The share price for Zee Entertainment Enterprises Ltd. rose over 3% to reach a six-month high after the company's board approved plans to raise funds via issue of fully convertible warrants to promotors. The total promoter shareholding will rise to 18.39%.

The board approved the issue of nearly 17 crore fully convertible warrants at Rs 132 apiece to promoter group entities Altilis Technologies Pvt. and Sunbright Mauritius Investments Ltd., according to a stock exchange filing.

The warrant price is above the SEBI-prescribed floor of Rs 128.58, with promoters voluntarily paying a Rs 3.42 premium per unit.

During the first of the two meetings held on Monday, the board, alongside JPMorgan, discussed growth plans and strategic initiatives. Taking into account JPMorgan's suggestions, the board decided to enhance its promotor shareholding in the second meeting.

As per regulatory norms, these promoters have to make an upfront payment of Rs 33 as a subscription for each warrant, which is equivalent to 25% of the warrant issue price.

The promoter entities can exercise their warrants in one or more tranches within 18 months from the date of allotment.

Zee will convene an extraordinary general meeting on July 10 to seek shareholder approval for the warrant issue.

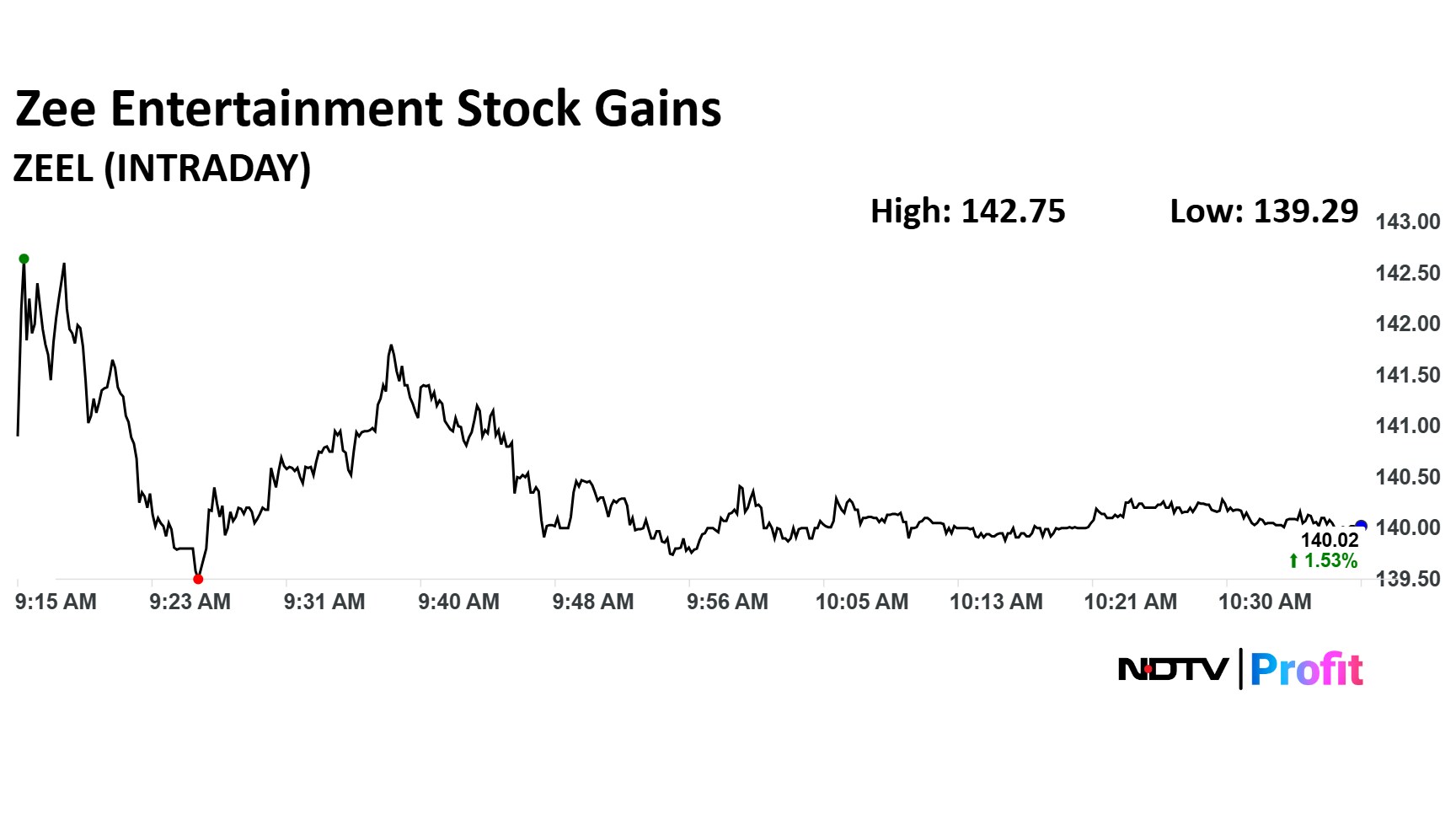

Zee Entertainment Shares Today

The scrip rose as much as 3.51% to Rs 142.75 apiece, the highest level since Dec. 9, 2024. It pared gains to trade 1.52% higher at Rs 140 apiece, as of 10:45 a.m. This compares to a 0.29% decline in the NSE Nifty 50.

It has risen 15.55% on a year-to-date basis, but fallen 14.48% in the last 12 months. Total traded volume so far in the day stood at 4.7 times its 30-day average. The relative strength index was at 59.69 .

Out of 20 analysts tracking the company, 11 maintain a 'buy' rating, four recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.