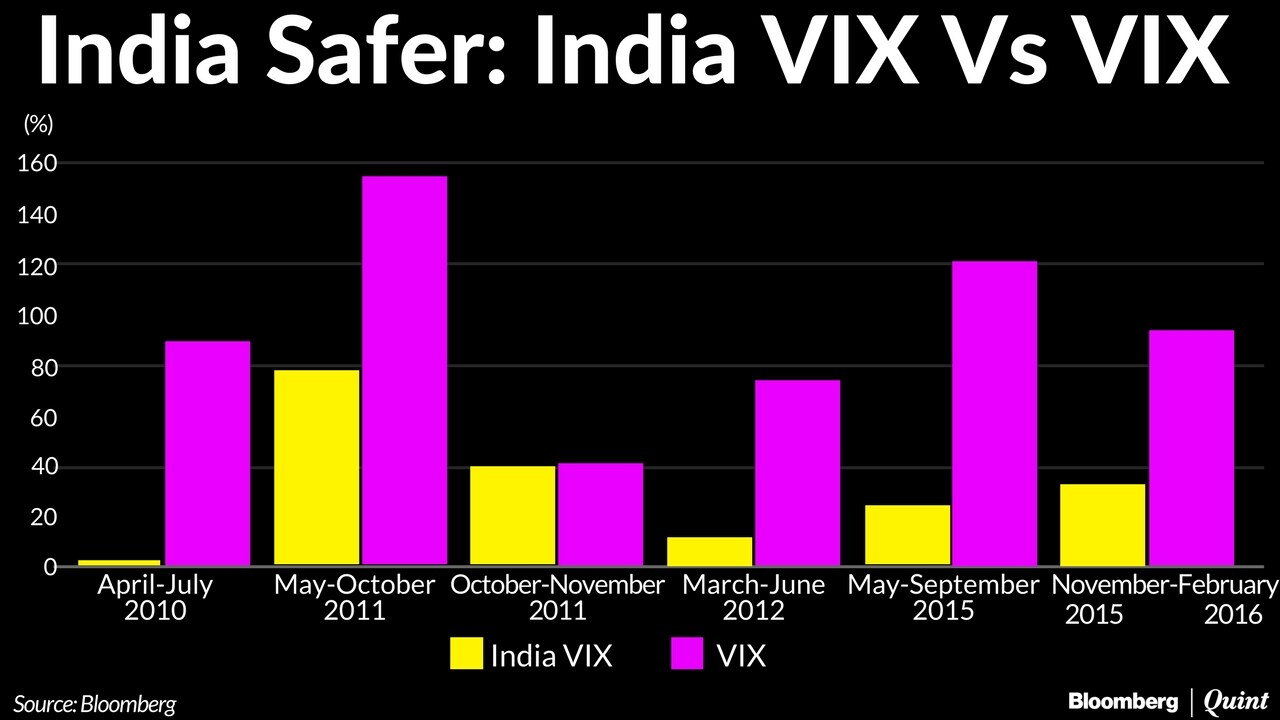

Volatility is an investor's biggest fear but if you are in India, you can be reasonably relaxed is what the chart here shows.

When stocks slump, the Indian equity market appears to be one of the safest place in the world and why do we say that? History, my dear Watson!

Since 2009, in four out of the six instances when the MSCI All-Country World Index dropped more than 10 percent, the NSE Volatility Index – India's fear gauge which tracks the bets for stock swings – rose the least among major national gauges.

The reason analysts feel India VIX has stood out is because the country's policy reforms have supported earning expectations. So the key takeaway here is that India is reasonably well placed for investors to park their funds if they foresee a rout ahead.

This is the chart of the day for you, keep watching BloombergQuint.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.