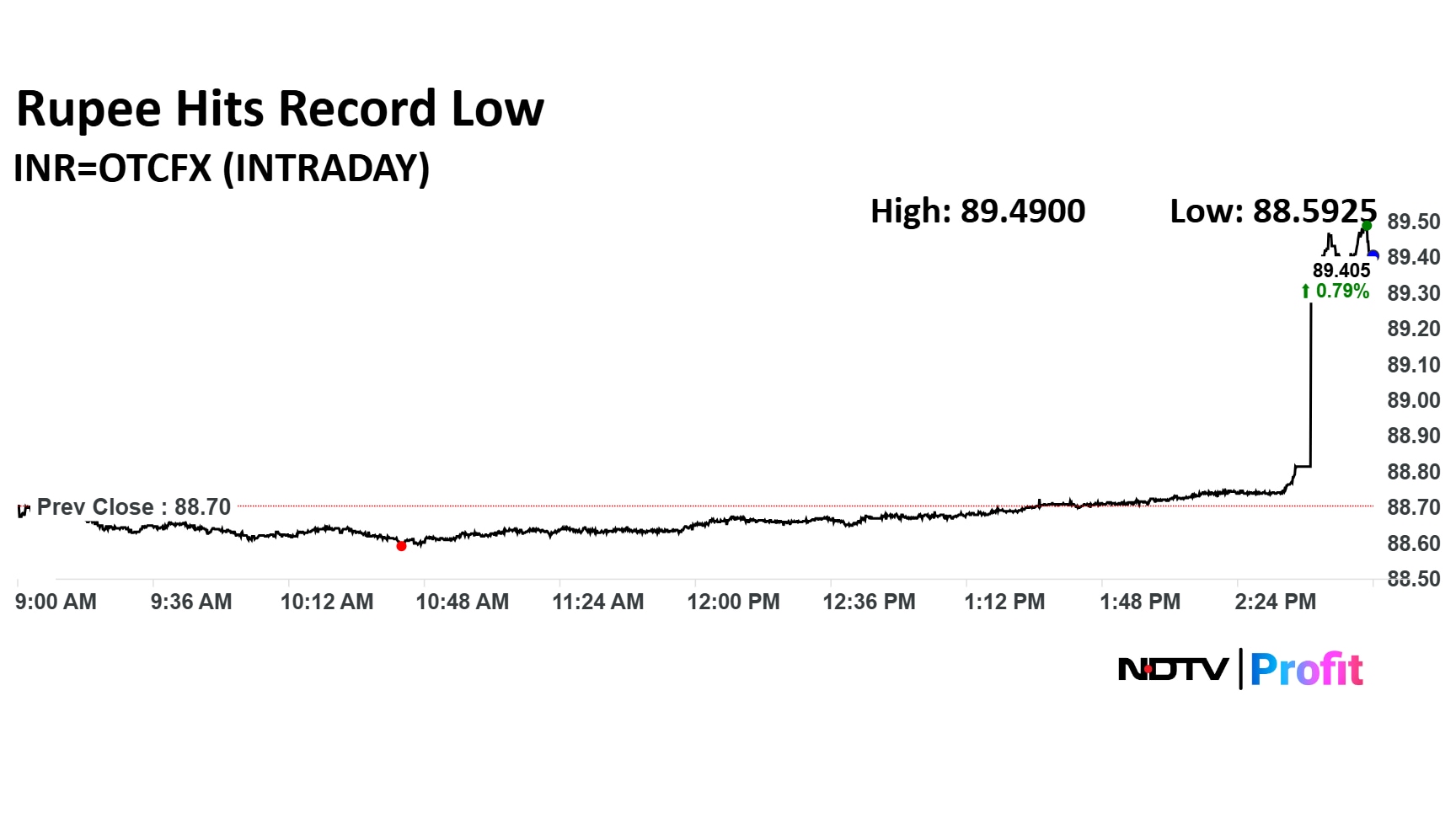

- Rupee fell 0.87% to close at a record low of 89.41 against the US dollar on Friday

- The currency declined past the crucial 89 level, triggering stop-loss orders on short-dollar bets

- Concerns over AI-led market rally and commodity price volatility fueled risk-off sentiment

The rupee weakened past a psychologically crucial level of 89 against US dollar on Friday. The Indian currency declined 0.87% against the green back and recorded the worst intraday decline since May 8.

The Indian unit settled 70 weaker against the greenback at 89.41 a dollar on Friday. It's the lowest closing level for the rupee.

During the last leg of the session, the rupee slumped 77 paise to a record low of 89.48 against the greenback on Friday. It settled at 88.71 a dollar in the previous, accoridng to data on Bloomberg.

The India-US trade deal has been an over hang for some time. Today, the trigger is the risk-off sentiment because of the concern of artificial intelligence-led rally and volatility in the commodity prices. Secondly, forex traders hoped that the central bank would protect the 89-a-dollar level. So, when the Indian currency weakened passed the level, stop loss got triggered on short-dollar bets. So there was a flair-up in the last one hour, Kotak Securities Head of Currency and Commodity Research Anindya Banerjee said.

The positive trigger could be India striking a deal with the US in the near-term, he said.

The Indian currency has emerged as the worst performing currency among its Asian peers. The rupee fell 0.86% on Friday, the worst intraday decline since

The Reserve Bank of India may step into restrict runaway depreciation in the Indian currency at around 89.50 a dollar level, according to Banerjee.

Markets across Asia and Europe logged losses, mirroring overnight movements on Wall Street on concerns over lofty valuations of technology stocks and heavy spending plans of IT companies, according to Bloomberg.

Moreover, the Bitcoin has retreated from record highs

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.