Here is a roundup of the day's other top stories in brief.

1. Micro Measures For A Macro Economy

In a highly anticipated press conference, Finance Minister Nirmala Sitharaman attempted to revive India's ailing economy by addressing concerns of the automobile sector, non-banking finance companies, and capital market investors. She, however, stayed away from any large fiscal stimulus given the government's limited headroom.

- Bringing cheer for equity investors, Sitharaman rolled back the enhanced surcharge on equity capital gains for foreign and domestic investors. The measure, announced in the Budget, was vigorously opposed by foreign portfolio investors.

- The Finance Minister announced several measures to boost the auto industry by clearing the air about BS IV vehicles, deferring revision of one-time registraton fee and lifting the ban on government purchase of vehicles.

- She also said the ministry will release upfront Rs 70,000 crore for state-owned bank recapitalisation, adding that banks have also agreed to pass on interest rate cuts.

Here are the top 10 announcements from the finance minister's press conference.

2. SGX Nifty Jumps Indicating Monday Gains

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, rose as much as 1.4 percent as equity investors rejoiced the finance minister's announcement to roll back enhanced surcharge on capital gains.

Earlier in the day, Indian equity benchmarks closed higher for the first time this week in anticipation of announcements from the government.

- The S&P BSE Sensex rose 0.63 percent to close at 36,701.16.

- The NSE Nifty 50 gained 0.82 percent to 10,829.35.

- Eight of the 11 sectoral gauges compiled by NSE ended higher.

Follow the day's trading action here.

The Indian rupee fell to its lowest in nine months against the U.S. dollar before recovering, tracking the rebound in the equity benchmarks.

- The domestic currency depreciated 22 paise to trade at 72.03 against the greenback—its lowest since December.

- Thereafter, it recovered and rose to 71.67 per dollar at close.

- Besides foreign fund outflows, forex traders said that a strong dollar in the overseas markets weighed on the sentiment.

Global factors, more than domestic cues, are responsible for the weakness in the currency.

3. Trump Says He'll Respond To China Tariffs; Powell Hints At Another Rate Cut

China announced plans to impose additional tariffs on $75 billion of American goods including soybeans, automobiles and oil, with the retaliation for President Donald Trump's latest planned levies on Chinese imports.

- Some of the countermeasures will take effect starting Sept. 1, while the rest will come into effect from Dec. 15, according to the announcement from the Chinese Finance Ministry.

- This mirrors the timetable the U.S. has laid out for 10 percent tariffs on nearly $300 billion of Chinese shipments.

The news from Beijing rekindled concerns about the world's two largest economies.

Federal Reserve Chairman Jerome Powell said the U.S. economy is in a favorable place but faces “significant risks” as growth abroad slows amid trade uncertainty.

- “Trade policy uncertainty seems to be playing a role in the global slowdown and in weak manufacturing and capital spending in the United States,” Powell said in the text of his remarks to central bankers gathered at the Kansas City Fed's annual symposium in Jackson Hole, Wyoming.

We will act as appropriate to sustain the expansion, with a strong labour market and inflation near its symmetric 2 percent objective.Jerome Powell, Chairman, U.S. Federal Reserve

Powell's remarks are seen as leaving the door open to another rate cut when the Fed meets next month.

President Donald Trump said he'll announce a response to Chinese tariffs Friday afternoon, as he also blasted the Federal Reserve, suggesting its chairman could be a greater “enemy” of the U.S. than Chinese President Xi Jinping.

Our Country has lost, stupidly, Trillions of Dollars with China over many years. They have stolen our Intellectual Property at a rate of Hundreds of Billions of Dollars a year, & they want to continue. I won't let that happen! We don't need China and, frankly, would be far....

August 23, 2019U.S. stocks slumped and Treasuries rallied after President Donald Trump said he'll respond to new Chinese tariffs and blasted Federal Reserve Chairman Jerome Powell. The dollar fell.

- The S&P 500 Index dropped as much as 1.7 percent, led by energy, technology and industrial shares.

- Ten-year yields halted a two-day advance after Powell's remarks bolstered speculation that the central bank will cut rates next month.

- The greenback reacted to Trump's comments that “we have a very strong dollar and a very weak Fed.”

- Oil sank and gold surged.

Get your daily fix of global markets here.

4. Amazon Deal Values Kishore Biyani's Future Retail At $5.8 Billion

Amazon.com Inc. will acquire an indirect stake in Kishore Biyani-founded Future Retail Ltd. as the Jeff Bezos-led firm plans to bolster its brick-and-mortar presence in one of the world's fastest-growing retail markets.

- Amazon.com NV Investment Holdings—the investment arm of the U.S.-based retailer—will buy a 49 percent stake, comprising both voting and non-voting shares, in Future Coupons Ltd., a promoter group entity of Future Retail, according to an exchange filing.

- As part of the agreement, Amazon has been granted an option to acquire all or part of the promoter shareholding in Future Retail, the operator of Big Bazaar supermarkets.

