Overseas investors turned net sellers on Thursday after two days of buying.

Foreign portfolio investors sold stocks worth Rs 964.47 crore, according to provisional data from the National Stock Exchange. Domestic institutional investors stayed net buyers for the eighth day and mopped up equities worth Rs 1,352.44 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 4,073 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The local currency closed 3 paise weaker against the U.S. Dollar at 83.47.

It closed at 83.44 on Tuesday.

Source: Bloomberg

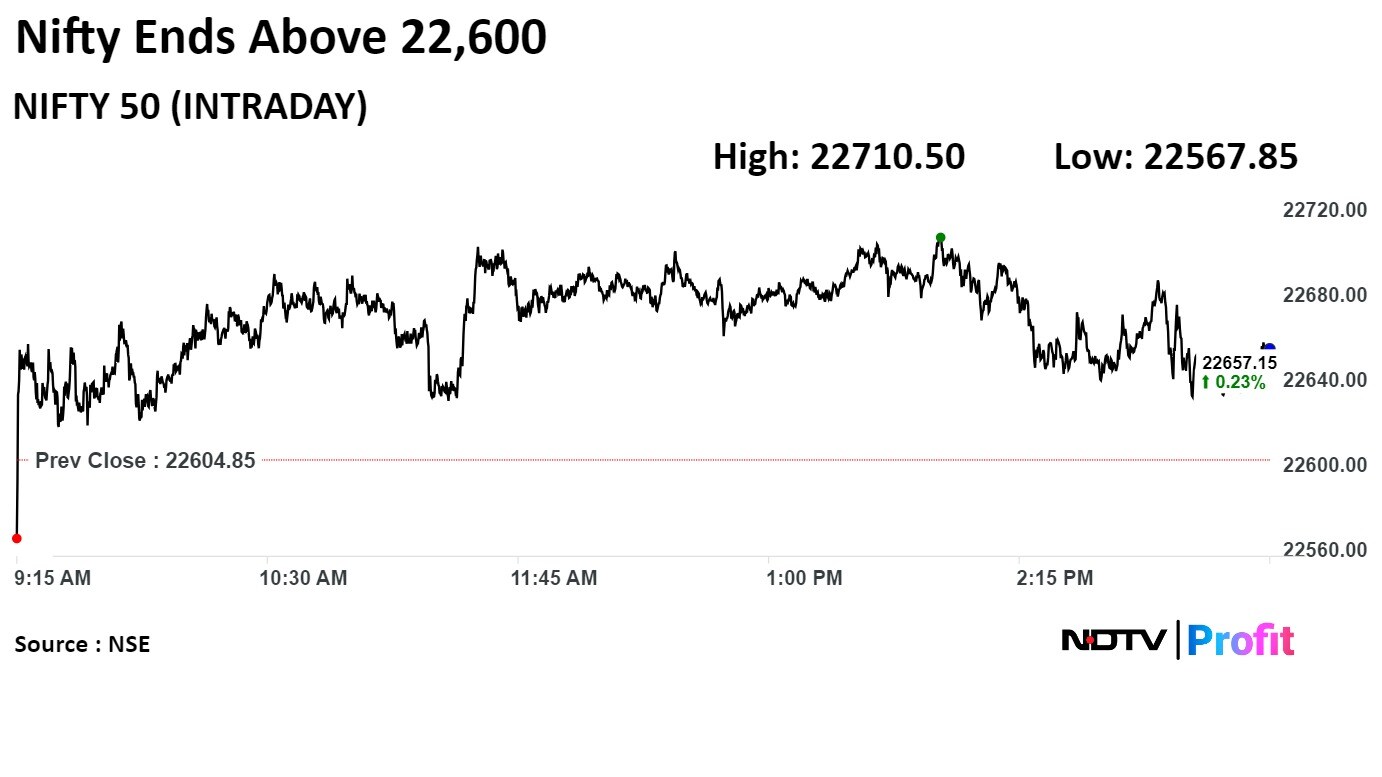

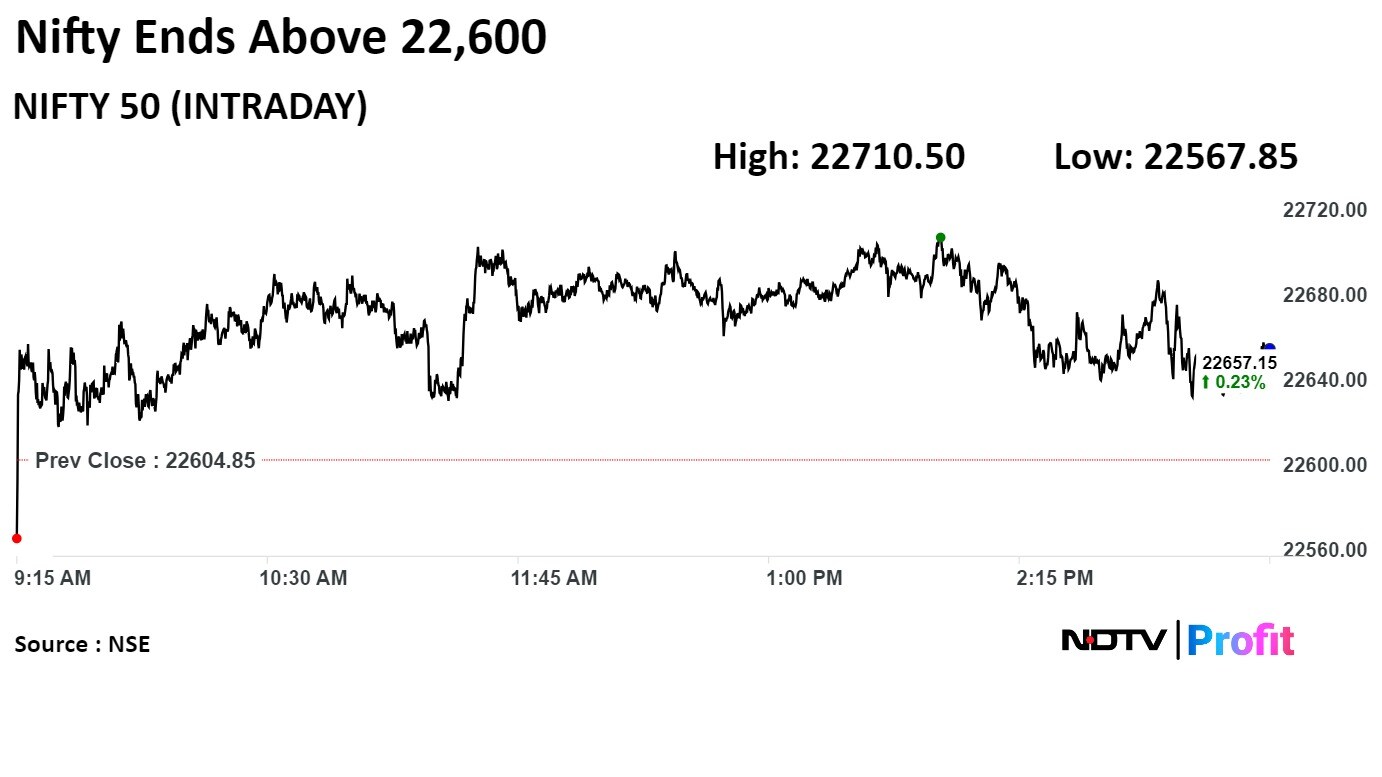

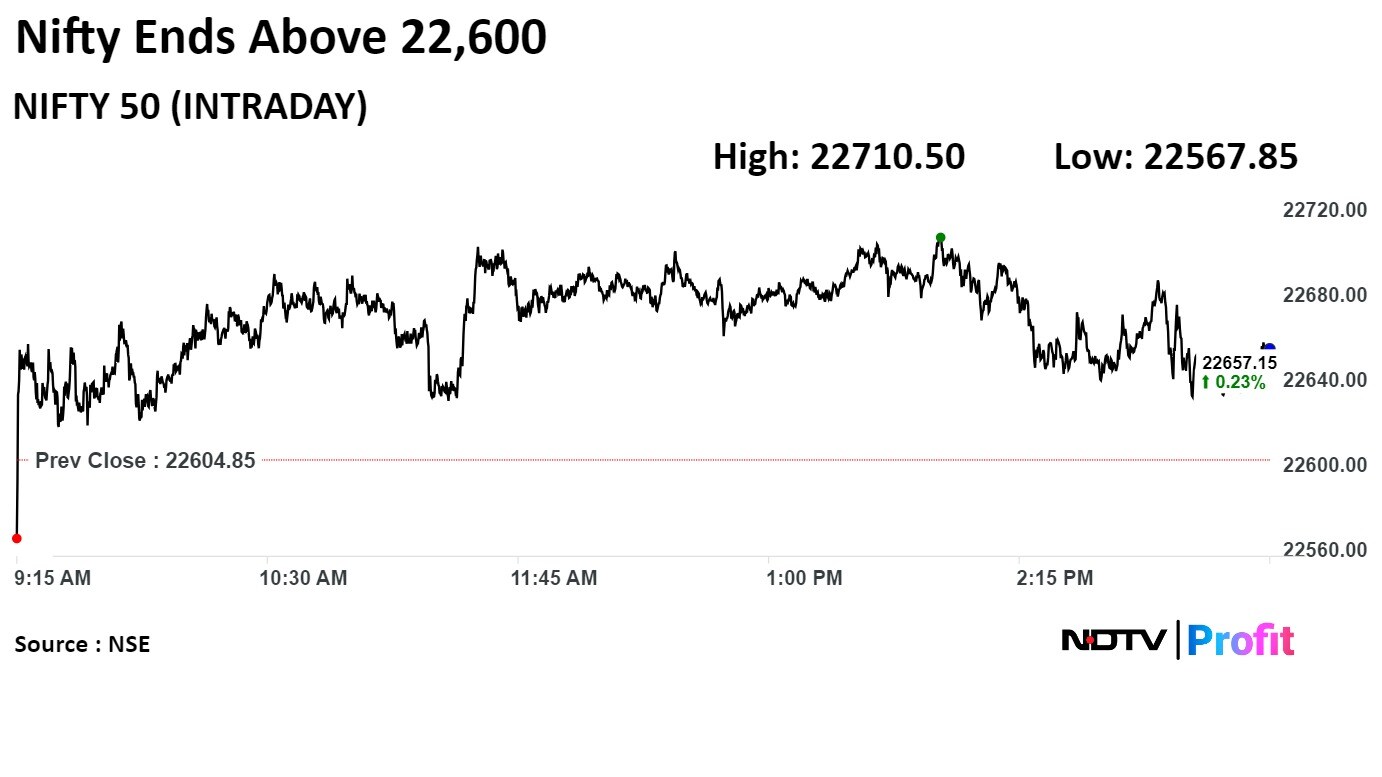

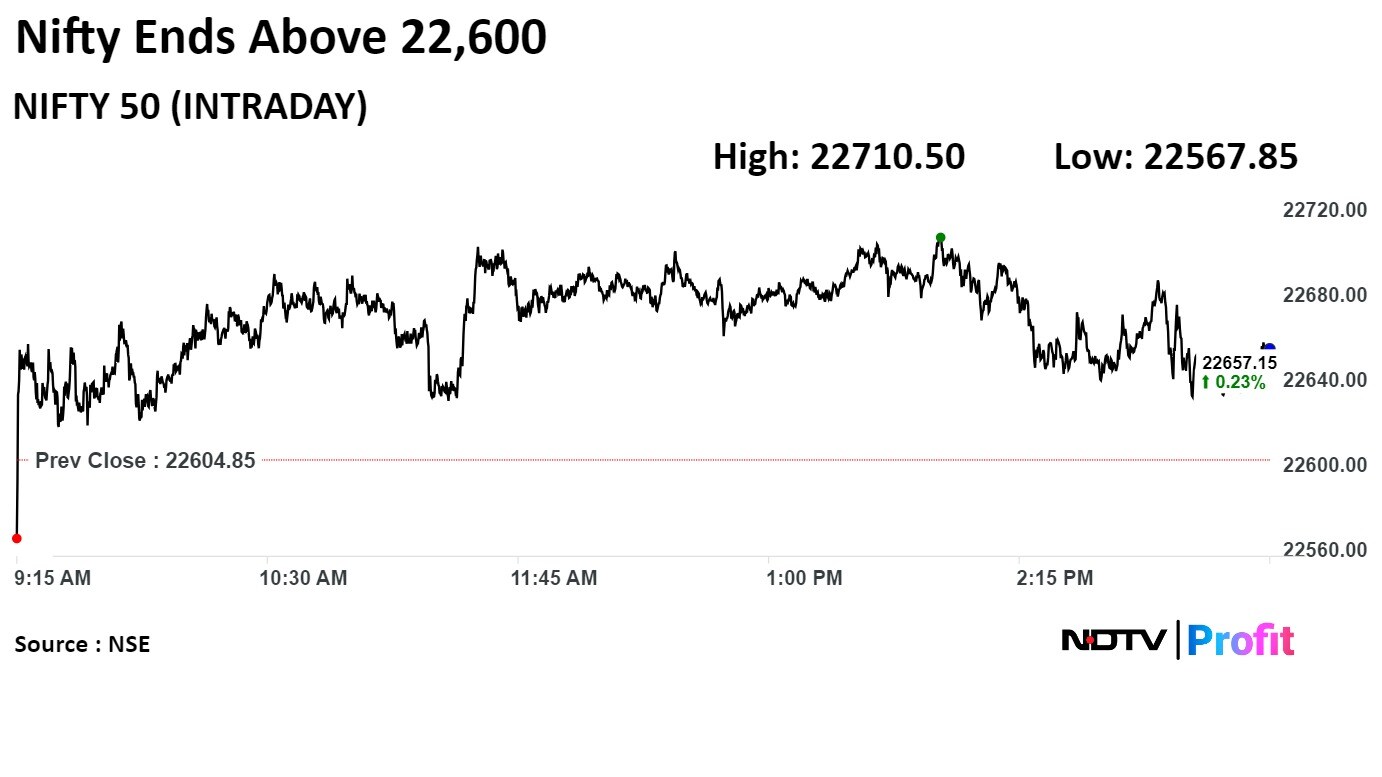

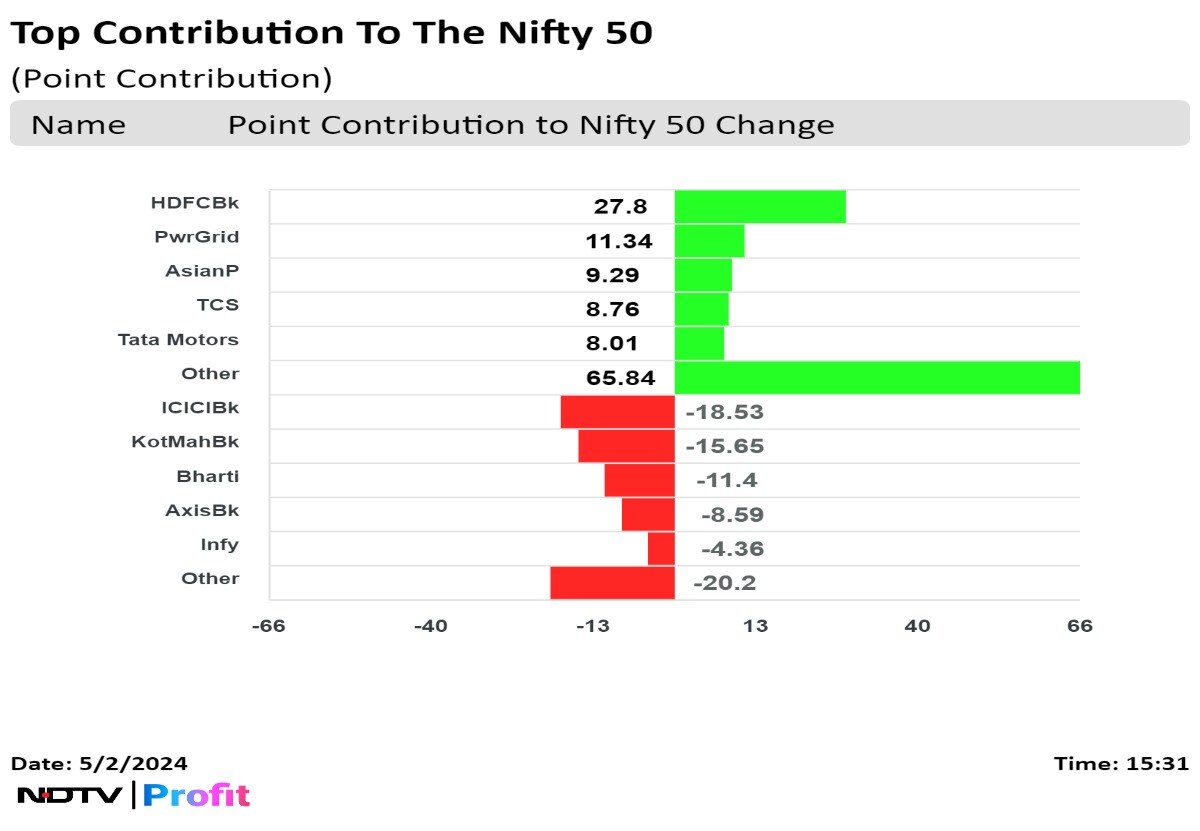

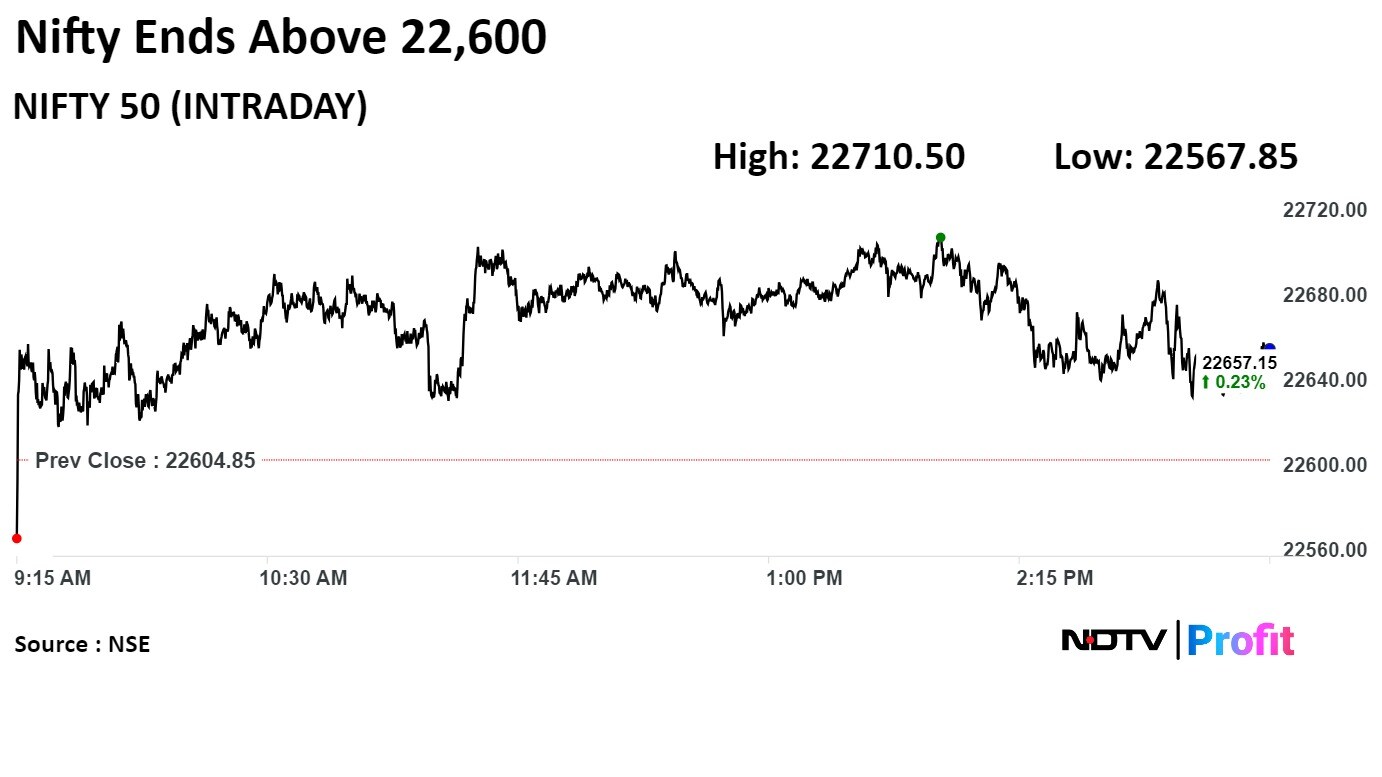

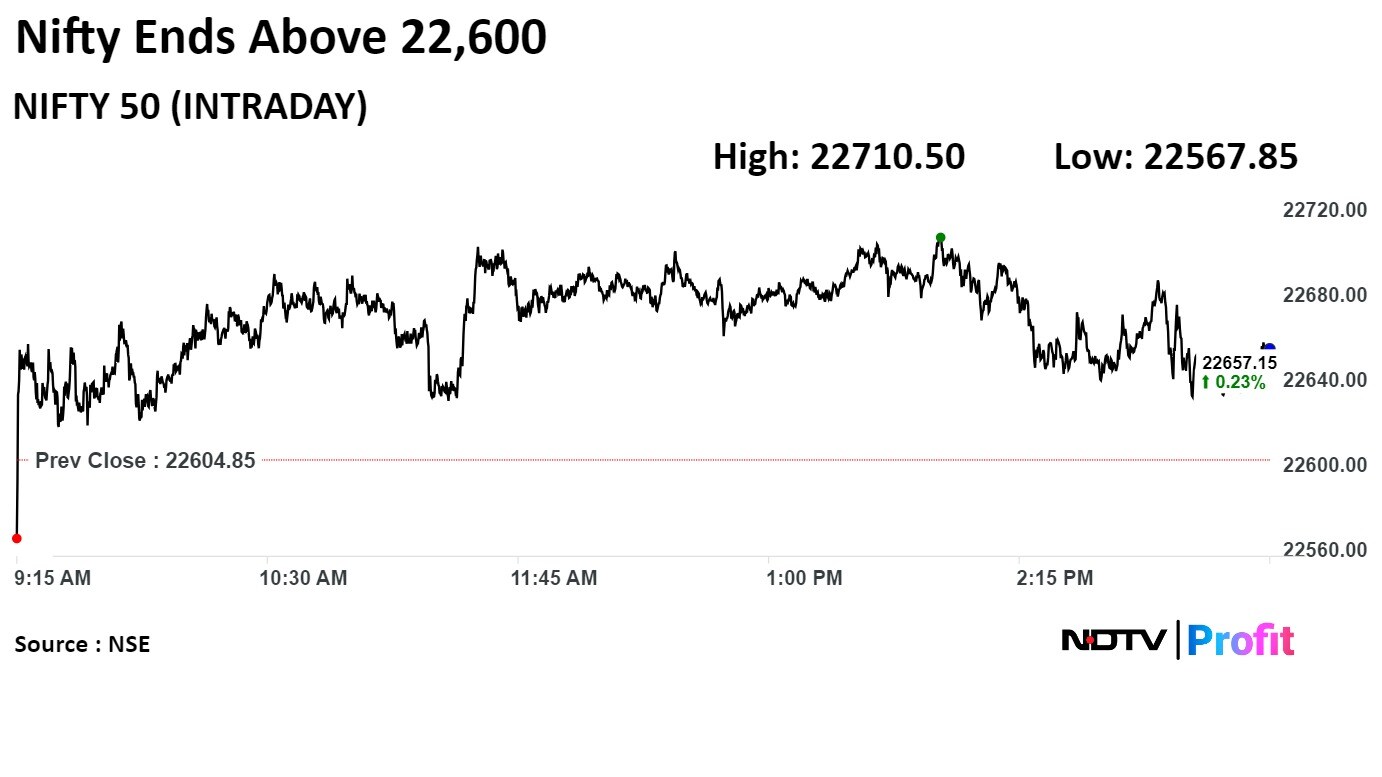

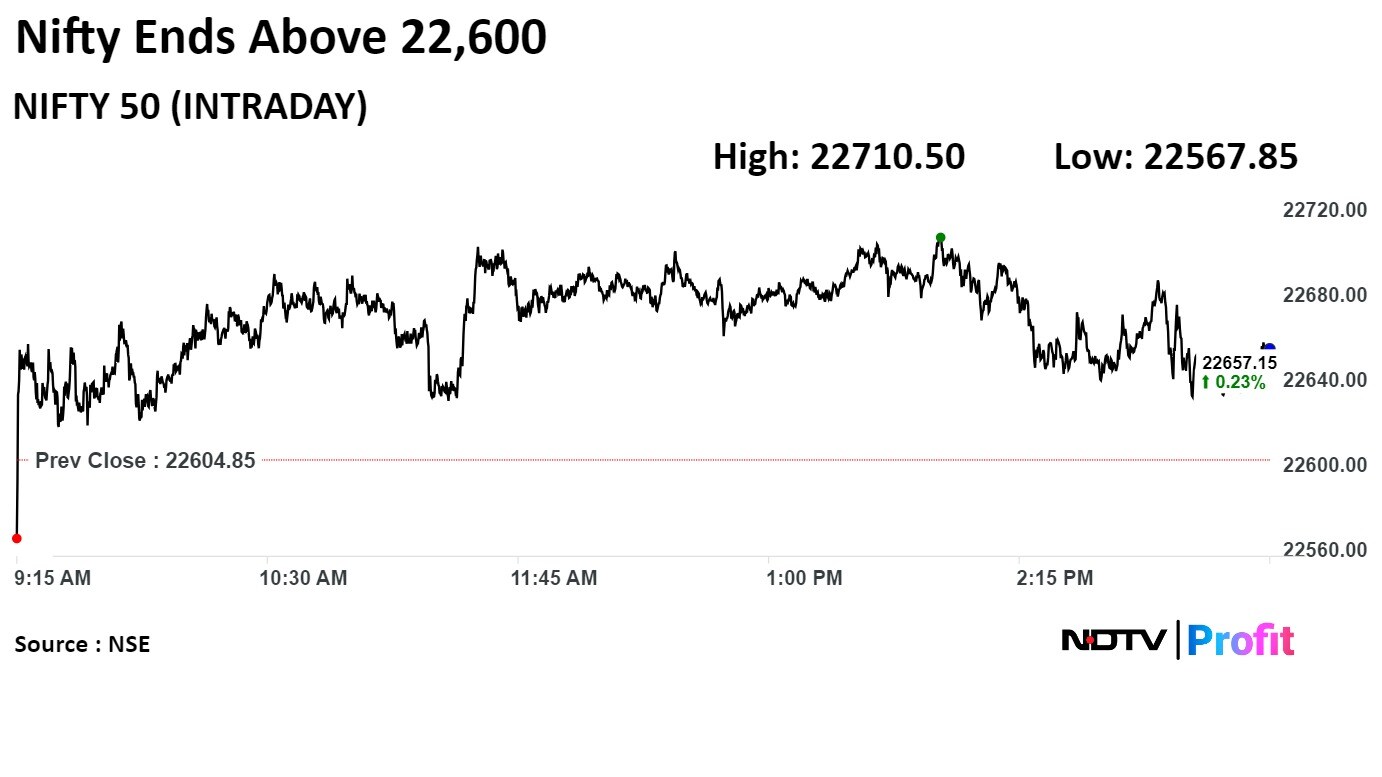

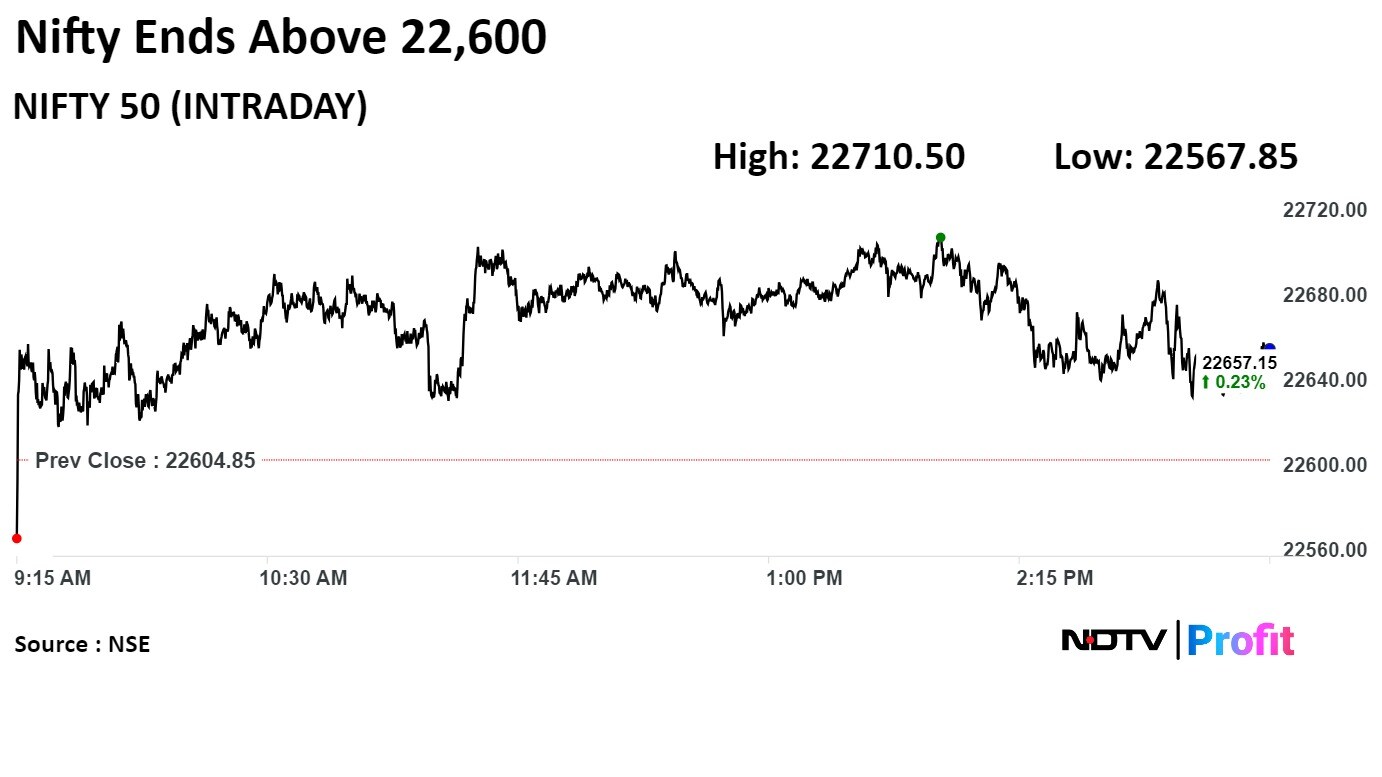

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

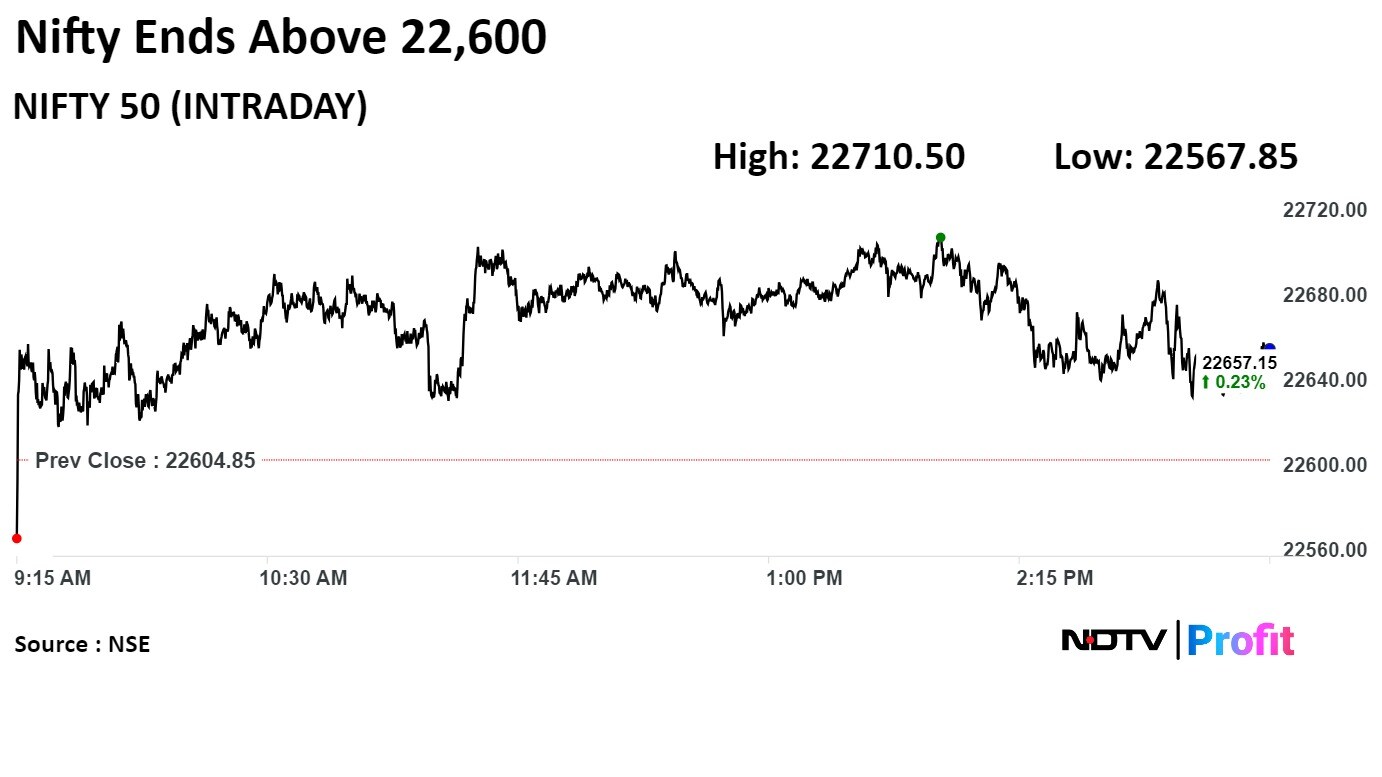

