Vedanta shares traded lower during early trade on Wednesday after the company confirmed the government's denial of extension for Cambay Basin oil block.

The Anil Agarwal-led company received an intimation on Sept. 19 from the Ministry of Petroleum & Natural Gas that the application for extension of Production Sharing Contract of Block CB-OS/2 has not been accepted.

"We are engaging with respective authorities and evaluating all resources available to resolve the same," a stock exchange filing said late Tuesday.

Vedanta Cairn, a subsidiary of Vedanta, was the operator of the block with 40% stake. Government-owned Oil and Natural Gas Corp. holds 50%. Originally, Tata Petrodyne Ltd. held a 10% stake in the block, which was sold to Invenire Energy in 2019, as per reports.

The CB-OS/2 Block is an offshore block off the west coast of India and was awarded to the contractors in 1998. After the commercial discovery of oil and gas, license was granted in 2002.

The production sharing contract (PSC) for the CB-OS/2 block, which includes the Lakshmi and Gauri fields, expired in June 2023. It is currently producing 3,400 barrels of oil per day and 3,40,000 SCMD of gas.

The govenrment has directed ONGC to take control of all data, assets, operations and responsibilities associated with the block in the capacity of Government Nominee.

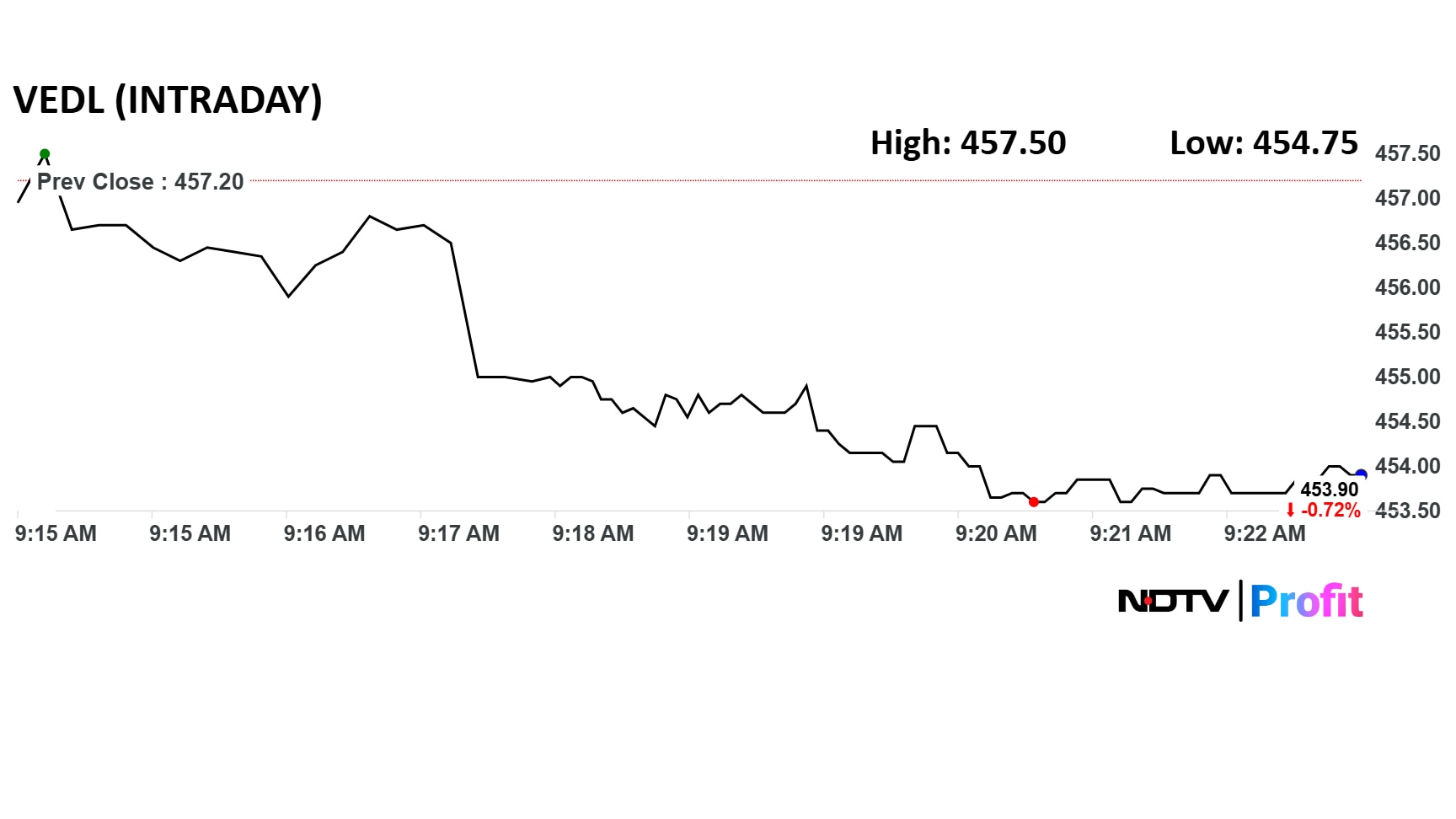

Vedanta share price fell 0.5% intraday to Rs 454.75 apiece. The benchmark Nifty 50 was down 0.35%. The relative strength index was at 64.

The stock has fallen 3% in the last 12 months and risen 2% on a year-to-date basis.

Ten out of the 15 analysts tracking Vedanta have a 'buy' rating on the stock, four recommend a 'hold' and one suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs xx implies a potential upside of 11%.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.