-The local currency strengthened by 2 paise to close at 83.49 against the U.S dollar.

-It closed at 83.51 on Thursday.

Source: Bloomberg

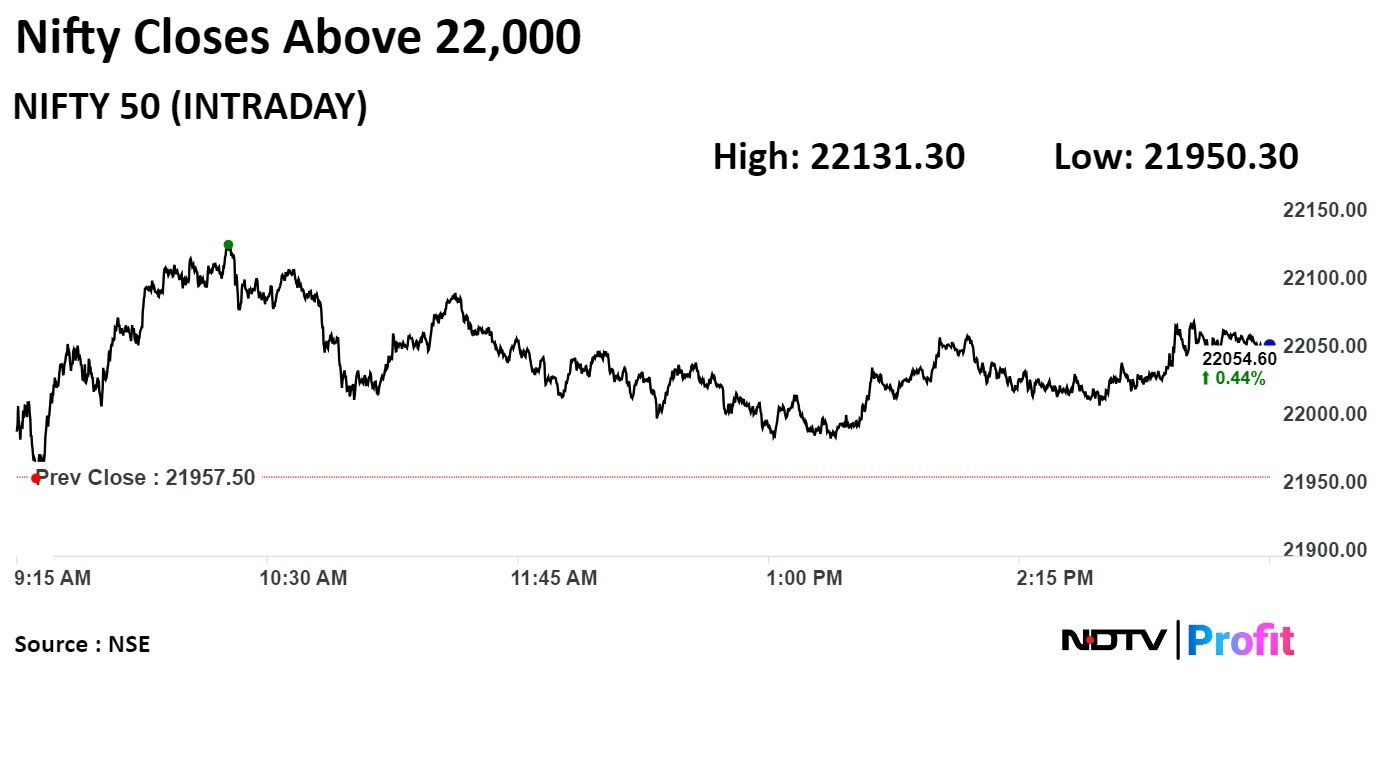

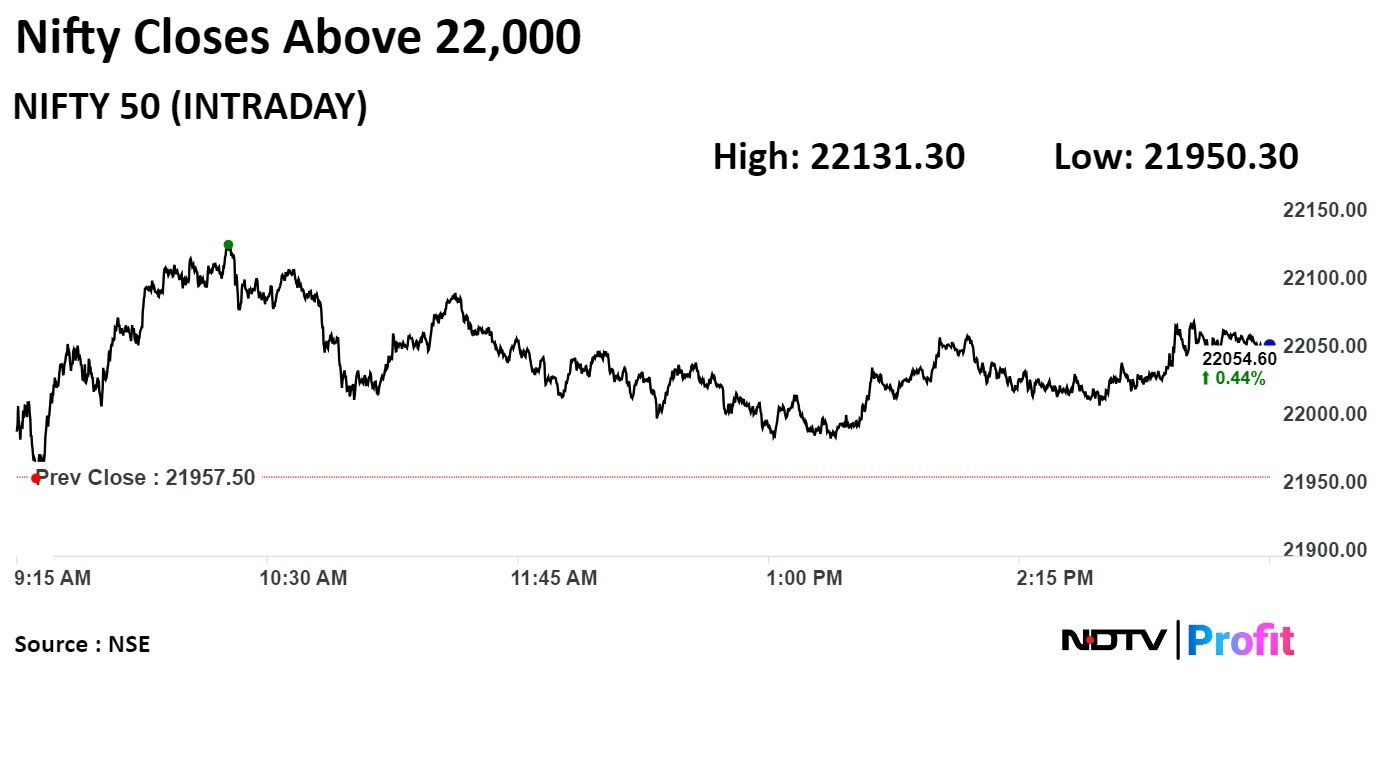

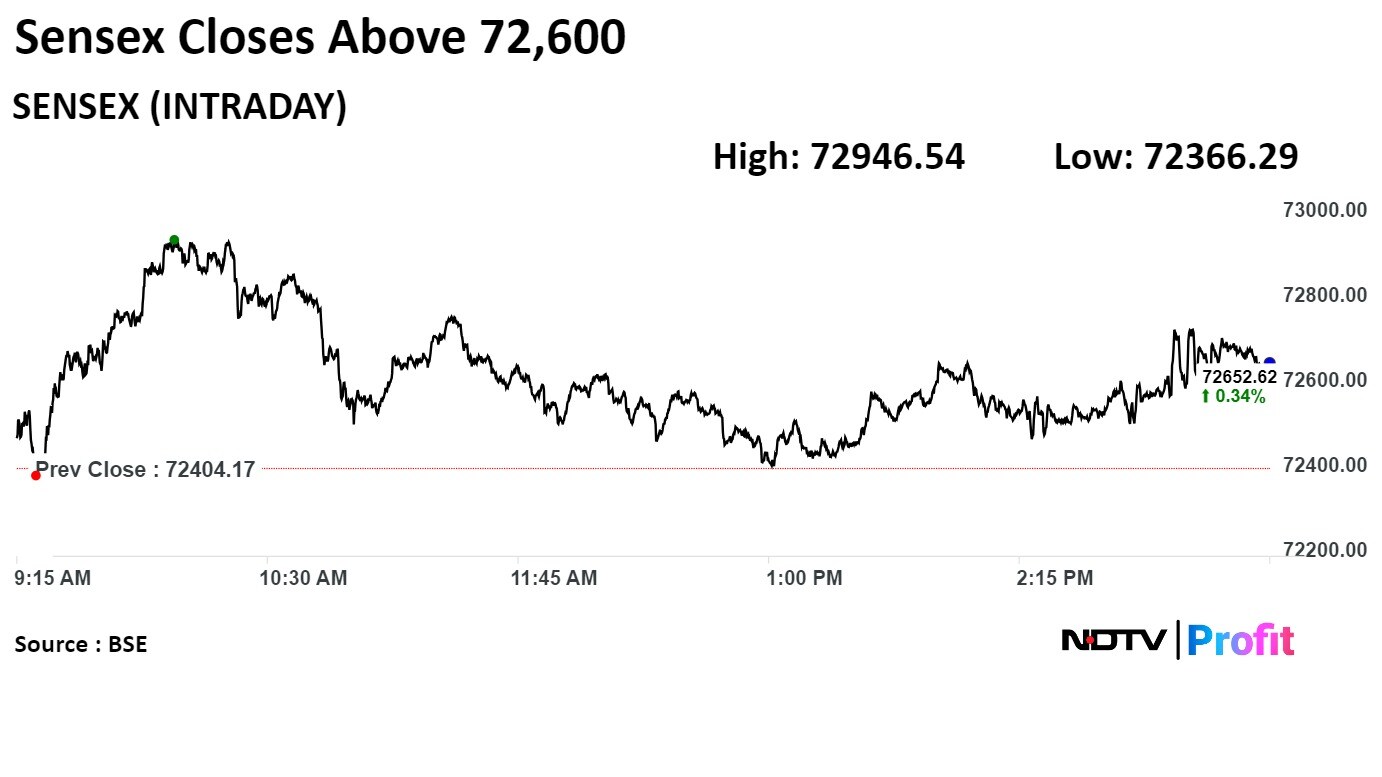

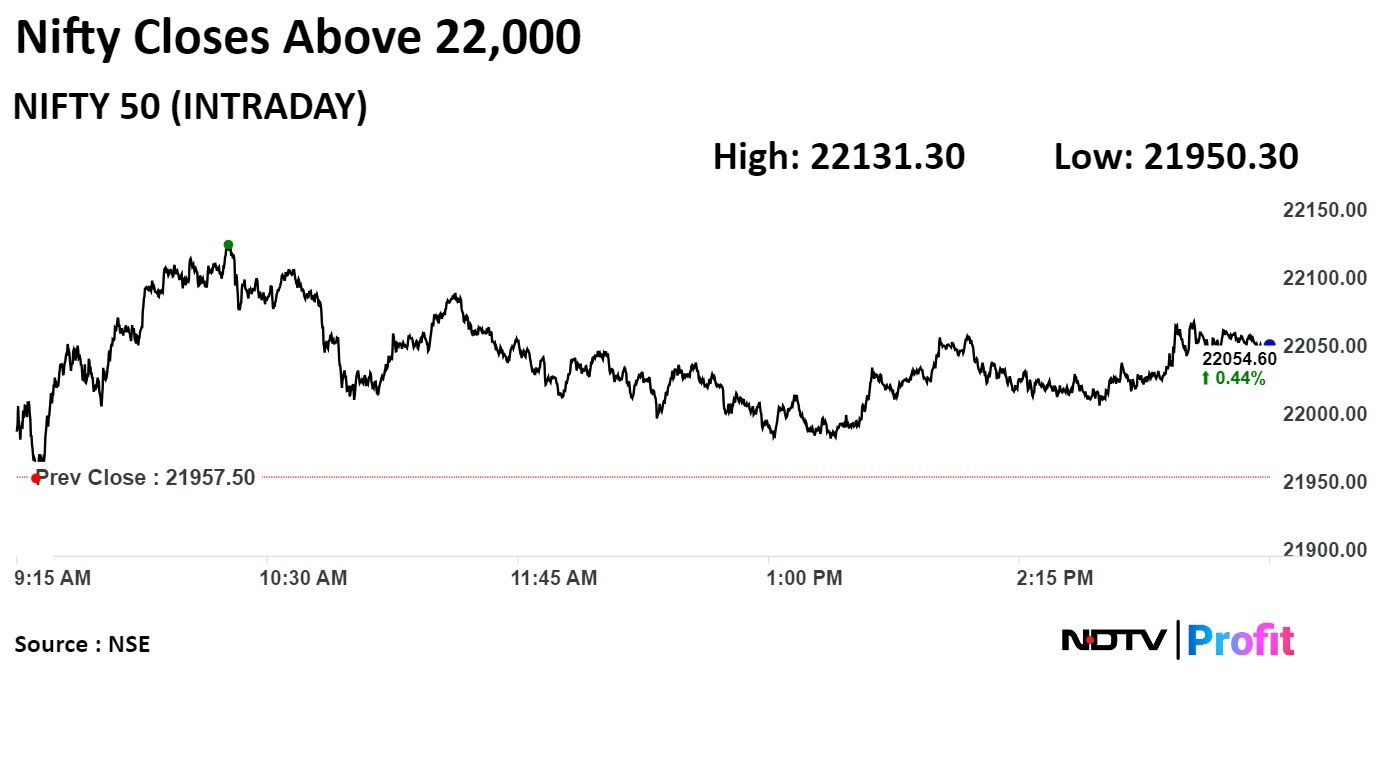

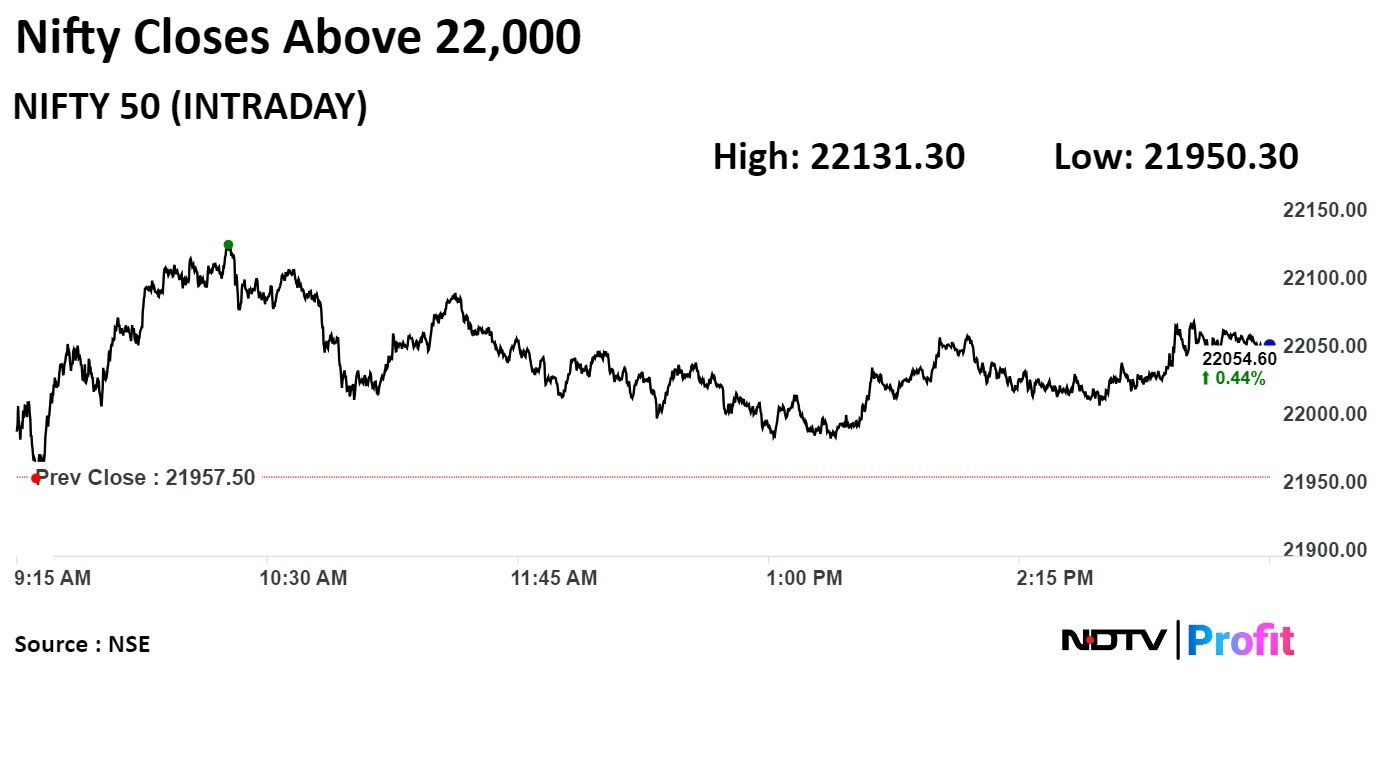

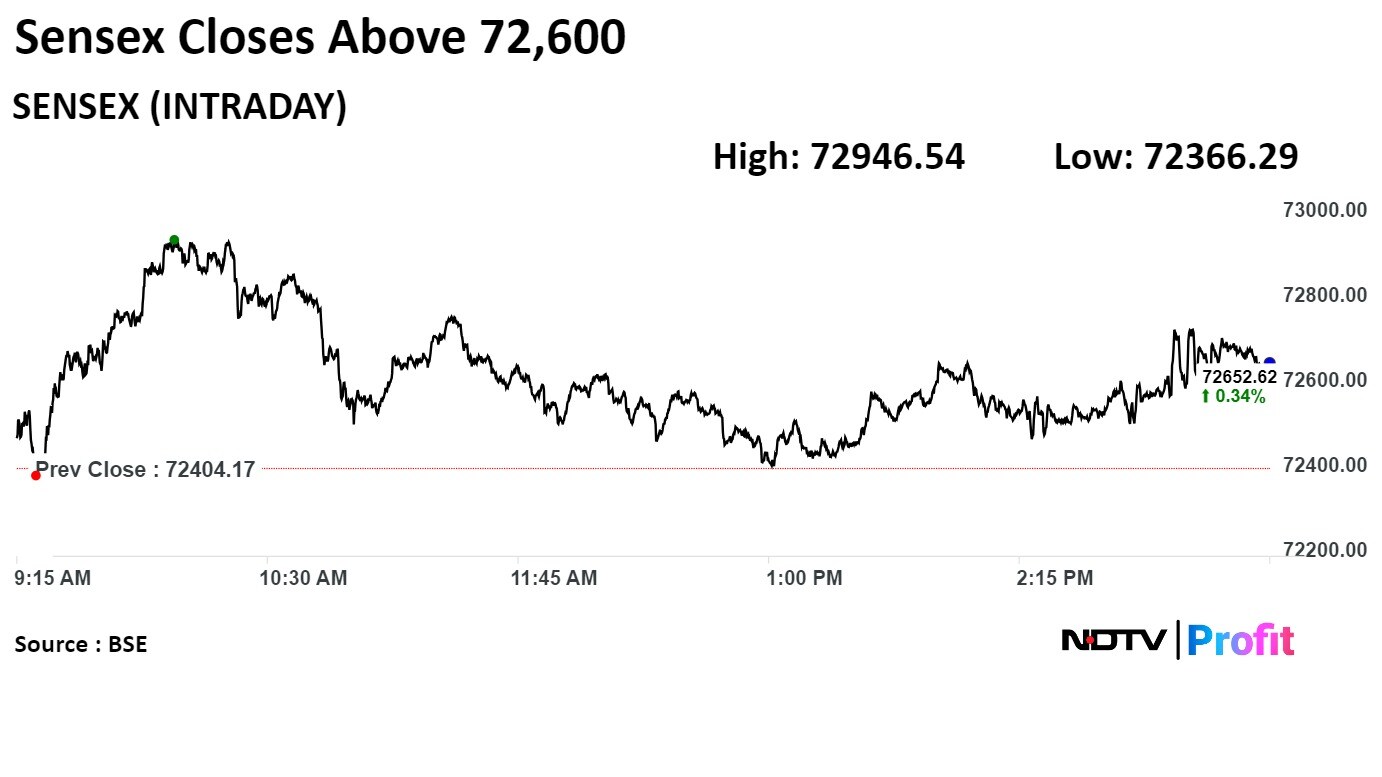

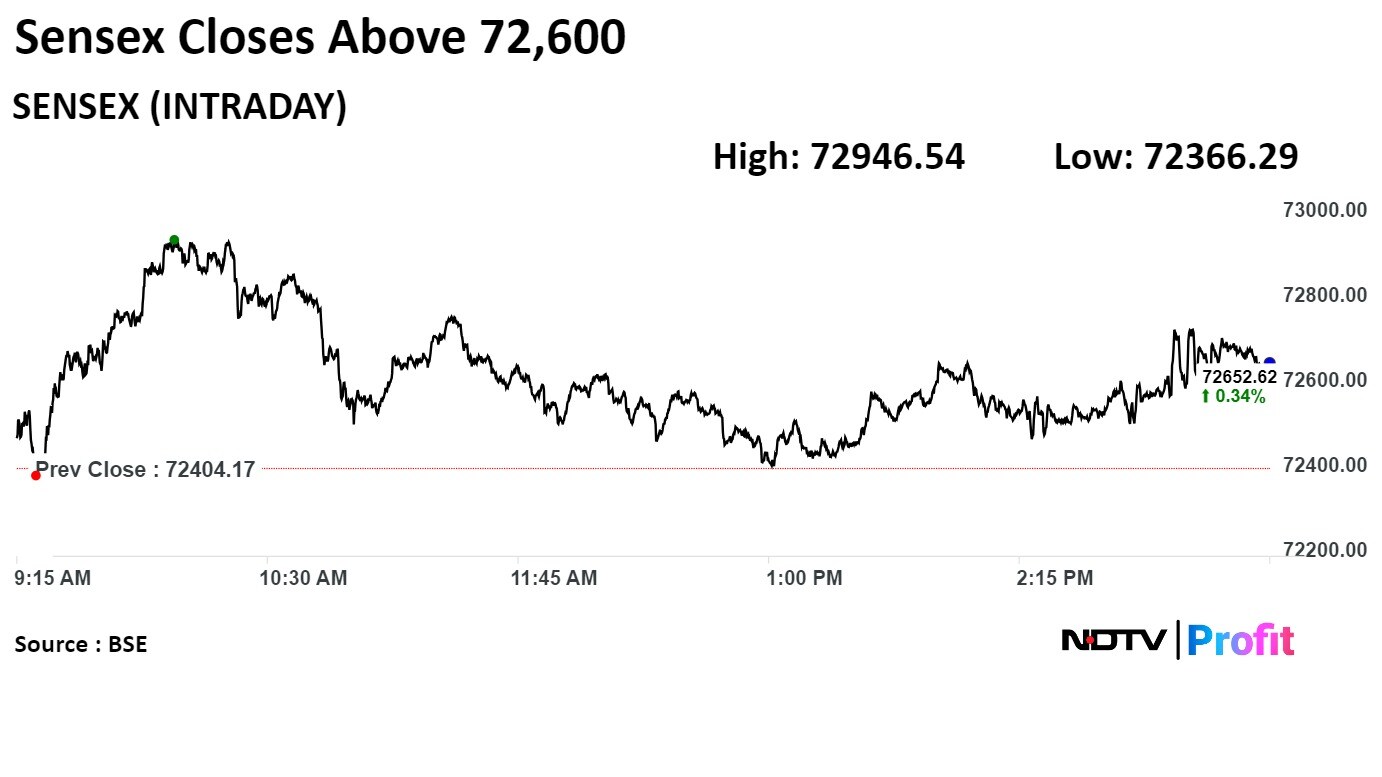

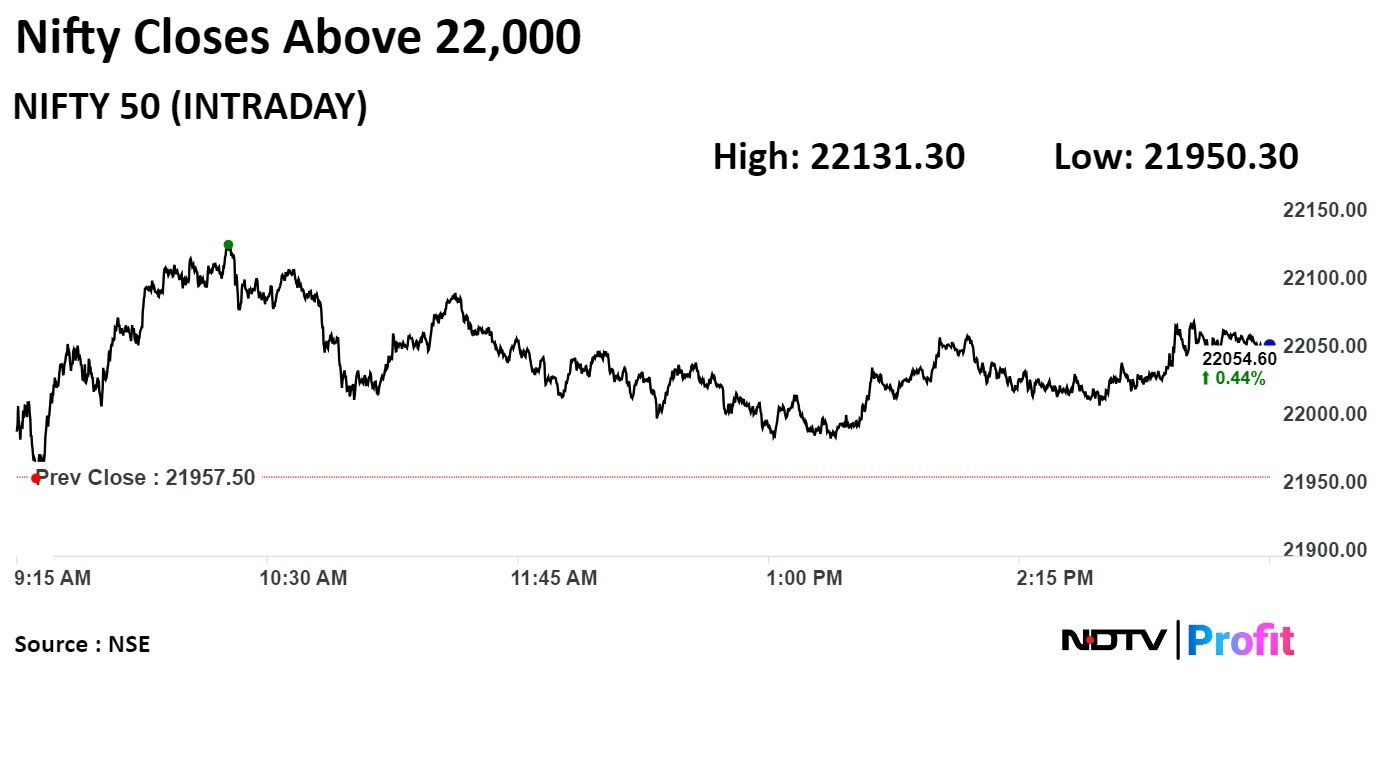

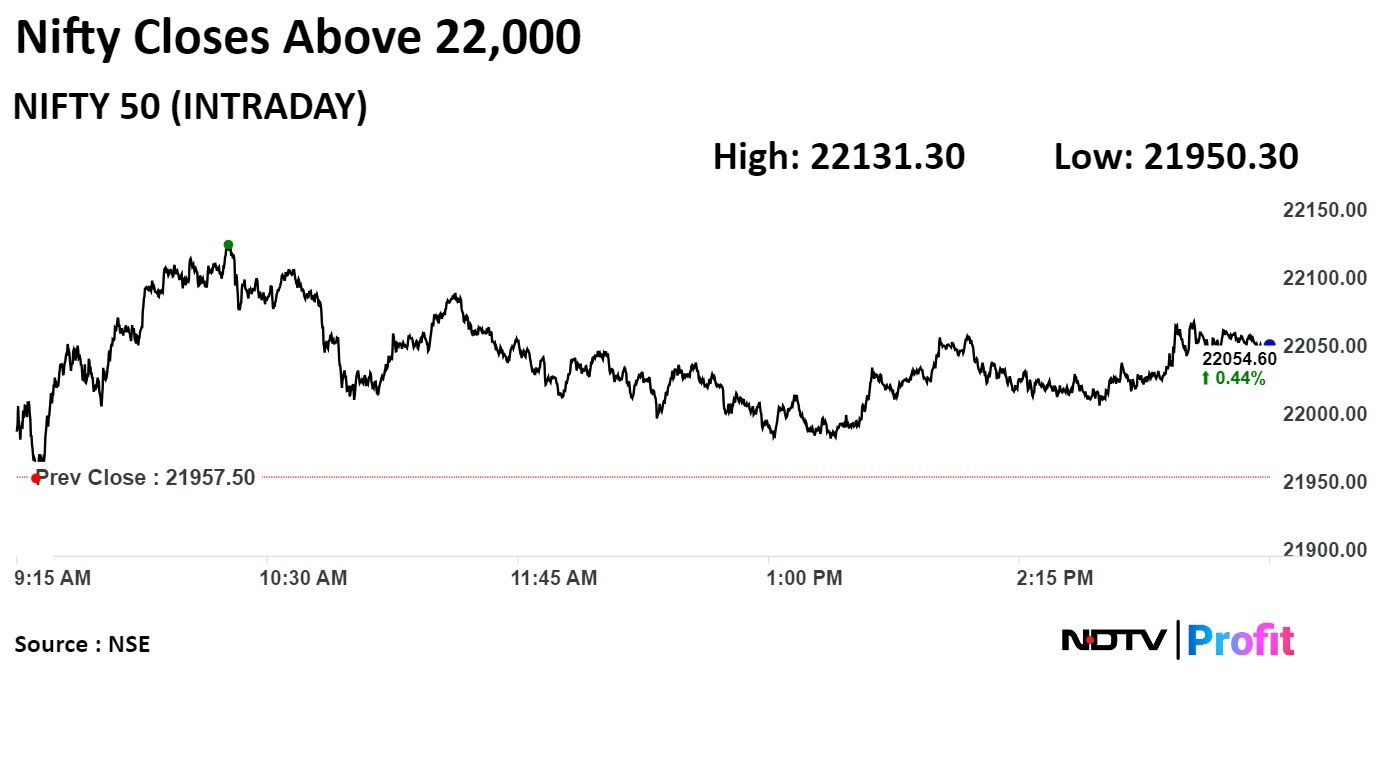

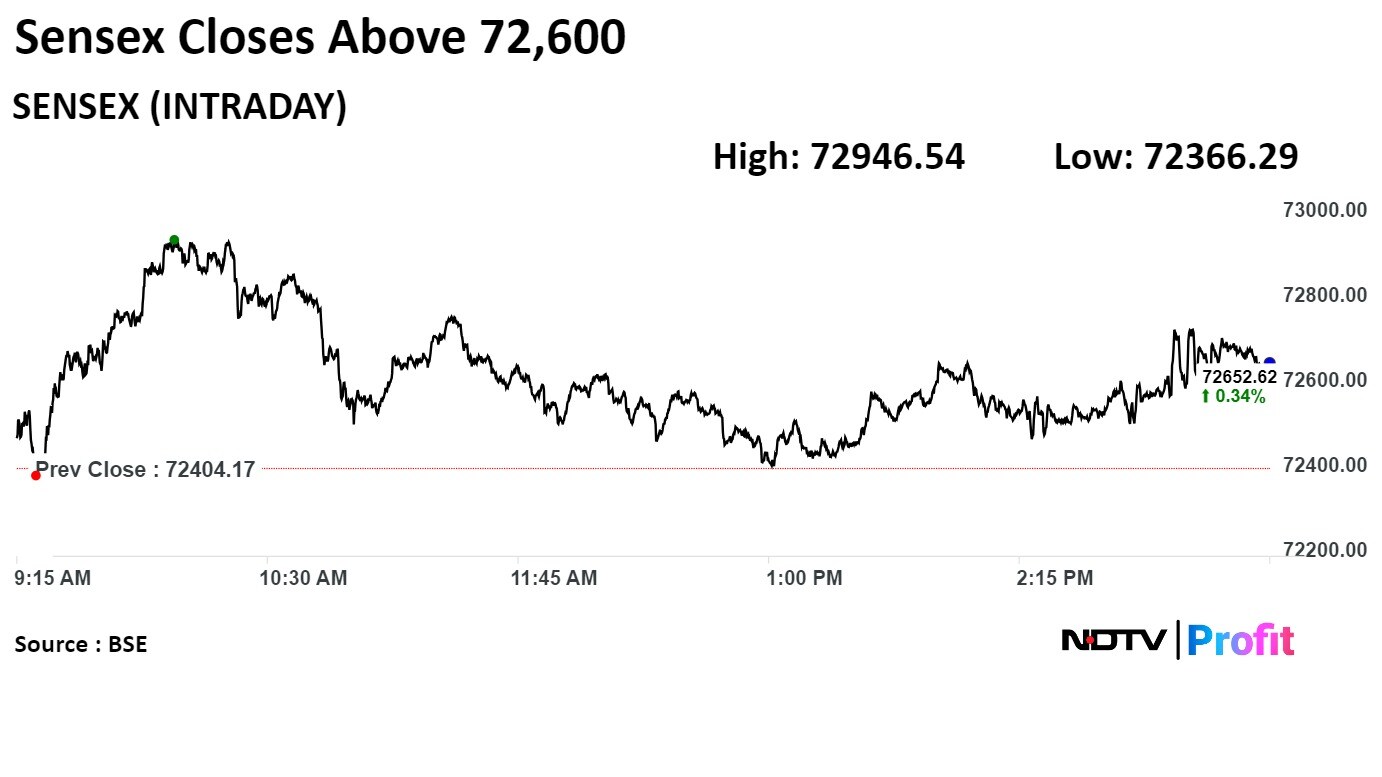

