FIIs (foreign institutional investors) sold equities worth Rs 45,200 crore in May. This is the second biggest monthly outflow since March 2020.

The selloff by foreign investors was a result of the US Federal Reserve's decision to raise interest rates to contain inflation and avoid a recession in the US economy.

As a result, both the Nifty 50 and the BSE-Sensex fell more than 3% during the month.

While companies in the financial services and IT sectors have borne the maximum brunt of the sell off, stocks that were overvalued have also seen a dip in the share price, irrespective of the sector they belong to.

One such stock is Adani Transmission.

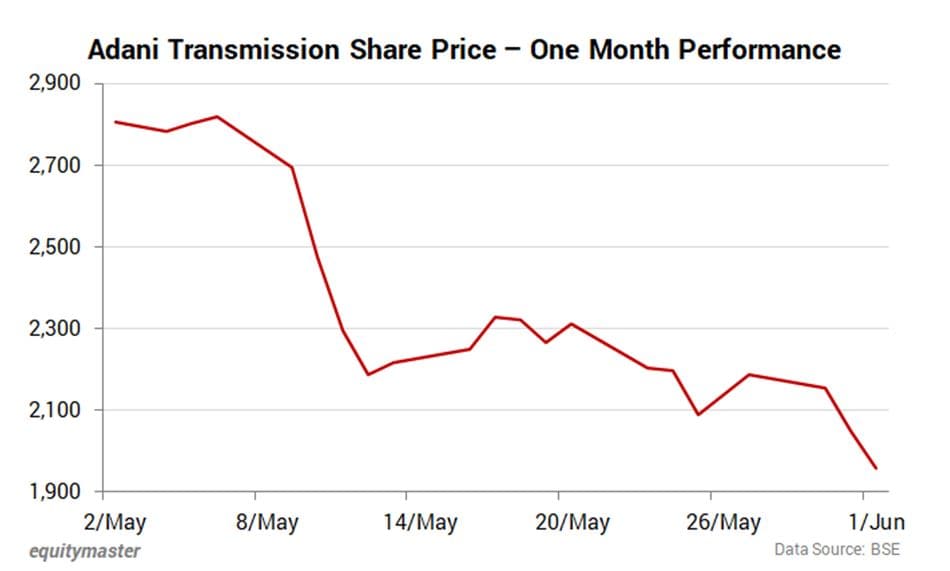

The company's shares have been in a down trend in the last few weeks. The stock is down 28% in the last month and 5% in the last 5 days alone.

Lets have a look at what factors has caused the stock to correct.

Rebalancing of the MSCI Index

Shares of a few Adani Group companies took a beating on 31 May 2022 as investors adjusted their holdings to reflect changes in the composition and weighings in the MSCI (Morgan Stanley Capital International) India Index.

Adani Green Energy, the group's biggest firm by market value, plunged a record 12% as its weight was reduced in the index.

As a result, shares of Adani Transmission also fell along with Adani Total Gas and Adani Power.

MSCI published additions and deletions to its global indices last month but the announcement didn't detail changes to the weightings of individual stocks in its indexes.

Weak Quarterly and Annual Results

Shares of Adani Transmission also lost during the month as it reported a 7.6% YoY decline in net profit at Rs 240 crore for the March 2022 quarter.

The net profit of the company came in at Rs 260 crore in the same period last year.

According to the company, the decline in profit was on account of net forex movement (mark to market) of Rs 820 m in distribution business.

However, total income rose to Rs 3,170 crore from Rs 2,880 crore.

For the full year, Adani Transmission's net loss stood at Rs 64.61 crore as against net loss of Rs 21.2 crore during the previous year.

Sales declined 2.1% to Rs 730 crore during the year compared to Rs 750 crore in the financial year 2021.

How have the shares of Adani Transmission performed recently

Shares of Adani Transmission are up 15.5% in 2022 compared to a 6.1% decline in the Sensex.

However, the stock is down 28% in the last month alone due to aggressive selling by investors across the board.

Its also down more than 30% from its 52 week high of Rs 3,000 which it touched on 12 April 2022.

About Adani Transmission

Adani Transmission is the transmission and distribution business arm of the Adani group, one of India's largest business conglomerates.

It's the country's largest private transmission company with a cumulative transmission network of 17,200 ckt km, out of which 12,350 ckt km is operational and 4,850 ckt km is at various stages of construction.

The company also operates a distribution business serving about 3 m plus customers in Mumbai.

With India's energy requirement set to quadruple in coming years, the company is fully geared to create a strong and reliable power transmission network and work actively towards serving retail customers and achieving 'Power for All' by 2022.

For more details about the power sector stocks, you can have a look at the power sector report on our website.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.