That's all for NDTV Profit's live market coverage on Sept 24. Thank you for joining us today!

Nifty Ends In Red, Above 25,000 Mark

Sensex Closes In Red, Below 82,000 Mark

Nifty Loses For Forth Consecutive Day

Top Nifty Losers TATA MOTORS & Bharat electronics Limited

Smallcap 250 Ends In Red, Drag Led By Balrampur Chini & Regington

Nifty Midcap150 Ends In Red, Drag Led By Godrej Property & Pb Fintech

All Sectors Ends In Red Except Nifty Fmcg

Nifty FMCG Emerges Top Sectoral Gainer, Gains Led By P&G & Hul

Nifty Realty Is The Top Sectoral Loser, Drag By Godrej Property & Dlf

Nifty Metal Snaps Its 4 Day Gaining Streak

Nifty It Falls For 4th Day In A Row

Nifty Realty Falls For 3rd Day In A Row

Nifty Oil & Gas, Pharma Falls For Third Day In A Row

Nifty FMCG Snaps 3 Day Losing Streak

Nifty Ends In Red, Above 25,000 Mark

Sensex Closes In Red, Below 82,000 Mark

Nifty Loses For Forth Consecutive Day

Top Nifty Losers TATA MOTORS & Bharat electronics Limited

Smallcap 250 Ends In Red, Drag Led By Balrampur Chini & Regington

Nifty Midcap150 Ends In Red, Drag Led By Godrej Property & Pb Fintech

All Sectors Ends In Red Except Nifty Fmcg

Nifty FMCG Emerges Top Sectoral Gainer, Gains Led By P&G & Hul

Nifty Realty Is The Top Sectoral Loser, Drag By Godrej Property & Dlf

Nifty Metal Snaps Its 4 Day Gaining Streak

Nifty It Falls For 4th Day In A Row

Nifty Realty Falls For 3rd Day In A Row

Nifty Oil & Gas, Pharma Falls For Third Day In A Row

Nifty FMCG Snaps 3 Day Losing Streak

Rupee closed 7 paise stronger at 88.69 against the greenback

It closed at 88.76 a dollar on Tuesday

Source: Bloomberg

These reforms aim to upgrade Indian shipping and port sector to global benchmarks

Create 30 lakh additional employment

Support overall investment of Rs 4.5 Lakh Crore

Potential to support 4.5 million GT shipbuilding capacity

Potential to reach 8.2 million GT shipbuilding output

Additional port capacity of 250 million MMTPA

Additional vessels: 2,500+

Cabinet Approves Schemes Worth Rs 69,725 Crore For Shipbuilding Sector

Cabinet Approves Bakhtiyarpur-Rajgir-Tilaiya Railway Project Worth Rs 2,192 Crore

Cabinet Approves National Highway Projects Worth Rs 3,822 Crore

Cabinet Approves Railway Productivity-Linked Bonus Worth Rs 1,866 Crore

Cabinet Approves Funds Worth Rs 15,034 Crore For Expanding Medical Education

Cabinet Approves Projects Worth Rs 94,916 Crore

Cabinet Approves CSIR Scheme For Capacity Building & HRD Worth Rs 2,277 Crore

Source: Ashwini Vaishnaw, Miniter of Railways of India, At Cabinet Briefing

GAIL(India) Ltd. has approved capacity expansion of Jamnagar-Loni petroleum prodcut pipeline to 6.5 million ton per annum from 3.25 million ton per annum. The company will invest Rs 5,364 crore for capacity expansion to 6.5 MMTPA from 3.25MMTPA.

Sudarshan Chemical's good pipleline on value ideas are expected to drive meaningful contribution in coming quarters. Market conditions are challenging. However, the company is building on trust and customer relationships.

Markets in UK, Germany, France, and Spain were trading in loss. US Federal Reserve Chair said that asset class is overvalued which weighed sentiment.

The FTSE 100 and CAC 40 were trading 0.15% and 0.21% down, respectively as of 2:45 p.m.

Shares of Wheels India Ltd. are surging in trade on Wednesday, reaching a 52-week high of Rs 911. This comes on the back of a favourable outlook on auto and auto ancillary sectors, following the recent GST cuts implemented by the government, says technical analyst Kush Bohra.

Bohra added that there is strong near-term momentum in the stock, especially after the rally on Wednesday.

VIP Industries' Non-Executive Independent Director Ramesh Damani resigned from the post.

Refex Industries received rs 474 crore order to supply Wind Turbine Generators and Tubular Towers for Wind Power Projects, the company said in the exchange filing.

Banking sector to drive Sensex to high levels along with infra

Bullish on electronics hardware firms like chips

India will become more Defence exporter

The downturns are temporary and will not last long

Economy will continue to do well and markets will recover amid tariff tensions.

Source: Mark Mobius At NDTV Profit

In the Hong Kong, Alibaba Group Holding share price ended near four-year high as it will boost the spending on artificial intelligence. Alibaba Group Holding share price ended 9.72% higher at Hong Kong Dollar 172.90, the highest level since Oct 25, 2021, according to Bloomberg data.

Alibaba Group will increase its spending on AI beyond its intial pledge of $50 billion target.

Markets in Japan recovered from intraday losses to end higher. The Nikkei 225 ended 0.30% higher.

South Korea's KOSPI and China's CSI 300 ended 1.54% and 1.02% higher, respectively.

Jupiter Wagons appointed Vinod Kumar Agarwal as chief financial officer.

Ideaforge Technology's arm signed a joint venture pact with first breach to set up joint venture for manufacturing and distribution of drones in the US.

United Polyfab Gujarat commissions windmill installation in Jamnagar with generation capacity of nearly 2.7 megawatt, the company said in the exchange filing.

Dabur India Ltd. received GST demand of Rs 272 crore from Tax Department, the company said in the exchange filing.