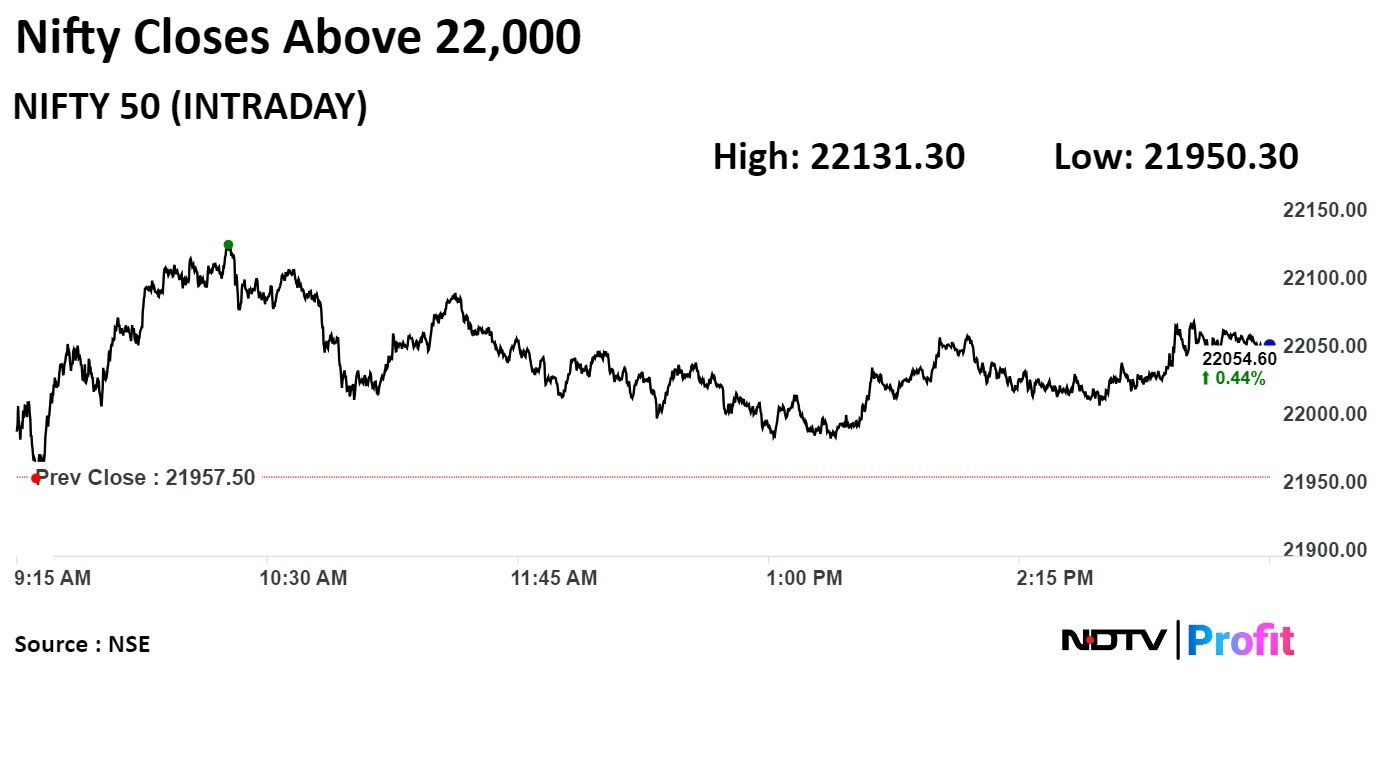

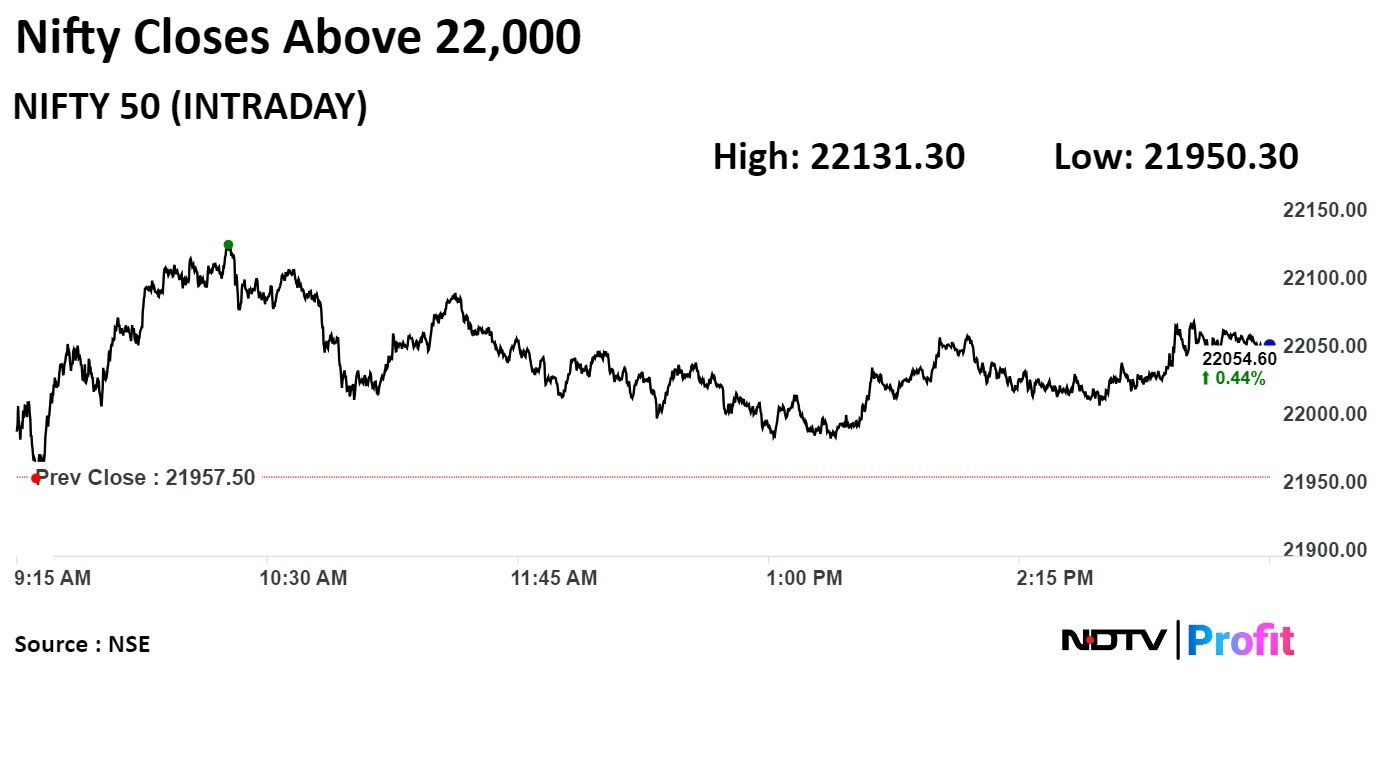

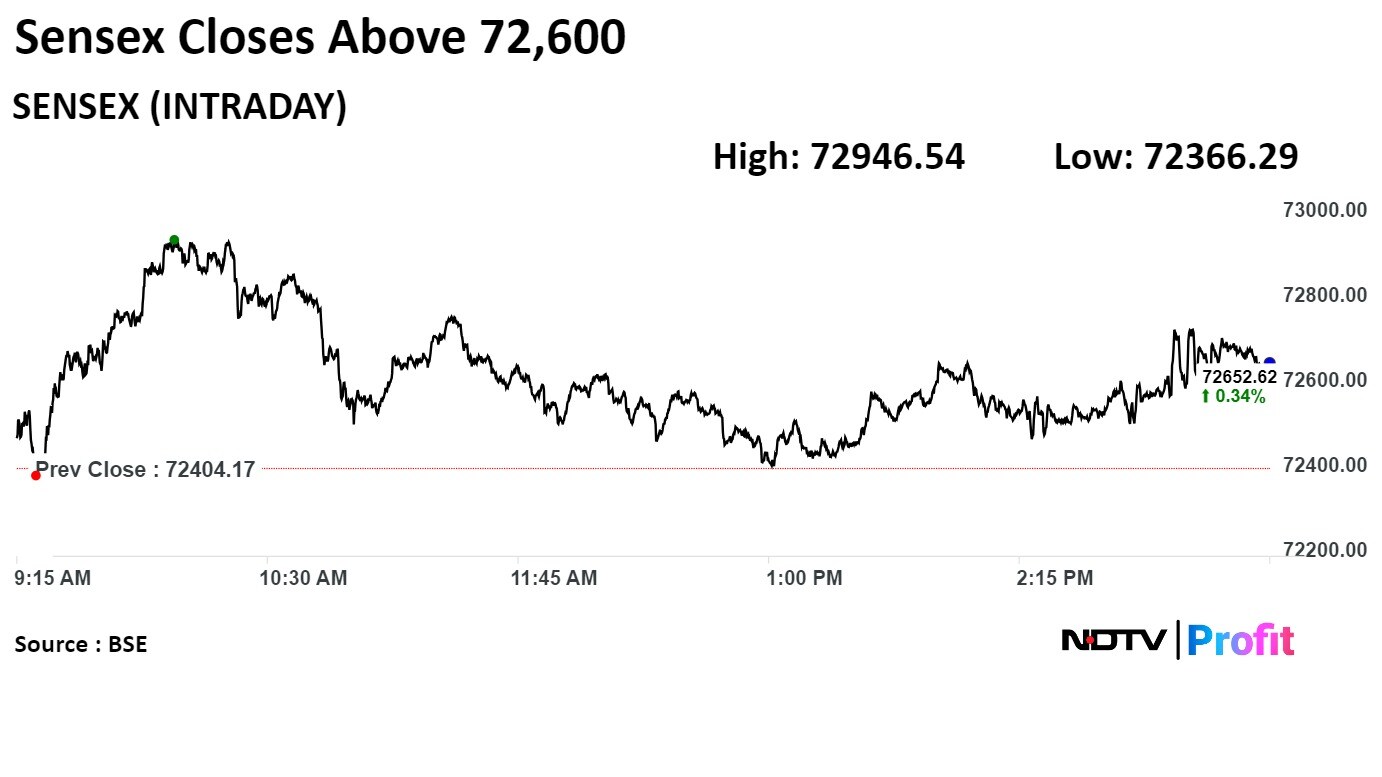

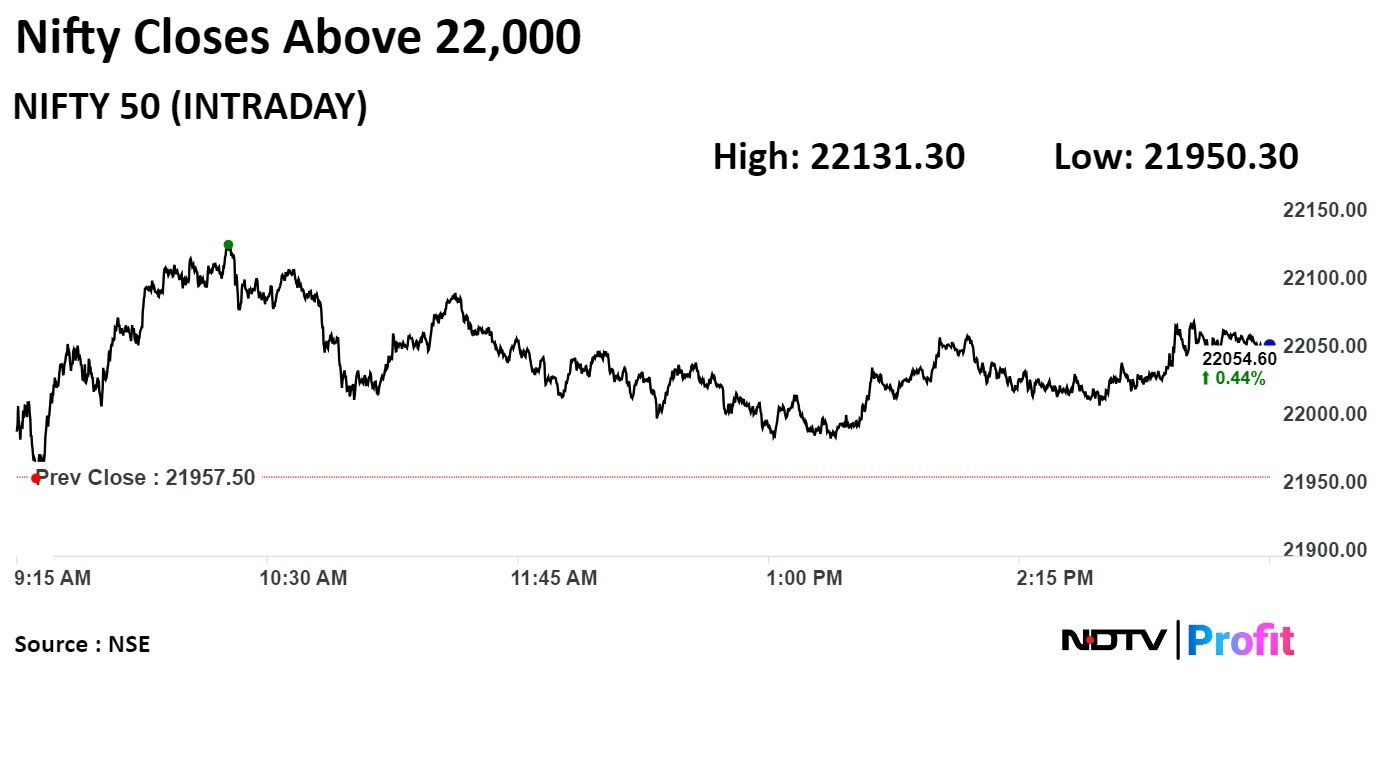

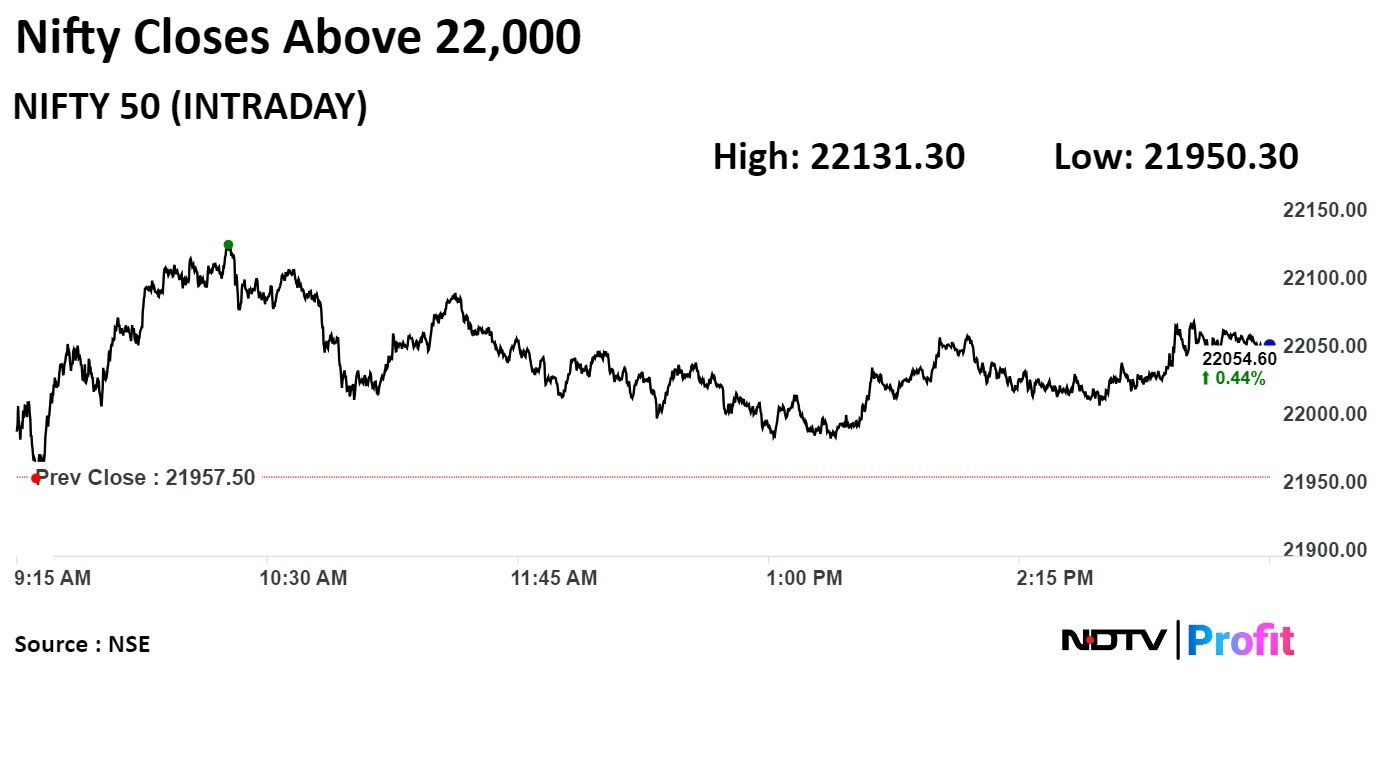

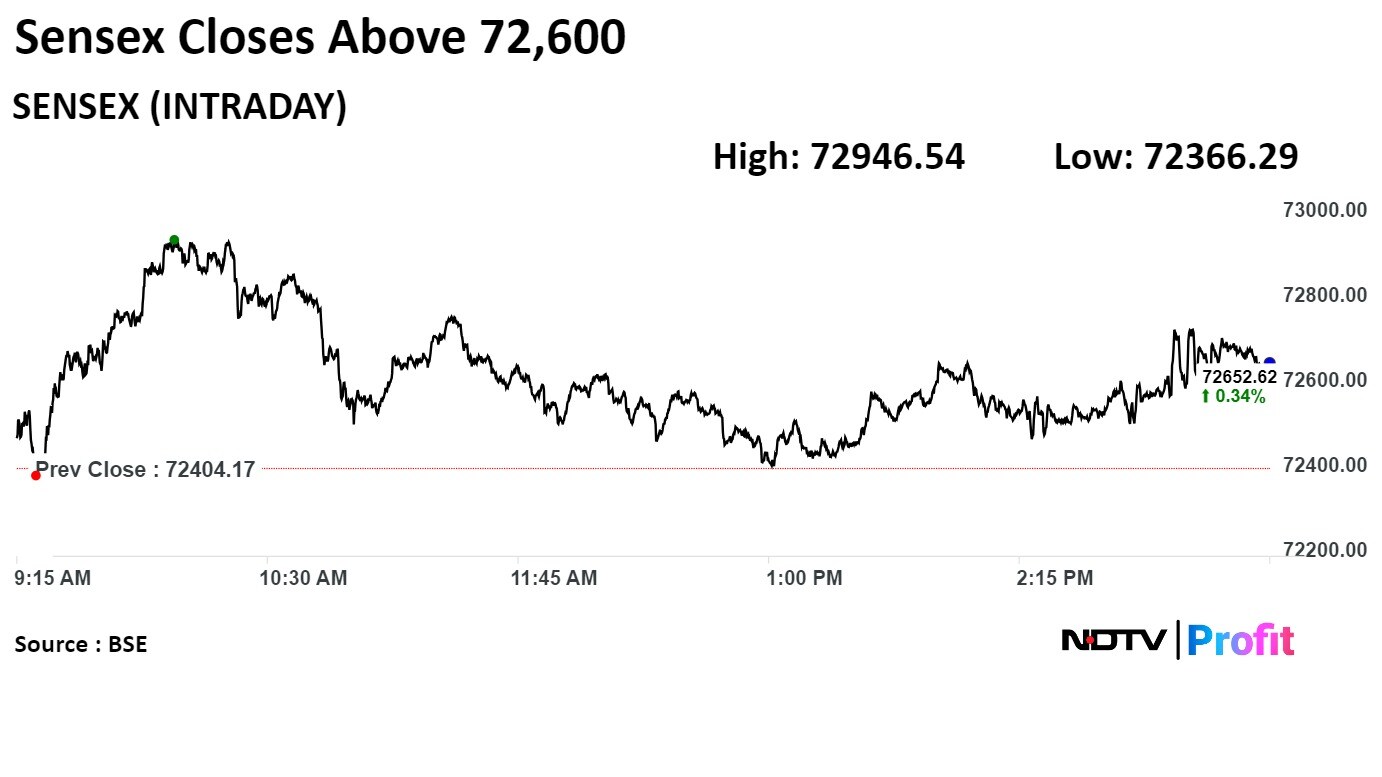

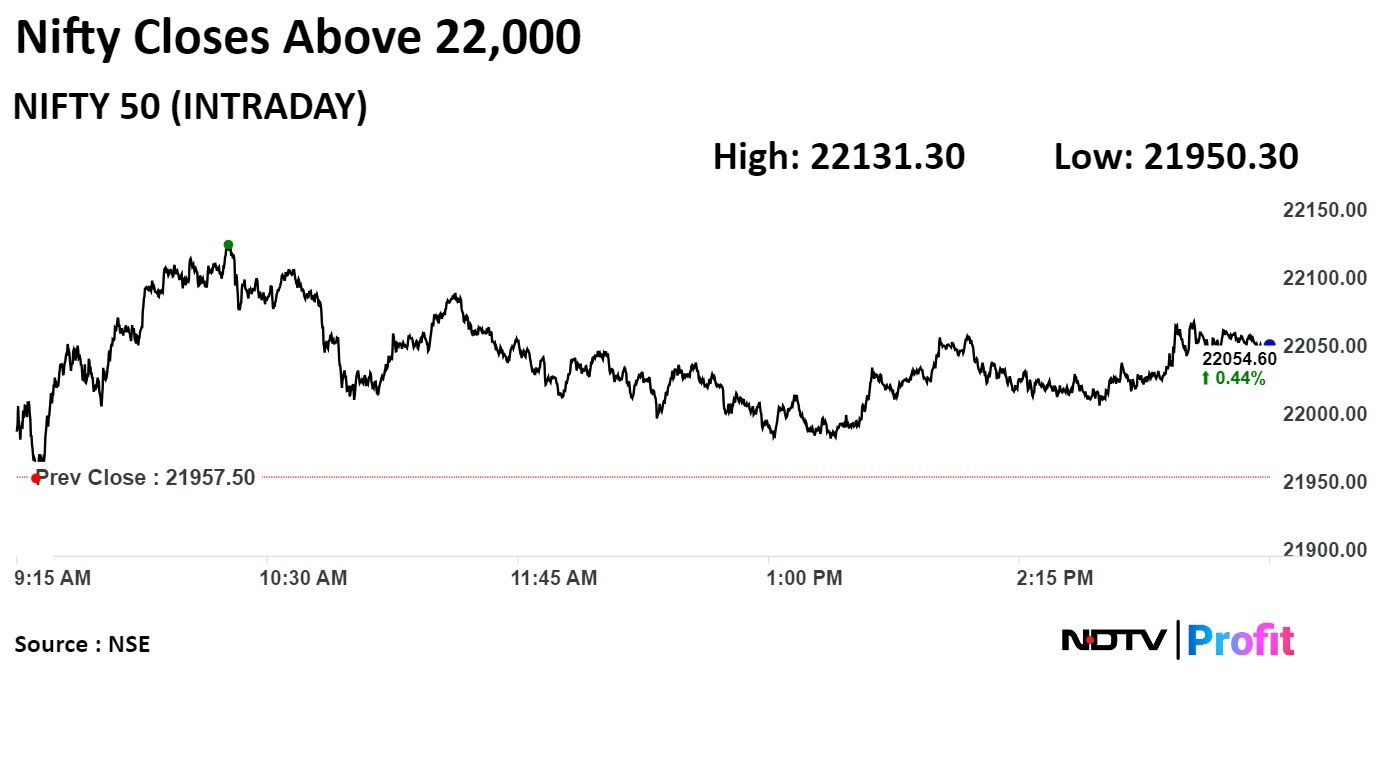

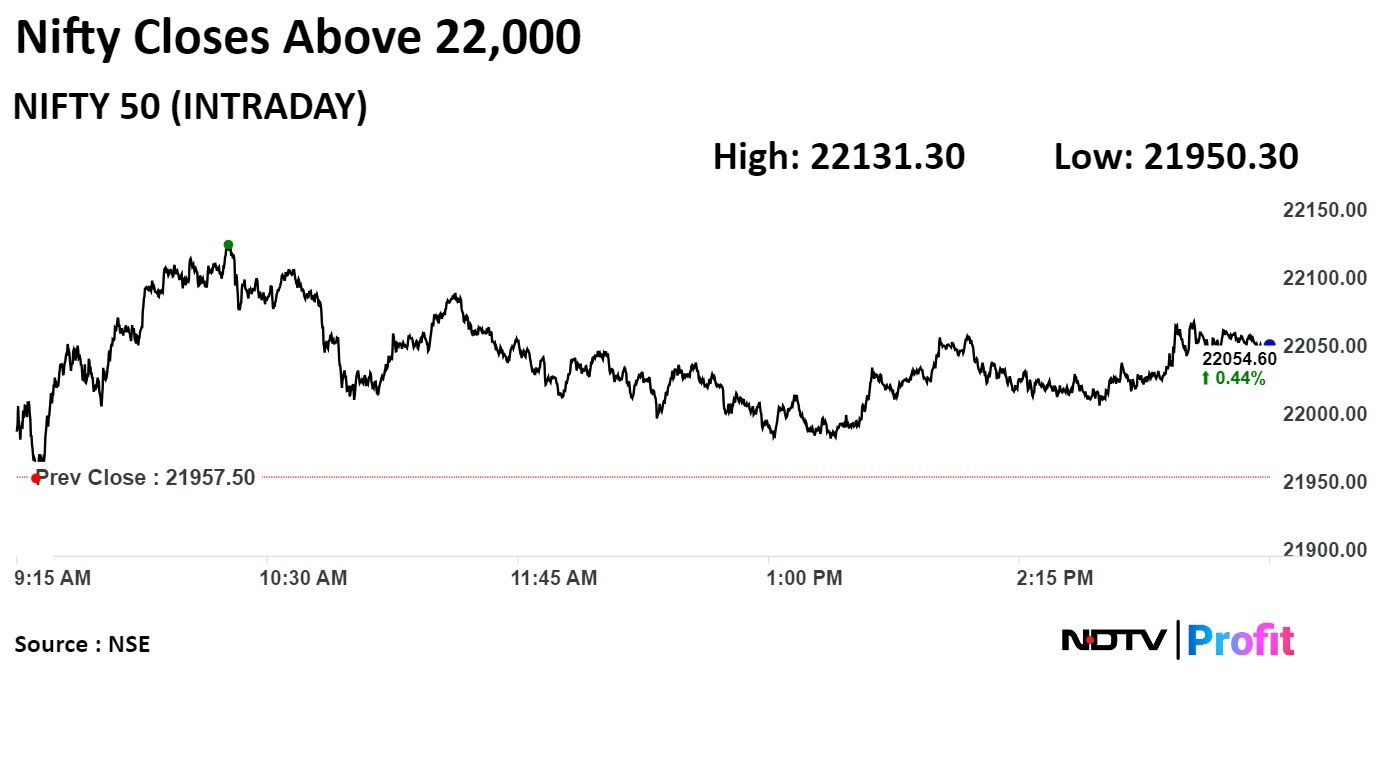

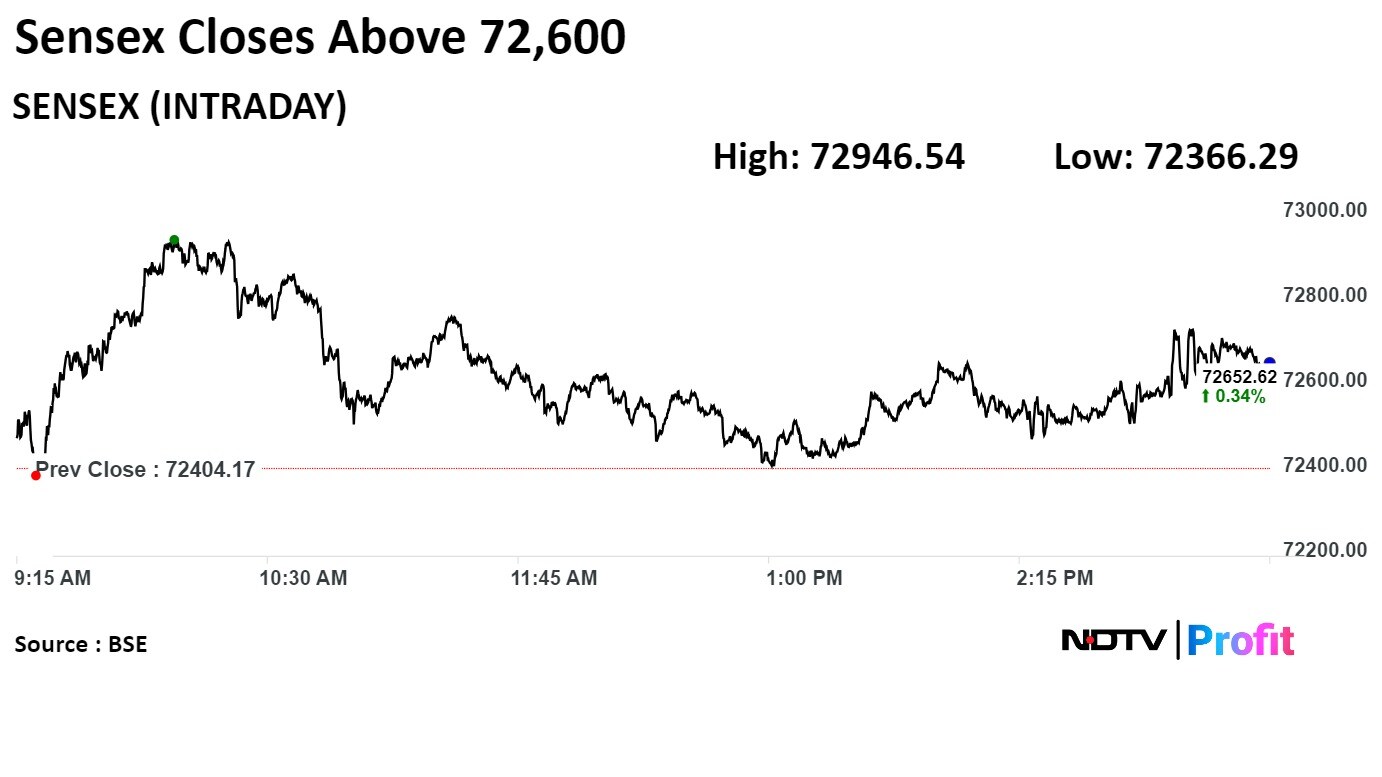

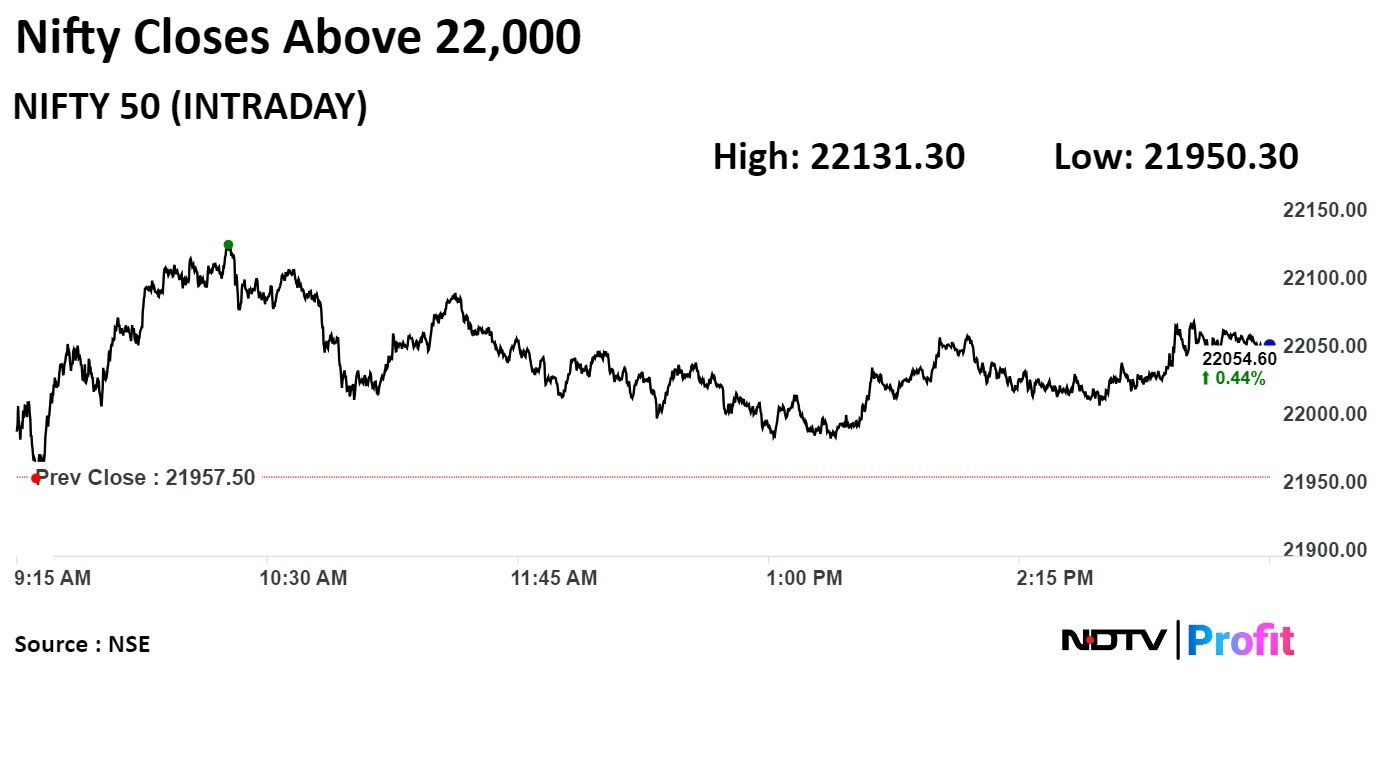

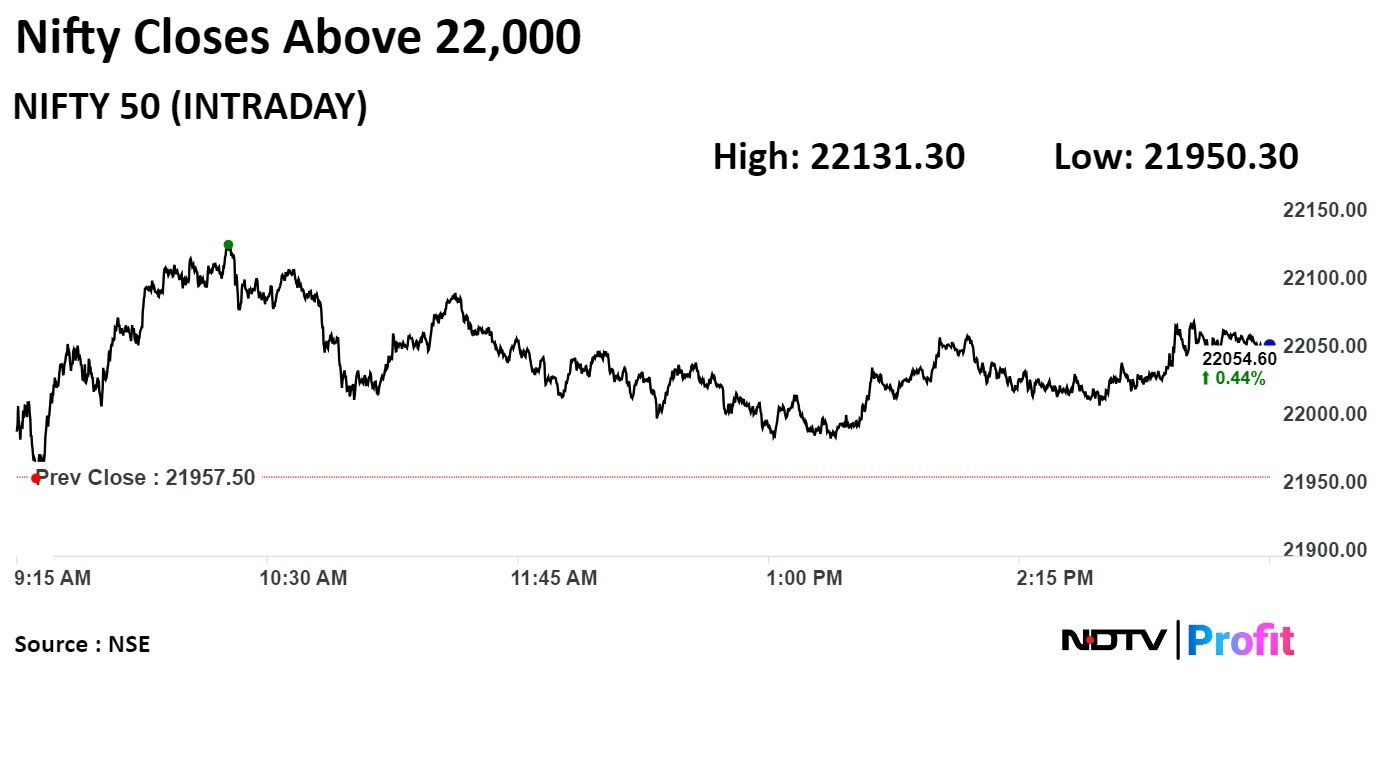

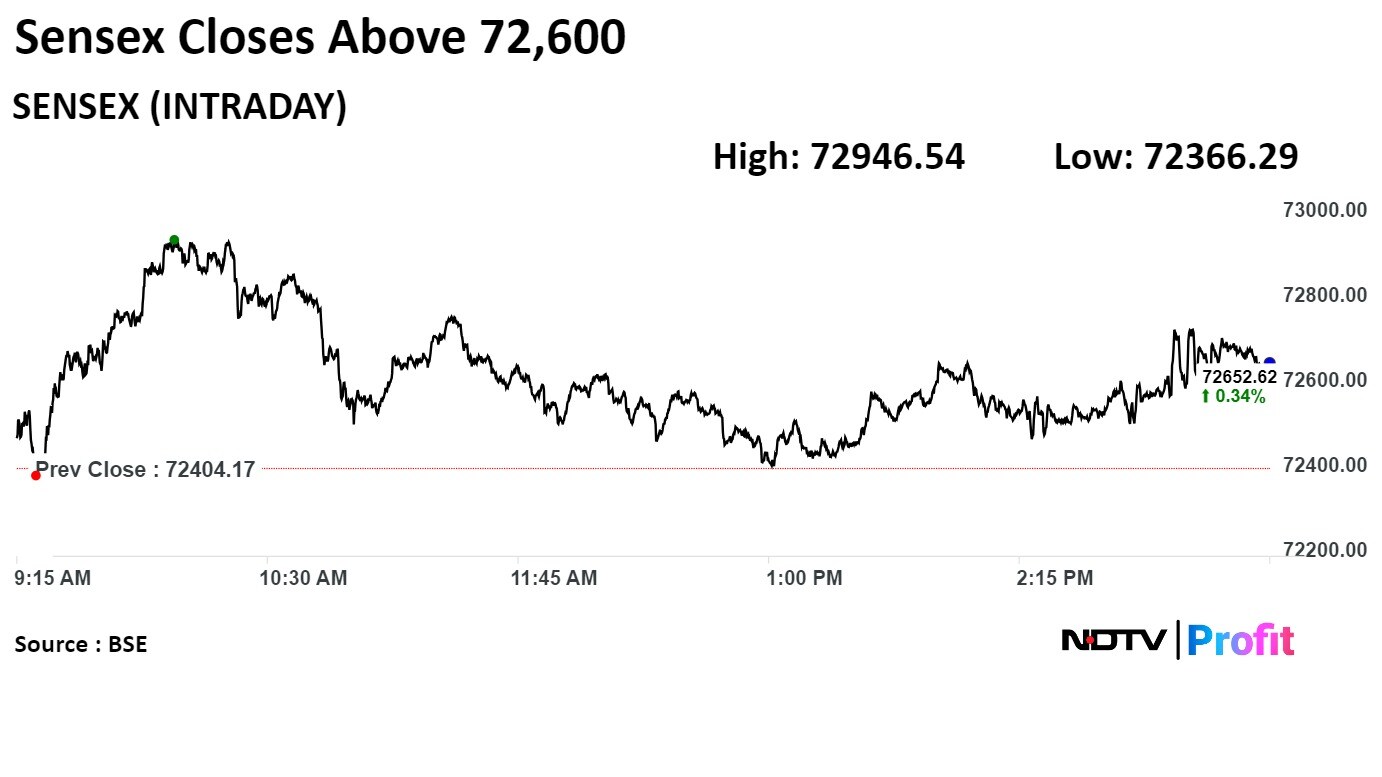

