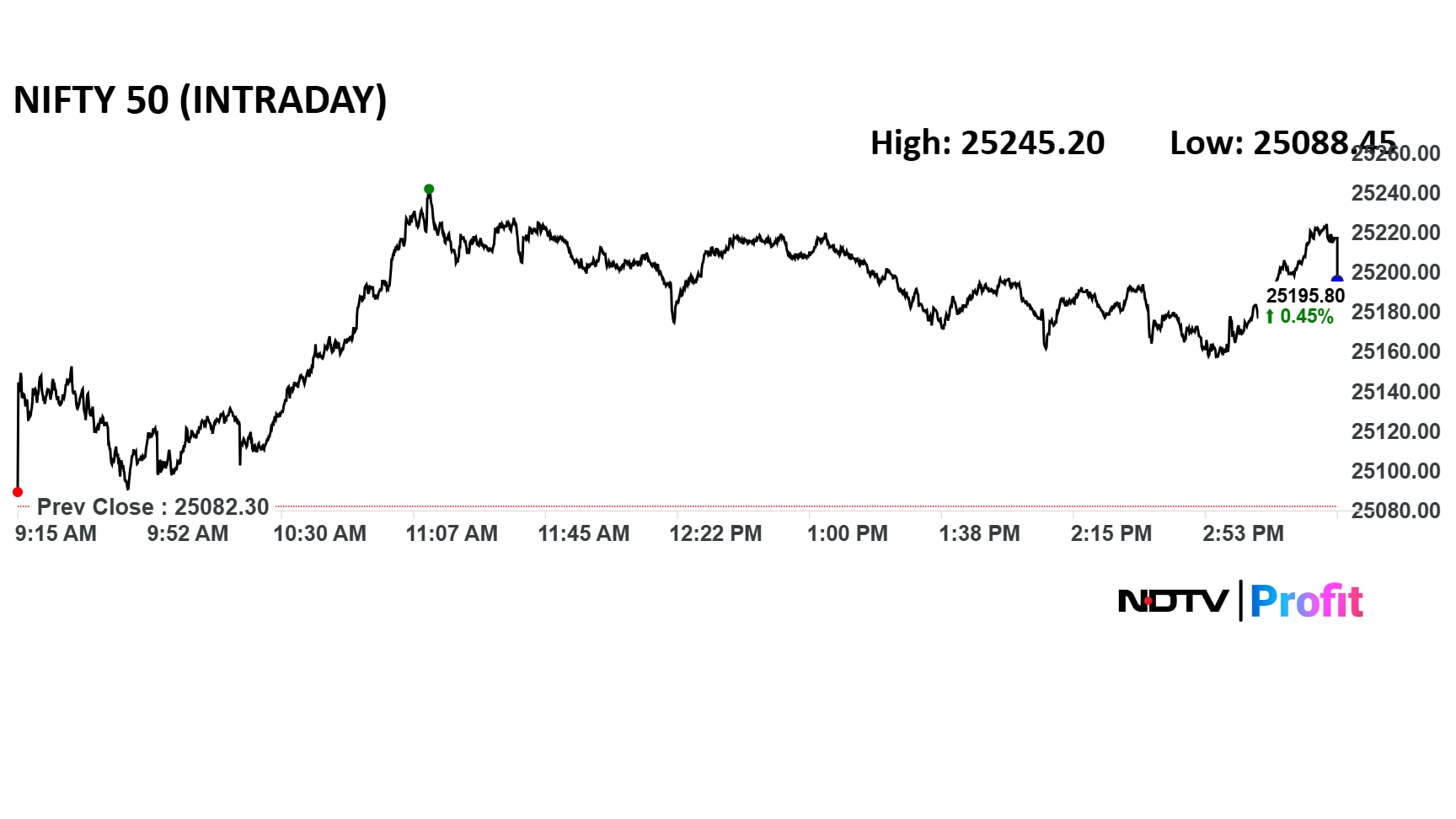

The NSE Nifty 50 is likely to trade within a range in the near term, with the key support placed at 25,100-24,900, according to Bajaj Broking Research.

"Going ahead, we expect the index to extend the up move towards 25,340 levels being the bearish gap area of last Friday. Strength above 25,340 will open up further upside towards 25,600 levels in the coming weeks," it said.

The Nifty formed a bullish candlestick pattern in the daily chart with a higher high and higher low, signalling buying demand, Bajaj Broking said.

