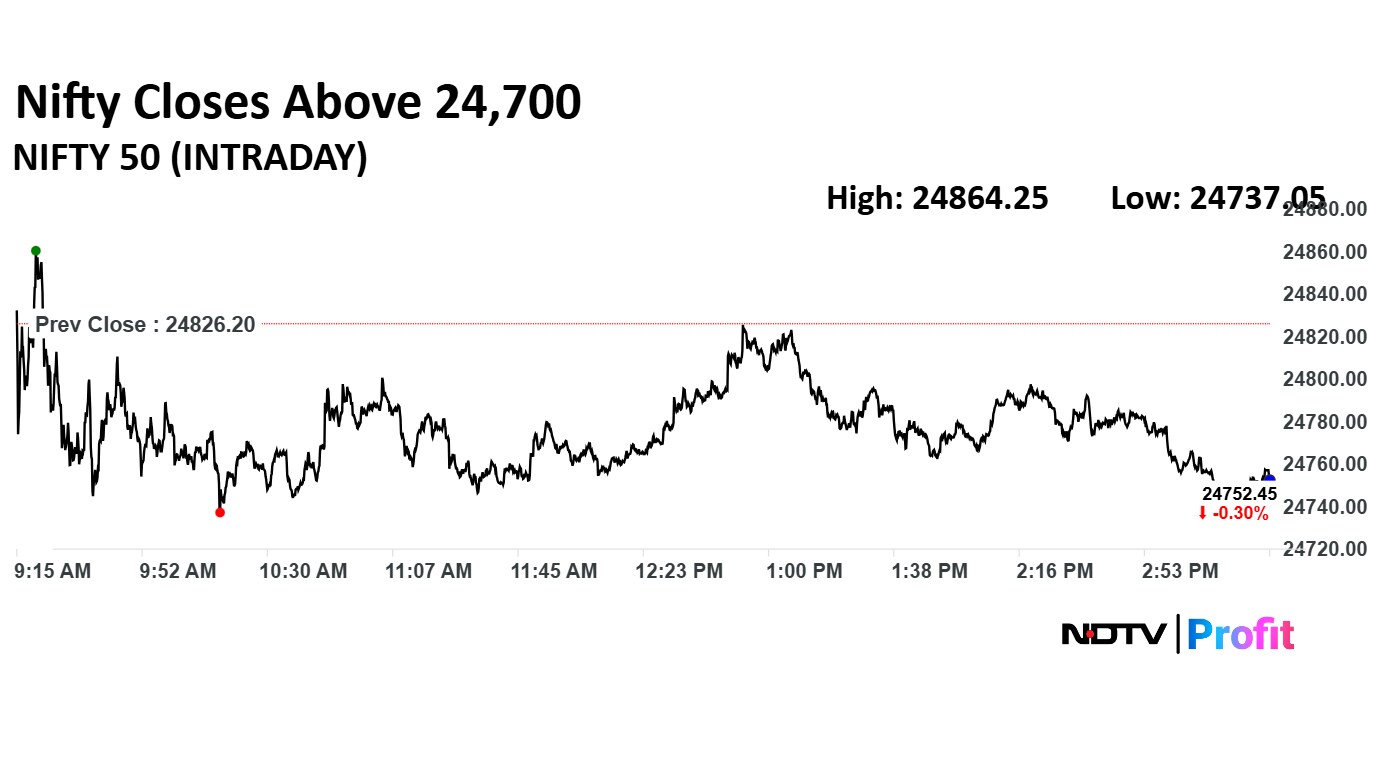

The NSE Nifty 50 opened flat and consolidated in a narrow band without a definite directional bias on Wednesday. It formed a red candle on the daily chart, which indicated weakness, according to analysts.

The index finds support near the 21-day exponential moving average at 24,570, according to Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd. "As long as the index holds above this level, the probability of a pullback move cannot be ruled out."

Yedve identified the resistance zone near 25,000–25,100 levels.

Analyst Mandar Bhojane, equity research analyst at Choice Broking, identified the support for the Nifty at 24,700 levels. Immediate resistance was seen at 24,900–25,000 levels by the analyst.