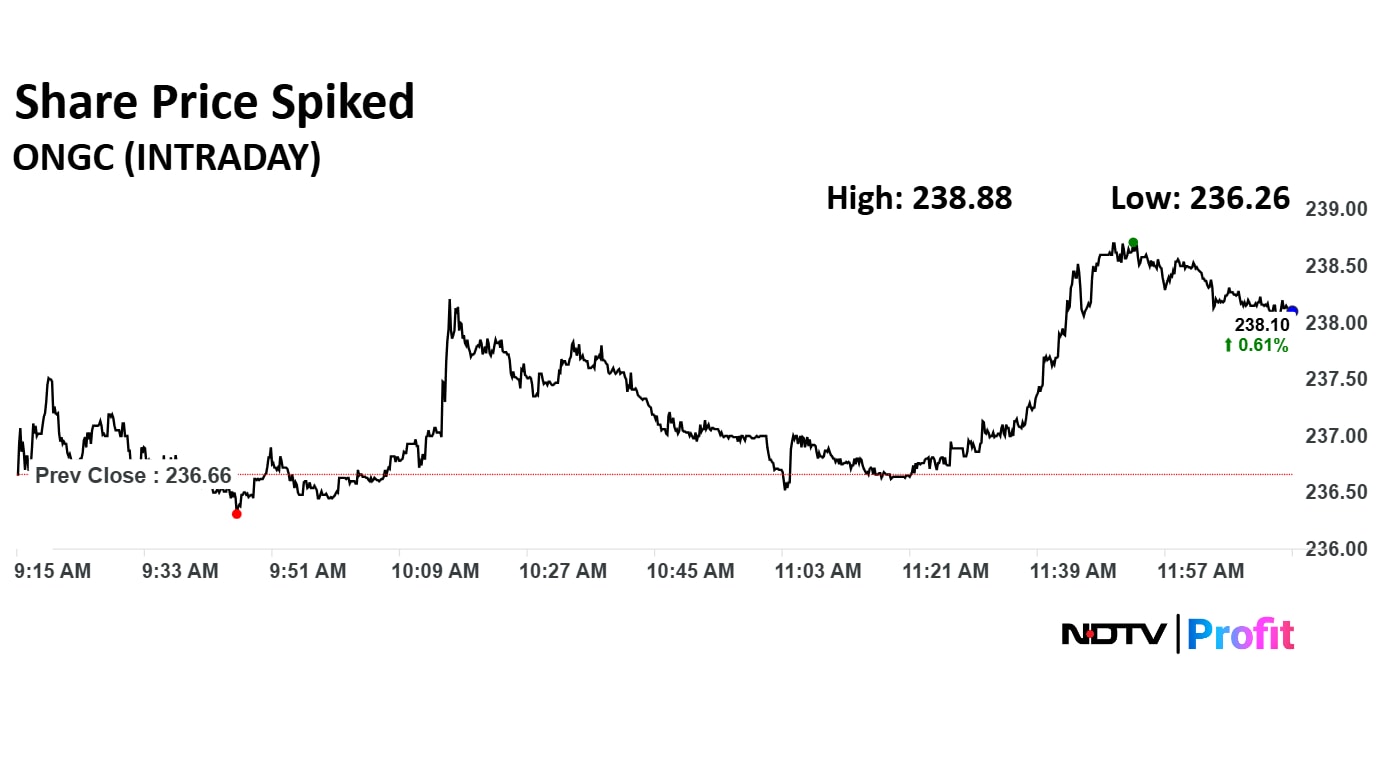

Oil and Natural Gas Corporation Ltd.'s share price rose nearly 1% on Wednesday. The company is targeting the acquisition of 2.5 to 3 gigawatts of renewable energy projects, Bloomberg reported citing a compnay official.

Oil and Natural Gas Corporation Ltd.'s share price rose nearly 1% on Wednesday. The company is targeting the acquisition of 2.5 to 3 gigawatts of renewable energy projects, Bloomberg reported citing a compnay official.

Go Digit General Insurance informed the exchanges that it has received a demand cum show cause notice worth Rs 14.9 crore from New Delhi GST Authority on Wednesday.

Go Digit General Insurance informed the exchanges that it has received a demand cum show cause notice worth Rs 14.9 crore from New Delhi GST Authority on Wednesday.

Adani Ports & Special Economic Zone Ltd. has seen a good upward trajectory, said Vaishali Parekh, Vice President, Technical Research, Prabhudas Lilladher.

SEBI's clean chit is remarkable achievement for Adani Group, said Vinit Bolinjkar, head, reasearch, Ventura Securities

Adani Group has delivered great growth despite the Hindenburg Case, said Ambareesh Baliga, Independent Market Analyst.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Ltd, an Adani Group Company.

Suzlon Ltd. is shifting its international focus away from the United States in light of US President Donald Trump raising tariffs on India. Instead, the clean energy company will focus more on other markets such as the European Union, South Africa and Australia, according to Chief Executive Officer JP Chalasani.

“We are now looking for geographical expansion of exports,” Chalasani told NDTV Profit in an interview.

Indian Markets Awoke To Headlines That Reverberated Beyond Dalal Street On Jan 24, 2023

Hindenburg’s Report Was Not Merely A Critique Of Your Adani Group

Hindenburg’s Report Was Direct Challenge To Audacity Of Indian Cos To Dream On Global Scale

Hindenburg Report Marked Beginning Of A Test That Pushed Every Dimension Of Our Resilience

Last Week, SEBI Delivered Resounding & Unequivocal Verdict Dismissing Allegations Against Us

With SEBI’s Clear And Final Word, Truth Has Prevailed

What Was Meant To Weaken Us Has Instead Strengthened The Very Core Of Our Foundations

This Moment Is More Than Regulatory Clearance, It Is Powerful Validation Of Transparency

Truest Evidence Of Our Resilience Lies Not In Word Words, But In Performance Over This Period

Portfolio EBITDA Rose From Rs 57,205 Crore In FY23 To Rs 89,806 Crore In FY25

Absolute Growth In Portfolio EBITDA Stands At 57%, 2-Year CAGR At 25%

Gross Block Expanded From Rs 4.12 Lakh Crore In FY23 To Rs 6.1 Lakh Crore In FY25

Disclaimer: NDTV is a subsidiary of AMG Media Networks Ltd, an Adani Group Company.

Edelweiss Financial Services announced public issuance of non-convertible debentures, aggregating upto Rs 300 crore, the exchange filing said.

India's government is considering a significant policy shift to increase the foreign investment limit in Public Sector Undertaking banks, a move that could trigger substantial passive inflows and is part of a broader economic reform agenda, according to a report by The Economic Times.

The proposal would raise the foreign portfolio investor limit from the current 20% to as high as 49%, while the government would retain a majority stake of over 51%. This move is expected to bring significant capital into the banking sector, particularly for banks included in key global indices.

The cement sector could prove to be resilient in the upcoming earnings season, according to Goldman Sachs.

Goldman Sachs has a 'buy' rating on UltraTech Cement Ltd., 'neutral' rating on Shree Cements Ltd., Dalmia Cement Ltd. and JSW Cement Ltd.

Price sustainability in July or August, despite weaker than expected volumes in a seasonally weak quarter, has driven stable operational numbers for Indian cement companies.

