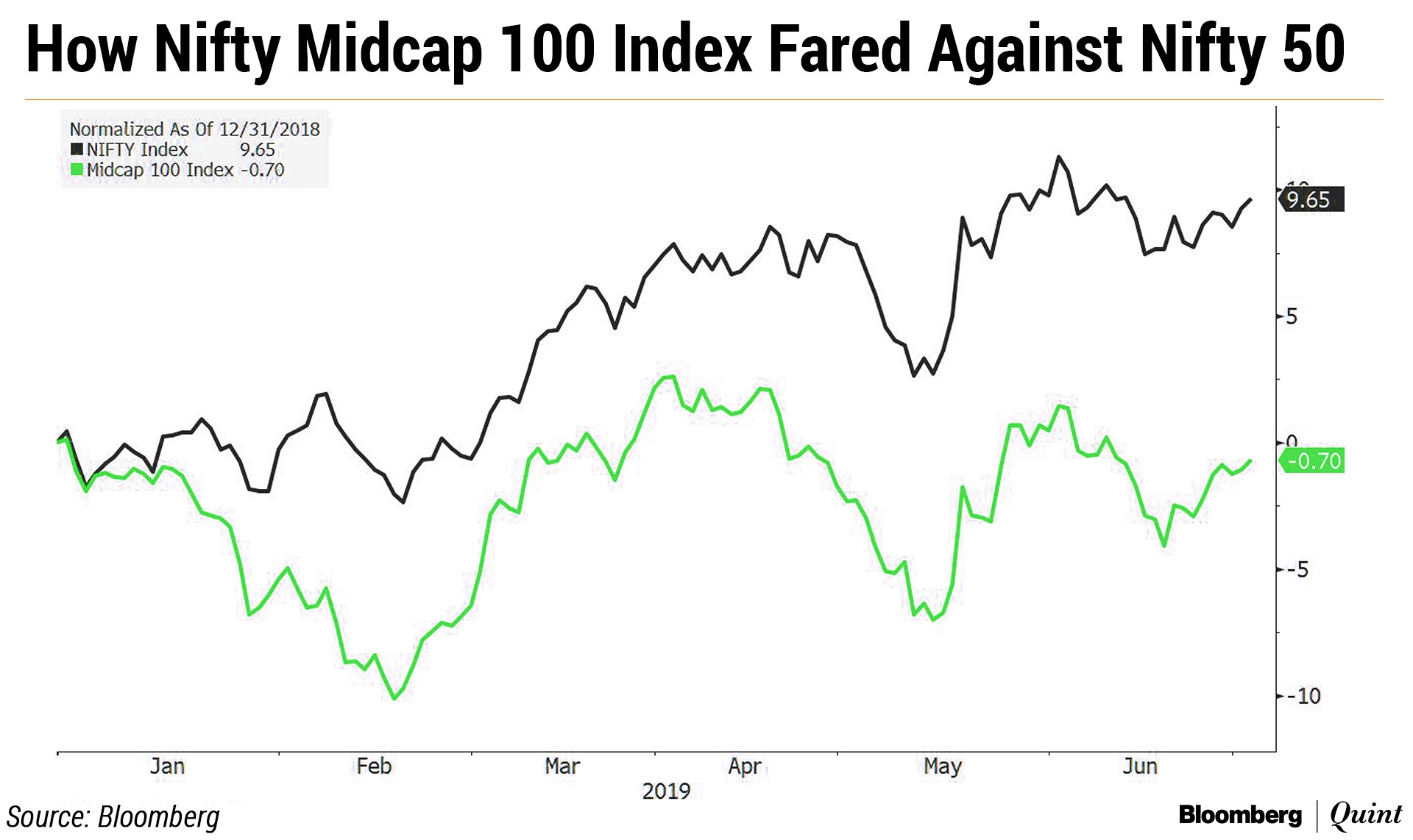

Investors had bet on a rebound in mid caps after Prime Minister Narendra Modi's return to power. But halfway through the year, stocks from the category still lag their larger peers.

The NSE's Nifty Midcap 100 Index is trading at a 10 percent discount to the Nifty 50 Index so far this year compared with the 2019 daily average of 6.8 percent. A higher weight of laggard sectors, a decline in investments by domestic institutions and debt troubles of some of the constituents have caused the mid-cap gauge to underperform.

“High valuation and overall risk aversion of investors led to the beginning of correction in mid- and small-cap valuations,” Sudip Bandyopadhyay, group chairman at Inditrade Capital Ltd., said. “This got compounded and aggravated by subsequent events like the IL&FS fiasco, promoters pledged shares issue, consumption-led economic slowdown and NBFC funding squeeze.”

Sectoral Setback

Sectors including consumer discretionary, healthcare, industrials, materials and power and utilities have lagged so far this year. These have a relatively larger weight on the mid-cap index compared with Nifty 50. By contrast, information technology and financials, which have gained, have more weight on Nifty 50.

