Thanks for following the live earnings coverage for the day. Do keep an eye on the blog tomorrow as well as we bring you the latest earnings, dividend details and more!

Good night

TARC Q4 Highlights (Consolidated, YoY)

Revenue up 24.6% to Rs 11.8 crore versus Rs 9.5 crore.

Ebitda Loss at Rs 83.6 crore versus Loss of Rs 17 crore.

Net Loss at Rs 104.5 crore versus Loss of Rs 51.7 crore.

Senco Gold Q4 Highlights (Consolidated, YoY)

Revenue up 21% to Rs 1,378 crore versus Rs 1,137 crore.

Ebitda up 44.9% to Rs 127 crore versus Rs 87.6 crore.

Margin at 9.2% versus 7.7%.

Net Profit up 93.8% to Rs 62 crore versus Rs 32 crore.

Lemon Tree Q4 Highlights (Consolidated, YoY)

Revenue up 15.6% to Rs 379 crore versus Rs 327 crore.

Ebitda up 19% to Rs 204 crore versus Rs 171 crore.

Margin at 53.9% versus 52.4%.

Net Profit up 26.4% to Rs 84.6 crore versus Rs 67 crore.

Concord Biotech Q4 Highlights (Consolidated, YoY)

Revenue up 34.8% to Rs 430 crore versus Rs 319 crore.

Ebitda up 41.8% to Rs 190 crore versus Rs 134 crore.

Margin at 44.3% versus 42.1%.

Net Profit up 47.8% to Rs 140 crore versus Rs 95 crore.

To pay a dividend of Rs 10.7.

SJVN Q4 Highlights (Consolidated, YoY)

Revenue up 4.5% to Rs 504 crore versus Rs 483 crore.

Ebitda up 0.4% to Rs 241 crore versus Rs 240 crore.

Margin at 47.8% versus 49.7%.

Net Loss at Rs 127.6 crore versus Profit of Rs 61 crore.

Declares final dividend of Rs 0.31.

Mazagon Dock's Ebitda is down due to a notable increase in the subcontract cost as it has seen a 834% or nearly nine-times increase to Rs 589 crore. This compares to the subcontract cost of Rs 63.49 crore in the previous year. The other income also saw a decline at Rs 309 crore compared to Rs 348 crore.

After posting fourth quarter results, the board of the company is set to pay Rs 2.71.

Source: Exchange filing

Mazagon Dock Q4 Highlights (Consolidated, YoY)

Revenue up 2.3% to Rs 3,174.40 crore versus Rs 3,103.60 crore.

Ebitda down 83% to Rs 90.00 crore versus Rs 524.07 crore.

Margin at 2.8% versus 16.9%.

Net Profit down 51% to Rs 325.29 crore versus Rs 662.97 crore.

NBCC Q4 Highlights (Consolidated, YoY)

Revenue up 16.2% to Rs 4,643 crore versus Rs 3,996 crore.

Ebitda up 19.4% to Rs 290 crore versus Rs 243 crore.

Margin at 6.2% versus 6.1%.

Net Profit up 29.3% to Rs 176 crore versus Rs 136 crore.

Amara Raja Q4 Highlights (Consolidated, YoY)

Revenue up 5.2% to Rs 3,060 crore versus Rs 2,908 crore.

Ebitda down 16.9% to Rs 341 crore versus Rs 410 crore.

Margin at 11.1% versus 14.1%.

Net Profit down 29.7% to Rs 162 crore versus Rs 230 crore.

To pay final dividend of Rs 5.20.

KNR Constructions Q4 Highlights (Consolidated, YoY)

Revenue down 31% to Rs 975 crore versus Rs 1,414 crore.

Ebitda down 40.8% to Rs 222 crore versus Rs 375 crore.

Margin at 22.7% versus 26.5%.

Net Profit down 60.6% to Rs 139 crore versus Rs 353 crore.

After posting fourth quarter results, the company has declared a dividend of Rs 210. The record date has been set by the company for June. 20.

Source: Exchange filing

Bajaj Auto Q4 Highlights (Standalone, YoY)

Revenue up 5.8% to Rs 12,147.97 crore versus Rs 11,484.68 crore.

