Overseas investors stayed net sellers on Thursday for fourth consecutive day.

Foreign portfolio investors sold stocks worth Rs 2,823.33 crore, according to provisional data from the National Stock Exchange. Domestic institutional investors stayed net buyers for the fourth day and mopped up equities worth Rs 6,167.56 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 4,562 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The local currency closed flat at 83.33 against the U.S. Dollar.

Source: Bloomberg

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

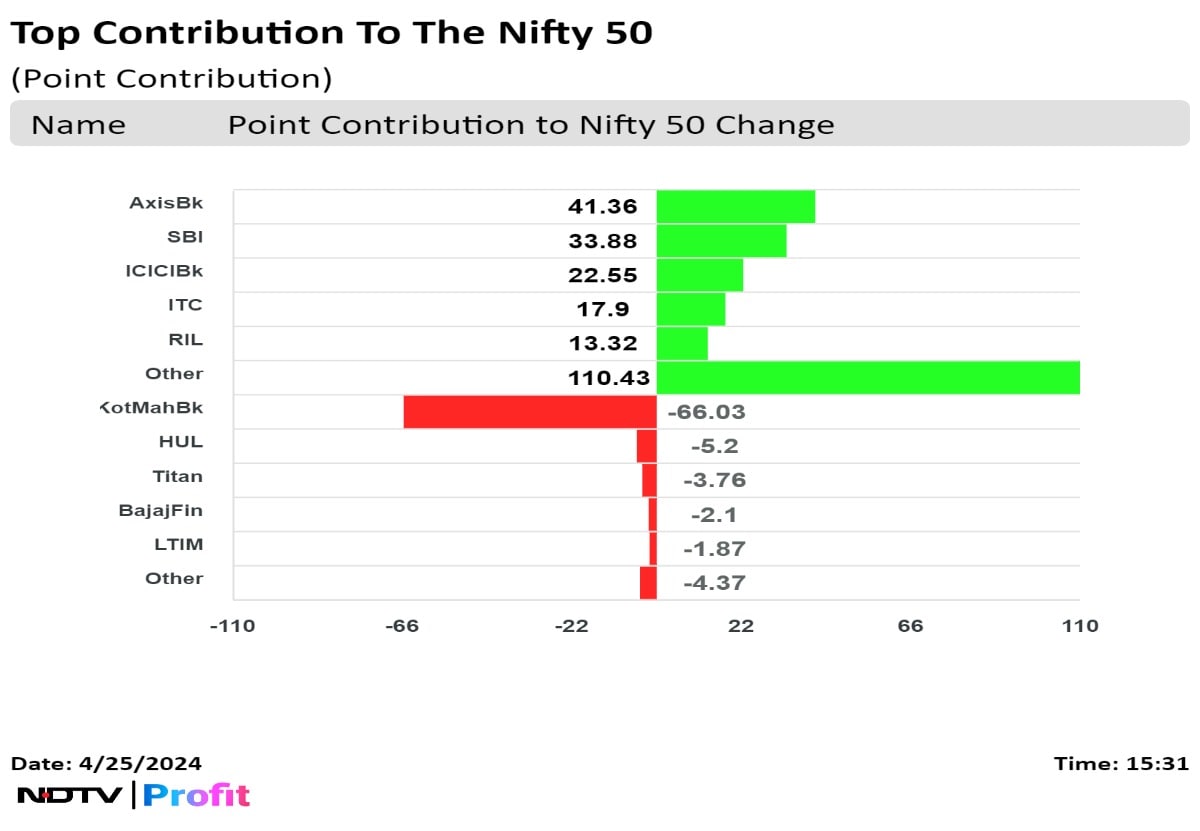

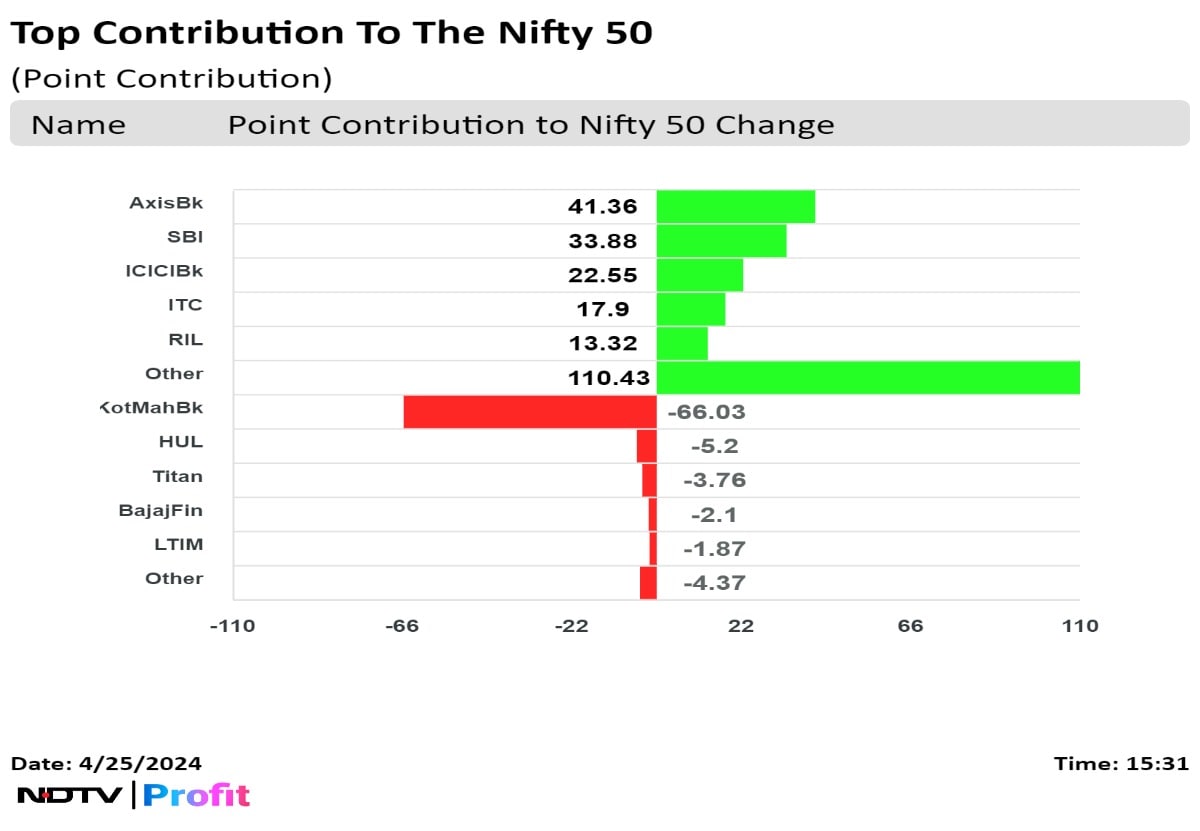

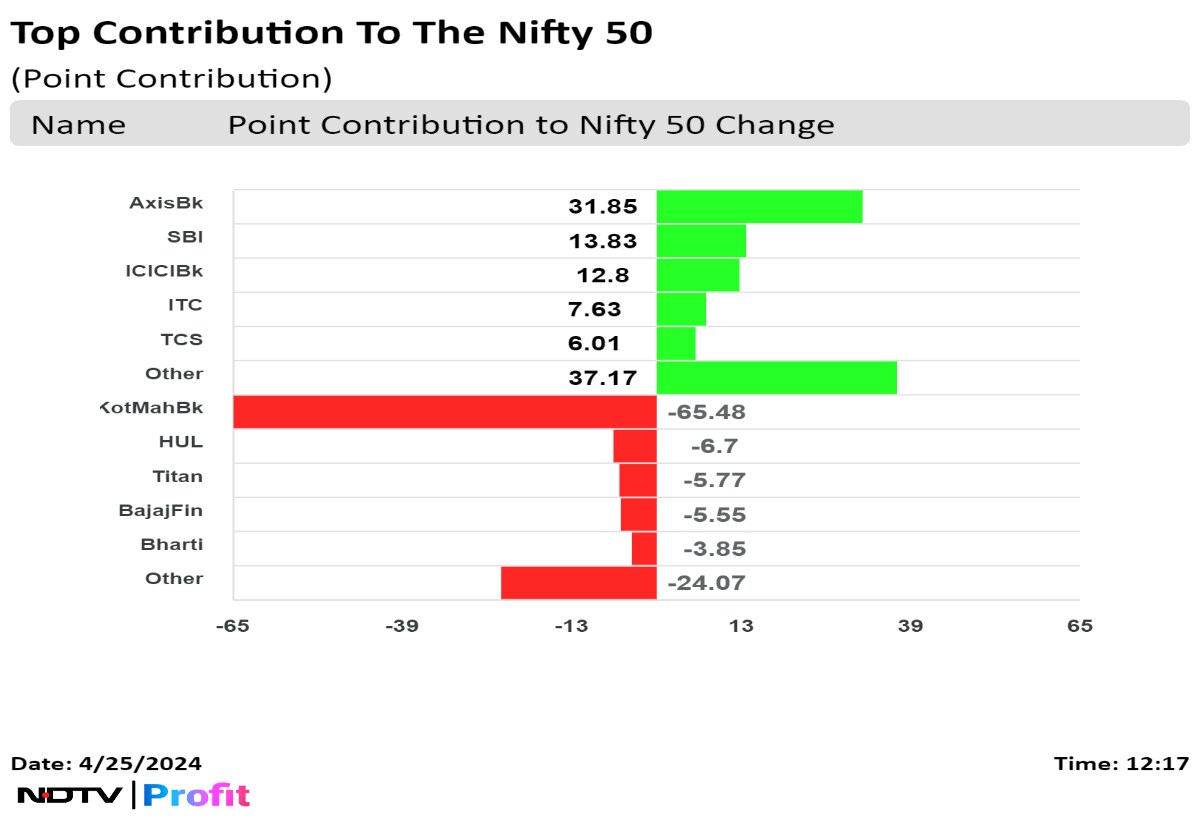

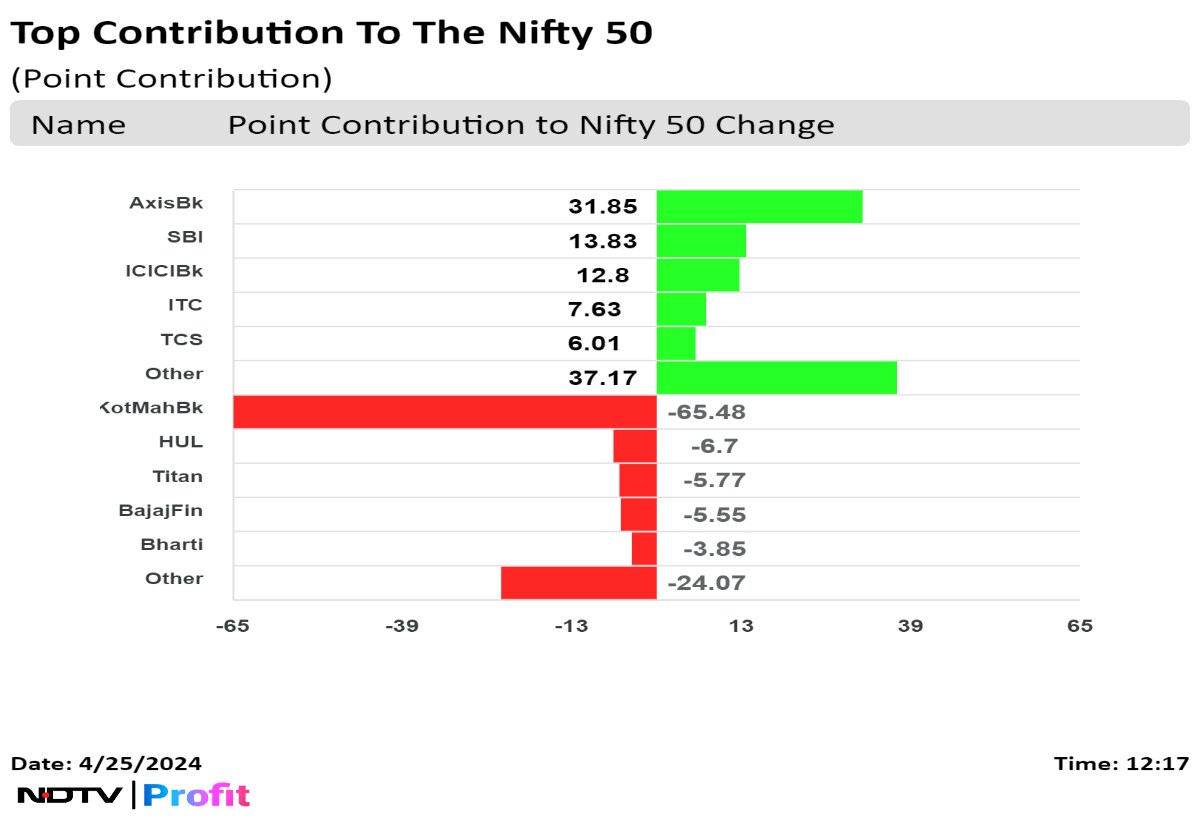

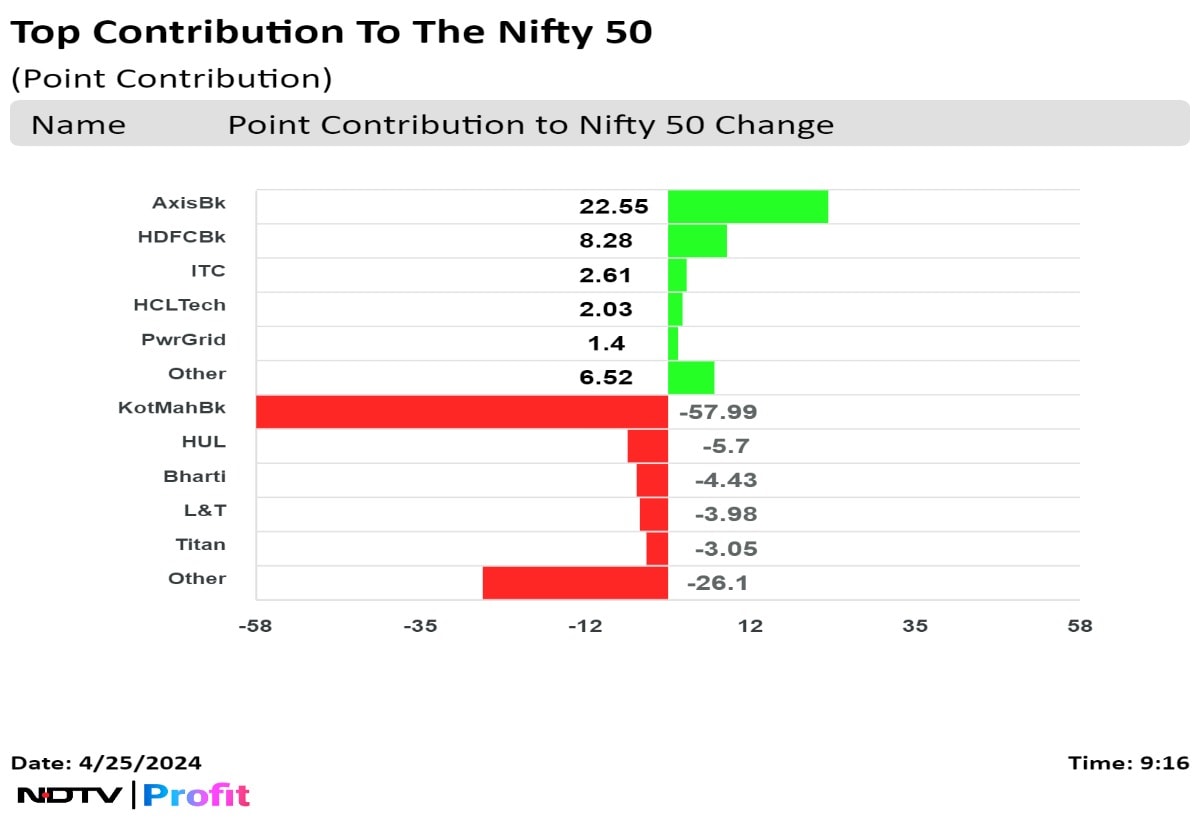

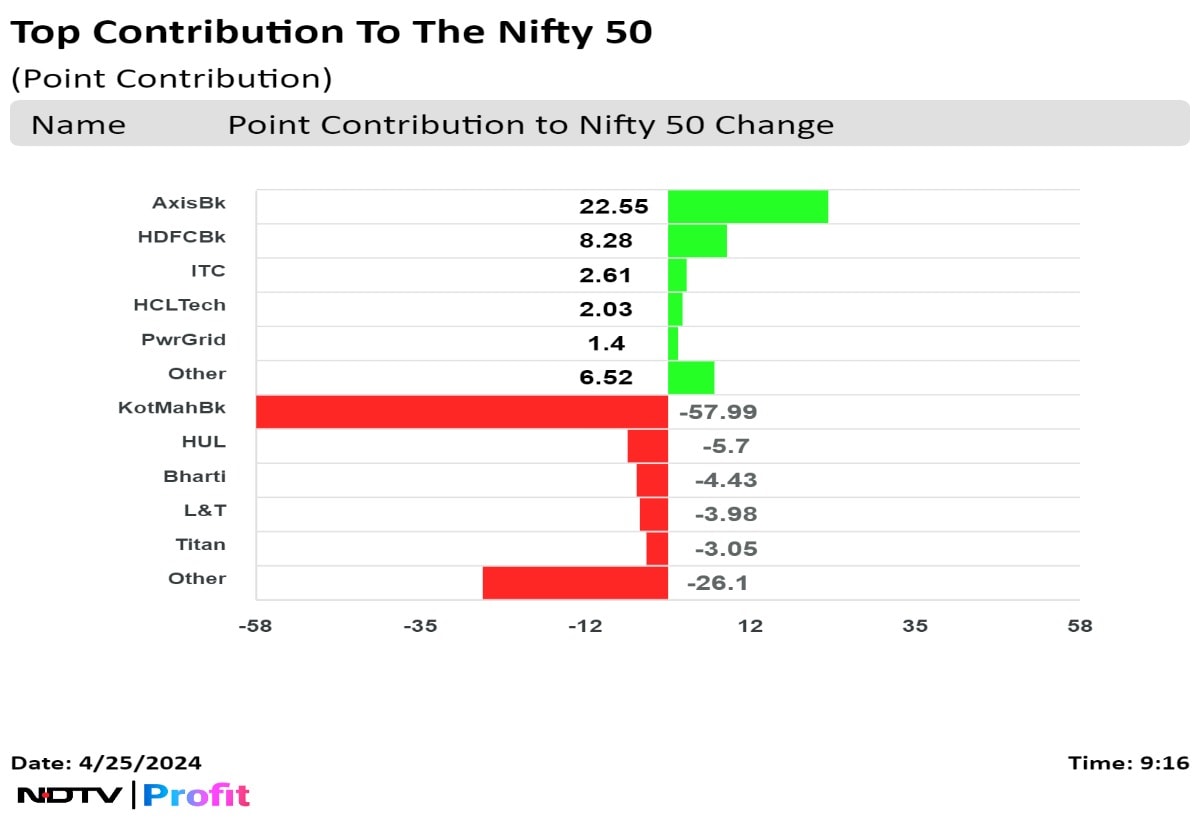

Shares of Axis Bank Ltd., State Bank Of India., ICICI Bank Ltd., ITC Ltd., and Reliance Industries Ltd. contributed the most to the gains.

While those of Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., Titan Co Ltd., Bajaj Finance Ltd., and LTIMindtree Ltd capped the upside.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Shares of Axis Bank Ltd., State Bank Of India., ICICI Bank Ltd., ITC Ltd., and Reliance Industries Ltd. contributed the most to the gains.

While those of Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., Titan Co Ltd., Bajaj Finance Ltd., and LTIMindtree Ltd capped the upside.

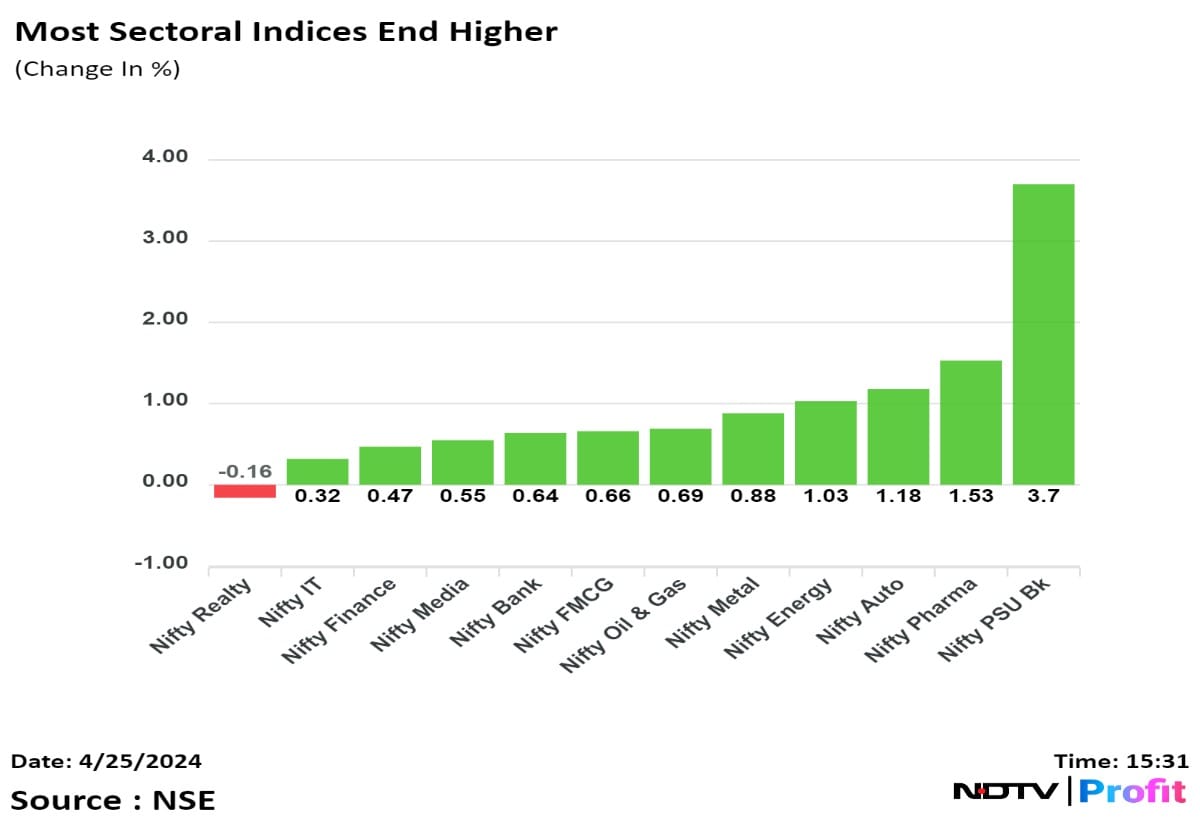

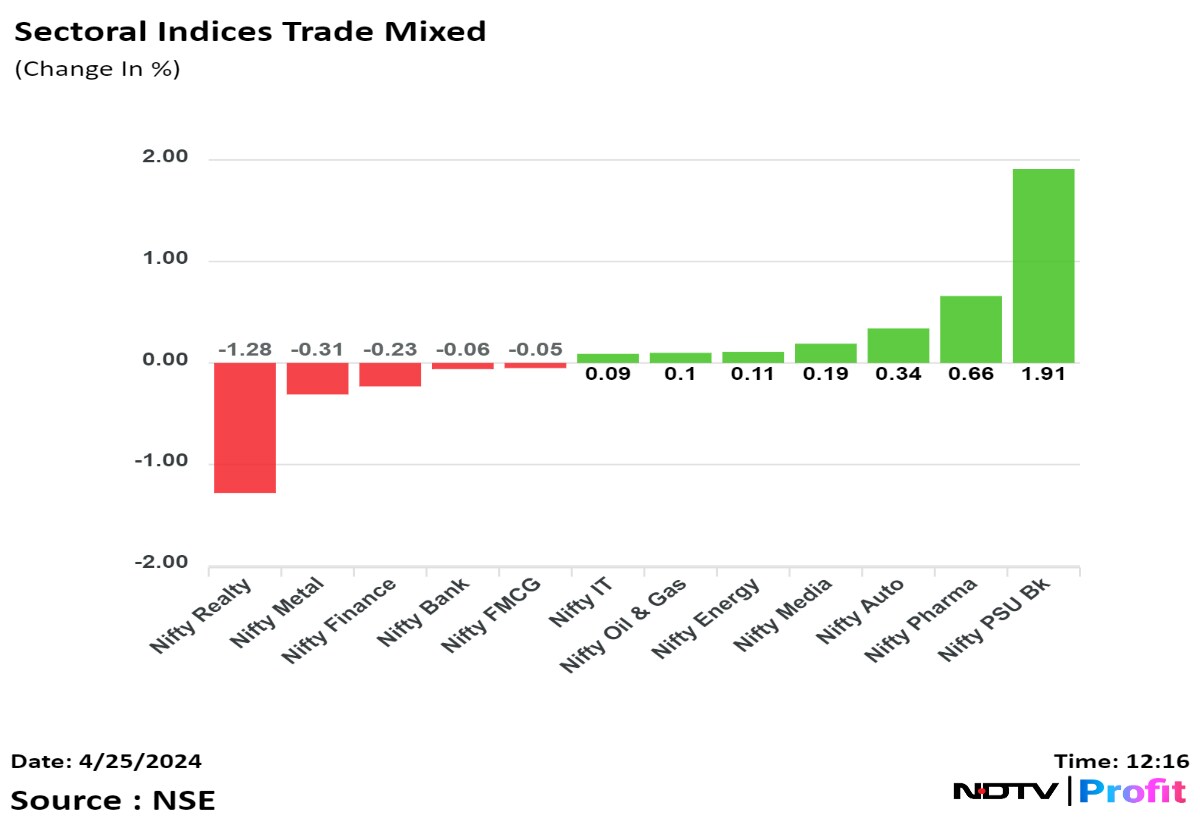

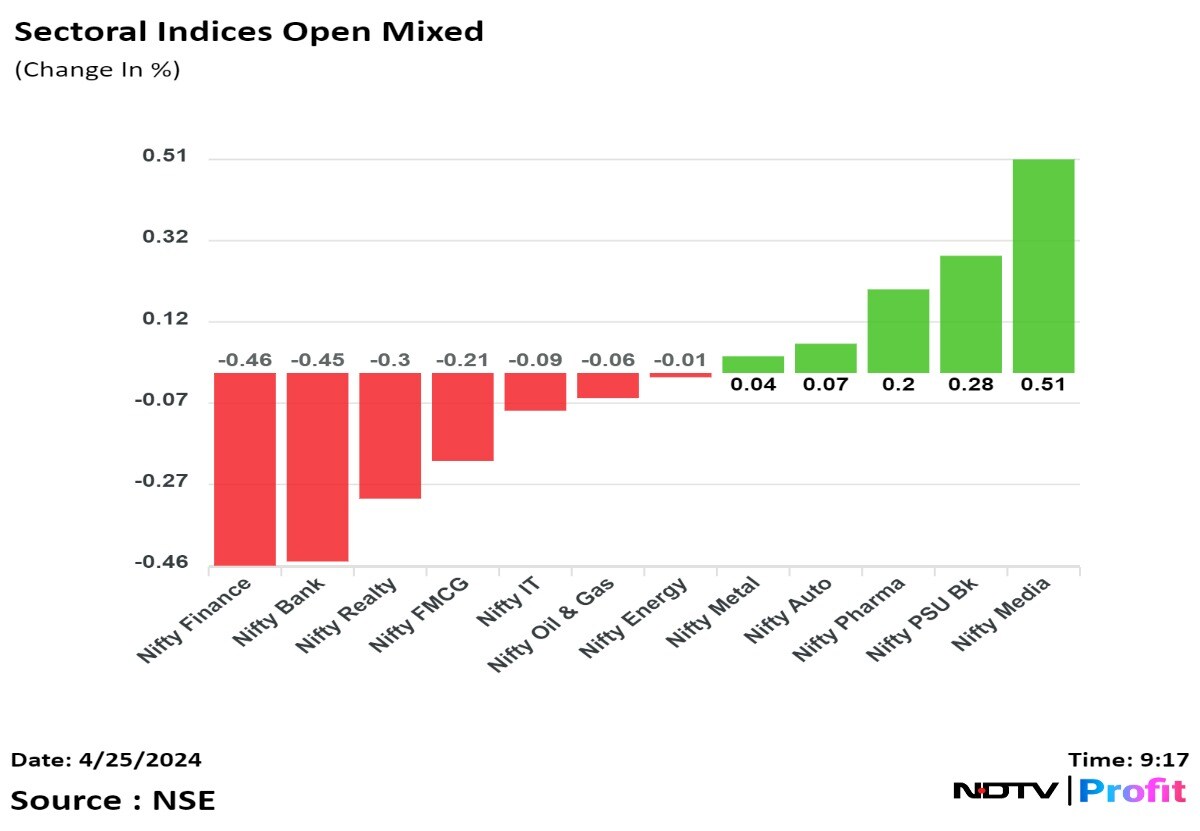

Except, Nifty Realty all sectoral indices ended higher with Nifty PSU Bank rising nearly 4%.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Shares of Axis Bank Ltd., State Bank Of India., ICICI Bank Ltd., ITC Ltd., and Reliance Industries Ltd. contributed the most to the gains.