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

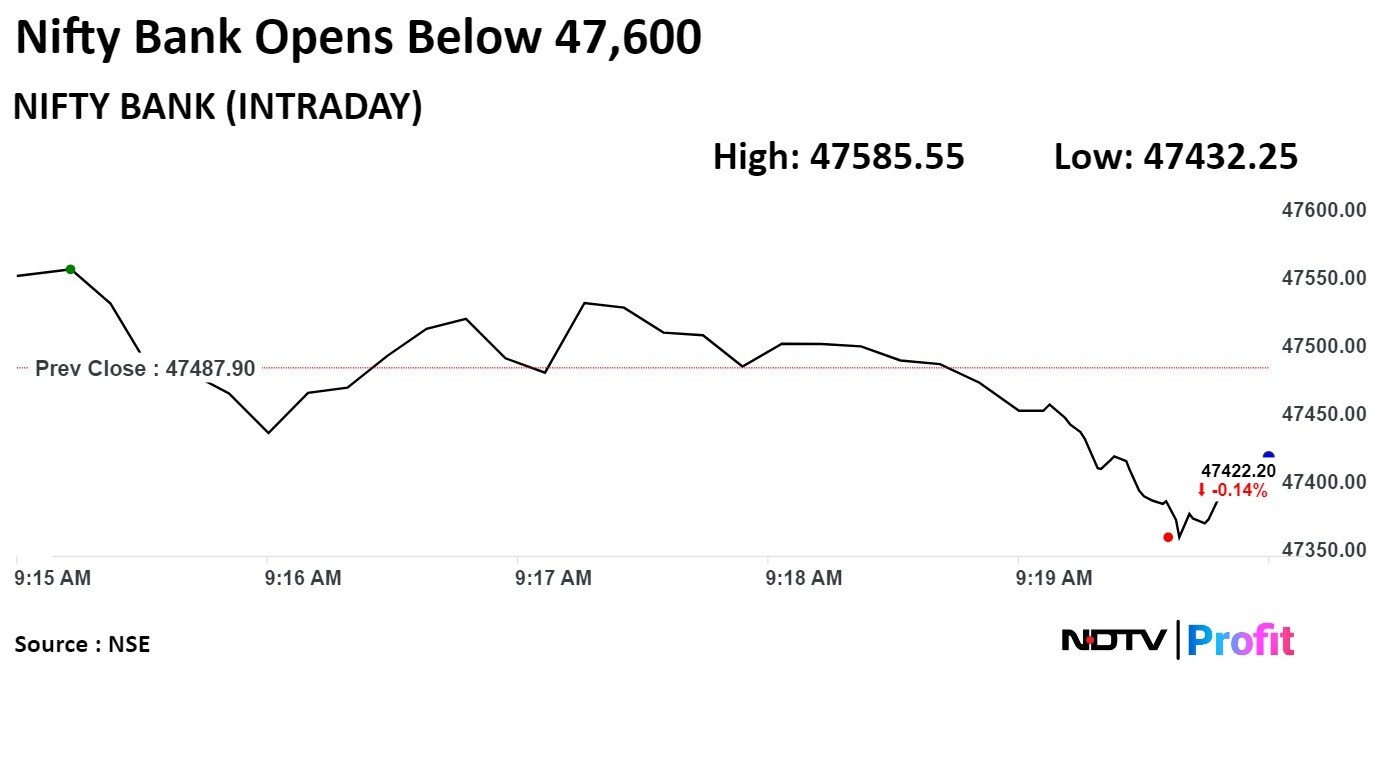

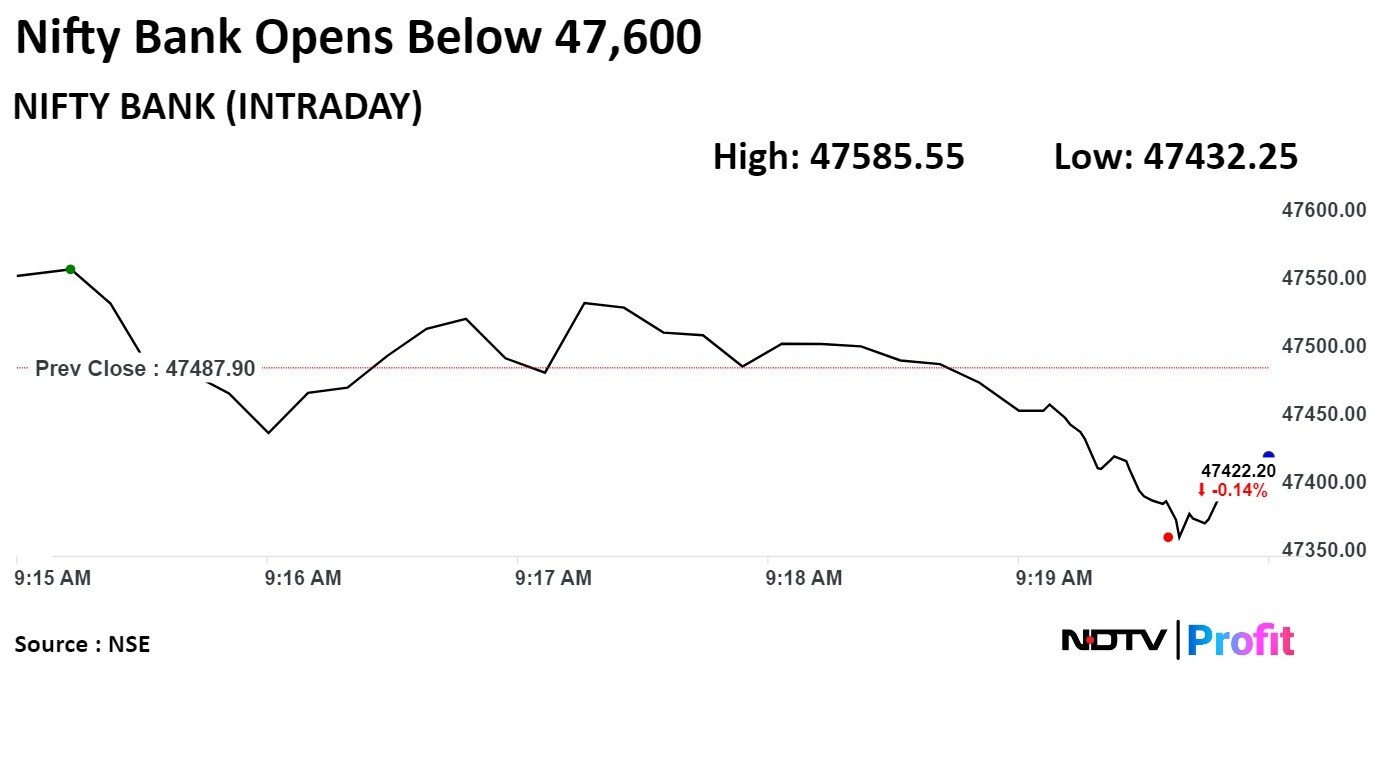

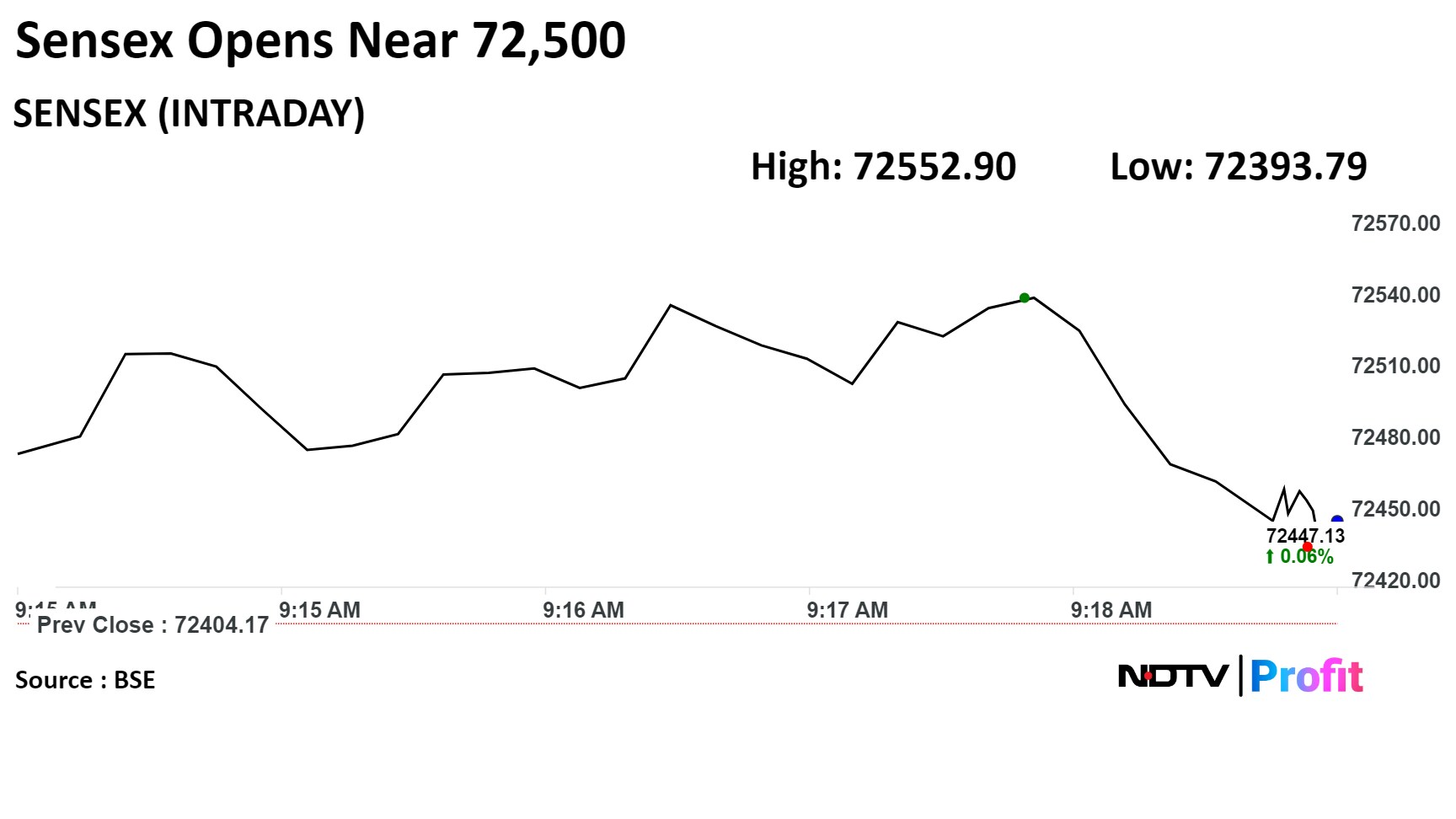

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

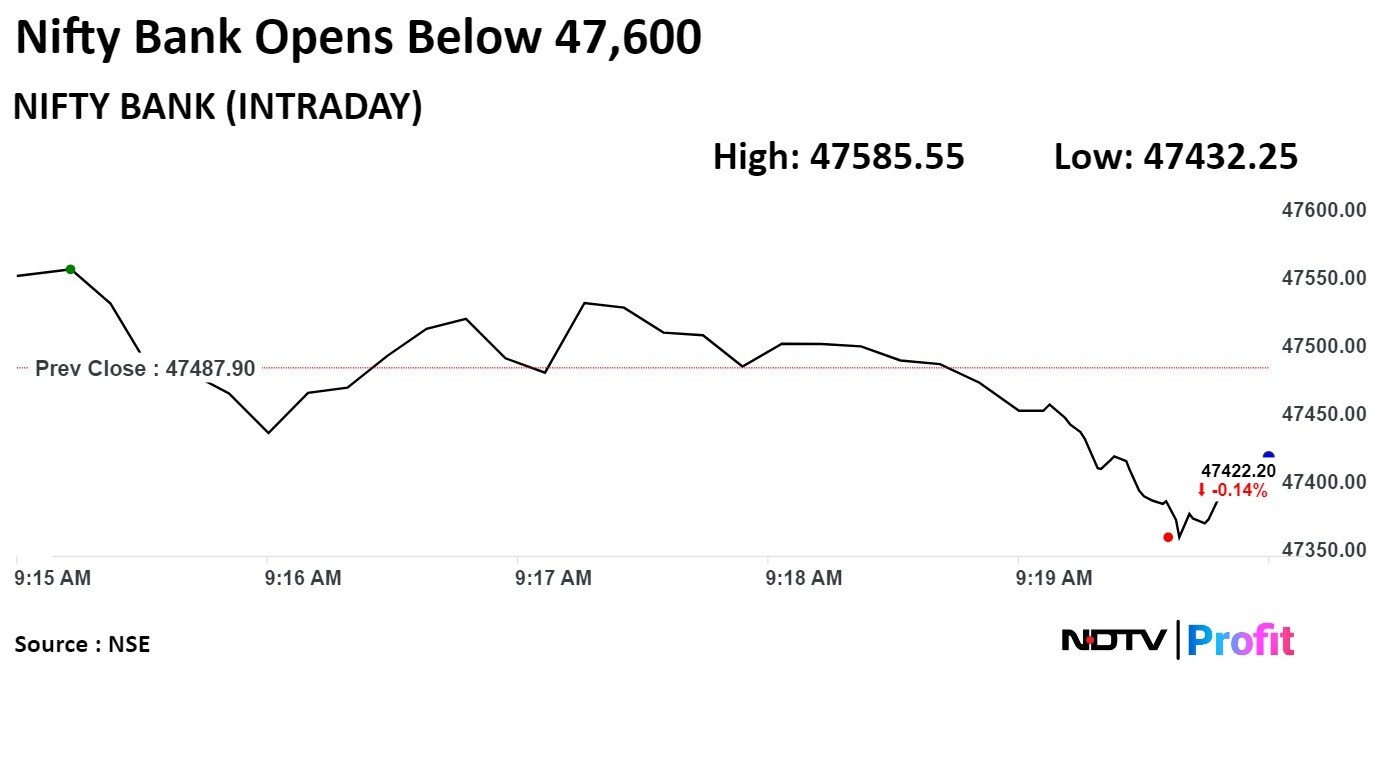

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

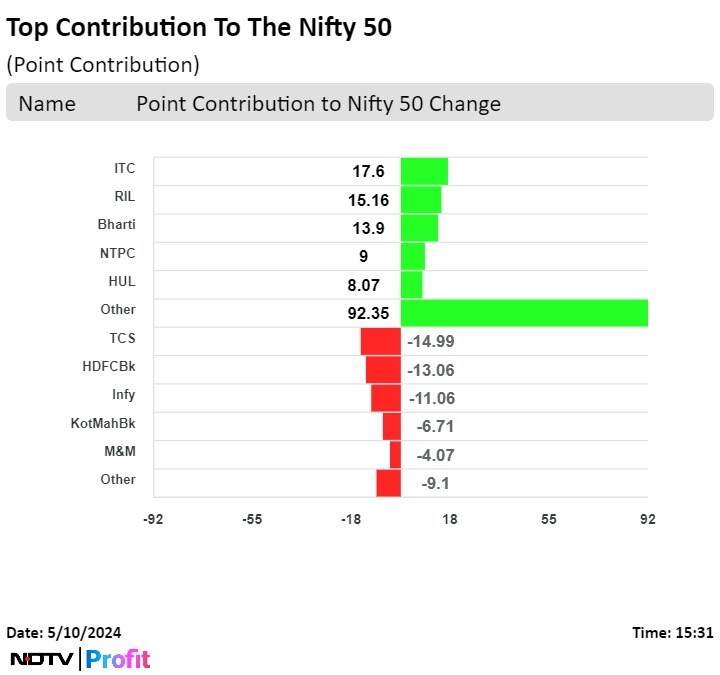

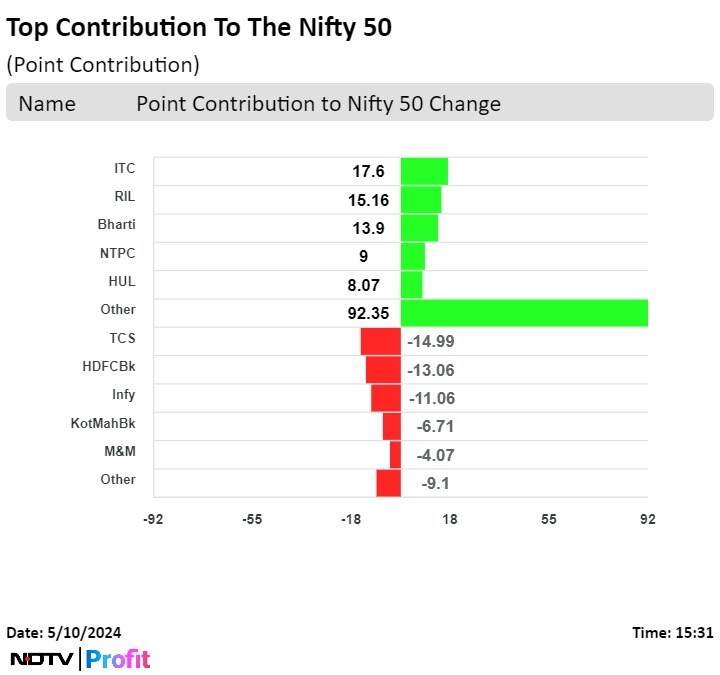

Shares of ITC Ltd., Reliance Industries Ltd., Bharti Airtel Ltd., NTPC Ltd., and Hindustan Unilever Ltd. contributed the most to the gains.

