87.58 a dollar on Thursday.

The Monetary Policy Committee cut the repo rate by 25 basis points to 6.25%. The RBI under the new Governor Sanjay Malhotra voted unanimously to continue with 'neutral' stance.

Interventions in the FX market focus on smoothening volatility, according to the RBI Governor. He added that the RBI does not target a certain level for Rupee's exchange rate.

RBI and MPC will continue to improve macroeconomic outcomes, said Malhotra in his policy speech, adding that, reassuring that all stakeholders that will continue with the consultative process.

The Indian rupee had opened stronger on Friday, ahead of the RBI's Monetary Policy announcement. The local currency strengthened by 11 paise to open at Rs 87.47 against the greenback, according to Bloomberg. It had closed at Rs 87.58 on Thursday.

"Indian rupee continued to log in fresh lows, with the currency touching almost 87.60 yesterday and RBI allowing the flexibility for more volatile movements in the currency pair," said Anil Kumar Bhansali, head of treasury and executive director of Finrex Treasury Advisors LLP.

Bhansali expects the rupee to trade in Rs 87.30 to 87.70 range on Friday, with a weakening bias. Exporters are to wait and watch the movement before taking a call, importers to buy all dips.

The RBI will announce the monetary policy today at 10 a.m., with 77% of market participants anticipating a 25 bps rate cut. It would be a historic rate cut, since it is coming after almost five years, with the last one being in May 2020. The decision comes amid growing concern worldwide over the potential damage to economic activity and growth from Trump's tariff threats. This would be new governor Sanjay Malhotra's first policy since he took over in December 2024, according to Bhansali.

The Reserve Bank of India is expected to trim the interest rate by 25 basis points to 6.25% at the policy meeting concluding Friday. The central bank has already announced liquidity enhancement measures that have improved conditions in the market. This appeared to be a prerequisite for cutting rates, said Kunal Sodhani, from FX Hub.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.