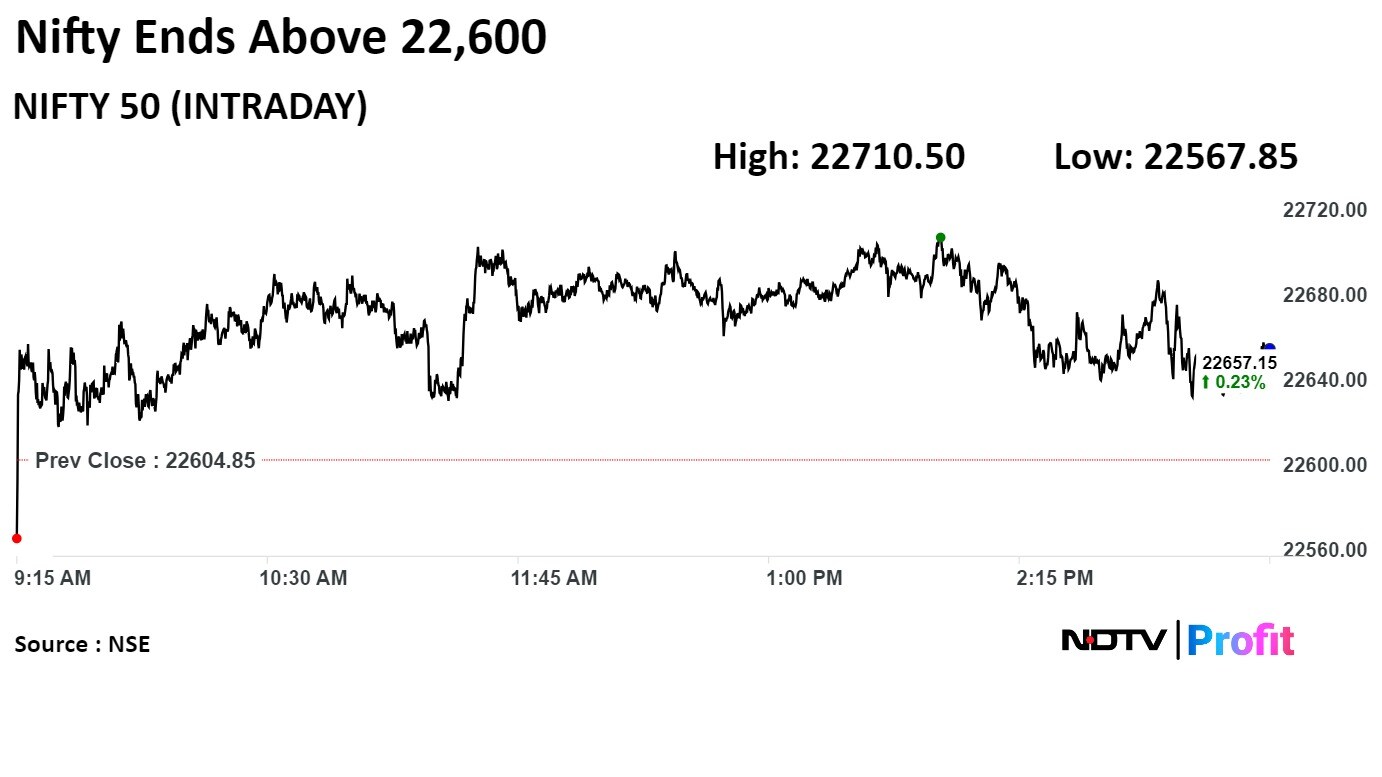

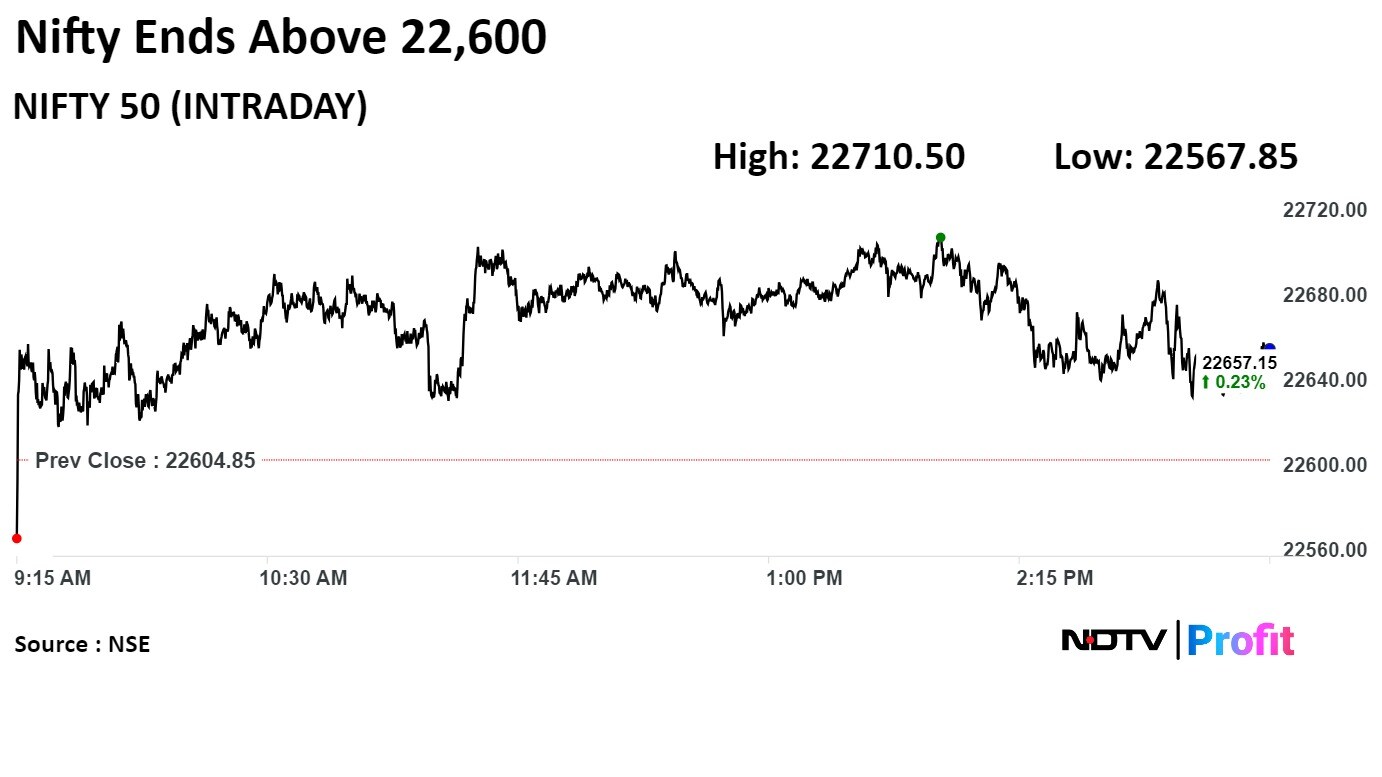

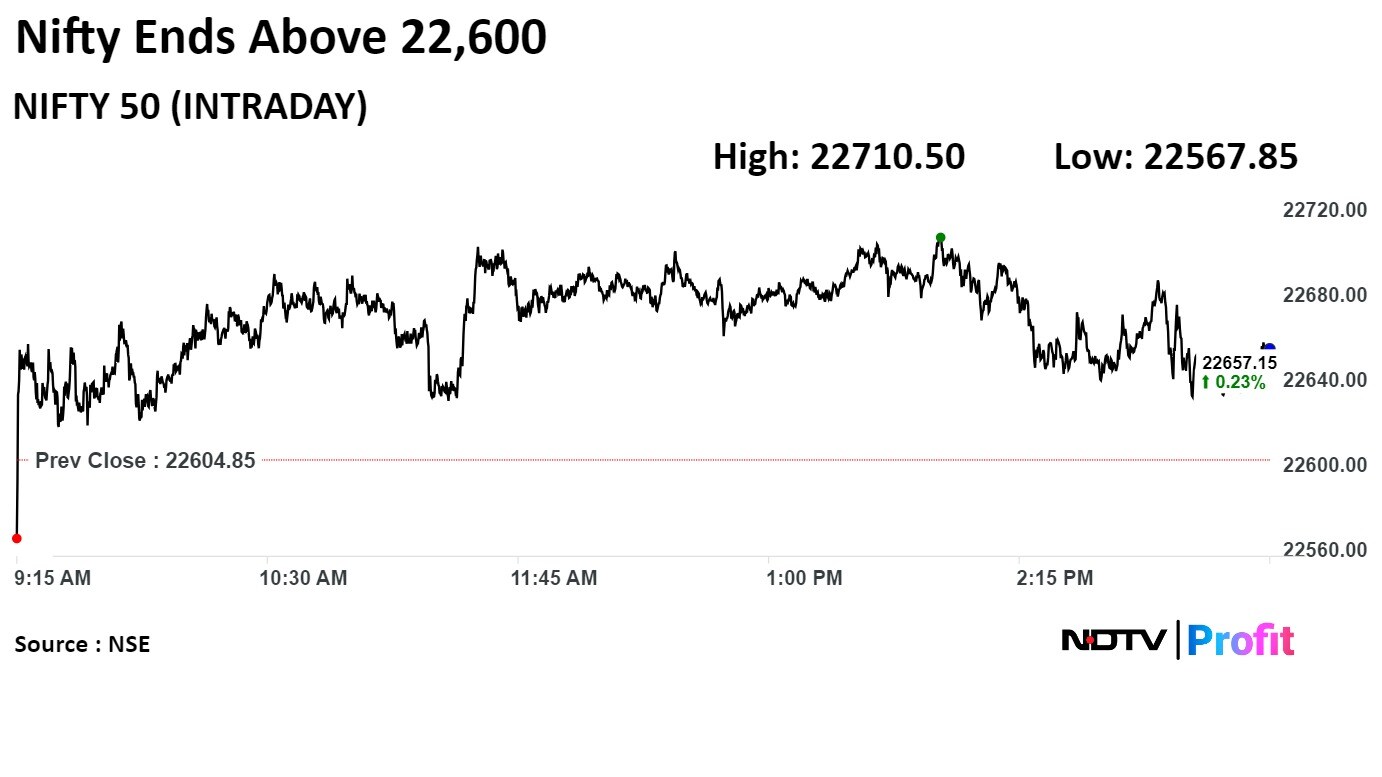

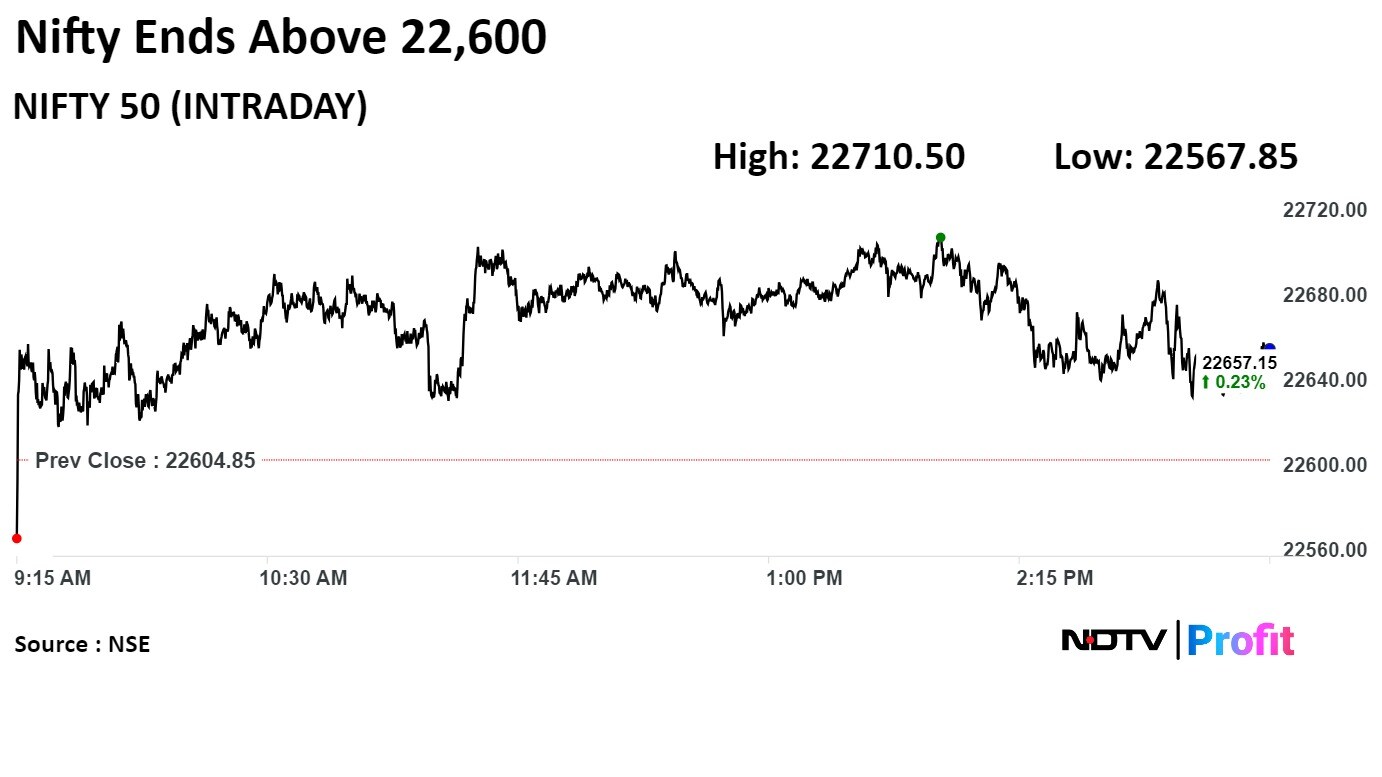

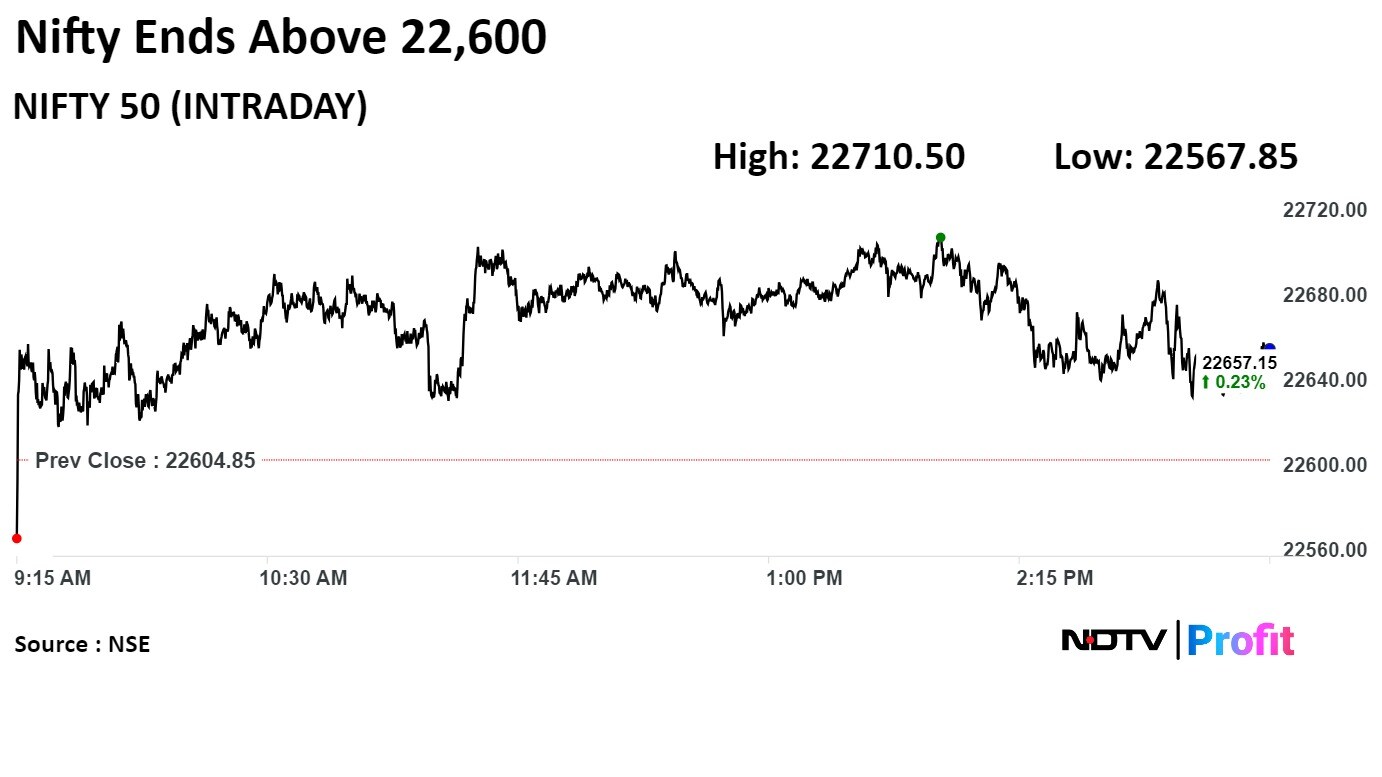

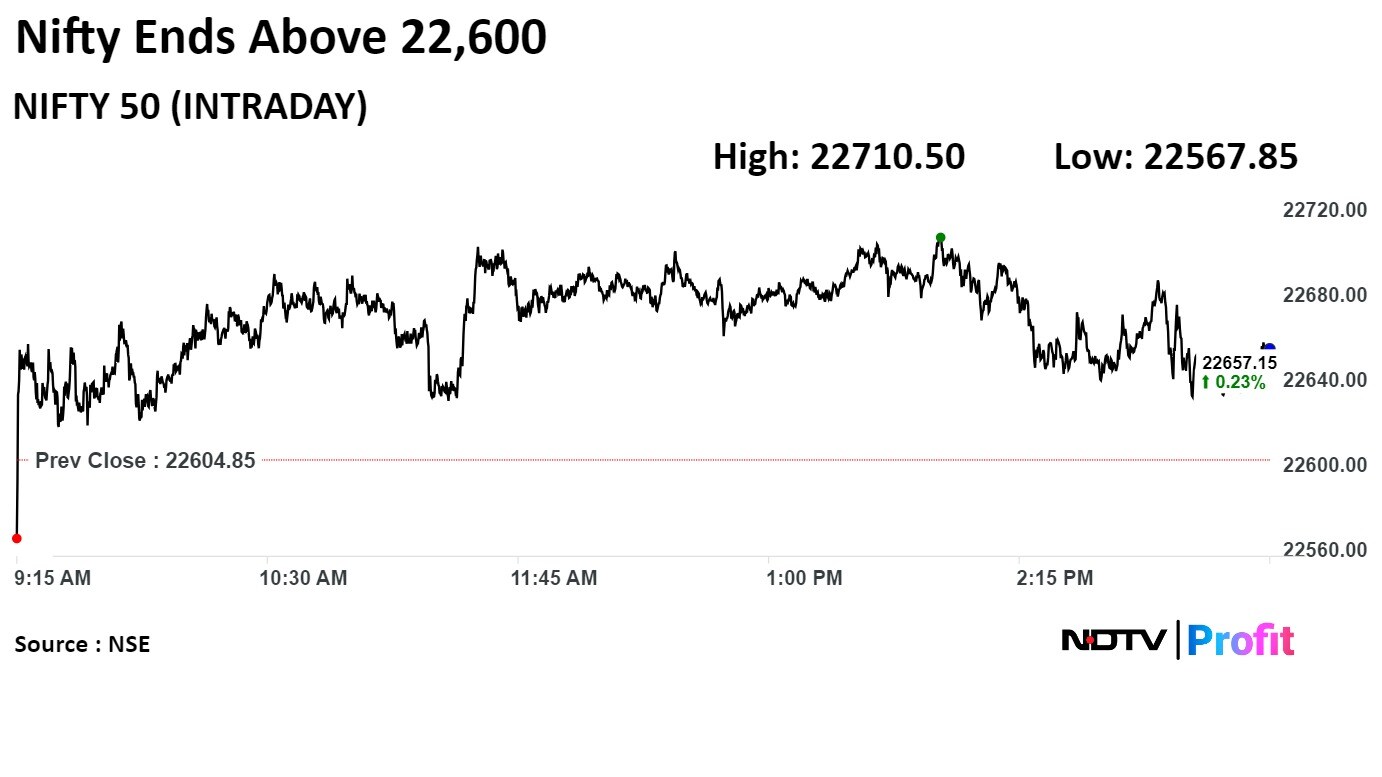

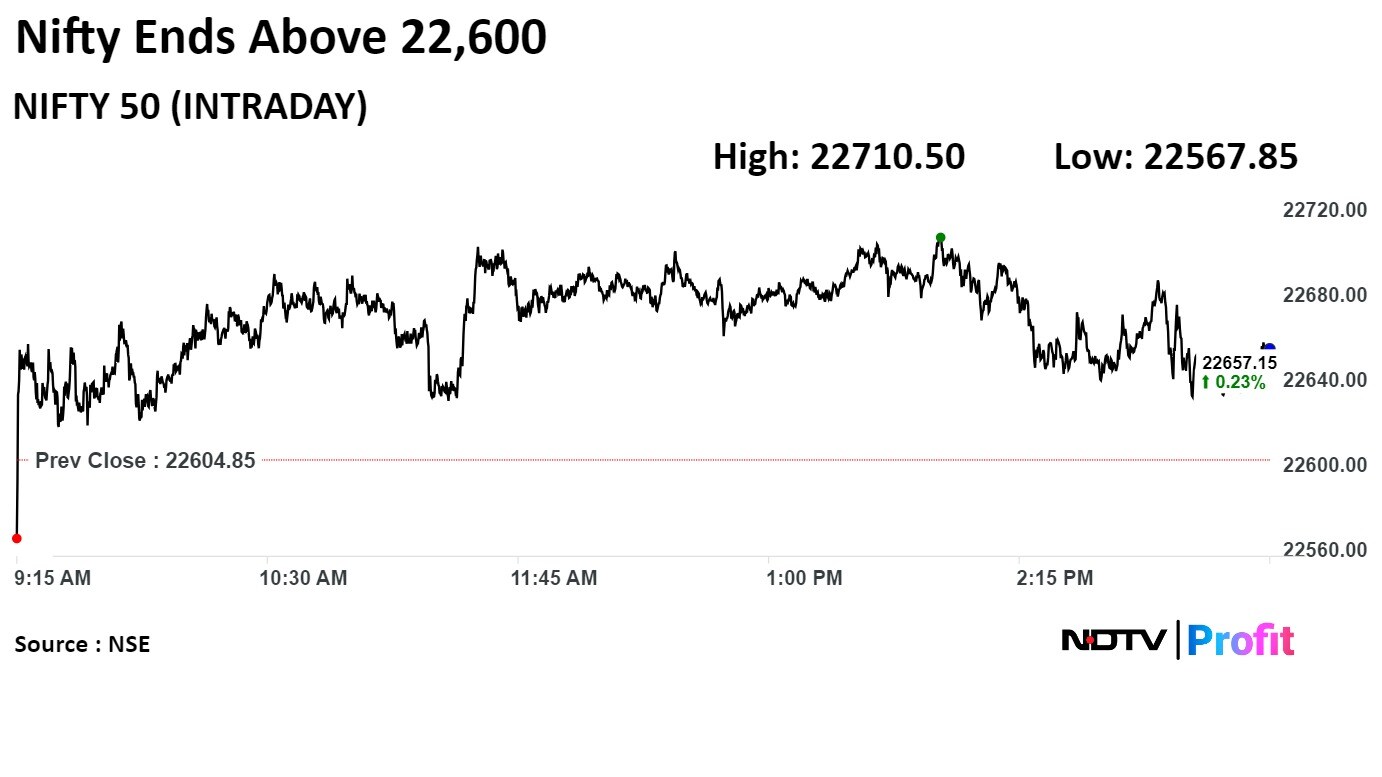

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

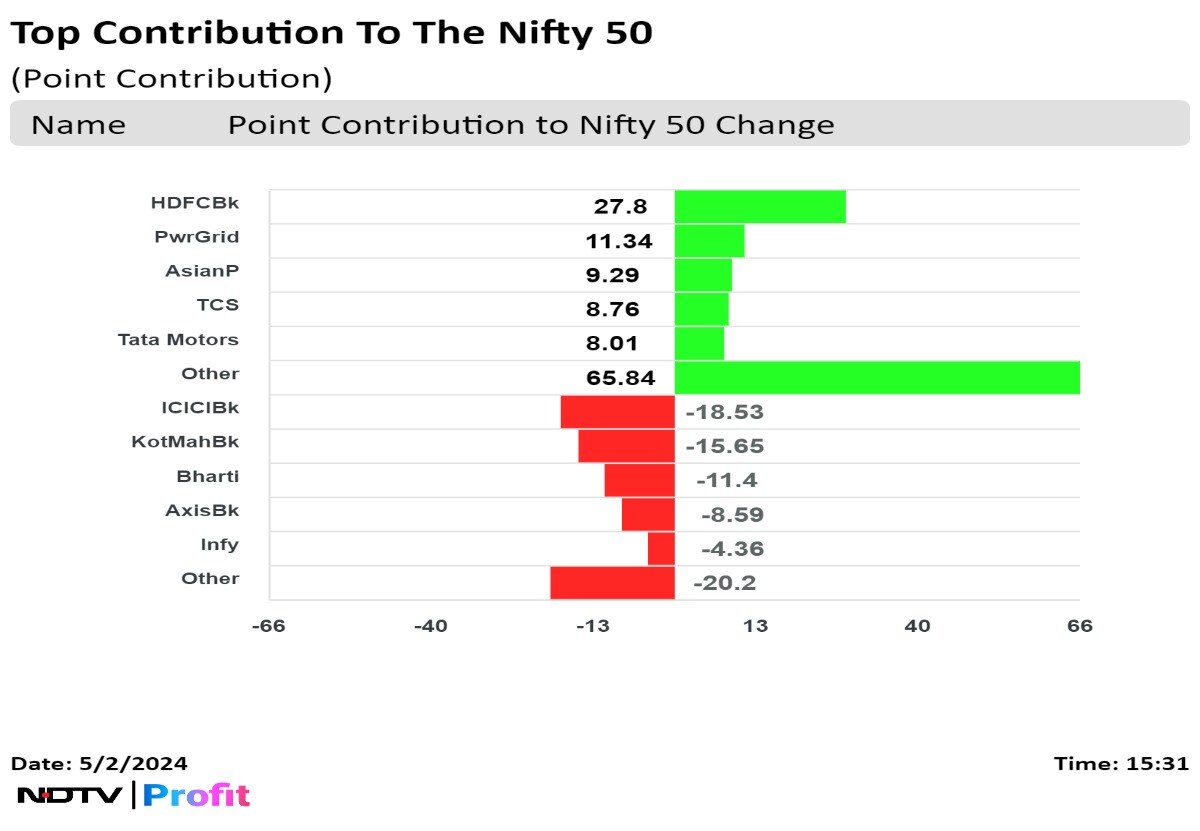

Shares of HDFC Bank Ltd., Power Grid Corp. Of India Ltd., Asian Paints Ltd., Tata Consultancy Services Ltd., and Tata Motors Ltd. contributed the most to the gains.

Meanwhile, those of ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and Infosys Ltd put pressure on the index.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Shares of HDFC Bank Ltd., Power Grid Corp. Of India Ltd., Asian Paints Ltd., Tata Consultancy Services Ltd., and Tata Motors Ltd. contributed the most to the gains.

Meanwhile, those of ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and Infosys Ltd put pressure on the index.

