Nifty Technicals Signal Potential For Short-Term Consolidation Amid Record Highs

The Nifty index regained strength, reaching an all-time high above 23400, with a strong bias for further rise anticipated after a brief consolidation period, Prabhudas Lilladher said in a research note.

"Nifty registered a record high of 23,411.90 and found trend line resistance, leading to profit booking on Monday. Thus, as long as the index remains below 23,412, profit booking can't be ruled out," Investment Interrmediates' Hrishikesh Yedve said. "On the downside, immediate support for the Nifty is placed near 23,000, followed by 22,600."

On Monday, Bank Nifty erased morning gains to ended little changed from the last Friday's close. "Technically, on the weekly scale, the index has formed a hanging man candlestick pattern," Yedve said, adding, "as per this pattern, 51,130-51,140 will act as resistance for the index."

F&O Action

Nifty June futures are currently down by 0.41% at 23,247, with a discount of 12 points, while open interest for these futures has decreased by 6.55%.

Nifty Bank June futures are showing a decline of 0.52% at 49,732, accompanied by a drop in open interest by 6.7%.

For the Nifty options' June 13 expiry, the maximum call open interest was observed at 24,000, and the maximum put open interest stood at 23,000. For the Bank Nifty options' June 12 expiry, the maximum call open interest reached 53,000, with the maximum put open interest at 47,000.

FII/DII Activity

Overseas investors remained net buyers of Indian equities on Monday for the second straight day. Foreign portfolio investors mopped up stocks worth Rs 2,572.4 crore, according to provisional data from the National Stock Exchange.

Meanwhile, domestic institutional investors turned net buyers and mopped up equities worth Rs 2,764.5 crore after a day of selling, NSE data showed.

Markets Recap

After recording fresh highs in early trade, the benchmark stock indices settled lower on Monday, tracking losses in shares of Infosys Ltd., HDFC Bank Ltd. and Mahindra & Mahindra Ltd. The NSE Nifty 50 settled 30.95 points or 0.13%, lower at 23,259.20, and the S&P BSE Sensex ended 203.28 points or 0.27%, lower at 76,490.08.

During the day, the Nifty rose as much as 0.52% to a fresh high of 23,338.70 and the Sensex rose 0.35% to a record high of 77,079.40.

Major Stocks In News

Raymond: Raymond Realty, an arm of the company, received a second redevelopment project in the Bandra (East) area of Mumbai. The project is estimated to generate over Rs 2,000 crore in revenue.

PTC Industries: The company announced its partnership with leading entities under the DTIS scheme in the Indian defence and aerospace sectors to advance the 'Make in India' initiative.

Rail Vikas Nigam: The Siemens-RVNL consortium has received a letter of acceptance from Bangalore Metro Rail Corporation for engineering, supply, erection, testing, and commissioning of 33 KV distribution and 750 V DC Third Rail Traction Electrification.

Repco Home Finance: CFO K. Lakshmi has resigned due to personal reasons.

Bank of Baroda: The company has kept MCLR unchanged across tenures, effective June 12.

NLC India: The company raised foreign currency loans up to $600 million and it will make an investment of Rs 994.5 crore in unit NLC India Renewables. To seek external assistance from the Multilateral Development Bank via DEA for renewable power projects.

Jubilant Foodworks: Domino's Pizza crossed the 2,000-store mark in India.

Vodafone Idea: The company will consider fund-raising in its board meeting on June 13.

H. G. Infra Engineering: The company incorporated a step-down subsidiary company, namely H. G. Jaipur Solar Project, to carry out business in the field of solar power.

InterGlobe Aviation: InterGlobe Enterprises, owned by the Rahul Bhatia family, is set to sell a 2% stake in the budget airline Indigo, according to Bloomberg. The deal will involve offloading 77 lakh shares at a minimum price of Rs 4,266 each, representing a 7% discount from Monday's closing price, the report said.

Global Cues

Most benchmarks in Asia-Pacific region were trading higher as market participants await the US May inflation data and Federal Reserve's policy decision.

The Nikkei 225 was trading 210.11 points or 0.54% higher at 39,248.27, and the KOSPI index was 6.84 points or 0.25% higher as of 06:54 a.m. on Tuesday.

The US stock market found it challenging to make significant progress due to a downturn in European assets affecting the overall mood.

The S&P 500 Index and Nasdaq 100 rose 0.26% and 0.35%, respectively, as of Monday. The Dow Jones Industrial Average rose 0.18%.