"A sustained close above 25,000 could invite fresh buying interest, potentially driving the index toward 25,400 and 25,600 levels," Bhojane said.

The analyst expects range-bound trading to continue due to lack of decisive breakout. He advised traders to remain cautious and look for confirmation signals before entering new positions.

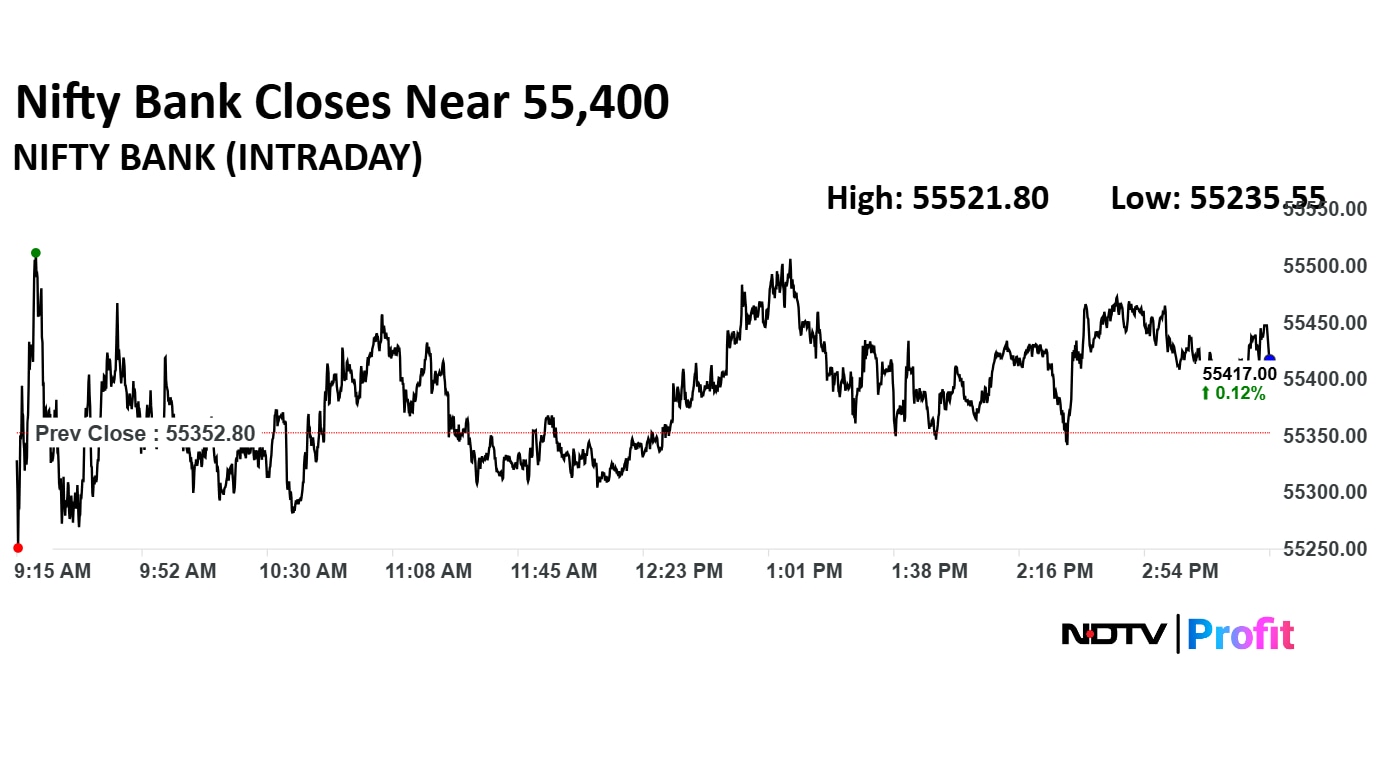

The Bank Nifty formed a small green candle on the daily chart, indicating strength. It is facing resistance near 56,000–56,100 levels on the upside, he said.

The analyst found the 21-DEMA support to be placed near 54,830. "As long as the index remains above this level, it could attempt a relief rally towards 56,000 levels," Yedve said.