While those of Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., Titan Co Ltd., Bajaj Finance Ltd., and LTIMindtree Ltd capped the upside.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended gains in the fifth consecutive session on the back of gains in the shares of Axis Bank and State Bank of India even as those of Kotak Mahindra Bank plunged nearly 11%.

The Nifty ended 0.75% or 167.95 points higher at 22,570.35 while the Sensex closed up by 0.66% or 486.50 points at 74,339.44.

"With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450," said Aditya Gaggar, director of Progressive Shares.

Shares of Axis Bank Ltd., State Bank Of India., ICICI Bank Ltd., ITC Ltd., and Reliance Industries Ltd. contributed the most to the gains.

While those of Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., Titan Co Ltd., Bajaj Finance Ltd., and LTIMindtree Ltd capped the upside.

Except, Nifty Realty all sectoral indices ended higher with Nifty PSU Bank rising nearly 4%.

Broader markets ended higher on BSE. The S&P BSE Midcap ended 0.73% up and the S&P BSE Smallcap ended 0.58% up .

On BSE, 18 sectors out of 20 advanced, and two declined. The S&P BSE Services index rose nearly 2% to become the top performer. The S&P BSE Consumer Durables index was the worst performer among peers.

Market breadth was skewed in favour of the buyers. Around 2,079 stock rose, 1,716 stocks declined, and 139 stocks remained unchanged on BSE.

Revenue at Rs 1,439.67 crore vs Rs 1,380.9 crore, up 4.25%

Ebitda at Rs 241.49 crore vs Rs 285.54 crore, down 15.43%

Margin at 16.77% vs 20.67%, down 390 bps

Net profit at Rs 75.02 crore vs Rs 105.27 crore, down 28.73%

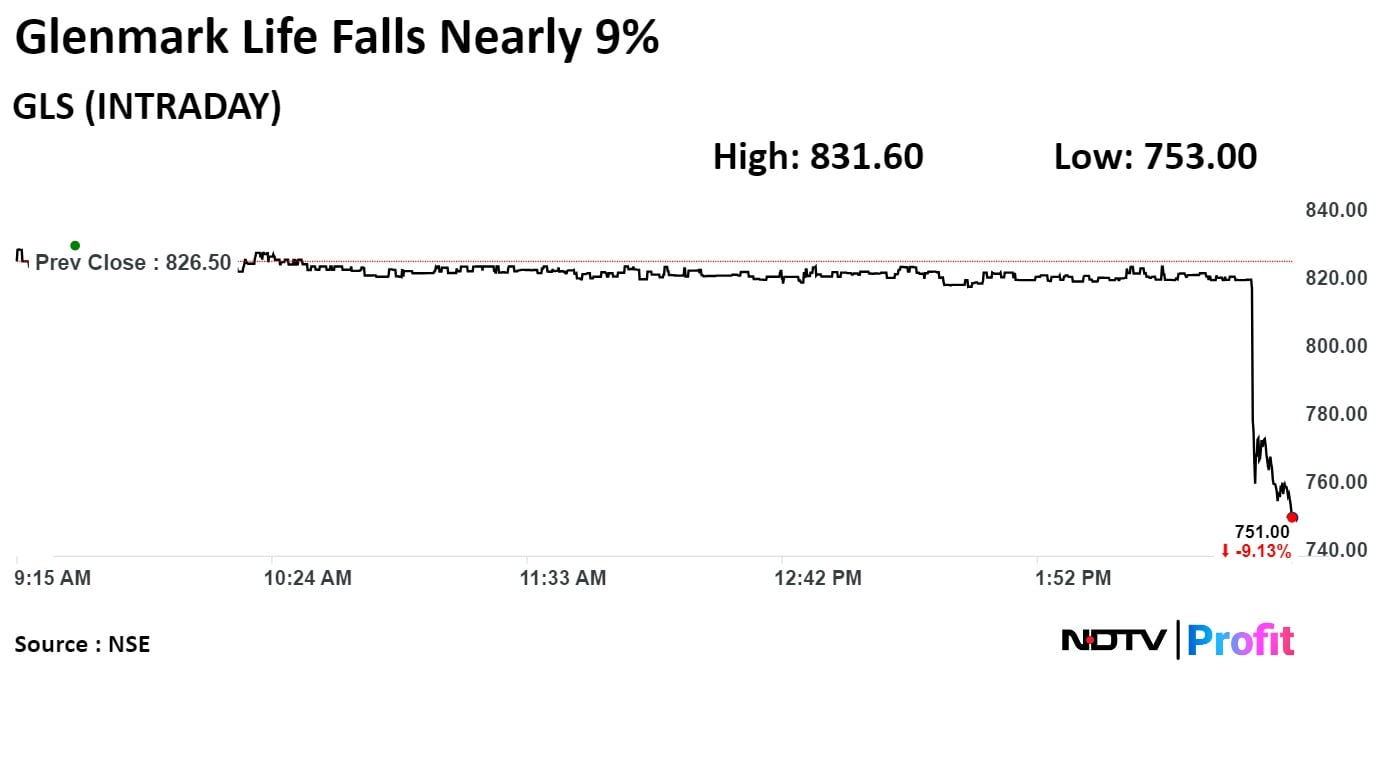

Revenue at Rs 536.6 crore vs Rs 621.3 crore, down 13.64%

EBITDA at Rs 141.5 crore vs Rs 206.4 crore, down 31.44%

Margin at 26.36% vs 33.22%

Net profit at Rs 97.9 crore vs Rs 146.4 crore, down 33.12%

Revenue at Rs 536.6 crore vs Rs 621.3 crore, down 13.64%

EBITDA at Rs 141.5 crore vs Rs 206.4 crore, down 31.44%

Margin at 26.36% vs 33.22%

Net profit at Rs 97.9 crore vs Rs 146.4 crore, down 33.12%

Unit incorporates JV with Assam Power Distribution Co

Source: Exchange Filing

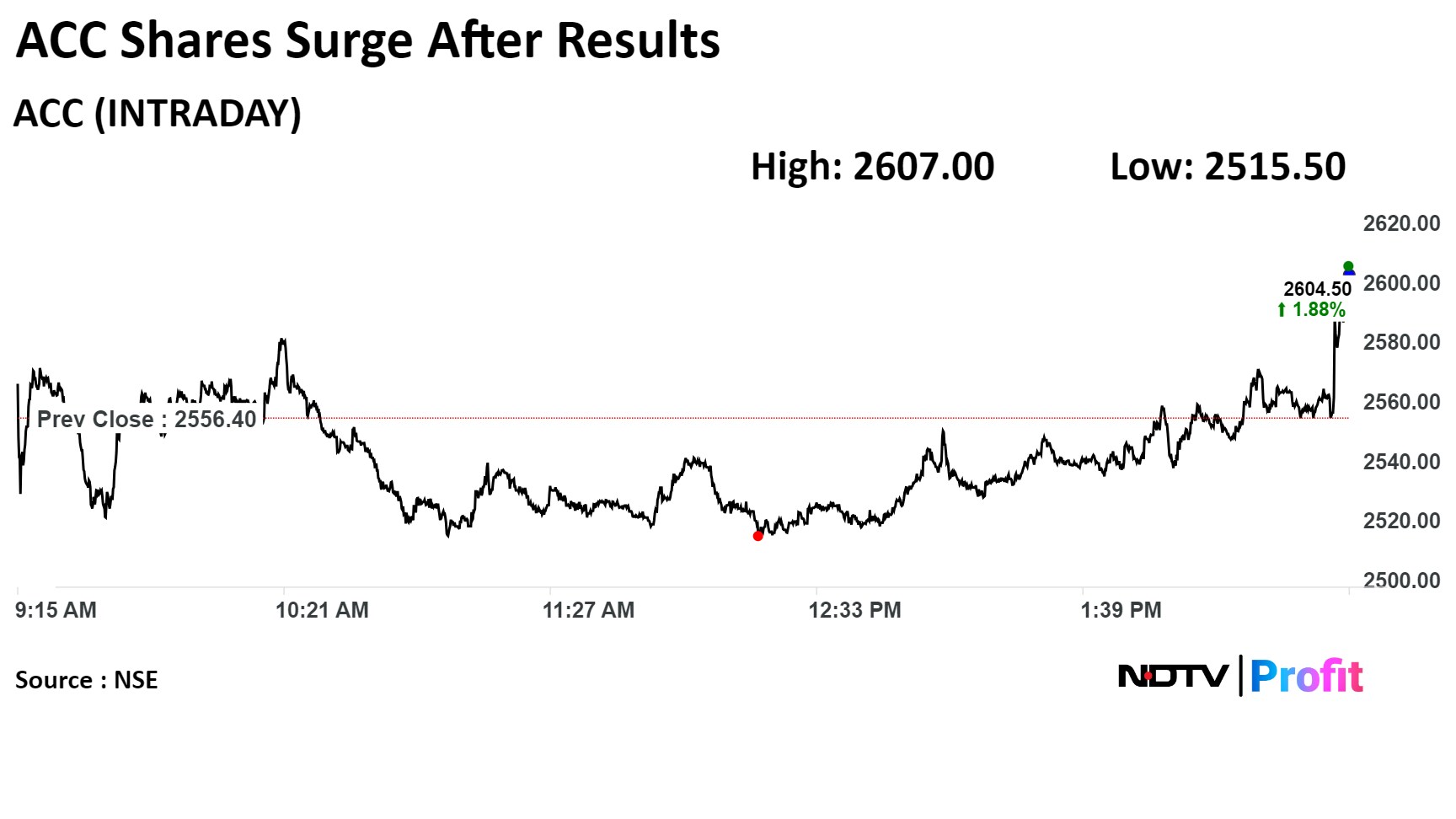

Revenue up 13% at Rs 5,409 crore vs Rs 4791 crore

Ebitda up 79% at Rs 837 crore vs Rs 468 crore

Margin at 15.5% vs 10%

Net profit at Rs 945 crore vs Rs 236 crore

Revenue up 13% at Rs 5,409 crore vs Rs 4791 crore

Ebitda up 79% at Rs 837 crore vs Rs 468 crore

Margin at 15.5% vs 10%

Net profit at Rs 945 crore vs Rs 236 crore

Unit Provident Housing gets Rs 1,150 crore investment from HDFC Capital

Source: Exchange Filing

Unit Provident Housing gets Rs 1,150 crore investment from HDFC Capital

Source: Exchange Filing

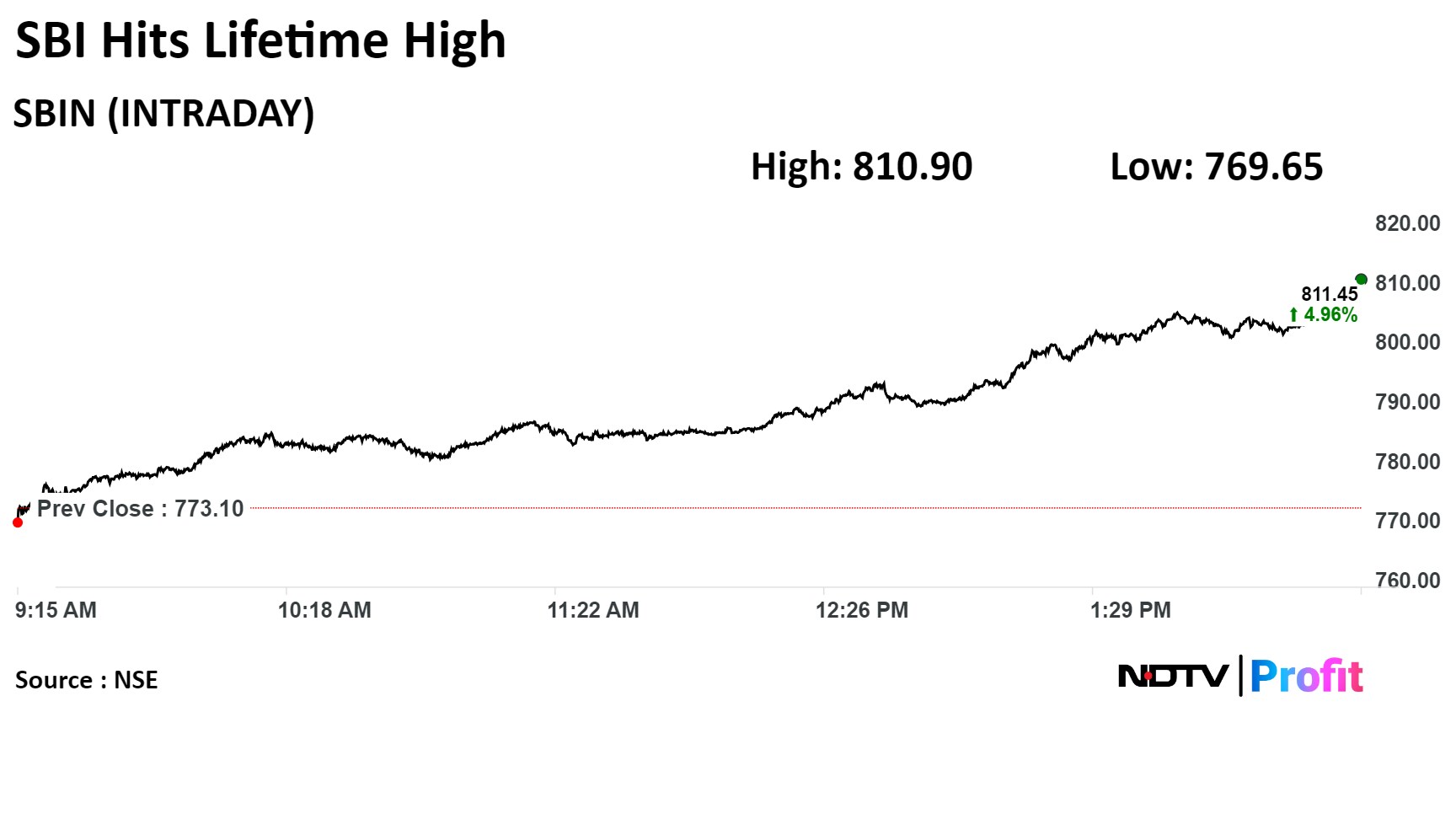

SBI shares rose as much as 5.11% to hits lifetime high. The stock has gained 26.25% on an year to date basis and 40.2% in the last twelve months.

SBI shares rose as much as 5.11% to hits lifetime high. The stock has gained 26.25% on an year to date basis and 40.2% in the last twelve months.

