.jpg?downsize=773:435)

Indian equity markets saw a record number of primary market issuances this year but the windfall gains may not necessarily translate into higher growth.

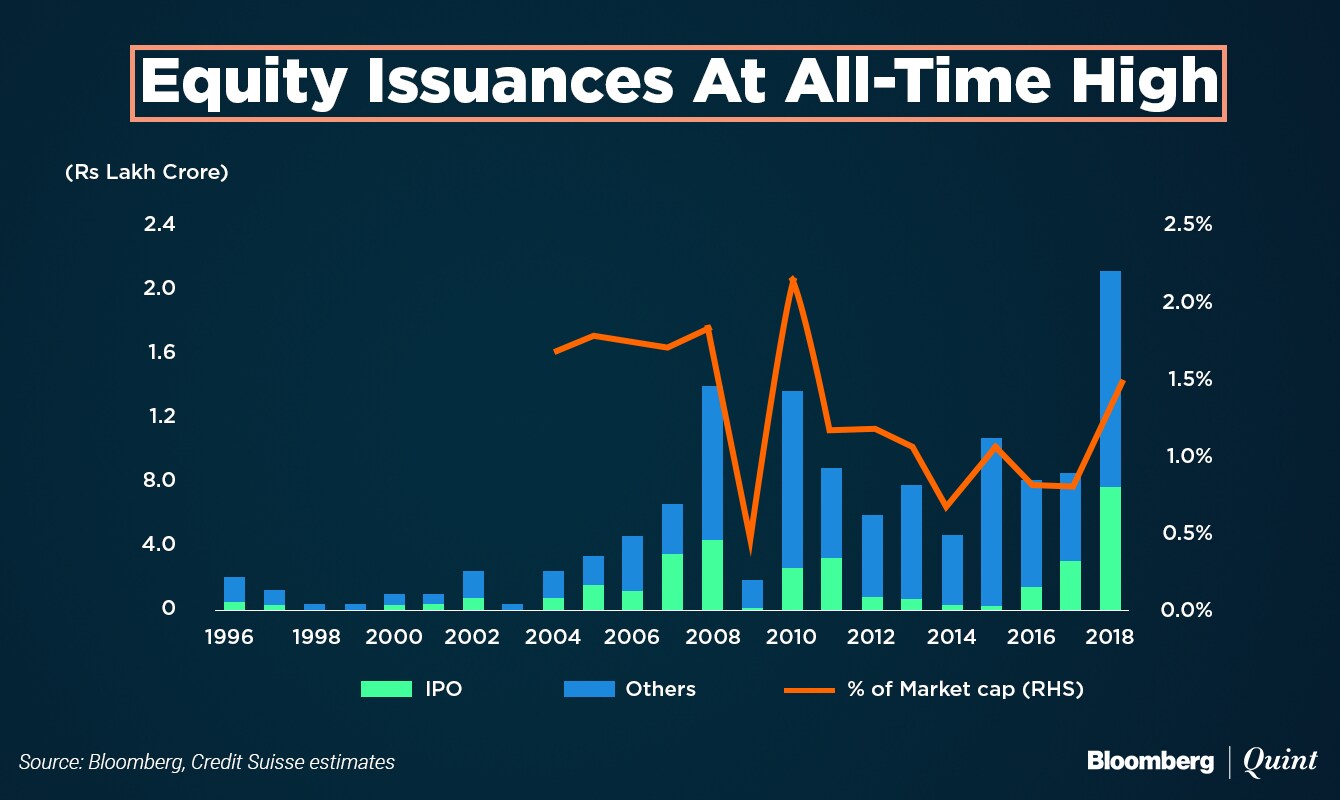

Equity issuances, already at a record high in absolute value, have hit Rs 1.6 lakh crore in fiscal 2018 out of the expected Rs 2.1 lakh crore, Credit Suisse analyst Neelkanth Mishra wrote in a note. The total estimated issuances are at 1.5 percent of the overall market capitalisation, the highest since fiscal 2010, the note added.

Also Read: Record Year for India IPOs May Be Ominous for Stocks

However, 62 percent of those fundraise is in the financial sector which means that “a large part of the money is just moving from one side to the other, and does not directly get deployed into new factories or growth,” Mishra said in an emailed statement attached to the research note.

Even for non-financial companies, a large sum is just secondary sales, the note added.

An investment pick-up is thus unlikely anytime soon.Credit Suisse Report

India's record year for initial public offerings so far hasn't made companies richer. It's the promoters and investors who cornered the bulk of the gains.

Of the Rs 29,000 crore raised in more than two dozen IPOs till October, 84 percent came from stake sales by existing shareholders. Companies got the remaining 16 percent by issuing new stock, the lowest in at least 29 years. When companies raise funds via the offer for sale route, the proceeds are used to pay existing shareholders who are looking to dilute their holding or exit the firm. On the other hand, when a company issues fresh shares, the proceeds can be used as a capital investment to grow the company.

Credit Suisse added that the estimated equity issuances in the current fiscal may rise further since the known pipeline looks small given the pace of addition this year. “Buoyant markets should attract more corporates to come to the market,” it said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.