"Long should be protected with a stop loss of 25,000 in Nifty. On the higher side, 25,331 could offer short-term resistance to Nifty," Nandish Shah, deputy vice president of HDFC Securities said.

A bullish "morning-star" candlestick formation near support further strengthens the case for a short-term uptrend. Immediate support remains at 25,000, according to Mandar Bhojane, senior technical and derivative analyst at Choice Broking. "Traders holding long positions can maintain a stop-loss at this level while aiming for targets of 25,700 and 26,000."

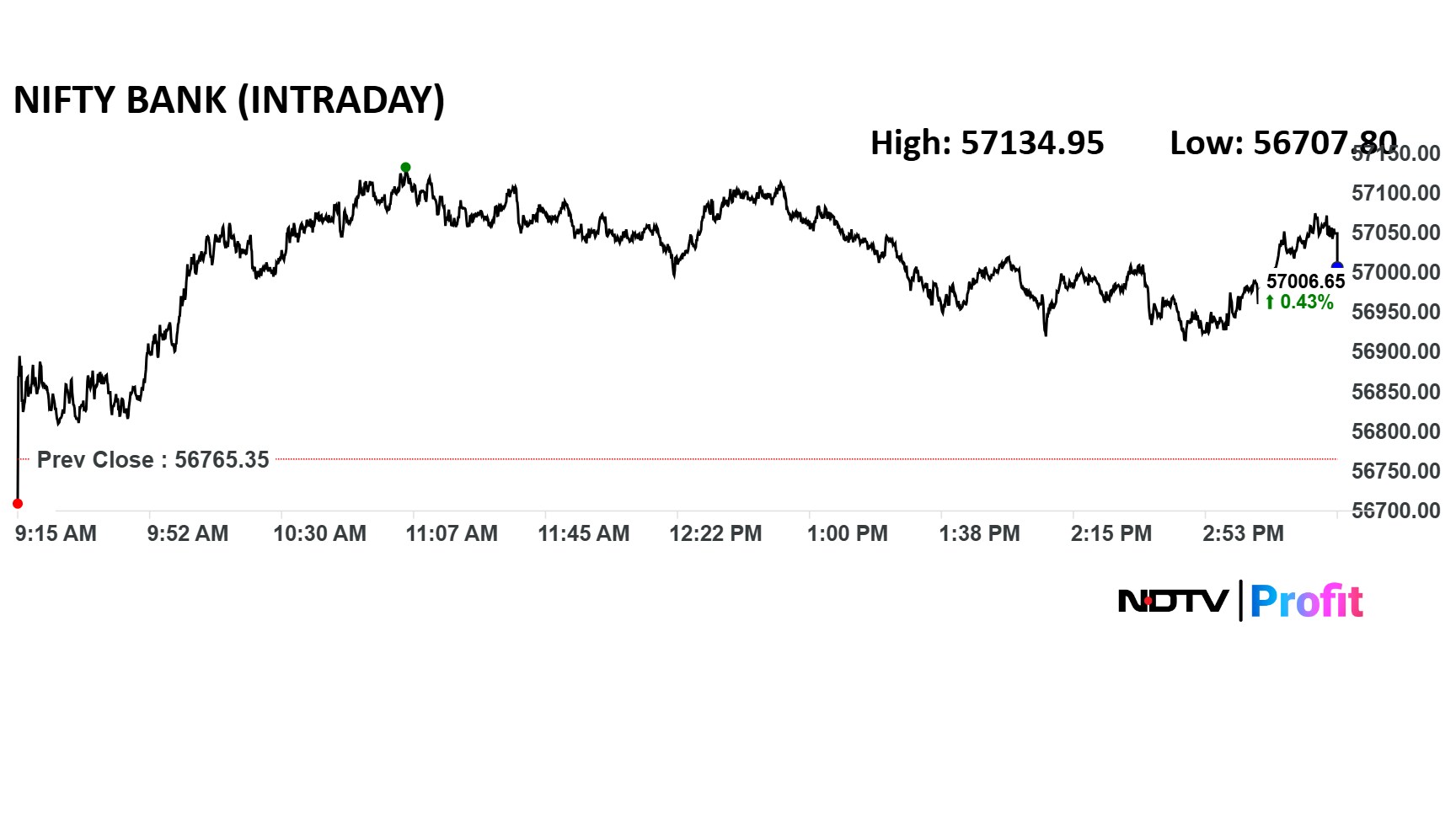

The Bank Nifty finds key short-term support at 56,000–55,500, according to Bajaj Broking. The firm advised investors to view the current consolidation in the index as a buying opportunity.

