The GLP-1 (Glucagon-like Peptide-1) market presents a significant opportunity, particularly given the upcoming patent expiry of semaglutide across key markets. GLP drugs, often called miracle drugs, are gaining momentum as a preferred medication choice for diabetes and weight-loss patients due to their efficacy. The success of semaglutide and tirzepatide is evident in their 2024 sales volumes and revenues, creating a clearer picture of demand.

Semaglutide (Ozempic, Wegovy, Rybelsus) generated $54.1 billion (Rs 4.8 lakh crore) in US revenue from 56 million doses in 2024. Tirzepatide (Mounjaro, Zepbound) generated $31.9 billion (Rs 28.6 lakh crore) from around 31.6 million doses in 2024. The market is also expected to grow fast. UBS estimates the global semaglutide market will grow at a 10.5% CAGR to $94 billion (Rs 8.4 lakh crore) by 2035, from $28 billion (Rs 2.5 lakh crore) in 2024.

According to the UBS Evidence Lab survey, semaglutide can be taken by mouth and as an injection, with injections emerging as the preferred option. Further, pens are the dominant dosage method, accounting for 59% (single use) and 28% (multi-use). This is where Shaily Engineering, a manufacturer of plastic products, is making its presence count, with a clearer growth opportunity.

A Precision Engineering Company To A Key Supplier Of Drug Delivery Pens

Founded in 1987, Shaily grew from a small molding setup into a precision engineering company focused on high-potential segments like healthcare. Between 2007 and 2015, Shaily pivoted into the pharmaceutical segment, driven by the launch of Wockhardt's reusable insulin pen. Seizing this opportunity, Shaily leveraged its expertise to manufacture pens and even acquired Sanofi as a customer.

Meanwhile, the company continued to expand its offerings and began manufacturing adjacent products to increase its wallet share with existing customers. For Shaily, the GLP-1 opportunity came like a booster shot. Shaily holds patented technology for fixed-dose and auto-injector pens, positioning it to benefit from the launch of generic GLP-1 medications.

Semaglutide Patent Expiry Opens The Generic Market

Founded in 1987, Shaily grew from a small molding setup into a precision engineering company focused on high-potential segments like healthcare. Between 2007 and 2015, Shaily pivoted into the pharmaceutical segment, driven by the launch of Wockhardt's reusable insulin pen. Seizing this opportunity, Shaily leveraged its expertise to manufacture pens and even acquired Sanofi as a customer.

Meanwhile, the company continued to expand its offerings and began manufacturing adjacent products to increase its wallet share with existing customers. For Shaily, the GLP-1 opportunity came like a booster shot. Shaily holds patented technology for fixed-dose and auto-injector pens, positioning it to benefit from the launch of generic GLP-1 medications.

Semaglutide Patent Expiry Opens The Generic Market

The market opportunity for Shaily is the launch of generic semaglutide products, as the patent is expected to expire in 2026 in key markets such as India, China, Turkey, Canada, and Brazil. These countries account for about 33% of the world's obese population, offering a total addressable market of 55-60 crore devices and revenue of ₹8,500 crore by 2030.

According to Shaily management, 50-60% of companies launching generic versions of semaglutide in Canada could use the Shaily injector pen. Therefore, it could capture a significant share of the generic GLP-1 market in that country. Meanwhile, eight pharma companies in India (Dr. Reddy's Laboratories, Biocon, Sun Pharma, including Cipla) are preparing to launch generic semaglutide.

Among them, two of the largest players (Dr Reddy's and Sun Pharma) are its clients. To capitalise on this opportunity, Shaily has already tied up with 23-24 global pharma companies for generic GLP-1. Notably, in most GLP-1 engagements, Shaily was selected as the sole device supplier, demonstrating its competitive strength.

Shaily Commands A Strong Competitive Moat

These tie-ups imply a projected market share of 50-60% in India, Canada, and Brazil, according to UBS. Also, Shaily has another competitive advantage due to patented technology. It holds 7 intellectual property (IP)-led injectable drug-delivery devices, mainly focused on GLP-1.

This includes the Toddy Auto-Injector (for Semaglutide), Pen Neo (for variable-and fixed-dose formats), and Pen Axiom (for diverse therapies). The fixed-dose delivery devices are reusable, positioning Shaily as a key partner in the GLP-1 and broader biologics delivery markets. This patent is difficult to obtain and takes a long time to get approval, making it less competitive.

Plus, the high cost of switching vendors for pharma companies, as the drug filing must mention the pen vendor, creates a significant entry barrier for peers. Also, capacity constraints and limited capabilities among global firms make Shaily a key player in the GLP-1 supply chain.

Scaling Up Capacity To Match Multi-Year Demand Visibility

The company plans to begin commercial supply of pens for the GLP-1 drug semaglutide in FY26. Anticipating high demand, Shaily is investing ₹150 crore to expand annual GLP-1 pen injector capacity from the existing 3.5 crore units to 4-5 crore units over the next 12-18 months. This brownfield capacity will be funded largely from internal sources.