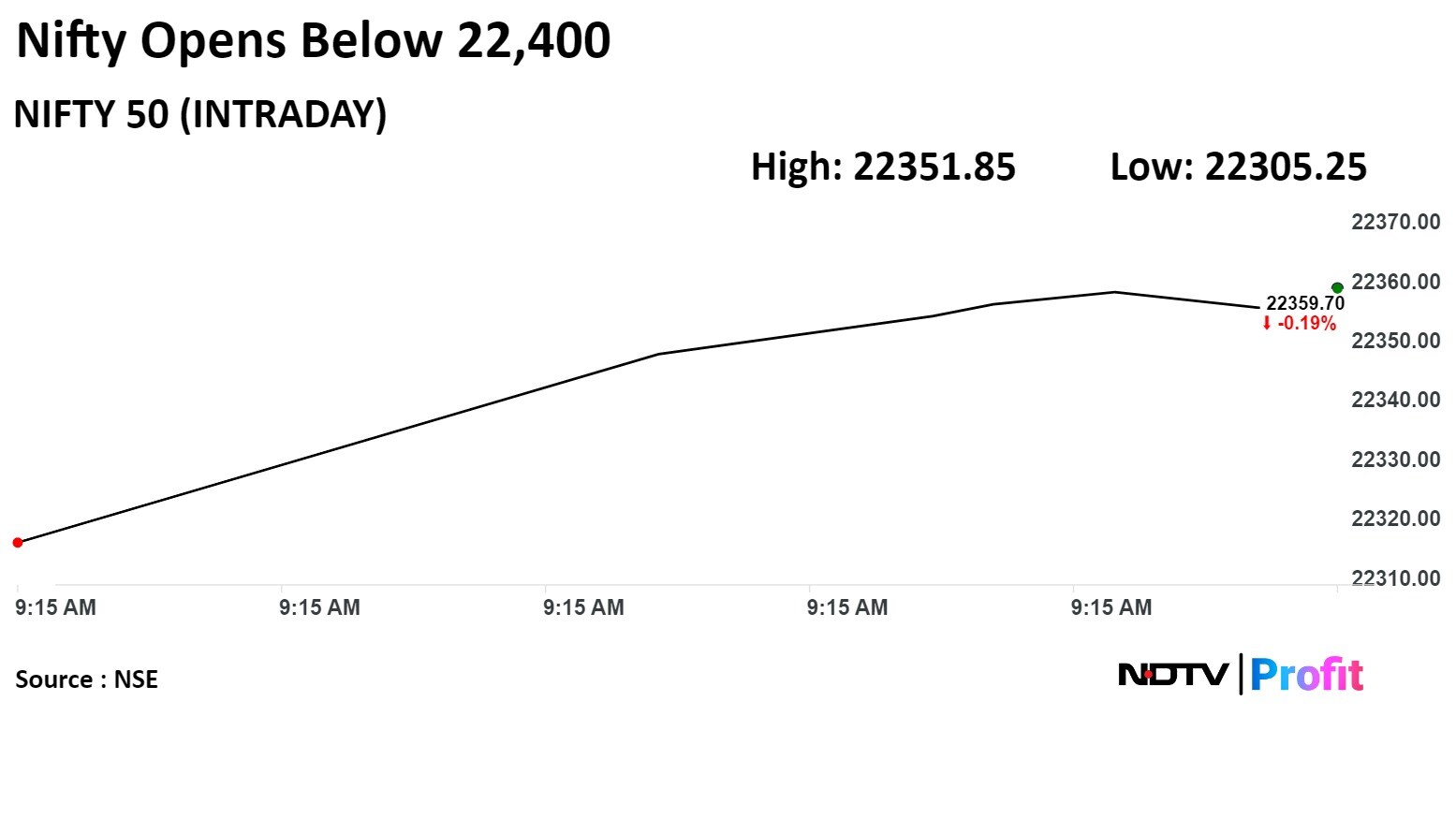

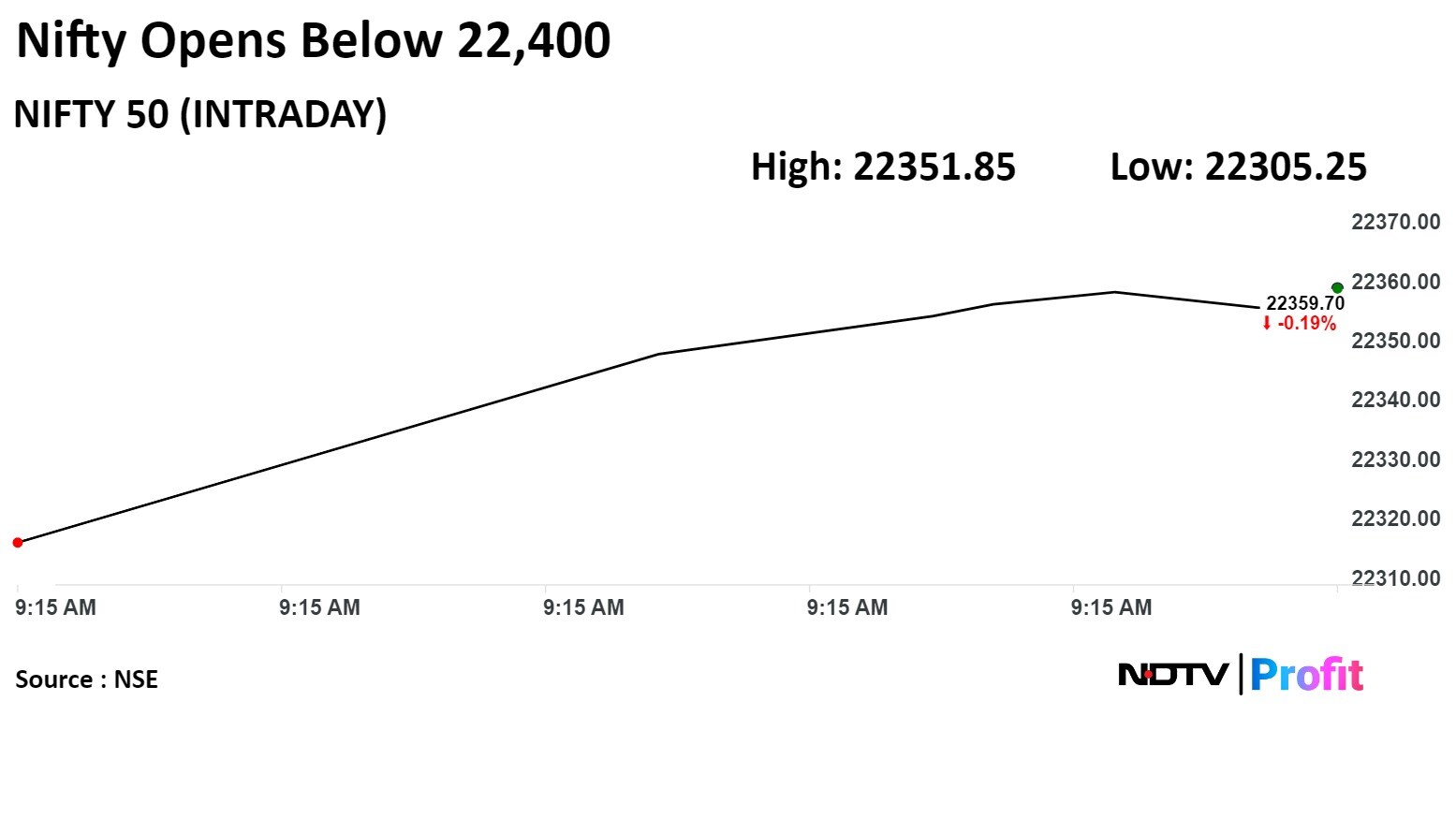

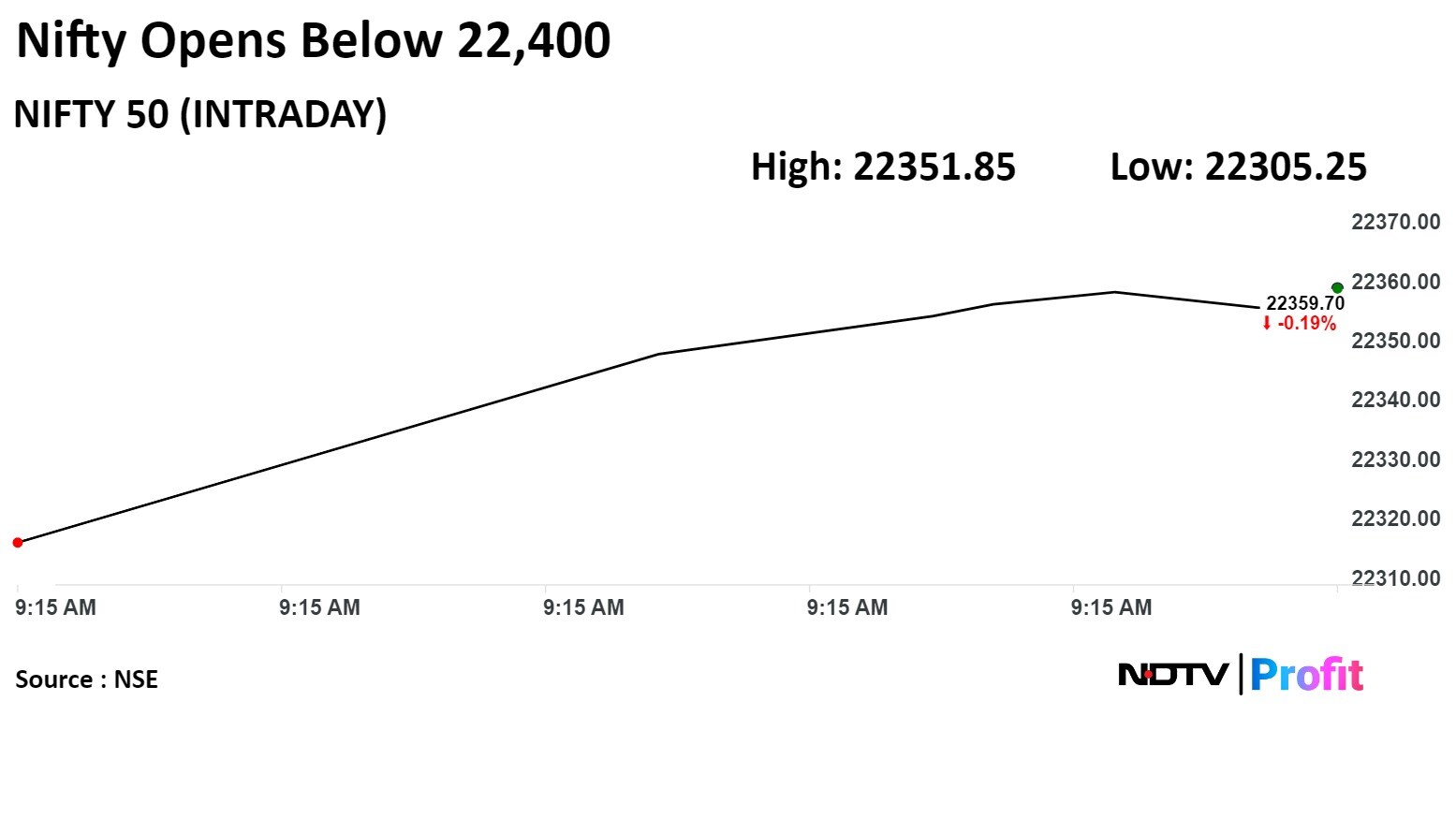

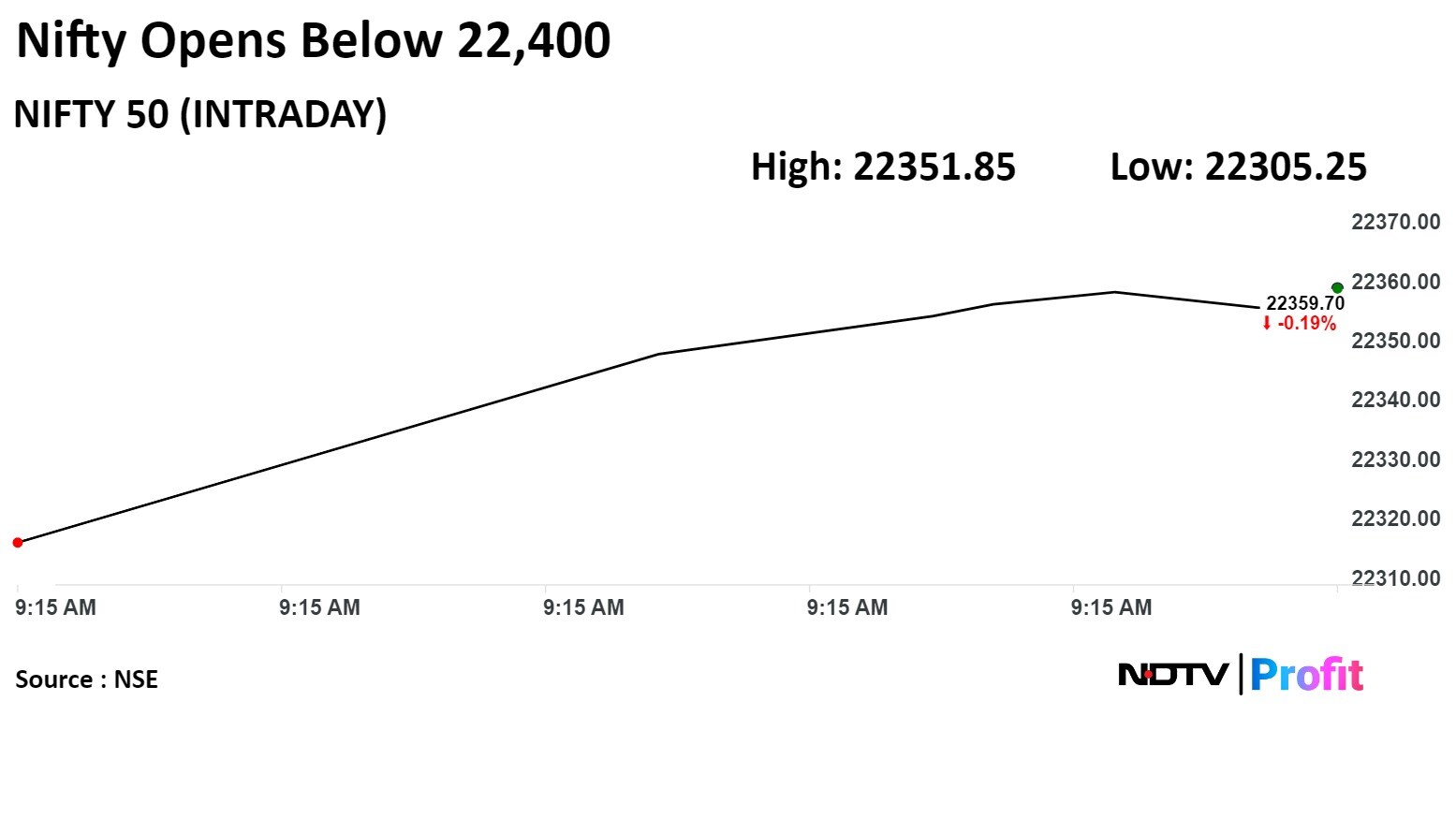

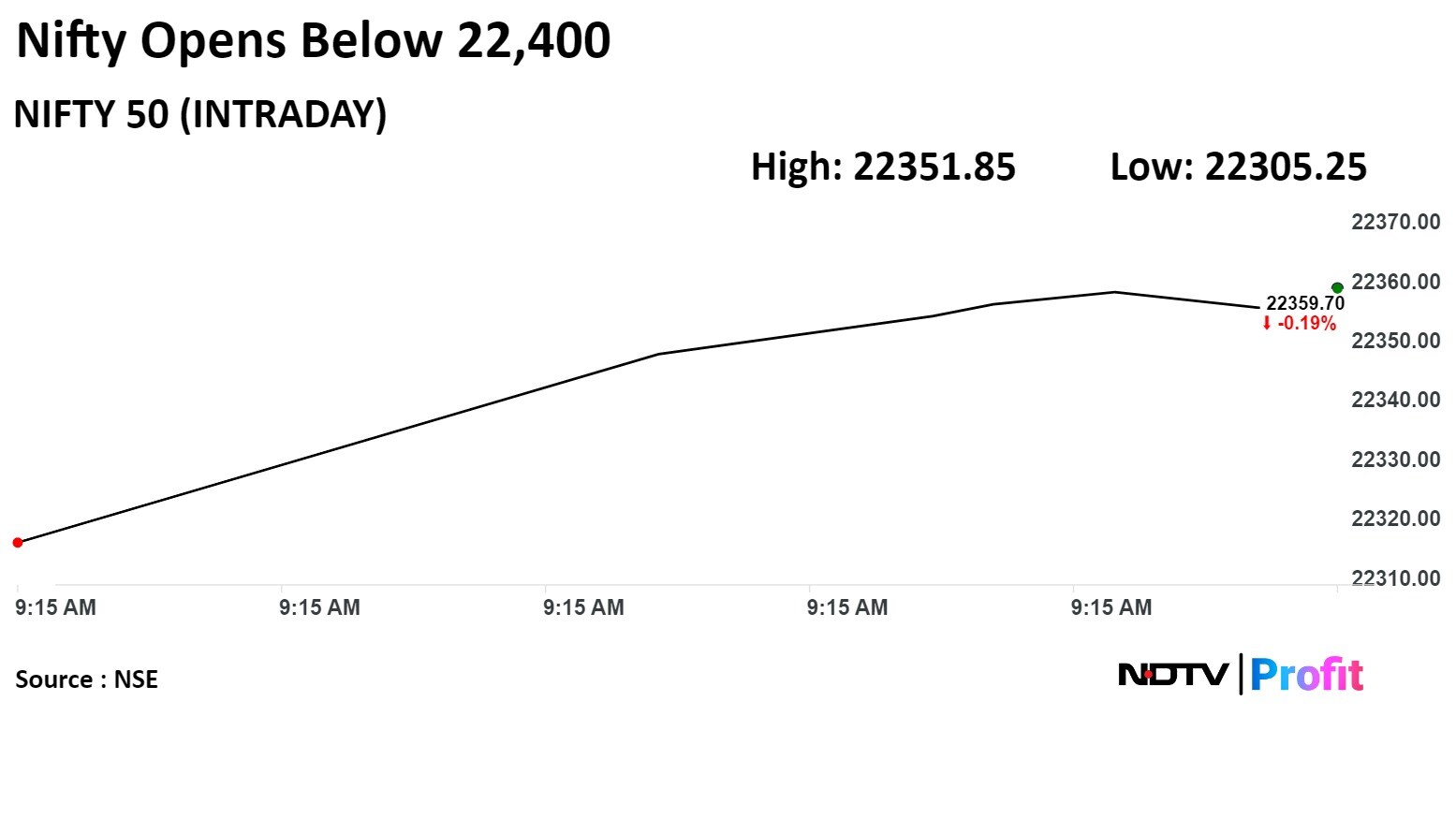

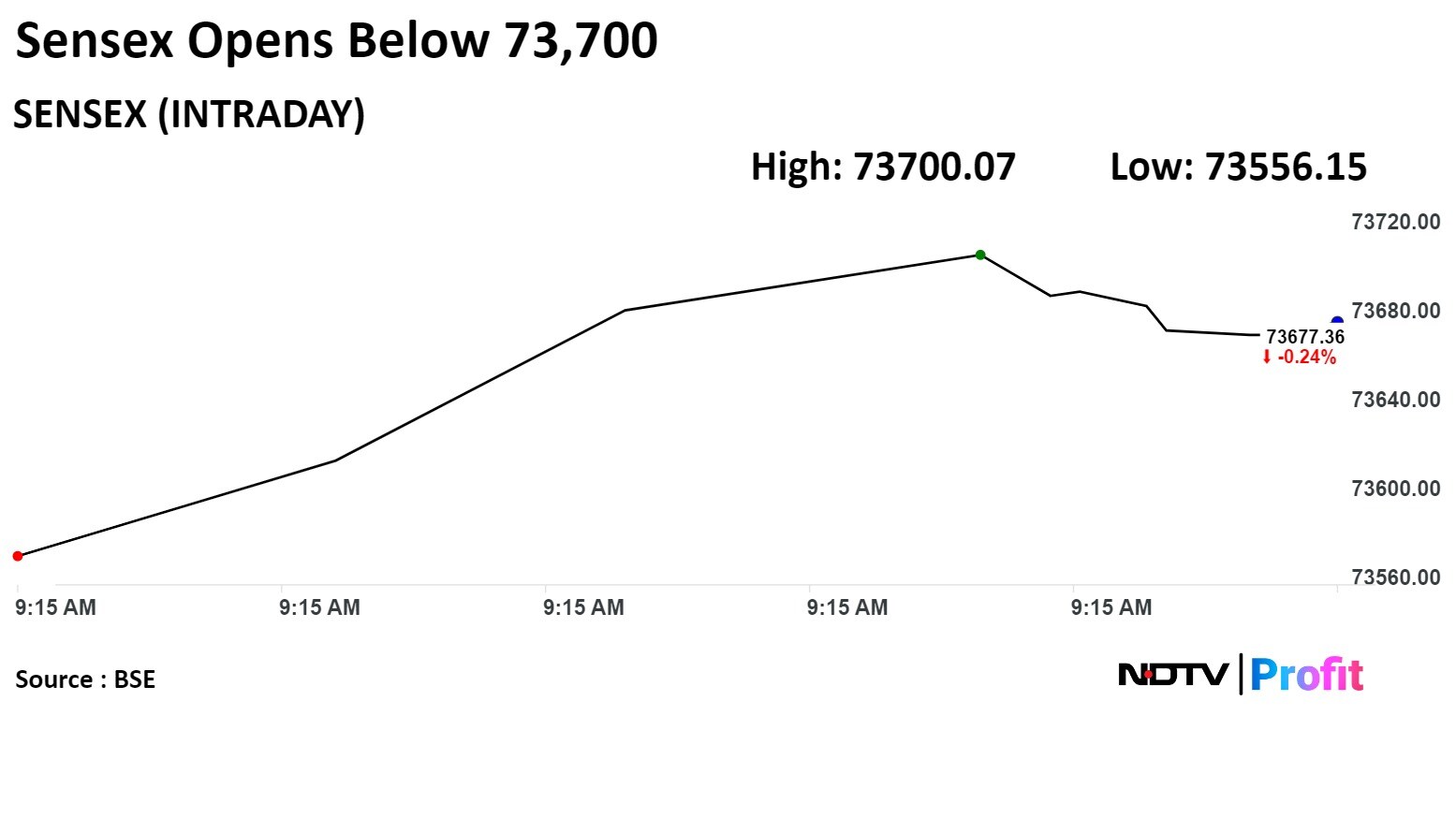

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

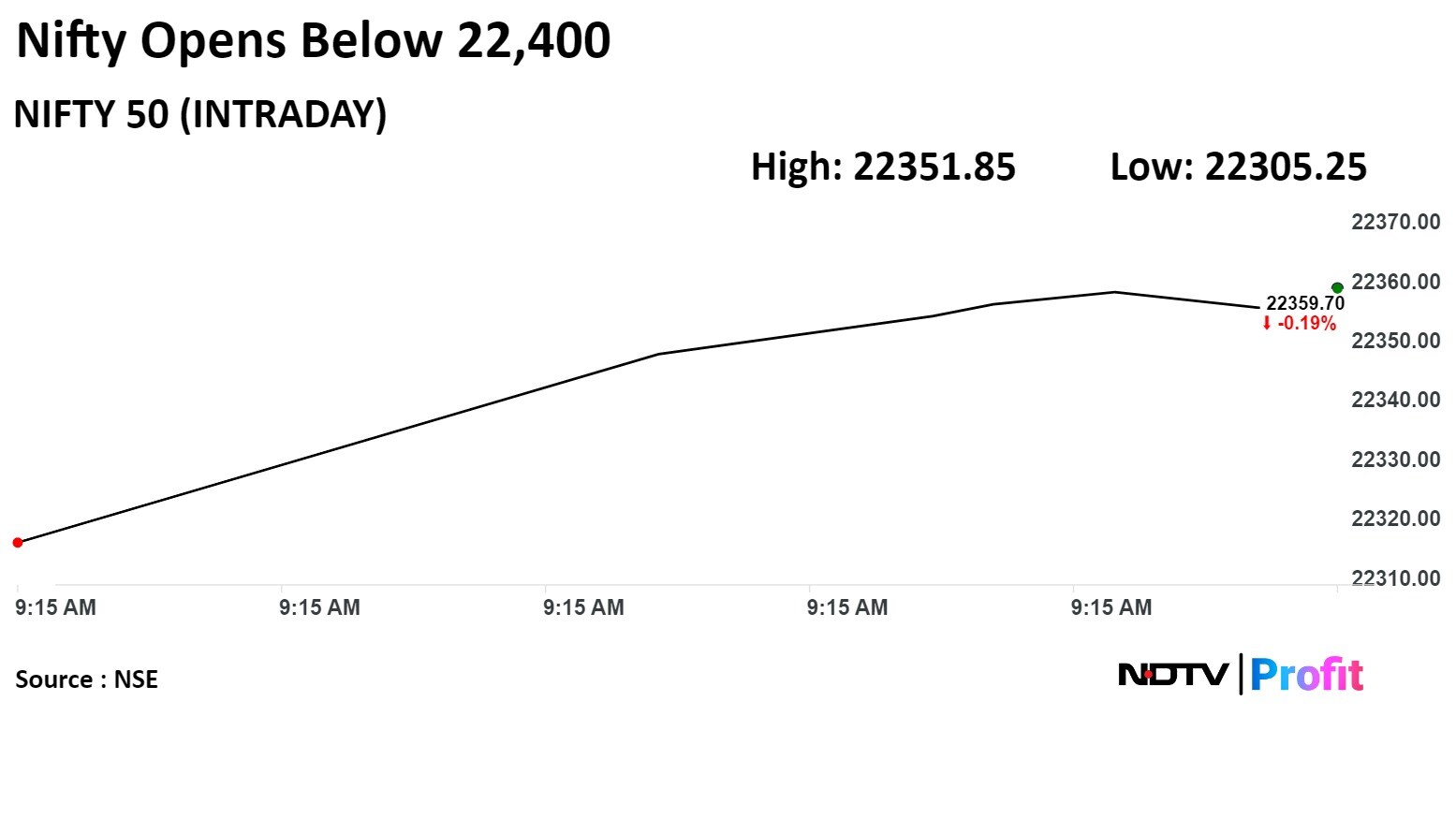

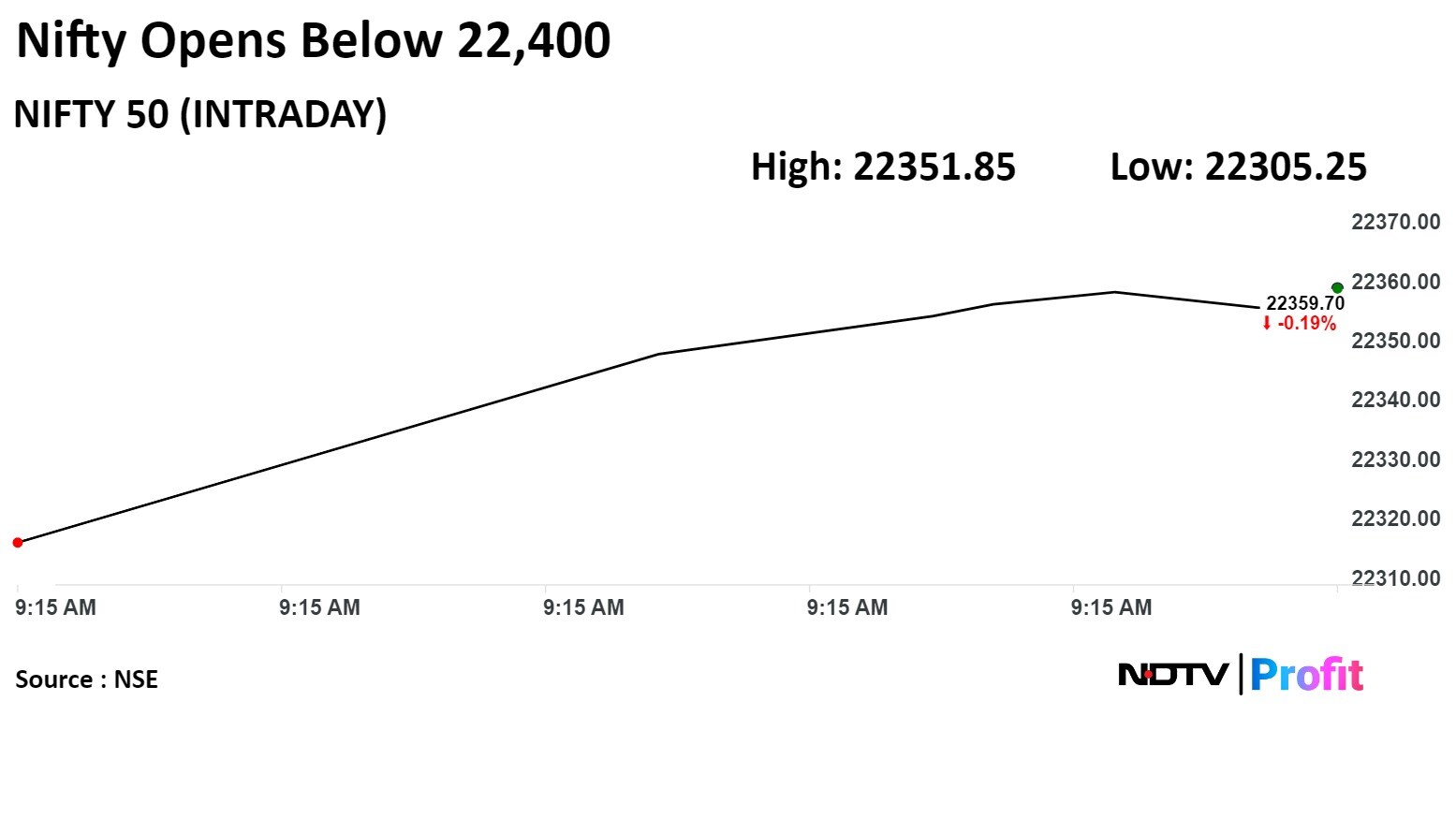

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

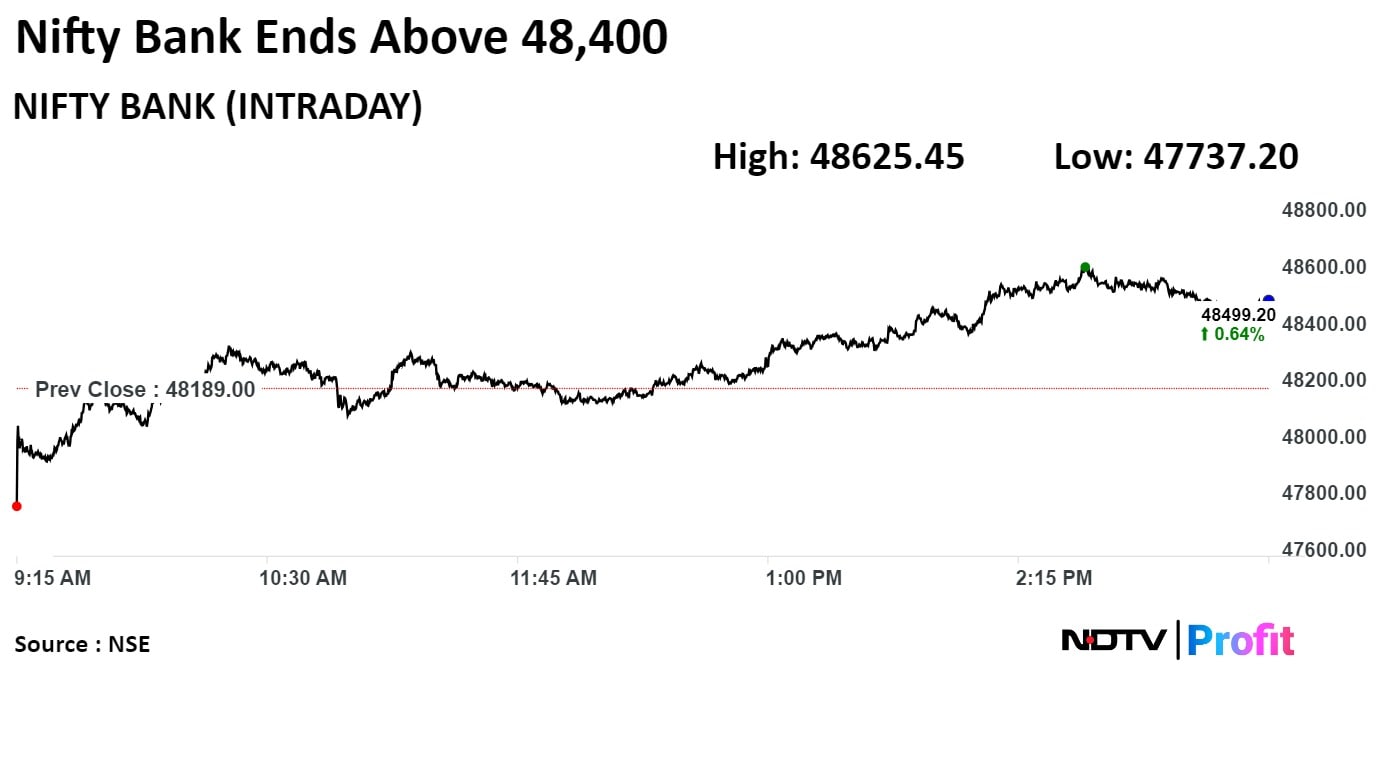

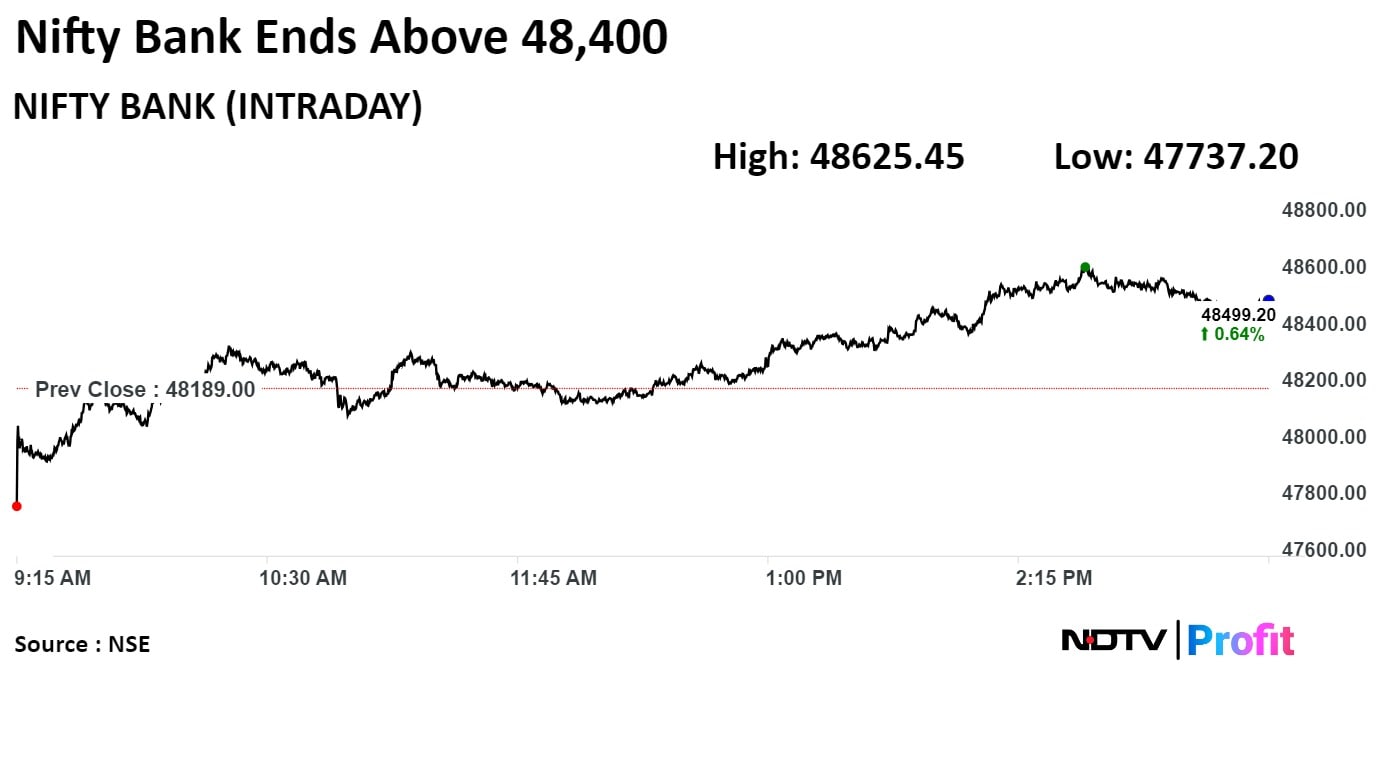

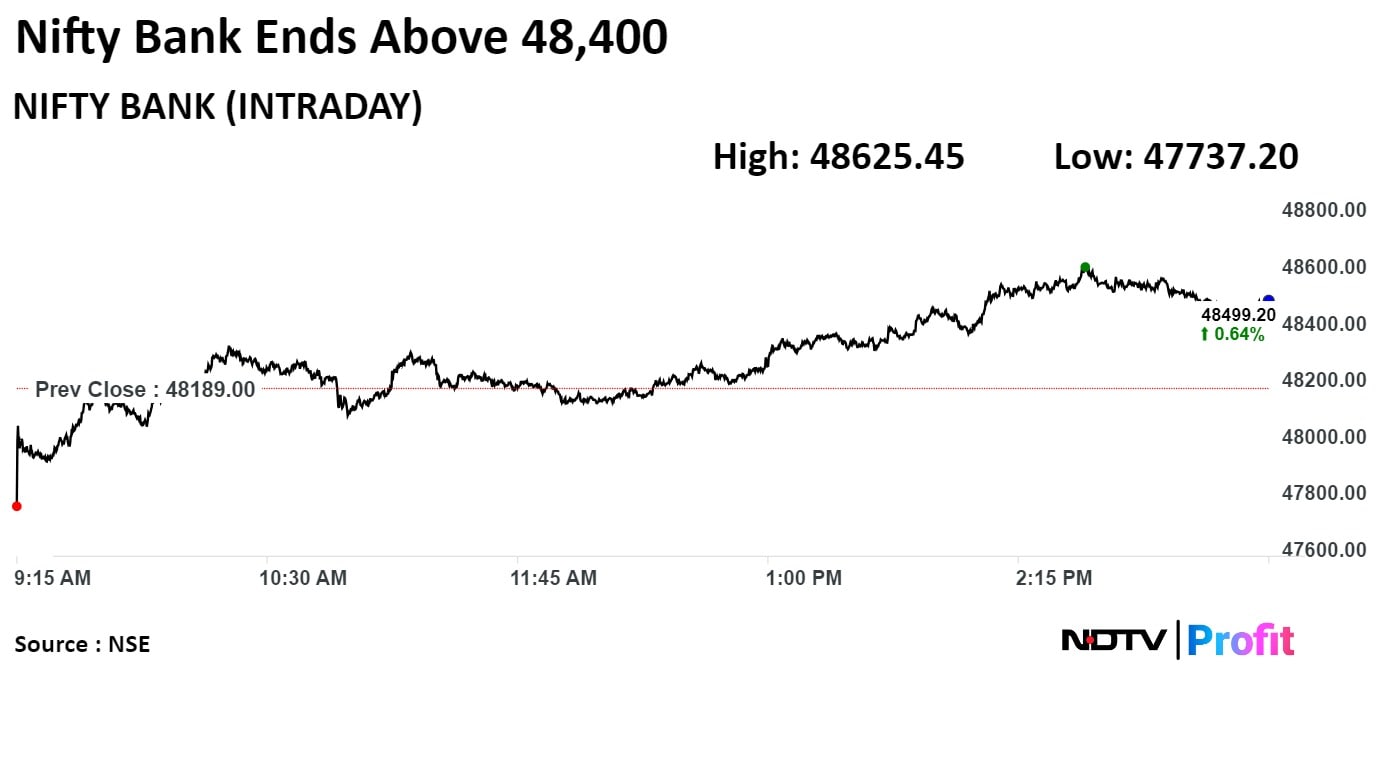

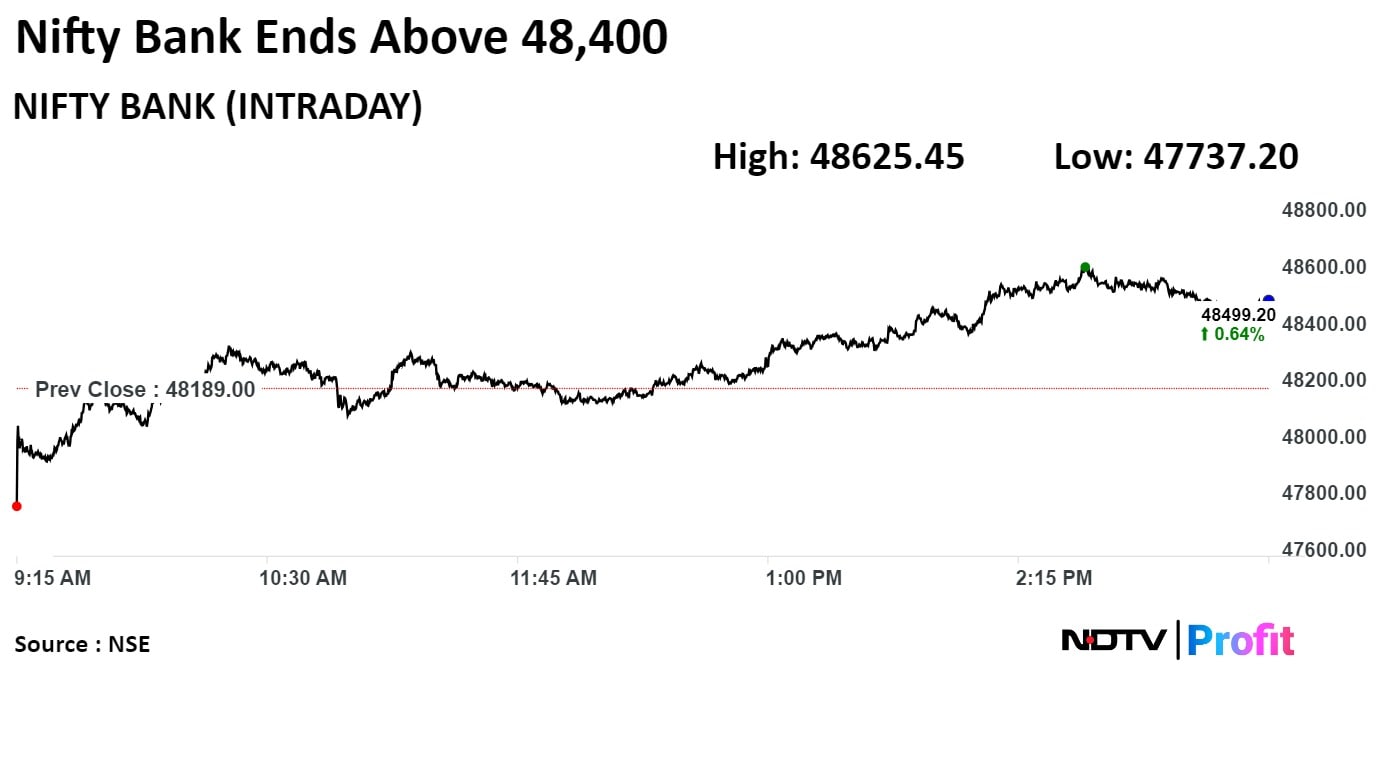

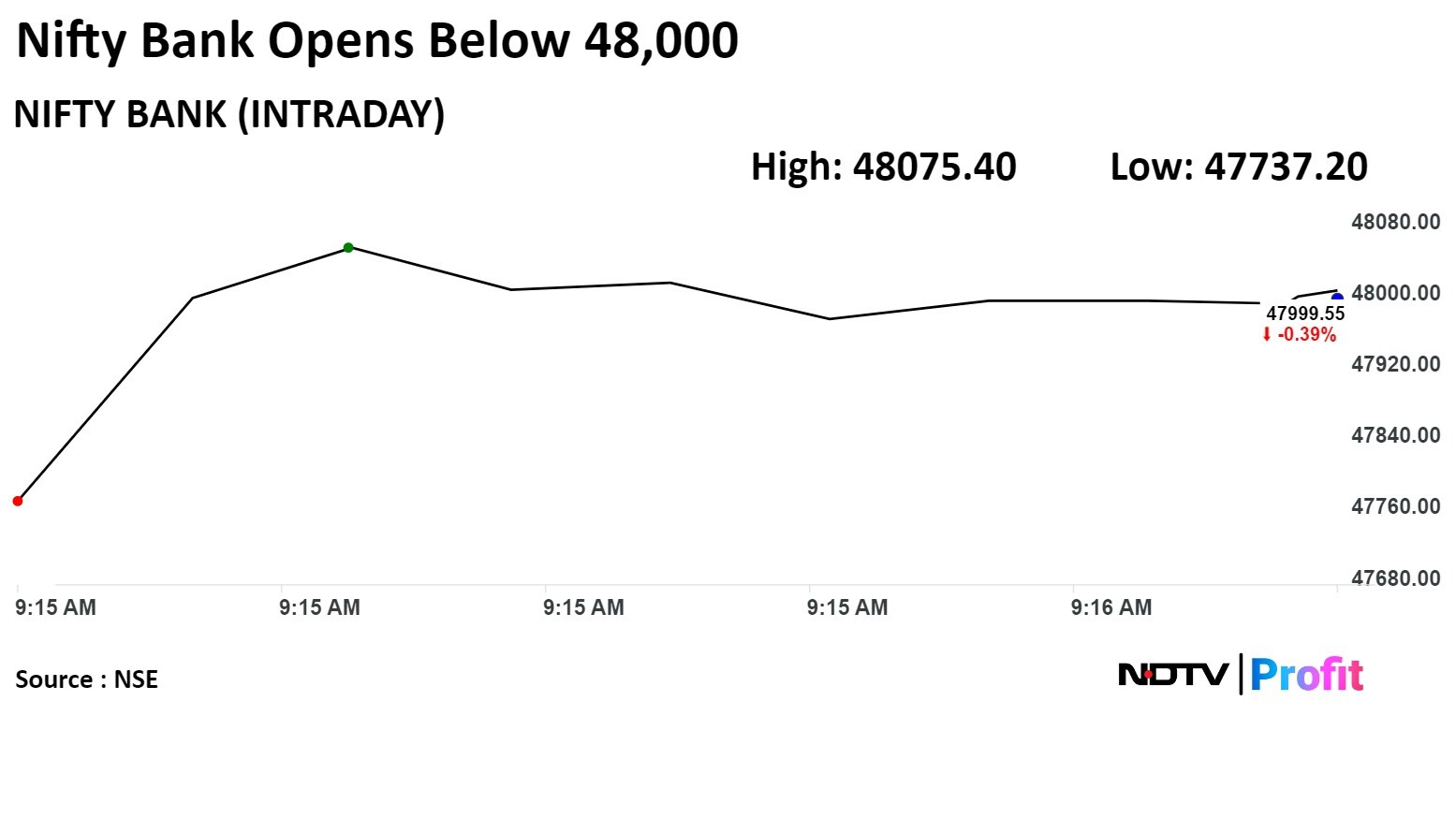

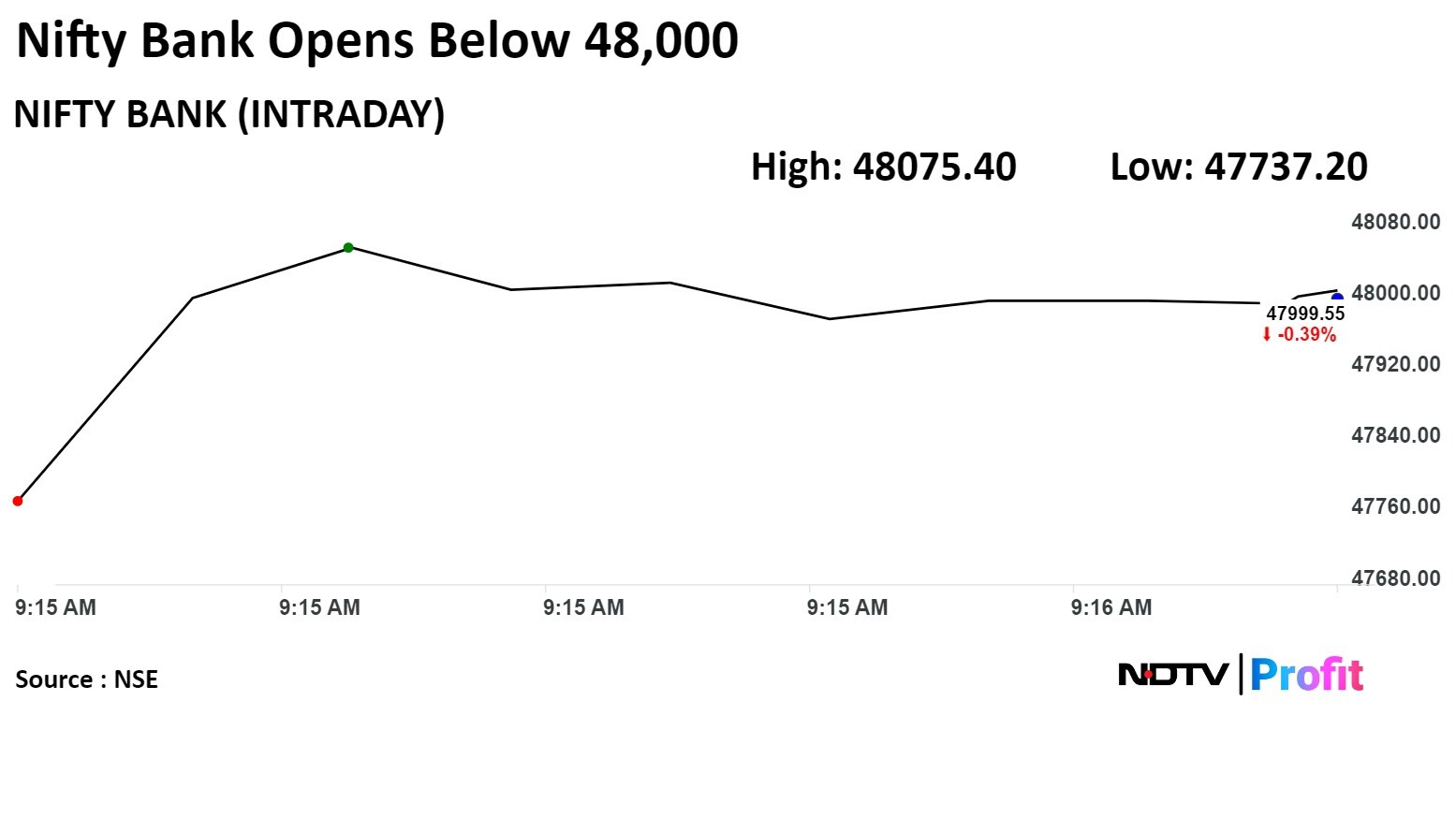

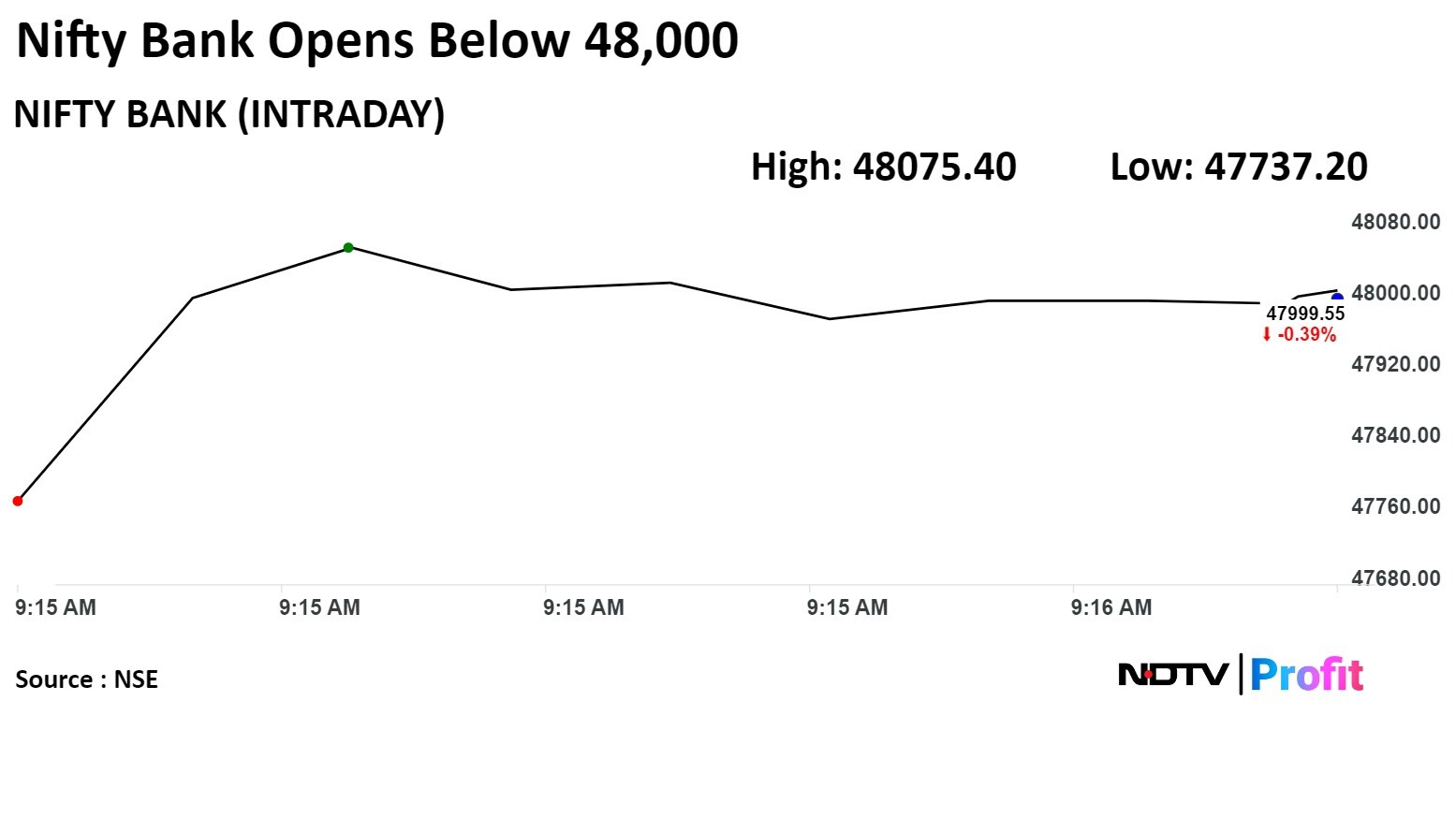

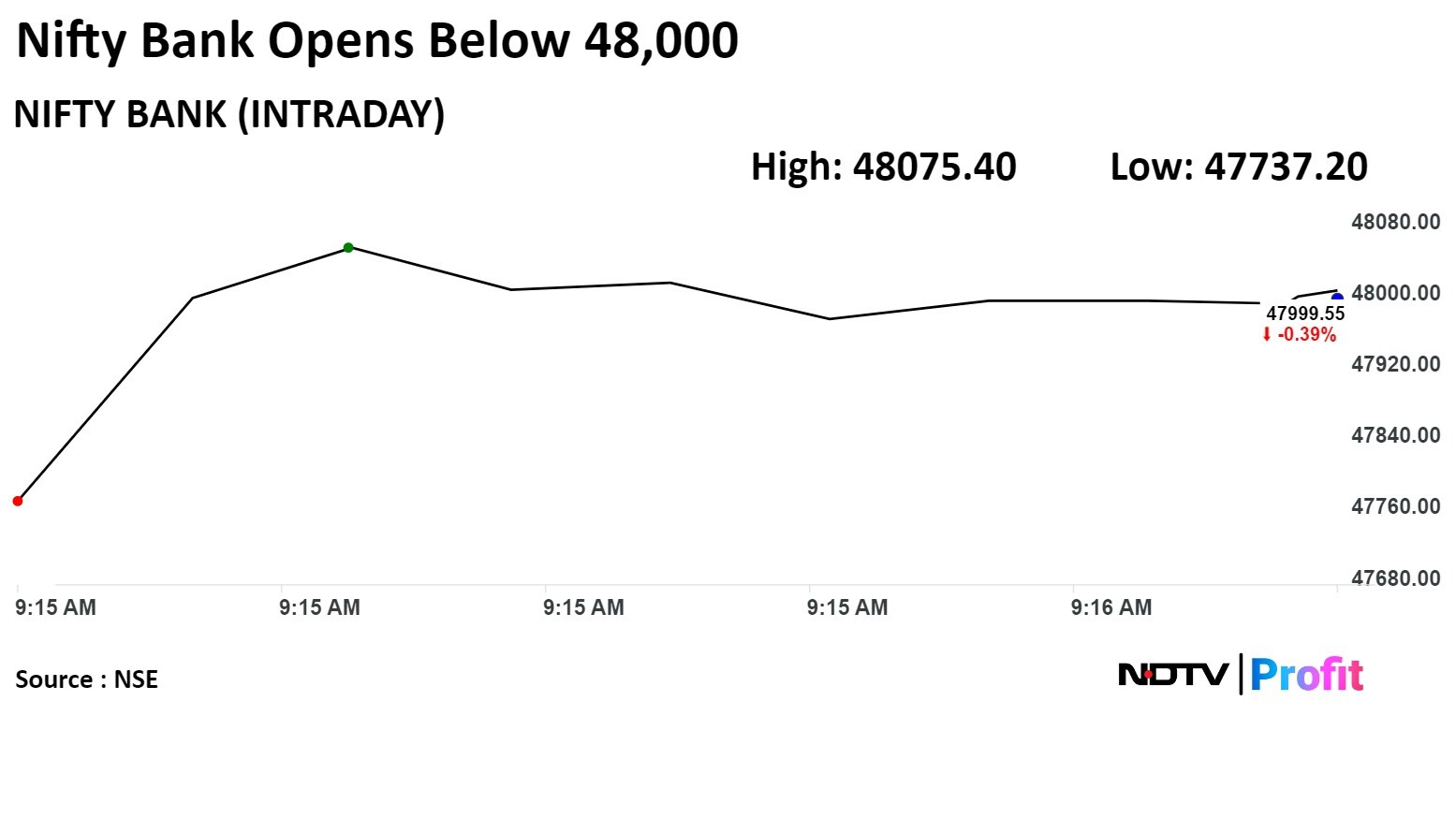

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

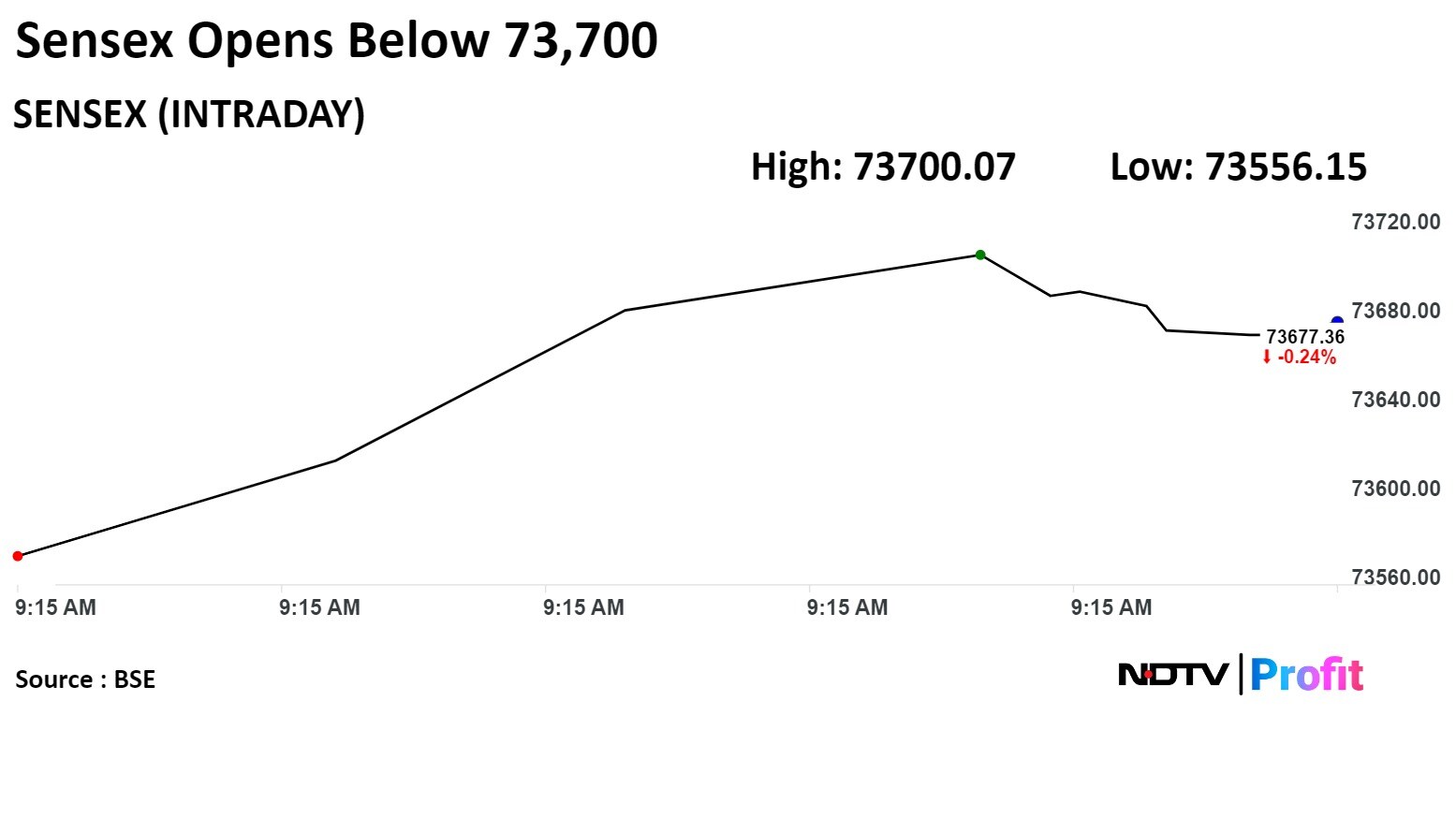

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

Axis Bank Ltd., State Bank of India, ICICI Bank Ltd., ITC Ltd., and Tata Consultancy Services Ltd. added to the index.

Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., Titan Co. Ltd., Bajaj Finance Ltd., and Bharti Airtel Ltd. weighed on the index.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

Axis Bank Ltd., State Bank of India, ICICI Bank Ltd., ITC Ltd., and Tata Consultancy Services Ltd. added to the index.

Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., Titan Co. Ltd., Bajaj Finance Ltd., and Bharti Airtel Ltd. weighed on the index.

On NSE, out of 12 sectors, seven sectors advanced and five declined. The NSE Nifty PSU Bank index rose the most, while the NSE Nifty Realty index declined the most.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

Axis Bank Ltd., State Bank of India, ICICI Bank Ltd., ITC Ltd., and Tata Consultancy Services Ltd. added to the index.

Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., Titan Co. Ltd., Bajaj Finance Ltd., and Bharti Airtel Ltd. weighed on the index.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

India's benchmark indices were little changed during midday on Thursday as market participants assessed the earnings from top companies. Nifty witnessed another session of trading within a tight range around the 22,400 mark.