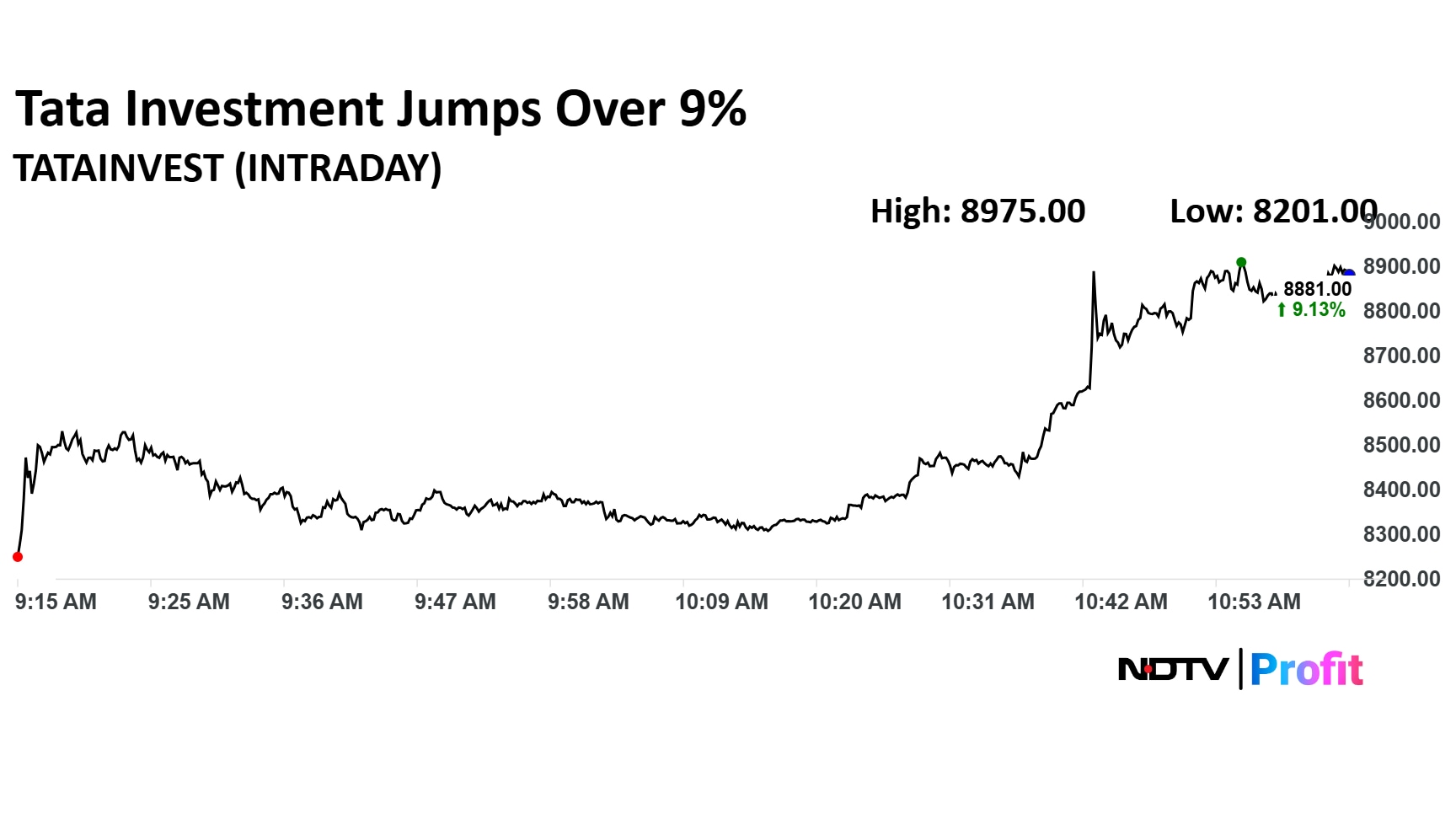

Tata Investment jumped 10.29% to Rs 8,975.00 apiece, the highest level since March 11, 2024. The company had announced the record date of stock split on Monday, fixing it as Oct. 14, 2025.

Tata Investment jumped 10.29% to Rs 8,975.00 apiece, the highest level since March 11, 2024. The company had announced the record date of stock split on Monday, fixing it as Oct. 14, 2025.

CESC Ltd. will issue 30,000 non-convertible debentures worth Rs 300 crore on private placement basis, the company said on the exchange filing.

Kaynes Technology India re-designated Managing Director Ramesh Kunhikannan as executive vice chairman.

Muthukumar Narayanaswamy will take over as managing director

Dr Lal PathLabs approved to acquire immovable property in New Delhi for Rs 74.51 crore, the company said in the exchange filing.

KRBL appointed AZB & Partners as independent law firm to understake thorough review of observations. AZB & Partners to submit report to relevant board committee, the company said in the exchange filing.

Directorate General of Trade Remedies has started an anti-dumping investigation on Ethambutol Hydrochloride imports.

Ethambutol Hydrochloride treats tuberculosis. Probe aims to protect domestic manufacturers of this key tuberculosis drug ingredient.

Lupin, Themis Medicare could benefit from reduced import pressure.

Aarti Pharmalabs's promoter Safechem Enterprises sold 1.89% in the company. The promoter holds 42.4% stake post stake sale, the company said in the exchange filing.

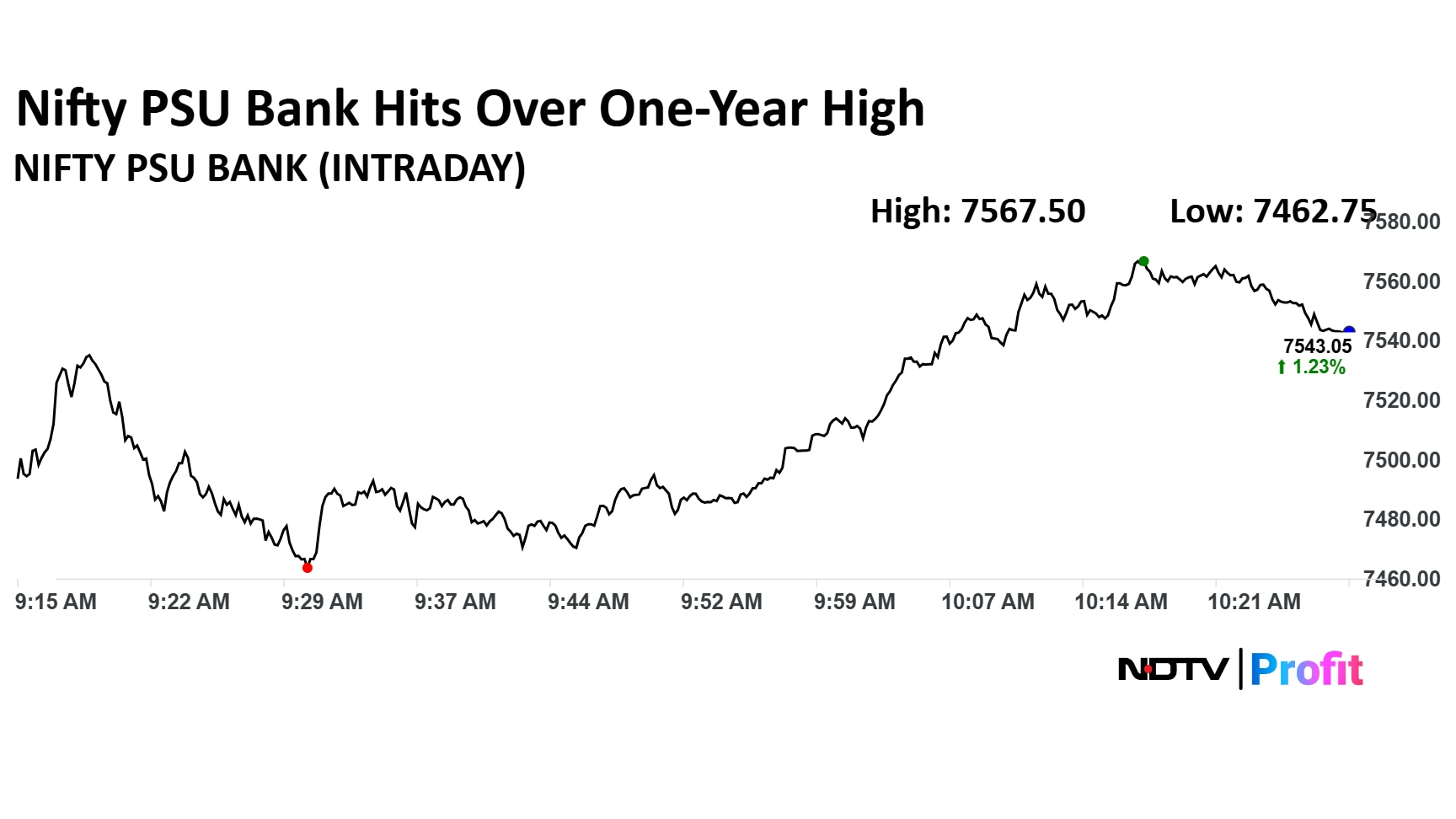

The NSE Nifty PSU Bank rose 1.56% to 7,567.5, the highest level since June 19, 2024. Indian Bank, Indian Overseas Bank, and Canara Bank are top gainers in the Nifty PSU Bank index.

