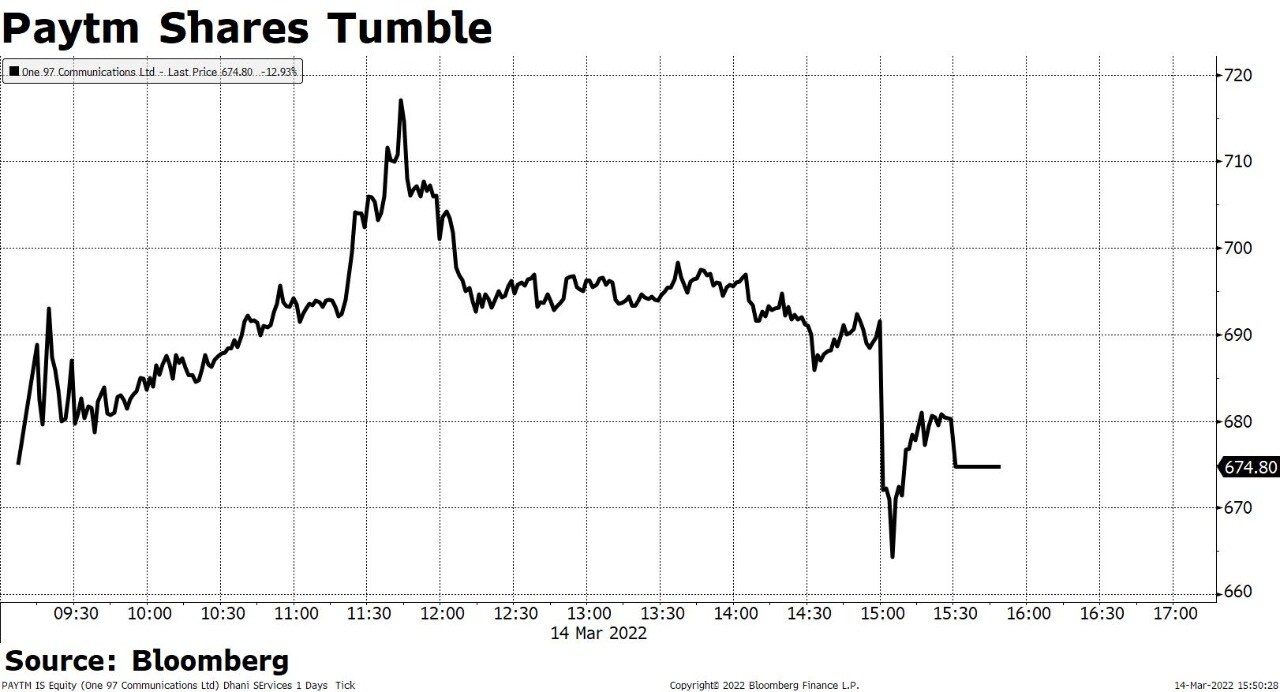

Shares of One97 Communications Ltd. closed at a record low after the Reserve Bank of India barred Paytm Payments Bank from onboarding new customers with immediate effect.

That prompted Morgan Stanley to cut target and downgrade One97, which owns 49% in Paytm Payments Bank. While the "near-term business impact on One97 is limited, this increases regulatory uncertainty", the financial services provider said in a March 13 report. "We lower price target as we mark to market our relative valuation as well as introduce bear case weighting."

The action, according to the RBI statement, followed material supervisory issues at the payments bank. The bank has also been directed to appoint an IT audit firm to conduct a comprehensive system audit of its IT system.

Morgan Stanley said it needs to "see potential implications of the IT audit, and this may take time to get resolved". "We expect the regulatory developments to weigh on valuation, as also seen in the cases of other banks facing negative regulatory strictures (HDFC Bank, RBL Bank and Bandhan Bank); this is despite management guiding to no significant earnings impact."

The research house, however, expects the near-term impact on business to be manageable. "Paytm has a large registered wallet user-base of which a significant base is inactive and could be activated. Further, customer acquisitions via UPI will continue."

Other highlights from Morgan Stanley's note on One97:

Downgrades to 'equal-weight' from 'overweight', cuts target price to Rs 935 from Rs 1,425 apiece.

Key Upsides: Allowance of merchant discount rate under UPI, introduction of interchange on wallets, and better-than-expected execution on financial services, in terms of underwriting and large bank/NBFC tie-ups.

Key Risks: Higher-than-expected competitive intensity in payments and/or reduction in payment charges, weak execution in financial services, and negative outcome of IT audit at Paytm Payments Bank.

Shares of One97 Communications fell 13.3%, the worst fall in three months, to Rs 672 apiece. The stock 12.21% down. Of the nine analysts tracking the company, four maintain a 'buy', two suggest a 'hold' and three recommend a 'sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 80.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.