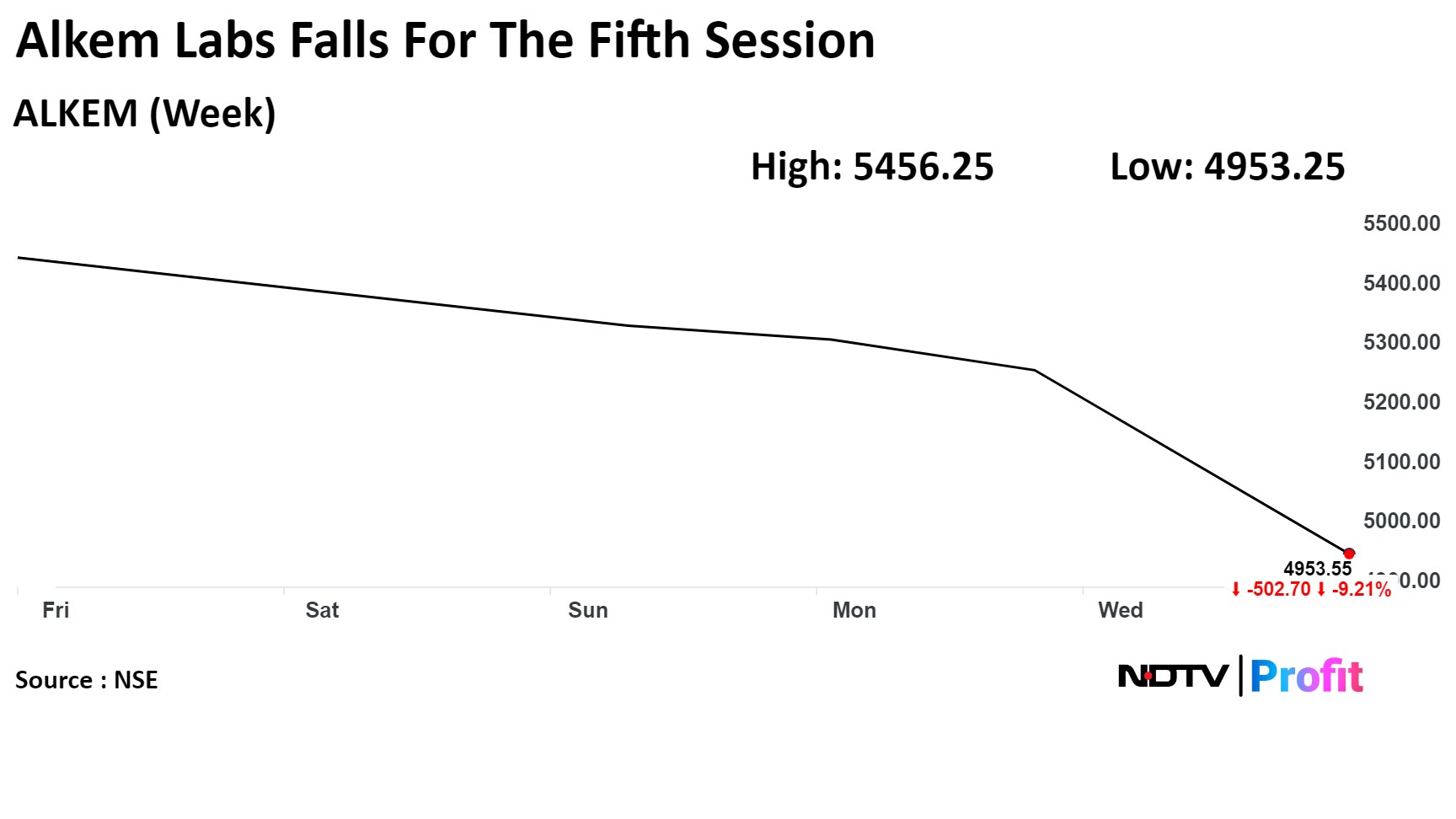

Shares of Alkem Laboratories Ltd. extended it loss for the fifth consecutive session on Thursday after the pharmaceutical firm's consolidated net profit in the fourth quarter of financial year 2024 missed analysts' estimates.

Alkem Q4 FY24 Earnings Highlights (Consolidated, YoY)

Revenue up 1.1% to Rs 2,936 crore versus Rs 2,903 crore (Bloomberg estimate: Rs 3,194.8 crore)

Ebitda up 14% to Rs 402 crore versus Rs 353 crore (Estimate: Rs 442 crore)

Margin at 13.7% vs 12.2% (Estimate: 13.8%)

Net profit up over fourfold at Rs 304 crore vs Rs 68 crore (Bloomberg Estimate: Rs 350.2 crore)

Nuvama Research downgraded the stock's rating to 'hold' from ‘buy'. It also reduced the stock's target price to Rs 5,730 from Rs 6,130 apiece, implying a potential upside of 8.9% from the previous close.

The brokerage cited the recent sharp rally and described Alkem's guidance of a 10% revenue growth and flat margin in the current fiscal as "conservative".

The company may see a revival of the anti-infective therapy due to an expected average to a strong monsoon season and lower base in the last fiscal. The margin will likely be flat due to higher research and development costs and operating expenses, according to Nuvama.

On the NSE, Alkem's stock fell as much as 6.99% during the day to Rs 4,894.60 apiece, the lowest since May 6. It was trading 5.93% lower at Rs 4,951.25 per share, compared to a 0.52% decline in the benchmark Nifty at 1:09 p.m.

The share price has fallen nearly 9% from its closing price on May 23. It has declined 4.78% on a year-to-date basis but risen 47.44% in the last 12 months. The total traded volume so far in the day stood at 4.35 times its 30-day average. The relative strength index was at 40.06.

Out of the 26 analysts tracking the company, 10 have a 'buy' rating on the stock, nine recommend 'hold' and seven suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.