Market Recap

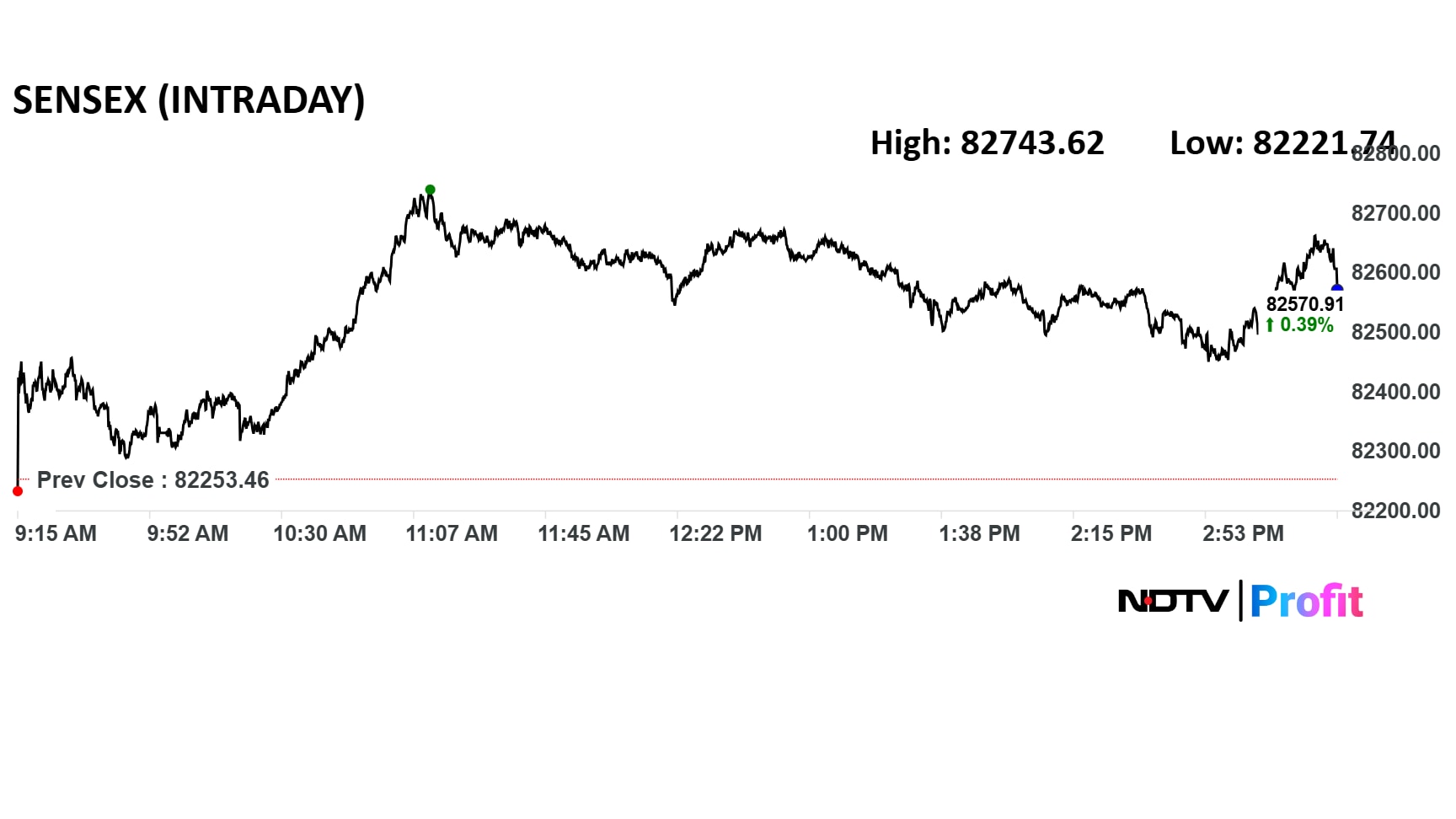

India's benchmark equity indices snapped four days of losses to close higher on Tuesday, led by gains in auto and financial stocks. HCLTechnologies Ltd. took a beating after June quarter disappointment.

The NSE Nifty 50 ended 113.5 points or 0.45% higher at 25,195.80, while the BSE Sensex closed 317.45 points or 0.39% up at 82,570.91.

Currency Update

The Indian rupee appreciated by 18 paise against the US dollar, closing at 85.81 on Tuesday.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.