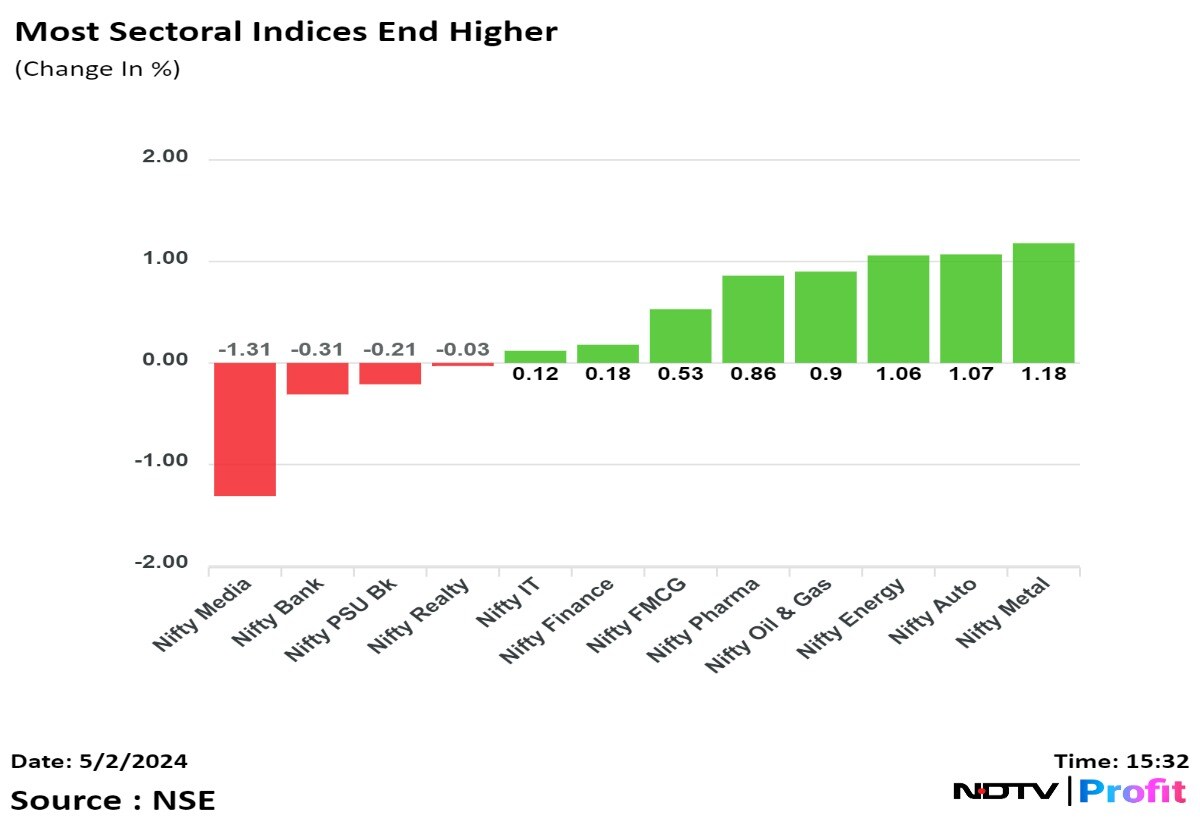

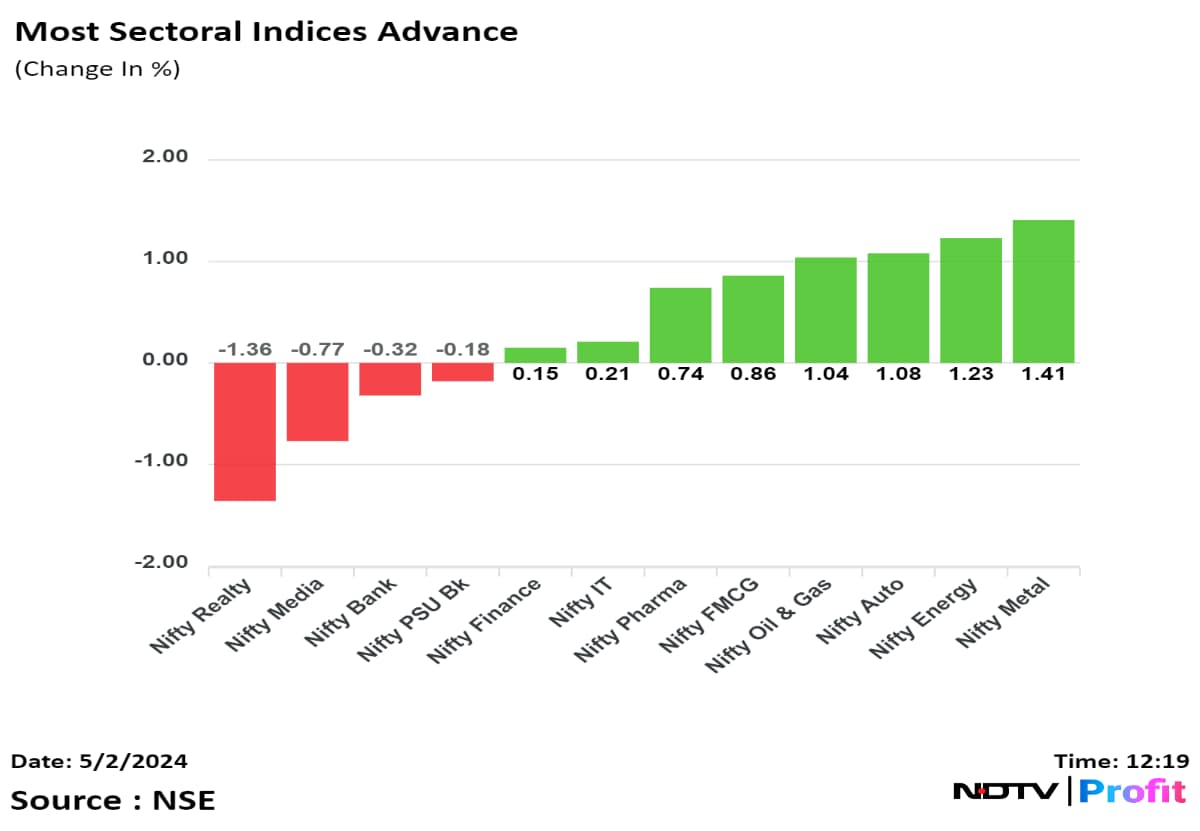

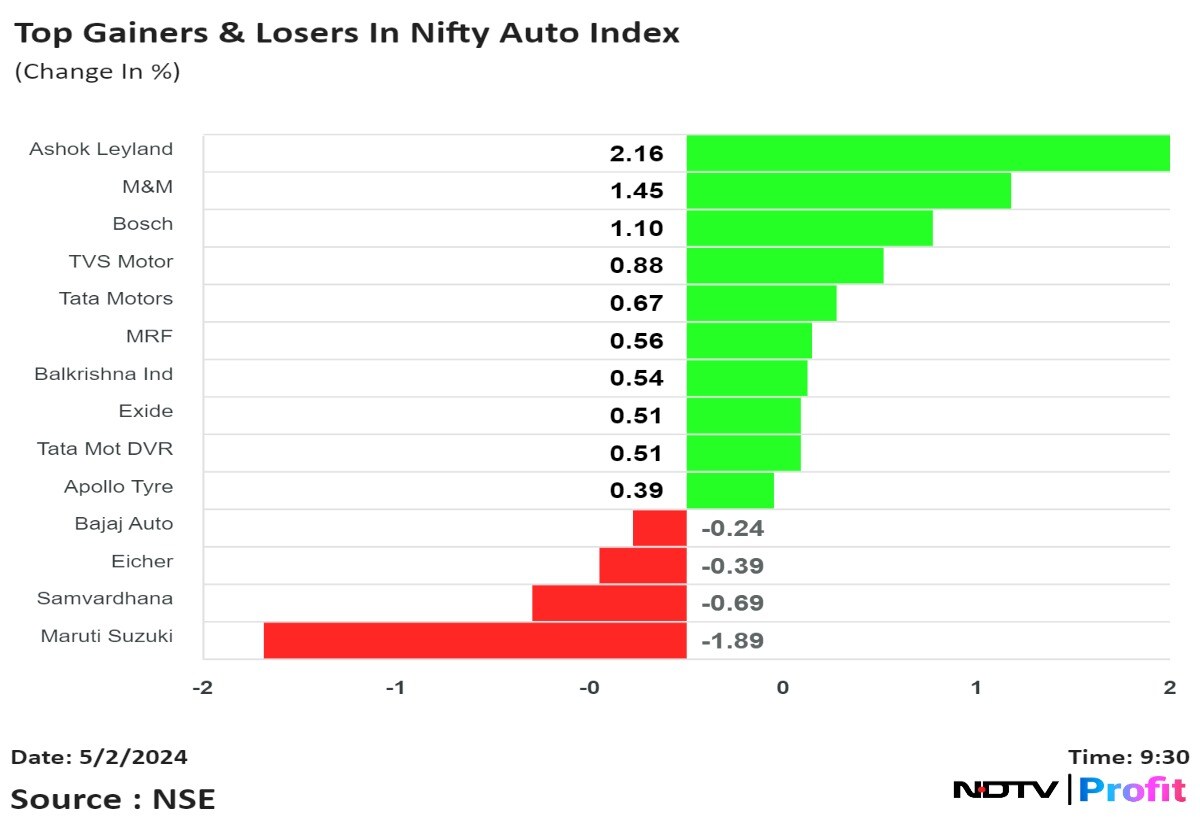

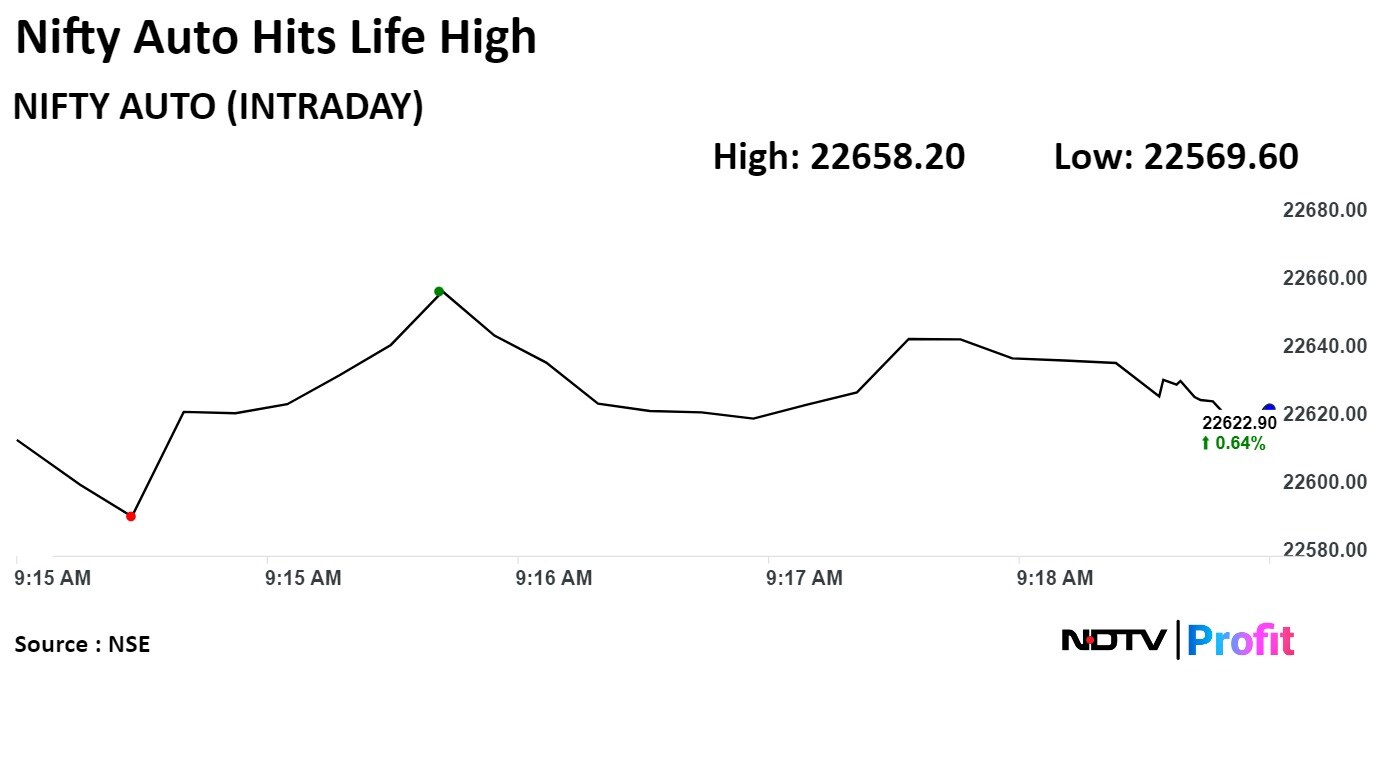

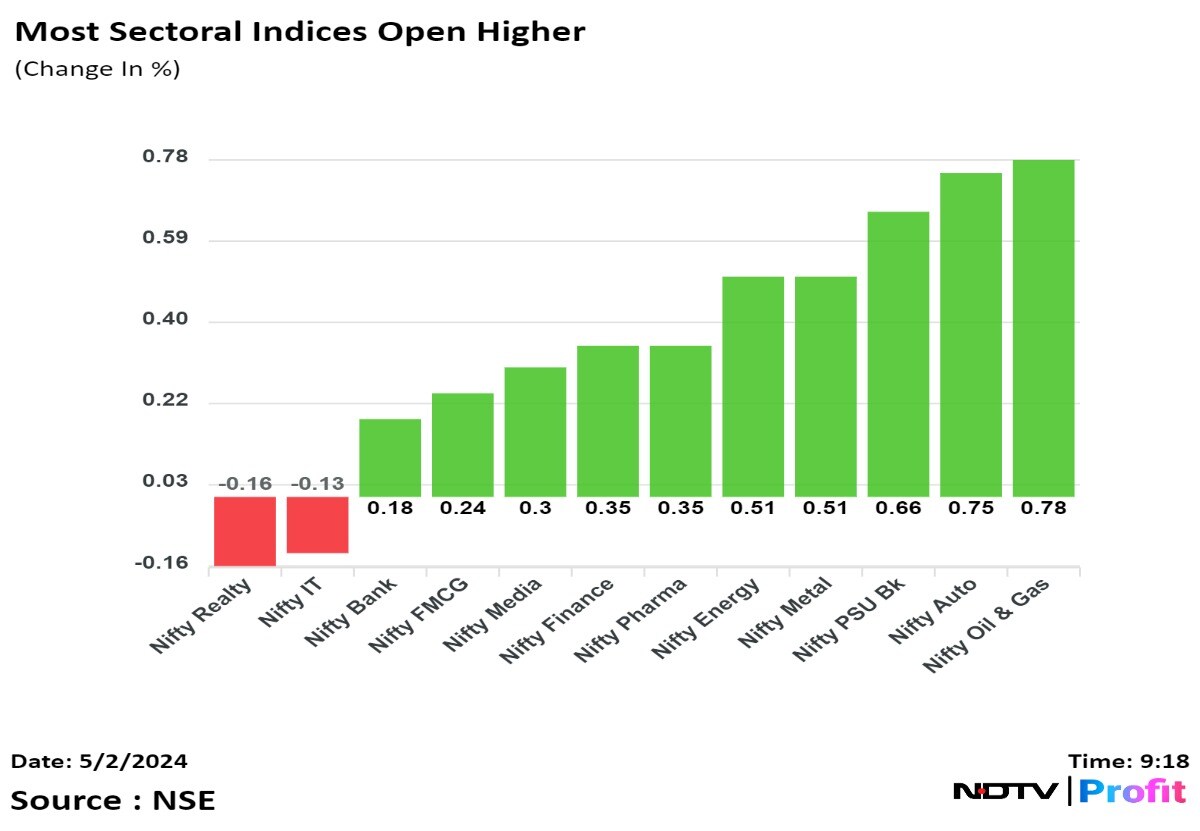

Most sectoral indices ended higher with Nifty Metal, Nifty Auto, and Nifty Energy leading.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Shares of HDFC Bank Ltd., Power Grid Corp. Of India Ltd., Asian Paints Ltd., Tata Consultancy Services Ltd., and Tata Motors Ltd. contributed the most to the gains.

Meanwhile, those of ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and Infosys Ltd put pressure on the index.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Benchmark equity indices ended the first session of the week on a positive note with led by gains in HDFC Bank and Powergrid but the upside was limited due to losses in the shares of ICICI Bank and Kotak Mahindra Bank.

The Nifty 50 ended at 22,657.15, up by 52.30 points or 0.23% and the Sensex gained 128.33 points or 0.17% at 74,611.11.

Nifty has been at a consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd.

He added that 22,800-22,850 will act as the resistance level and 22,300-22,250 will be a support level.

Shares of HDFC Bank Ltd., Power Grid Corp. Of India Ltd., Asian Paints Ltd., Tata Consultancy Services Ltd., and Tata Motors Ltd. contributed the most to the gains.

Meanwhile, those of ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and Infosys Ltd put pressure on the index.

Most sectoral indices ended higher with Nifty Metal, Nifty Auto, and Nifty Energy leading.

Broader markets ended higher on BSE. The S&P BSE Midcap ended 0.91% higher, and the S&P BSE Smallcap settled 0.29% higher.

On BSE, 15 sectors out of 20 advanced, and five declined. The S&P BSE Utilities was the top gainer, and the S&P BSE Bankex declined the most.

Market breadth was evenly split between buyers and sellers. Around 1,913 stocks rose, 1,924 stocks declined, and 120 stocks remained unchanged on BSE.

"The broader market largely traded range bound, while positive commentary from the auto companies on recent volume numbers led the sector to outperform," said Vinod Nair, head of research at Geojit Financial Services.

Approves re-appointment of Rajesh Adani as MD for 5 more years effective June 10, 2025

Approves re-appointment of Pranav Adani as ED for 5 more years effective April 1, 2025

Source: Exchange filing

Revenue at Rs 3327.77 crore vs Rs 2623.83 crore, up 26.82%

Ebitda at Rs 241.9 crore vs Rs 179.16 crore, up 35.01%

Margin at 7.26% vs 6.82%, up 44 bps

Net profit at Rs 169.7 crore vs Rs 225.3 crore, down 24.67%

Revenue at Rs 96,420.98 crore vs Rs 1,27,539.5 crore

Ebitda at Rs 11,779.38 crore vs Rs 9,154.72 crore, up 28.67%

Margin at 12.21% vs 7.17%, up 503 bps

Net profit at Rs 3,335.27 crore vs Rs 2,421.6 crore, up 37.73%

Revenue at Rs 1023.26 crore vs Rs 891.64 crore, up 14.76%

EBITDA at Rs 217.46 crore vs Rs 193.99 crore, up 12.09%

Margin at 21.25% vs 21.75%, down 50 bps

Net profit at Rs 93.84 crore vs Rs 68.45 crore, up 37.09%

Unit Aurogen South Africa to buyout South African JV Purple Bellflower for Rs 11.9 crore