While those of Tata Consultancy Services Ltd., HDFC Bank Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., and Mahindra & Mahindra Ltd. capped the upside.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Shares of ITC Ltd., Reliance Industries Ltd., Bharti Airtel Ltd., NTPC Ltd., and Hindustan Unilever Ltd. contributed the most to the gains.

While those of Tata Consultancy Services Ltd., HDFC Bank Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., and Mahindra & Mahindra Ltd. capped the upside.

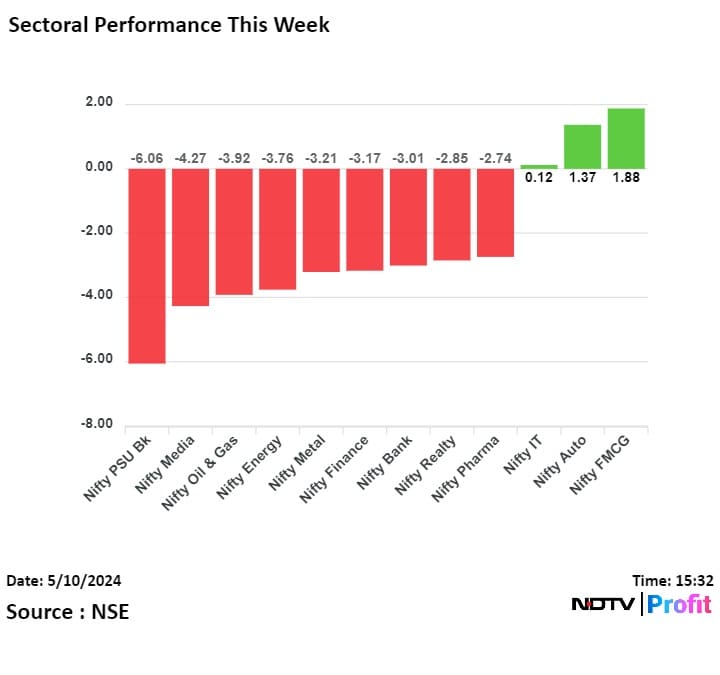

Most sectors ended the week lower but Nifty FMCG, Nifty Auto, and Nifty IT outperformed.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Shares of ITC Ltd., Reliance Industries Ltd., Bharti Airtel Ltd., NTPC Ltd., and Hindustan Unilever Ltd. contributed the most to the gains.

While those of Tata Consultancy Services Ltd., HDFC Bank Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., and Mahindra & Mahindra Ltd. capped the upside.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Benchmark equity indices logged their worst week in nearly months as they lost nearly 2% this week. Today, the indices ended higher after five sessions led by gains in BPCL and Hero MotoCorp.

The Nifty ended 0.44% or 97.10 points higher at 22,054.60 and the Sensex rose 248.45 points or 0.34% to close at 72,652.62. On a weekly basis, the Nifty lost 1.87% and the Sensex lost 1.64%, marking their worst week since the one that ended March 15.

Both the Nifty and Bank nifty has given a very bad weekly close and they are on a very critical support zone, said Kunal Shah, senior technical & derivative analyst at LKP Securities. He added that the last hope for Nifty is 21,800, if that breaks correction will continue to 21,200 mark.

For Nifty Bank, the larger part of the correction is over, said Shah. The next immediate support will be 47050 which is a 100-day exponential moving average.

Shares of ITC Ltd., Reliance Industries Ltd., Bharti Airtel Ltd., NTPC Ltd., and Hindustan Unilever Ltd. contributed the most to the gains.

While those of Tata Consultancy Services Ltd., HDFC Bank Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., and Mahindra & Mahindra Ltd. capped the upside.

Most sectors ended the week lower but Nifty FMCG, Nifty Auto, and Nifty IT outperformed.

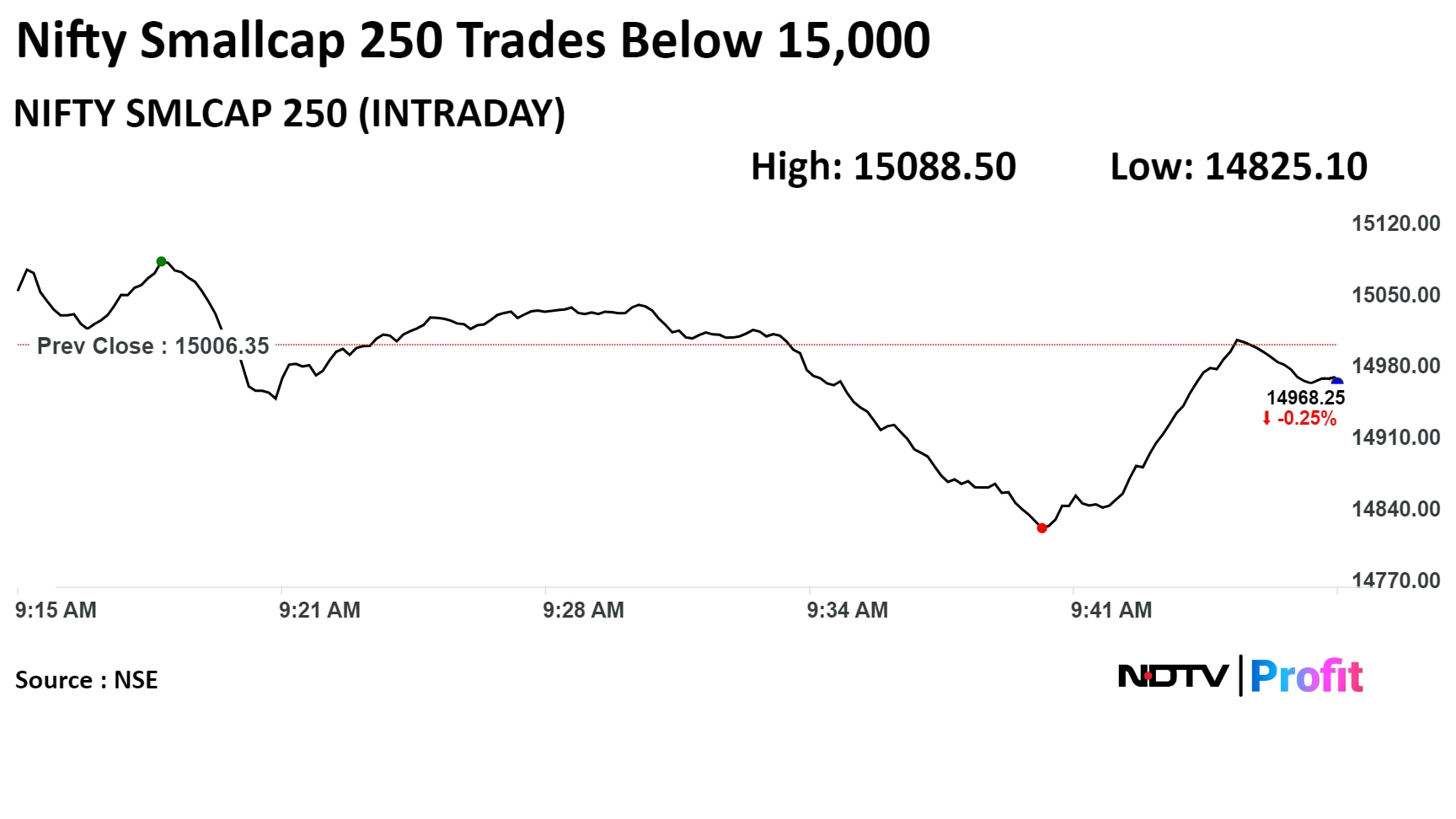

Broader markets outperformed benchmark indices. The S&P BSE Midcap ended 0.81% higher, and the S&P BSE Smallcap settled 0.80% higher.

On BSE, 16 sectoral indices advanced, and four declined out of 20. The S&P BSE Utilities was the top performing sector, while the S&P BSE IT index emerged as the worst performing sector among peers on Friday.

Market breadth was skewed in favour of buyers. Around 2,216 stock advanced, 1,590 stocks fell, and 125 stocks remained unchanged on BSE.

Net profit at Rs 4,886 crore vs Rs 4,775 crore, up 2.3% YoY

NII at Rs 11,792 crore vs Rs 11,525 crore, up 2% YoY

Gross NPA at 2.92% vs 3.08% QoQ

Net NPA at 0.68% vs 0.70% QoQ

Revenue at Rs 546.88 crore vs Rs 596.63 crore, down 8.34%

EBITDA at Rs 143.49 crore vs Rs 202.44 crore, down 29.11%

Margin at 26.23% vs 33.93%, down 769 bps

Net profit at Rs 114.55 crore vs Rs 149.44 crore, down 23.34%

US FDA completes inspection at Unit VII of Apitoria Pharma with 1 observation

Source: Exchange Filing

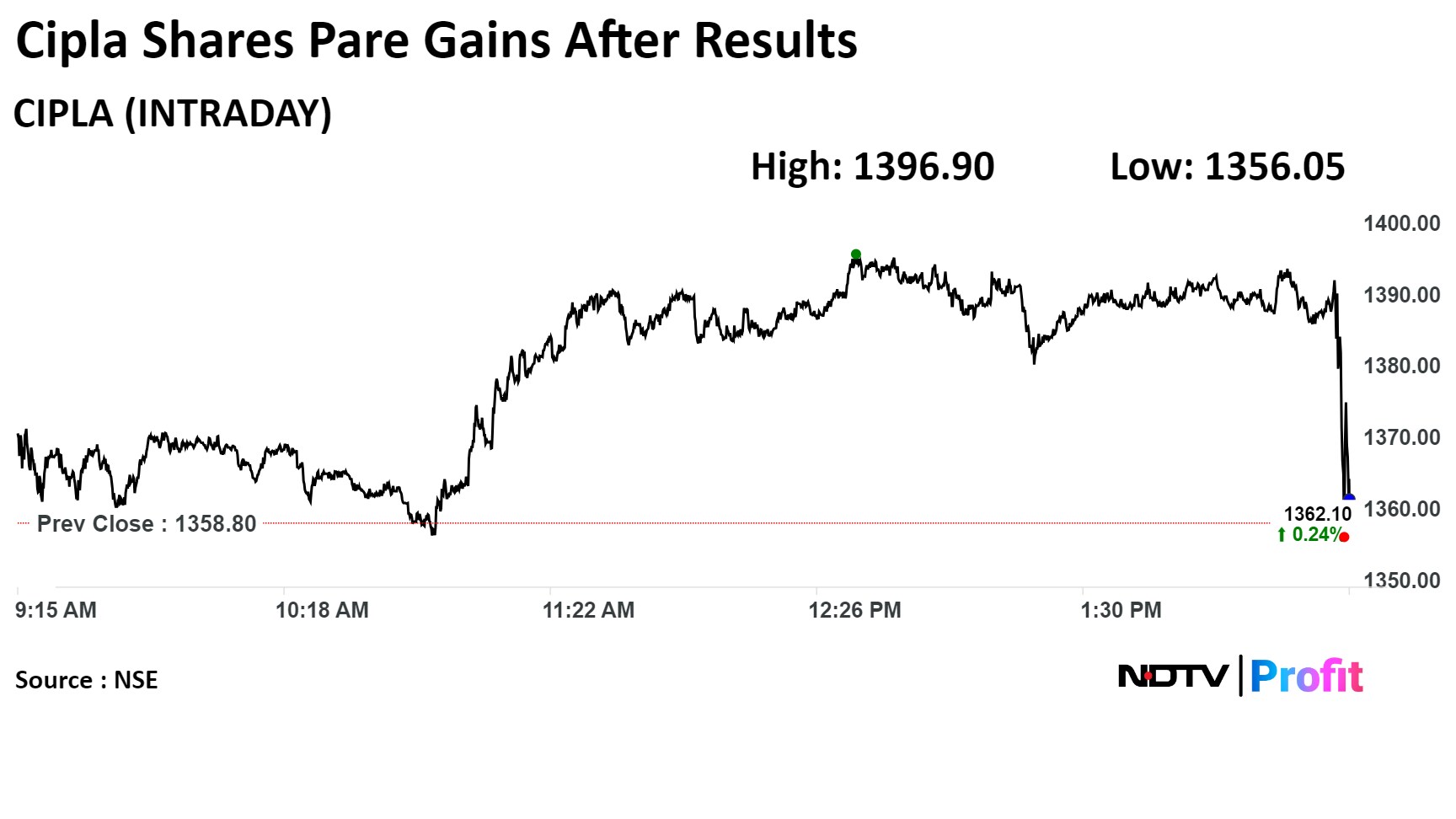

Net profit at Rs 932 crore vs Bloomberg estimates of Rs 868 crore

Revenue at Rs 6,163 crore vs Bloomberg estimates of Rs 6,234 crore

EBITDA at Rs 1,316 crore vs Bloomberg estimates of Rs 1,370 crore

Margin at 21.4% vs Bloomberg estimates of 22%

Board recommends a final dividend of Rs 13/share

Net profit at Rs 932 crore vs Bloomberg estimates of Rs 868 crore

Revenue at Rs 6,163 crore vs Bloomberg estimates of Rs 6,234 crore

EBITDA at Rs 1,316 crore vs Bloomberg estimates of Rs 1,370 crore

Margin at 21.4% vs Bloomberg estimates of 22%

Board recommends a final dividend of Rs 13/share

Revenue at Rs 1,497.33 crore vs Rs 1,455.98 crore, up 2.84%

EBITDA at Rs 930.8 crore vs Rs 856.38 crore, up 10.59%

Margin at 62.16% vs 58.81%, up 334 bps

Net profit at Rs 905.08 crore vs Rs 721.94 crore, up 25.36%

Board declares fourth interim dividend of Rs 10.8/share

Revenue at Rs 1,497.33 crore vs Rs 1,455.98 crore, up 2.84%

EBITDA at Rs 930.8 crore vs Rs 856.38 crore, up 10.59%

Margin at 62.16% vs 58.81%, up 334 bps

Net profit at Rs 905.08 crore vs Rs 721.94 crore, up 25.36%

Board declares fourth interim dividend of Rs 10.8/share

Downgrade to Sell with a reduces target of Rs 1,850 vs Rs 2,675 earlier.

SRF’s 4Q EBITDA was down 25% YoY but up 23% QoQ

Management has guided for 20% growth in revenues from Chemicals segment in FY25

Fluorochemicals business impacted by Chinese dumping of refrigerants

Management expects US market to decline in 2024 due to lower quotas

Specialty chemicals to rampup of multiple new plants commissioned in FY24

Lower FY25/26 EBITDA by 20-23% on

-slower than expected rampup of specialty chemicals capacities

-weaker ref gas volumes/pricing

-lower margins in the packaging films business

Revenue at Rs 631.69 crore vs Rs 560.41 crore, up 12.71%

EBITDA at Rs 102.92 crore vs Rs 98.13 crore, up 4.88%

Margin at 16.29% vs 17.51%, down 121 bps

Net profit at Rs 2.04 crore vs Rs 135.48 crore, down 98.49%

Revenue at Rs 545.4 crore vs Rs 491 crore, up 11.07%

EBITDA at Rs 144.7 crore vs Rs 115.6 crore, up 25.17%

Margin at 26.53% vs 23.54%, up 298 bps

Net profit at Rs 85.8 crore vs Rs 56.9 crore, up 50.79%

Revenue at Rs 545.4 crore vs Rs 491 crore, up 11.07%

EBITDA at Rs 144.7 crore vs Rs 115.6 crore, up 25.17%

Margin at 26.53% vs 23.54%, up 298 bps

Net profit at Rs 85.8 crore vs Rs 56.9 crore, up 50.79%

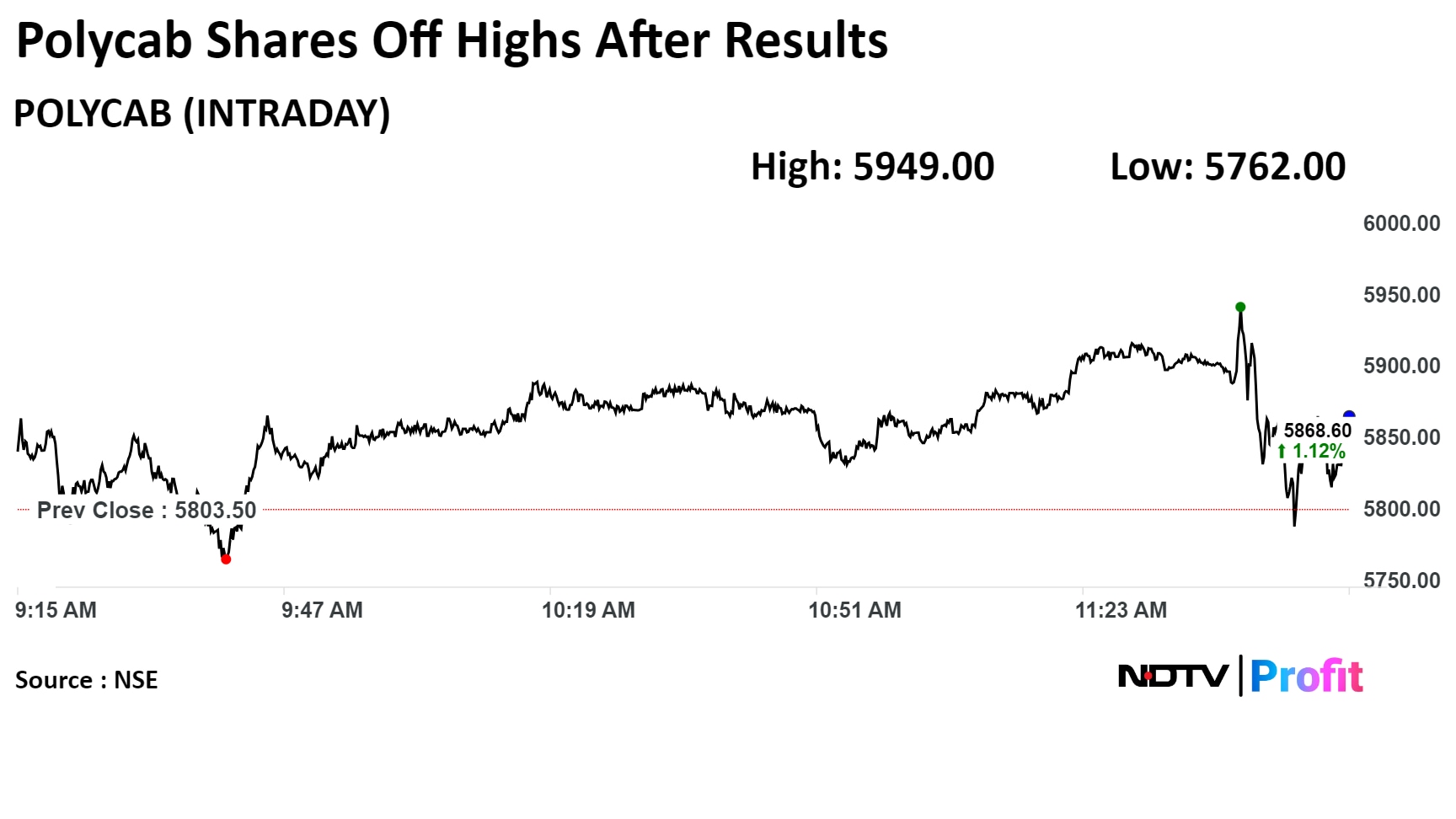

Shares of Polycab Ltd. rose to its highest level since its listing on the bourses after it posted 29% uptick in its net profit during January-March.

Its consolidated net profit rose 29% on the year to Rs 553 crore in fourth quarter from Rs 429 crore.

Shares of Polycab Ltd. rose to its highest level since its listing on the bourses after it posted 29% uptick in its net profit during January-March.

Its consolidated net profit rose 29% on the year to Rs 553 crore in fourth quarter from Rs 429 crore.

The scrip rose as much as 8.52% to Rs 6,297.80 apiece, the highest level since its listing on April 16, 2019. It was trading 8.20% higher at Rs 6,279.40 apiece, as of 1:42 p.m. This compares to a 0.33% advance in the NSE Nifty 50 Index.

It has risen 91.51% in 12 months, and on year-to-date basis, it has risen 11.99%. Total traded volume so far in the day stood at 4.9 times its 30-day average. The relative strength index was at 75.89. which implied the stock is overbought.

Out of 32 analysts tracking the company, 22 maintain a 'buy' rating, six recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 9.6%.

Buys 80.7% stake in Home Credit India for Rs 554 crore

Source: Exchange filing

Commences commercial operations at its computing server manufacturing plant in Faridabad, Haryana

Source: Exchange filing

Gets approval for Sevelamer Carbonate tablets

Source: Exchange filing

Indian Coast Guard in pact with Hindalco for manufacturing & supply of marine grade aluminium

Source: Press release

The scrip rose as much as 9.46% intraday to Rs 752 apiece, the highest level, before paring gains to trade 7.08% higher at Rs 781.95 apiece, as of 12:40 p.m. This compares to a 0.33% advance in the NSE Nifty 50.

It has risen 15.64% on a year-to-date basis and 103.61% in the last 12 months. Total traded volume so far in the day stood at 15.98 times its 30-day average. The relative strength index was at 73.32, indicating that the stock may be overbought.

Out of the nine analysts tracking the company, six maintain a 'buy' rating and three recommend a 'hold, according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.5%.

The scrip rose as much as 9.46% intraday to Rs 752 apiece, the highest level, before paring gains to trade 7.08% higher at Rs 781.95 apiece, as of 12:40 p.m. This compares to a 0.33% advance in the NSE Nifty 50.

It has risen 15.64% on a year-to-date basis and 103.61% in the last 12 months. Total traded volume so far in the day stood at 15.98 times its 30-day average. The relative strength index was at 73.32, indicating that the stock may be overbought.

Out of the nine analysts tracking the company, six maintain a 'buy' rating and three recommend a 'hold, according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.5%.

Revenue at Rs 5,592 crore vs Rs 4,324 crore, up 29%

EBITDA at Rs 762 crore vs Rs 609 crore, up 25%

Margin at 13.6% vs 14.1%

Net profit at Rs 553 crore vs Rs 429 crore, up 29%

Revenue at Rs 5,592 crore vs Rs 4,324 crore, up 29%

EBITDA at Rs 762 crore vs Rs 609 crore, up 25%

Margin at 13.6% vs 14.1%

Net profit at Rs 553 crore vs Rs 429 crore, up 29%

Banking system liquidity at highest level since Feb 28 on payments for tax deducted at source and excise duty, say call money traders

--Liquidity in deficit of Rs 1.77 lakh crore as on May 9

--Banks have maintained excess CRR balances of Rs 18,000 crore

--Traders expect another variable rate repo auction to meet short-term liquidity needs

--3-day call money rate seen in the range of 6.70-6.80%

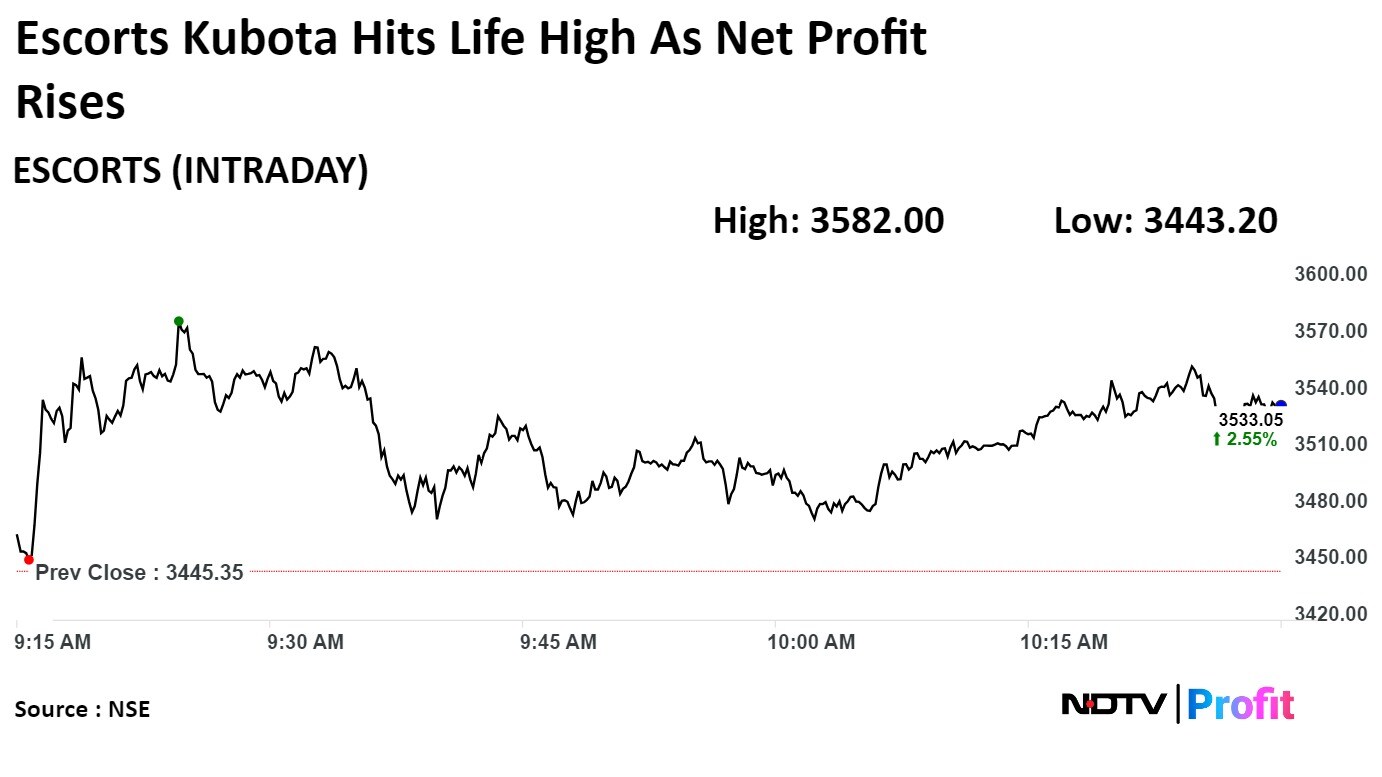

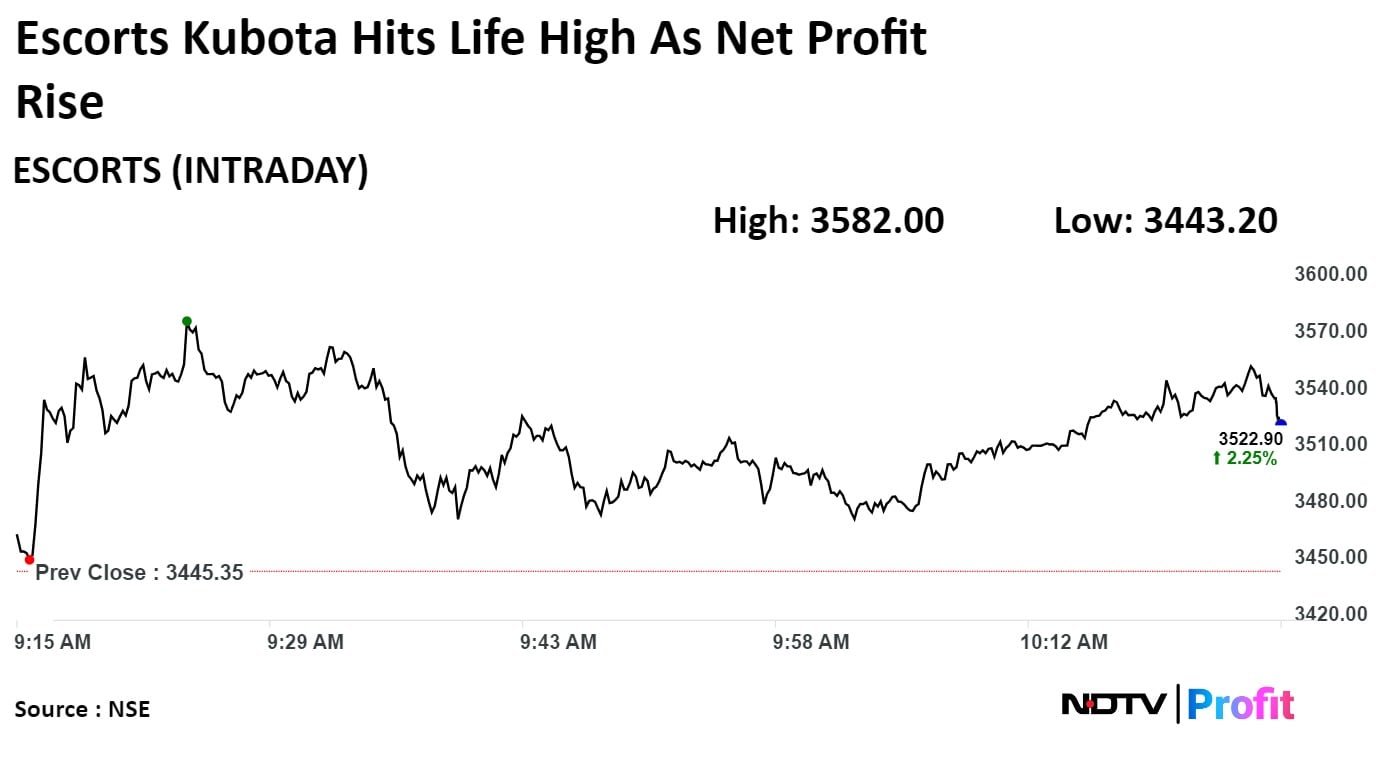

CLSA on Escorts

Maintain Sell with TP 2151, 40% downside

Believe valuation is quite expensive considering tractor industry is mid-single digit growth industry

Q4 volumes fell due to lower-than-average rainfall and high base from last year

Increase our growth estimate for domestic tractor industry volumes for FY25 from 5% to 10%

Factoring in market share gains for Escorts over the next eight years, from 10.3% to 13%

Believe this is already factored in the stock

CLSA on Escorts

Maintain Sell with TP 2151, 40% downside

Believe valuation is quite expensive considering tractor industry is mid-single digit growth industry

Q4 volumes fell due to lower-than-average rainfall and high base from last year

Increase our growth estimate for domestic tractor industry volumes for FY25 from 5% to 10%

Factoring in market share gains for Escorts over the next eight years, from 10.3% to 13%

Believe this is already factored in the stock

Escorts Kubota Ltd. rose 3.97% to Rs 3,582.00, the highest level since March 1, 1995. It was trading 2.76% higher at Rs 3,540.45 as of 11:41 a.m., as compared to 0.41% advance in the NSE Nifty 50 index.

