- CopperTech Metals, a Vedanta arm, filed confidential draft papers for an IPO with the US SEC

- The IPO proceeds will likely fund expansion of Konkola copper mine needing over $1 billion

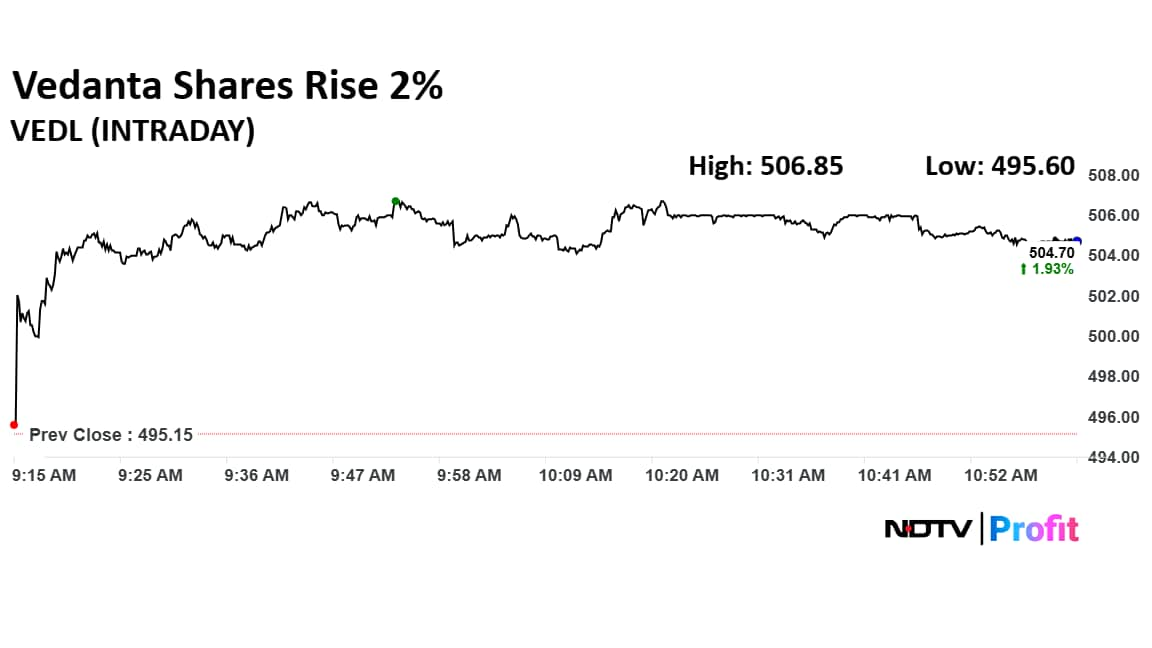

- CopperTech shares rose over 2% easing merger fears between Vedanta and Vedanta Resources

CopperTech Metals Inc. an arm of Vedanta Resources Ltd. has filed confidential draft papers for a potential initial public offering, the company said in a press release on Monday.

CopperTech has submitted a draft registration statement on Form S-1 to the US Securities and Exchange Commission relating, the company said in its statement. However, it added that the IPO is expected to take place following the completion of the SEC review and is subject to market conditions.

The shares of the company rose over 2% on Tuesday after the announcement. The rise in shares come as it eases the fear of merger between Vedanta and Vedanta Resources. The funds raised would likely help fund the Konkola copper mine expansion as the parent needs over $1 billion for this project.

The company has already spent $200-250 million dollars on the mine, and it is expected that the remaining $500 million dollars may be raised through IPO. This move will ease the pressure on Vedanta Resources to source for its own finances.

Vedanta Share Price Today

The scrip rose as much as 2.36% to Rs 506.85 apiece on Tuesday, highest since Nov. 21. It pared gains to trade 2.11% higher at Rs 505.60 apiece, as of 11:00 a.m. This compares to a 0.11% decline in the NSE Nifty 50 Index.

It has risen 13.56% in the last 12 months and 13.72% year-to-date. Total traded volume so far in the day stood at 9.81 times its 30-day average. The relative strength index was at 52.70.

Out of 14 analysts tracking the company, 10 maintain a 'buy' rating and four recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target of Rs 571.15 implies an upside of 12.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.