At 12:21 p.m., the NSE Nifty 50 was trading 0.45 points or 0.01% lower at 22,401.95, and the S&P BSE Sensex was trading 15.62 points or 0.021% lower at 73,837.32.

The Nifty 50 fell 0.43% to hit an intraday low of 22,305.25, and the Sensex declined 0.40% to touch 73,556.15 so far on Thursday.

"Analysis of option data indicates an increase in open interest for both at-the-money and near ATM call and put strikes, suggesting a continued period of consolidation. However, a clear move beyond the range of 22300 to 22450 will indicate a breakout," said Shrey Jain, founder and chief executive at SAS Online.

If the Bank Nifty breaks above 48,200, we expect short-covering activity. Until such a move occurs, consolidation is likely to persist within the range of 47,500 to 48,200. Traders are advised to consider buying opportunities during any downward movements in the market," Jain said.

Axis Bank Ltd., State Bank of India, ICICI Bank Ltd., ITC Ltd., and Tata Consultancy Services Ltd. added to the index.

Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., Titan Co. Ltd., Bajaj Finance Ltd., and Bharti Airtel Ltd. weighed on the index.

On NSE, out of 12 sectors, seven sectors advanced and five declined. The NSE Nifty PSU Bank index rose the most, while the NSE Nifty Realty index declined the most.

Broader markets outperformed benchmark indices. The S&P BSE Midcap rose 0.19%, and the S&P BSE Smallcap rose 0.36%.

On BSE, 13 sectors out of 20 rose, and seven sectors fall. The S&P BSE Services rose the most, while the S&P BSE Realty index declined the most among peers.

Market breadth was skewed in favour of the buyers. Around 1,996 stocks advanced, 1,602 stocks declined, and 166 stocks remained unchanged on BSE.

Revenue up 36.23% to Rs 489.9 crore from Rs 359.6 crore

Ebitda up 90.96% at Rs 91.51 crore from Rs 47.92 crore

Margin up 535 bps at 18.67% from 13.32%

Net profit up 86.81% at Rs 60.23 crore from Rs 32.24 crore

Revenue up 15.35% to Rs 323 crore from Rs 280 crore

Ebitda up 8.04% at Rs 141 crore from Rs 130.5 crore

Margin down 295 bps at 43.65% from 46.6%

Net loss was at Rs Rs 309.3 crore from Rs 277.1 crore

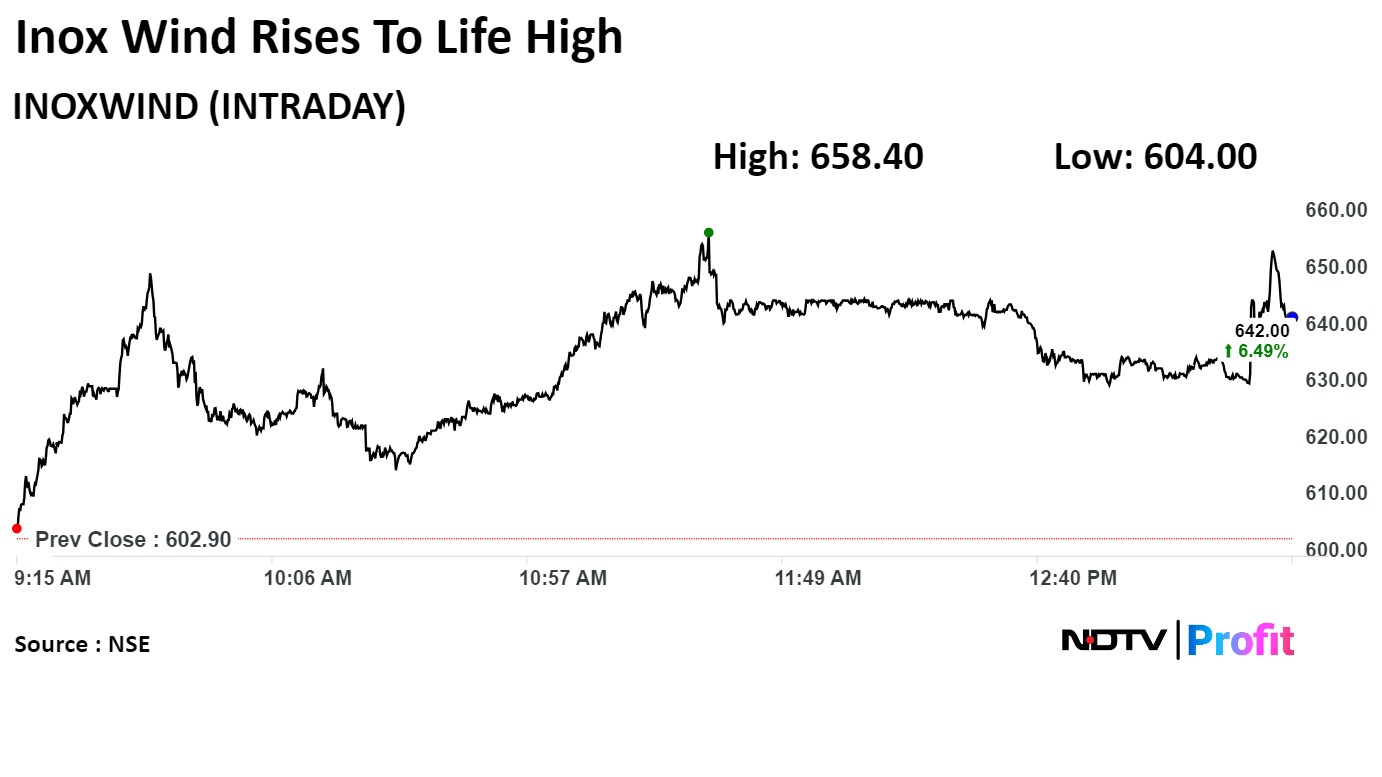

Inox Wind Ltd. approved bonus issue of shares in ratio of 3:1.