Brent crude was trading 0.12% higher at $81.75 a barrel. Gold fell 0.07% to $2,309.36 an ounce.

Money Market Update

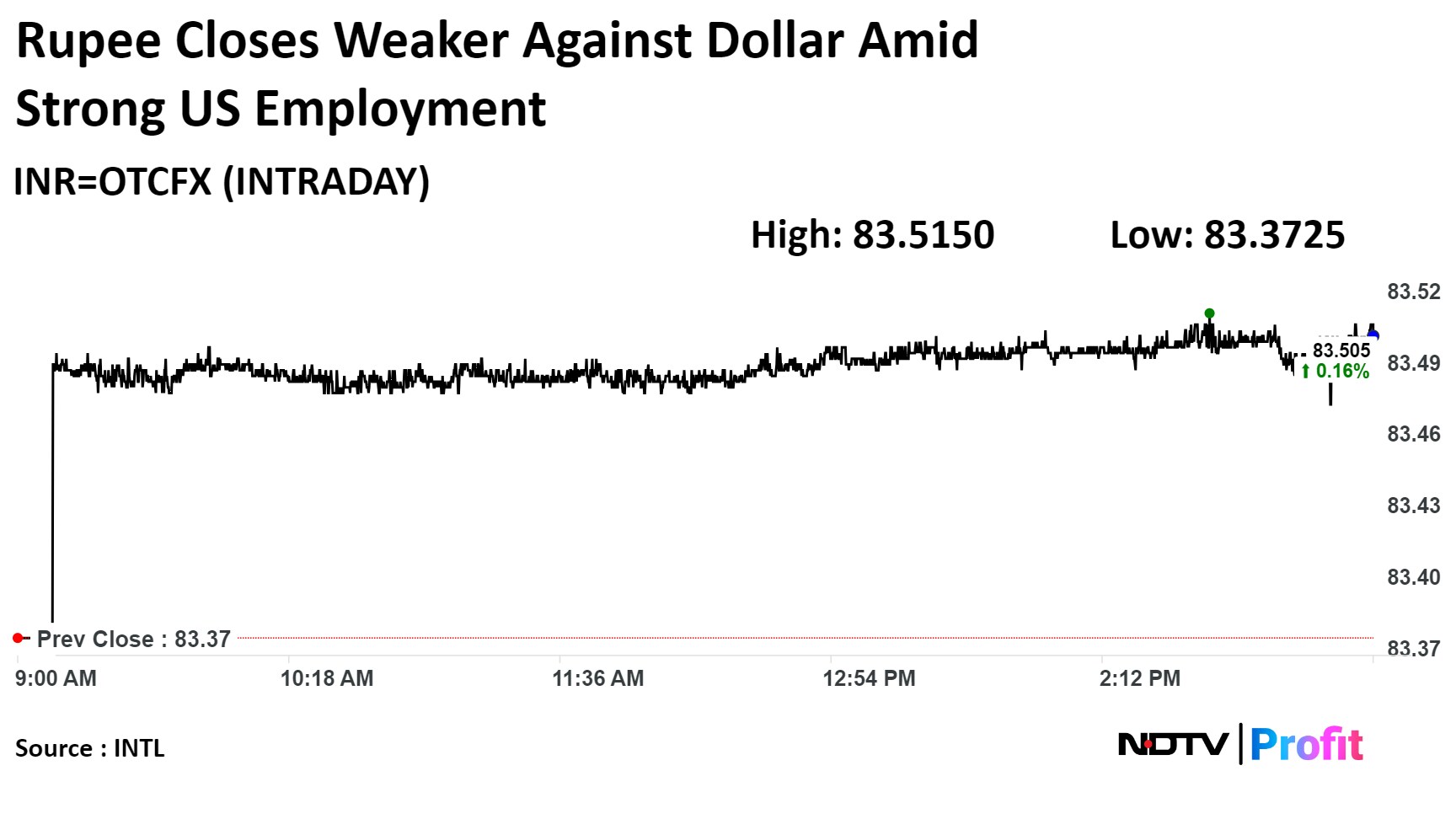

The rupee closed weaker against the dollar on Monday amid robust US employment data and stable oil prices.

The local currency closed 13 paise weaker at 83.51 against the greenback. It opened 11 paise weaker at 83.49 against the dollar, according to Bloomberg data. The rupee had closed at 83.38 on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.