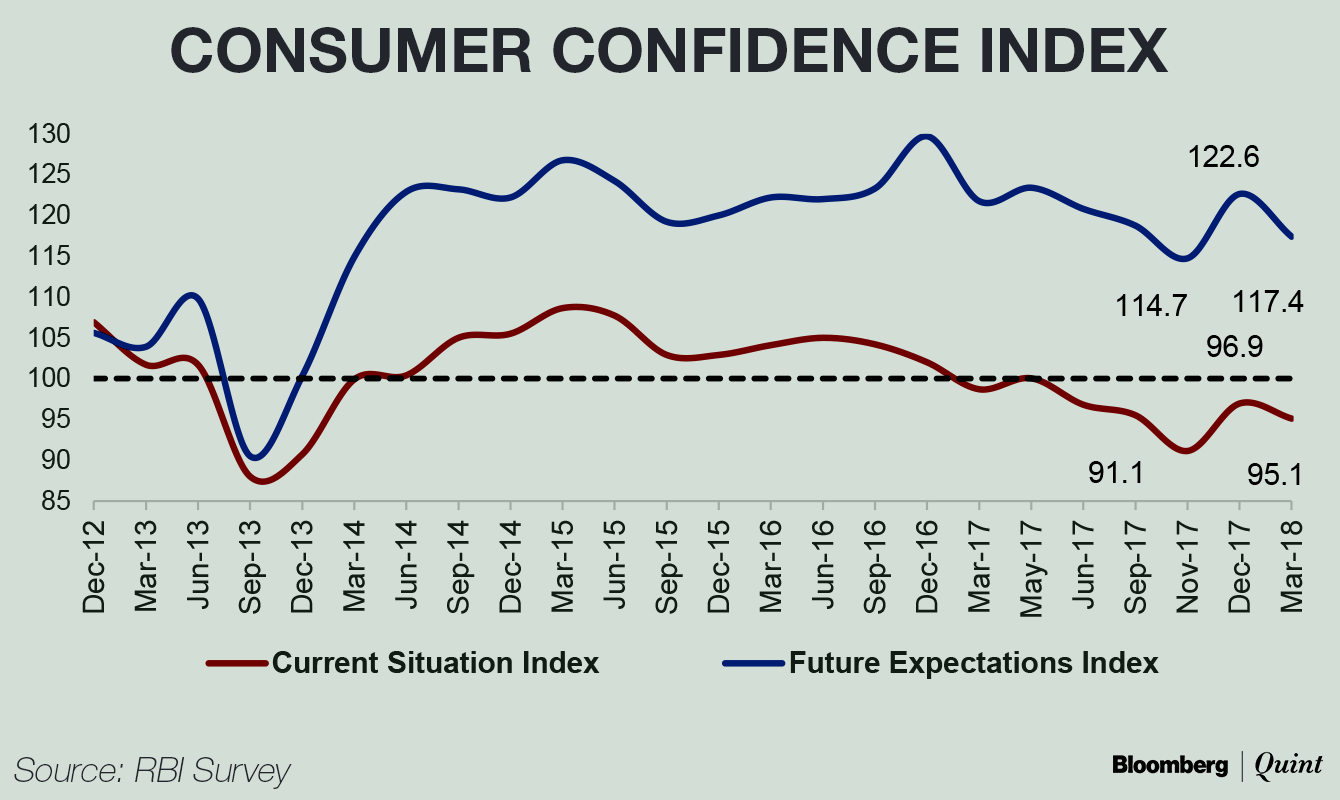

Consumer confidence weakened in the March-ended quarter mainly due to mounting concerns over the country's economic progress and employment growth.

The Reserve Bank of India's latest survey showed that both current consumer confidence and future expectations dropped marginally from December 2017 when there was a visible uptick. “The Current Situation Index has remained in the pessimistic zone since March 2017, while the Future Expectations Index followed a similar trajectory,” the forward looking survey said.

The CSI reading dipped to 95.1 from 96.9 in December. The future expectations for the next year fell to 117.4 from 122.6 three months ago. A reading below 100 is perceived to be pessimistic.

