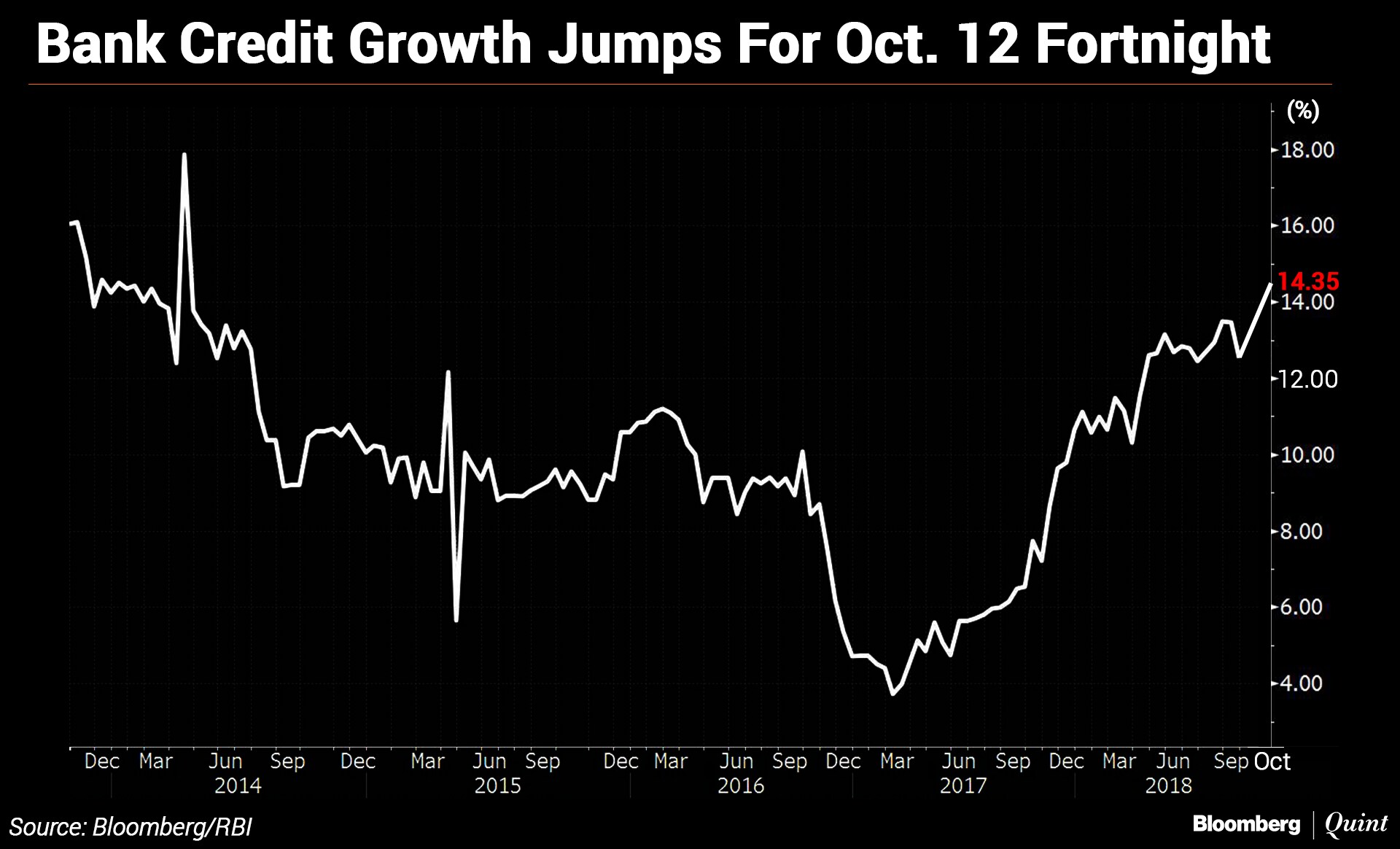

Bank credit growth rose to its highest in more than four years as strains in the domestic debt market pushed borrowers back towards the banking system.

Bank credit rose 14.35 percent for the fortnight ending Oct. 12, 2018, data released by Reserve Bank of India showed. Credit growth stood at 12.51 percent in the previous fortnight. At over 14 percent, credit growth is now at its highest in over four years, according to Bloomberg data.

Apart from increased credit demand due to the festive season and higher oil prices, banks stand to benefit from the turmoil in the debt market. Tight liquidity conditions and risk aversion in the market has pushed up rates in the debt market. This would prompt borrowers to go back and use available limits for bank credit.

Credit spreads have widened 30-50 basis points over the past one month, according to Edelweiss Research. One year AAA-rated corporates are raising funds at close to 8.9 percent compared to 8.6 percent earlier. Borrowing rates for AA-rated corporates increased 8.9 percent to 9.1 percent, while A-rated companies are borrowing at 10.7 percent. The rise has closed the gap with bank lending rates. The weighted average lending rates for fresh loan sanctions are between 9.3 percent and 9.4 percent across public and private sector banks, the RBI data showed.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.