Source: Exchange filing

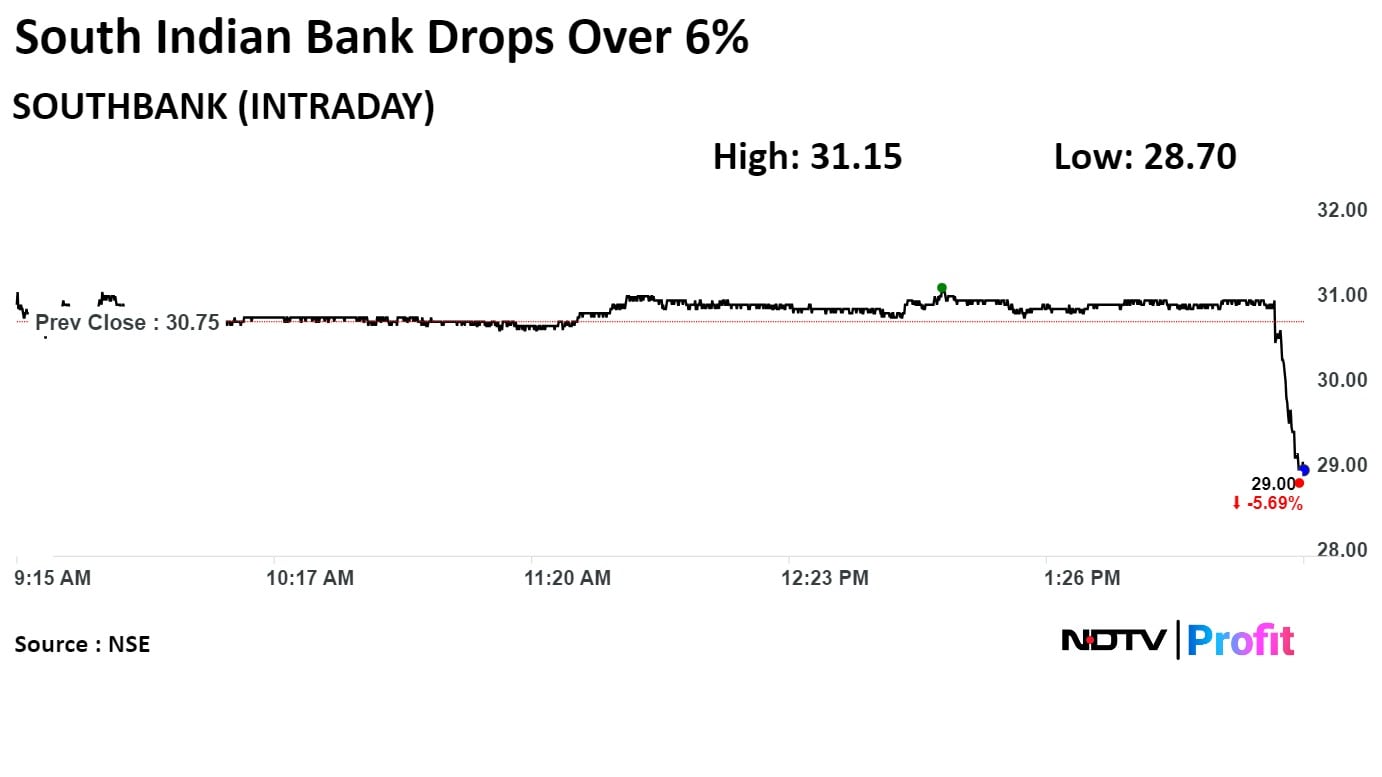

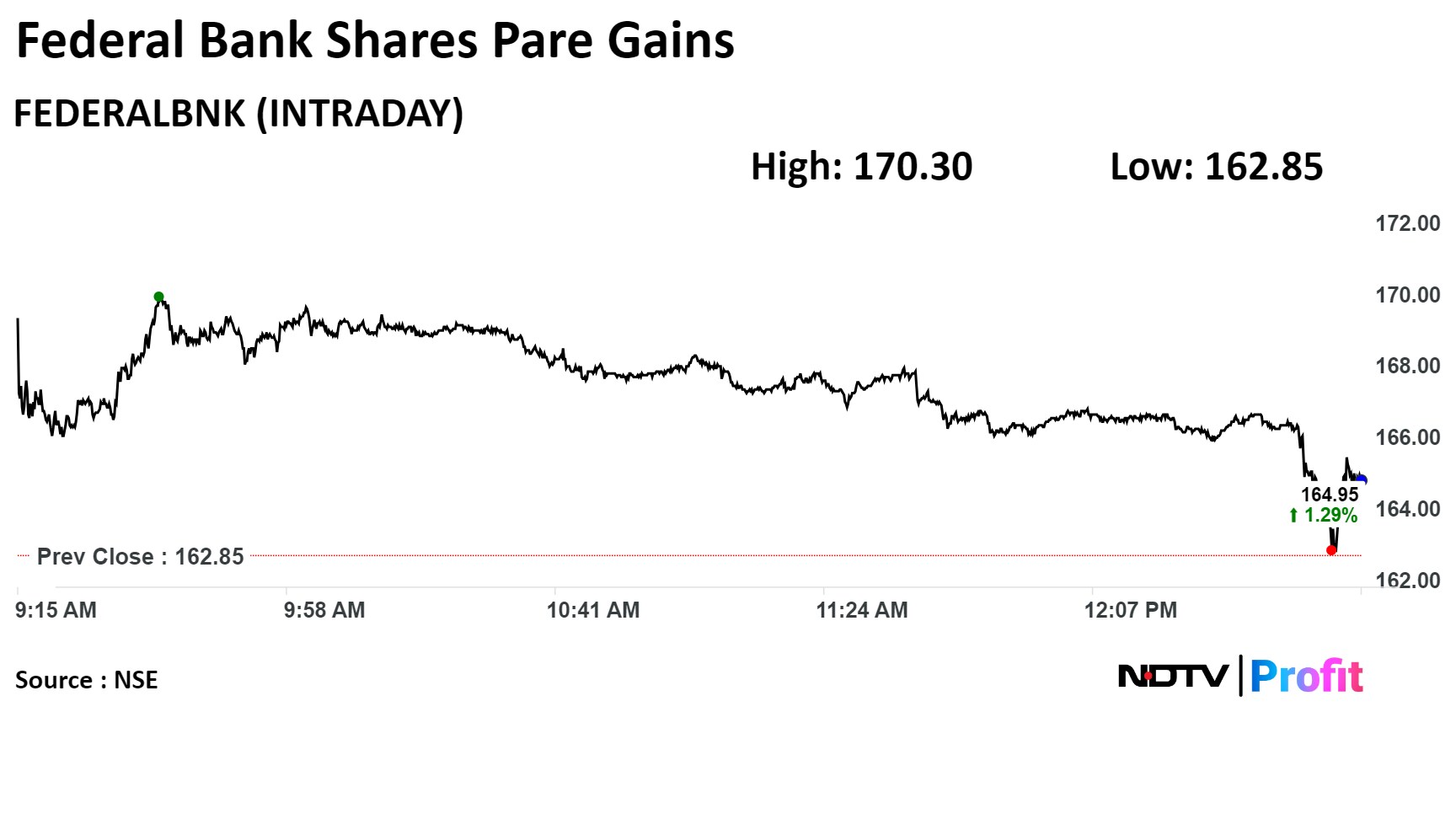

Net profit at Rs 288 crore vs Rs 334 crore, down 14% YoY

Gross NPA at 4.50% vs 4.74% QoQ

Net NPA at 1.46% vs 1.61% QoQ

NII at Rs 875 crore vs Rs 857 crore, up 2% YoY

Net profit at Rs 288 crore vs Rs 334 crore, down 14% YoY

Gross NPA at 4.50% vs 4.74% QoQ

Net NPA at 1.46% vs 1.61% QoQ

NII at Rs 875 crore vs Rs 857 crore, up 2% YoY

Total global sales rose 3.3% YoY to 345,840 units

India total sales rose 10% YoY to 63,701 units

South Korea sales fell 4.4% to 63,733 units

Ex-Korea, global sales rose 5.2% to 282,107 units

Source: Company statement

Revenue up 5% at Rs 2,815 crore vs Rs 2,678 crore

EBITDA up 14% at Rs 467 crore vs Rs 410 crore

Margin up 127 bps at 16.58% vs 15.3%

Net profit up 17% at Rs 341 crore vs Rs 293 crore

Revenue up 5% at Rs 2,815 crore vs Rs 2,678 crore

EBITDA up 14% at Rs 467 crore vs Rs 410 crore

Margin up 127 bps at 16.58% vs 15.3%

Net profit up 17% at Rs 341 crore vs Rs 293 crore

Revenue down 13% at Rs 1,697 crore vs Rs 1,950 crore

Ebitda up 4.6% at Rs 335 crore vs Rs 320 crore

Margin up 332 bps at 19.75% vs 16.42%

Net profit up 2% at Rs 214 crore vs Rs 210 crore

Sees FY25 cargo volumes at 460-480 MMT

Sees FY25 revenue at Rs 29,000-31,000 crore

Sees FY25 EBITDA at Rs 17,000-18,000 crore

Sees net debt-to-EBITDA in FY25 to be in the range of 2.2-2.5 times

Sees FY25 capex to be in the range of Rs 10,500-11,500 crore

Revenue at Rs 6,896.5 crore vs Rs 5,796.85 crore, up 18.96%

Ebitda at Rs 4,043.85 crore vs Rs 3,271.34 crore, up 23.61%

Margin at 58.63% vs 56.43%, up 220 bps

Net profit at Rs 2014.77 crore vs Rs 1139.07 crore, up 76.87%

Revenue at Rs 6,896.5 crore vs Rs 5,796.85 crore, up 18.96%

Ebitda at Rs 4,043.85 crore vs Rs 3,271.34 crore, up 23.61%

Margin at 58.63% vs 56.43%, up 220 bps

Net profit at Rs 2014.77 crore vs Rs 1139.07 crore, up 76.87%

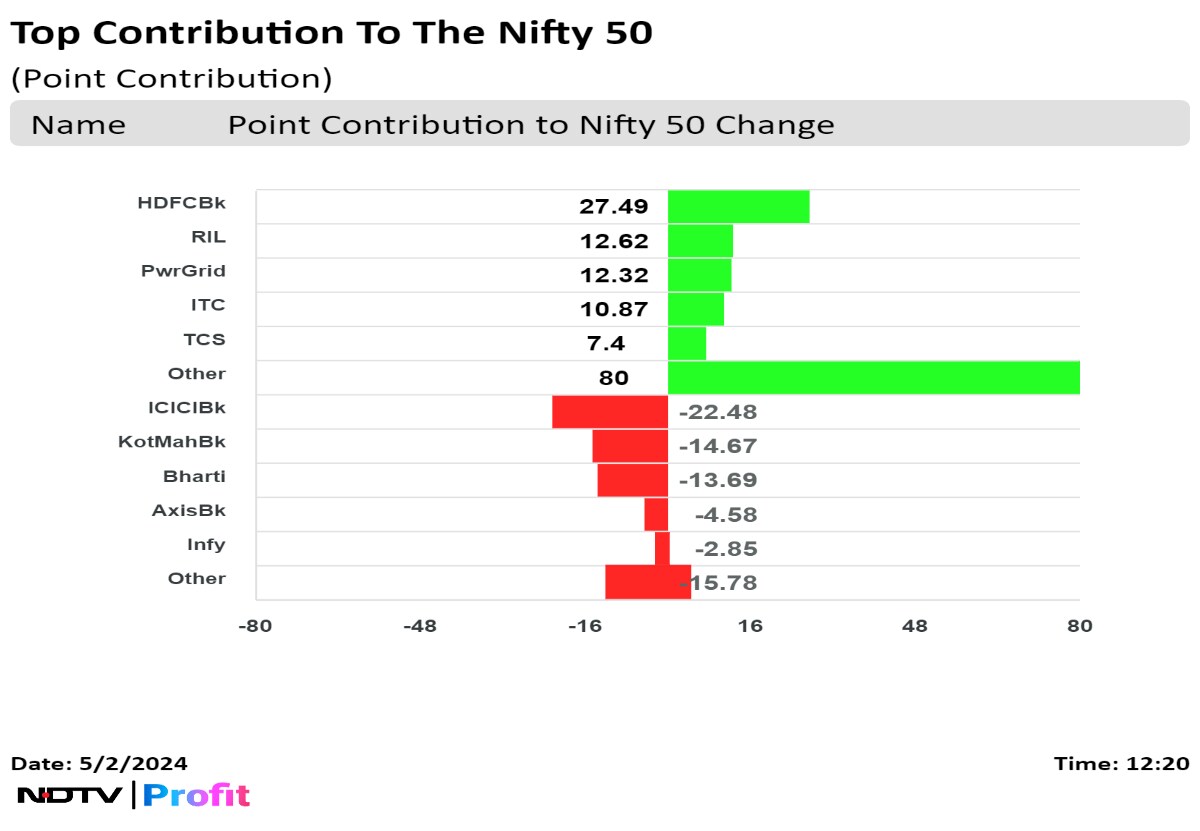

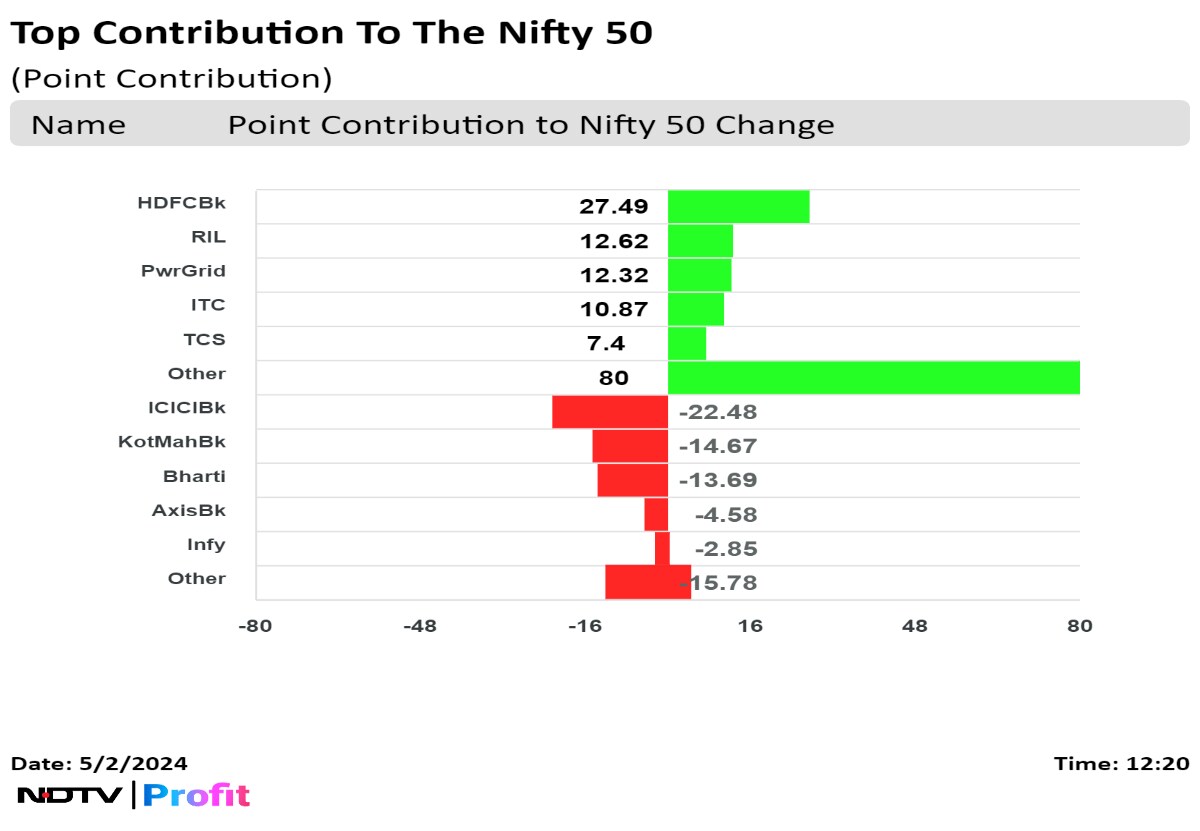

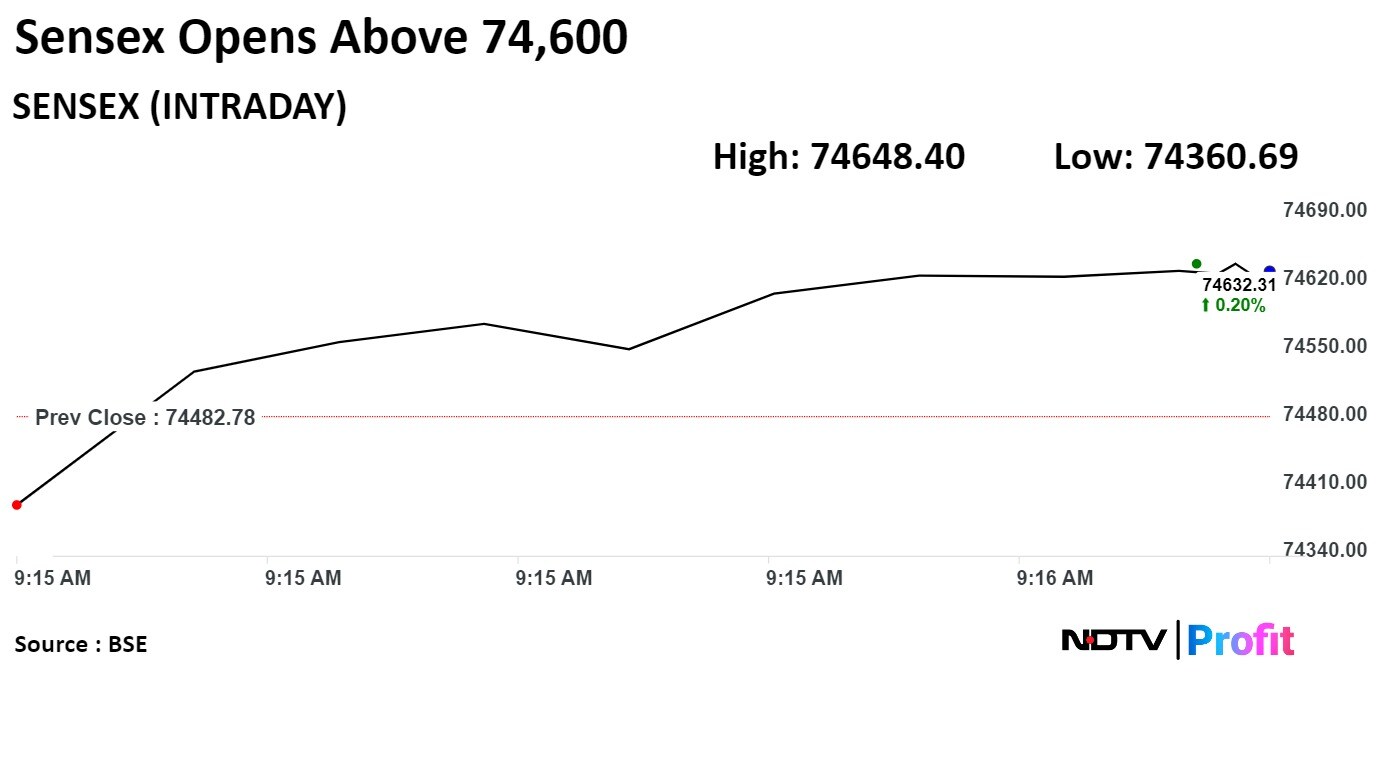

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Power Grid Corp. of India, ITC Ltd., and Tata Consultancy Services Ltd. were positively contributing to the Nifty.

While those of ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and Infosys Ltd. were weighing on the index.

On NSE, eight sectors advanced and four declined. The NSE Nifty metal rose the most, and the NSE Nifty Realty declined the most.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Power Grid Corp. of India, ITC Ltd., and Tata Consultancy Services Ltd. were positively contributing to the Nifty.

While those of ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and Infosys Ltd. were weighing on the index.

On NSE, eight sectors advanced and four declined. The NSE Nifty metal rose the most, and the NSE Nifty Realty declined the most.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Power Grid Corp. of India, ITC Ltd., and Tata Consultancy Services Ltd. were positively contributing to the Nifty.

While those of ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and Infosys Ltd. were weighing on the index.

On NSE, eight sectors advanced and four declined. The NSE Nifty metal rose the most, and the NSE Nifty Realty declined the most.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

India's benchmark stock indices were trading higher through midday on Thursday led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

As of 12:55 p.m., the NSE Nifty 50 was 74.55 points, or 0.33%, higher at 22,679.40, and the S&P BSE Sensex gained 223.79 points, or 0.30%, to 74,706.57. The Nifty rose 0.45% to 22,706.90 and Sensex rose 0.44% to 74,812.43 so far in the day.

"Today, the Sensex and Nifty 50 are expected to trend positively, influenced by a blend of global market signals. This comes as Federal Reserve officials opt to maintain interest rates, in line with what the market anticipated," said Shrey Jain, founder and chief executive officer at SAS Online.

During the previous trading session, Nifty briefly reached the 22,800 threshold, but couldn't maintain this elevation, ultimately closing near 22,600. As the week comes to an end, Jain expects Nifty to consolidate around its current levels, fluctuating within a wider spectrum of 22,600 and 22,750.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Power Grid Corp. of India, ITC Ltd., and Tata Consultancy Services Ltd. were positively contributing to the Nifty.

While those of ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and Infosys Ltd. were weighing on the index.

On NSE, eight sectors advanced and four declined. The NSE Nifty metal rose the most, and the NSE Nifty Realty declined the most.

Broader markets outperformed benchmark indices, with the S&P BSE Midcap rising 0.77% and the S&P BSE Smallcap gaining 0.35% through midday on Thursday.

On BSE, out of 20 sectors, 16 advanced and four declined. The S&P Utilities rose the most, while S&P BSE Realty was the worst performer.

The market breadth was skewed in the favour of the buyers. Around 1,967 stocks advanced, 1,684 stocks declined, and 165 stocks remained unchanged on BSE.

BSE's recent hike in Sensex and Bankex future options contract trading charges is expected to reduce the impact of Securities Exchange Board of India's fees on its earnings, analysts said.

BSE's recent hike in Sensex and Bankex future options contract trading charges is expected to reduce the impact of Securities Exchange Board of India's fees on its earnings, analysts said.

BSE Ltd. rose as much as 3.94% to Rs 2,900, the highest level since April 26. It was trading 2.78% higher at Rs 2,867.85, as of 12:51 p.m., compared to 0.30% advance in the NSE Nifty 50 index.

The scrip gained 414.02% in 12 months, and on year-to-date basis, it has risen 29.02%. Total traded volume so far in the day stood at 0.82 times its 30-day average. The relative strength index was at 54.04.

Out of eight analysts tracking the company, five maintain a 'buy' rating, three recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.0%.

NII up 15% at Rs 2,195 crore vs Rs 1,909 crore YoY

Net profit at Rs 906 crore vs Rs 903 crore YoY

Net NPA at 0.6% vs 0.64% QoQ

Gross NPA at 2.13% vs 2.29% QoQ

The stock had hit its lifetime high in the early trade.

NII up 15% at Rs 2,195 crore vs Rs 1,909 crore YoY

Net profit at Rs 906 crore vs Rs 903 crore YoY

Net NPA at 0.6% vs 0.64% QoQ

Gross NPA at 2.13% vs 2.29% QoQ

The stock had hit its lifetime high in the early trade.