India's government is considering a significant policy shift to increase the foreign investment limit in Public Sector Undertaking banks, a move that could trigger substantial passive inflows and is part of a broader economic reform agenda, according to a report by The Economic Times.

The NSE Nifty PSU Bank rose 1.56% to 7,567.5, the highest level since June 19, 2024. Indian Bank, Indian Overseas Bank, and Canara Bank are top gainers in the Nifty PSU Bank index.

India's government is considering a significant policy shift to increase the foreign investment limit in Public Sector Undertaking banks, a move that could trigger substantial passive inflows and is part of a broader economic reform agenda, according to a report by The Economic Times.

Swan Defence has signed a memorandum of understanding with Europe's Royal IHC to design and build offshore oil and gas vessels, the company said in the exchange filing.

HSBC has upgraded Indian equities from 'neutral' to 'overweight', saying that the market now looks attractive on a regional basis after a year of underperformance, with a Sensex price target of 94,000.

The Indian equity market has seen tremendous weakness since mid-September. 2024, ranking among the world's worst performers. But HSBC analyst Herald Van Der Linde, in the Asia Strategy note, says the pain is over and valuations are no longer a concern.

Gold has actually outperformed the BSE Sensex without any real cash flow.

No surprise that gold has risen the way it has since there are plenty of triggers.

Currencies are being run on faith. Currency is a "store of value" and a "medium of exchange" and gold is taking over the "store of value" aspect of it.

The initial public offering (IPO) of Jaro Institute, which opened on Tuesday, September 23, was subscribed 0.87 times on the first day.

The unlisted shares have been trading at a premium in the grey market (GMP), indicating positive listing gains for investors.

Amid the ongoing subscription, the GMP as well as the Day 2 subscription status of Jaro Institute of Technology Management and Research Limited are in focus today. Here’s a look at what the latest trends indicate for the IPO.

VMS TMT listed at Rs 104.9 apiece on National Stock Exchange compared to issue price of Rs 99 apiece. This indicated a premium of 5.96%.

VMS TMT listed at Rs 105 apiece on BSE, which indicated a premium of 6.06%.

Larsen & Toubro Ltd. is in pact with Bharat Electronics Ltd. to support advanced medium combat aircraft program for Indian Air Force. The consortium to participate in expression of interest notice issued by the Government.

Larsen & Toubro Ltd. will jointly contribute to India's fifth generation fighter aircraft, the company said in the exchange filing.

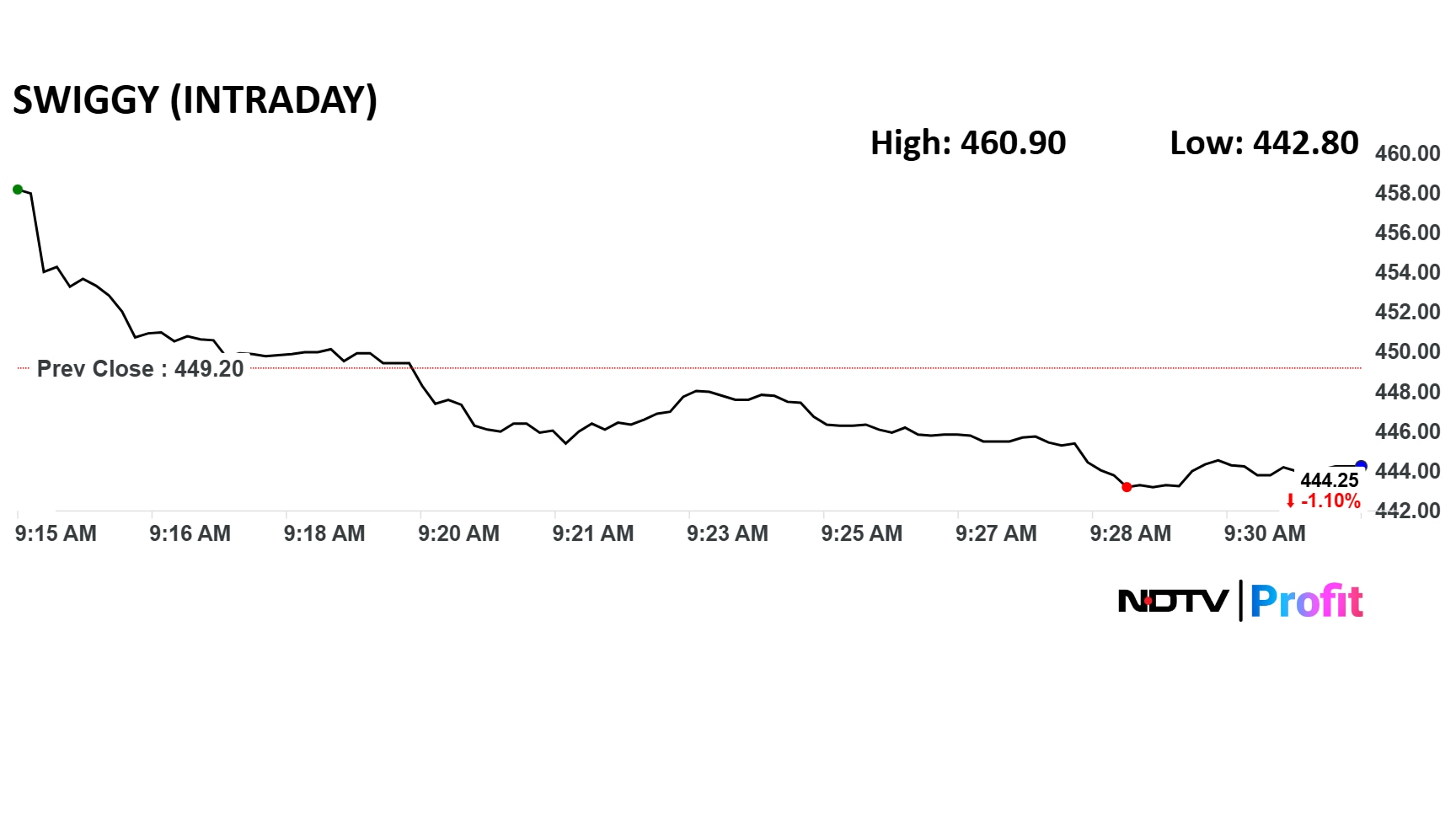

Shares of Swiggy rose during early trade on Wednesday after the board approved to separate quick commerce business 'Instamart' through a slump sale and the fully divest its stake in Rapido to Prosus and WestBridge for a total consideration of Rs 2,400 crore.

The stock rose as much as 2.6% to 460.9 apiece on the NSE, before slipping into red. The benchmark Nifty 50 was down 0.35%. The relative strength index was 56 and the total traded turnover was Rs 214 crore.

Shares of Swiggy rose during early trade on Wednesday after the board approved to separate quick commerce business 'Instamart' through a slump sale and the fully divest its stake in Rapido to Prosus and WestBridge for a total consideration of Rs 2,400 crore.

The stock rose as much as 2.6% to 460.9 apiece on the NSE, before slipping into red. The benchmark Nifty 50 was down 0.35%. The relative strength index was 56 and the total traded turnover was Rs 214 crore.

"Having broken below key technical zones, indices could stay under pressure unless there is strong confirmation above resistances. For now, a “sell on strength” or range-play approach is prudent."Amruta Shinde, Technical, Research Analyst, Choice Broking

Suzlon Energy will start order supply from next quarter.

