JM Financial Ltd. has initiated coverage on Zinka Logistics Solutions Ltd.— the provider of digital platform BlackBuck—with a 'buy' rating and a target price of Rs 570 by March 2026. This target price implies a 41% upside from the current market price.

BlackBuck is India's largest full-stack technology platform for truck operators, offering a range of services including payments (tolling and fueling), telematics, load matching, and vehicle financing. The company operates an ecosystem-led business model, allowing it to acquire customers through any of its offerings and then cross-sell other services with minimal additional costs.

As of the second quarter of fiscal 2025, BlackBuck had approximately 700,000 monthly transacting truck operators, with over 47% using two or more of its services. The company holds nearly 40% of the market share in truck tolling through its FASTag services and has over 390,000 monthly active telematics devices, the brokerage noted.

BlackBuck's revenue grew at a compound annual growth rate of 63% from fiscal 2022 to fiscal 2024. The company turned adjusted Ebitda profitable in the second half of fiscal 2024. JM Financial forecasts a revenue growth of around 31% over FY24-29, with Ebitda margins expected to reach over 45%.

BlackBuck's digital platform, the BlackBuck app, serves the diverse needs of truck operators, offering services that help manage their business and increase their income. The platform's ecosystem-driven model ensures regular engagement from truck operators and allows for efficient cross-selling of services, resulting in a high lifetime value to customer acquisition cost ratio.

The road transport sector is crucial to India's economy, accounting for over 70% of freight movement. With more than a million annual transacting truck operators, BlackBuck is well-positioned to capitalise on India's growing economic needs. The company's comprehensive service offerings and strong market presence make it a key player in the logistics and transportation industry, the brokerage noted.

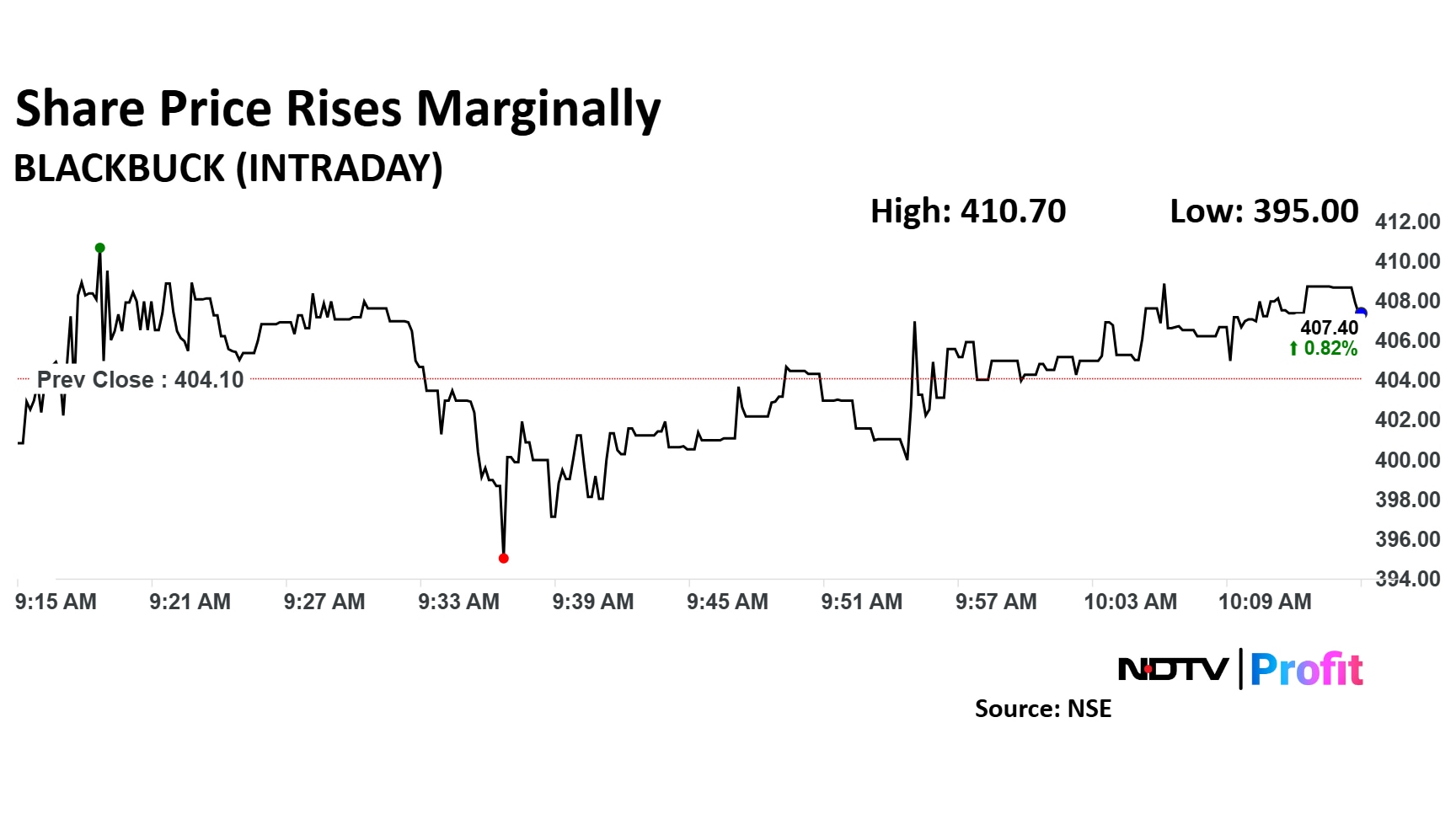

Zinka Logistics Share Price

Shares of Zinka Logistics fell as much as 2.25% to Rs 395 apiece. They recovered to trade 0.22% higher at Rs 405 apiece, as of 10:12 a.m. This compares to a 0.96% decline in the NSE Nifty 50.

The stock has risen 55.74% in the last 12 months. The relative strength index was at 54.

The one analyst tracking the company has a 'sell' rating, according to Bloomberg data. The average 12-month analyst's consensus price target implies an upside of 10.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.