Varun Beverages Ltd. reported a 40.3% year-on-year rise in net profit for the fourth quarter of this financial year. The company follows a January-December period to report its quarterly results.

The Pepsi bottler recorded a consolidated net profit of Rs 185 crore for the quarter ended December, compared to Rs 132 crore in the same quarter of the previous fiscal, according to its stock exchange notification. This was above Bloomberg's estimates of Rs 163 crore.

Revenue increased by 39.8% year-on-year for the three months ended December, reaching Rs 3,689 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 38.7% year-on-year to Rs 418 crore. The Ebitda margin was flat at 15.7%.

The jump in revenue comes on the back of 23.2% jump in consolidated volumes. While South Africa sales volumes rose 12.5%, Indian volumes grew 11.4%.

Additionally, the company has become net debt free through prepayment of debts, by using the proceeds from the QIP issue.

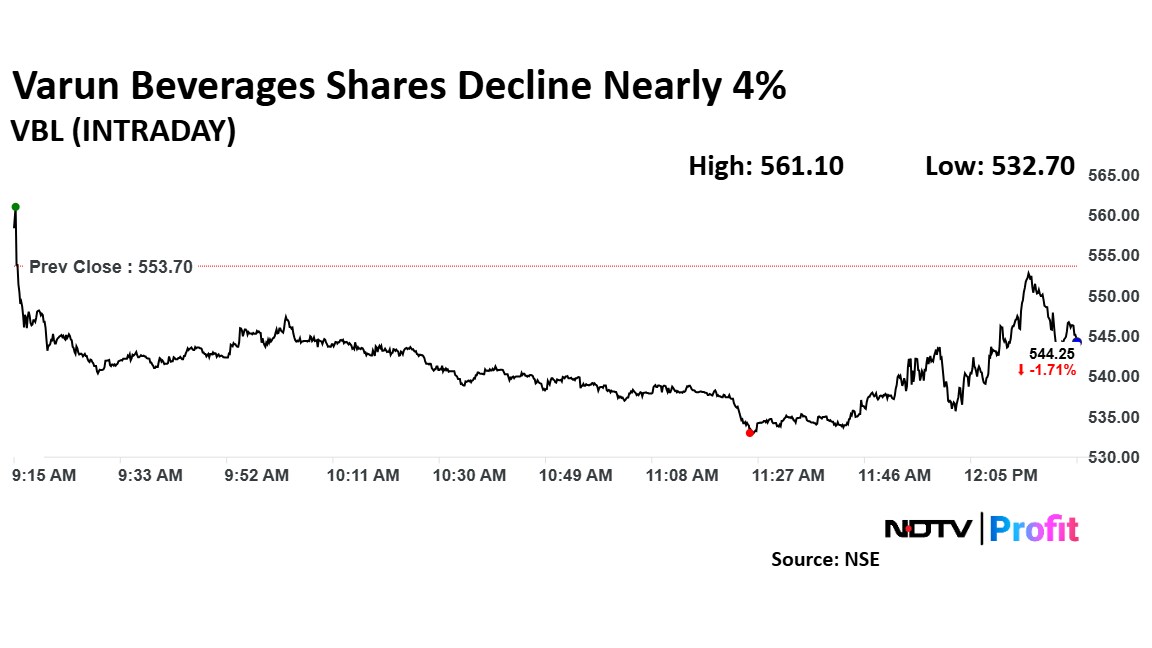

Varun Beverages Share Decline

Despite reporting a strong result, shares of Varun Beverages fell as much as 3.79% to Rs 532.70 apiece, the lowest level since Jan. 28. It pared losses to trade 2.29% lower at Rs 541 apiece, as of 12:26 p.m. This compares to a 0.88% advance in the NSE Nifty 50.

The stock has fallen 1.83% in the last 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 40.

Out of 26 analysts tracking the company, 23 maintain a 'buy' rating and three recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 31.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.