Ebitda up 6% to Rs 2,450.59 crore versus Rs 2,306.25 crore.

Margin at 20.2% versus 20.1%.

Net Profit up 6% to Rs 2,049.31 crore versus Rs 1,936.00 crore.

"The next phase of our growth will come from the Roadster X motorcycle, even as we build on the S1 line of scooters," said Bhavish Aggarwal, Ola Electric CEO.

The fundamentals of the company remains strong, with a singular focus on vertical integration and robust product franchise, he added.

The company after posting fourth quarter results, the company is expecting to clock in a revenue of Rs 850 crore in the first quarter of financial year 2026. The management expects gross the margin at 28-30 in Q1 FY26 compared to 19.2% in the fourth quarter of financial year 2025.

The company is expecting to clock deliveries of 65,000 units in Q1 FY26 versus 51,375 units in Q4 FY25. The company has also embarked on ‘Project Lakshya’ to reduce costs, ‘Project Vistaar’ to grow volumes in FY26.

ICRA Q4 Highlights (Consolidated, YoY)

Revenue up 10% to Rs 136 crore versus Rs 124 crore.

Ebitda up 18.7% to Rs 59.2 crore versus Rs 49.8 crore.

Margin at 43.4% versus 40.2%.

Net Profit up 19% to Rs 55.7 crore versus Rs 47 crore.

To pay dividend of Rs 60.

Landmark Cars Q4 Highlights (Consolidated, YoY)

Revenue up 26.3% to Rs 1,091.20 crore versus Rs 863.90 crore.

Ebitda up 2% to Rs 54.64 crore versus Rs 53.47 crore.

Margin at 5.0% versus 6.2%.

Net Profit down 86% to Rs 1.42 crore versus Rs 10.50 crore.

Ola Electric Q4 Highlights (Consolidated, YoY)

Revenue down 61.8% to Rs 611.00 crore versus Rs 1,598.00 crore.

Ebitda loss widens by 123% to Rs 695.00 crore versus Rs 312.00 crore.

Net Loss widens by 109% to Rs 870.00 crore versus Rs 416.00 crore.

After posting fourth quarter results, the board of the company is also set to pay a dividend of Rs 3.

Source: Exchange filing

Sobha Q4 Highlights (Consolidated, YoY)

Revenue up 62.6% to Rs 1,240.61 crore versus Rs 762.86 crore.

Ebitda up 52% to Rs 94.05 crore versus Rs 62.06 crore.

Margin at 7.6% versus 8.1%.

Net Profit up 476% to Rs 40.85 crore versus Rs 7.09 crore.

Suzlon Energy Q4 Highlights (Consolidated, YoY)

Revenue up 73.15% to Rs 3,773 crore versus Rs 2,179 crore.

Ebitda up 88.42% to Rs 646.53 crore versus Rs 343.12 crore.

Ebitda margin up 138 bps at 17.13% versus 15.74%.

Net Profit up 365.35% to Rs 1,182 crore versus Rs 254 crore.

Lumax Auto Q4 Highlights (Consolidated, YoY)

Revenue up 49.6% to Rs 789 crore versus Rs 400 crore.

Ebitda up 70.5% to Rs 157 crore versus Rs 92 crore.

Margin at 19.8% versus 23%.

Net Profit up 32% to Rs 58.4 crore versus Rs 44.2 crore.

Welspun Living Q4 Highlights (Consolidated, YoY)

Revenue up 2.7% to Rs 2,646 crore versus Rs 2,575 crore.

Ebitda down 11.9% to Rs 315.8 crore versus Rs 358.6 crore.

Margin at 11.9% versus 13.9%.

Net Profit down 9.7% to Rs 131.8 crore versus Rs 146 crore.

Engineers India Q4 Highlights (Consolidated, YoY)

Revenue up 25.5% at Rs 1,010 crore versus Rs 805 crore.

EBITDA at Rs 301 crore versus Rs 77.4 crore.

Margin at 29.8% versus 9.6%.

Net profit at Rs 280 crore versus Rs 115.5 crore.

To pay final dividend of Rs 2 per share.

Wockhardt Q4 Highlights (Consolidated, YoY)

Revenue up 6.1% at Rs 743 crore versus Rs 700 crore.