Market Recap

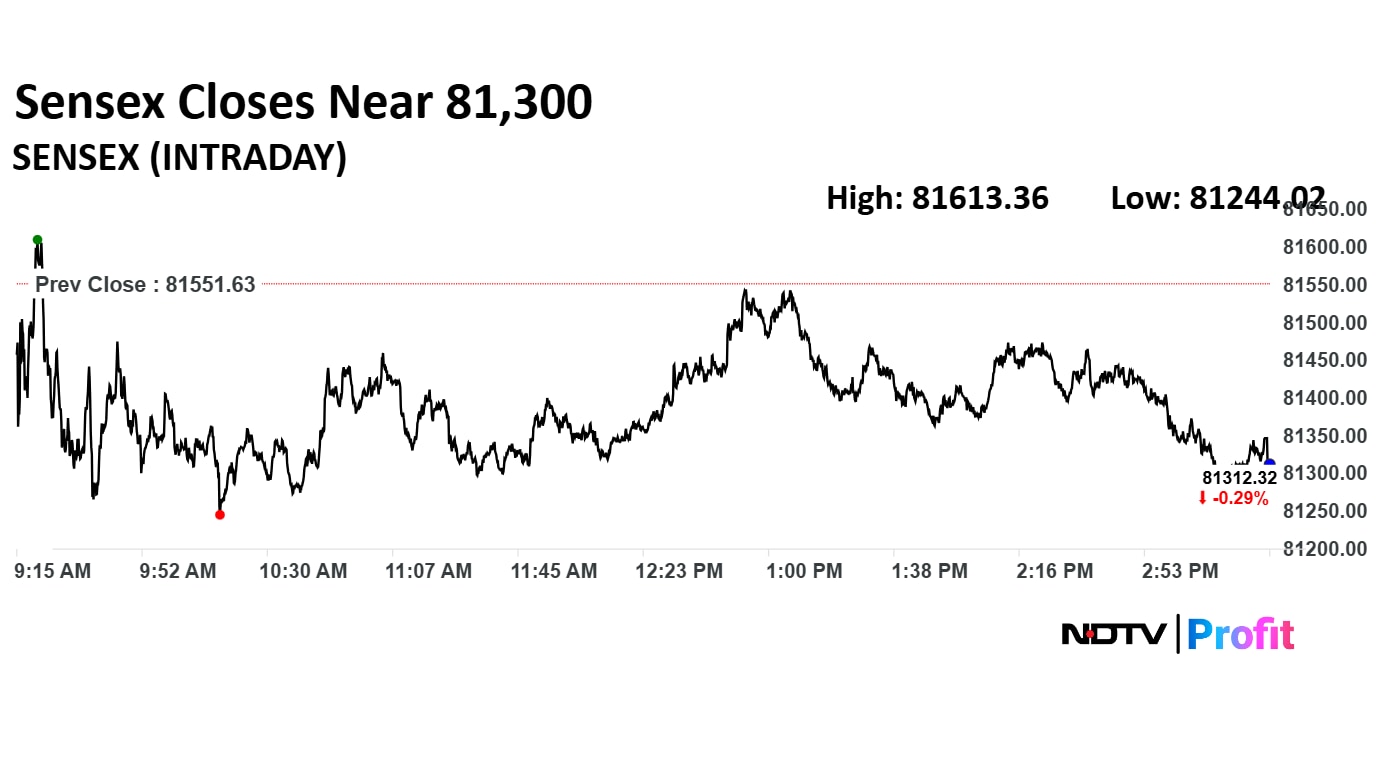

The benchmark equity indices closed lower for the second consecutive session on Wednesday as share prices of ITC Ltd. and Reliance Industries Ltd. dragged the most.

The NSE Nifty 50 closed 73.75 points or 0.3% lower at 24,752.45 and the BSE Sensex ended 239.31 points or 0.29% down at 81,312.32. During the day, the Nifty fell 0.36% to 24,737, while the Sensex dropped 0.38% to 81,244.