This expansion is supported by strong customer commitments and multi-year revenue potential. Therefore, capacity utilisation should not be a problem, as this incremental capacity is expected to reach peak capacity by FY28.

In addition, Shaily is already building a strong pipeline of next-generation drug-delivery devices for GLP-1 delivery needs, including wearable injectors (Mira), large-volume injectors, and high-viscosity auto-injectors. The diversification strategy aims to reduce dependence on any single therapy by developing devices across multiple platforms.

Shifting Financial Mix Shows The Shift towards Healthcare

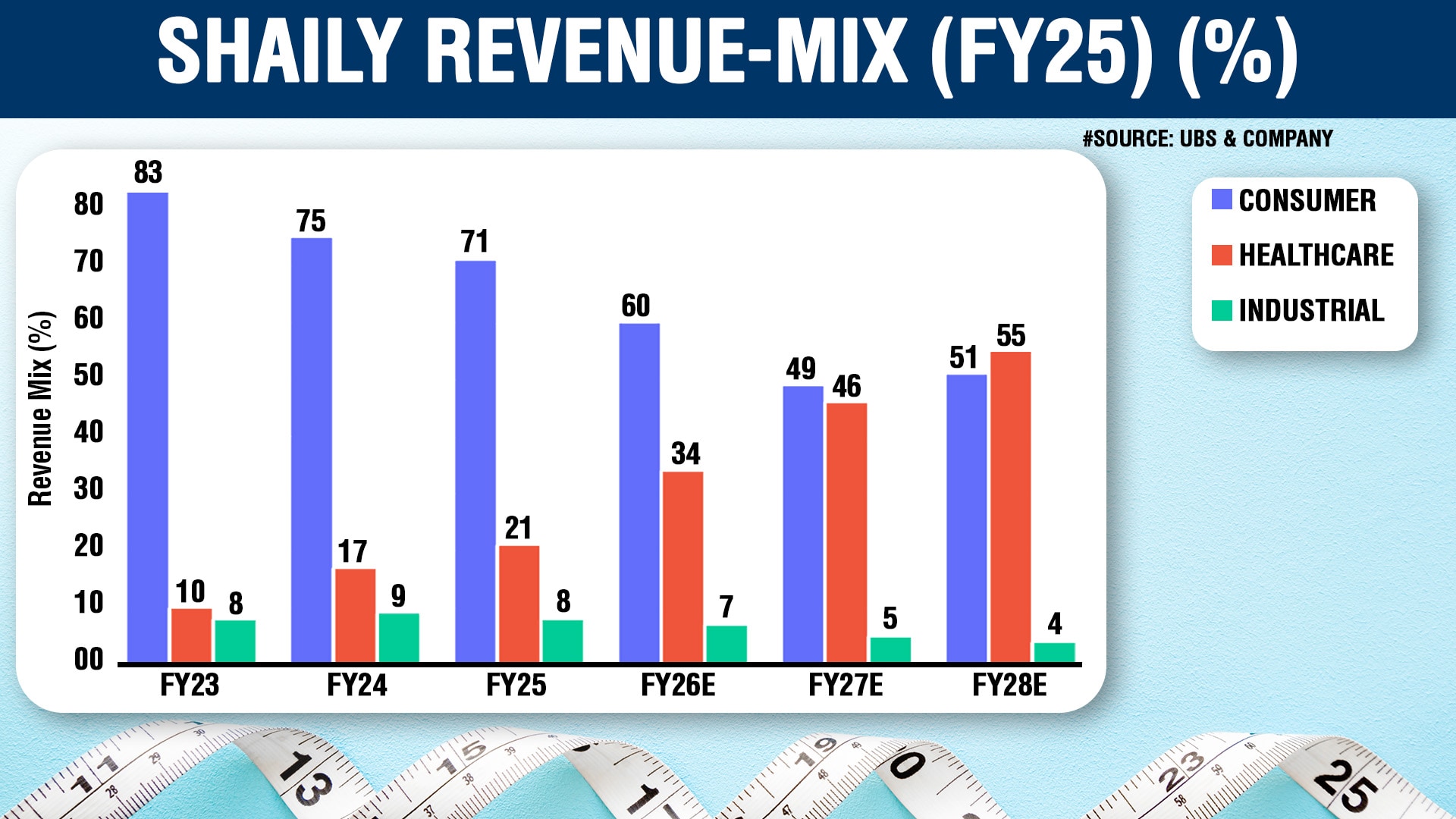

Financials have already shown this shift. Shaily's revenue has grown by around 30%, from Rs 607 crore in FY23 to Rs 787 crore in FY25. In the revenue mix, the healthcare vertical share has grown from 10% in FY23 to 21% in FY25, while the consumer vertical (dominant one) share has declined from 83% to 71% over the same period.

Management now expects the healthcare segment to account for over 50% of total revenue by FY28. Most of the revenue (78%) came from exports. In addition, healthcare margins (60%) are significantly higher than consumer (13%) and industrial (3%). This shift is expected to increase its profitability in the coming years.

