Vedanta Ltd.'s shares were trading unchanged during early trade on Thursday, ahead of the annual general meeting and amid the Viceroy Research controversy. Chairman Anil Agarwal is set to address shareholders later in the day at the AGM.

On Wednesday, short seller Viceroy Research shorted the debt stack of Vedanta Resources, the parent company and majority owner of Vedanta, alleging the group structure is financially unsustainable and poses a material risk to creditors.

The US-based short seller's report came ahead of AGM and sent its shares sliding by as much as 6.2% during the day.

Vedanta Group dismissed the short-seller report, calling it a “malicious combination of selective misinformation and baseless allegations” aimed at discrediting the group.

The company said the report was released without any attempt to seek a response from Vedanta and alleged it was created solely to trigger false market sentiment. It claimed the report contains only a compilation of publicly available information, which has been taken out of context and presented in a misleading way to profit from the resulting reaction.

“The timing of the report is suspect and could be to undermine the forthcoming corporate initiatives,” a Vedanta Group spokesperson said in a statement. “Our stakeholders are discerning enough to understand such tactics.”

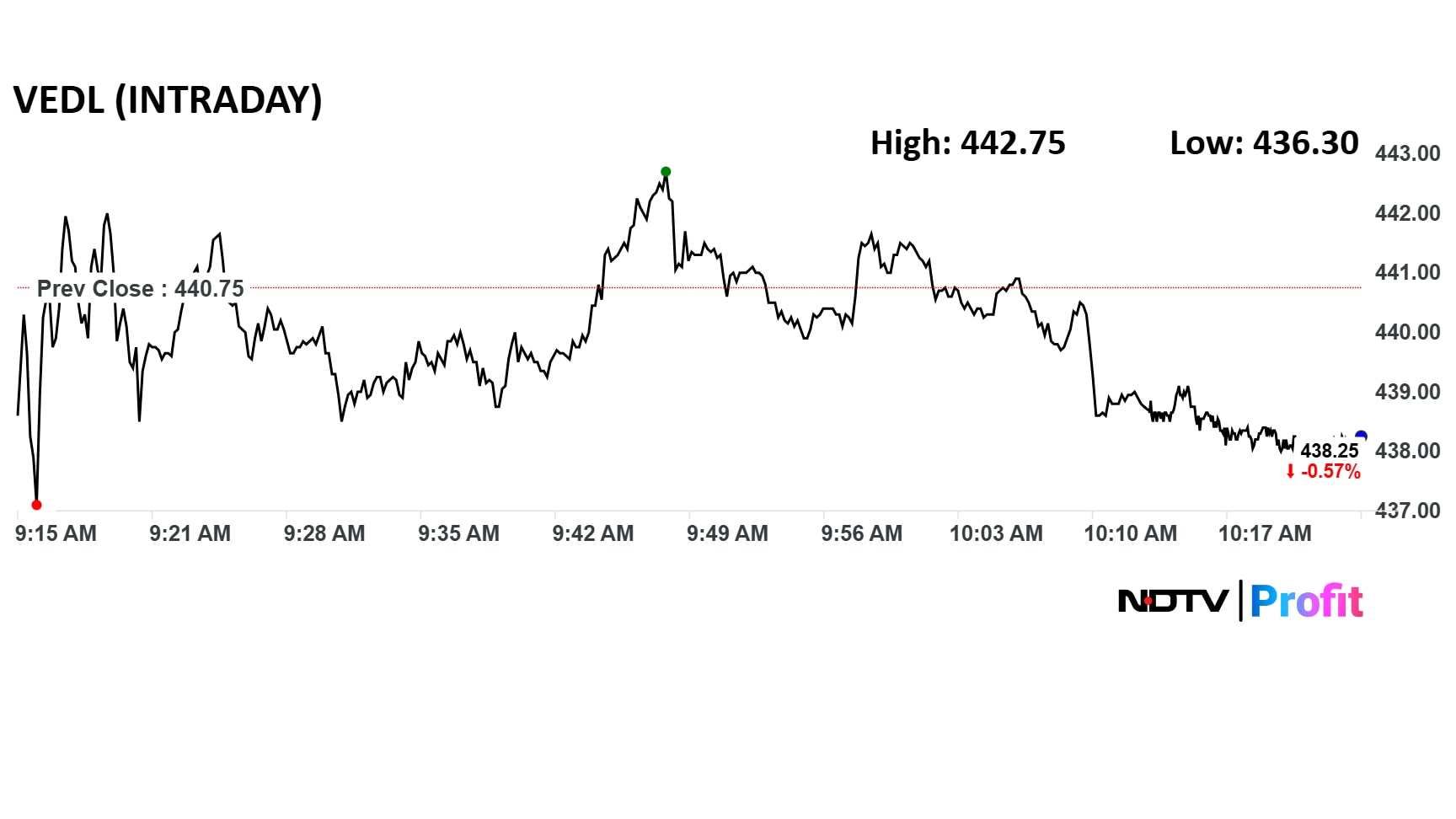

Vedanta Share Price Movement

Vedanta's share price has been rangebound for the day. The scrip was trading 0.6% lower by 10:25 a.m.

Vedanta's share price has been rangebound for the day. The scrip was trading 0.6% lower by 10:25 a.m. The benchmark NSE Nifty 50 was down 0.2%.

The stock has fallen 4% in the last 12 months and 1.3% on a year-to-date basis. The total traded volume so far in the day was Rs 210 crore. The relative strength index was at 43.

Out of 16 analysts tracking Vedanta, 11 have a 'buy' rating on the stock, four recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 516 implies a potential upside of 17%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.