The crisis at Infrastructure Leasing & Financial Services Ltd. spurred the biggest monthly outflow from money market schemes in at least a decade in September as mutual funds faced redemption pressure. Yet, equity inflows surprised.

Inflows into equity mutual funds rose during the month, snapping a four-month decline. Net investments in equity funds rose 33.4 percent sequentially to Rs 11,172 crore in September, according to data released by the Association of Mutual Funds of India. The industry, however, witnessed an overall outflow of Rs 2.3 lakh crore during the month compared with an inflow of Rs 1.74 lakh crore in August.

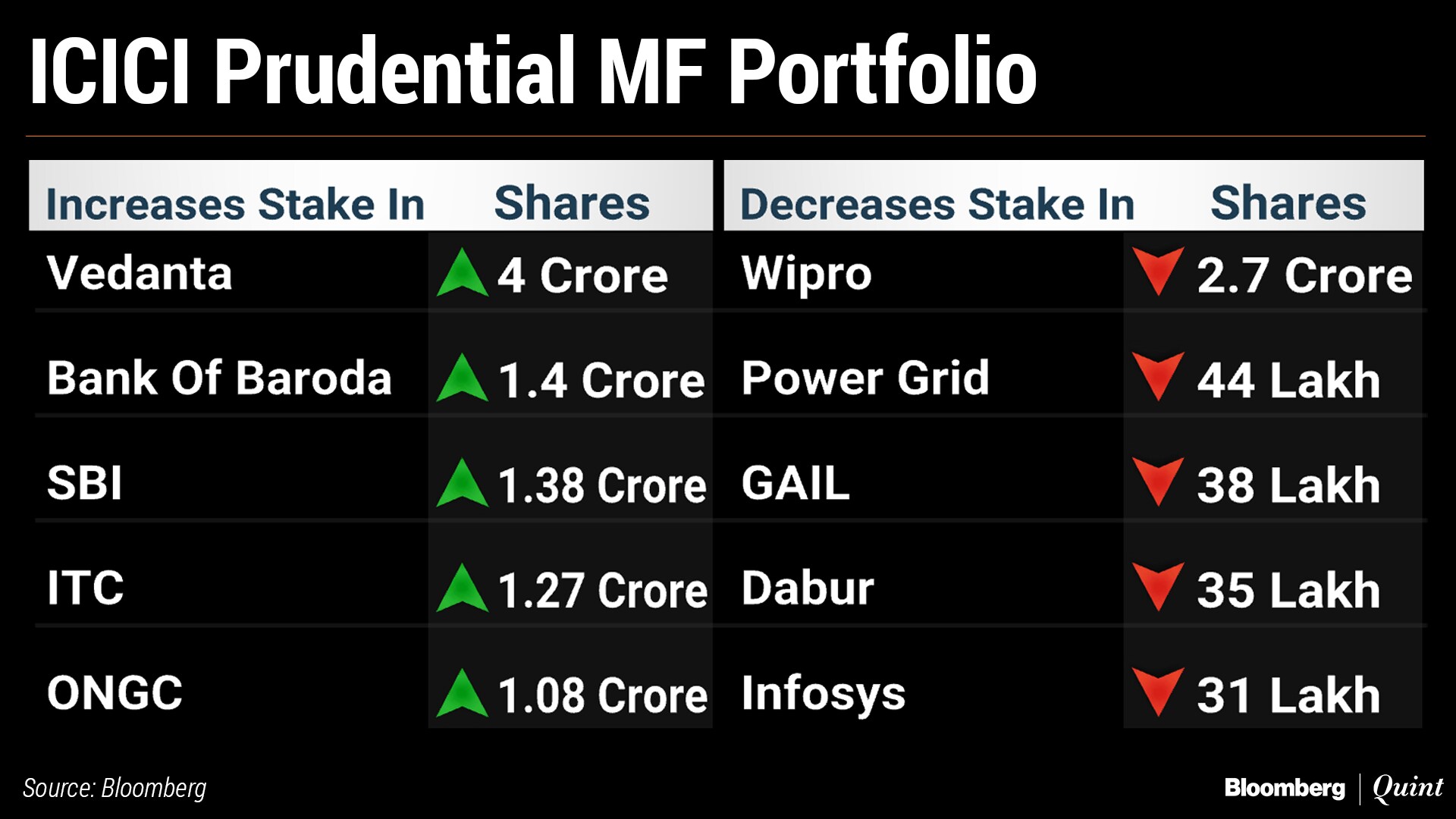