The company added order of around 1GW in last 40 days.

GST, ALMM will boost demand for renewable Energy.

Suzlon Energy is on track of 60% growth for FY26

Source: Group CEO JP Chalasani At NDTV Profit

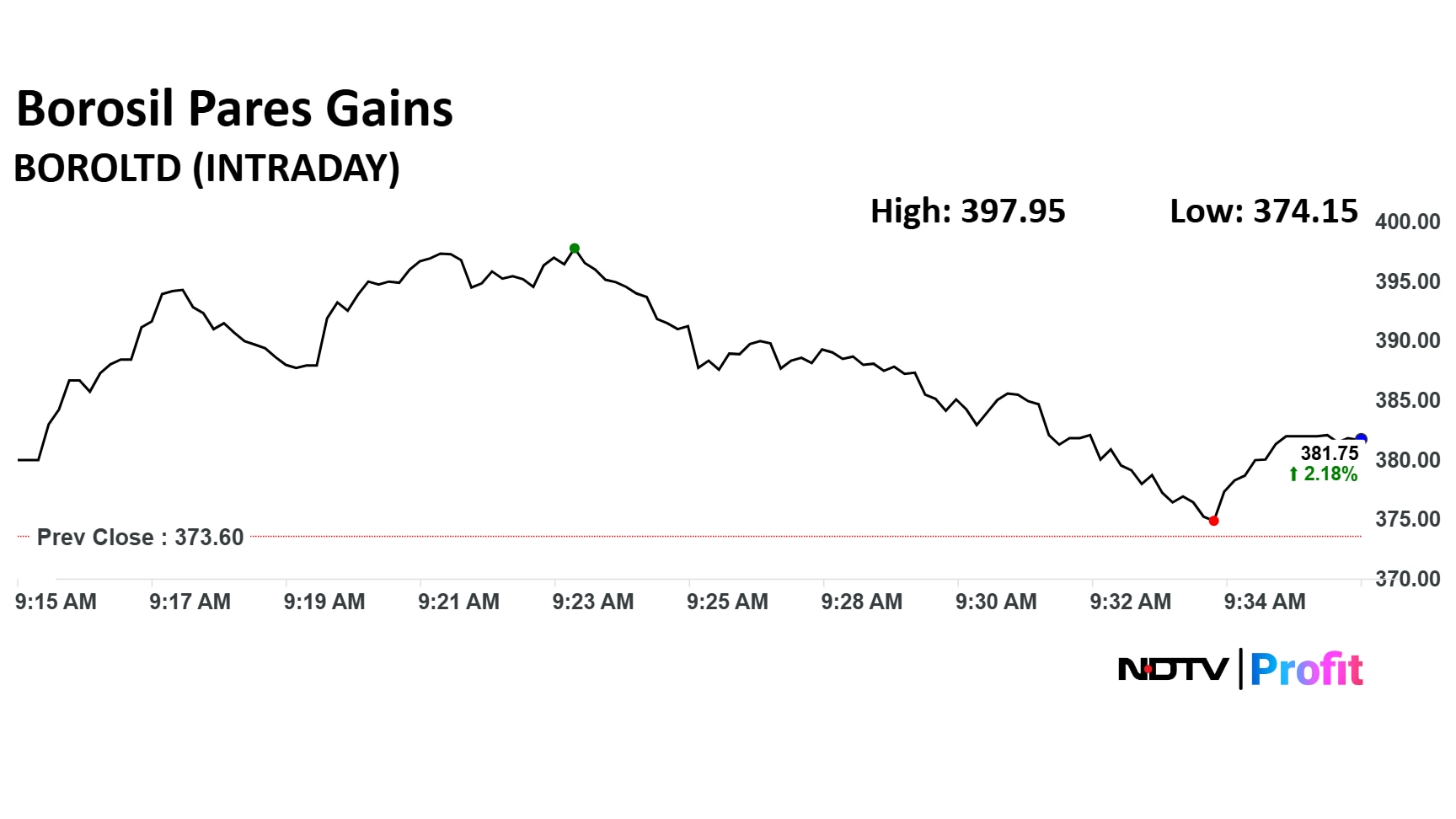

Borosil share price jumped 6.52% to Rs 397.95 apiece, the highest level since Feb 7. It pared gains to trade 2.21% higher at Rs 381.85 apiece as of 9:39 a.m.

Borosil share price jumped 6.52% to Rs 397.95 apiece, the highest level since Feb 7. It pared gains to trade 2.21% higher at Rs 381.85 apiece as of 9:39 a.m.

Ashok Leyland Ltd. share price fell are trading with cuts of almost 2.5% in Wednesday morning trade following a Goldman Sachs note, which downgraded the stock to 'neutral', although the target price of Rs 140 has remained unchanged.

Goldman Sachs note cited a likely shift in the broader economy away from capital expenditure towards consumption, a trend that may favour passenger cars over commercial vehicles.