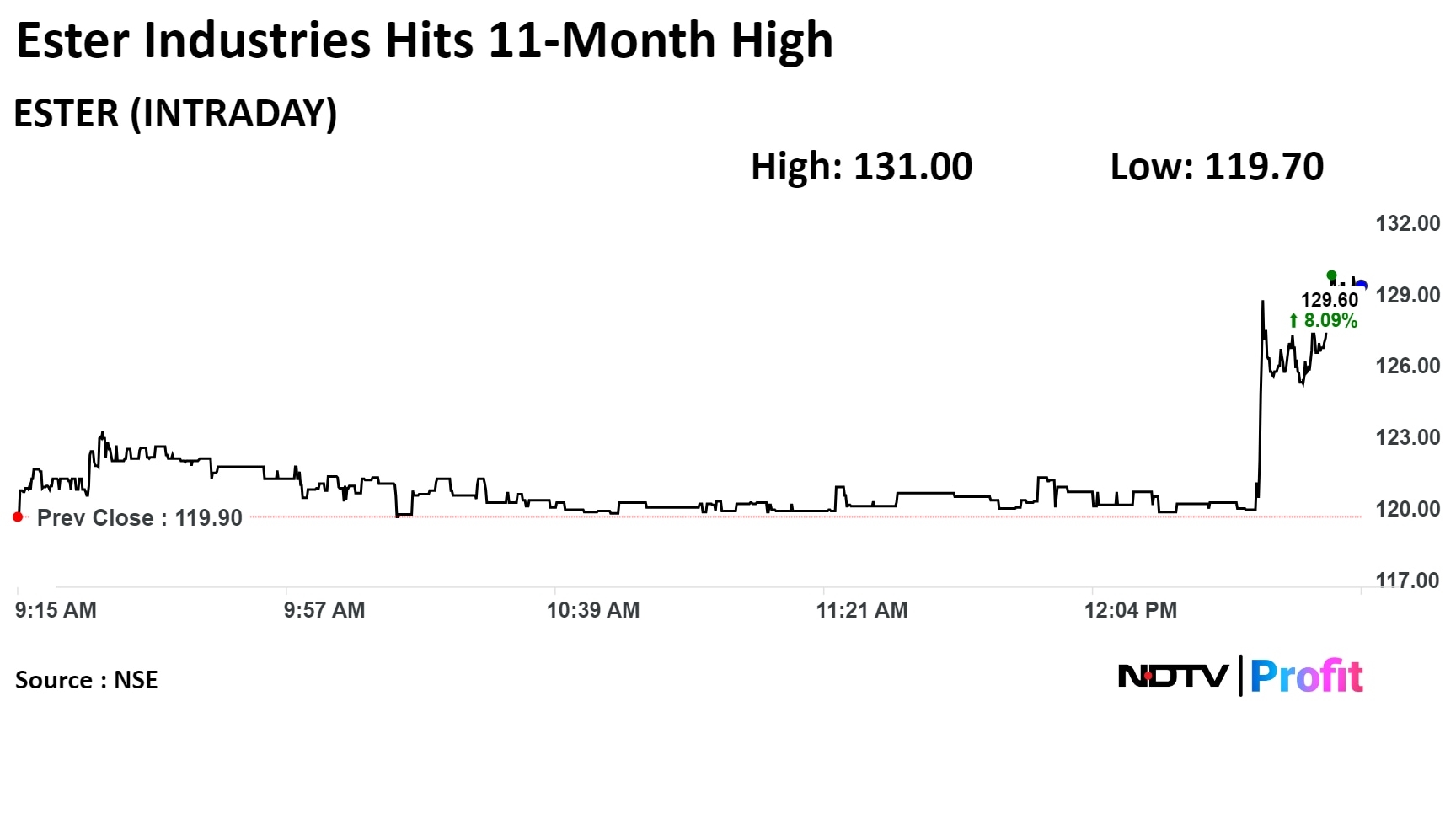

In pact for JV to set up polymer manufacturing facility in India

Soruce: Exchange filing

In pact for JV to set up polymer manufacturing facility in India

Soruce: Exchange filing

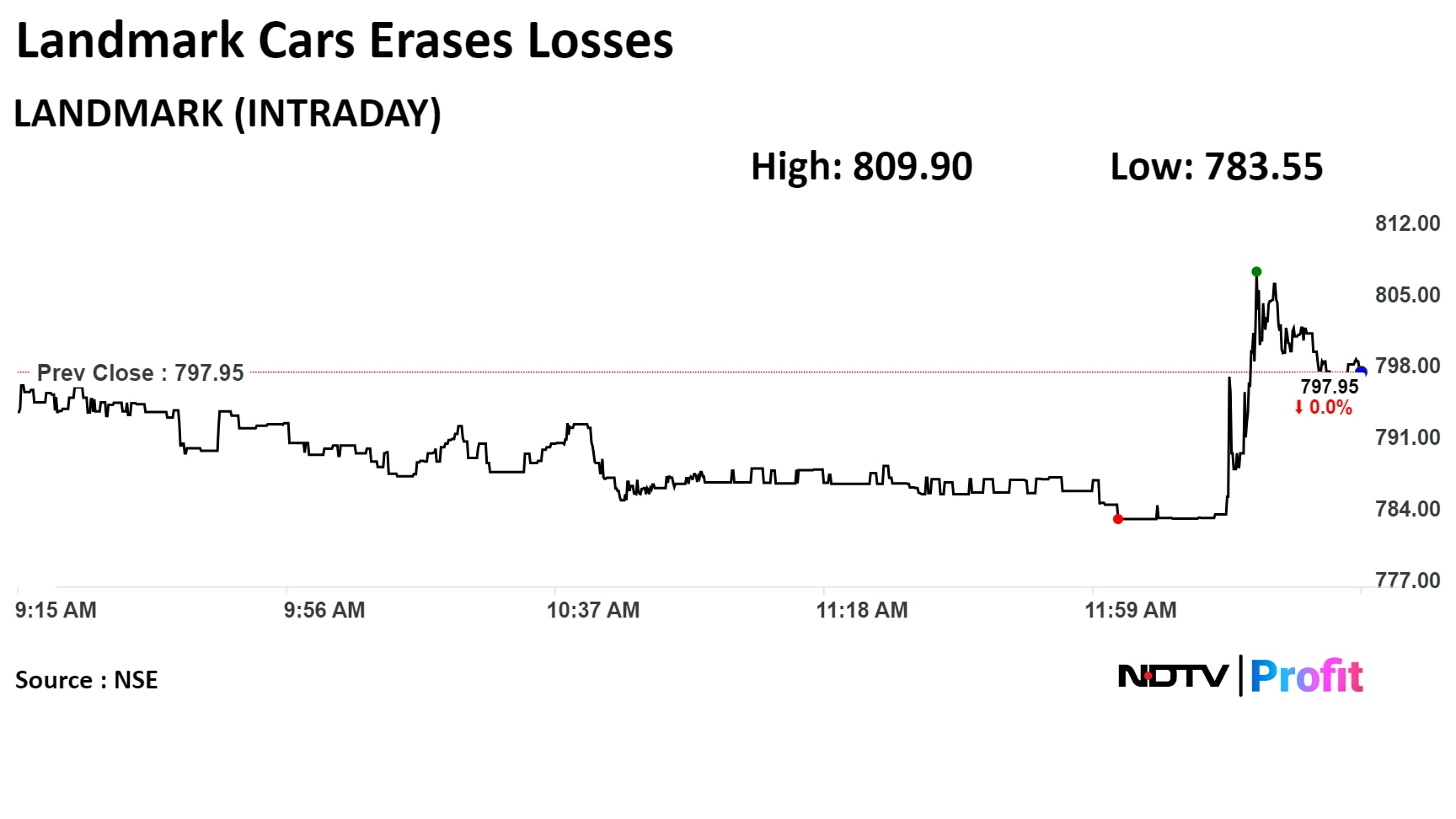

Gets LoI from Honda Cars India for acquiring existing dealership operations in Jaipur, Alwar and Bhiwadi in Rajasthan

Source: Exchange filing

Gets LoI from Honda Cars India for acquiring existing dealership operations in Jaipur, Alwar and Bhiwadi in Rajasthan

Source: Exchange filing

April iron ore sales at 3.53 MT, up 3% YoY

April iron ore output at 3.48 MT, down 1% YoY

Source: Exchange filing

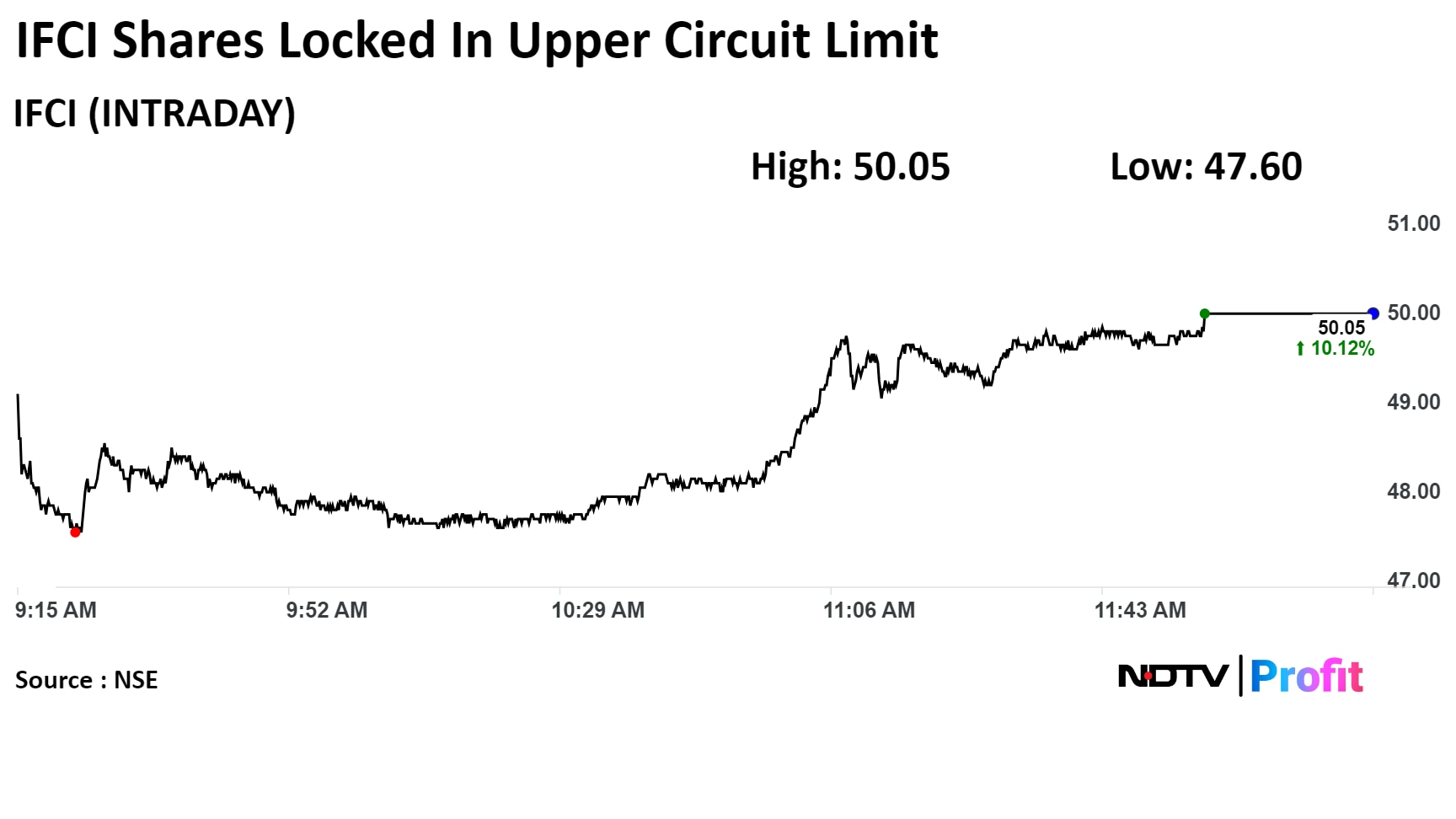

The stock snapped a two-day fall and rose as the company turned profitable and reported a standalone net profit of Rs 198.85 crore as against a net loss of Rs 239.22 crore a year ago and Rs 26.21 crore in the December quarter.

The stock snapped a two-day fall and rose as the company turned profitable and reported a standalone net profit of Rs 198.85 crore as against a net loss of Rs 239.22 crore a year ago and Rs 26.21 crore in the December quarter.

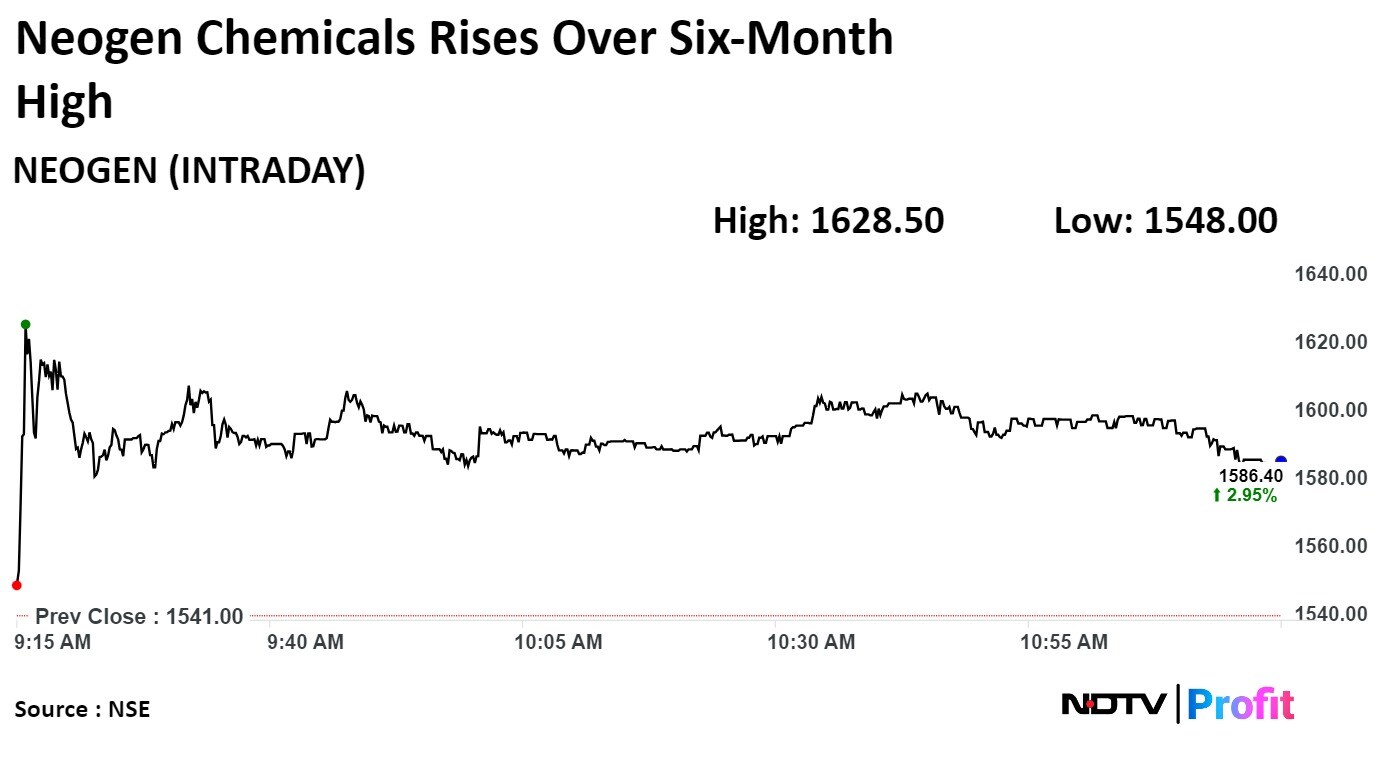

Neogen Chemicals Ltd. rose to the highest level in over six months Thursday after the company recorded a rise in its net profit.

The chemical producers' net profit grew 18.3% to 16.93 crore in January-March, from 14.31 crore in the corresponding period of the previous financial year.

Neogen Chemicals Ltd. rose to the highest level in over six months Thursday after the company recorded a rise in its net profit.

The chemical producers' net profit grew 18.3% to 16.93 crore in January-March, from 14.31 crore in the corresponding period of the previous financial year.

The stock rose 5.58% to Rs 1,628.50, the highest level since 23 Oct, 2023. It was trading 2.86% higher at Rs 1,586.28 as of 11:26, compared to 0.15% advance in the NSE Nifty 50 index.

The scrip has risen 2.69% in 12 months, and on year-to-date basis, it has risen 7.14%. Total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 74.15.

Out of nine analysts tracking the company, six maintain a 'buy' rating, three recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.7%.

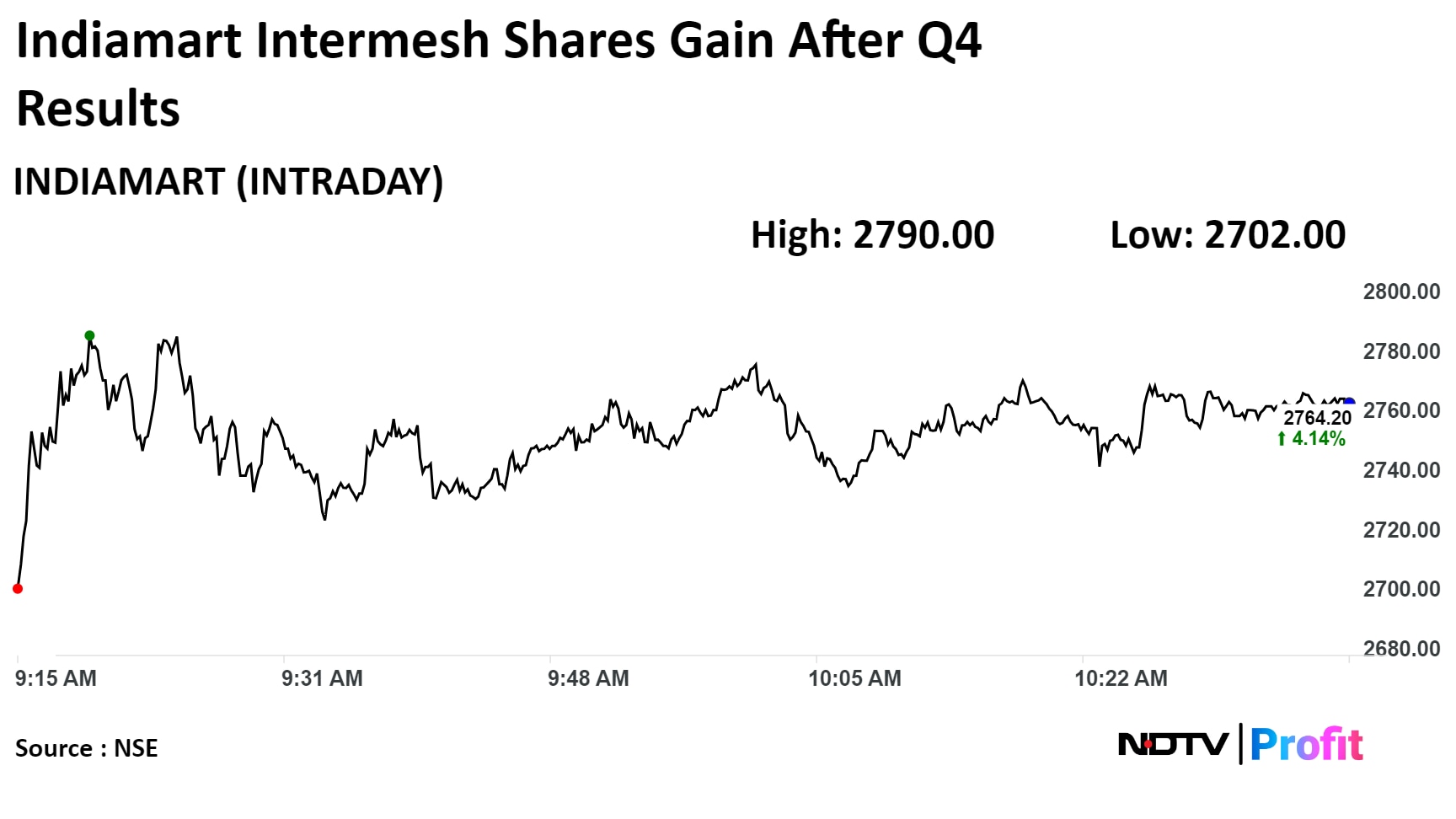

Shares of Indiamart Intermesh jumped to hit its highest level in over two months as its net profit for the quarter ended March was higher than what the analysts had estimated.