It has declined 72.86% in 12 months. Total traded volume so far in the day stood at 4.7 times its 30-day average. The relative strength index was at 53.40.

Out of 22 analysts tracking the company, six maintain a 'buy' rating, six recommend a 'hold,' and 10 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 13.6%.

Upgraded India to Overweight

Downgraded China to Neutral after a solid run, but also acknowledge upside risks over the near-term

China's recent rally has not yet been supported by improving fundamentals

EM country strategy favour markets with inflecting earnings and strong EPS momentum

Bharat Petroleum Ltd.'s shares rose over 5% on NSE as its net profit rose 24.34% on the quarter to Rs 4,224 crore.

Bharat Petroleum Ltd.'s shares rose over 5% on NSE as its net profit rose 24.34% on the quarter to Rs 4,224 crore.

The scrip rose as much as 5.03% to Rs 621.95 apiece, the highest level since May 9. It was trading 3.39% higher at Rs 612.20 apiece, as of 10:18 a.m. This compares to a 0.77% advance in the NSE Nifty 50 Index.

It has risen 62.84% in 12 months. Total traded volume so far in the day stood at 6.1 times its 30-day average. The relative strength index was at 50.70.

Out of 33 analysts tracking the company, 19 maintain a 'buy' rating, five recommend a 'hold,' and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.6%.

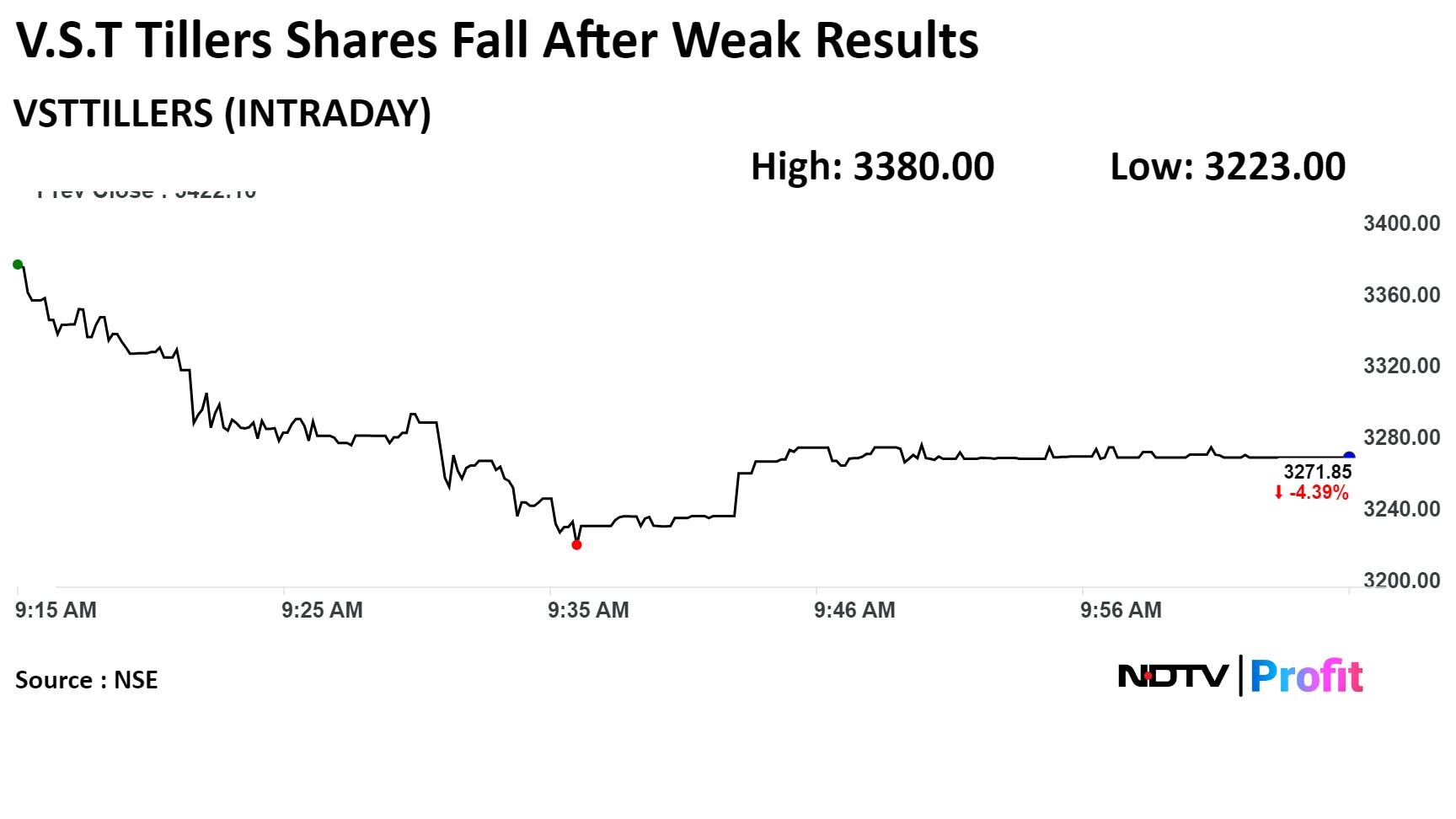

Shares of V.S.T Tillers fell today after the company reported weak results in the March quarter. The company's net profit fell 13.44% year-on-year to Rs 34.75 crore.

VST Tillers Tractors (Consolidated, YoY)

Revenue down 15.25% at Rs 273 crore vs Rs 323 crore.

Ebitda down 15.25% at Rs 39.83 crore vs Rs 54.55 crore.

Margin down 234 bps at 14.56% vs 16.9%.

Net profit down 13.44% at Rs 34.75 crore vs Rs 40.15 crore.

Shares of V.S.T Tillers fell today after the company reported weak results in the March quarter. The company's net profit fell 13.44% year-on-year to Rs 34.75 crore.

VST Tillers Tractors (Consolidated, YoY)

Revenue down 15.25% at Rs 273 crore vs Rs 323 crore.

Ebitda down 15.25% at Rs 39.83 crore vs Rs 54.55 crore.

Margin down 234 bps at 14.56% vs 16.9%.

Net profit down 13.44% at Rs 34.75 crore vs Rs 40.15 crore.

The scrip fell as much as 5.82% to Rs 3,223 apiece, the lowest level since April 15. It pared losses to trade 4.39% lower at Rs 3,271.90 apiece, as of 10:10 a.m. This compares to a 0.64% advance in the NSE Nifty 50 Index.

It has fallen 13.20% on a year-to-date basis but risen 17% in the last twelve months. Total traded volume on the NSE so far in the day stood at 0.73 times its 30-day average. The relative strength index was at 46.22.

Out of the four analysts tracking the company, three maintain a 'buy' rating and one recommend a 'hold, according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.1%.

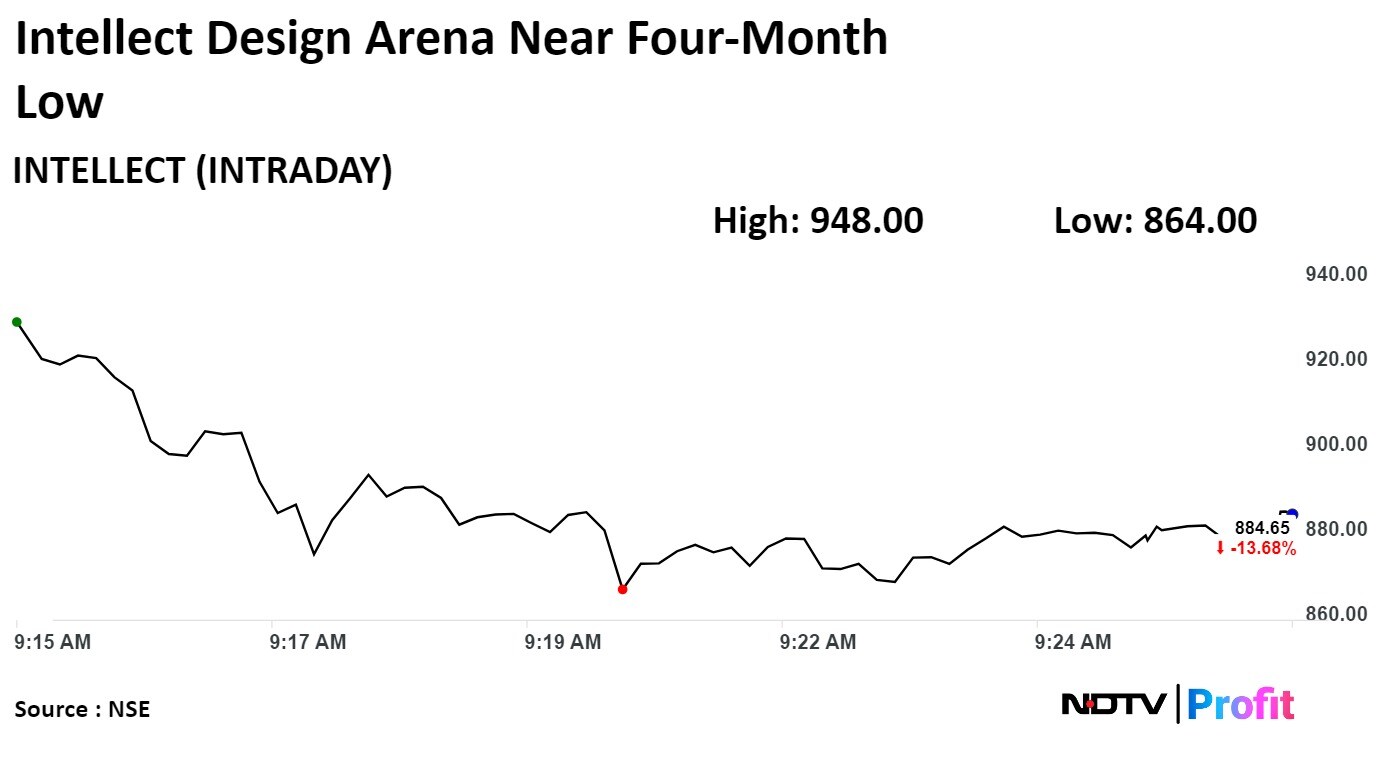

Intellect Design Arena Ltd. fell over 15% to the lowest level since mid-January as the company's net profit declined during fourth quarter. Its consolidated net profit fell 13.58% to Rs 73.35 crore in fourth quarter, from Rs 84.88 crore in the previous quarter.

Intellect Design Arena Ltd. fell over 15% to the lowest level since mid-January as the company's net profit declined during fourth quarter. Its consolidated net profit fell 13.58% to Rs 73.35 crore in fourth quarter, from Rs 84.88 crore in the previous quarter.

