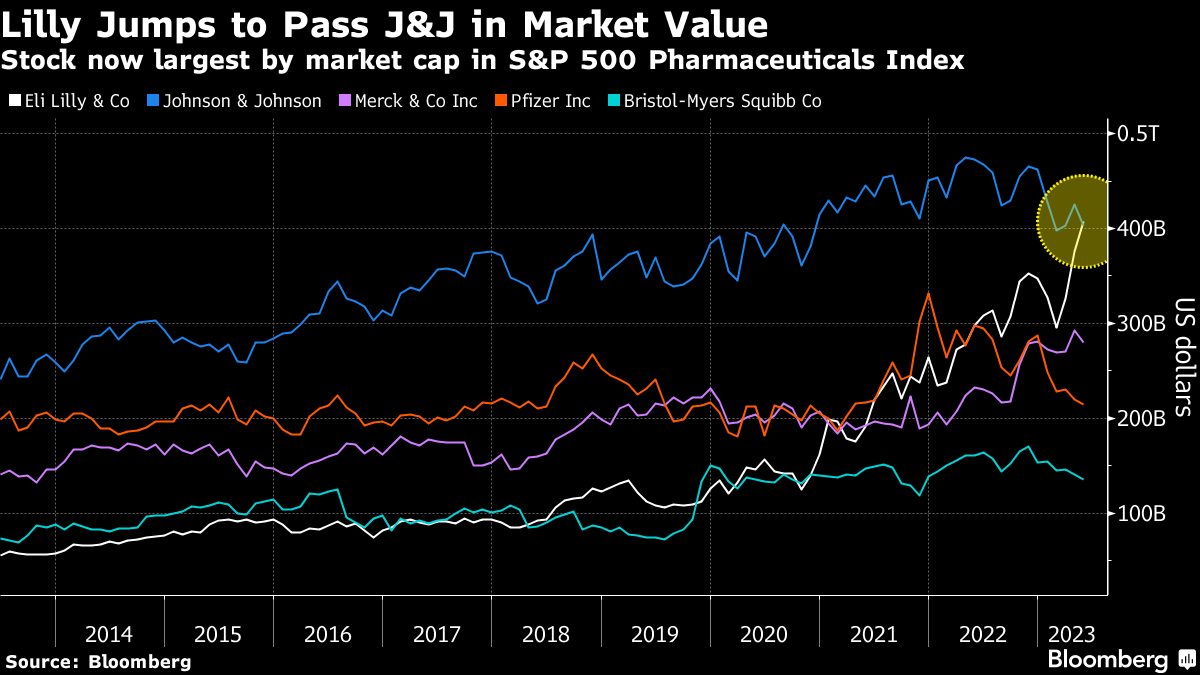

(Bloomberg) -- Eli Lilly & Co.'s third straight month of gains has helped it become the largest pharmaceutical company in the world by market value, surpassing Johnson & Johnson.

An 8.5% gain in May for Lilly lifted its shares to a record high and pushed its market capitalization to about $408 billion. J&J, meanwhile, slumped 5.3% during the month, dragging its value down to $403 billion. The Lilly rally was fueled in large part by two major announcements. The first was that its new diabetes drug worked for obesity, followed shortly by news that its experimental treatment for Alzheimer's succeeded in a final-stage trial.

“Lilly is participating in arguably the two areas of therapeutics that investors are kind of most interested in,” Jared Holz, a managing director at Mizuho Securities, said in an interview. “The street is essentially saying that they're willing to ascribe very significant value for the large market opportunities and then very little for what they believe are more niche.”

In late April, Lilly said that diabetes drug Mounjaro had succeeded in a second final-stage trial in obesity. Approval would open up an vast new market for the drug, allowing it to go head-to-head with Novo Nordisk A/S's Wegovy, the leading GLP-1 drug approved for weight loss.

Read More: Obesity Drug Hit Makes Novo Nordisk More Valuable Than Nestle

Meanwhile, Novo Nordisk's market value has more than doubled since the start of 2021 amid the popularity of its new GLP-1 drugs for diabetes and obesity. In March, it became the second-most valuable company in Europe, knocking Swiss food conglomerate Nestle SA into third place.

One trial showed that patients who take the highest dose of Mounjaro lost an average of 50 pounds. Analysts estimate its annual sales will approach $18 billion by 2029, according to figures compiled by Bloomberg.

Lilly also plans to apply this quarter for approval of its Alzheimer's drug donanemab, after a late-stage trial showed it was capable of modifying the disease course of the most common form of dementia — only the second drug to to so. The therapy removes an abnormal protein, called amyloid, from the brains of Alzheimer's patients and would compete with Eisai Co.'s Leqembi.

“Over the past like five to 10 years, when people talk about pharma, they kind of always lead with Pfizer, J&J, Merck,” Holz said. “Lilly is like fourth or fifth maybe, and now it's first. So a reassortment of the standings I think, is meaningful.”

J&J's spinoff of its consumer health unit into a new company earlier this year has been the biggest hit to its shares, according to Holz, which have fallen 12% this year. The company could regain at least some of its value with purchases, he said.

Losing its leading position “could put a little bit more pressure or urgency on the part of J&J to augment both its medical device and pharmaceuticals businesses over time,” Holz said.

--With assistance from Nacha Cattan and Bre Bradham.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.