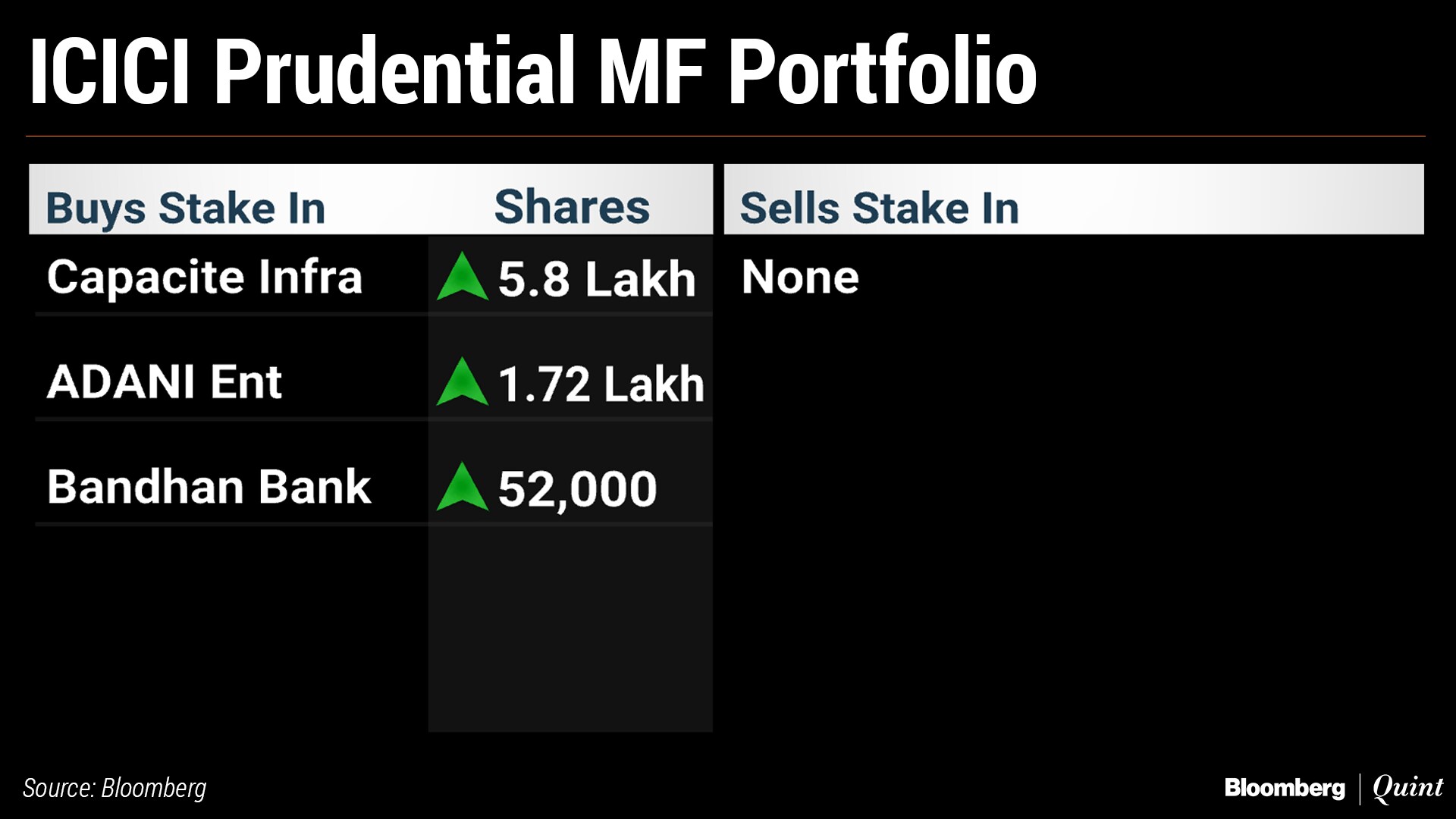

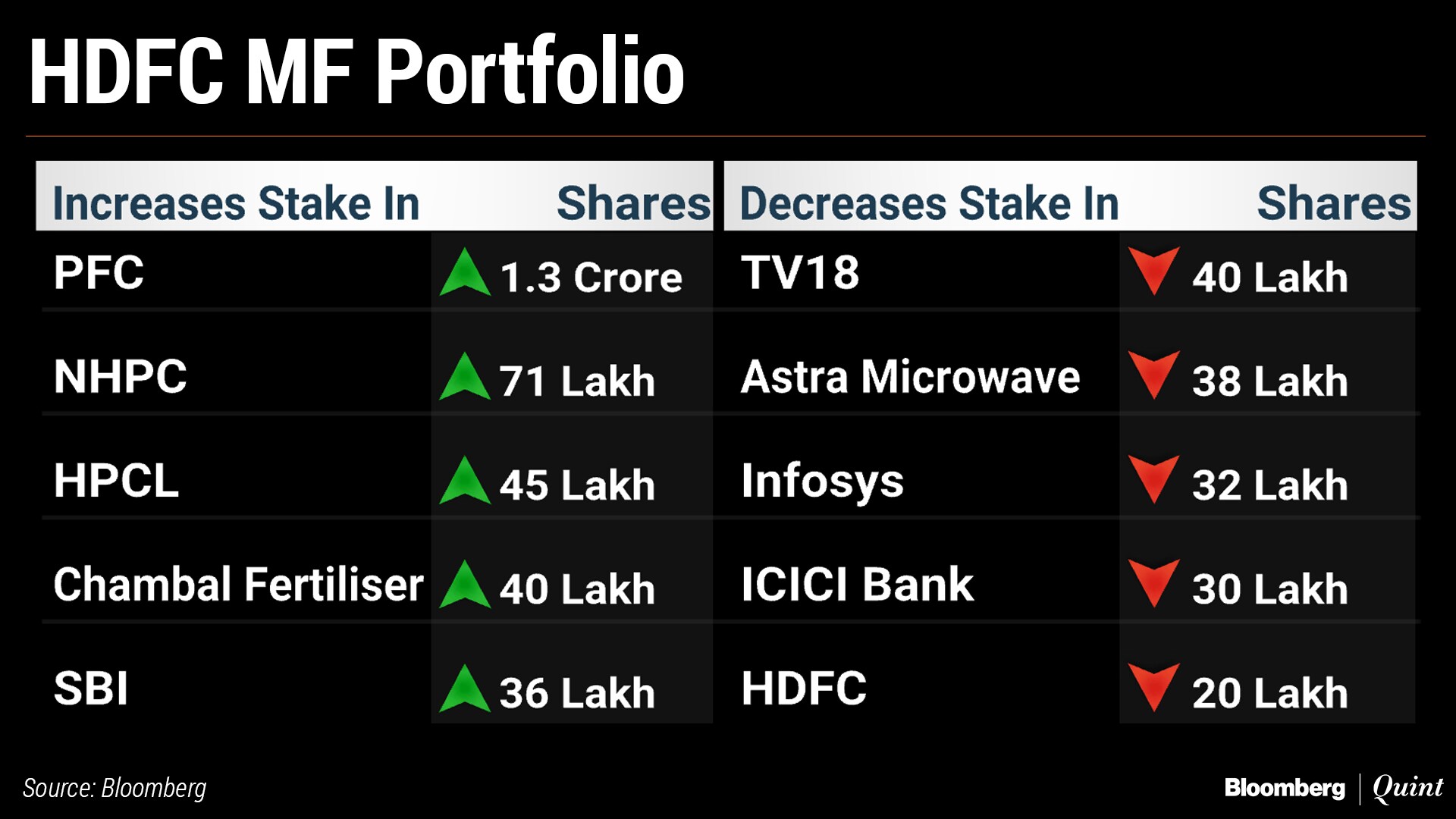

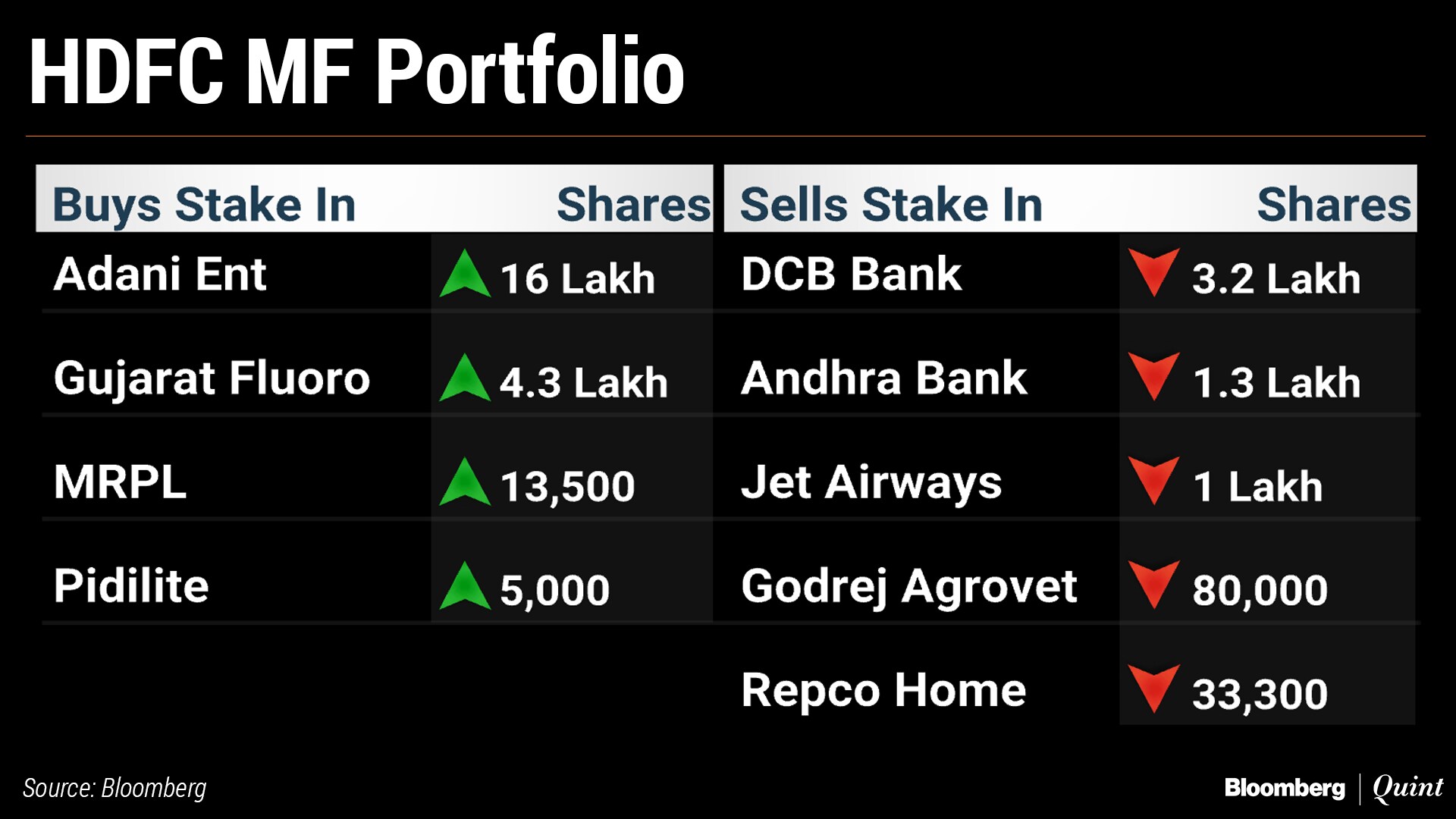

Here's what the top three asset managers bought and sold in September:

ICICI Prudential Mutual Fund

India's largest asset manager has equity assets of nearly Rs 1.1 lakh crore invested in 622 securities. It allocated 24 percent of the portfolio to financials and 10.9 percent to utilities.

HDFC Mutual Fund

The fund house manages equity assets worth more than Rs 1.25 lakh crore across 392 stocks. By industry, it has the highest exposure to financials at 30.2 percent, followed by industrials at 13.6 percent.

