Consumer inflation in India remained steady in September as the rise in food prices softened, keeping the macro indicator below the Reserve Bank of India's medium-term target.

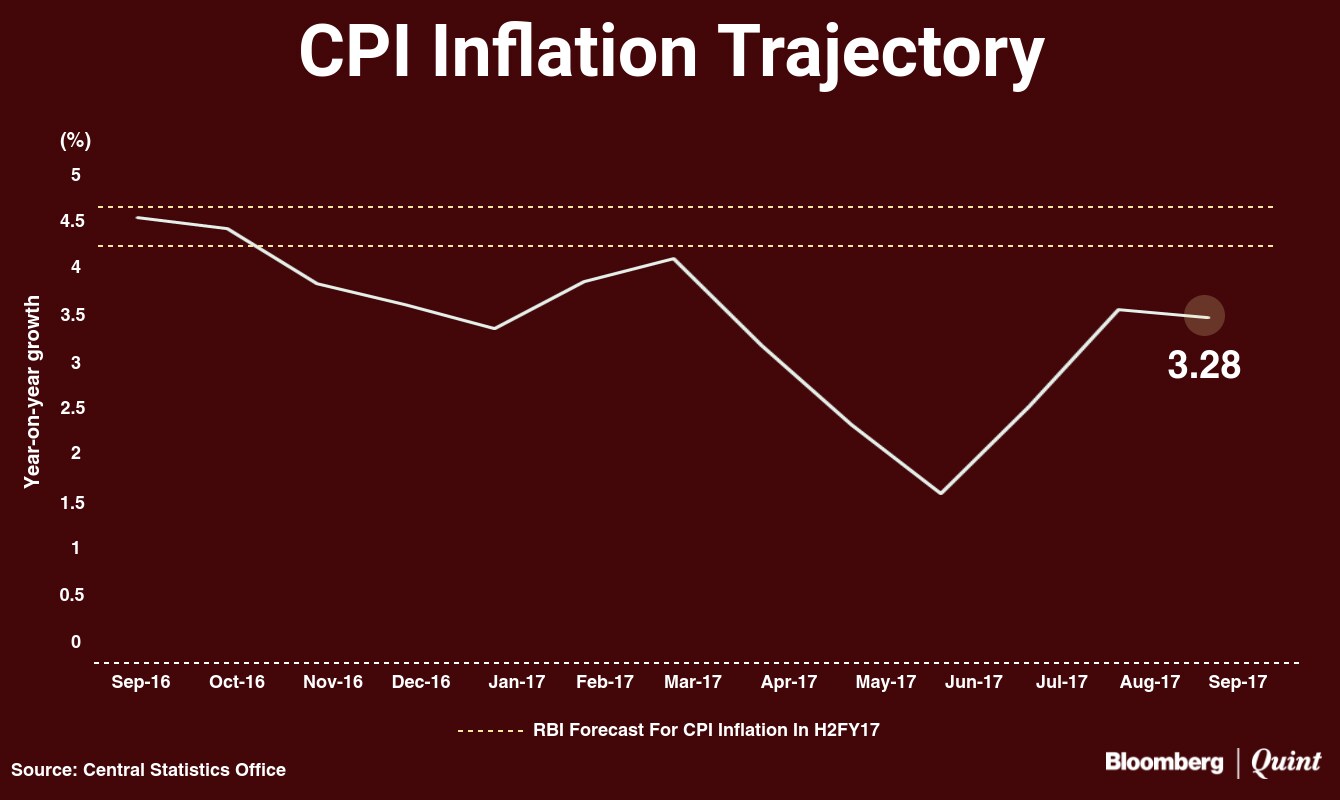

Consumer prices in September rose 3.28 percent over the same month last year, according to data from the Central Statistics Office. CPI inflation in August was revised to 3.28 percent. Economists polled by Bloomberg had expected inflation to come in slightly higher at 3.53 percent.

“This happened primarily due to a decline in food items such cereals, sugar and vegetables”, Sunil Kumar Sinha, principal economist at India Ratings and Research, said in an emailed statement.

Food prices rose 1.25 percent, slower than the 1.52 percent increase in August. “The unwinding of a seasonal surge in tomato prices likely cooled inflation,” Bloomberg Intelligence economist Abhishek Gupta had said in a prior note.

Inflation stabilised in September after accelerating for two straight months as vegetable prices rose sequentially due to seasonal spikes. Onion prices in August had jumped nearly 57 percent over last year, while tomato prices nearly tripled.

Core inflation continued to rise though. Inflation in housing rose to 6.1 percent, while fuel and light inflation climbed 5.5 percent over last year. Prices of clothing and footwear too were up 4.63 percent. India Ratings expects the recent cut in excise duty on fuel to bring the headline inflation lower.

The lower inflation is in contrast to RBI's expectations. In its October monetary policy, the central bank raised its inflation forecast to 4.2 percent in the third quarter, and 4.6 percent in the fourth quarter. The less-than-expected inflation figure may now add pressure on Governor Urjit Patel to cut lending rates in the December policy review with India's economic growth at a three-year low.

CRISIL had said in an earlier note that a December rate cut would happen only if growth weakens further and inflation undershoots the monetary policy committee's forecast.

Also Read: India's Industrial Output Rises Most In Six Months

Key Highlights

- Prices of pulses and food products continued to soften, falling 22.5 percent over last year. Prices had declined 24 percent in August and July.

- Vegetable prices rose 3.9 percent compared to 6.1 percent in August.

- Food and beverage prices rose 1.76 percent over last year in September, slower than the 1.96 percent rise in August

- Inflation in sugar and confectionary items stood at 6.77 percent compared to 7 percent in August.

- Prices of spices fell 2.3 percent.

- Housing inflation stood at 6.1 percent compared to 5.6 percent in August.

- Fuel and light inflation rose to 5.56 percent in September from 4.94 percent in August.

Watch Upasna Bhardwaj, economist at Kotak Mahindra Bank discuss the fineprint of the inflation and industrial production numbers and the way forward for the economy.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.