Adani Energy Solutions Ltd. has received a Letter of Intent from REC Power Development and Consultancy Ltd. to establish a transmission system. The project aims to evacuate 20 GW of power from Rajasthan's Renewable Energy Zone under Phase-III Part-I, through a tariff-based competitive bidding process, as per an exchange filing.

The LoI, issued on Dec. 3, 2024, is contingent upon Adani Energy's unconditional acceptance and fulfillment of specific conditions within 10 days, as per the note. It will also require the execution of binding agreements between the involved parties to finalise the deal.

The project, estimated at around Rs 25,000 crore, is set to become AESL's biggest order win once the formal award process is completed.

It involves the establishment of 6 GW High-Voltage Direct Current terminal stations at Bhadla in Rajasthan and Fatehpur in Uttar Pradesh, along with transmission lines and a corresponding alternating current network connecting the two stations, Business Standard reported citing sources.

As of September, AESL's under-construction transmission project pipeline was valued at Rs 27,300 crore, comprising 12 projects, the company noted in a prior media statement.

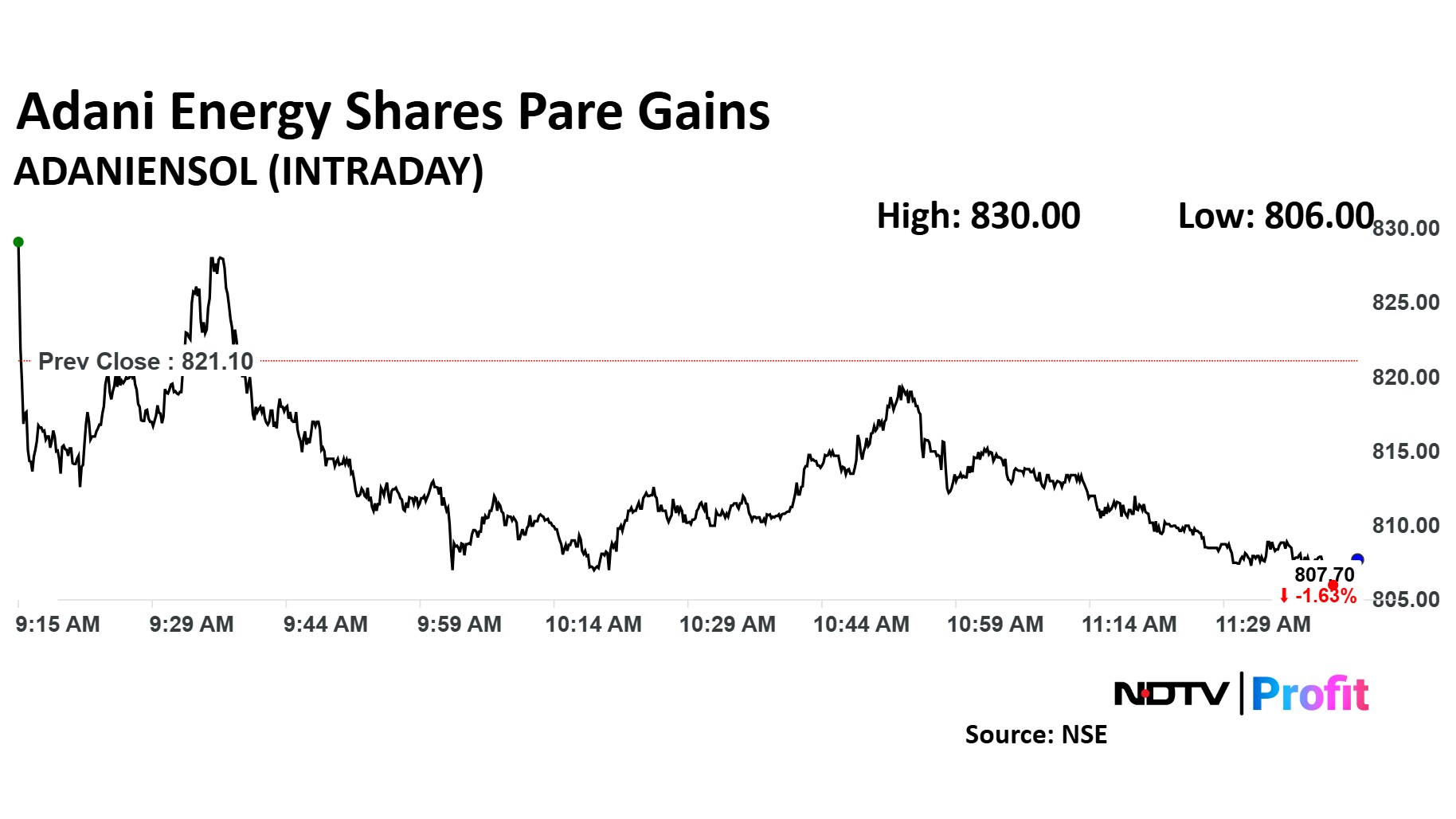

Adani Energy Share Price Today

Share price of Adani Energy rose as much as 2.03% to Rs 830 apiece. It pared gains to trade 0.58% lower at Rs 808.75 apiece, as of 11:32 a.m. This compares to a 0.47% decline in the NSE Nifty 50.

The stock has fallen 23.86% on a year-to-date basis. The relative strength index was at 47.02.

Six analysts who track the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 82.6%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.