Swap ratio of Inox Wind & Inox Wind Energy has been updated to 632:10

Source: Exchange filing

Inox Wind Ltd. approved bonus issue of shares in ratio of 3:1.

Swap ratio of Inox Wind & Inox Wind Energy has been updated to 632:10

Source: Exchange filing

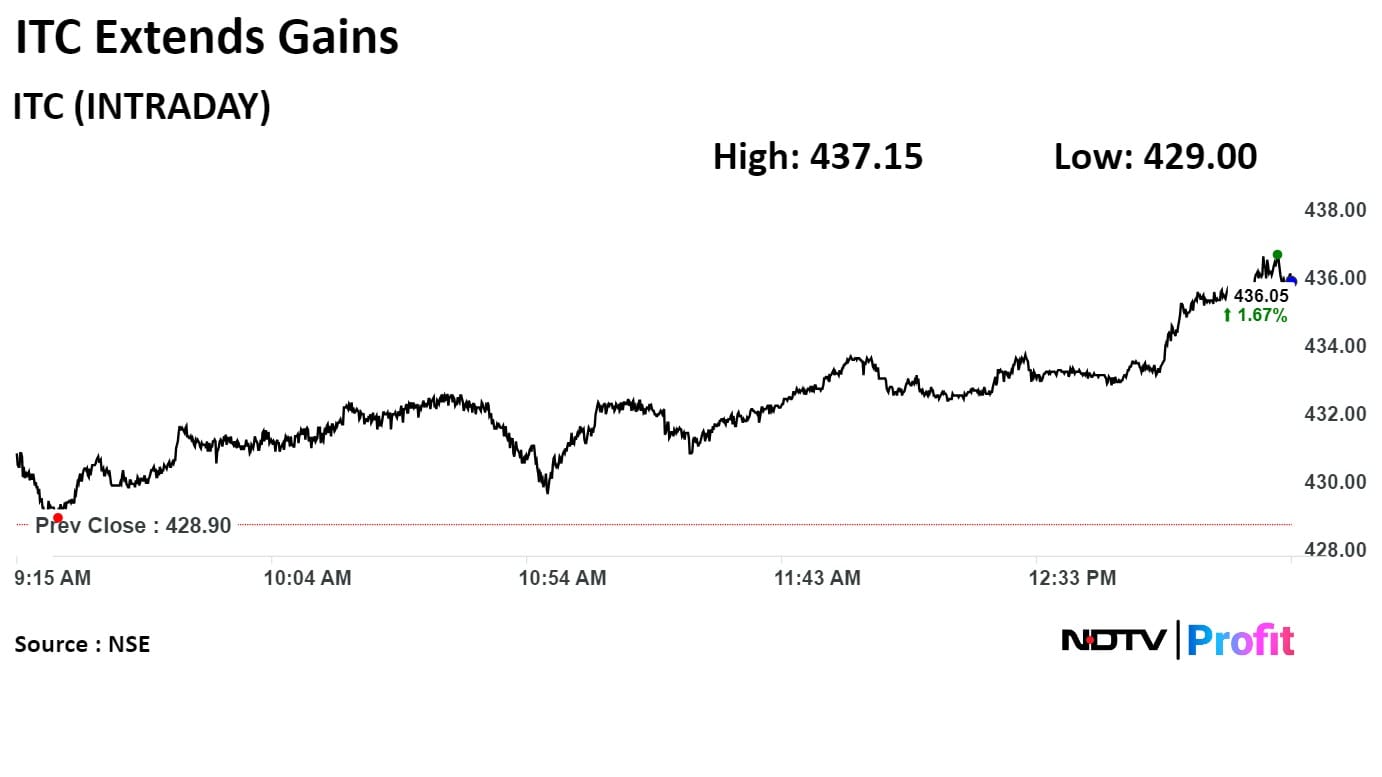

Unit WelcomHotels Lanka launches 352-room hotel ITC Ratnadipa in Colombo

Source: Exchange Filing

Unit WelcomHotels Lanka launches 352-room hotel ITC Ratnadipa in Colombo

Source: Exchange Filing

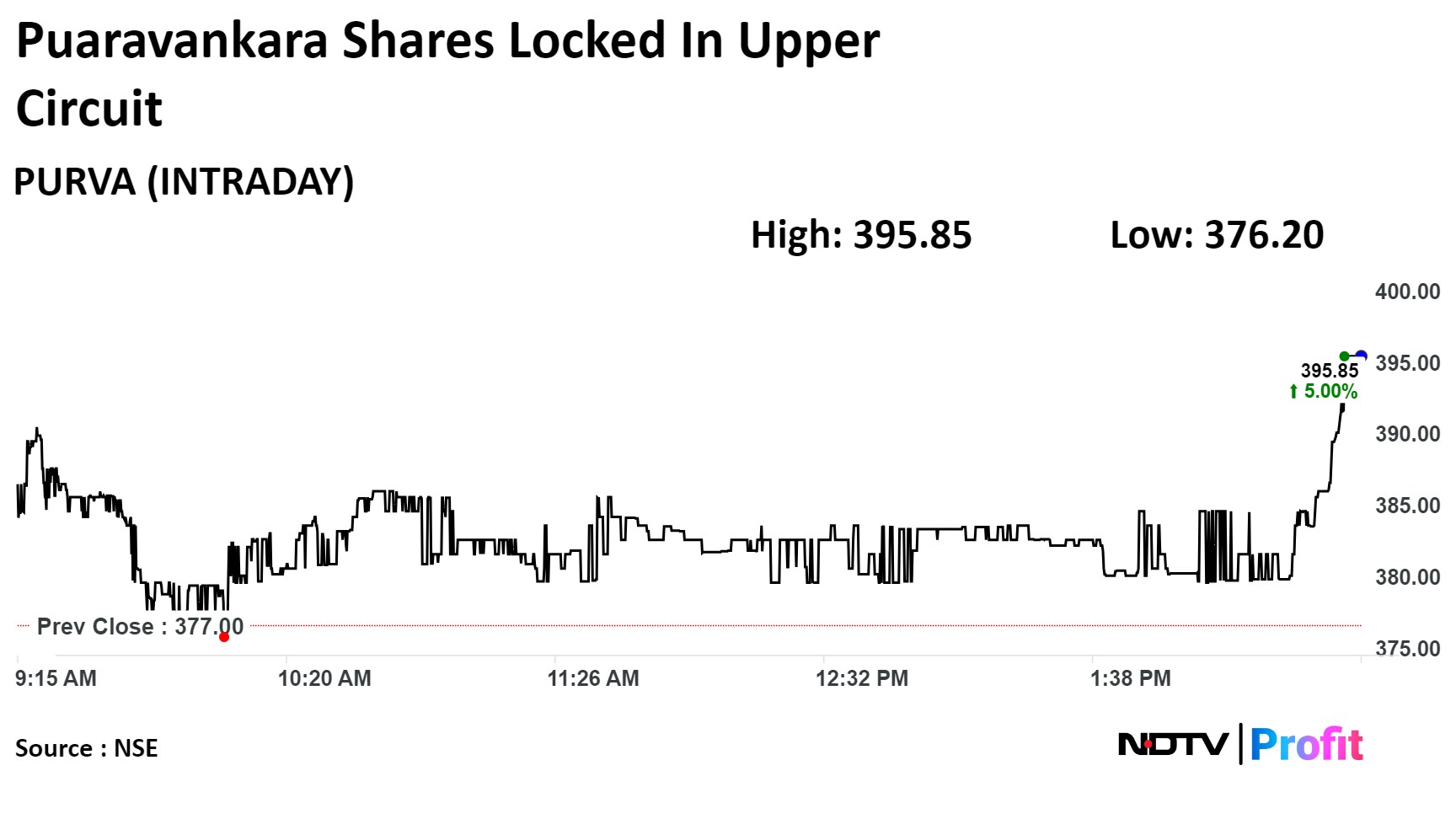

Guiding pre-sales growth of little over 20%

Volume growth to contribute 5-10% of pre-sales growth

Will further assess to scale up our presence in Bengaluru beyond the 2 projects

Saw modest increases in land prices

Delivered 9000 units last year, targeting 5-digit units delivery this year

Source: Company's management in conference call

India showing broadbased growth, aiding global growth path

See rebound in global economic growth on the back of fading recession

Kharif crop prospects look bright with the IMD’s prediction of an above-normal monsoon

Above-normal monsoon in 2024 bodes well for a good harvest, easing inflation concerns

Record-breaking stock market performance reflects a buoyant domestic economic landscape

Slowing of trade resulted in merchandise trade deficit narrowing in FY24

India's forex reserves reached an all-time high, sufficient to cover 11 months of projected imports & more than 100% of total external debt

Source: DEA

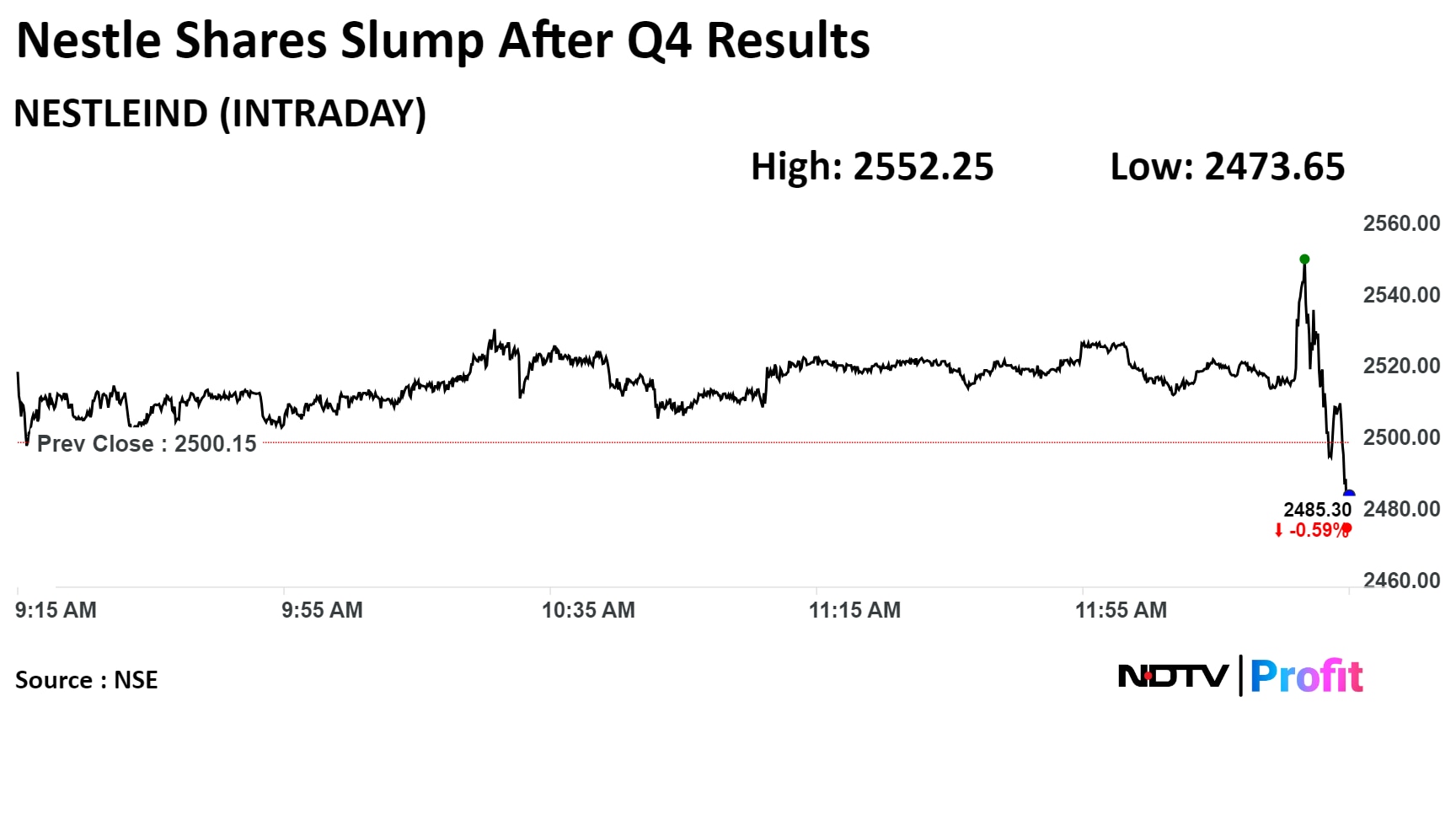

Nestle India YoY

Revenue up 9% at Rs 5,268 crore vs Rs 4831 crore

Ebitda up 23% at Rs 1349 crore vs Rs 1096 crore

Margin at 25.6% vs 22.7%

Net profit up 27% at Rs 934 crore vs Rs 737 crore

Confectionery delivered strong performance, fuelled by KITKAT. This makes India the second-largest market for the brand globally.

Milk Products and Nutrition witnessed strong growth despite inflationary pressures.

India emerged as the largest market worldwide for Maggi

Nestle India forms JV with Dr. Reddy’s Laboratories to take health science nutraceutical portfolio to consumers

Nestle India YoY

Revenue up 9% at Rs 5,268 crore vs Rs 4831 crore

Ebitda up 23% at Rs 1349 crore vs Rs 1096 crore

Margin at 25.6% vs 22.7%

Net profit up 27% at Rs 934 crore vs Rs 737 crore

Confectionery delivered strong performance, fuelled by KITKAT. This makes India the second-largest market for the brand globally.

Milk Products and Nutrition witnessed strong growth despite inflationary pressures.

India emerged as the largest market worldwide for Maggi

Nestle India forms JV with Dr. Reddy’s Laboratories to take health science nutraceutical portfolio to consumers

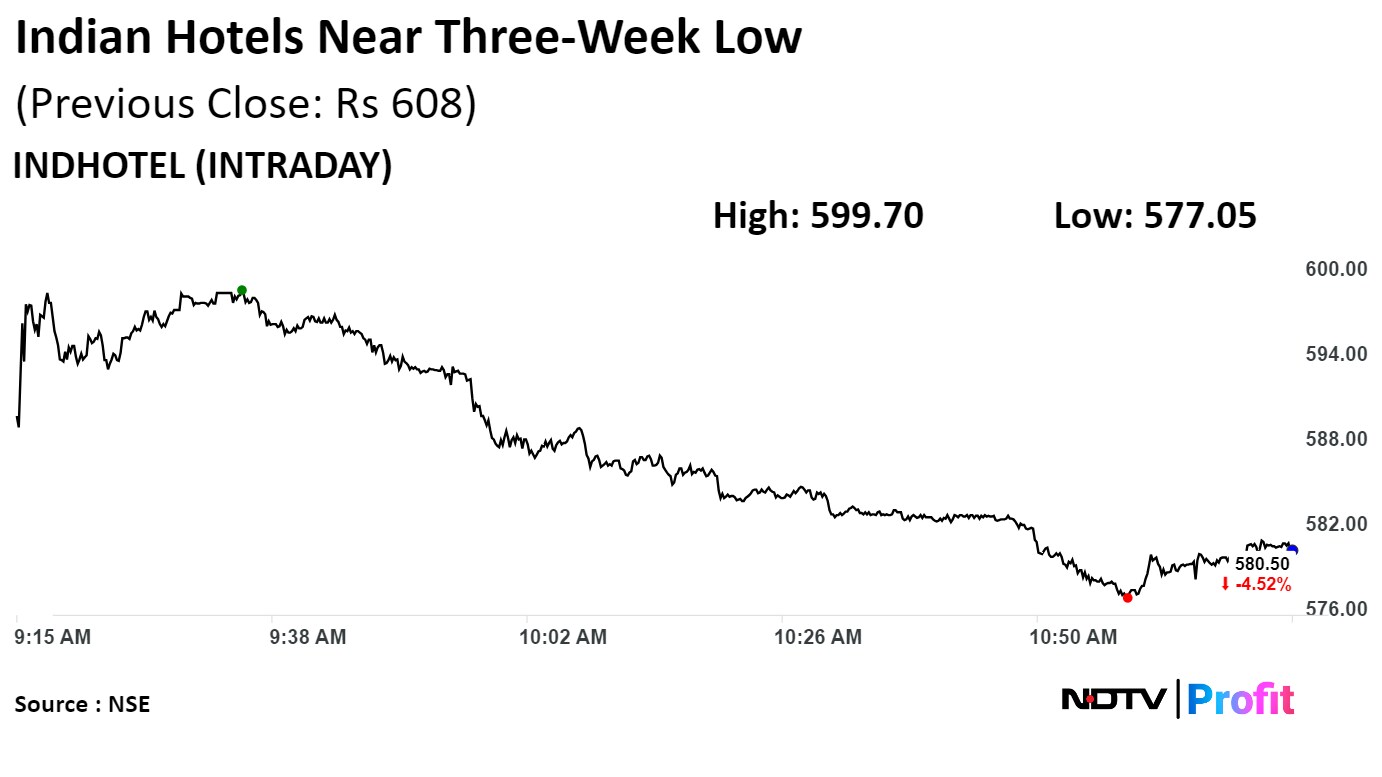

The Indian Hotels Co. declined to near three-week lows on Thursday after the company's profit margin missed analysts' expectations.

The hotel and resort operator's profit margin rose 167 basis points to 34.6% in the quarter ended March 2024, according to an exchange filing. That compares with 35.5% consensus of analysts polled by Bloomberg.

The Indian Hotels Co. declined to near three-week lows on Thursday after the company's profit margin missed analysts' expectations.

The hotel and resort operator's profit margin rose 167 basis points to 34.6% in the quarter ended March 2024, according to an exchange filing. That compares with 35.5% consensus of analysts polled by Bloomberg.

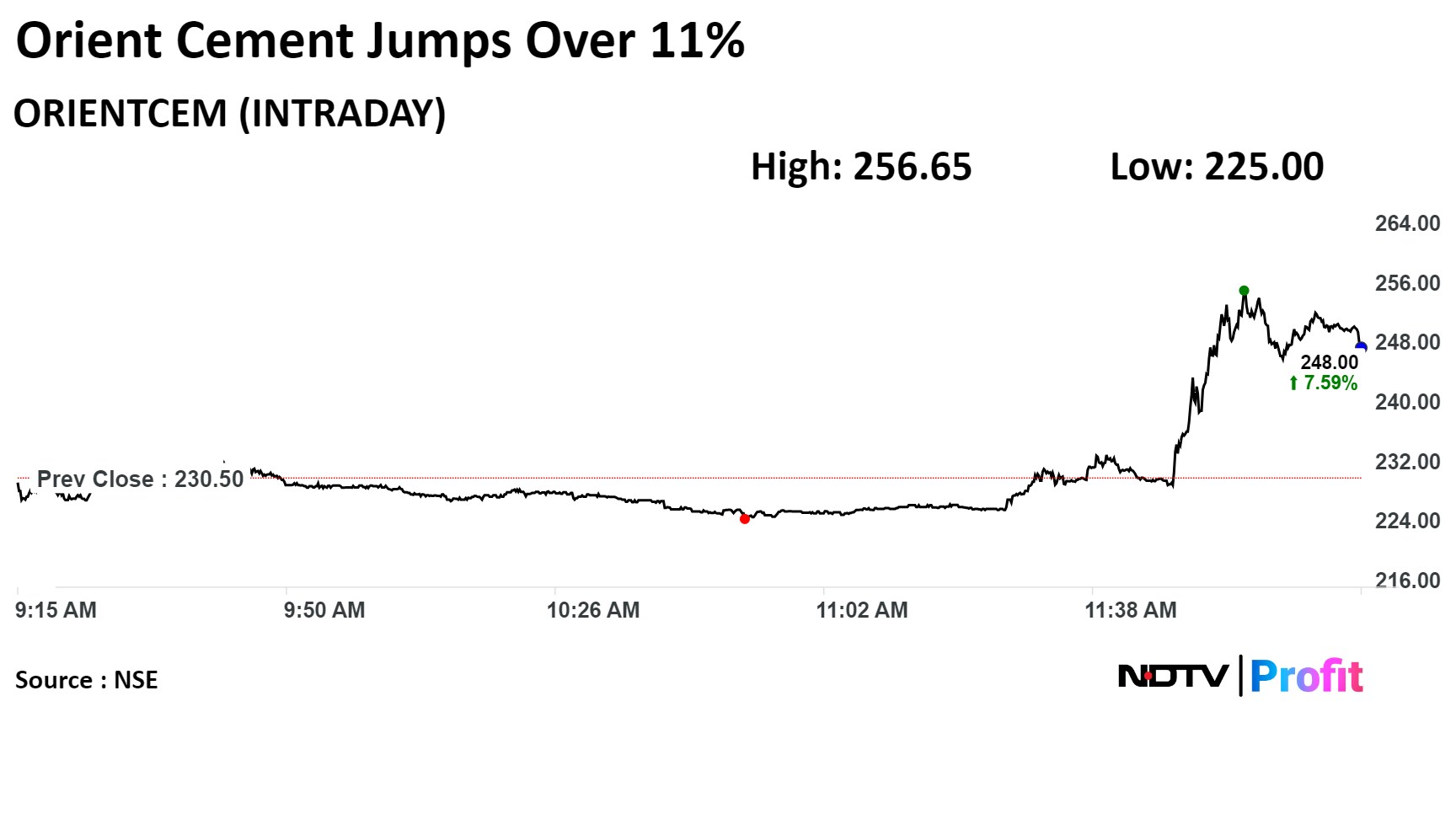

Orient Cement gained as much as 11.34% to Rs 256.65 in two months. The stock has fallen 2.8% year-to-date but risen 91.7% in the last twelve months.

Orient Cement gained as much as 11.34% to Rs 256.65 in two months. The stock has fallen 2.8% year-to-date but risen 91.7% in the last twelve months.

In pact with Sun & Sun Inframetric, Mosaic Infra for construction of hospital in Raipur

Source: Exchange Filing

NCLT orders on Subhash Chandra to not have any impact on company

Alert: Clarifies on report of NCLT order against Subhash Chandra

Source: Exchange Filing

In pact to launch 300-room hotel in Hyderabad

Source: Exchange Filing

The shareholders of Swiggy have given their nod for a Rs 10,400-Crore IPO to be launched

IPO to have an offer-for-sale portion of shares worth up to Rs 6,664 crore and and a fresh issue of shares worth up to Rs 3,750 crore

Swiggy could also raise up to Rs 750 crore in a pre-IPO anchor round

Source: RoC filings

Plans capacity addition at its manufacturing facility at an investment of Rs 650-700 crore

Capacity addition at manufacturing facility to be funded via internal accruals

Proposed facility to be operational by Jan 2027

Source: Exchange Filing

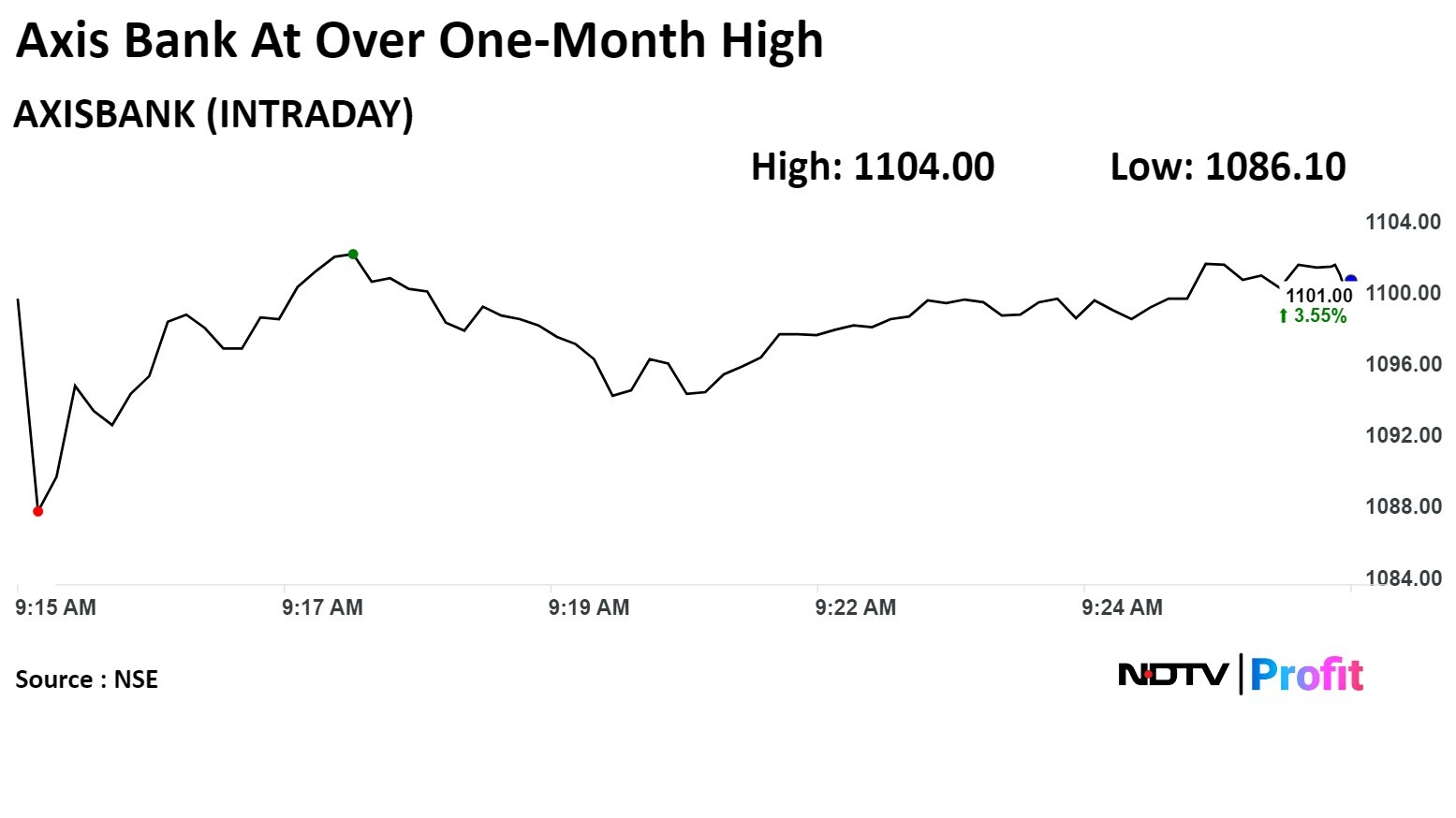

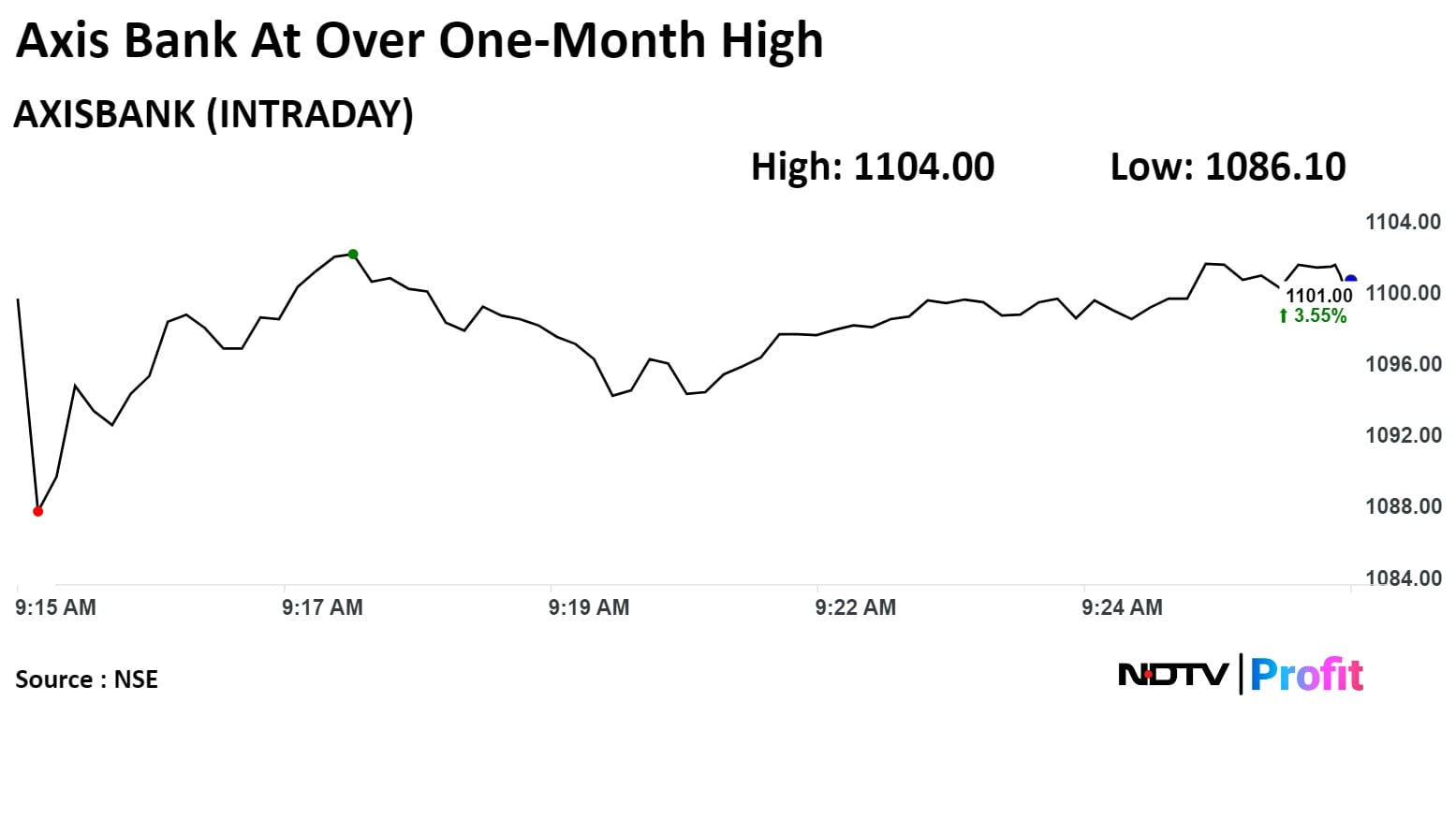

Approves re-appointment of Amitabh Chaudhry as MD & CEO for 3 years effective Jan 1, 2025

Source: Exchange Filing

Shares of Dalmia Bharat Ltd. fell to over one-month low after the company reported decline in its net profit during January-December.