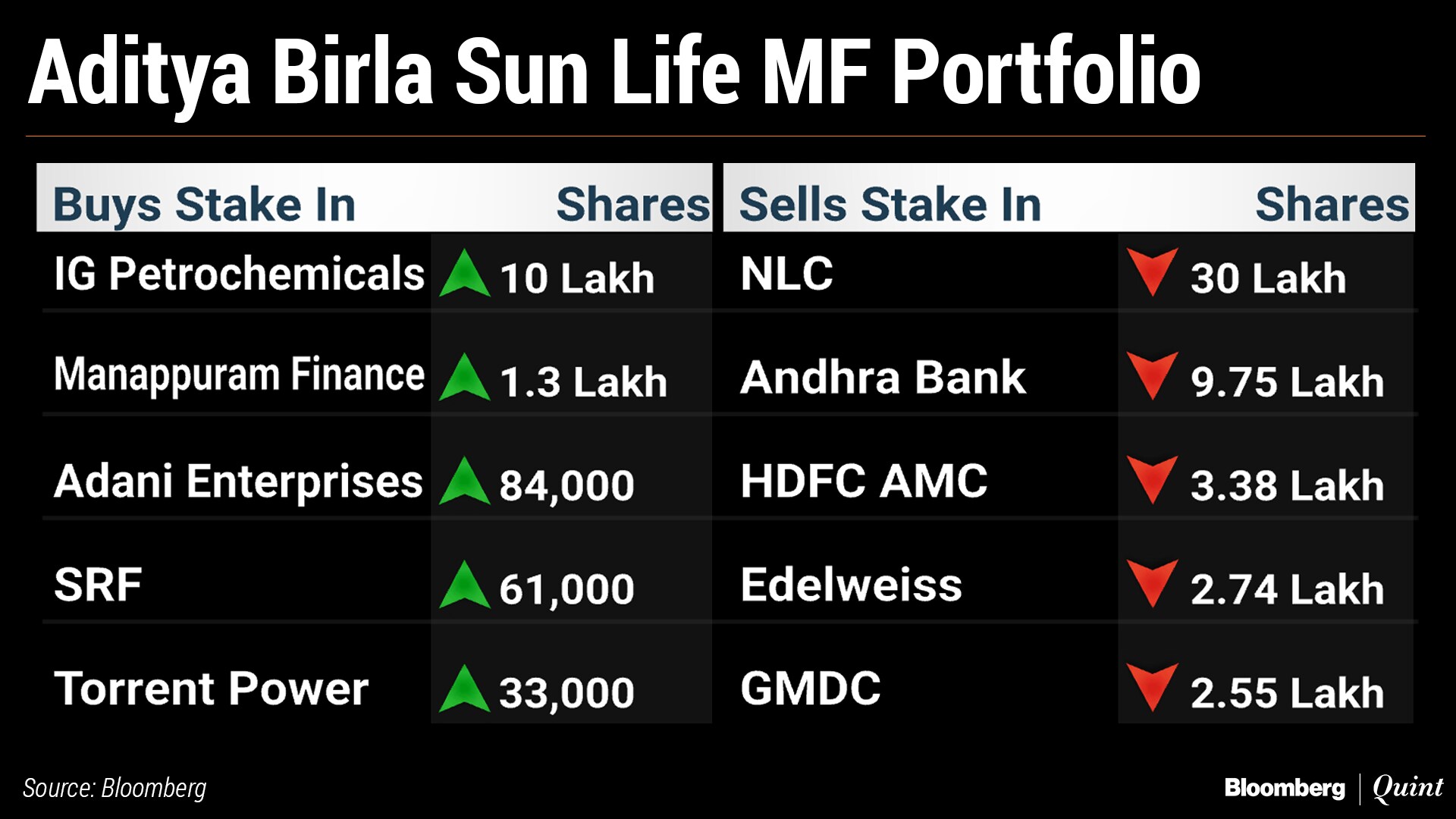

Aditya Birla Sun Life Mutual Fund

The fund house manages equity assets worth more than Rs 70,000 crore, invested in 498 securities. Its highest exposure is towards financials at 29.7 percent, followed by materials at 13.7 percent.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.