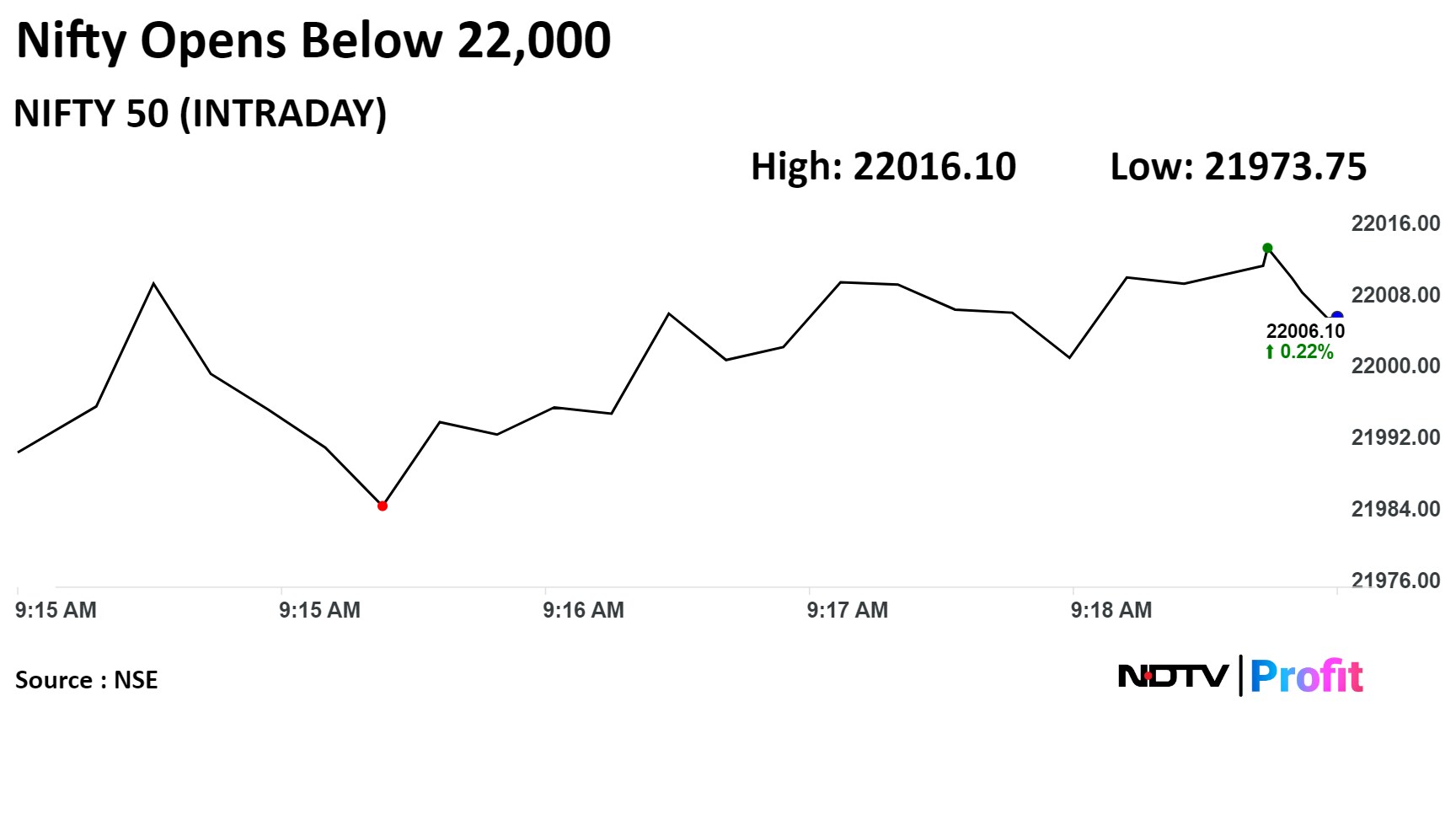

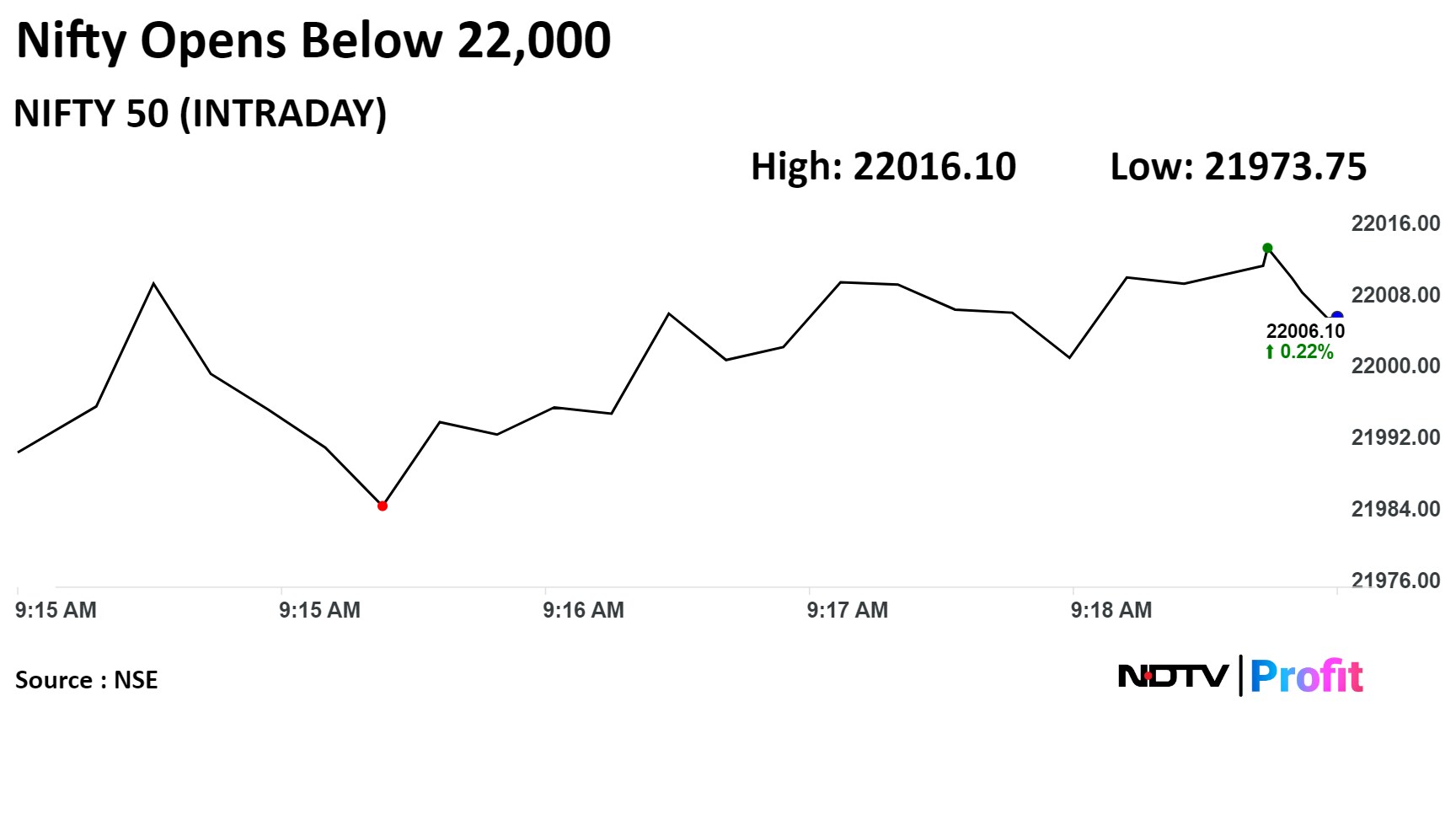

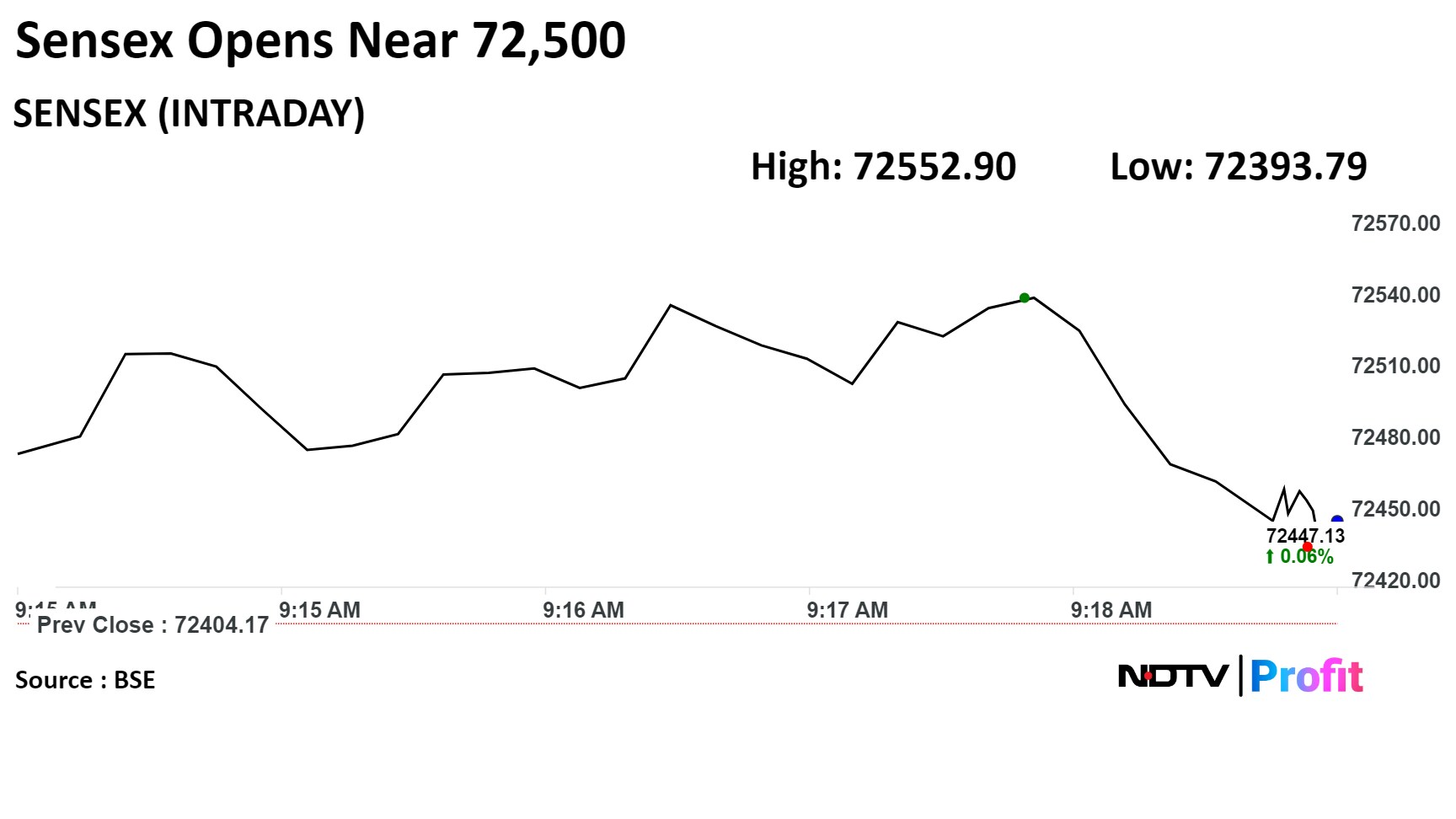

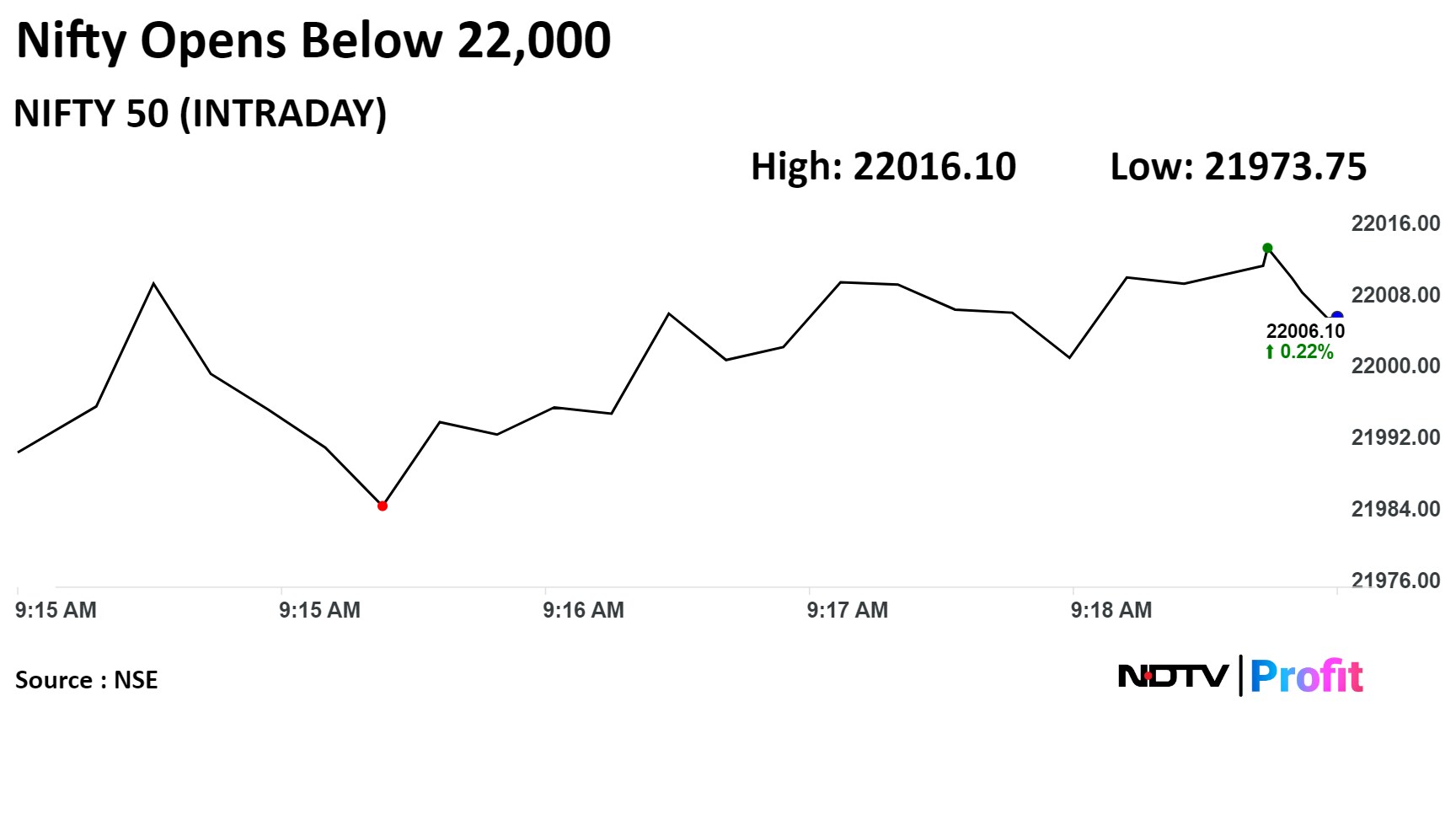

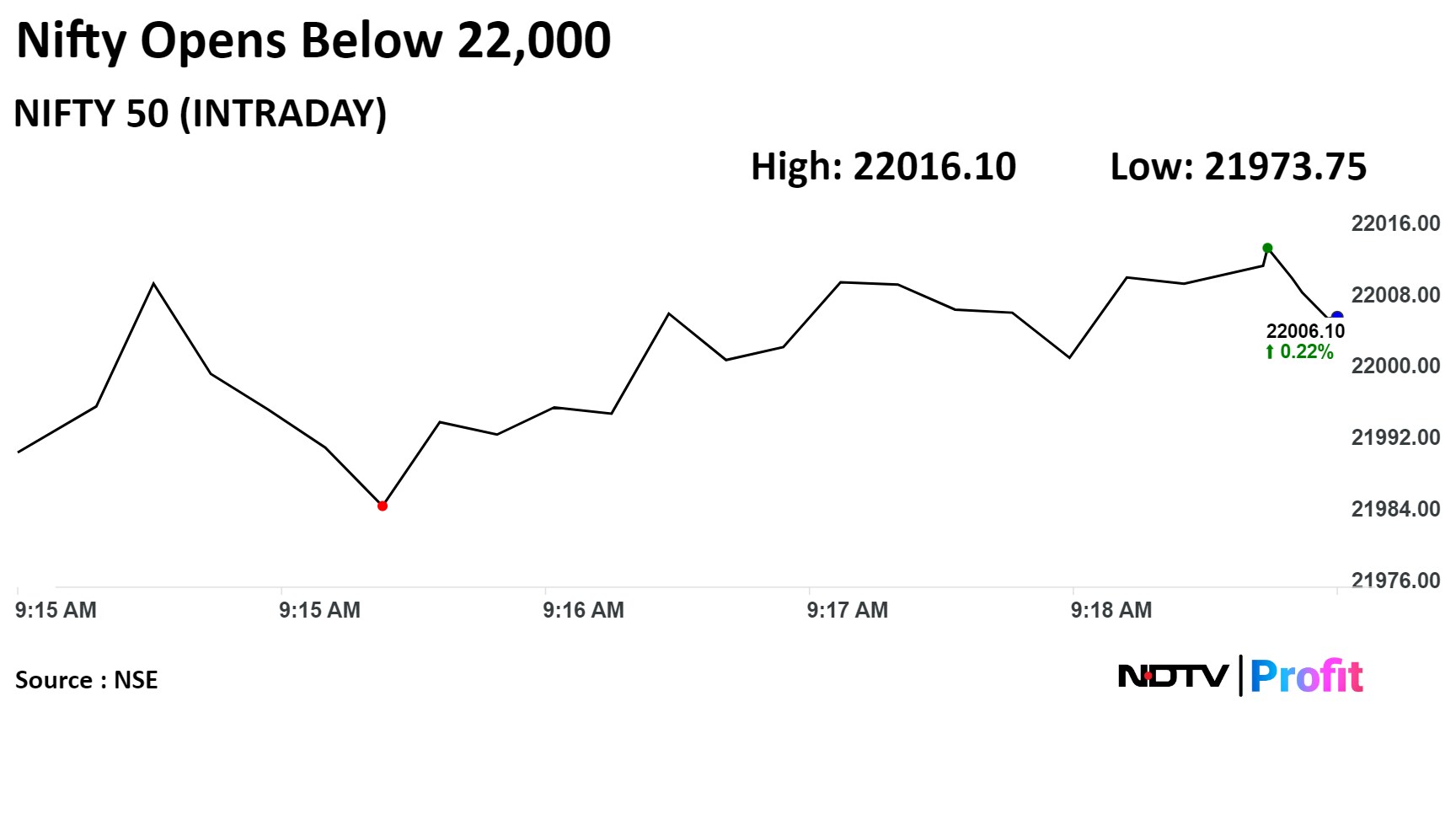

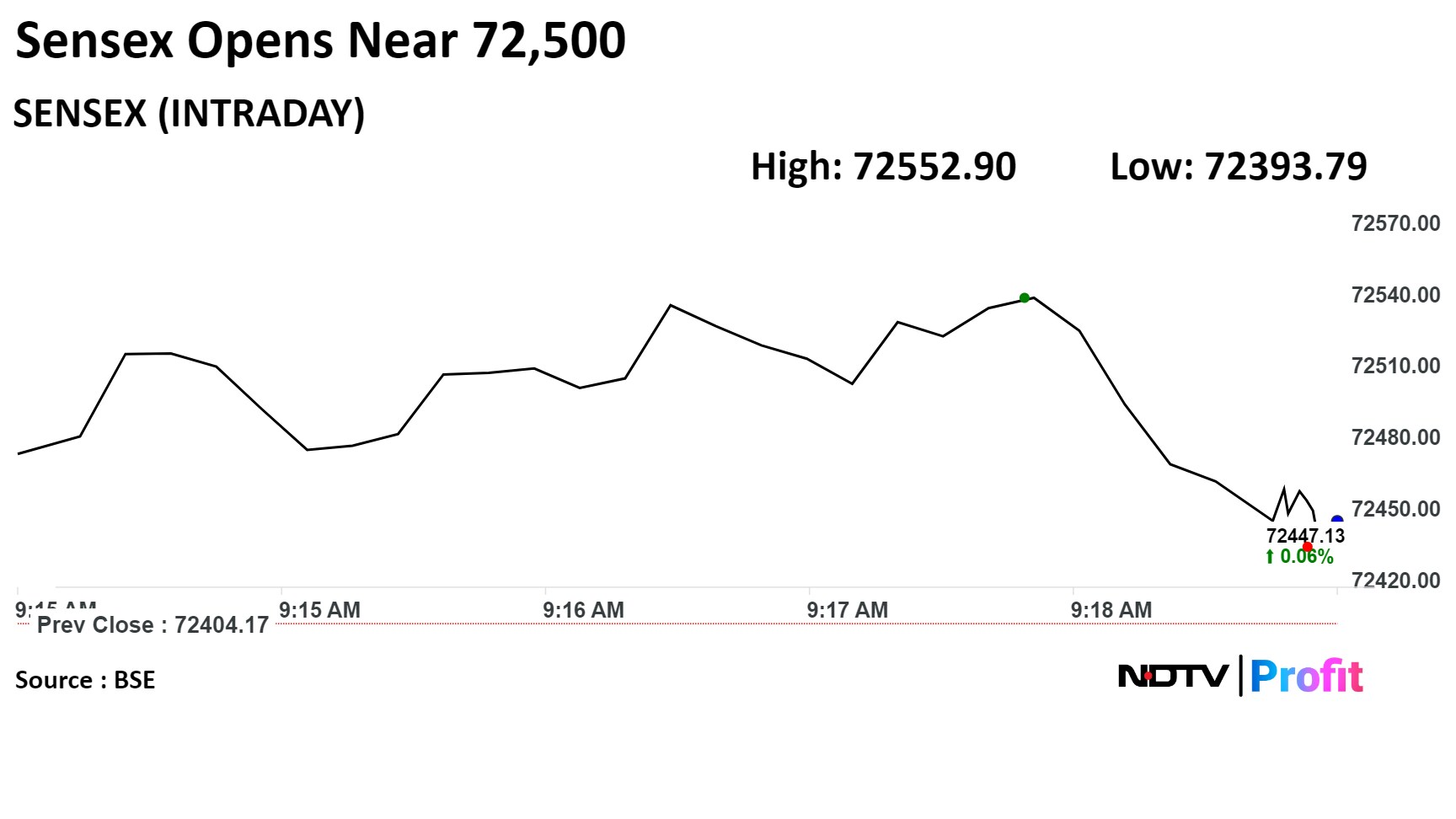

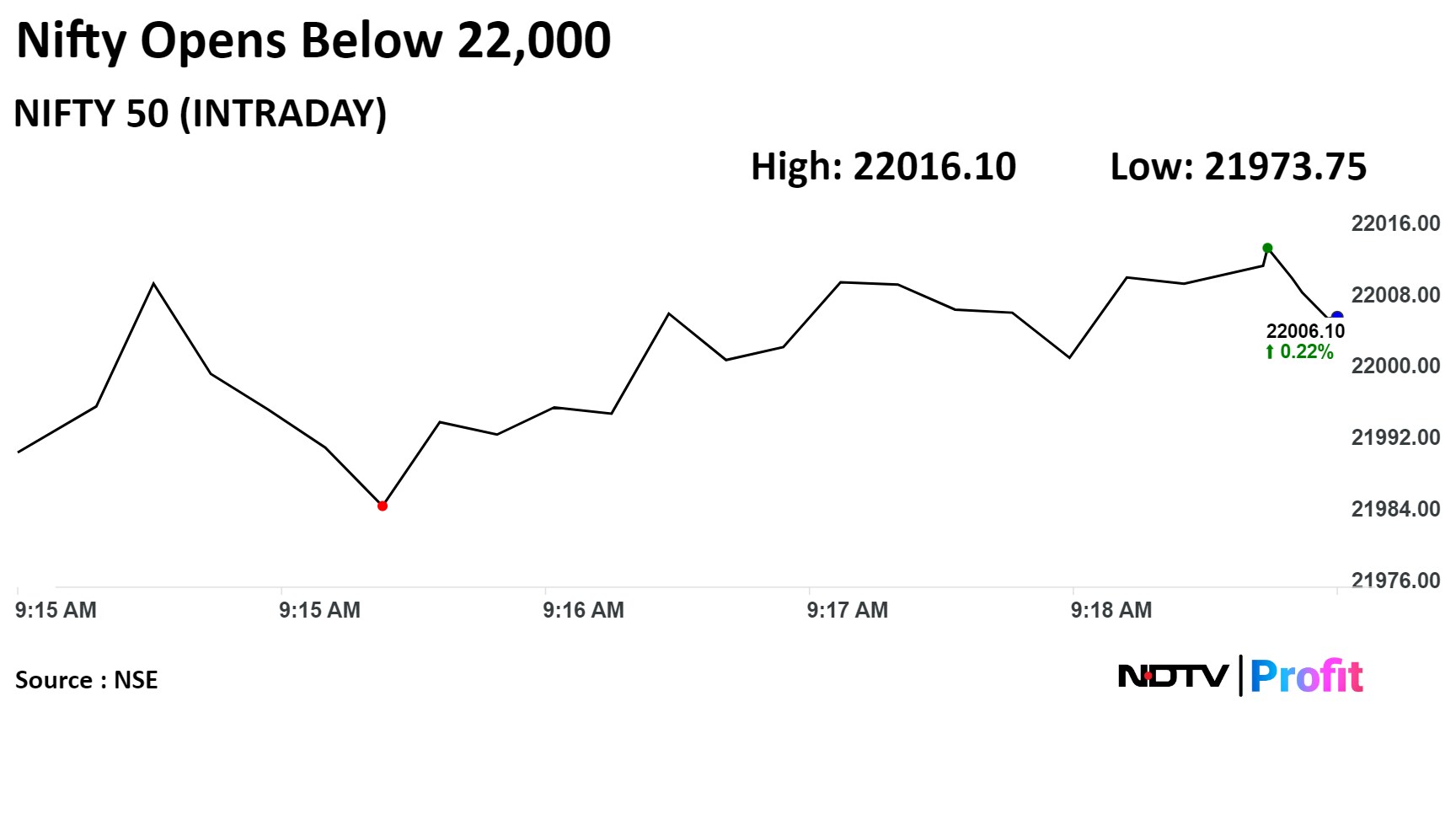

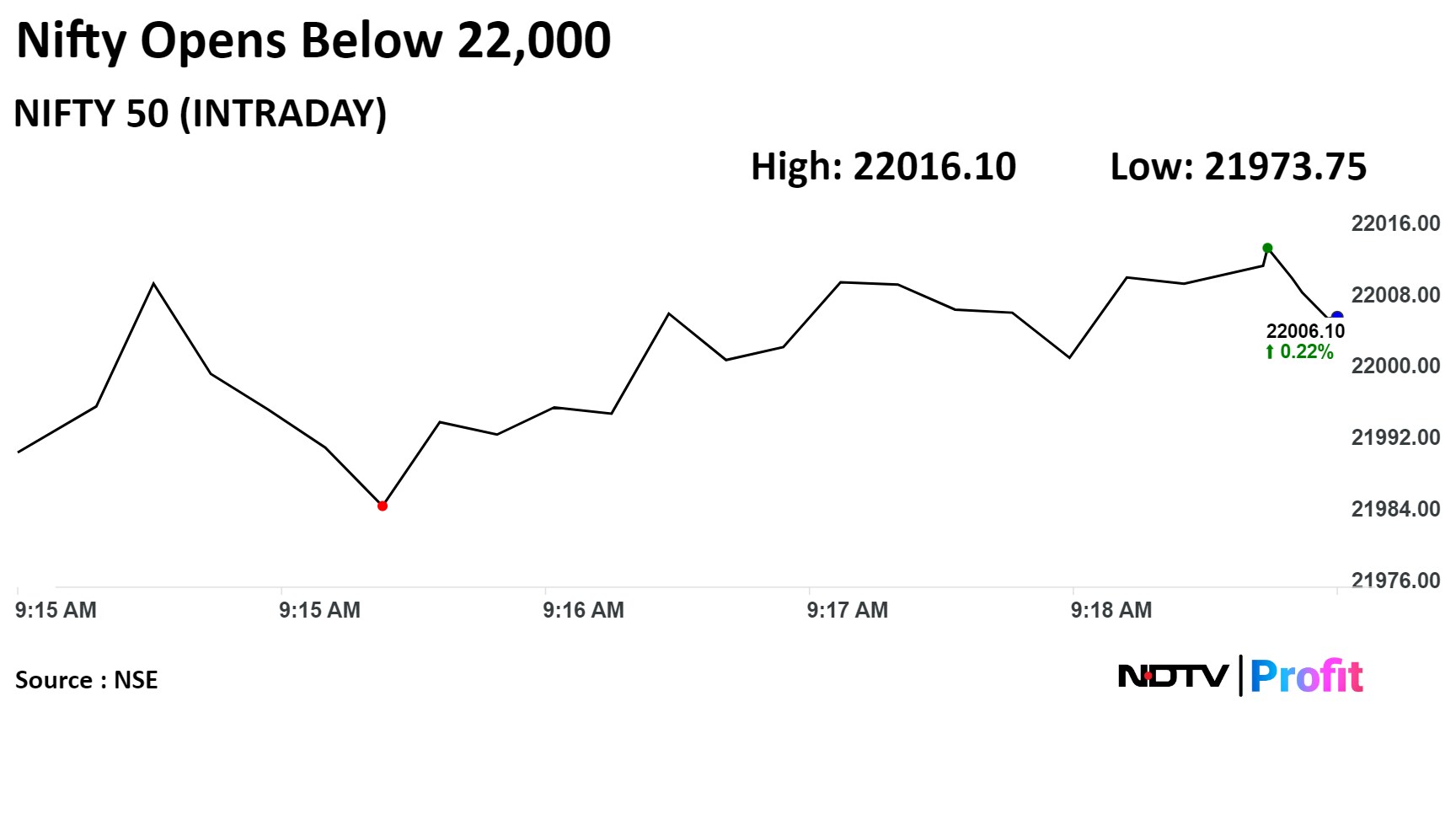

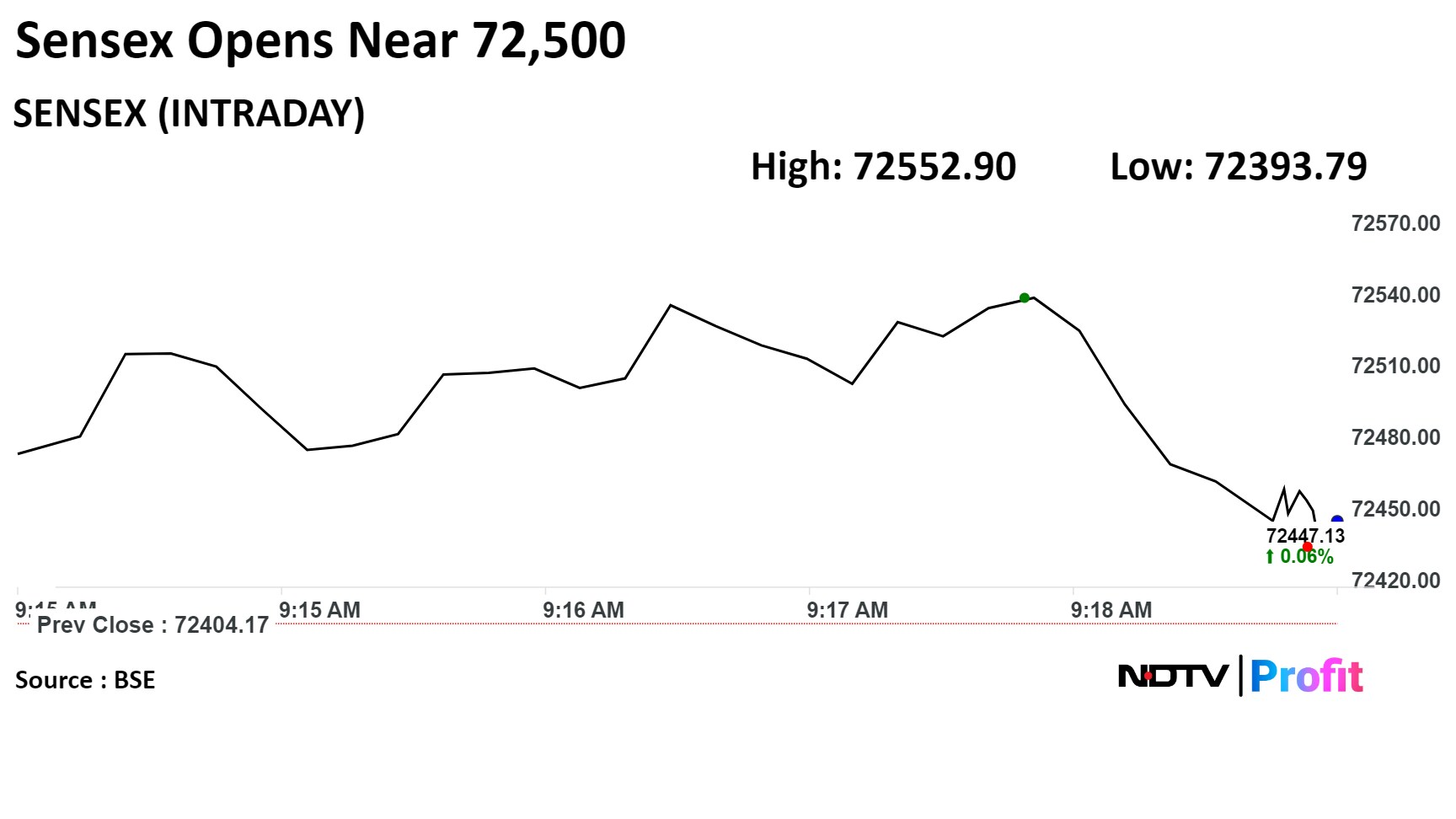

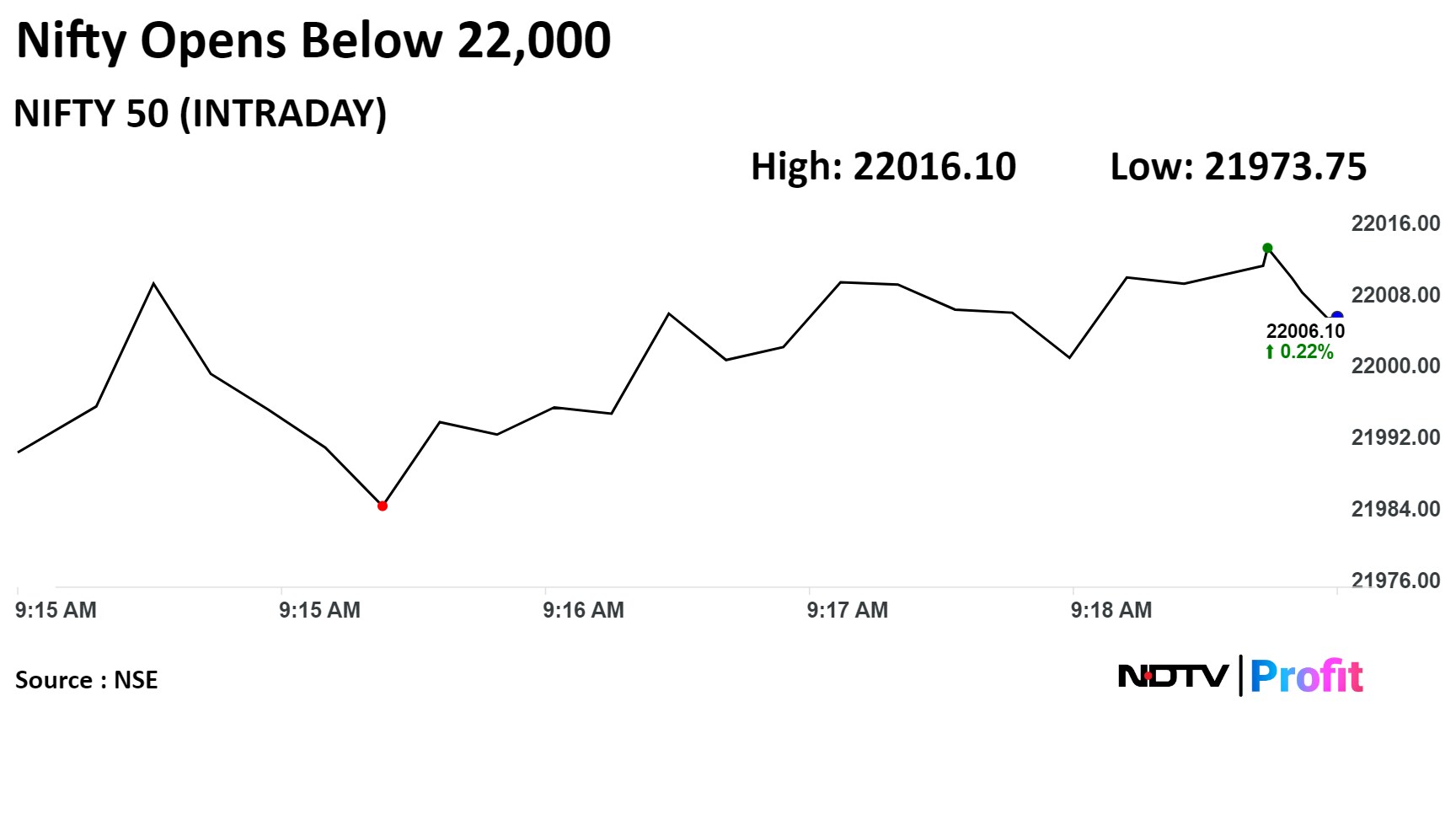

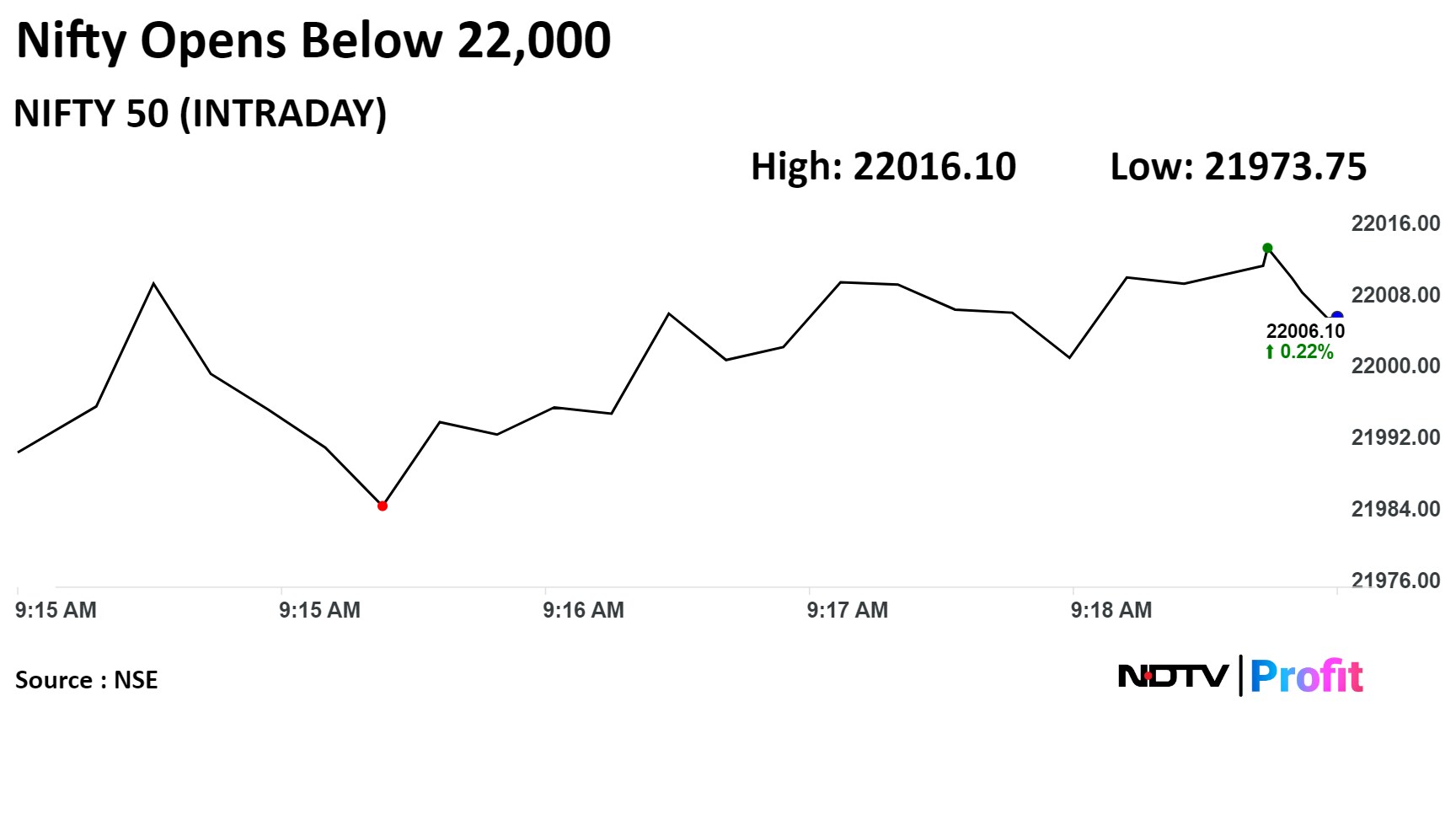

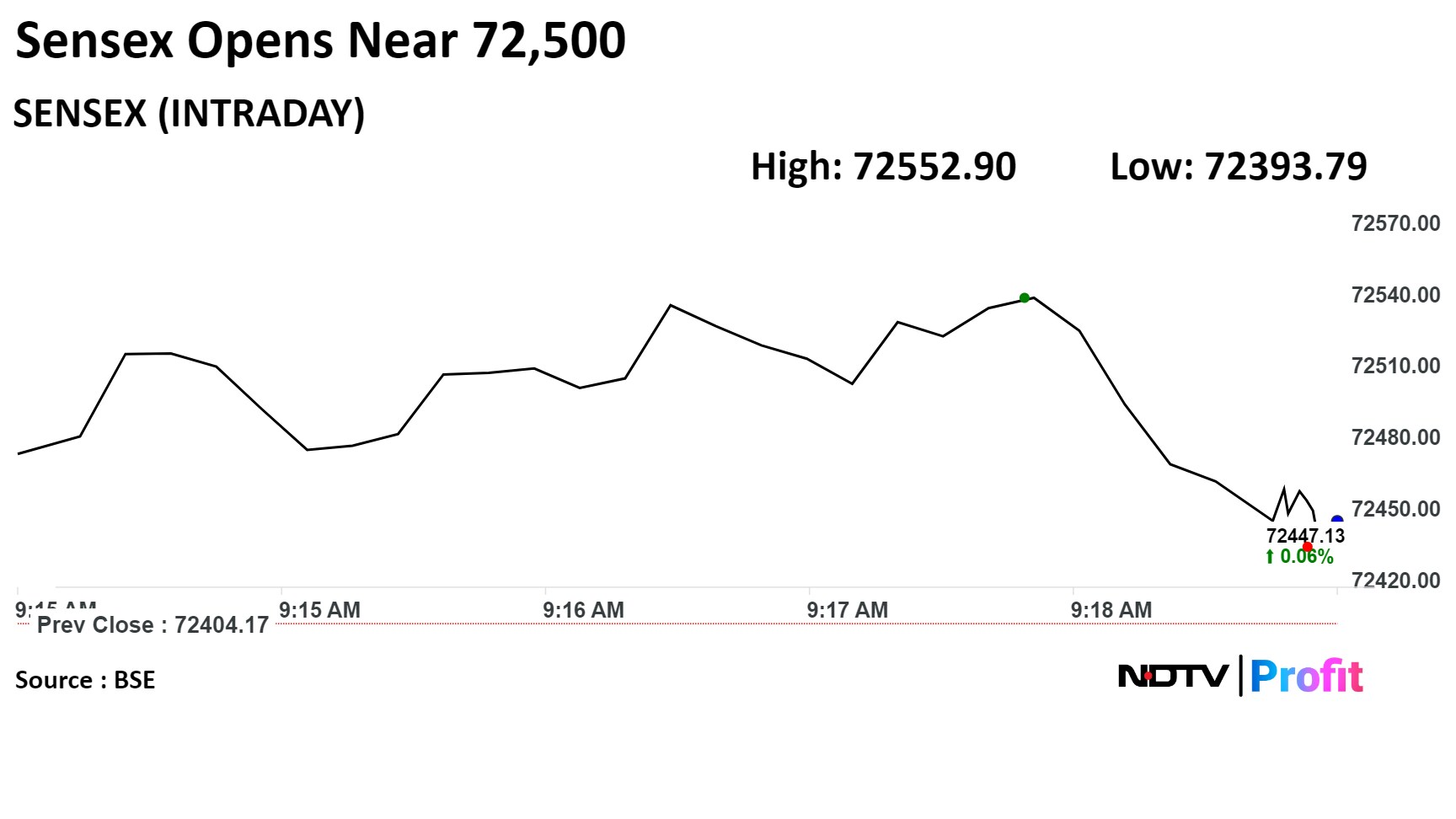

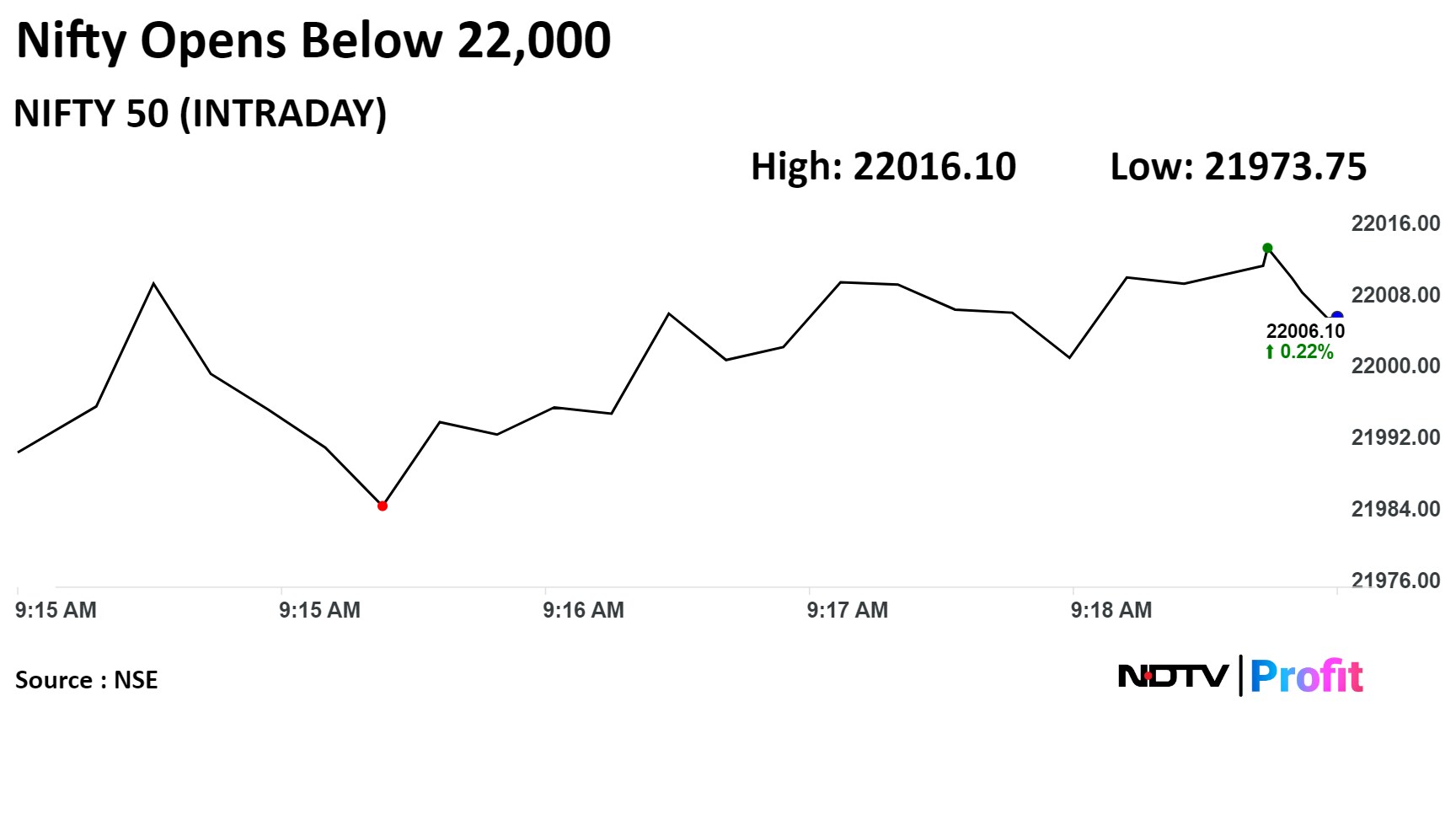

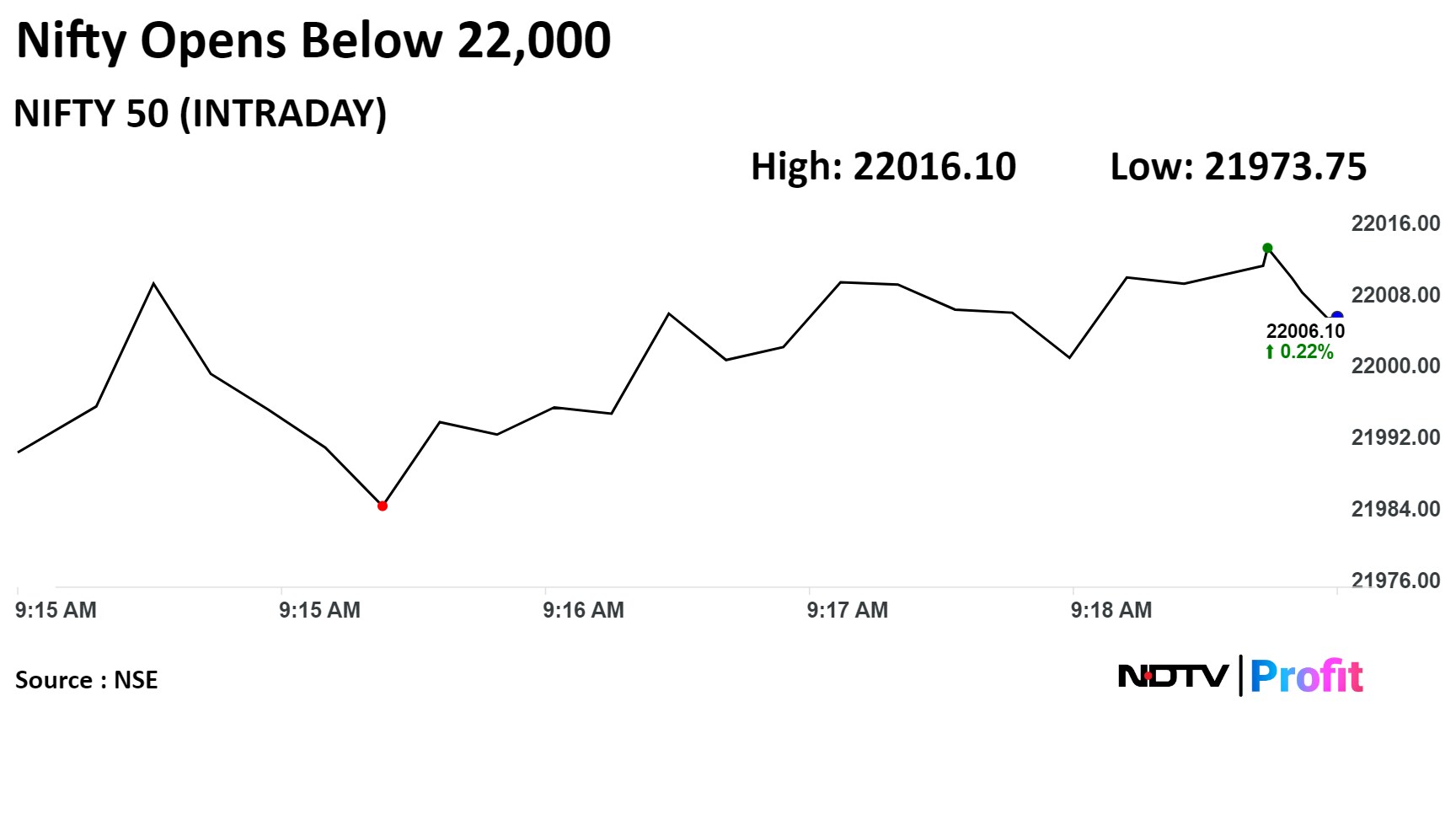

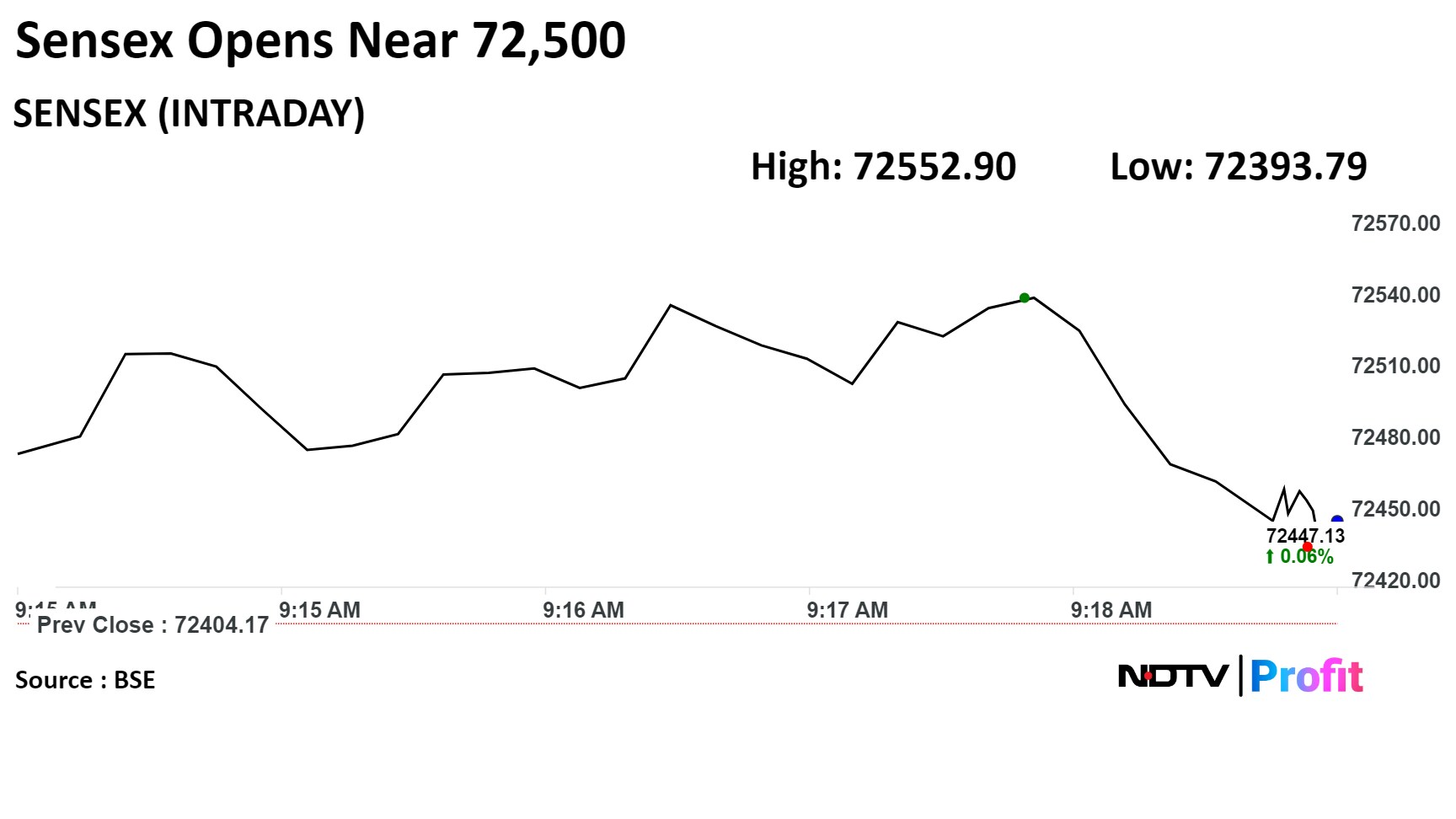

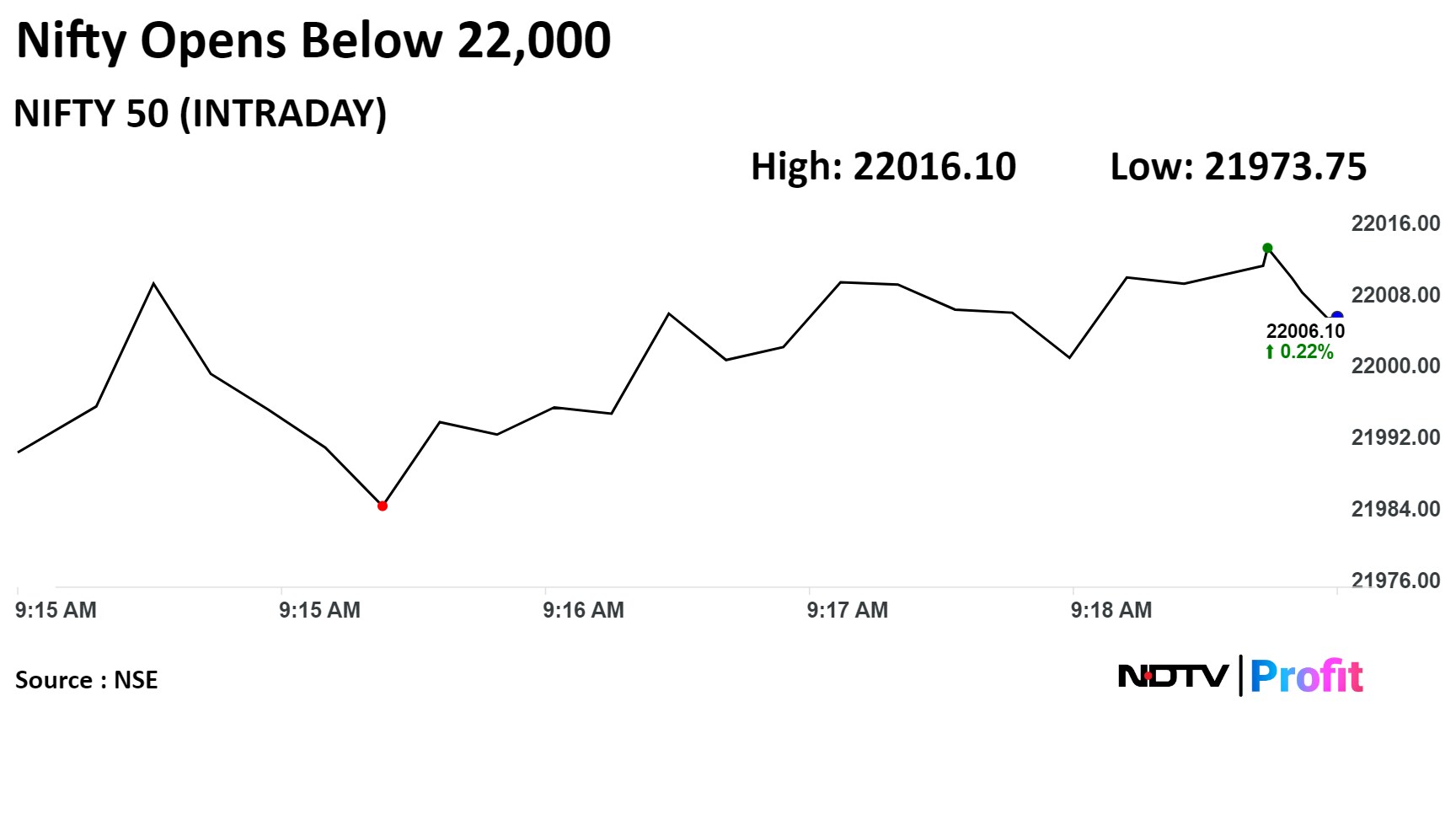

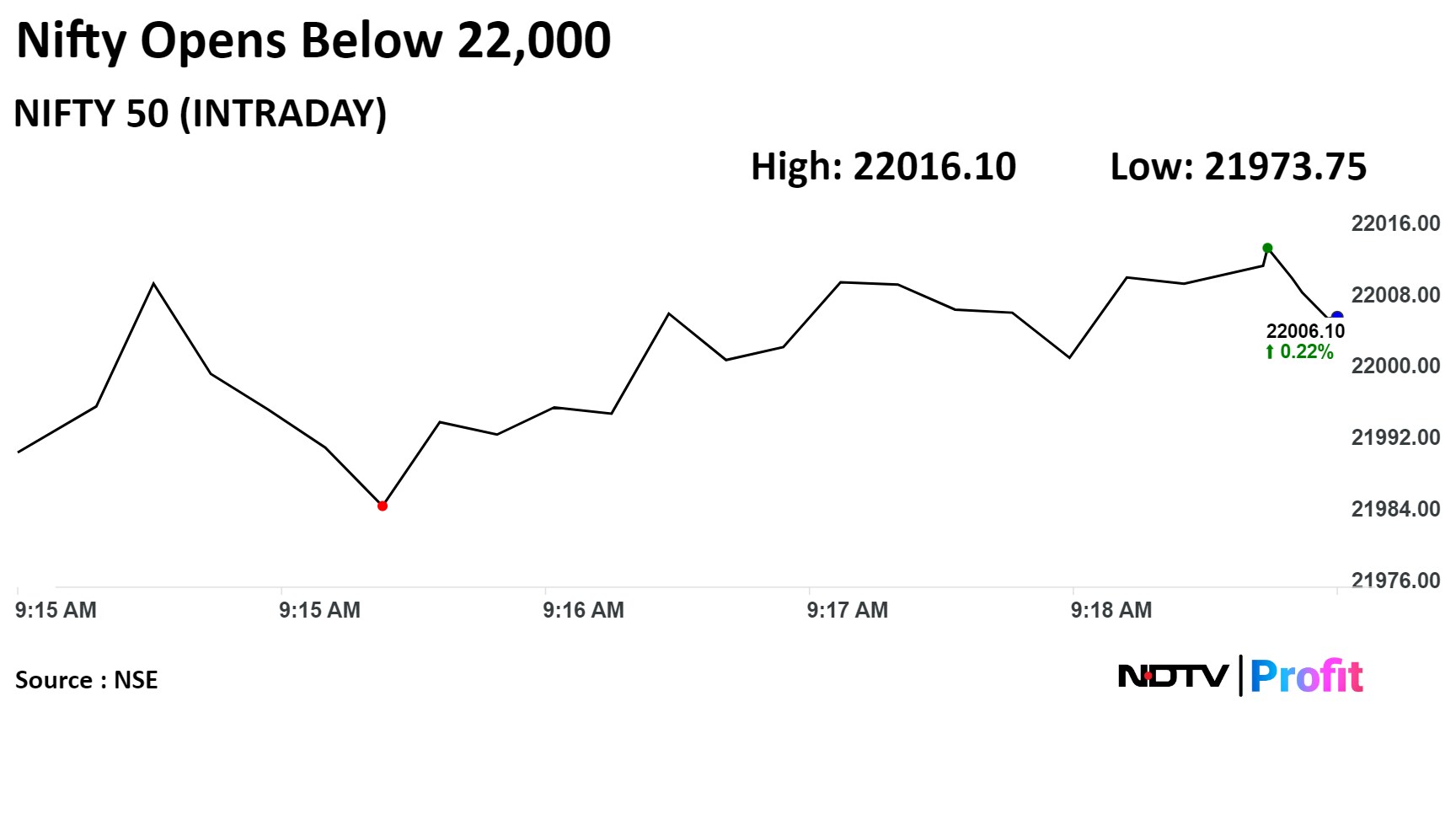

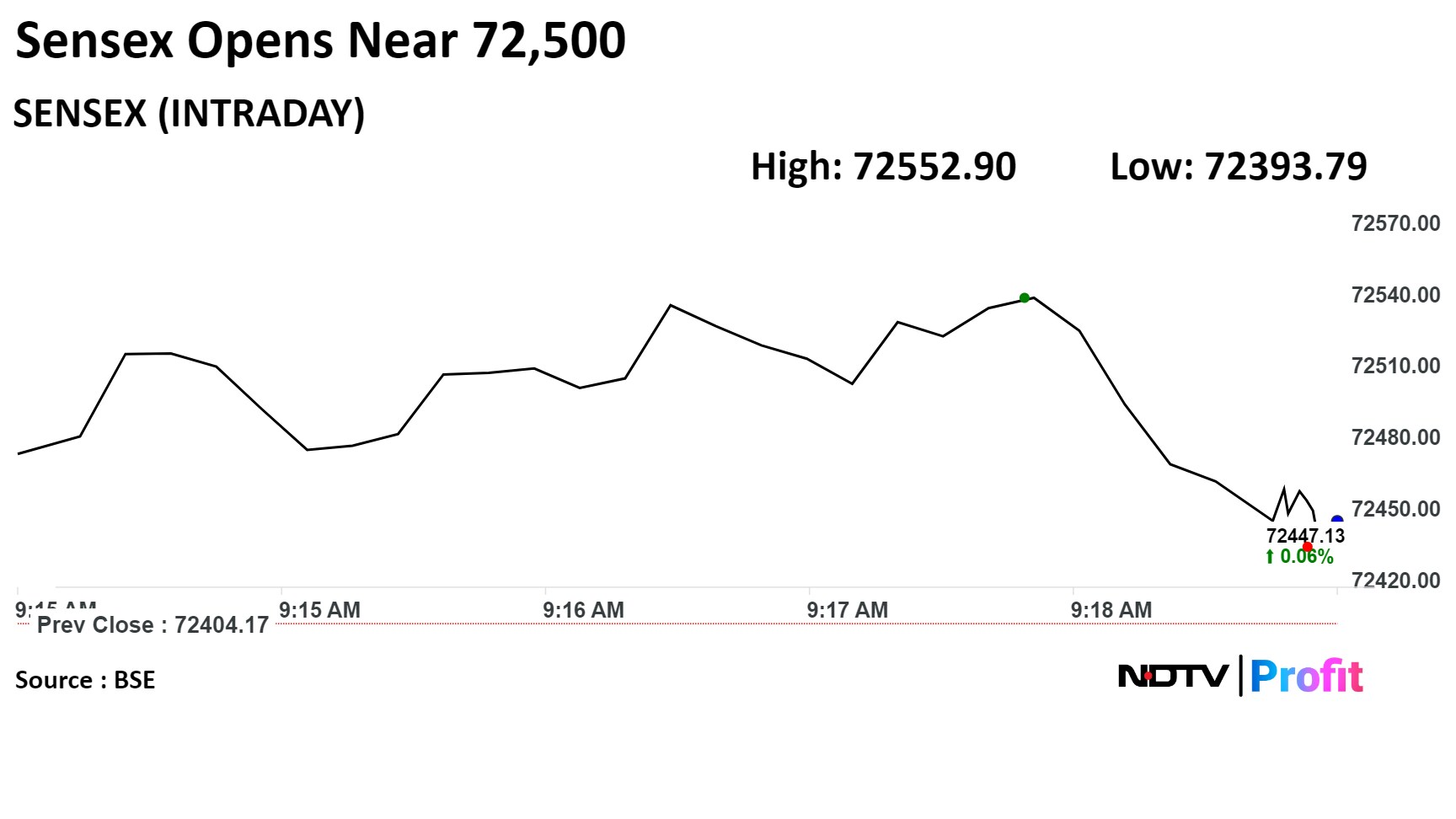

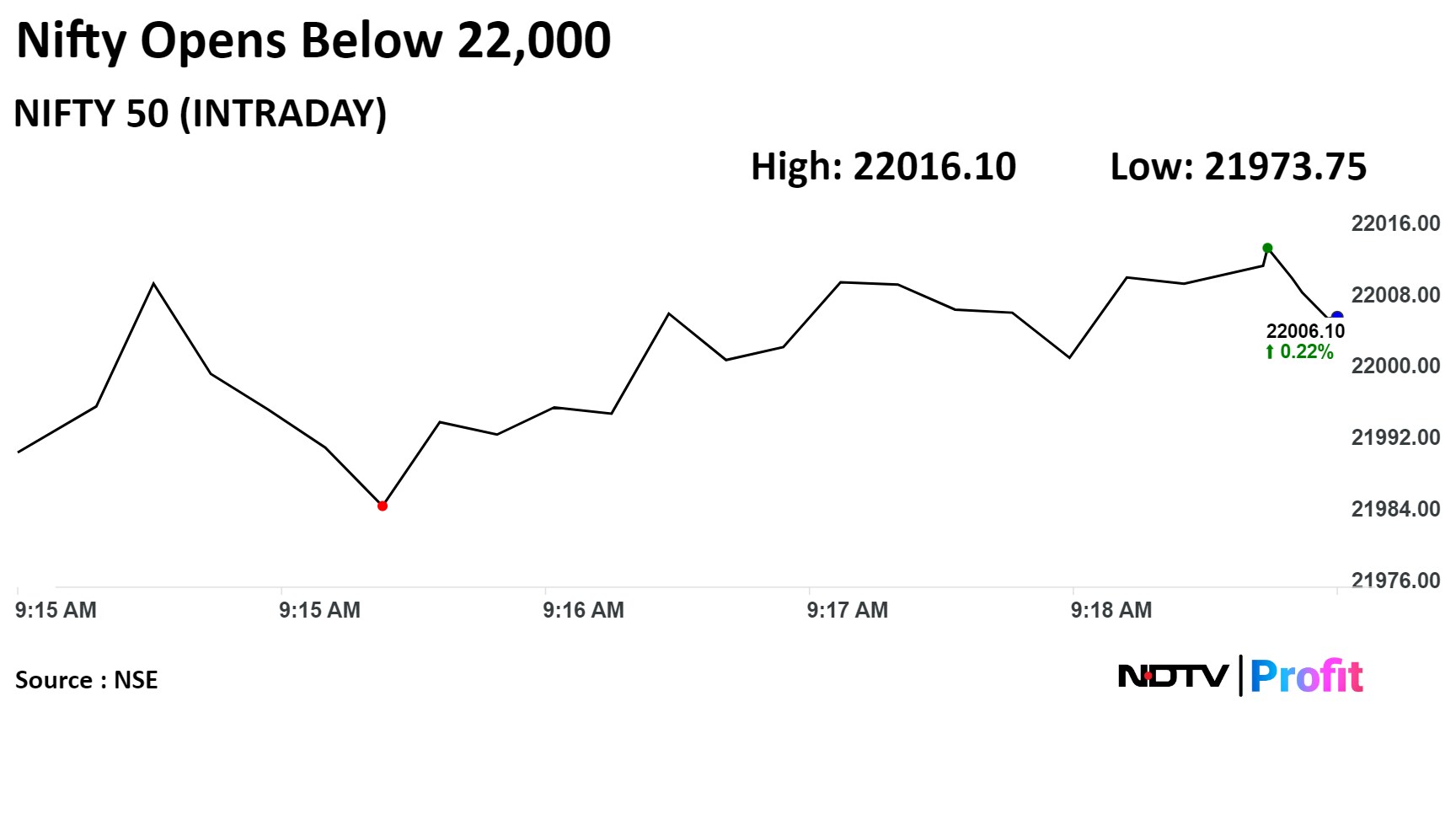

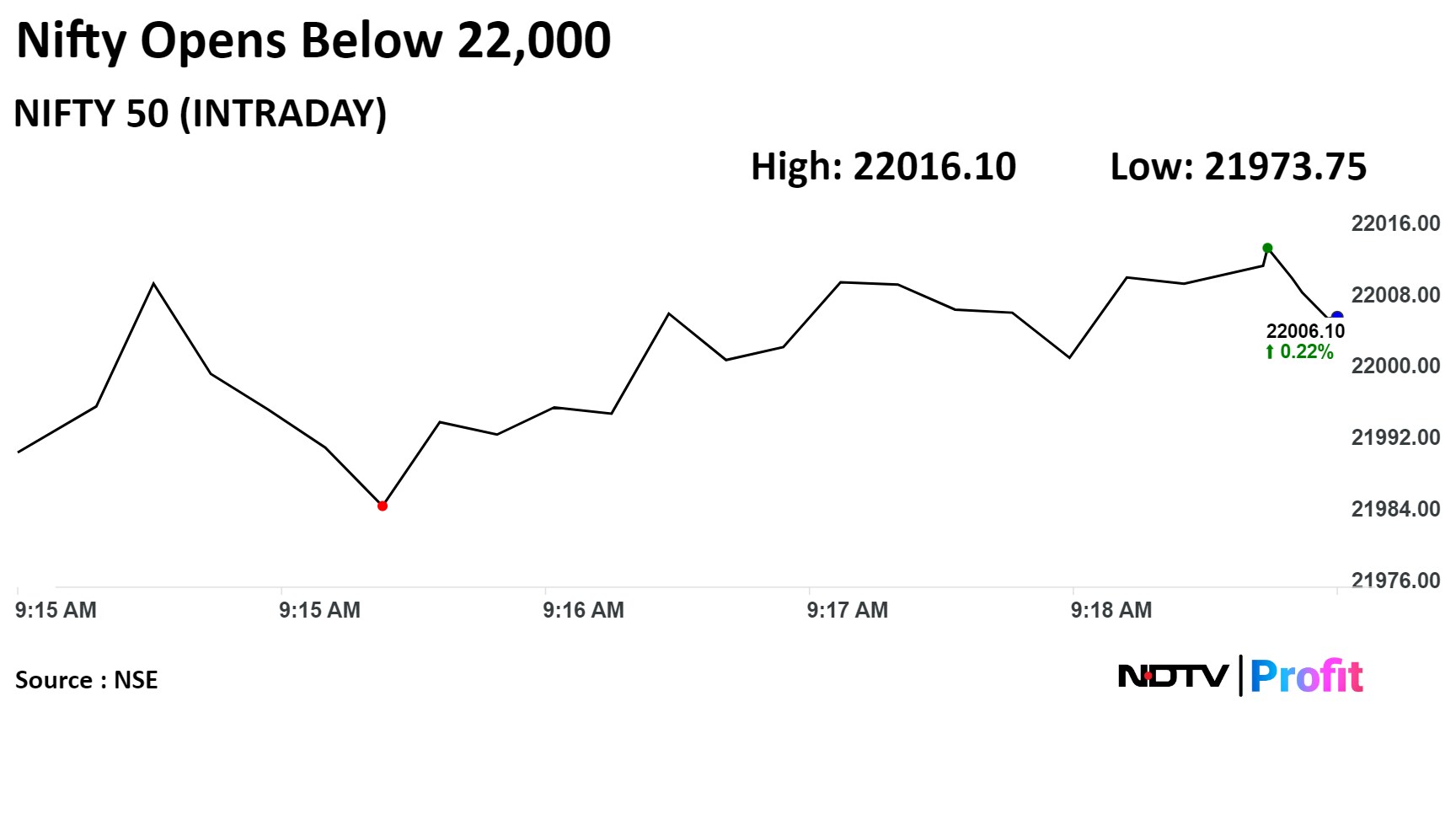

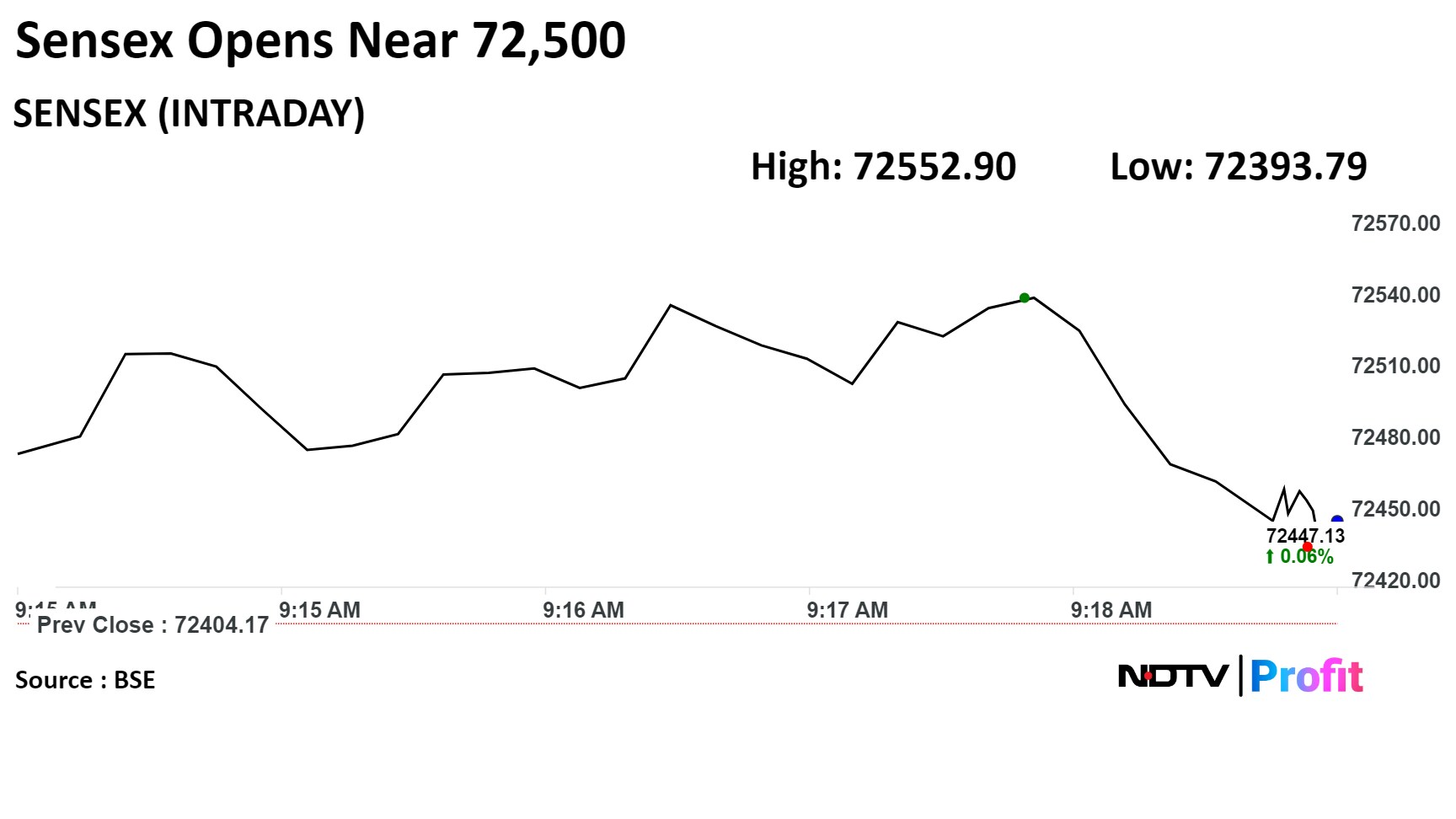

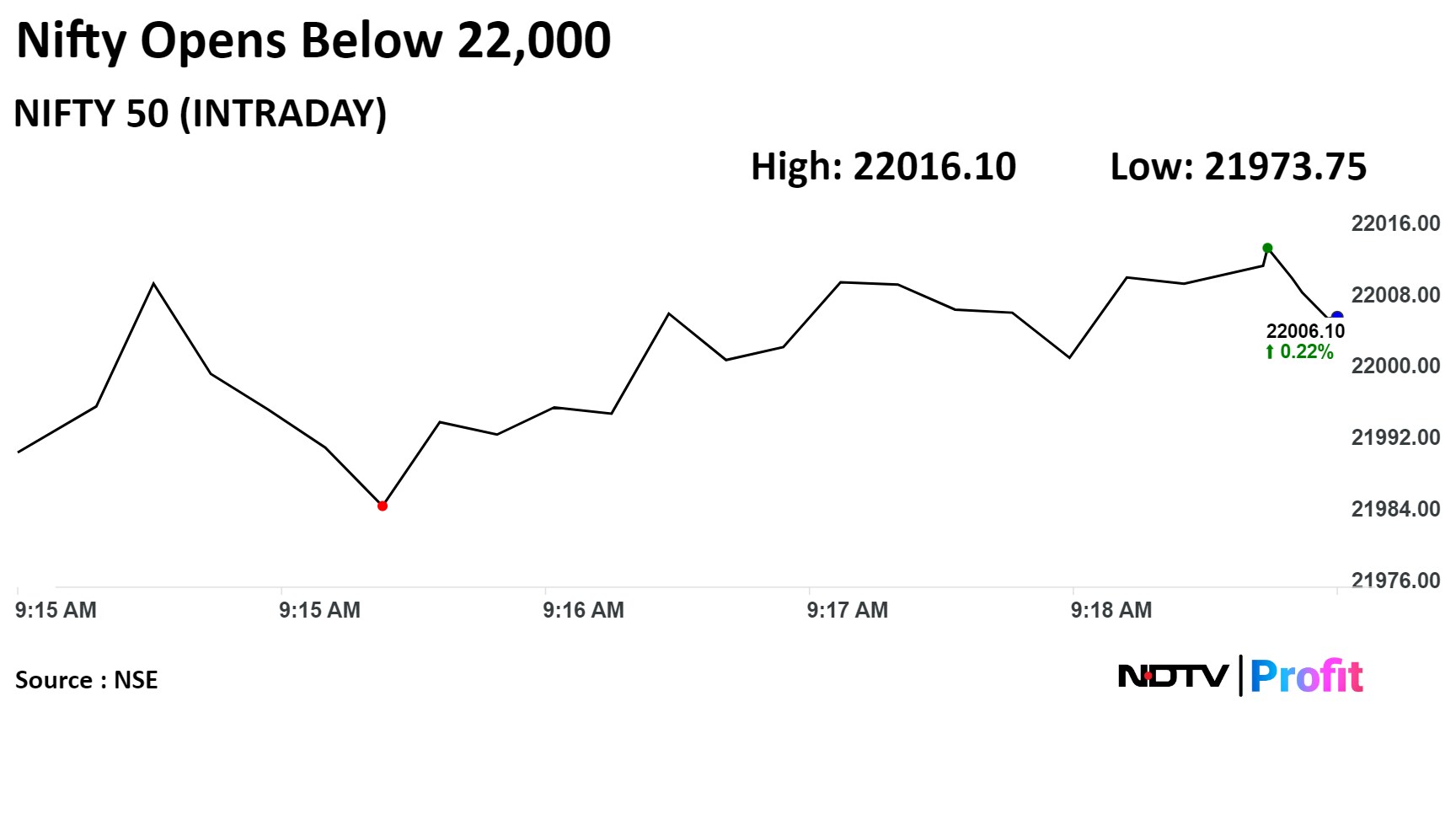

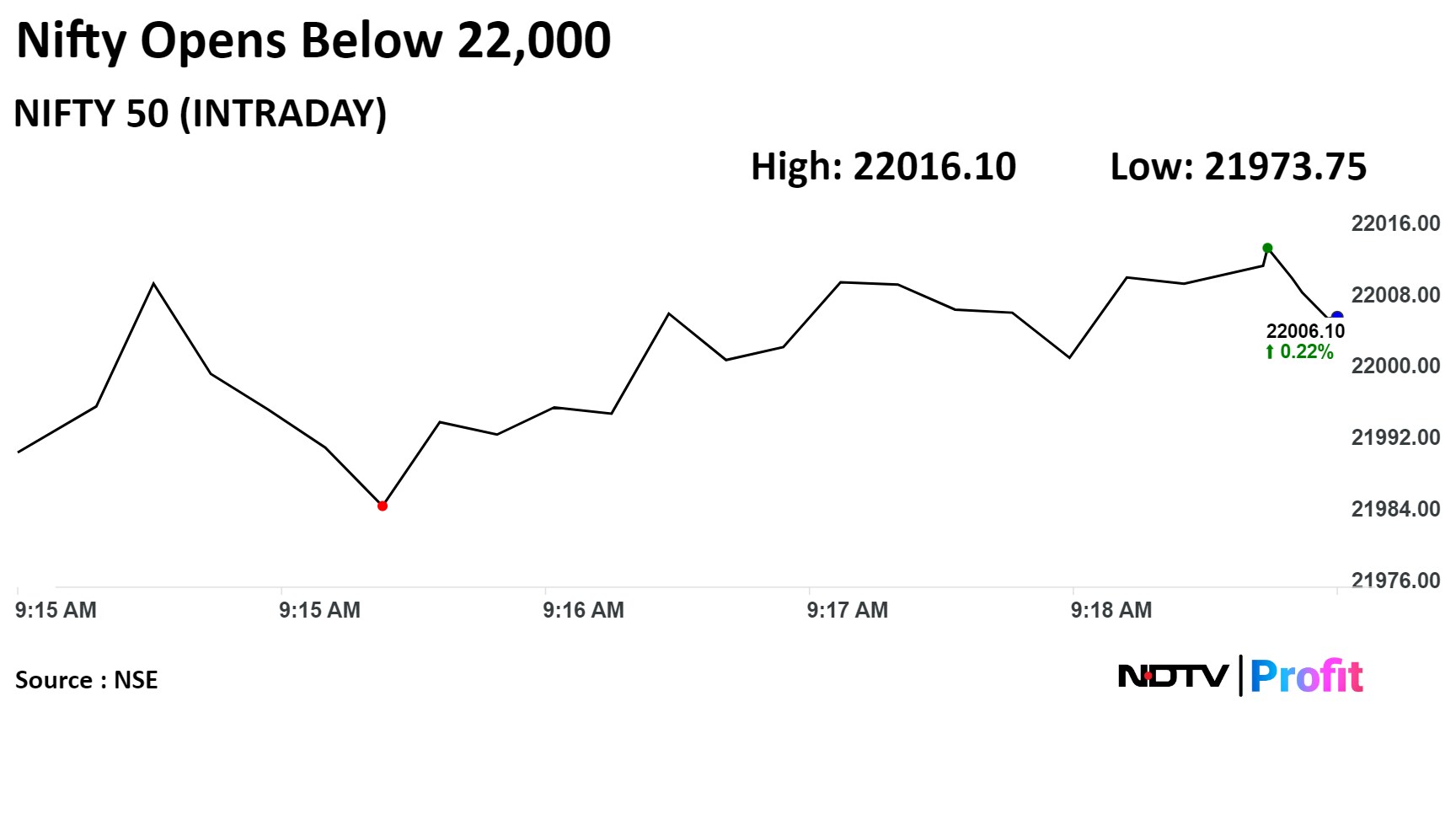

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

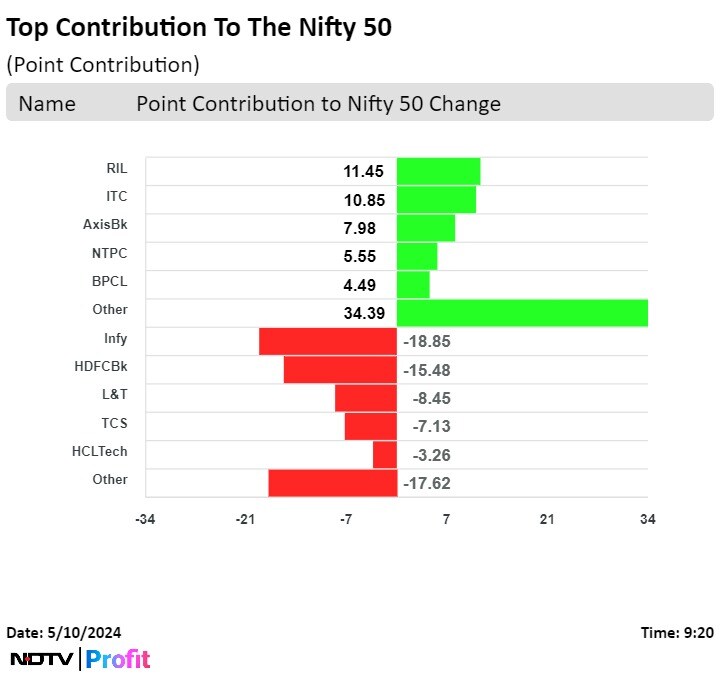

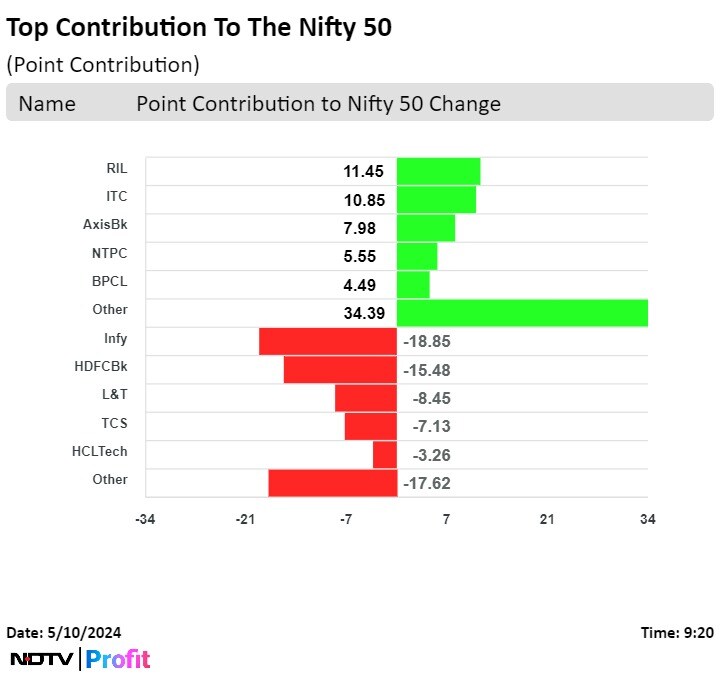

Shares of Reliance Industries Ltd., ITC Ltd., Axis Bank Ltd., NTPC Ltd., and Bharat Petroleum Corp. Ltd. contributed the most to the gains.

While those of Infosys Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., and HCL Tech were the top draggers.

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Shares of Reliance Industries Ltd., ITC Ltd., Axis Bank Ltd., NTPC Ltd., and Bharat Petroleum Corp. Ltd. contributed the most to the gains.

While those of Infosys Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., and HCL Tech were the top draggers.

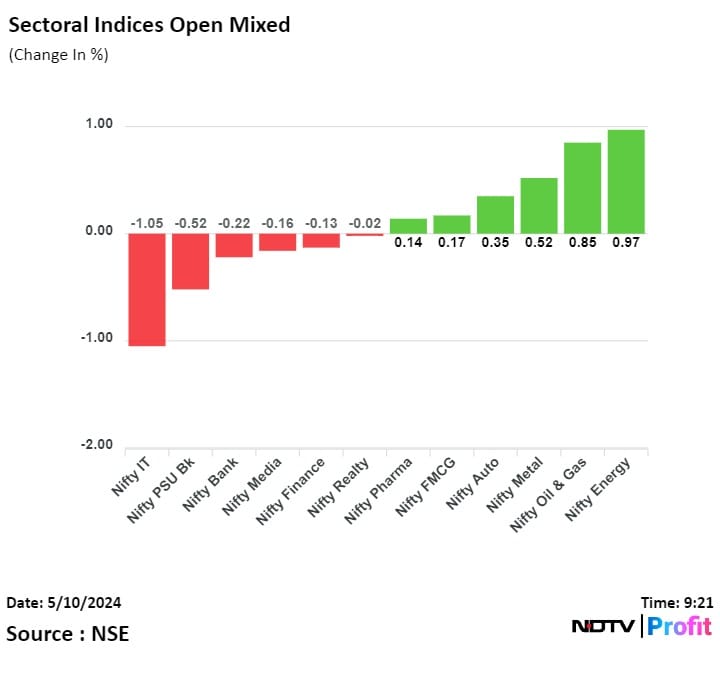

Sectoral indices were mixed at open. Nifty Energy and Nifty Oil & Gas rose the most but Nifty IT fell over 1%.

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Shares of Reliance Industries Ltd., ITC Ltd., Axis Bank Ltd., NTPC Ltd., and Bharat Petroleum Corp. Ltd. contributed the most to the gains.

While those of Infosys Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., and HCL Tech were the top draggers.

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Benchmark equity indices recovered from their Thursday's fall and opened higher on the back of gains in the shares of ITC and State Bank of India.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

"On the downside, Nifty has good support in the 21800-21700 zone. Investors can begin with tiny investments near the indicated support zone for the long run," said Deven Mehata, research analyst at Choice Broking. "Traders can buy near the support zone, with a strict stop loss of 21700 on a closing basis."

Shares of Reliance Industries Ltd., ITC Ltd., Axis Bank Ltd., NTPC Ltd., and Bharat Petroleum Corp. Ltd. contributed the most to the gains.

While those of Infosys Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., and HCL Tech were the top draggers.

Sectoral indices were mixed at open. Nifty Energy and Nifty Oil & Gas rose the most but Nifty IT fell over 1%.

Market breadth was skewed in the favour of buyers. Around 1,844 stocks rose, 970 fell and 100 remain unchanged on the BSE.

Broader markets outperformed with S&P BSE Midcap rising 0.34% and S&P BSE Smallcap was 0.23% higher.

Sixteen out of the 20 sectoral indices on the BSE rose while four fell. S&P BSE Information Technology fell nearly 1%.

At pre-open, the Nifty was at 21,990.95, 33.45 points or 0.15% and the Sensex rose to 72,475.45, higher by 71.28 points or 0.09%.

Reported earnings and commentary imply early signs of stagnation

Recent equity capital infusion in renewable, higher power demand to benefit company in future opportunities

Sees risk to pace of execution

Expect earnings growth to be affected by lower coal prices

Key catalysts: slower execution of PSP, slower government reforms

Key upside risks: quick start of PSP, announcement of distribution reforms, higher coal prices

The yield on the 10-year bond opened flat at 7.12%.

It closed at 7.13% on Thursday.

Source: Bloomberg

Jefferies maintains Buy on Bharat Petroleum

Q4 Ebitda was 30% below Jefferies estimates

Q4 miss driven by weaker refining segment

Lower GRMs on narrowing Russian crude discounts

Diesel/Petrol marketing margins at Rs 3/7.6 per liter

Expect better profitability among peers in FY25/26

-Raise FY25/26 earnings by 7%/14%

The local currency strengthened by 3 paise to open at 83.48 against the U.S dollar.

It closed at 83.51 on Thursday.

Source: Bloomberg

Changes rating to ADD from Buy with TP Rs 3,850, Upside 12%

Revised up TP of Rs 3,850/sh vs. Rs 3,350 earlier

Strong export outlook backed by new product introduction

Commencement of direct component exports to Kubota amid global sourcing shift to India

Management guided for low-to-mid single-digit industry growth in FY25 on normal monsoons

Raise FY25E/26E EPS by 2%/3% on higher other income

Sets price band in the range of Rs 258-272 per share

Source: Company statement

Raised target to Rs 910 from Rs 755 earlier

Maintains Buy

Q4FY24: Robust volume growth; impressive EBITDA margin

Expansion to pay off; poised to gain in Pune and Kolkata

Growth momentum to sustain; healthy returns despite expansion