The cement producer's consolidated net profit dropped 47.45% to Rs 320 crore in fourth quarter from Rs 609 crore in the corresponding period in the last financial year.

Shares of Dalmia Bharat Ltd. fell to over one-month low after the company reported decline in its net profit during January-December.

The cement producer's consolidated net profit dropped 47.45% to Rs 320 crore in fourth quarter from Rs 609 crore in the corresponding period in the last financial year.

The scrip fell 6.00% to Rs 1,845, the lowest level since March 14. It was trading 5.33% lower at Rs 1,858 as of 10:42 a.m., as compared 0.17% advance in the NSE Nifty 50 index.

The scrip declined 3.27% in 12 months, and year to date basis it has fallen 18.69%. Total traded volume so far in the day stood at 6.5 times its 30-day average. The relative strength index was at 33.65.

Out of 33 analysts tracking the company, 28 maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside

In pact to offer exclusive duty-free shopping benefits

Source: Exchange Filing

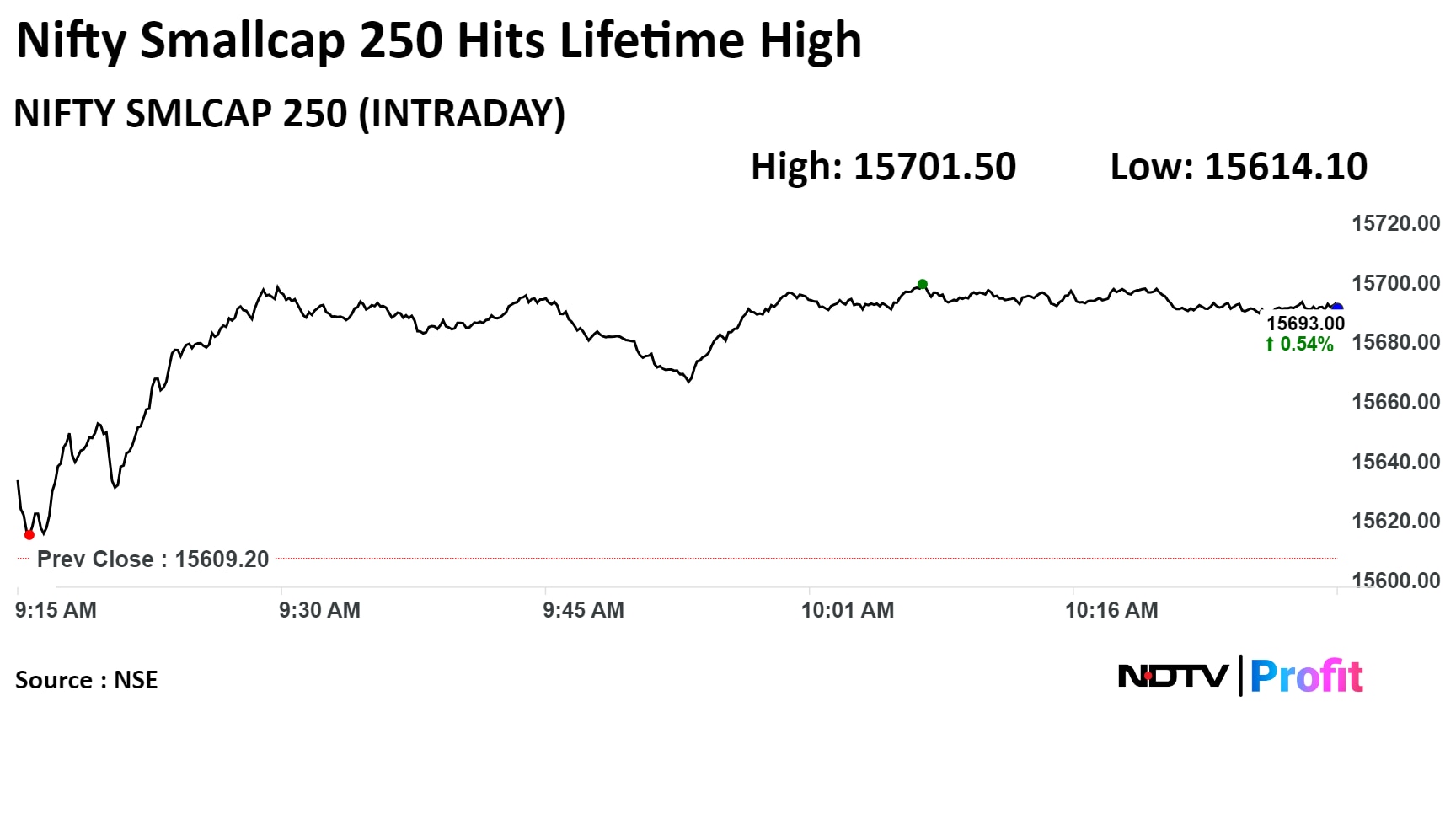

The index hit its lifetime high in the second session.

The index hit its lifetime high in the second session.

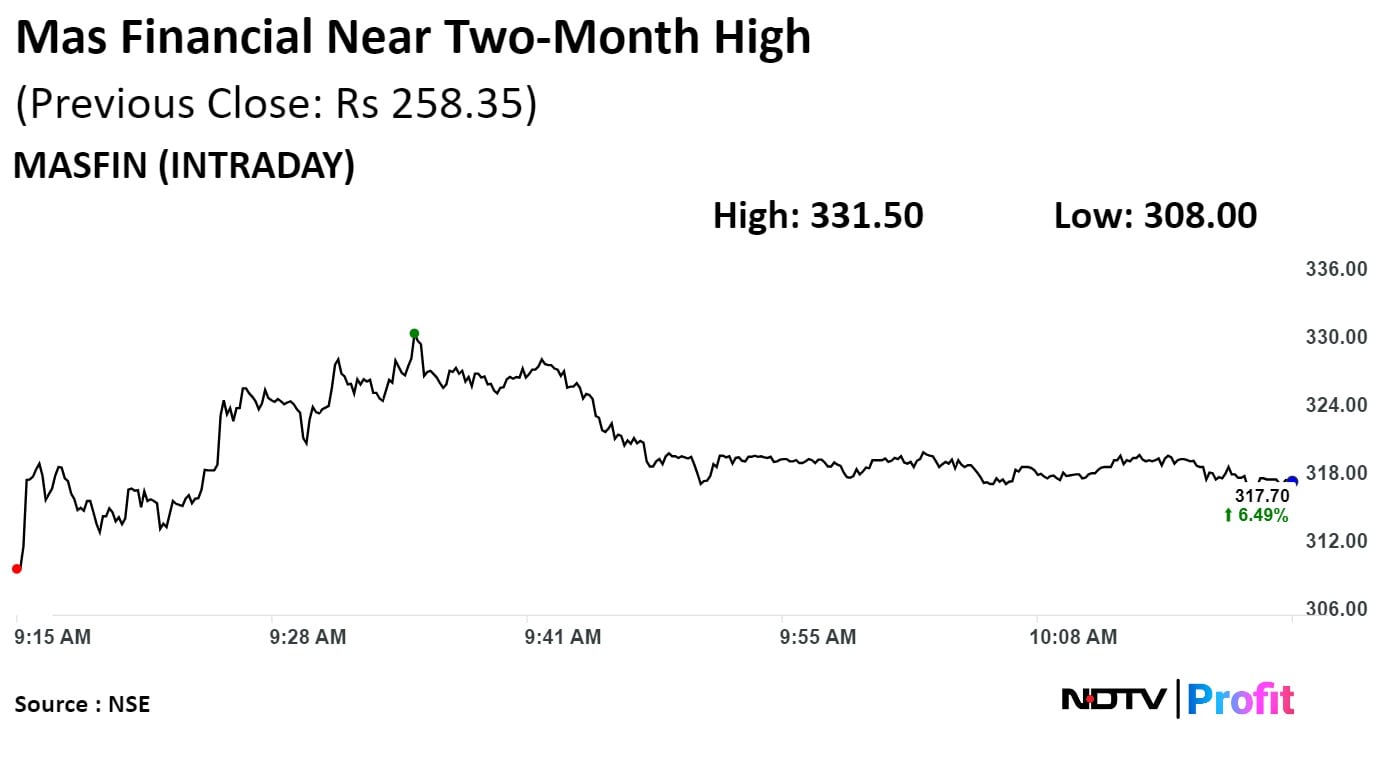

Mas Financial Services jumps to near two-month high on NSE after its net profit rose and beat Bloomberg's estimates.

The stock rose as much as 11.11% to Rs 331.50 apiece, the highest level since March 1. It erased gains to trade 6.45% higher at Rs 317.60 apiece, as of 10:24 a.m. This compares to a 0.23% advance in the NSE Nifty 50 Index.

It has risen 36.68% in 12 months. Total traded volume so far in the day stood at 35 times its 30-day average. The relative strength index was at 66.94.

Three analysts tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.7%.

Mas Financial Services jumps to near two-month high on NSE after its net profit rose and beat Bloomberg's estimates.

The stock rose as much as 11.11% to Rs 331.50 apiece, the highest level since March 1. It erased gains to trade 6.45% higher at Rs 317.60 apiece, as of 10:24 a.m. This compares to a 0.23% advance in the NSE Nifty 50 Index.

It has risen 36.68% in 12 months. Total traded volume so far in the day stood at 35 times its 30-day average. The relative strength index was at 66.94.

Three analysts tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.7%.

Brokerages have slashed their target price for Kotak Mahindra Bank Ltd. as the private lender's growth and interest margins could be adversely impacted due to the Reserve Bank of India's recent crackdown. Citi Research said that this led to earnings being hit in the medium term.

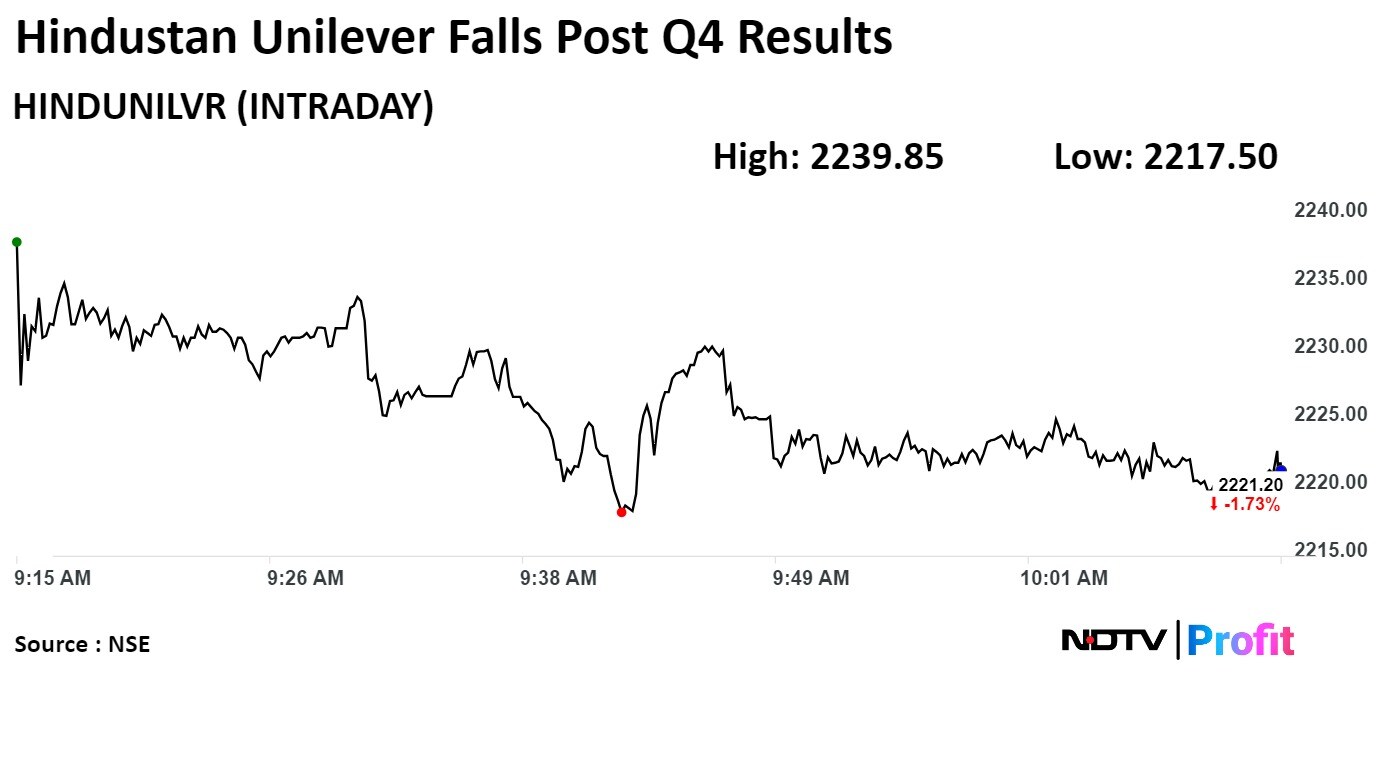

Hindustan Unilever's fourth-quarter profit missed estimates amid sustained demand woes and increasing competition from local peers.

The standalone net profit of India's largest consumer goods maker declined 5.7% to Rs 2,406 crore in the January-March quarter, according to an exchange filing. That compares with the Rs 2,479-crore consensus estimate of analysts tracked by Bloomberg.

Hindustan Unilever's fourth-quarter profit missed estimates amid sustained demand woes and increasing competition from local peers.

The standalone net profit of India's largest consumer goods maker declined 5.7% to Rs 2,406 crore in the January-March quarter, according to an exchange filing. That compares with the Rs 2,479-crore consensus estimate of analysts tracked by Bloomberg.

Hindustan Unilever Ltd. fell as much as 1.9% to Rs 2,217.50 apiece, the lowest level since April 19. It was trading 1.68% lower at Rs 2,222.25 apiece, as of 10:08 a.m. This compares to a 0.02% advance in the NSE Nifty 50 Index.

It has declined 16.67% on year to date basis, and declined 9.64% in 12 months. Total traded volume so far in the day stood at 0.44 times its 30-day average. The relative strength index was at 38.25.

Out of 43 analysts tracking the company, 25 maintain a 'buy' rating, 13 recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.8%.

Goldman Sachs On HUL

Maintains Neutral and reduces target price to Rs2475 from Rs2550

FY25 price growth is likely to be flat YoY

Volume recovery in our view will be gradual, as weakness in categories like soaps

They lower their FY25/26 EPS estimates by 2.7% and 4.2% respectively

Morgan Stanley On HUL

Rates equal weight with a target price of Rs. 2,350 (4% upside)

Numbers were below their estimates for the fifth quarter in a row

Weaker top-line growth expected in the near term due

Weaker topline due to to negative pricing growth and lower volume growth

Gradual demand improvement to continue

Expectation of better monsoons and improving macro-economic indicators augurs well for demand recovery

Jefferies Maintains HOLD on HUL, lowers target to Rs 2530 from Rs 2750

Q4 results in line with estimates, with near flat revenue growth and ebitda decline

Portfolio disparity: Half grew mid single digit, while soaps, tea & mass skin declined

Price growth to remain slightly negative in near-term, denting revenue growth.

Cut FY25-26 EPS estimates by 5-6%

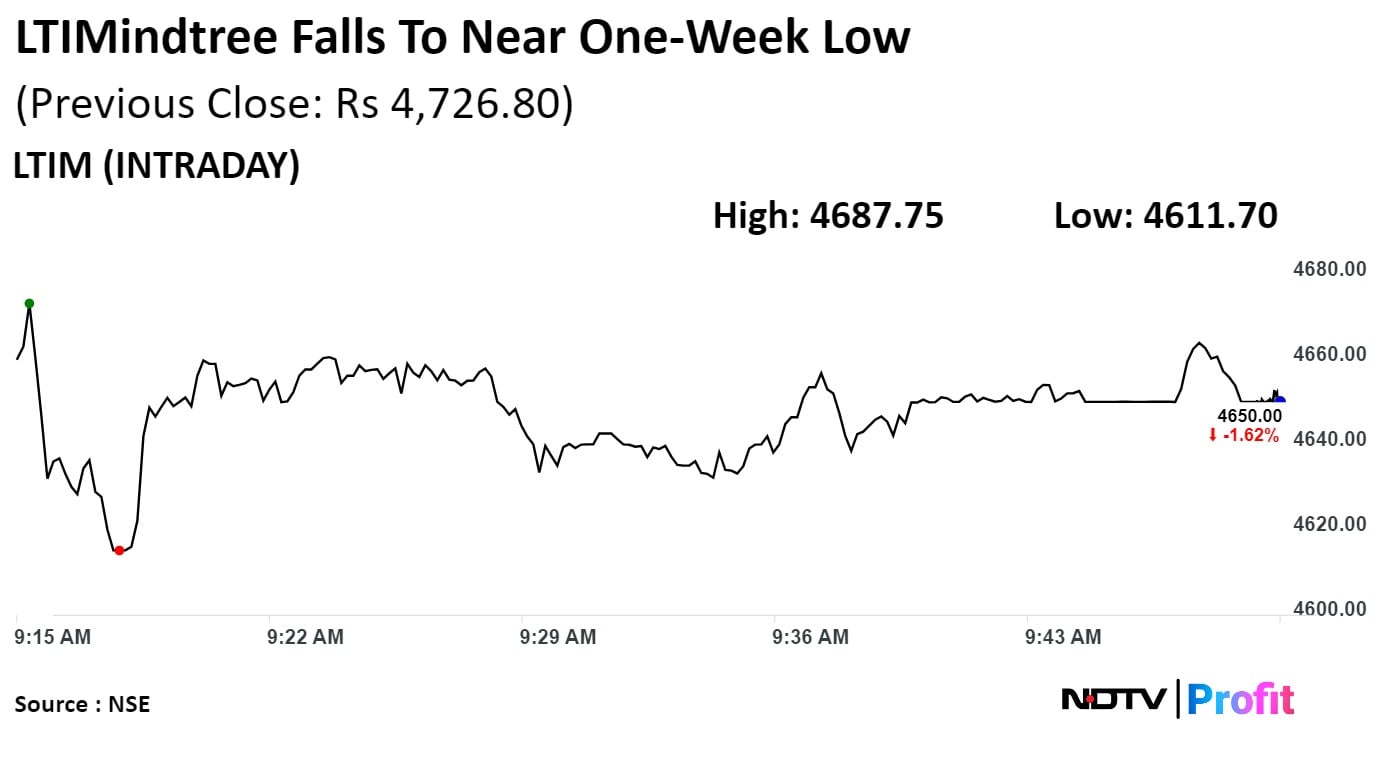

LTIMindtree Ltd. declined to near one-week low after its net profit declined missing Bloomberg's estimates on slow down worries during January-March quarter.

LTIMindtree Ltd.'s net profit fell 5.86% on sequential basis to Rs 1,100 crore, compared to Rs 1,154 crore analysts estimated in a Bloomberg's survey.

LTIMindtree Ltd. declined to near one-week low after its net profit declined missing Bloomberg's estimates on slow down worries during January-March quarter.

LTIMindtree Ltd.'s net profit fell 5.86% on sequential basis to Rs 1,100 crore, compared to Rs 1,154 crore analysts estimated in a Bloomberg's survey.

To acquire PureSoftware Technologies for up to Rs 779 crore

PureSoftware is a focused product digital engineering services company which also provides BFSI solutions

Source: Exchange filing

-- Launches premium plans with introductory pricing of Rs 29 per month for a single device and family plan at Rs. 89 per month for up to 4 devices

-- IPL and select entertainment content to remain free to view and with ads

Source: Company

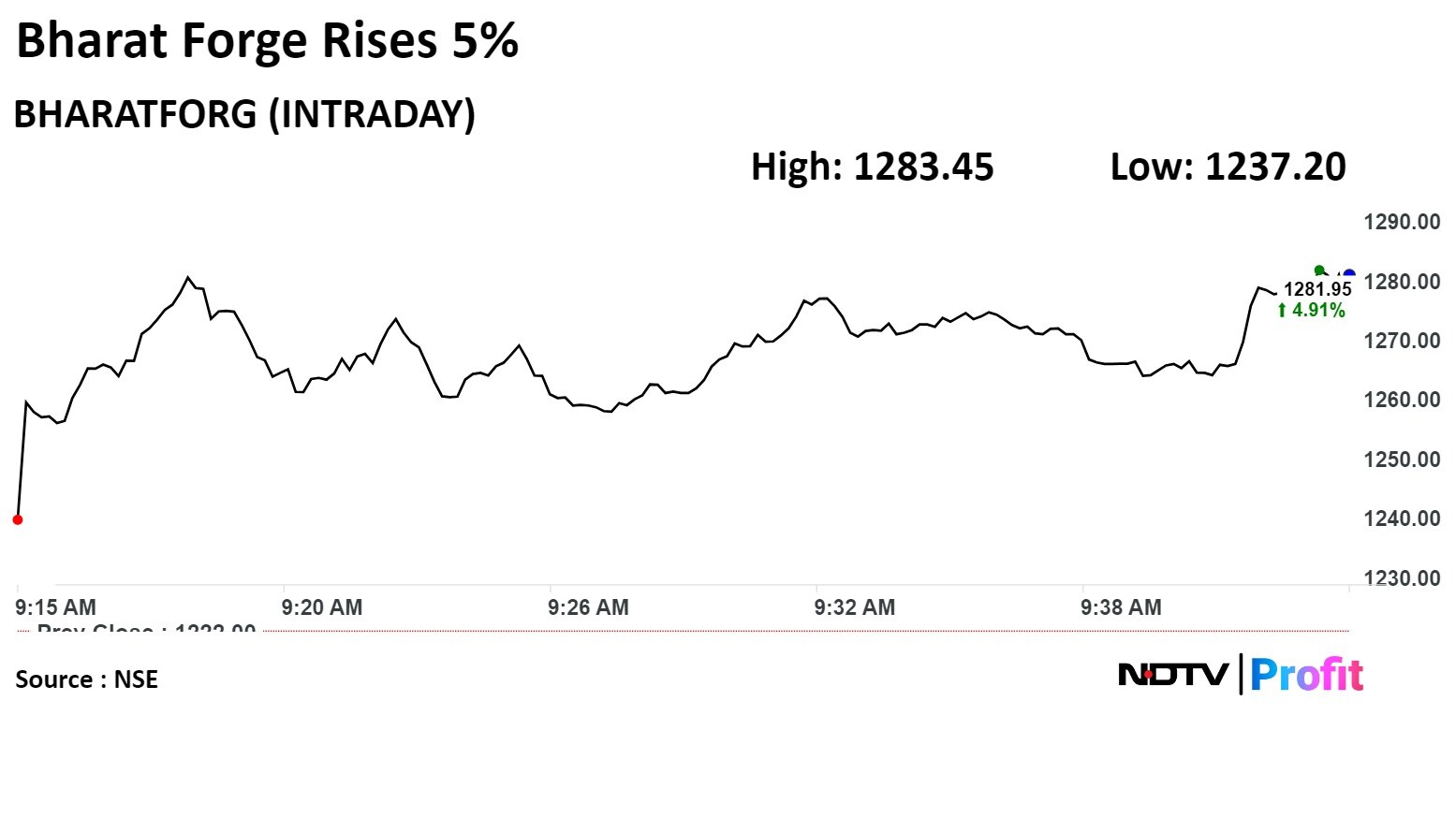

Upgrade to Buy from Underperform, TP of 1450 from 1000 earlier, upside 19%

Widely expected downturn in US Truck Market remains elusive

Large Global truck OEMs point to steady demand fundamentals

ISM, Spot Truck Rentals, Used Truck Values starting to relect upside

Upcoming EPA emission norms in 2027 will trigger pre-buy demand from CY25

Truck downcycle, if any in H225 will be short lived

Company's underperformance vs truckmakers and indian suppliers make relative risk reward better

Solid scale up in Defence and Industrial bearing fruit

Estimate upped by 7-15%; raise multiple to 18x FY26 EV/EBITDA

Vodafone Idea hit a lower circuit of 10% at Rs 11.80 after the listing of fresh shares that were allotted in the follow-on public offer (FPO). It, however, pared the losses quickly to trade 1.53% lower at Rs 12.90, which is above its issue price of Rs 11 per share.

It is noteworthy that the Vodafone Idea board approved the issue price of Rs 11 per share for its Rs 18,000-crore follow on public offer. The FPO issue was subscribed 6.36 times with qualified institutional buyers leading with subscription of 17.56 times, according to the exchanges. The face value of the equity shares is Rs 10 each.

Read at

Axis Bank Ltd. is likely to maintain a strong profitability and growth acceleration over the medium term, and the rise in fees will help the lender maintain its healthy return on assets, according to brokerages.