EBITDA at Rs 64 crore versus loss of Rs 103 crore.

Margin at 8.61%.

Net loss at Rs 25 crore versus loss of Rs 170 crore.

ISGEC Heavy Engineering Q4 Highlights (Consolidated, YoY)

Revenue down 6.6% at Rs 1,744 crore versus Rs 1,867 crore.

EBITDA down 56.3% at Rs 152 crore versus Rs 348 crore.

Margin at 8.7% versus 18.6%.

Net profit up 16.4% at Rs 98.1 crore versus Rs 84.2 crore.

Varroc Engineering Q4 Highlights (Consolidated, YoY)

Revenue up 6.3% at Rs 2,099 crore versus Rs 1,975 crore.

EBITDA down 2.4% at Rs 213 crore versus Rs 219 crore.

Margin at 10.2% versus 11.1%.

Net profit down 63.9% at Rs 20.5 crore versus Rs 56.8 crore.

Century Plyboards (India) Q4 Highlights (Consolidated, YoY)

Revenue up 13% at Rs 1,198 crore versus Rs 1,061 crore.

EBITDA down 2% at Rs 135 crore versus Rs 137 crore.

Margin at 11.2% versus 13%.

Net profit down 34% at Rs 52.5 crore versus Rs 79.5 crore.

To pay final dividend of Re 1 per share.

Campus Activewear Q4 Highlights (Consolidated, YoY)

Revenue up 11.5% at Rs 406 crore versus Rs 364 crore.

EBITDA up 12% at Rs 71.5 crore versus Rs 63.9 crore.

Margin flat at 17.6%.

Net profit up 7% at Rs 35 crore versus Rs 32.8 crore.

Samvardhana Motherson International Q4 Highlights (Consolidated, YoY)

Revenue up 6% at Rs 29,317 crore versus Rs 27,666 crore.

EBITDA down 1.6% at Rs 2,643 crore versus Rs 2,686 crore.

Margin at 9% versus 9.7%.

Net profit up 19.6% at Rs 1,051 crore versus Rs 879 crore.

To pay final dividend of Rs 0.35 per share.

To issue bonus shares in 1:2 ratio.

Alkem Laboratories Q4 Highlights (Consolidated, YoY)

Revenue up 7.1% at Rs 3,144 crore versus Rs 2,936 crore.

EBITDA down 2.7% at Rs 391 crore versus Rs 402 crore.

Margin at 12.4% versus 13.7%.

Net profit up 4.2% at Rs 306 crore versus Rs 294 crore.

To pay final dividend of Rs 8 per share.

Ipca Laboratories Q4 Highlights (Consolidated, YoY)

Revenue up 10.5% at Rs 2,247 crore versus Rs 2,033 crore.

EBITDA up 33.2% at Rs 429 crore versus Rs 322 crore.

Margin at 19.1% versus 15.8%.

Net profit up 13.8% at Rs 67.8 crore versus Rs 59.6 crore.

To pay final dividend of Rs 2 per share.

Sansera Engineering had its target price reduced from Rs 1,669 to Rs 1,643 per share by Nomura amid possible tailwinds from US trade tariffs. The research firm maintained its 'buy' stance on the company as fourth quarter margins were in line with its estimates.

Bajaj Auto is estimated to see a standalone revenue growth at Rs 12,113.02 crore, with Ebitda projected at Rs 2,434.14 crore, resulting in a margin of 20.1%. The estimated net profit for Bajaj Auto is Rs 2,013.12 crore.