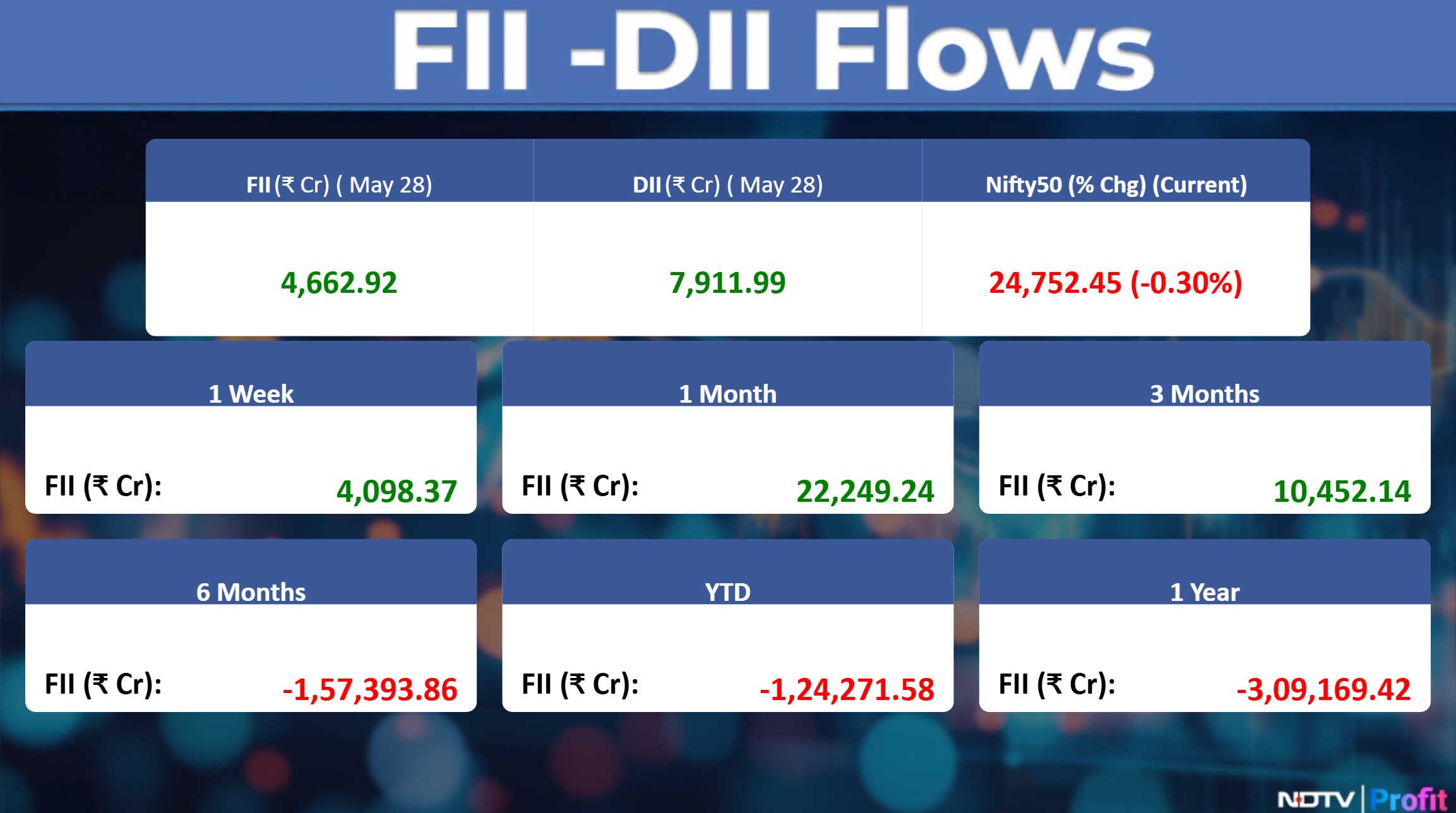

FII/DII

Foreign portfolio investors mopped up stocks worth Rs 4,662.9 crore, according to the provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the seventh straight session as they bought equities worth Rs 7,912 crore, the data showed.