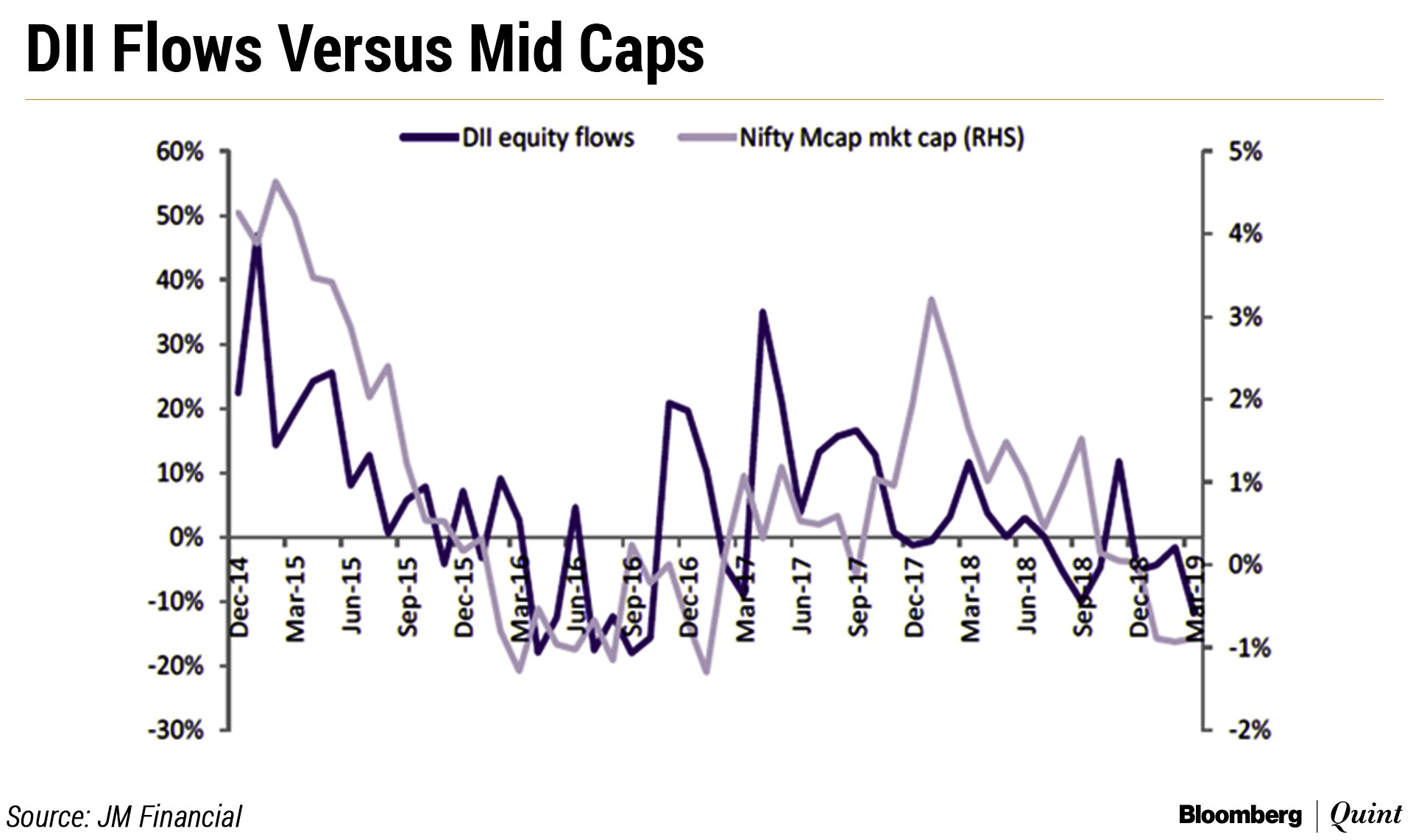

DII Shock

Mid-cap stocks jump whenever domestic institutions pour money into the markets, the 12-month moving averages analysed by JM Financial show. So far in 2019, this category of investors has sold shares worth Rs 7,988 crore, adding to pressure on mid caps.

Debt Trouble

Less than 1 percent stocks in Nifty 50—Yes Bank, Indiabulls Housing Finance Ltd., Zee Entertainment Enterprises Ltd. and Sun Pharmaceutical Industries Ltd.—are battling debt and corporate governance fears. But at least 10 percent of Nifty Midcap 100 constituents are facing such concerns, pulling the index down.

Besides governance, leverage and sectoral weight, Gurmeet Chadha, chief executive officer and co-founder of Complete Circle Consultants Pvt. Ltd., said the introduction of additional surveillance measures—aimed at checking any abnormal rise in stock prices not commensurate with the financial health of companies—aggravated the pain of the mid-cap stocks.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.