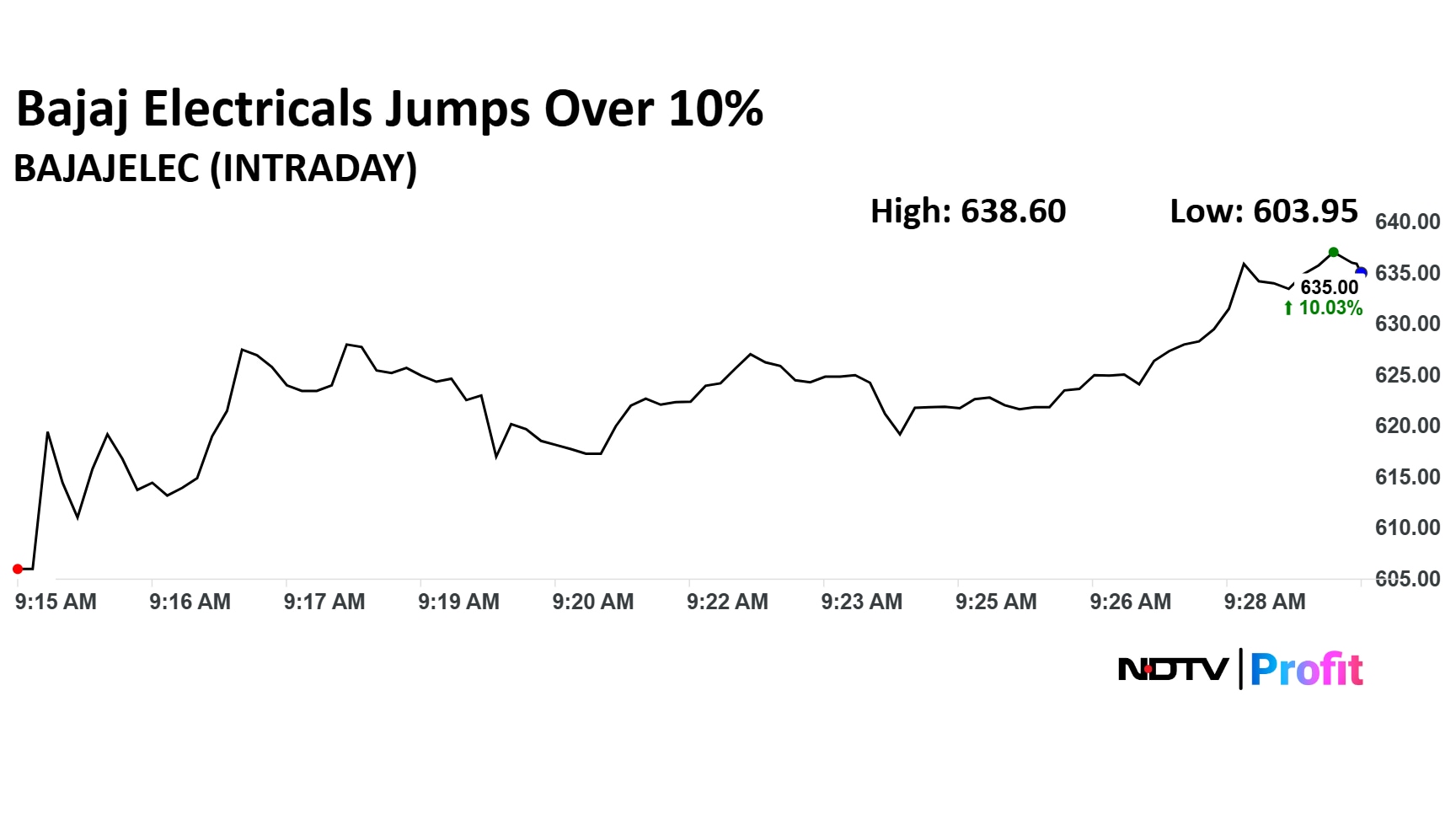

Bajaj Electricals Ltd. share price jumped 11.60% to Rs 638.60 apiece, the highest level since July 28. Its board has approved a proposal to acquire the ‘Morphy Richards’ brand and related intellectual property rights for Rs 146 crore in India and neighboring territories from Glen Electric Limited, subject to approvals.

Bajaj Electricals Ltd. share price jumped 11.60% to Rs 638.60 apiece, the highest level since July 28. Its board has approved a proposal to acquire the ‘Morphy Richards’ brand and related intellectual property rights for Rs 146 crore in India and neighboring territories from Glen Electric Limited, subject to approvals.

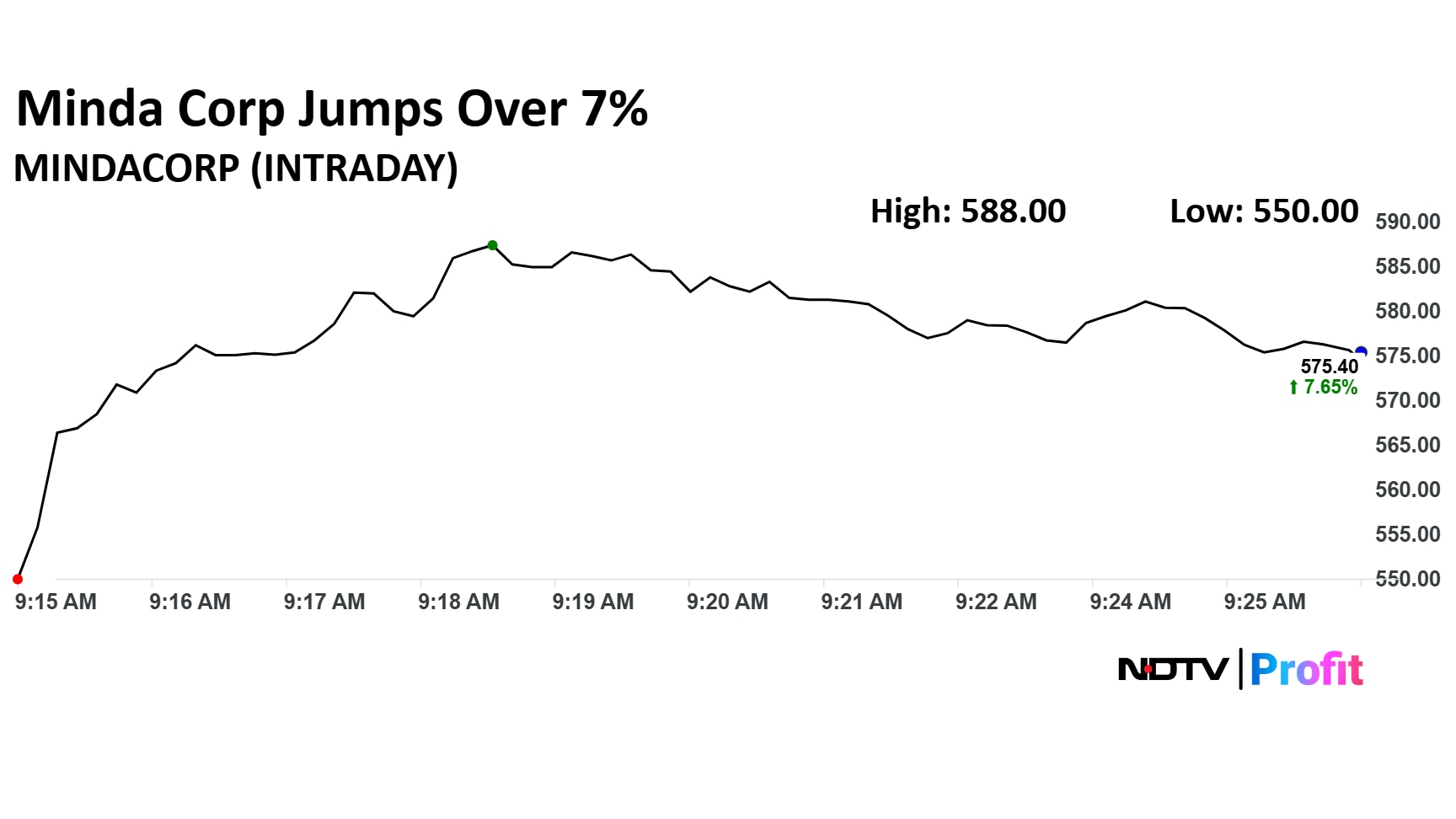

Minda Corp share price jumped 10.01% to Rs 588 apiece, the highest level Jan 21, 2025. The company has successfully allotted 5,000 non-convertible debentures with a total value of Rs 50 crore.

Minda Corp share price jumped 10.01% to Rs 588 apiece, the highest level Jan 21, 2025. The company has successfully allotted 5,000 non-convertible debentures with a total value of Rs 50 crore.

