VRL Logistics Ltd.'s stock hit the 20% upper circuit during early trade on Thursday after its third-quarter profit rose over fourfold and trading volumes surged. The results were released after market hours on Wednesday.

Net profit surged 334% to Rs 59.42 crore compared to Rs 13.7 crore in the year-ago period. Analysts' consensus estimates compiled by Bloomberg had projected Rs 38 crore.

Revenue from operations rose 12% from Rs 737 crore to Rs 825 crore in the October-December quarter. The estimate was Rs 824 crore.

On the operating side, earnings before interest, tax, depreciation and amortisation rose 76.4% to Rs 166 crore. Last year it was Rs 94.3 crore. Ebitda margin improved to 20.2% from 12.8%.

Freight hikes were implemented across all sectors and geographies leading to increase in realisation and improvement in margins while maintaining tonnage, VRL Logistics said.

Capex during the quarter rose to Rs 276 crore.

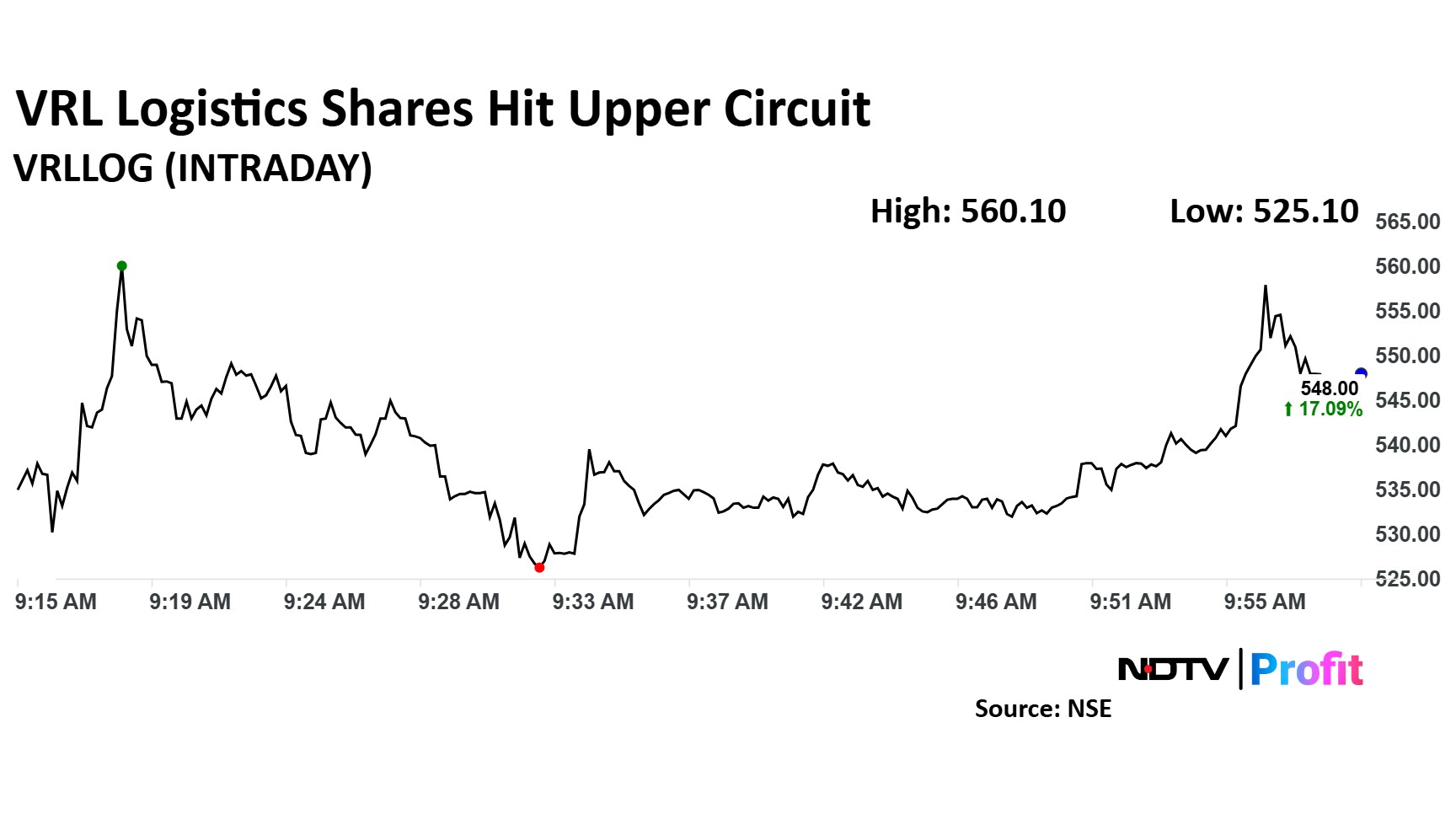

VRL Logistics share price advanced 20% intraday to Rs 560.1 apiece, the highest since Dec. 12, 2024.

VRL Logistics share price advanced 20% intraday to Rs 560.1 apiece, the highest since Dec. 12, 2024. The scrip was trading 17% higher at Rs 548 by 10:00 a.m. The benchmark NSE Nifty 50 was down 0.25%.

The stock has fallen 20% in the last 12 months. The total traded volume so far in the day stood at 123 times its 30-day average. The relative strength index was at 51.

Nine out of the 11 analysts tracking VRL Logistics have a 'buy' rating on the stock, and one each recommends a 'hold' and 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 634 implies a potential upside of 19%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.