The FPIs had bought shares worth Rs 348.45 crore on Monday.

F&O Cues

Nifty May Futures down by 0.46% to 24,747 at a discount of 5 points.

Nifty May futures open interest down by 22.83%.

Nifty Options May 29 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: Nil.

Major Stocks In The News

IndusInd Bank: Securities And Exchange Board of India barred former IndusInd Bank chief executive officer Sumant Kathpalia and four others from dealing in the share market. The individuals have been restricted from buying, selling or dealing in securities, either directly or indirectly, in any manner until further orders, the SEBI said in an interim order on Wednesday.

Gensol Engineering: The National Company Law Tribunal in Ahmedabad ordered the freezing and attachment of all bank accounts and lockers belonging to Gensol Engineering and its associated entities.

Infosys: The company entered an agreement with a E.ON to enable AI-Powered digital workplace transformation.

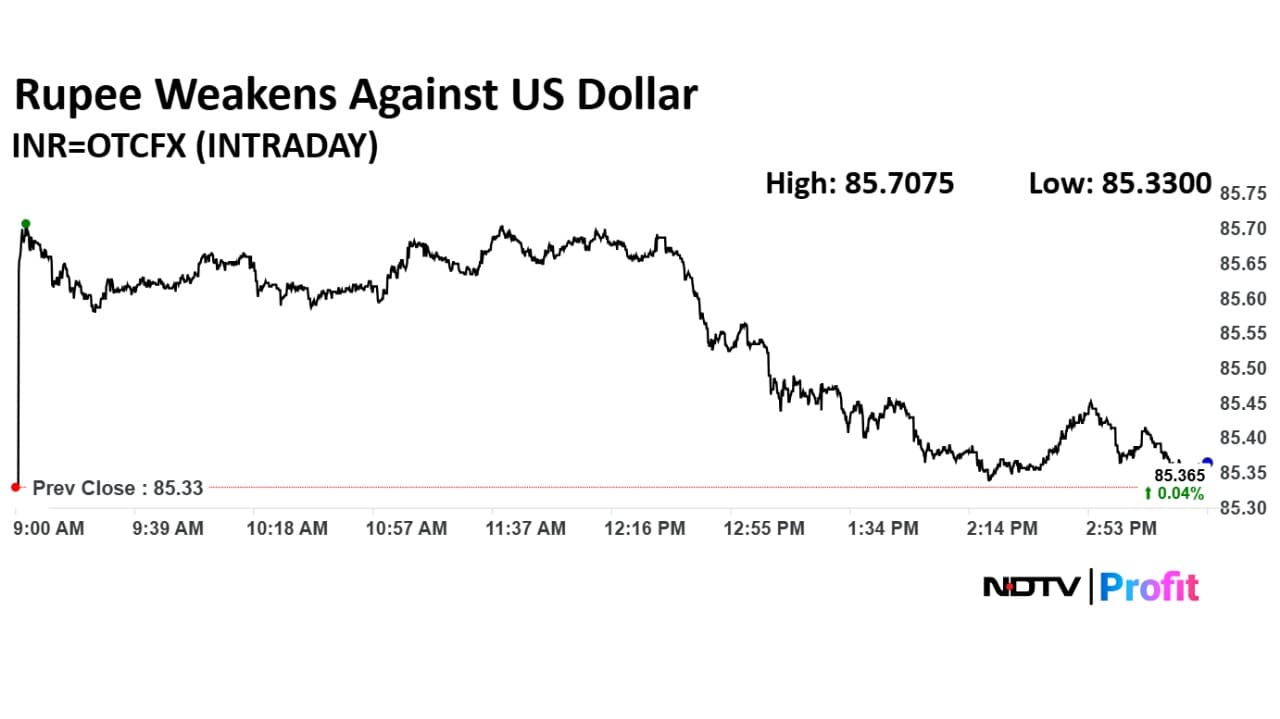

Currency Recap

The Indian rupee weakened by 3 paise to close at 85.37 against the US dollar on Wednesday, extending its fall for the second day, in comparison to its previous close of 85.33 on Tuesday.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.