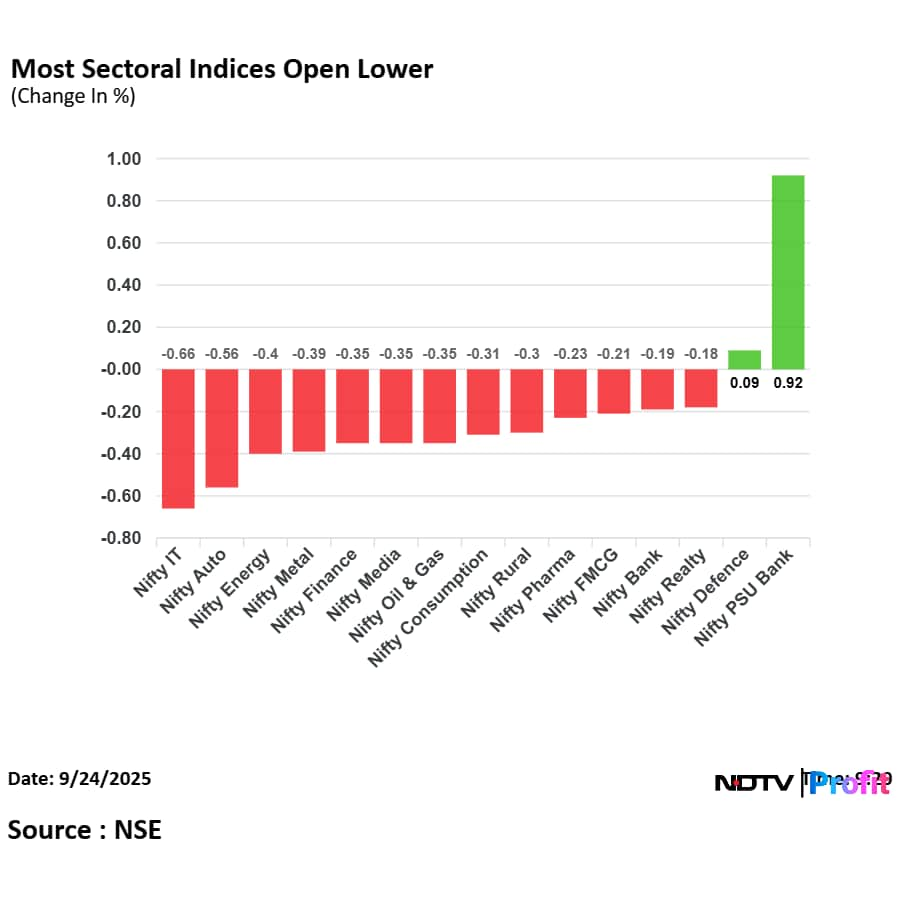

On National Stock Exchange, 13 sectoral indices declined, two advanced out of 15. The NSE Nifty PSU Bank advanced the most, while the NSE Nifty IT remained under pressure.

On National Stock Exchange, 13 sectoral indices declined, two advanced out of 15. The NSE Nifty PSU Bank advanced the most, while the NSE Nifty IT remained under pressure.

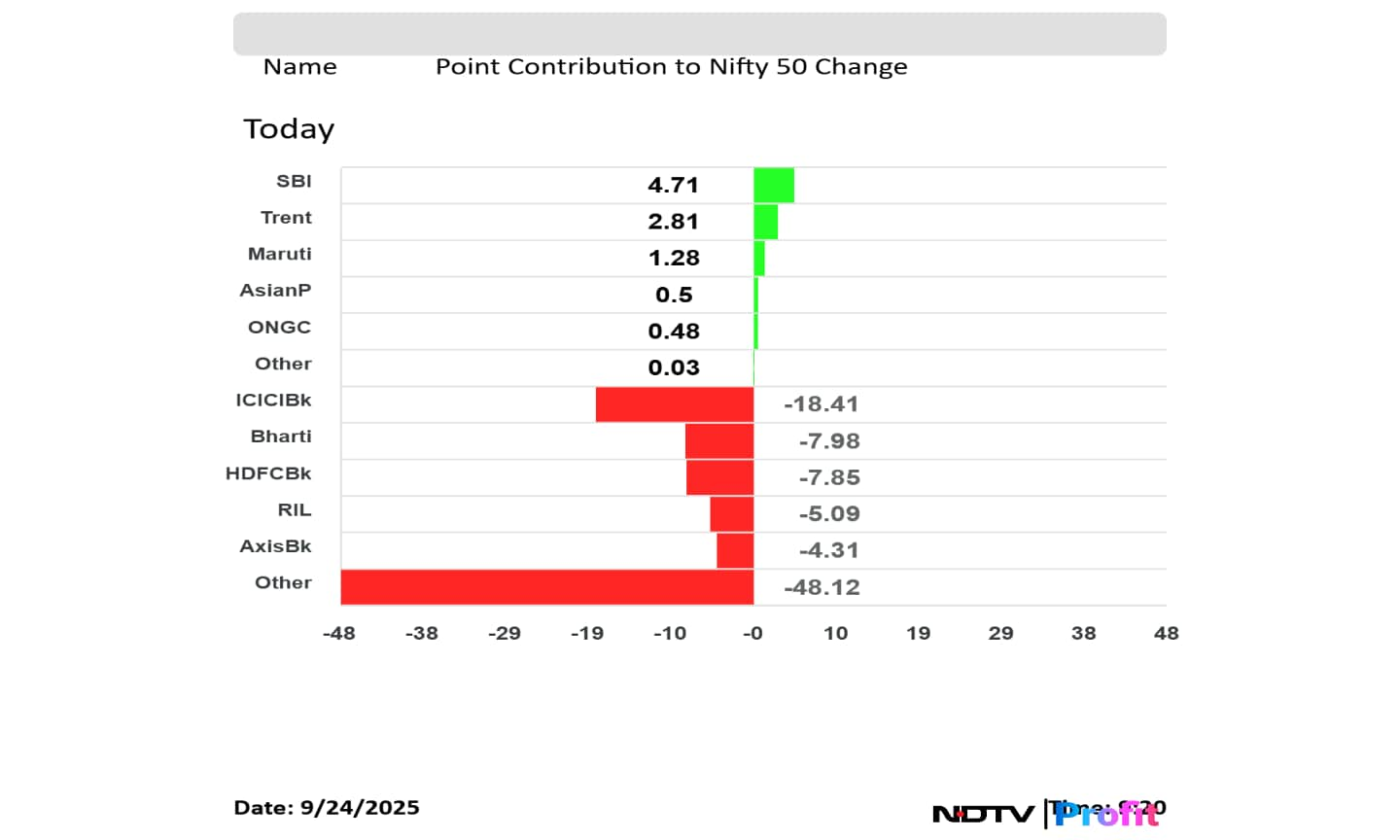

ICICI Bank Ltd., Bharti Airtel Ltd., HDFC Bank Ltd., Reliance Industries Ltd., and Axis Bank Ltd. weighed on the NSE Nifty 50 index.

State Bank of India, Trent Ltd., Maruti Suzuki India Ltd., Asian Paints India Ltd., and Oil and Natural Gas Corp added to the NSE Nifty 50 index.

ICICI Bank Ltd., Bharti Airtel Ltd., HDFC Bank Ltd., Reliance Industries Ltd., and Axis Bank Ltd. weighed on the NSE Nifty 50 index.

State Bank of India, Trent Ltd., Maruti Suzuki India Ltd., Asian Paints India Ltd., and Oil and Natural Gas Corp added to the NSE Nifty 50 index.

The NSE Nifty 50 and BSE Sensex extended losses tracking a decline in ICICI Bank Ltd., HDFC Bank Ltd., and Bharti Airtel Ltd. share prices. The indices were trading 0.31% and 0.12% down, respectively as of 9:18 a.m.

Asian share indices were trading with losses after US Federal Reserve Chair said that equities are overvalued; and the path to reduce rate is not going to be risk-free.

The NSE Nifty 50 and BSE Sensex extended losses tracking a decline in ICICI Bank Ltd., HDFC Bank Ltd., and Bharti Airtel Ltd. share prices. The indices were trading 0.31% and 0.12% down, respectively as of 9:18 a.m.

Asian share indices were trading with losses after US Federal Reserve Chair said that equities are overvalued; and the path to reduce rate is not going to be risk-free.

The yield on the 10-year bond opened flat at 6.47%

Source: Bloomberg

Rupee opened flat at 88.76 against the greenback

Source: Bloomberg

India now appears attractive on a regional basis

Upgrade to Overweight from Neutral; Sensex target at 94,000

Local investors have remained resilient

Earnings growth expectations can fall a little further

Valuations are no longer a concern

Government policy is becoming a positive factor for equities

Most foreign funds are lightly positioned

In a major development, the US government has proposed sweeping changes to the H-1B visa programme, aiming to do away with the traditional lottery system in order to accommodate a weighted-selection process that prioritises higher-skilled and higher-paid foreign workers.

