HCL Technologies Ltd. reported a mixed set of earnings in the first quarter and maintained its sales outlook for the current financial year.

Net profit rose 9 percent year-on-year to Rs 2,431 crore for the three months ended June, according to the company's exchange filing today. That's higher than the Rs 2,294 crore consensus estimate of analysts tracked by Bloomberg.

The higher-than-expected rise in profit can be attributed to highest ever bookings in the quarter, the company said in a press release accompanying the results.

“We achieved highest ever bookings in this quarter led by our next-gen infrastructure services as well as Mode 2 offerings. Our combined Mode 2 and 3 offerings contributed 26.6 percent of our revenues and it grew 9.6 percent quarter-on-quarter,”C Vijayakumar, President and Chief Executive Officer, HCL Tech

Sales in dollar terms rose 0.8 percent to $2,055 million, in line with the $2,070 million forecast. Revenue in constant currency terms rose 5.3 percent to Rs 13,878 crore for the quarter compared to a Rs 13,921 crore estimate.

HCL Tech expects its sales to grow between 9.5 percent and 11.5 percent in constant currency terms in financial year 2018-19. Guidance for margins stood at 19.5-20.5 percent for the same period.

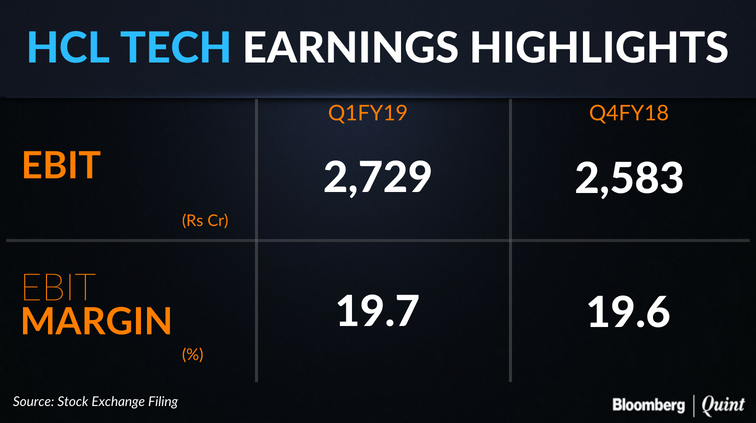

Earnings before interest and tax rose 5.7 percent sequentially to Rs 2,729 crore. EBIT margin contracted slightly to 19.7 percent from 19.9 percent.

The stock has risen 7.4 percent so far this year, compared with the 24 percent jump in the NSE IT Index and 9.5 percent gain in the S&P BSE Sensex.

Revenues from the core business have remained flattish with majority gains coming from Mode-2 and Mode-3 services. Organic growth has been disappointing. Decline in key verticals like financial services and manufacturing has led to a miss on the top-lineMilan Desai, Analyst, IIFL

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.