The current perceptions on general economic situation dived sharply from the neutral level polled in the last round, and respondents continued to express concerns about the current employment situation with the year-outlook less than positive as seen in the previous round.RBI Consumer Confidence Survey

Only 48 percent of the respondents think that economic conditions in the country would improve a year from now. A quarter of the respondents expect things to go downhill from here. Eighty five percent of the respondents also said that they expect their spending to rise in a year.

Also Read: Are We Set Up For A Prolonged Pause In Rates?

Higher Inflation Expectations

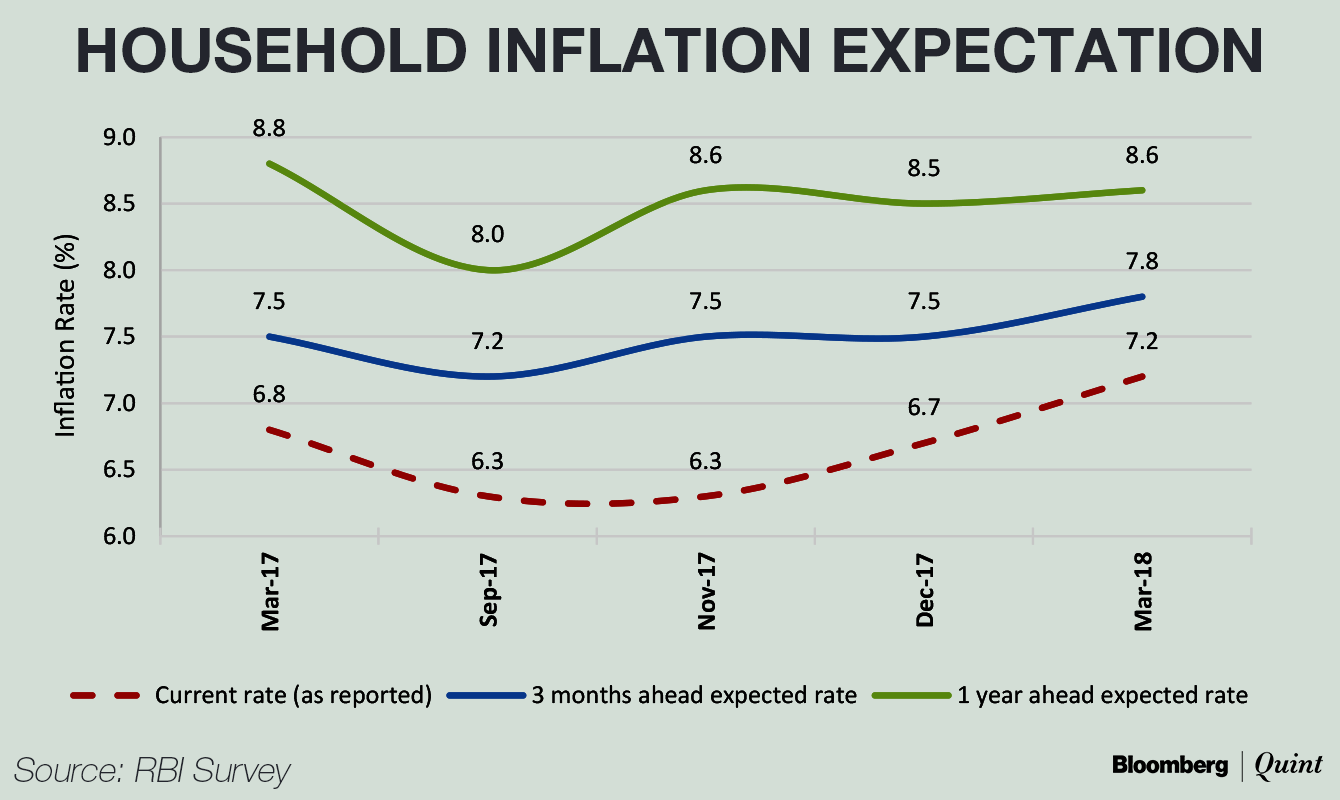

Over 80 percent of the people surveyed expect a surge in general prices in the next three months. Nearly half of them anticipate prices to rise faster that the current pace.

Median inflation expectations rose by 30 basis points to 7.8 percent and 10 basis points to 8.6 percent for three months ahead and one year ahead period, respectively, the RBI survey showed.