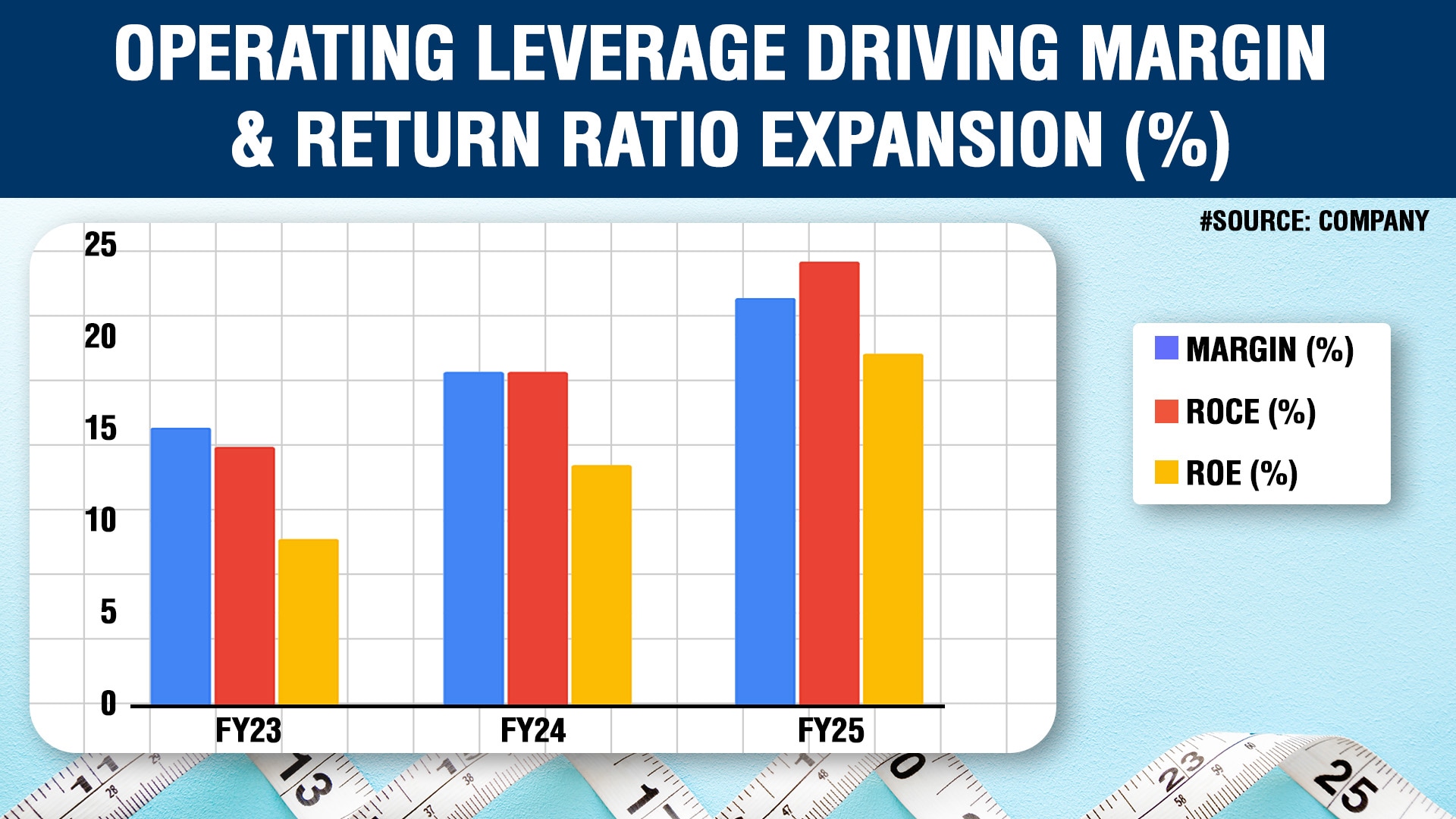

Numbers reflect this shift. Increasing revenue contribution from the healthcare segment has expanded its blended margin to 22% in FY25, from 15% in FY23. As a result, Profit after tax (PAT) has more than doubled to Rs 93 crore from Rs 35 crore. And, management expects this expansion to continue, driven by revenue growth of more than 25% annually over the coming years.

As such, the healthcare business is expected to be the core revenue driver, accounting for 50% of the Shaily revenue by FY28, up from 21% in FY25. With the higher margins in healthcare vertically, profitability is expected to outpace topline growth. The company's return ratios have also improved a lot.

Return on capital employed is 24%, up from 14% in FY23, and return on equity is 19%, up from 9%. Margin expansion, improved profitability, and ramping up new capacity will expand return ratios and enhance stakeholder value.

The company's rich valuation already reflects its strong growth prospects. It trades at a price-to-earnings (P/E) multiple of 81.6x. UBS estimates the price at Rs 4,000, based on a 45x FY28 expected PE multiple, which it considers a discount to the peak multiple of 60x.

The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. Readers are advised to conduct their own research or consult a qualified professional before making any investment or business decisions. NDTV Profit does not guarantee the accuracy, completeness, or reliability of the information presented in this article.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.