Shares of Somany Ceramics jumped to the highest level in three months on Thursday after Nuvama raised target price on the stock. The upgrade came on the back of company's fourth-quarter earnings beating analysts' estimates.

The company's net profit rose 38.9% year-on-year to Rs 34 crore in the quarter ended March 2024, according to an exchange filing. Analysts polled by Bloomberg estimated a net profit of Rs 31.45 crore.

Somany Ceramics Q4 FY24 (Consolidated, YoY)

Revenue up 8.6% at Rs 738 crore. (Bloomberg estimate: Rs 700 crore).

Ebitda up 30.3% at Rs 79 crore. (Bloomberg estimate: Rs 68.37 crore).

Margin at 10.8% vs 9% (Bloomberg estimate: 9.8%).

Net profit up 38.9% at Rs 34 crore. (Bloomberg estimate: Rs 31.45 crore).

Nuvama noted that despite weak demand, the company strengthened its working capital to 8 days compared to 31 a year ago, cash flows improved to Rs 390 crore versus Rs 160 crore a year ago, and pared debt. The brokerage has retained its 'buy' for the stock and raised the target price to Rs 914 apiece from Rs 907 apiece.

"While demand is muted, SOMC is confident of outgrowing the industry, and expects low double-digit volume growth (versus the industry's 5-6%) with an improved Ebitda margin," Nuvama said.

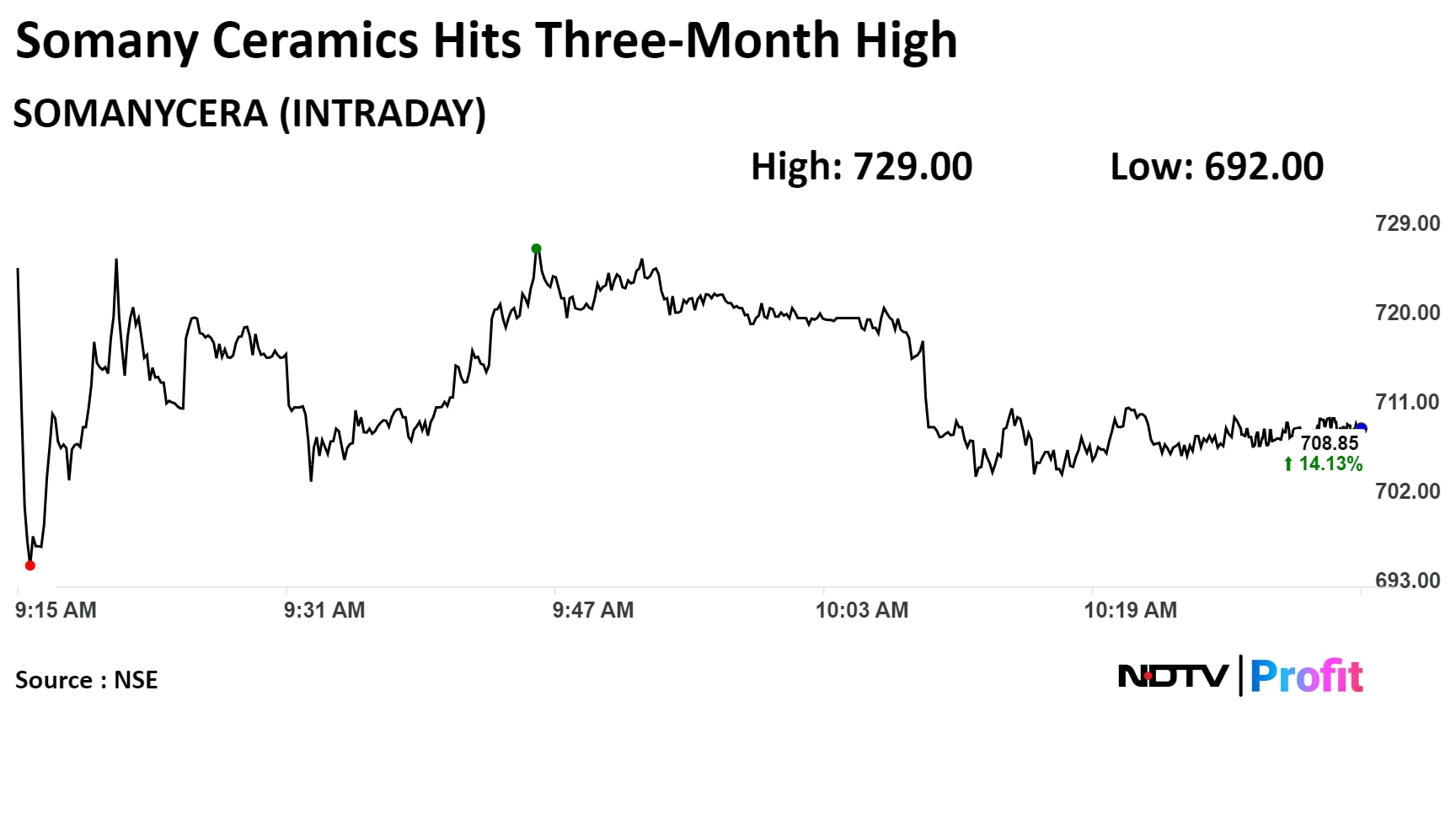

Shares of the company rose as much as 17.37% to Rs 729 apiece, the lowest level since Feb. 7. It pared gains to trade 13.98% higher at Rs 708 apiece as of 10:38 a.m. This compares to a flat NSE Nifty 50 Index.

The stock has fallen 1.31% on a year-to-date basis and risen 11.76% in the last twelve months. Total traded volume on the NSE so far in the day stood at 31.12 times its 30-day average. The relative strength index was at 74.08, indicating that the stock may be overbought.

Out of the 22 analysts tracking the company, 21 maintain a 'buy' rating one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 23%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.