Going ahead, the people surveyed expect prices of food products to increase the most, followed by an uptick in prices of non-food items and cost of services. Half of them also said that housing prices will rise at a faster pace.

Also Read: Monetary Policy: MPC Begins New Financial Year With A Status Quo On Rates

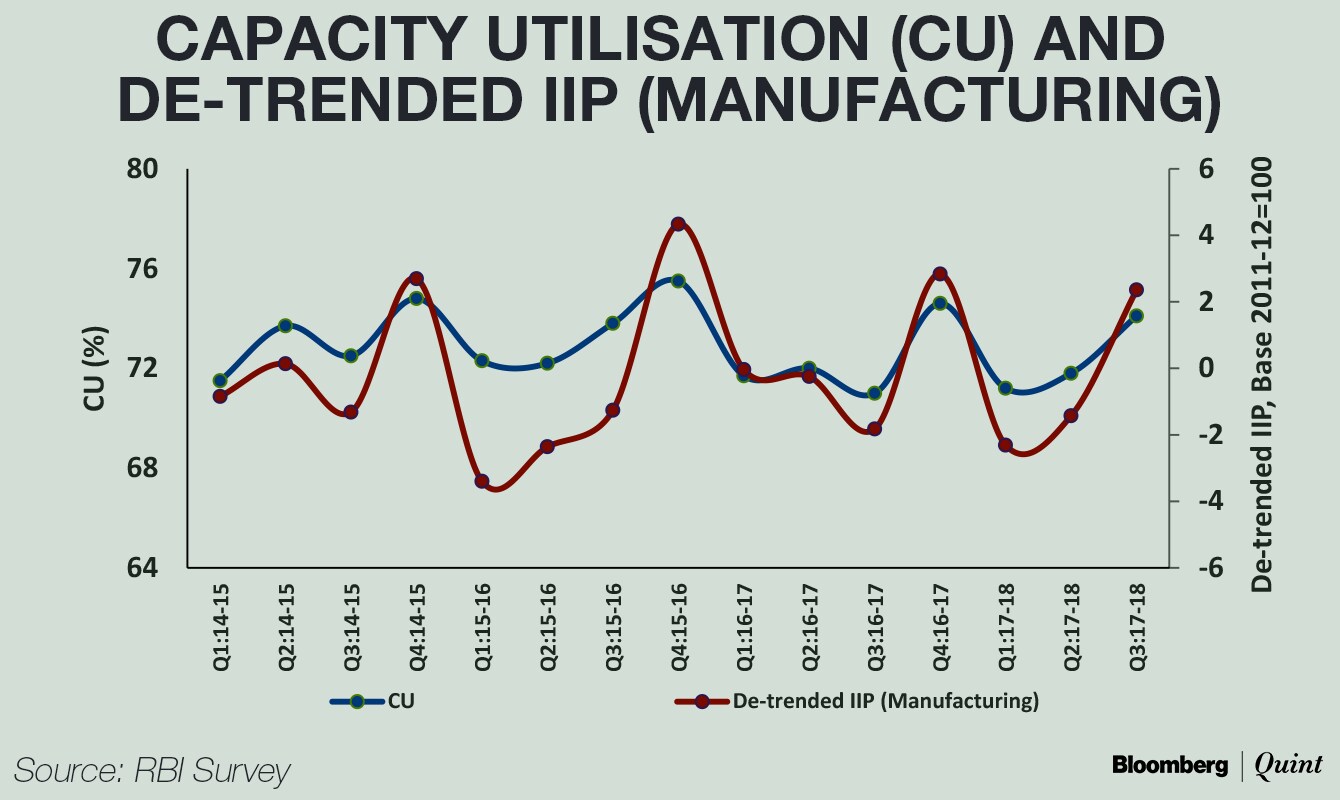

Capacity Utilisation Picks Up

The manufacturing sector's capacity utilisation in the December-ended quarter improved further, with a co-incident uptick in the industrial activity. Seasonally adjusted capacity utilisation increased for the first time in financial year 2017-18 as the sector recovered from disruptions from India's new sales tax regime.

At an aggregate level, capacity utilisation at 940 Indian manufacturing firms increased to 74.1 percent in the third quarter, from 71.8 percent in the previous quarter. New orders grew 21 percent in the three months leading to December, compared to the 6.5 percent growth seen till September.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.