Axis Bank Ltd. is likely to maintain a strong profitability and growth acceleration over the medium term, and the rise in fees will help the lender maintain its healthy return on assets, according to brokerages.

Kotak Mahindra's stock fell as much as 10% during the day to hit a lower circuit of Rs 1,658.55 apiece on the NSE. It was trading 9.59% lower at Rs 1,666 apiece, compared to a 0.31% decline in the benchmark Nifty 50 as of 9:20 a.m.

It has fallen 11.82% in the last 12 months. The total traded volume so far in the day stood at 389 times its 30-day average. The relative strength index was at 33.

Twenty-five out of the 44 analysts tracking the company have a 'buy' rating on the stock, 15 recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 2.4%.

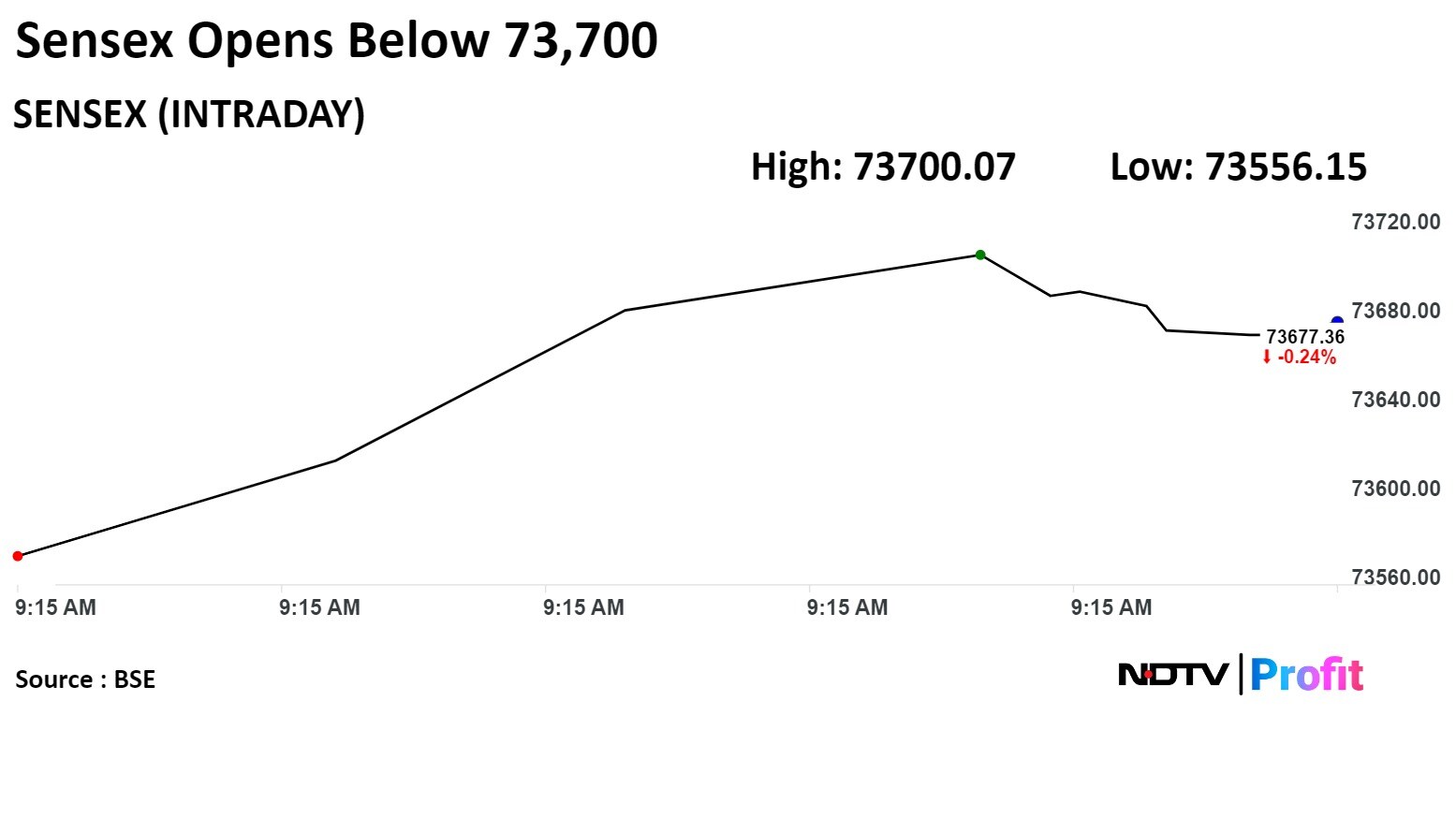

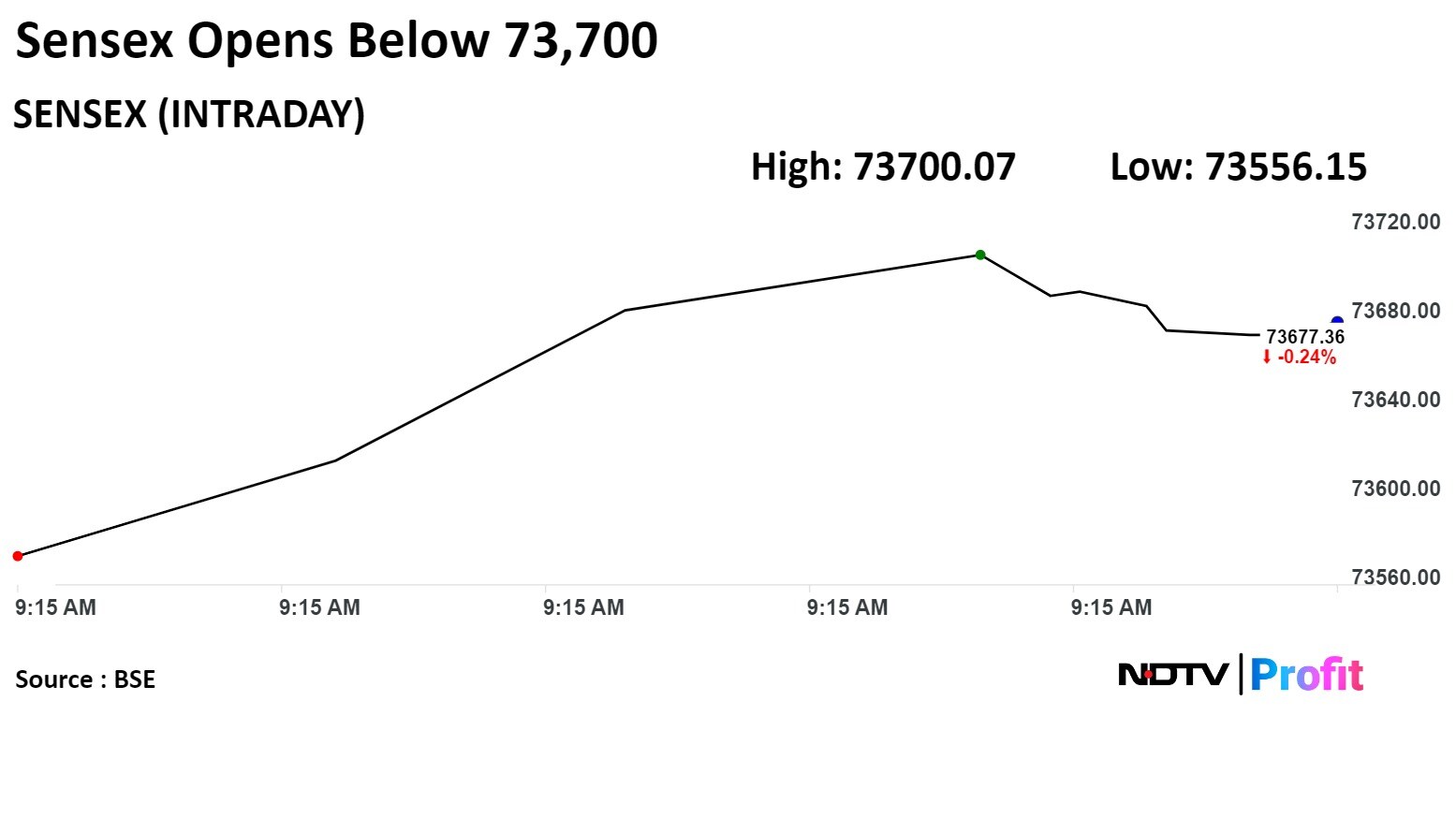

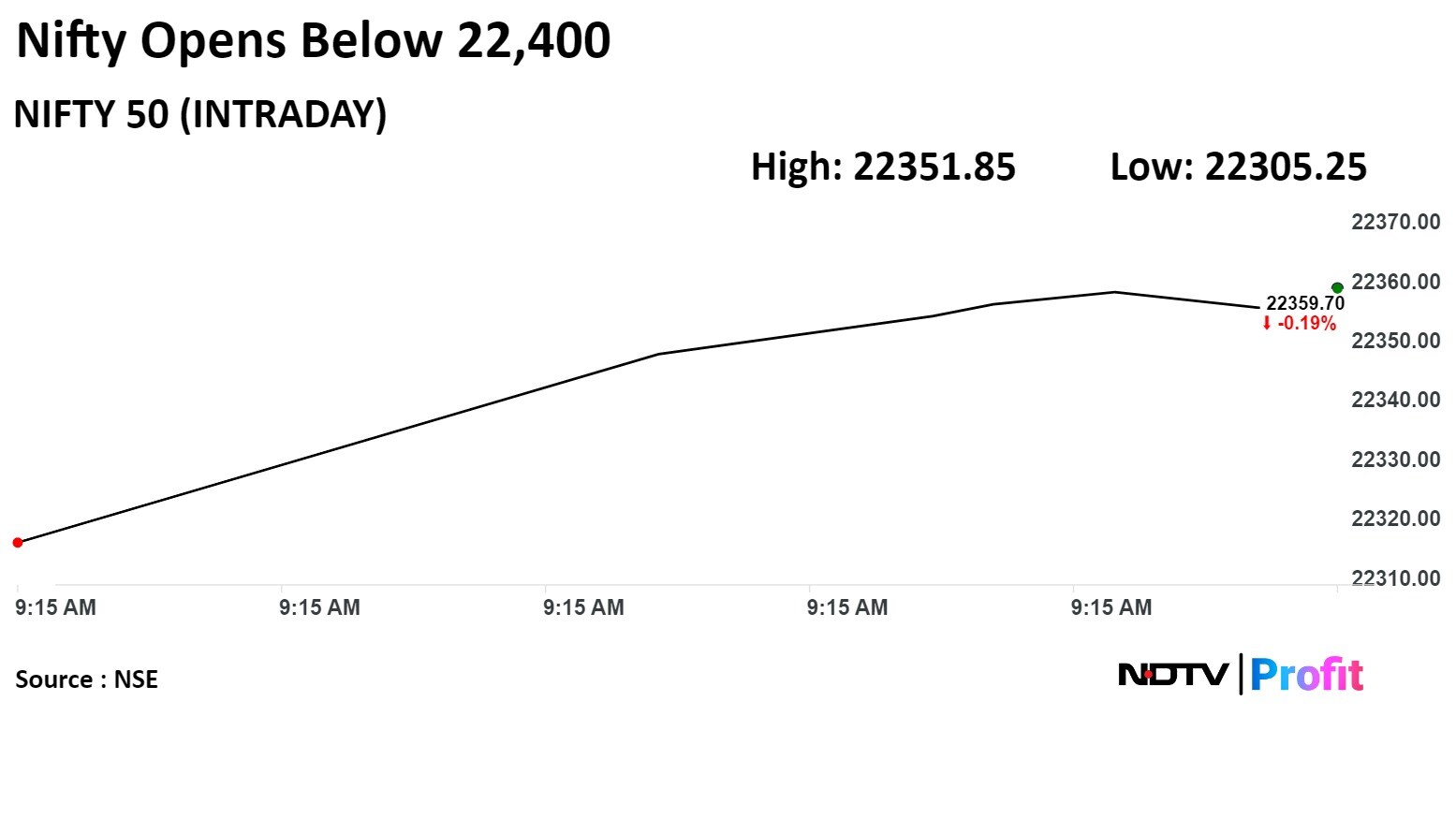

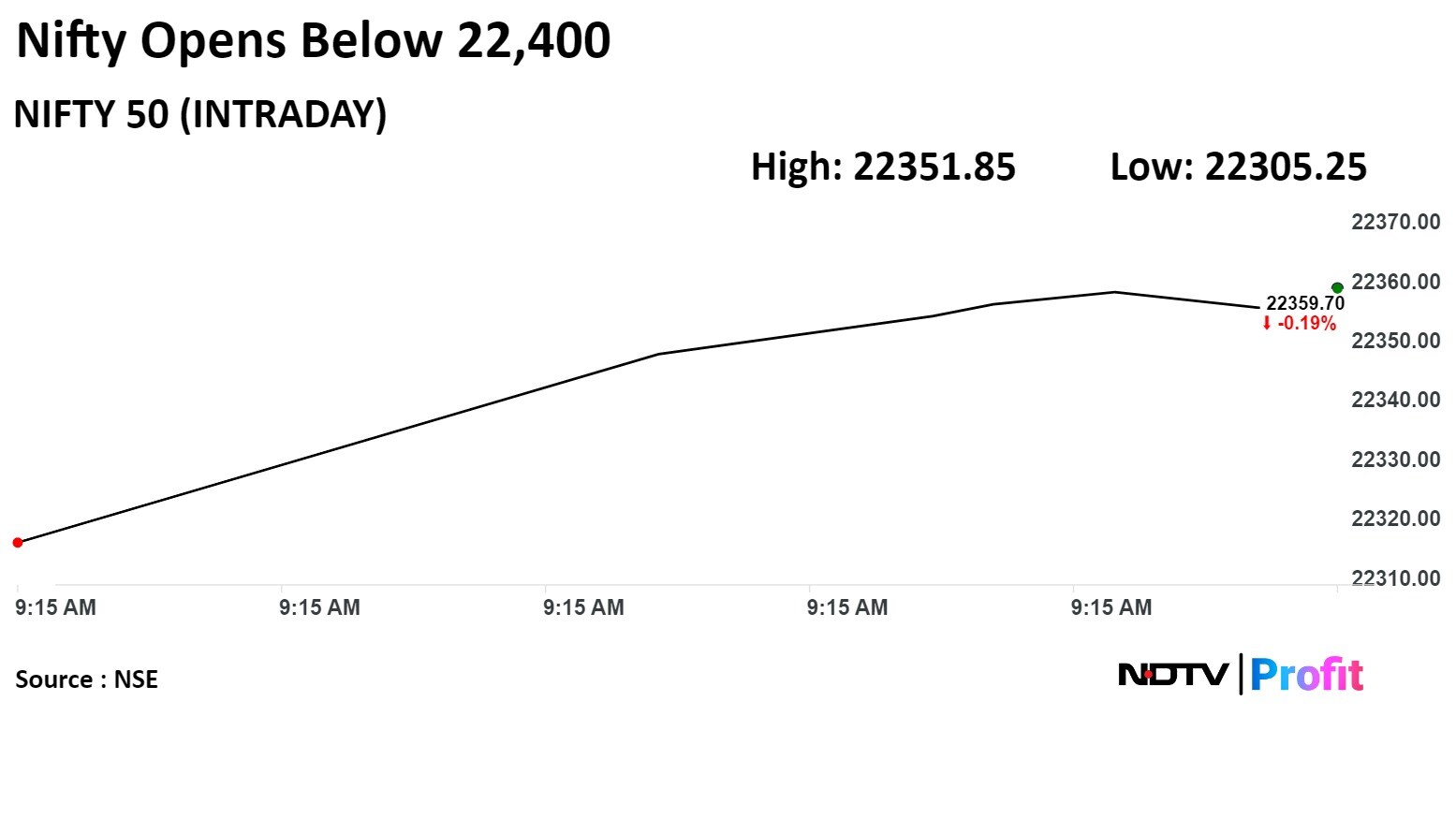

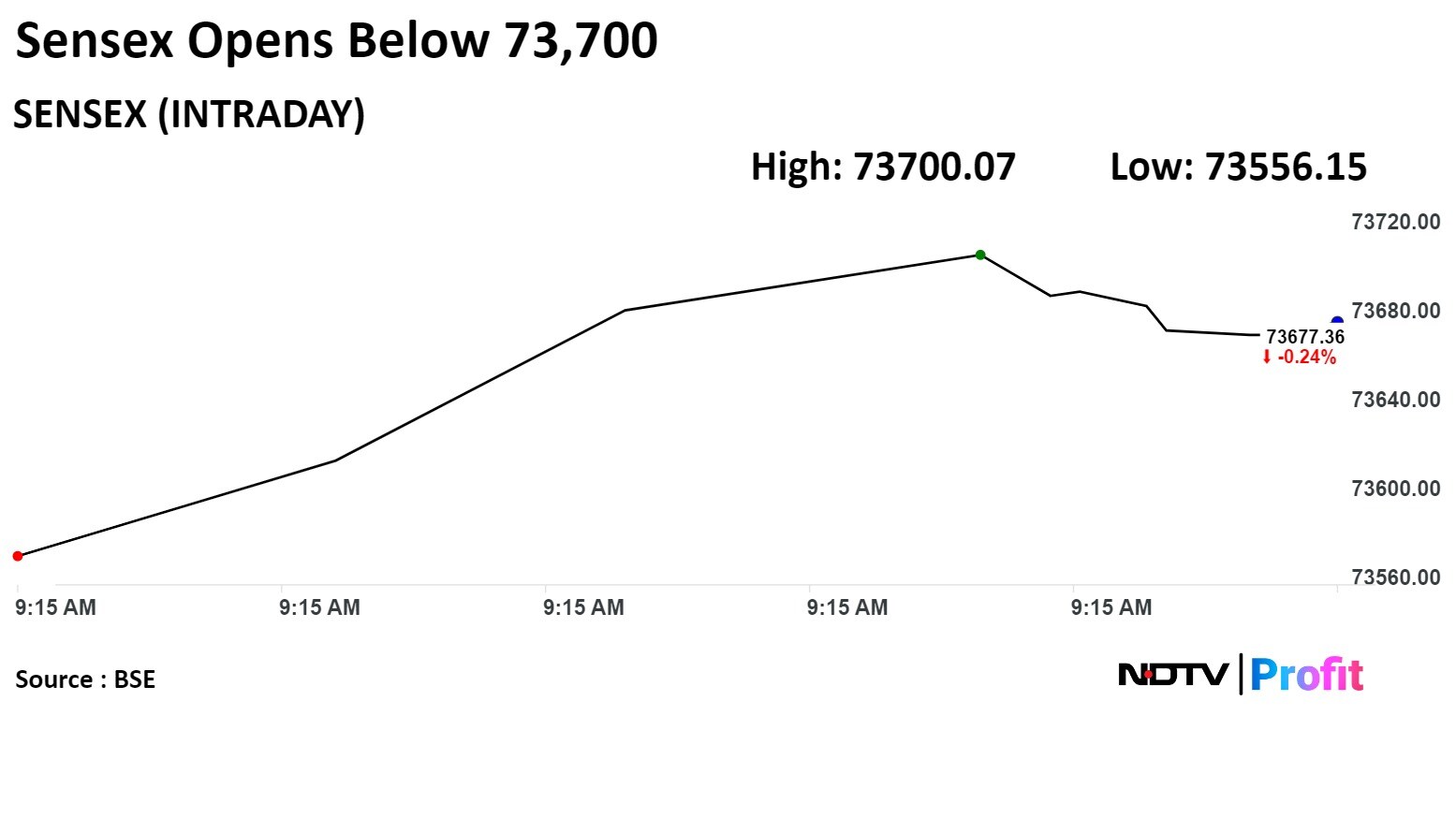

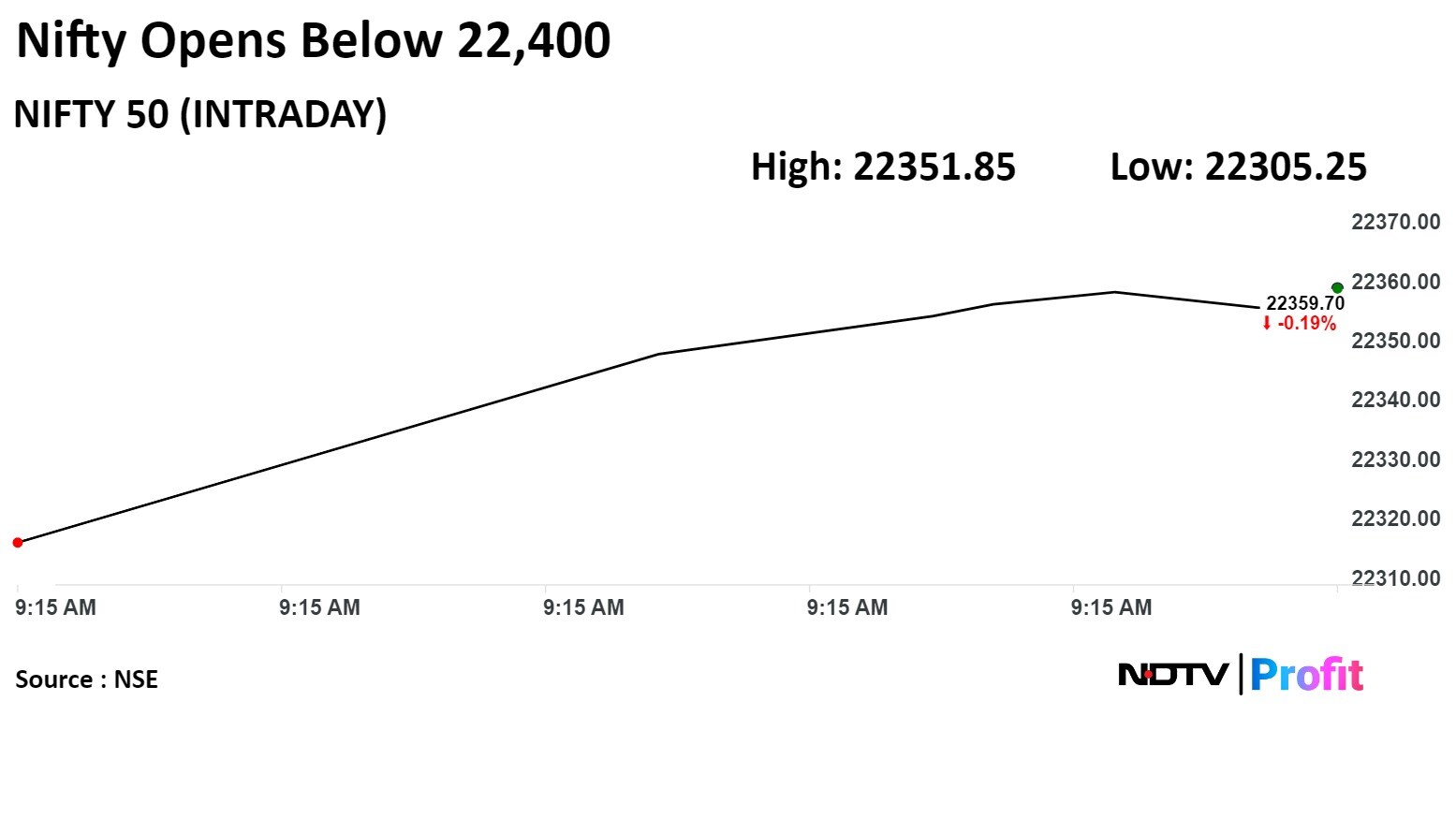

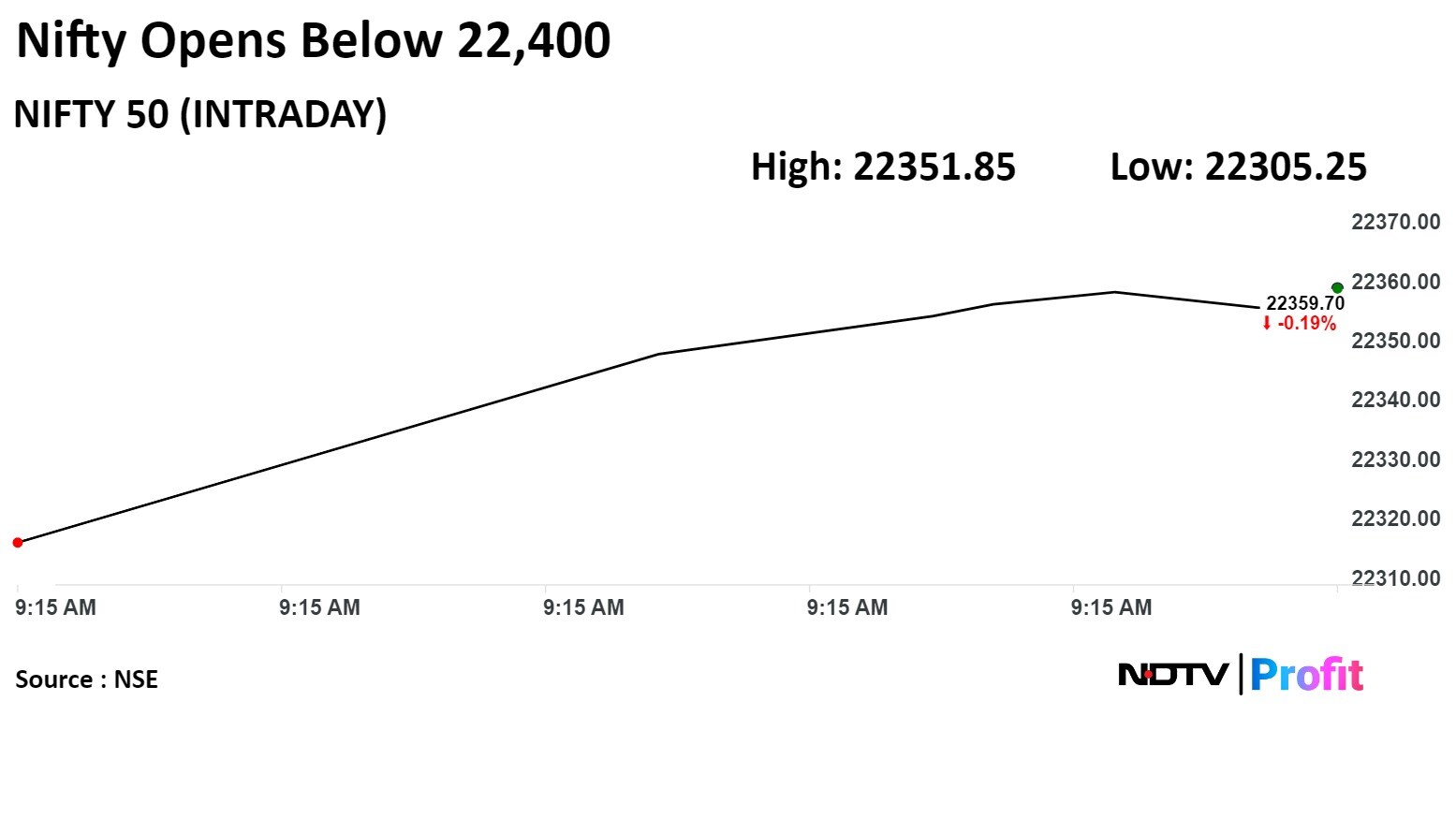

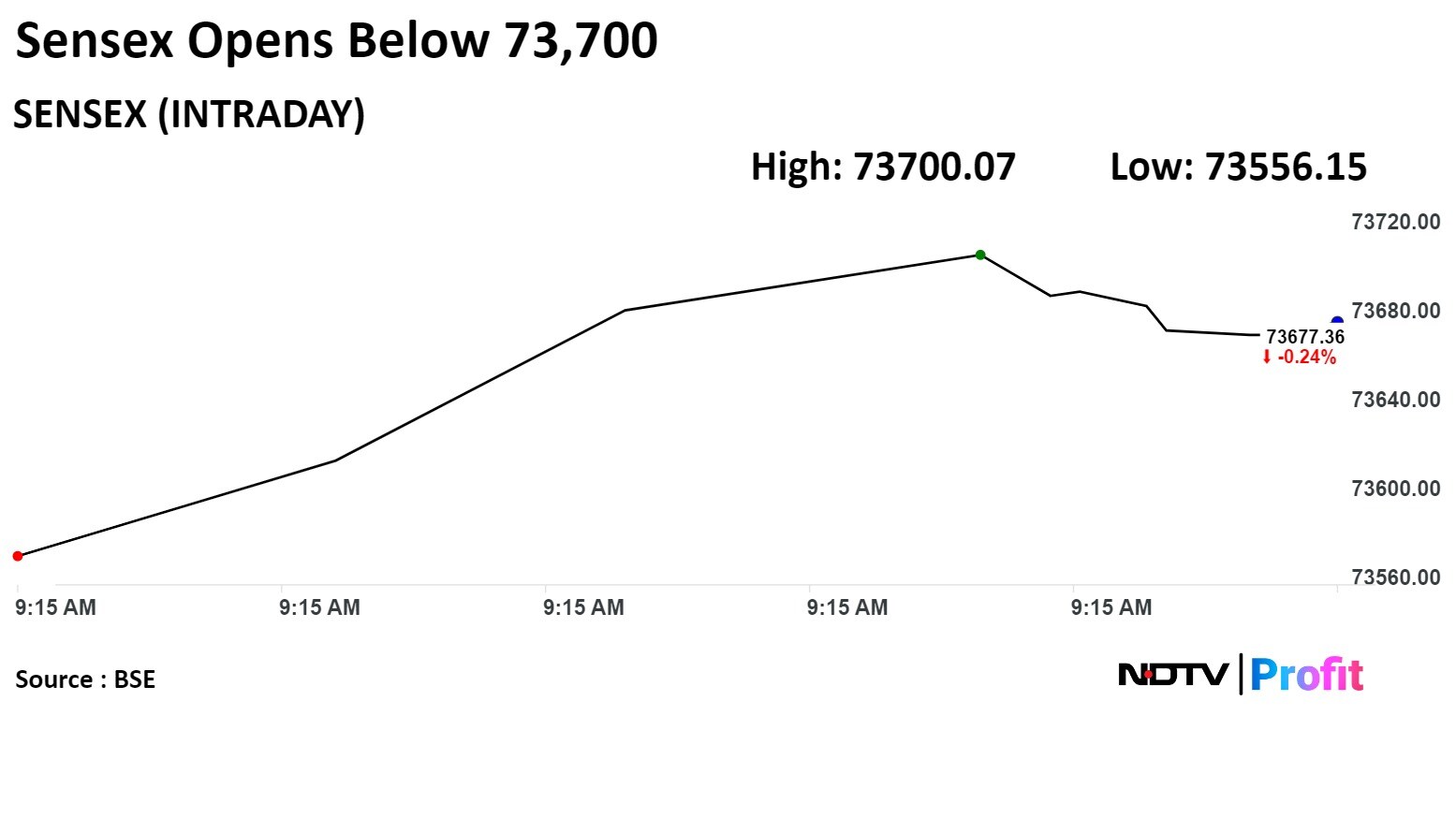

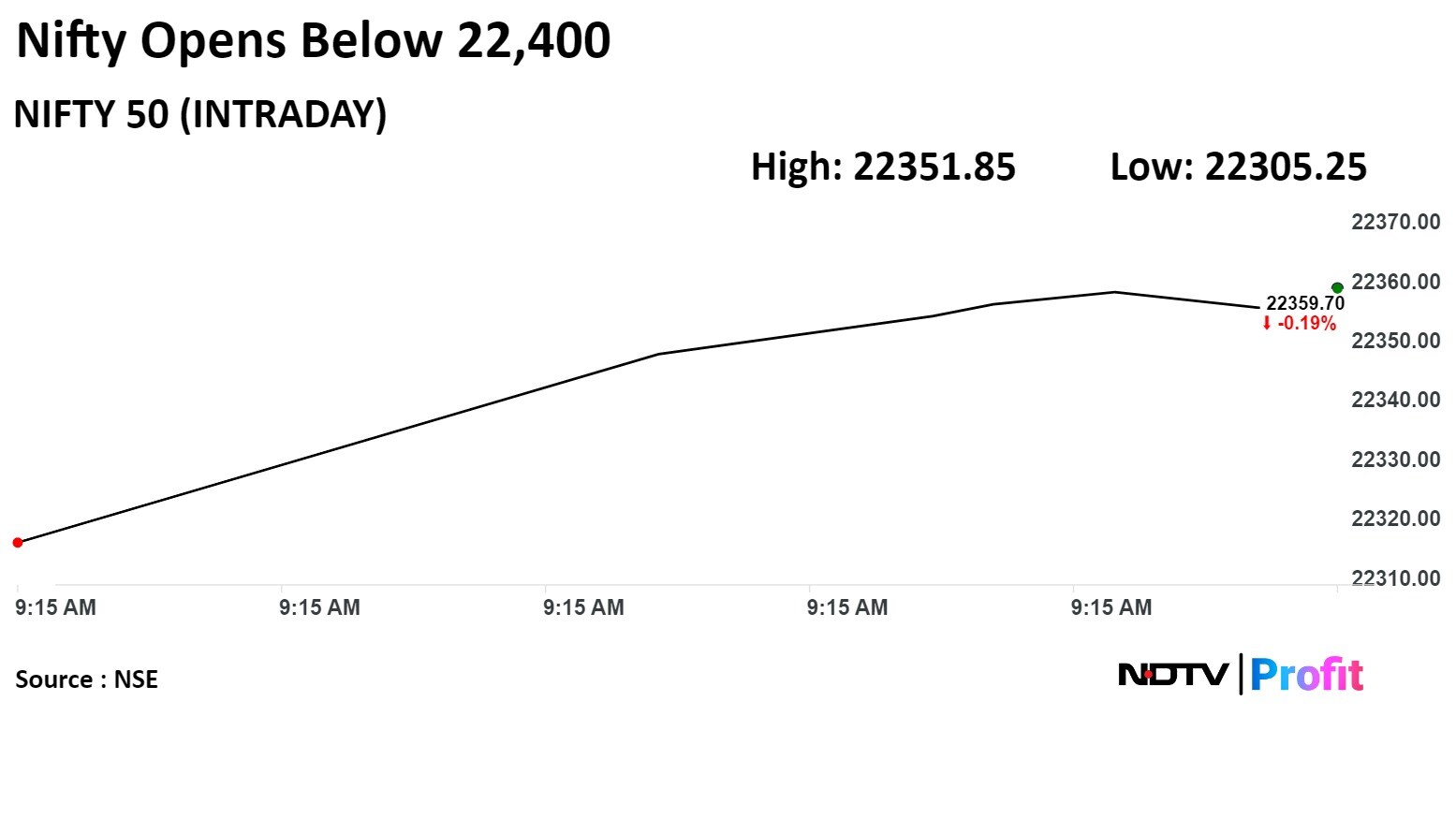

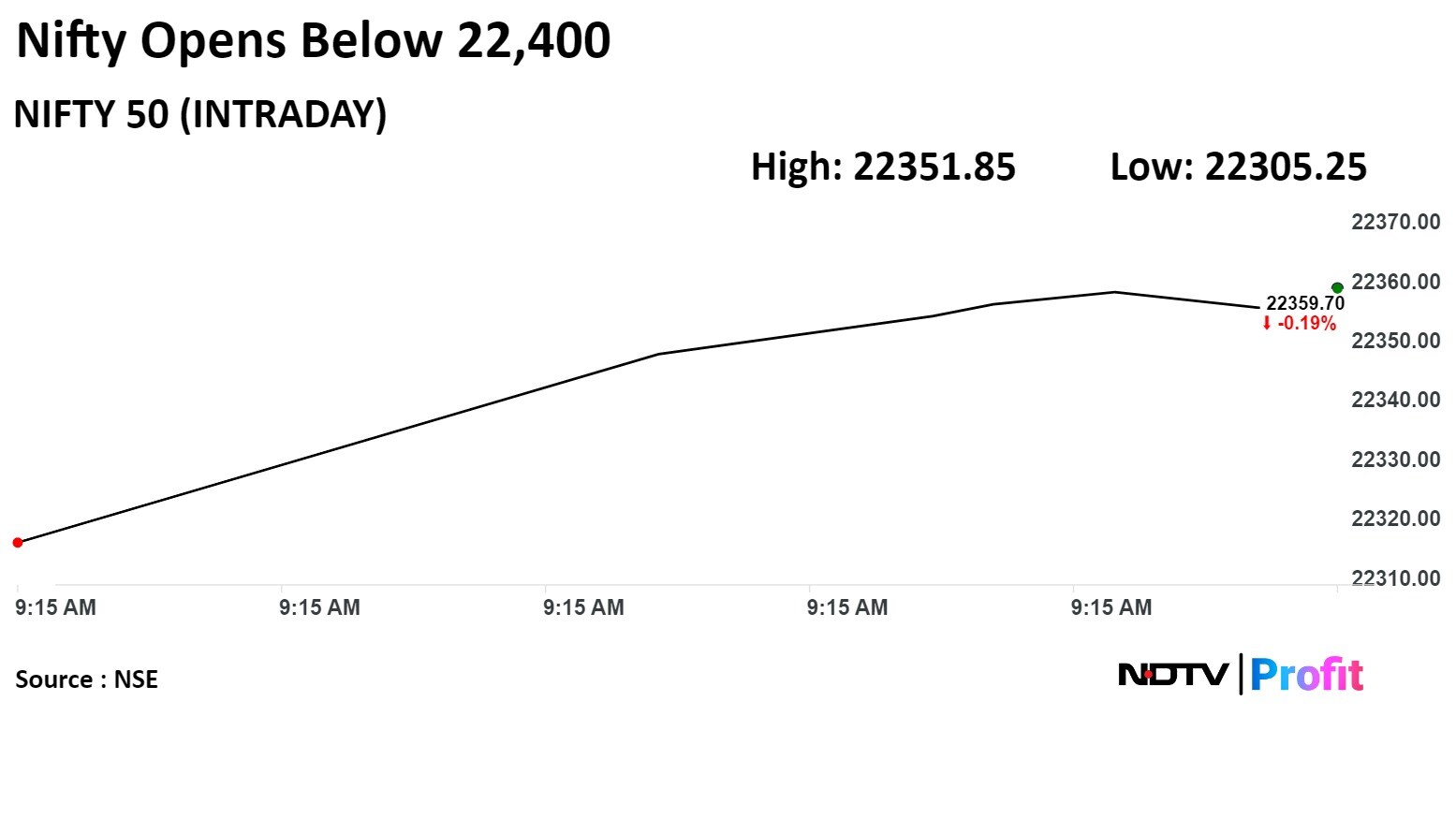

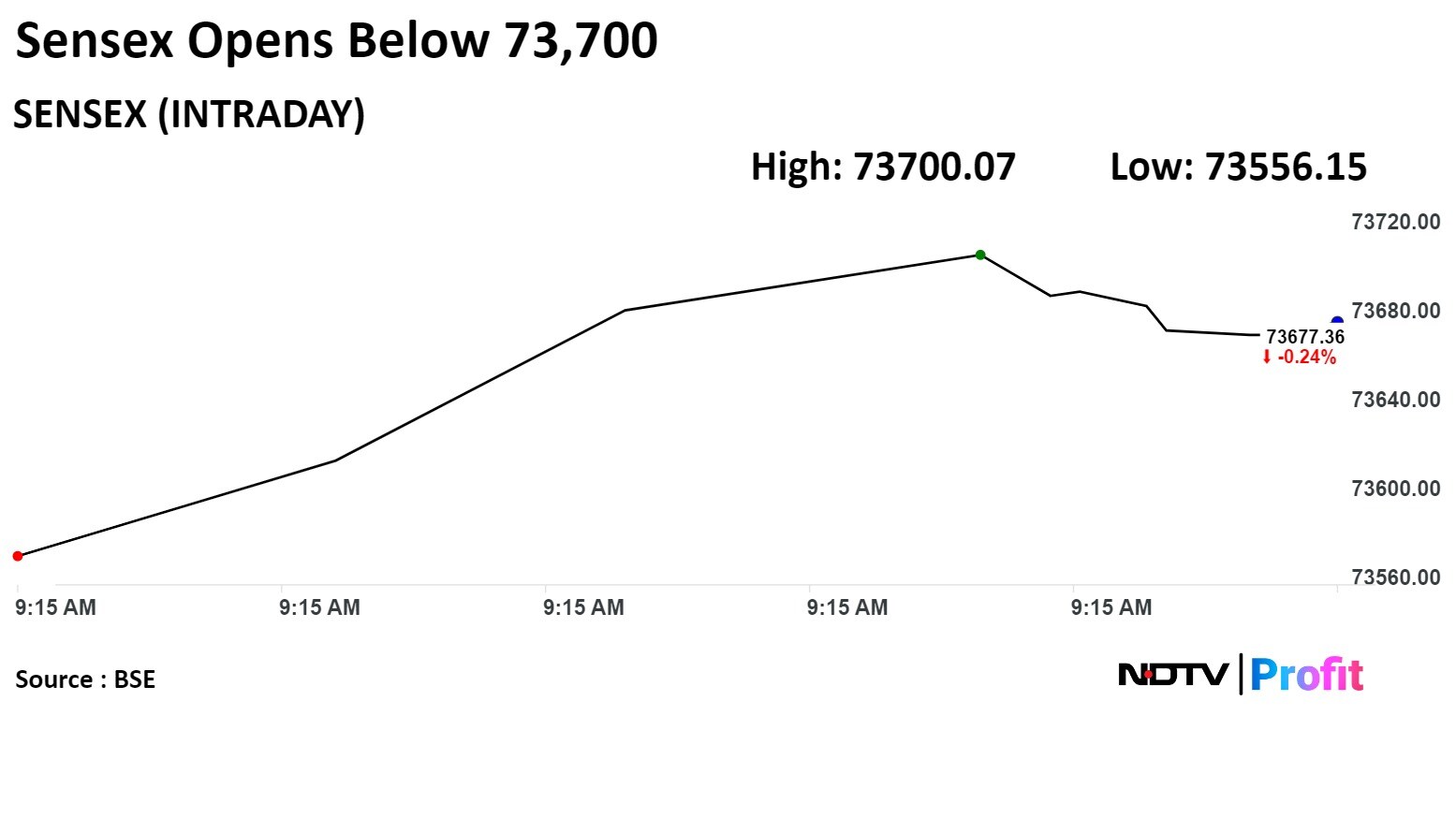

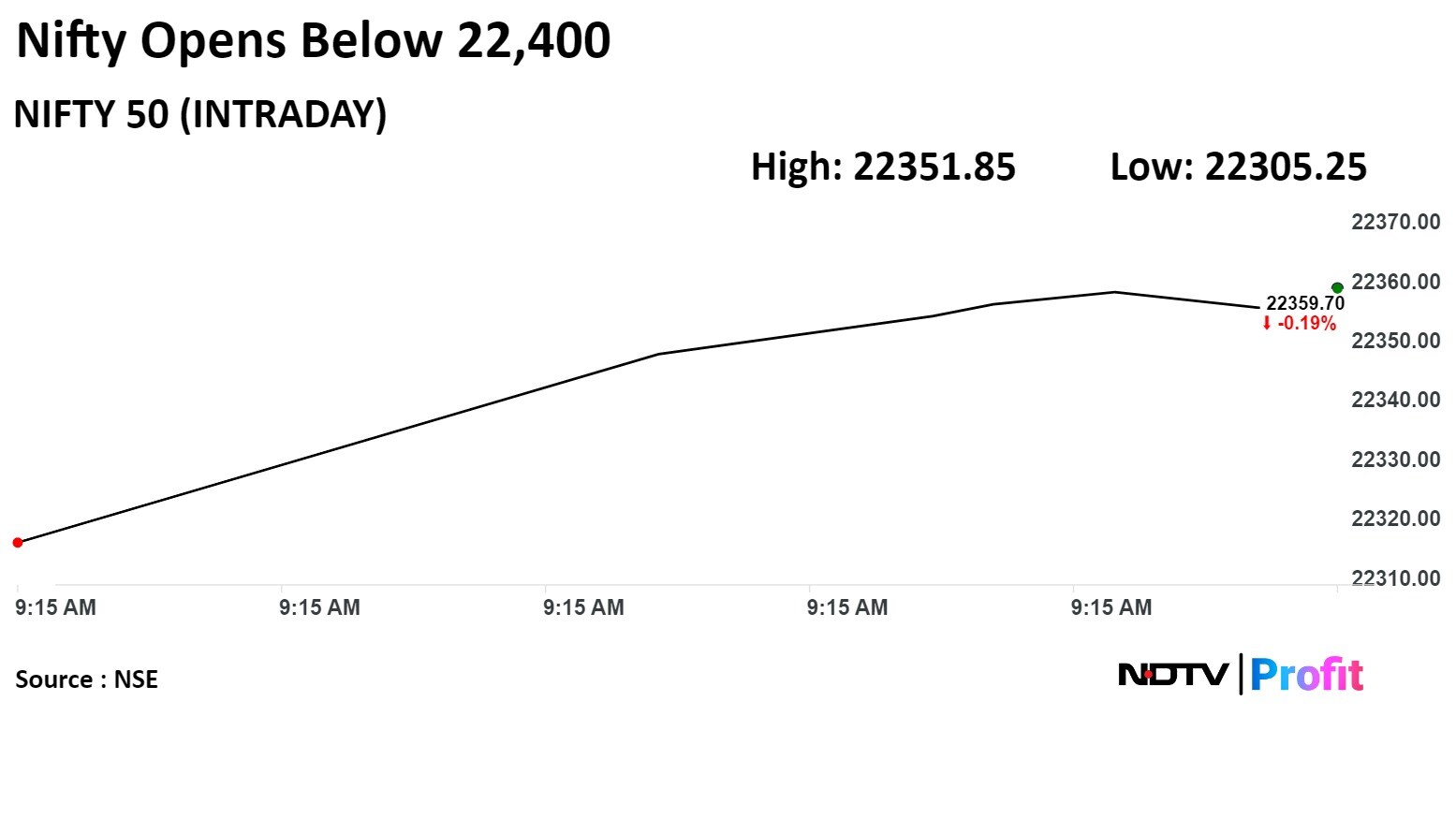

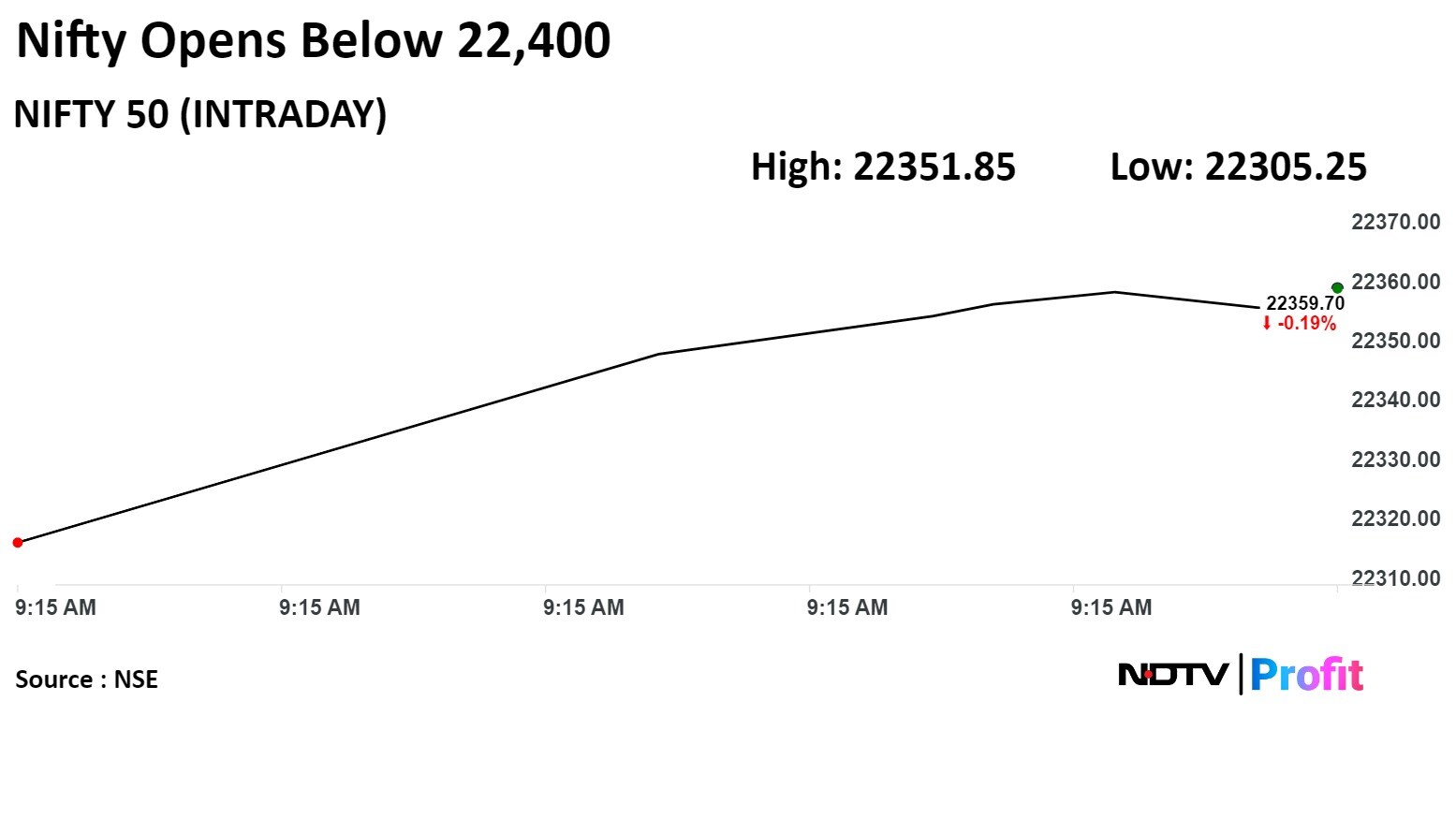

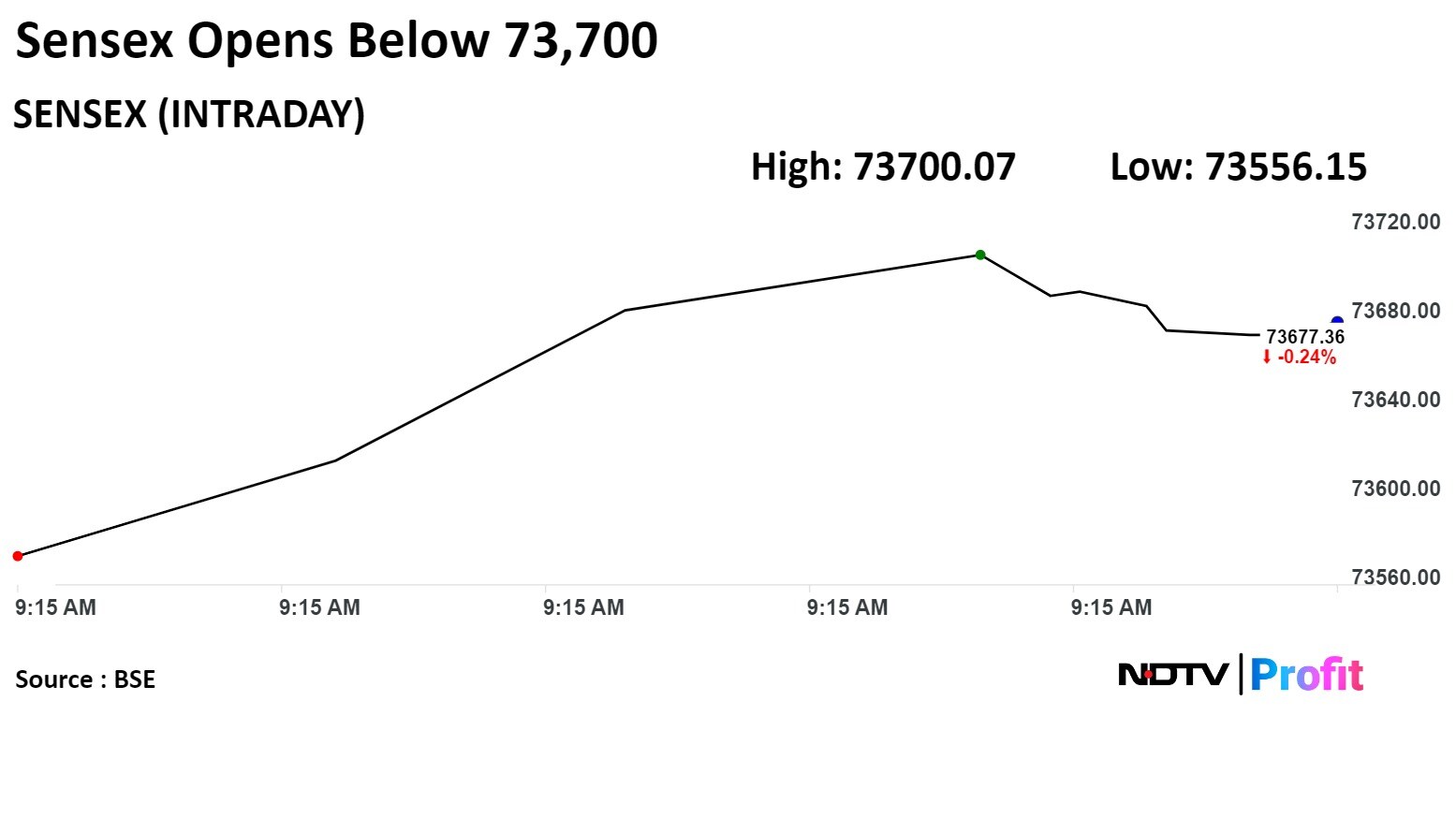

Benchmark equity indices snapped their four day rally as shares of Kotak Mahindra Bank weighed on them after RBI's action against the bank.

At pre-open, the S&P BSE Sensex Index was at 73,572.34, down 280.6 points or 0.38% while the NSE Nifty 50 was down 85.50 points or 0.38% at 22,316.90.

"On the technical front, nothing has changed in Nifty50 and we continue to stick to our view that is need to fill the 22,430-22,500 gap zone to extend its uptrend while a level of 22,200 (50DMA) will continue to act as support," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their four day rally as shares of Kotak Mahindra Bank weighed on them after RBI's action against the bank.