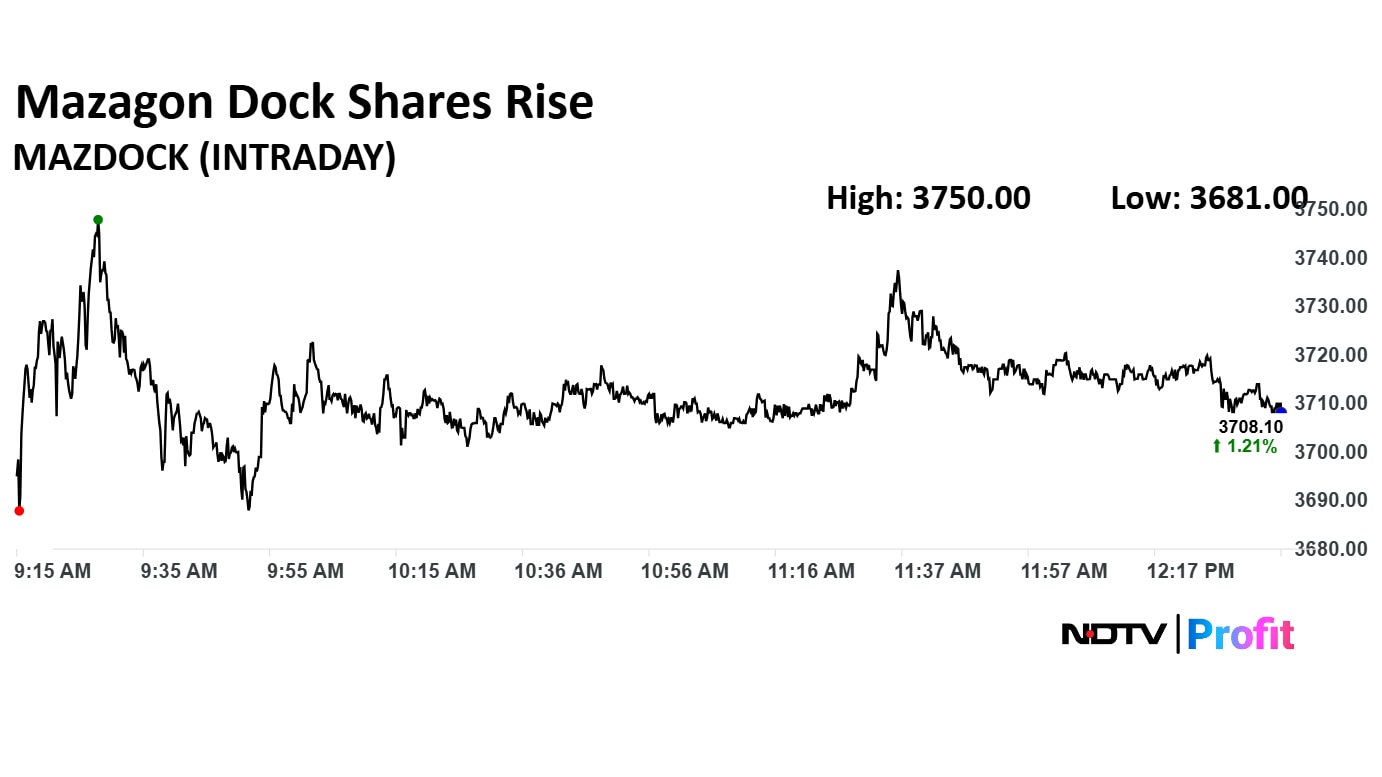

Share price of the shipbuilder hit a life-time high ahead of its final quarter results on Thursday. The stock is currently trading at 1.26% higher at Rs 3,710 apiece.

Share price of the shipbuilder hit a life-time high ahead of its final quarter results on Thursday. The stock is currently trading at 1.26% higher at Rs 3,710 apiece.

Telecom major Vodafone Idea Ltd. is set to announce the results for the fourth quarter on May 30. The company is one of the major telecom service providers in India.

The renewable energy player is expected to post revenue from operations of Rs 3,841.8 crore, jumping 76% from its March-quarter revenue of Rs 2,179.2 crore.

Suzlon's net profit is likely to be Rs 456.2 crore, as per analysts tracked by Bloomberg, an 11.9% increase from Rs 254.1 crore in the corresponding quarter of the previous fiscal.

On the operating side, earnings before interest, taxes, amortisation and depreciation is Rs 577.3 crore, up from Rs 359.8 crore. Margins, however, are expected to see a contraction from 16.5% to 15%.

Hello, and welcome to NDTV Profit's coverage of March-quarter earnings.

As many as 555 companies are scheduled to share their results on Thursday, with notable names like Bajaj Auto Ltd., energy sector players Suzlon Energy and SJVN and hospitality player Lemon Tree Hotels among them. Government-backed India Tourism Development Corp. will also release its earnings.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.