- Nifty trends inversely follow the Dollar/Rupee currency pair recently hitting a new low for INR

- Government rate cut led to Dollar decline and a mild rally in Nifty last week

- Despite INR depreciation, Nifty has shown long-term upward trend with intermittent currency impact

While all of us have been trying to find some reason or the other to make the index move higher through our sheer combined thoughts, the Nifty had different ideas. It has been, instead, an inverse follower of the trends in the Dollar/Rupee pair. And since recent times have seen the INR hit a new low against the Dollar, this was a new element that put paid to the attempts at moving higher. See chart 1 that details the moves of the Nifty vs the UsdInr pair in recent times.

The big thrust of the 26th kindled hopes that it would carry us all through to higher levels. But, as the Dollar rose, that upside move turned into a quick consolidation and a decline. The fall was most disappointing for many. Note that govt action (seemingly) towards the end of the week (rate cut) has seen the $ drop some leading to some mild rally in the Nifty. So, the real driver of local trends is the moves in the currency.

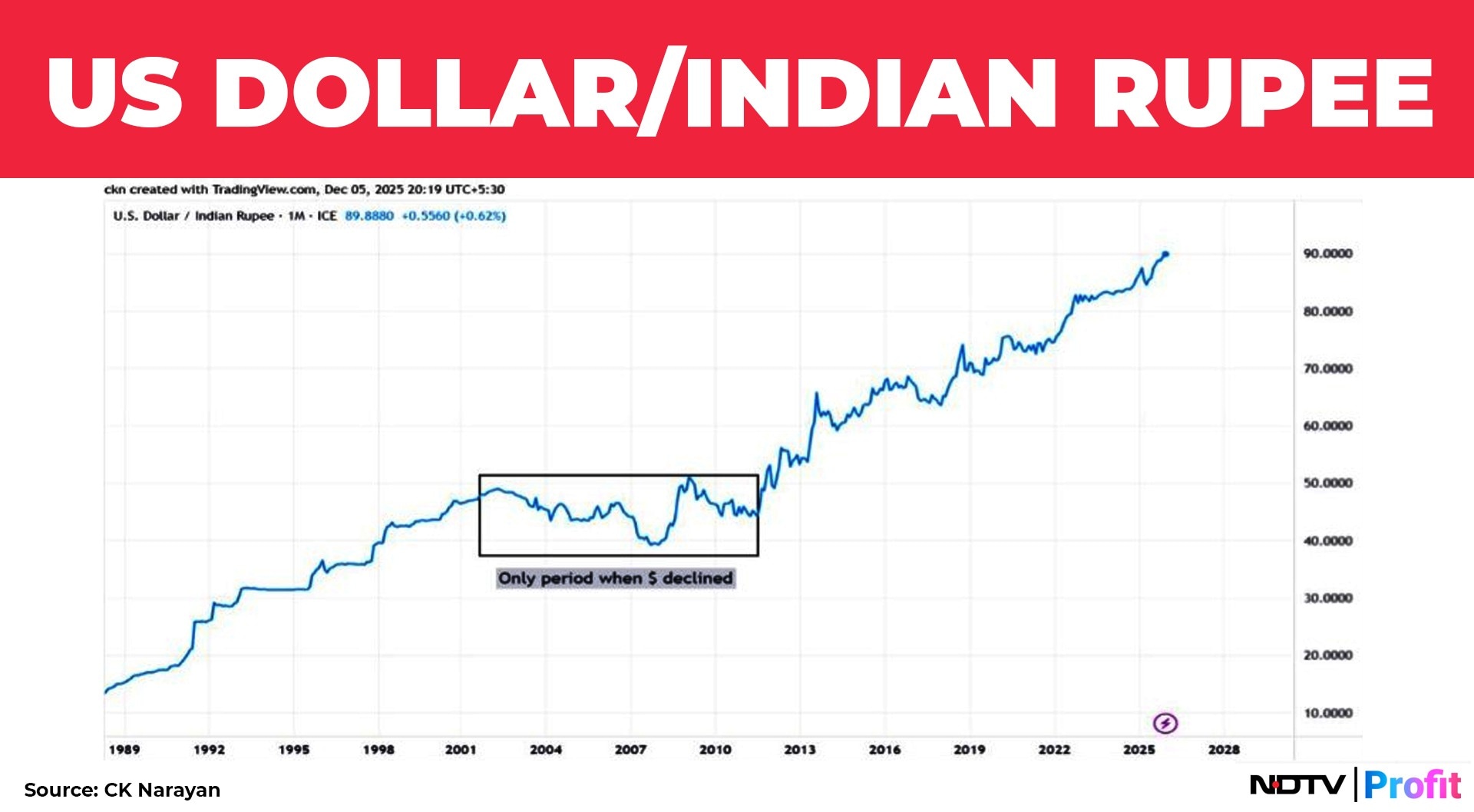

Taking a look at the currency chart by itself (chart 2- UsdInr), I find that there has been only one phase when the Dollar has dipped seriously. This was during the super bull market from 2003-08 when FII money poured in.

The rest of the time, the INR kept depreciating (for various reasons) and of late, that has taken on some acceleration. Now, we are beyond 90. But in and through all that depreciation, the Nifty has kept rising too. So, we have to conclude that the currency impact is intermittent; to produce reactions and consolidations but the run of the trend here seems inexorable. That is a bigger signal that we need to carry with us. I mention this in particular because the TV networks and others were all full of this commentary about the weak Rupee factor. In the short term, yes. In the long term, No.

With the push upward on Friday, the weekly candle became a lower shadow affair, implying that the bulls live to fight another week. Does that really matter, in the larger scheme of things? Last week's letter was entitled Stay bullish and buy the dips. Many may say this is easier said than done. Of course it is. But isn't that just the point? Today there is a surfeit of information from all sides but the ability to process that information has not increased! This is probably a bigger problem today than not having information was in the past! The only way out is through adopting a good method. In the last letter, I also mentioned that with too many macro stuff flying around in the air, it is far simpler to allow the prices to tell us what they want to do. Chart 3 carries the update.

The pitchfork was threatened with a break but seems to be surviving. The upward thrust candle of 26 Nov is still patent, so short-term bullish signals are not violated yet. On the RSI chart, there is a hint of a possible reverse divergence. Now some sign of strength in the Rsi chart in the week ahead could see us through. Something to watch.

Given all these, buying the dip would not have been difficult-if we kept our head straight through the initial decline of the week. The reverse divergence signal, if it comes through, will enable the index to reach new highs yet again in the week ahead.

With that as the background, we have to continue our stance. No change there. Learn to ignore the noise and cut through it to see the real picture. Stock-specific moves still rule at times like these for those wanting quick trades. But for those following the main trend through the indices, it is still a hold long-buy more on dips market. The fresh rate cut and positive commentary from the RBI governor should gladden hearts. Positive bytes should come from the Putin visit. Next week may be the turn of the US Fed to cheer the Street with rate cuts. So, enough stuff to keep the trend going. Continue long.

The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. Readers are advised to conduct their own research or consult a qualified professional before making any investment or business decisions. NDTV Profit does not guarantee the accuracy, completeness, or reliability of the information presented in this article.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.