Target valuation at 50x (vs 45x earlier) rolled over to FY26

US Dollar Index at 105.28.

US 10-year bond yield at 4.45%.

Brent crude up 0.55% at $84.34 per barrel.

GIFT Nifty traded up 0.05%, or 11 points at 22,139.50 as of 7:29 a.m.

Nymex crude up 0.64% at $79.77 per barrel.

Bitcoin was up 0.34% at $62,846.82.

US Dollar Index at 105.28.

US 10-year bond yield at 4.45%.

Brent crude up 0.55% at $84.34 per barrel.

GIFT Nifty traded up 0.05%, or 11 points at 22,139.50 as of 7:29 a.m.

Nymex crude up 0.64% at $79.77 per barrel.

Bitcoin was up 0.34% at $62,846.82.

Nifty May futures down by 1.43% to 22,072.85 at a premium of 115.35 points.

Nifty May futures open interest up by 20.14%.

Nifty Bank May futures down by 1.05% to 47,688, at a premium of 180.1 points.

Nifty Bank May futures open interest up by 11.04%.

Nifty Options May 16 Expiry: Maximum Call open interest at 23,000 and Maximum Put open interest at 21,000.

Bank Nifty Options May 15 Expiry: Maximum Call Open Interest at 48,000 and Maximum Put open interest at 45,000.

Securities in ban period: Aditya Birla Fashion Ltd., Balrampur Chini Mills Ltd., Canara Bank, GMR Airports Infrastructure Ltd., Vodafone Idea Ltd., Punjab National Bank, Piramal Enterprises Ltd., Steel Authority of India Ltd., and Zee Entertainment Enterprise Ltd.

Moved into short-term ASM framework: Allsec Technologies, Cartrade Technologies, Future Consumer.

Ex/record dividend: Aptech, HDFC Bank Ltd., Transformers and Rectifiers, Bank of Maharashtra, Ramkrishna Forgings, UCO Bank, DCB Bank.

Nilkamal: Seetha Kumari bought 0.78 lakh shares (0.52%) at Rs 1,870.2 apiece.

ICICI Lombard Insurance: Bharti Enterprises sold 38.5 lakh shares (0.75%) at Rs 1,722.5 apiece, while ICICI Bank bought 21 lakh shares (0.42%), Axis Mutual Fund bought 4 lakh shares (0.08%), Morgan Stanley Asia Singapore Pte bought 4.5 lakh shares (0.09%), Goldman Sachs Singapore Pte bought 2.25 lakh shares (0.04%), Blackstone Aqua Master Sub-Fund bought 0.75 lakh shares (0.01%), and others at Rs 1,722.5 apiece.

One97 Communications Ltd.: Paytm has refuted media reports on its lending partners invoking loan guarantees due to repayment defaults. The company acts as a distributor of loans and does not provide a first-loss default guarantee or other loan guarantees to its lending partners.

Brigade Enterprises Ltd.: The company will develop a residential project in Bengaluru, with a gross development value of Rs 660 crore.

Adani Enterprises Ltd.: The company’s Mauritius-based arm, Adani Global, acquired a 49% stake in UAE-based Sirius Digitech for $24,500.

Shyam Metallics and Energy Ltd.: The company's stainless-steel sales in the month of April were at 6,886 per tonne, up 33.7% from the previous year. Aluminium foil sales also went up 22.1% at 1,338 metric tonne and pellet sales were at 50,557 metric tonnes, down 62.2% YoY.

Tata Steel Ltd.: The company increased its stake in the arm of Indian Steel & Wire Products Ltd. to 98.61%.

Life Insurance Corp.: The company received a GST, interest and penalty order worth Rs 127 crore, including interest of Rs 114 crore.

Solara Active: The company will raise Rs 450 crore via a rights issue.

Bharat Petroleum Corp (Standalone, QoQ)

Revenue up 1.62% at Rs 1.16 lakh crore versus Rs 1.15 lakh crore (Bloomberg estimate: Rs 1.21 lakh crore).

Ebitda up 47.97% at Rs 9,213 crore versus Rs 6,226 crore (Bloomberg estimate: Rs 8,766 crore).

Margin up 251 bps at 7.9% versus 5.39% (Bloomberg estimate: 7.3%).

Net profit up 24.34% at Rs 4,224 crore versus Rs 3,397 crore (Bloomberg estimate: Rs 5,342 crore).

Board recommended final dividend of Rs 21 per share.

Bonus issue in the ratio of 1:1.

Note: Exceptional item of Rs 1,798 crore.

Abbott India Ltd. (Consolidated, YoY)

Revenue up 7.14% at Rs 1,439 crore versus Rs 1,343 crore (Bloomberg estimate: Rs 1,476 crore).

Ebitda up 17.71% at Rs 330 crore versus Rs 280.35 crore (Bloomberg estimate: Rs 351 crore).

Margin up 205 bps at 22.93% versus 20.87% (Bloomberg estimate: 23.8%).

Net profit up 24.04% at Rs 287.06 crore versus Rs 231.42 crore (Bloomberg estimate: Rs 278 crore).

Recommended final dividend of Rs 410 per share.

Relaxo Footwears Ltd. (YoY)

Revenue down 2.3% at Rs 747.2 crore versus Rs 764.9 crore (Bloomberg estimate: Rs 797 crore).

Ebitda up 2.1% at Rs 120.4 crore versus Rs 117.9 crore (Bloomberg estimate: Rs 124 crore).

Margin At 16.1% versus 15.4% (Bloomberg estimate: 15.6%).

Net profit down 3% at Rs 61.4 crore versus Rs 63.3 crore (Bloomberg estimate: Rs 59.62 crore).

Intellect Design Arena Ltd. (Consolidated, QoQ)

Revenue down 3.27% at Rs 614 crore versus Rs 634 crore (Bloomberg estimate: Rs 631 crore).

Ebit up 4.65% at Rs 101 crore versus Rs 96.67 crore (Bloomberg estimate: Rs 100 crore).

Margin up 124 bps at 16.48% vs 15.23% (Bloomberg estimate: 15.89%).

Net profit down 13.58% at Rs 73.35 crore versus Rs 84.88 crore (Bloomberg estimate: Rs 90.77 crore).

Mahanagar Gas Ltd. (Consolidated, QoQ)

Revenue up 2.76% at Rs 1,613 crore versus Rs 1,569 crore (Bloomberg estimate: Rs 1,547 crore).

Ebitda down 11.95% at Rs 395 crore versus Rs 449 crore (Bloomberg estimate: Rs 421 crore).