- Amazon can exercise its option to buy the promoter shareholding in Future Retail between the third and tenth years.

The promoters have also agreed to certain restrictions.

5. SBI Decides Not To Lower Savings Account Deposit Rates

The nation's largest lender will not lower deposit rates for savings account even as the Reserve Bank of India cut its benchmark interest rate.

- State Bank of India has fixed the interest rate at 3 percent for customers with savings account balances of more than Rs 1 lakh.

- Customers who have balances up to Rs 1 lakh will continue to earn 3.5 percent interest, it said in a media statement.

- This comes even as the RBI's Monetary Policy Committee lowered the repo rate—at which the central bank lends to its clients—by 35 basis points to 5.4 percent in its latest policy meet in August.

- Had this rate cut been transmitted to savings bank deposits, customers with balances less than Rs 1 lakh would have earned 2.65 percent interest, SBI said in the statement.

SBI started benchmarking its savings rate to the repo rate in May.

6. ARCs Close To Recovering Nearly Half The Debt They Acquired

Recoveries on bad assets by asset reconstruction companies have risen to nearly half as of 2018, according to Crisil Ratings Ltd.

- The ratings agency said in a report that it prepared with Assocham and the ARC Association of India that gross recovery as a percentage of principal debt acquired by the country's ARCs is expected to range between 44 percent and 48 percent.

- Recovery rates are driven by lower vintage and better quality of assets that have been acquired in recent years and is also driven by changes in regulatory framework and improved credit discipline among borrowers, Crisil said.

Assets managed by ARCs have grown due to resolution in a few large stressed accounts and write-offs.

7. Worst July In Six Years For Air Passenger Growth

Air passenger growth slowed in July amid a prolonged slowdown in the economy.

- The number of passengers flying Indian airlines grew at 3 percent year-on-year last month, the worst pace in July in at least six years, according to BloombergQuint's calculations based on the data from Directorate General of Civil Aviation.

- That compares with the 18 percent monthly average passenger growth in the last five years.

- Nearly 1.19 crore Indians took to the skies in July this year, the data showed.

While the overall passenger growth is in single digits, yields too, have come down to last year's levels.

8. How Charlie Munger Thinks About The Stock Market

Work hard, have a few insights, search for mis-priced bets, bet seldom. That's what Vishal Khandelwal learned from Charlie Munger.

- The wise ones bet heavily when the world offers them that opportunity.

- They bet big when they have the odds.

- And the rest of the time, they don't.

9. Partial Relief For Chidambaram

The Supreme Court today granted protection from arrest to former Union Finance Minister P Chidambaram in the money laundering case lodged by Enforcement Directorate.

- This even as the apex court agreed to hear on Aug. 26 the Central Bureau of Investigation and ED's cases in the INX Media matter.

- Chidambaram will however continue to be in the Central Bureau of Investigation's custody as the apex court did not intervene in the matter for which he has been sent for custodial interrogation of the agency till Monday.

- The hearing witnessed heated exchange of words between prosecution counsel and Solicitor General Tushar Mehta and Chidambaram's party colleagues Kapil Sibal and AM Singhvi.

Here's what transpired at the Supreme Court today.

10. The 20 Asian Families That Control $450 Billion

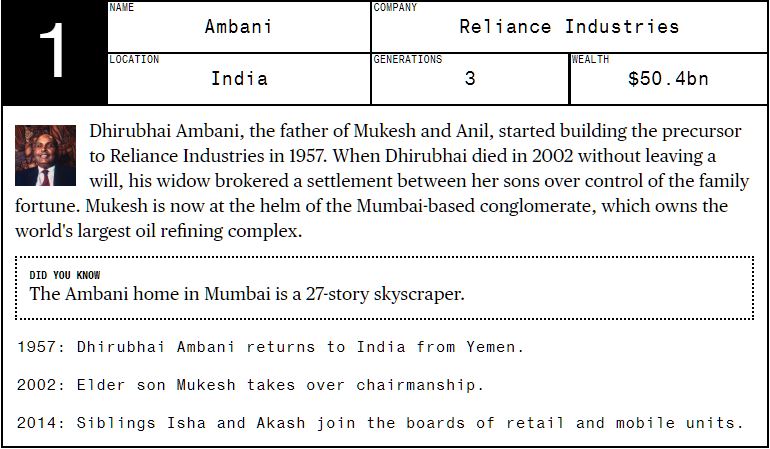

Mukesh Ambani's late father, who started the family's business empire with $100, used to tell his son that he didn't know what it was like to be poor.

- For the Ambanis, whose palatial home towers over Mumbai and is one of the world's most expensive private residences, that has never been truer. They are Asia's richest family, with a $50 billion fortune.

- The region's 20 wealthiest clans are now worth more than $450 billion combined, underscoring how the world's economic growth engine is minting fortunes on an unprecedented scale.

Here's the full list of Asia's 20 richest clans.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.