.jpg?downsize=773:435)

- Shares of Tata Consultancy Services Ltd have dropped over 36% from their 52-week high

- New US $100,000 annual fee on H-1B visas raises operational cost concerns for Indian IT firms

- Analysts note IT sector growth is limited by short-term budgets and regulatory uncertainties

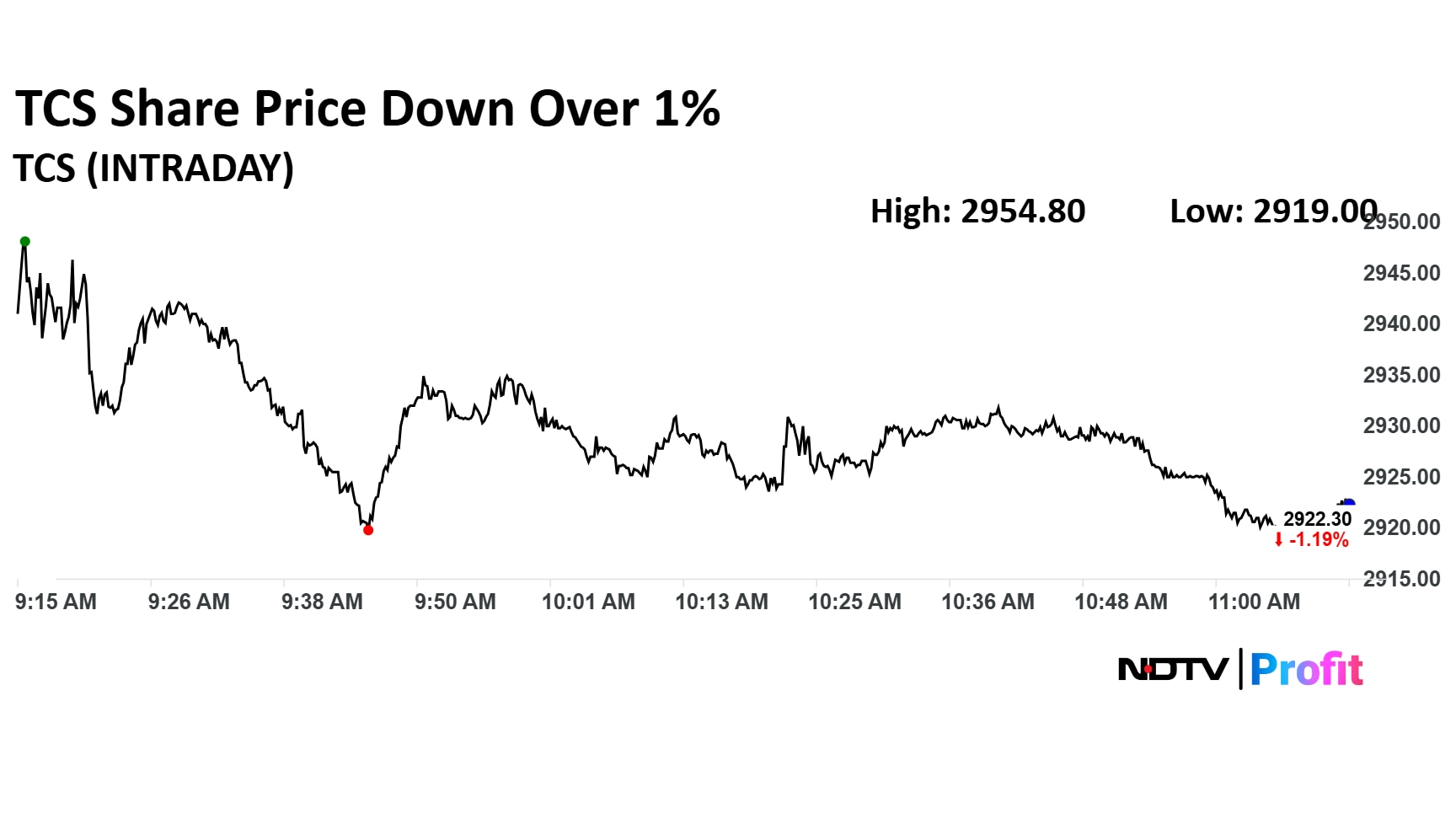

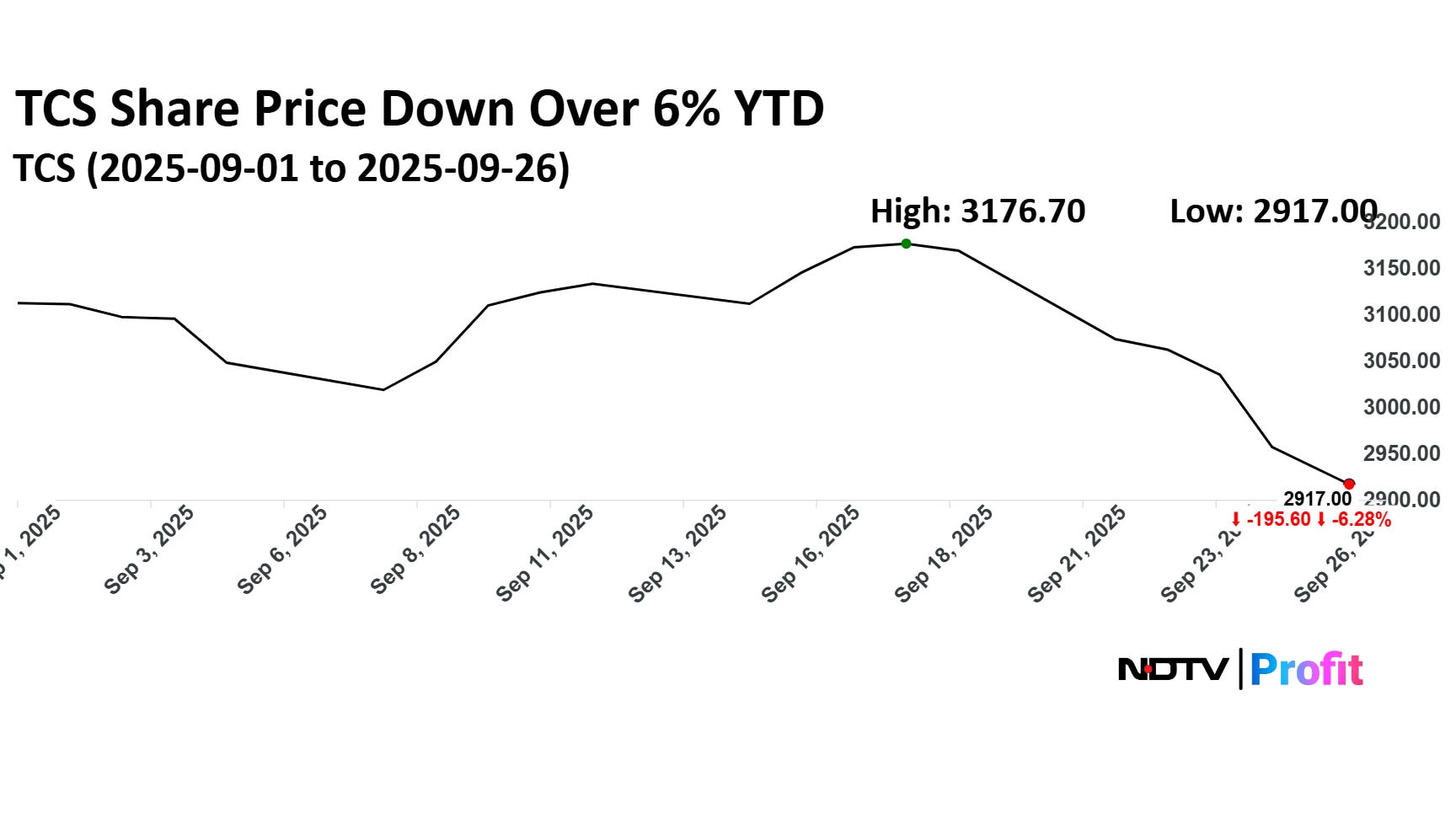

Shares of Tata Consultancy Services Ltd., are trading over 1% lower today, continuing a downtrend that has seen the scrip decline by a substantial 36% from its 52-week high. This decline is part of the broader struggle of the sector as it grapples with multiple macroeconomic, regulatory, and geopolitical pressures. The stock has now entered the oversold territory with its relative strength index falling below 45 to 42.80 levels as of Friday.

The stock is being pulled down by factors, including the muted growth outlook signaled by Accenture results, fresh concerns over the H-1B visa hike and trade policy shifts. Further, there is a general overhang of low growth expectations across the information technology industry.

Global Cues And Uncertainity

A primary factor weighing on the stock is the looming regulatory environment in the United States, particularly the H-1B visa regime.

US President Donald Trump has signed a sweeping proclamation imposing a new $100,000 annual fee for H-1B visa applications—a big shift in U.S. skilled worker immigration policy aimed at curbing abuse and prioritising highly skilled professionals over mass recruitment by outsourcing firms.

TCS, like all major Indian IT firms, relies heavily on this mechanism for its largest market, and any proposed tightening of visa rules can directly impact operational costs and the ability to execute projects onshore. Also adding to this uncertainty is US President's tariffs that has spooked the markets, bringing in a risk-off mood.

Headwinds For The Indian IT Sector

The overall earnings overhang in the IT sector is a critical drag. This pessimism was recently reinforced by the latest quarterly results and guidance from IT bellwether Accenture. Brokerages noted that Accenture's muted growth outlook suggests that demand for large discretionary IT spending remains soft.

This directly fuels expectations that Indian IT firms will continue to experience low growth, leading to Citi and Jefferies expressing caution over the sector's ability to show significant growth acceleration in the coming fiscal years.

Limited Budgets

While some analysts have pointed to pockets of strength, such as the Financial Services vertical, which has higher exposure for companies like TCS, the overall sentiment remains subdued. The persistent worry that technology budgets are still focused on short-term cost takeout projects rather than long-term strategic transformation contributes to the negative outlook, limiting the stock's potential for a significant price-to-earnings ratio expansion.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.