Margin down 410 bps at 24.49% versus 28.6% (Bloomberg estimate: 27.2%).

Net profit down 20.46% at Rs 252 crore versus Rs 317 crore (Bloomberg estimate: Rs 297 crore).

Recommended final dividend of Rs 18 per share.

Hikal Ltd. (Consolidated, YoY)

Revenue down 5.72% at Rs 514 crore versus Rs 545 crore.

Ebitda up 7.32% at Rs 94.46 crore versus Rs 88.01 crore.

Margin up 223 bps at 18.37% versus 16.14%.

Net profit down 5.63% at Rs 33.97 crore versus Rs 36 crore.

VST Tillers Tractors Ltd. (Consolidated, YoY)

Revenue down 15.25% at Rs 273 crore versus Rs 323 crore.

Ebitda down 15.25% at Rs 39.83 crore versus Rs 54.55 crore.

Margin down 234 bps at 14.56% versus 16.9%.

Net profit down 13.44% at Rs 34.75 crore versus Rs 40.15 crore.

Tata Motors Ltd., Eicher Motors Ltd., Cipla Ltd., Bank of Baroda, ABB India Ltd., Union Bank of India, Polycab India Ltd., Bank of India, Thermax Ltd., Kalyan Jewellers Ltd., Aarti Industries Ltd., Cholamandalam Financial Holdings, Dr Lal Pathlabs, Piramal Pharma Ltd., Finolex Industries Ltd., Fine Organics Industries Pvt., Sapphire Foods Ltd., Syrma SGS Technology Ltd., VIP Industries Ltd., Dilip Buildcon Ltd., Ami Organics Ltd., TCI Express Ltd., Sharda Cropchem Pvt., Punjab and Sind Bank, Great Eastern Shipping Co., and Neuland Laboratories Ltd.

Most benchmarks in the Asia-Pacific region extended gains to the second day, as higher-than-expected initial jobless claims in the US fuelled hopes the Federal Reserve will cut rates soon.

Hong Kong's Hang Seng, Japan's Nikkei and Topix, Australia's S&P ASX 200, and South Korea's Kospi rose, while China's CSI 300 fell.

The number of people filing for initial unemployment benefits in the US rose from 22,000 to a seasonally adjusted 231,000 in the week ended May 4, marking the highest level since last August. A Bloomberg survey forecasted 212,000 claims for the week.

The S&P 500 and Nasdaq Composite rose by 0.27% and 0.51%, respectively, as of 11:25 a.m. New York time. The Dow Jones Industrial Average rose by 0.85%.

Brent crude was up 0.55% at $84.34 per barrel, and gold rose 0.20% to $2,351.06 an ounce.

The May futures contract of the GIFT Nifty traded higher by 0.05%, or 11 points, at 22,139.50 as of 7:29 a.m.

India's benchmark stock indices recorded their worst fall since January on Thursday, tracking declines in shares of heavyweights HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industries Ltd.

Market capitalisation of the Nifty Total Market, which tracks the performance of 750 stocks listed on the NSE, fell Rs 6.7 lakh crore in Thursday's crash, according to data on the NSE.

The NSE Nifty 50 ended 345 points, or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points, or 1.45% lower at 72,404.17.

Overseas investors in Indian equities remained net sellers on Thursday for the sixth consecutive session, as the sell-off hit a new high in nearly a month. Foreign portfolio investors offloaded stocks worth Rs 6,994.9 crore—the highest since April 12. Domestic institutional investors remained net buyers for the 13th day and mopped up equities worth Rs 5,642.5 crore, according to provisional data from the National Stock Exchange.

The Indian currency closed flat at 83.51 against the US dollar.

Most benchmarks in the Asia-Pacific region extended gains to the second day, as higher-than-expected initial jobless claims in the US fuelled hopes the Federal Reserve will cut rates soon.

Hong Kong's Hang Seng, Japan's Nikkei and Topix, Australia's S&P ASX 200, and South Korea's Kospi rose, while China's CSI 300 fell.

The number of people filing for initial unemployment benefits in the US rose from 22,000 to a seasonally adjusted 231,000 in the week ended May 4, marking the highest level since last August. A Bloomberg survey forecasted 212,000 claims for the week.

The S&P 500 and Nasdaq Composite rose by 0.27% and 0.51%, respectively, as of 11:25 a.m. New York time. The Dow Jones Industrial Average rose by 0.85%.

Brent crude was up 0.55% at $84.34 per barrel, and gold rose 0.20% to $2,351.06 an ounce.

The May futures contract of the GIFT Nifty traded higher by 0.05%, or 11 points, at 22,139.50 as of 7:29 a.m.

India's benchmark stock indices recorded their worst fall since January on Thursday, tracking declines in shares of heavyweights HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industries Ltd.

Market capitalisation of the Nifty Total Market, which tracks the performance of 750 stocks listed on the NSE, fell Rs 6.7 lakh crore in Thursday's crash, according to data on the NSE.

The NSE Nifty 50 ended 345 points, or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points, or 1.45% lower at 72,404.17.

Overseas investors in Indian equities remained net sellers on Thursday for the sixth consecutive session, as the sell-off hit a new high in nearly a month. Foreign portfolio investors offloaded stocks worth Rs 6,994.9 crore—the highest since April 12. Domestic institutional investors remained net buyers for the 13th day and mopped up equities worth Rs 5,642.5 crore, according to provisional data from the National Stock Exchange.

The Indian currency closed flat at 83.51 against the US dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.