This comes on the back of US President Donald Trump's recent move to levy a $100,000 one-time fee for fresh H-1B visa petitioners. The move was made to tighten restrictions around the H-1B visa programme and promote 'American workers'.

Shares of Swiggy will be in focus on Wednesday after the board approved to separate quick commerce business 'Instamart' through a slump sale and the fully divest its stake in Rapido to Prosus and WestBridge for a total consideration of Rs 2,400 crore.

The board approved the slump sale of the Instamart on Sept. 23 to Swiggy Instamart, an indirect step-down wholly-owned subsidiary of the company.

BMW Ventures Ltd.'s initial public offering to raise up to Rs 231.66 crore will open on Wednesday, Sept. 24 and close on Friday, Sept. 26. The price band has been set at Rs 94 to Rs 99 per share.

The Bihar-based company's IPO will comprise only a fresh issue of 2.34 crore equity shares, with no offer for sale component. The market capitalisation based on the upper price band of BMW Ventures is Rs 858.48 crore.

Nifty Sep futures is down by 0.10% to 25,252 at a premium of 83 points.

Nifty Sep futures open interest down by 2.70%.

Nifty Options 30th Sep Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank, Sammaan Capital, HFCL

Nifty Sep futures is down by 0.10% to 25,252 at a premium of 83 points.

Nifty Sep futures open interest down by 2.70%.

Nifty Options 30th Sep Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank, Sammaan Capital, HFCL

Personal loans are one of the most popular financial tools nowadays. Whether it's for home renovation, medical emergencies, travel, or even debt consolidation, they provide quick access to funds without requiring collateral.

Yet, despite their convenience, many people hesitate to apply for personal loans because of myths and misconceptions. Some think getting a loan is difficult, while others worry it will hurt their credit score.

The initial public offering (IPO) of Saatvik Green Energy was subscribed 6.57 times on the third and final day of bidding on September 23.

The issue received bids for 9,38,08,672 shares against 1,42,71,970 offered.

The Qualified Institutional Buyers (QIBs) booked the issue 10.84 times. The Non-Institutional Investors’ (NIIs) category was subscribed 10.04 times. Retail investors booked their quota 2.66 times.

The GIFT Nifty was trading 0.10% or 26 points lower at 25,190 as of 7:57 a.m., which indicated a slight lower open for the benchmark NSE Nifty 50 index.

The NSE Nifty 50 ended lower for the second straight session on Monday with investor sentiment cautious amid concerns over currency depreciation, foreign institutional investor outflows, and global policy uncertainties, according to analysts.

The benchmark, which closed 0.13% lower at 25,169.50, formed a second consecutive high wave candle with a lower high and lower low in the daily chart, Bajaj Broking said. "The Nifty on expected lines is seen consolidating in a range for the third session in a row. We expect it to extend the same and trade in the range of 25,500–25,000 in the coming sessions."

"Investor sentiment in the domestic market remains underpinned by an expected pickup in growth supported by tax reforms and the recent GST cut that are set to fuel consumption. However, persistent foreign fund outflows, a record-weak rupee at 88.78/USD, and stretched valuations are keeping investor sentiment cautious. Adding to the volatility are global headwinds—from U.S. tariff threats to visa fee hikes, which are putting additional pressure on the IT stocks and other export linked sectors."Ponmudi R, CEO of Enrich Money

"A sustained move above 25,100 could spark a rebound towards 25,300–25,350, while failure to hold 25,080 may drag the index lower to 25,000–24,950. With GIFT Nifty pointing to a flat start, the market tone remains delicately balanced—slightly bullish above 25,100, but vulnerable if 25,080 is breached."Hariprasad K, Analyst and Founder, Livelong Wealth

"The RBI appears to be allowing gradual weakening of the rupee, intervening selectively to smooth volatility rather than attempting to defend a fixed level. The Indian rupee dropped to new record lows today, trading around 88.80 as multiple external pressures converged. Despite the depreciation, implied volatility in options markets remains relatively modest, suggesting that investor behavior is cautious but not panicked."Abhishek Goenka, Founder & CEO, IFA Global.

"The Indian rupee fell to record lows of 88.80 as tariff issues and US H-1B visa fees issues continued to rattle the Indian markets with FPIs taking money off the markets continuously sighting that Indian exports will get severely affected by the twin issues. The RBI was conspicuous by its absence in the fall of rupee probably trying to help exporters to some extent to mitigate the after effects of the tariffs on the Indian exports. The Rupee has been at record lows against the three major currencies it trades in mainly viz dollar, pound and the Euro."Anil Kumar Bhansali, Treasury Head At Finrex

Union Commerce Minister Piyush Goyal's trade talk meeting in New York on Monday went "well", NDTV sources confirmed. They added that further meetings could be potentially expected while Commerce Minister is in the US.

Sources also expressed optimism about reaching a bilateral trade deal with the US in the fall, despite the slew of summer hurdles and additional tariff complications introduced by President Donald Trump.

E.I.D. Parry India Ltd. dissolved and sold assets of arm Alimtec S.A. The arm has no contributrion to company's revenue and income.

Prime Focus's board allotted 18.8 crore shares at Rs 120 apiece issue price on a preferential basis. It acquires 12.53% stake in Luxembourg's DNEG.

Vedanta clarified that the government denied application for extension of production sharing contract of block CB-OS/2. The company is engaging with respective authorities, evaluating resources available to resolve concerns.

Vedanta clarified on reports of government denying extensions for Cambay Basin oil block, the company said in the exchange filing.

Jain Resource Recycling Ltd. has raised Rs 562.5 crore from anchor investors on Tuesday, ahead of its initial public offering. The company allotted 2.42 crore shares at Rs 232 apiece to 40 anchor investors.

Goldman Sachs Funds- Goldman Sachs India Equity Portfolio got the highest allocation of 10.67%. Axis Mutual Fund Trustee Ltd.'s fund got the second highest allotment of 9.60% and HDFC Mutual Fund- HDFC Manufacturing Fund got 8.89% stake in the company.

Oil prices rose for a second session on Wednesday after US President Donald Trump continue his rhetoric on Russia and as a deal to resume oil exports from Iraq's Kurdistan did not come through.

Brent crude was trading flat at $67.86 a barrel as of 6:59 a.m.

Markets in Japan, Australia, and South Korea fell, tracking a Wall Street decline, after the US Federal Reserve Chair Jerome Powell said that stocks are overvalued. He also said that that path to rate reduction is nit clear.

The Nikkei 225 and KOSPI were trading 0.11% and 0.47% down, respectively as of 6:53 a.m. The S&P ASX 200 was trading 0.73% down.

The GIFT Nifty was trading 0.11% or 28 points down at 25,216.50 as of 6:31 a.m. This implied that the NSE Nifty 50 will likely open on negative note.

Traders will keep an eye on Infosys Ltd., Minda Corp Ltd., HCLTech Ltd., ICICI Bank Ltd., and Tech Mahindra Ltd. in Wednesday's session.

The Nifty 50 and Sensex ended slightly lower on Tuesday, tracking a decline in HDFC Bank Ltd., and ICICI Bank Ltd. The indices closed 0.13% and 0.07% down, respectively.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.