At pre-open, the S&P BSE Sensex Index was at 73,572.34, down 280.6 points or 0.38% while the NSE Nifty 50 was down 85.50 points or 0.38% at 22,316.90.

"On the technical front, nothing has changed in Nifty50 and we continue to stick to our view that is need to fill the 22,430-22,500 gap zone to extend its uptrend while a level of 22,200 (50DMA) will continue to act as support," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their four day rally as shares of Kotak Mahindra Bank weighed on them after RBI's action against the bank.

At pre-open, the S&P BSE Sensex Index was at 73,572.34, down 280.6 points or 0.38% while the NSE Nifty 50 was down 85.50 points or 0.38% at 22,316.90.

"On the technical front, nothing has changed in Nifty50 and we continue to stick to our view that is need to fill the 22,430-22,500 gap zone to extend its uptrend while a level of 22,200 (50DMA) will continue to act as support," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their four day rally as shares of Kotak Mahindra Bank weighed on them after RBI's action against the bank.

At pre-open, the S&P BSE Sensex Index was at 73,572.34, down 280.6 points or 0.38% while the NSE Nifty 50 was down 85.50 points or 0.38% at 22,316.90.

"On the technical front, nothing has changed in Nifty50 and we continue to stick to our view that is need to fill the 22,430-22,500 gap zone to extend its uptrend while a level of 22,200 (50DMA) will continue to act as support," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices snapped their four day rally as shares of Kotak Mahindra Bank weighed on them after RBI's action against the bank.

At pre-open, the S&P BSE Sensex Index was at 73,572.34, down 280.6 points or 0.38% while the NSE Nifty 50 was down 85.50 points or 0.38% at 22,316.90.

"On the technical front, nothing has changed in Nifty50 and we continue to stick to our view that is need to fill the 22,430-22,500 gap zone to extend its uptrend while a level of 22,200 (50DMA) will continue to act as support," said Aditya Gaggar, director of Progressive Shares.