Shares of Indiamart Intermesh jumped to hit its highest level in over two months as its net profit for the quarter ended March was higher than what the analysts had estimated.

Manufacturing PMI falls to 58.8 in April vs 59.1 in March

Source: S&P Global

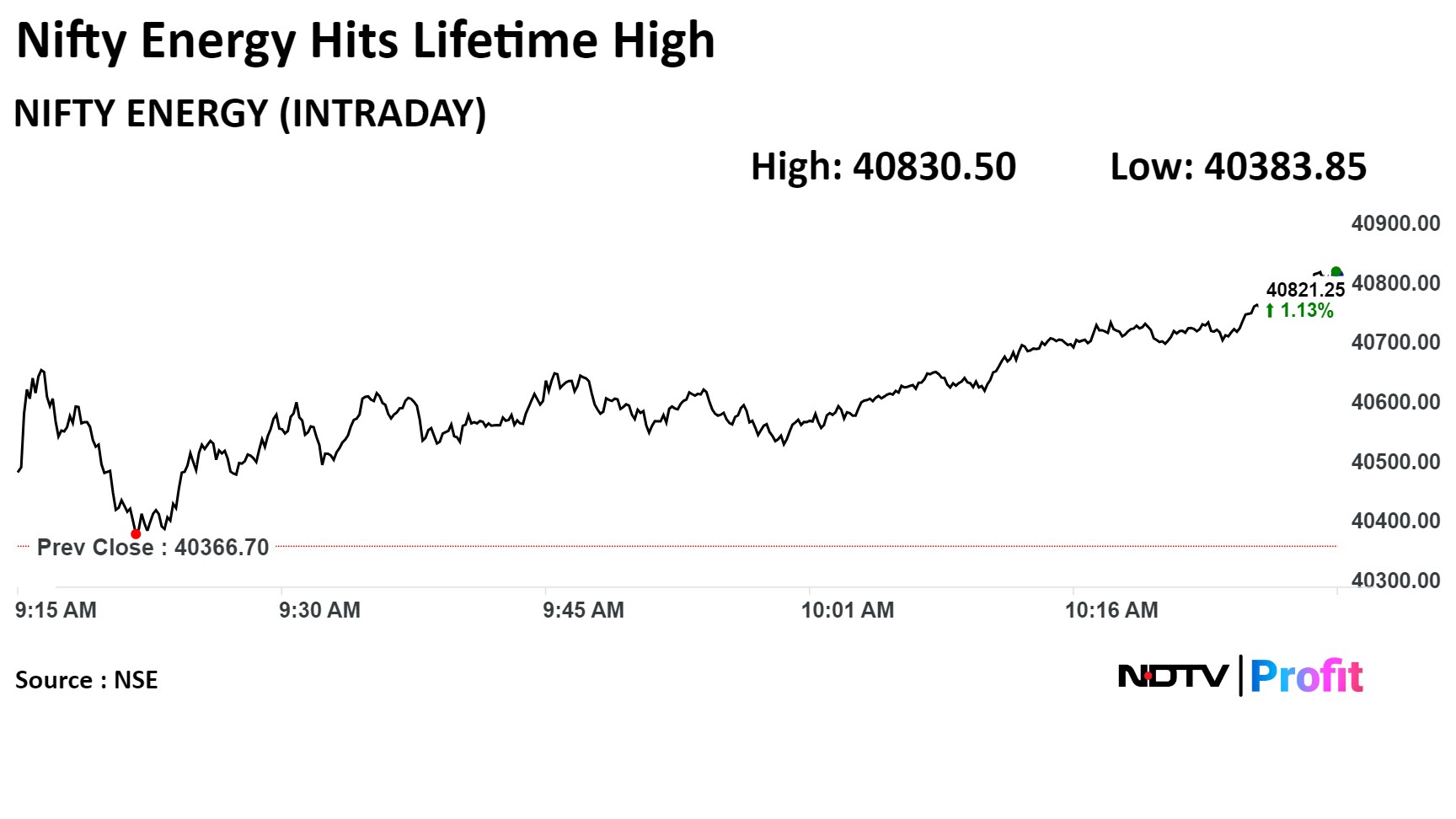

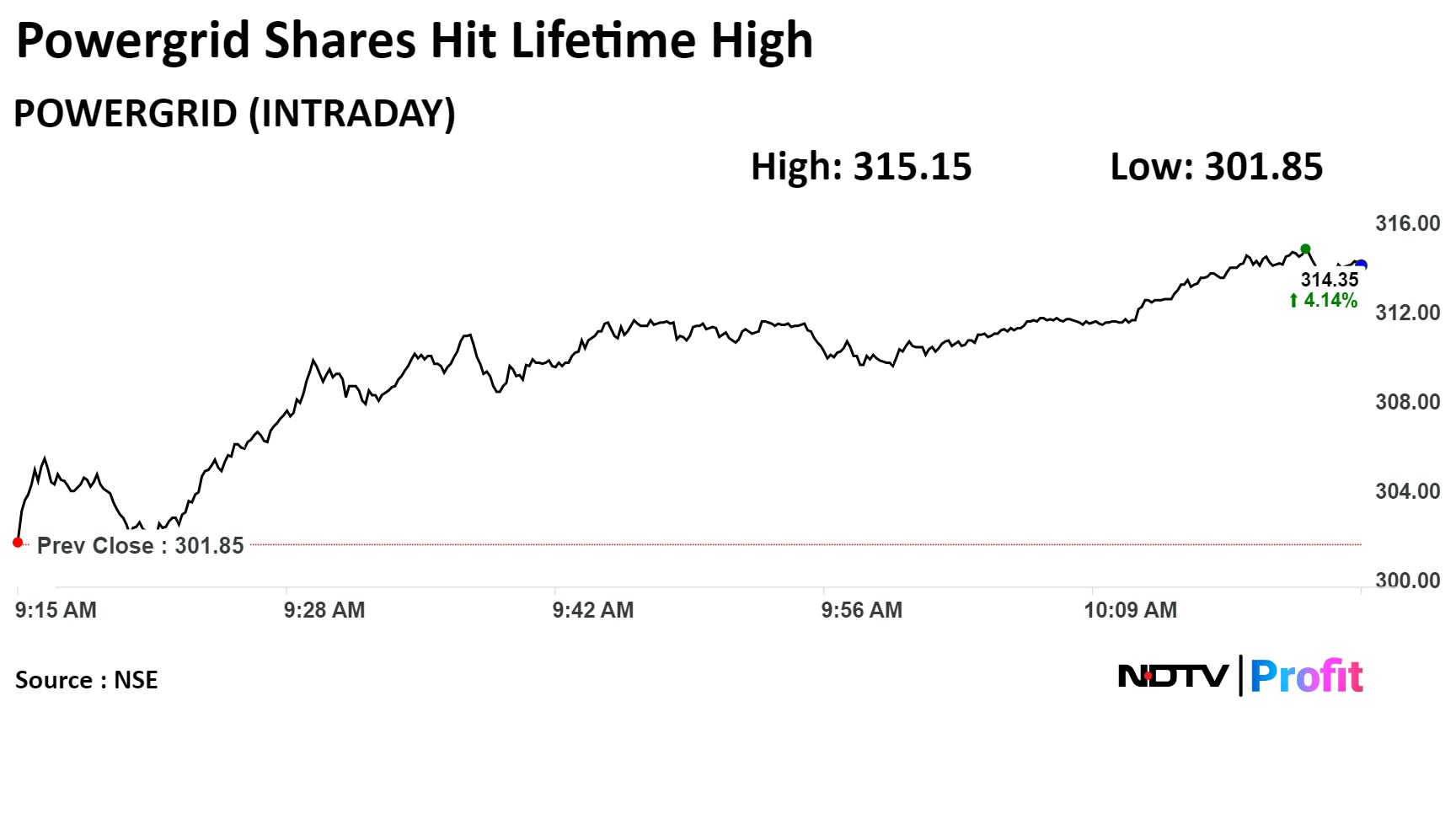

Out of the Nifty Energy constituents, only two fell. Shares of Power Grid Corp. Of India and Bharat Petroleum Corp. Ltd. were the top gainers.

Out of the Nifty Energy constituents, only two fell. Shares of Power Grid Corp. Of India and Bharat Petroleum Corp. Ltd. were the top gainers.

The stock has risen nearly 8% in the three-day rally.

The stock has risen nearly 8% in the three-day rally.

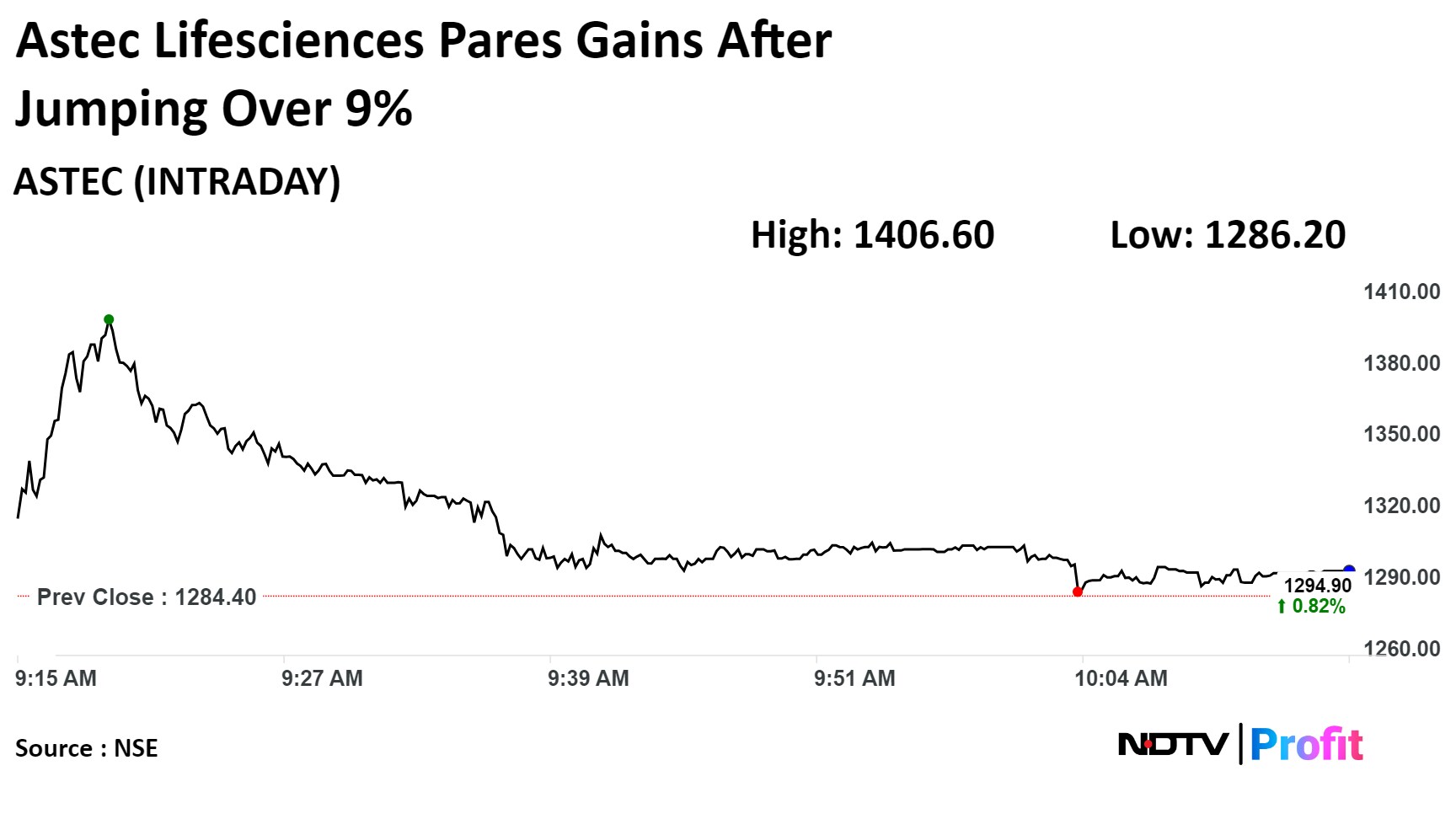

Adi Godrej and family have made an open offer to acquire a 26% stake in

Astec LifeSciences Ltd. Nadir Godrej is leading the offer to buy more than 50.99 lakh shares at a price of Rs 1,069.75 per share, aggregating to Rs 545.5 crore, the company told the exchanges on Thursday. This is at a discount of 17% to the last closing price of the stock.

Adi Godrej and family have made an open offer to acquire a 26% stake in

Astec LifeSciences Ltd. Nadir Godrej is leading the offer to buy more than 50.99 lakh shares at a price of Rs 1,069.75 per share, aggregating to Rs 545.5 crore, the company told the exchanges on Thursday. This is at a discount of 17% to the last closing price of the stock.

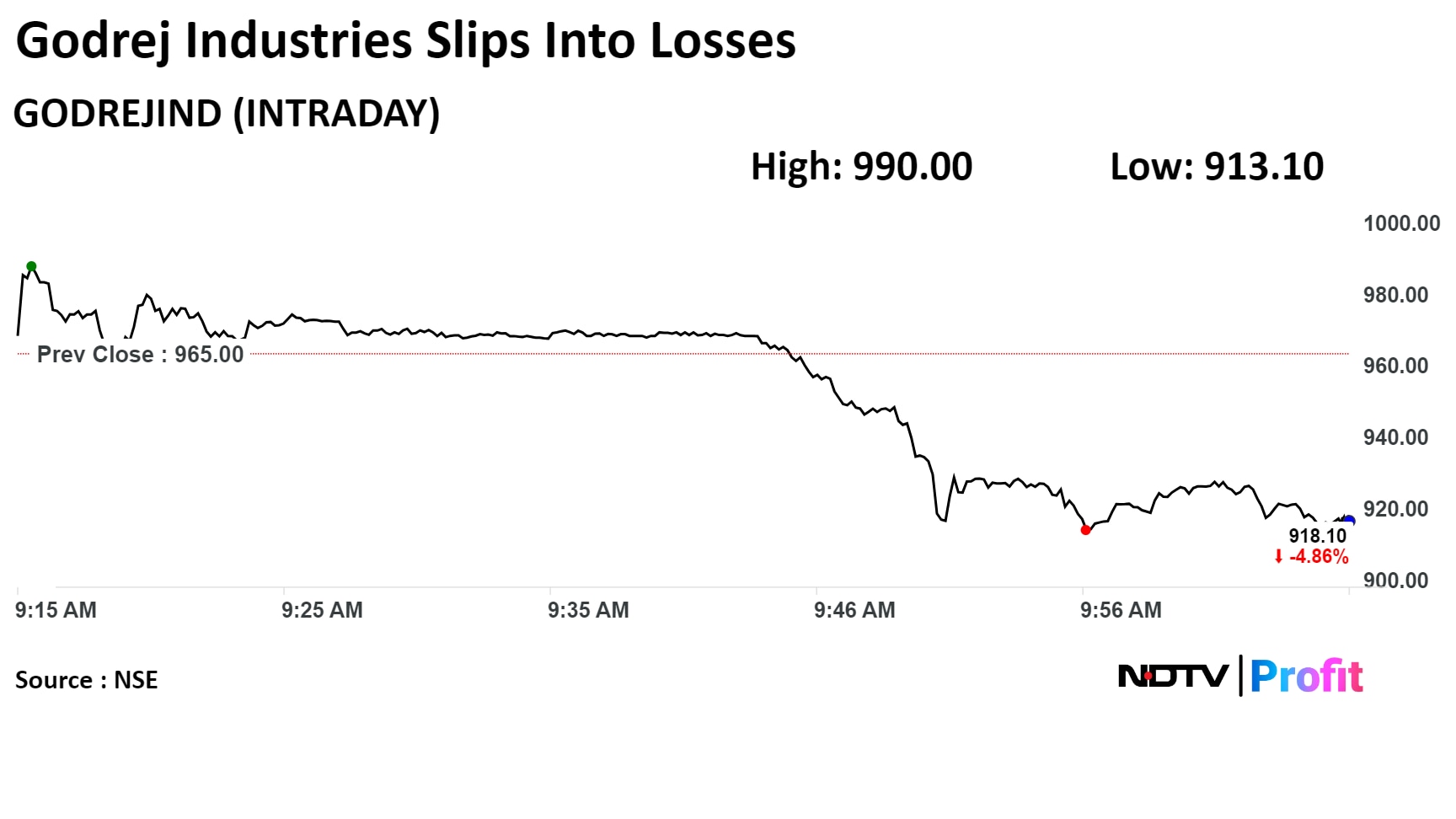

The company announced it will split the 125-year-old conglomerate to “maintain harmony and better align ownership.”

The company announced it will split the 125-year-old conglomerate to “maintain harmony and better align ownership.”

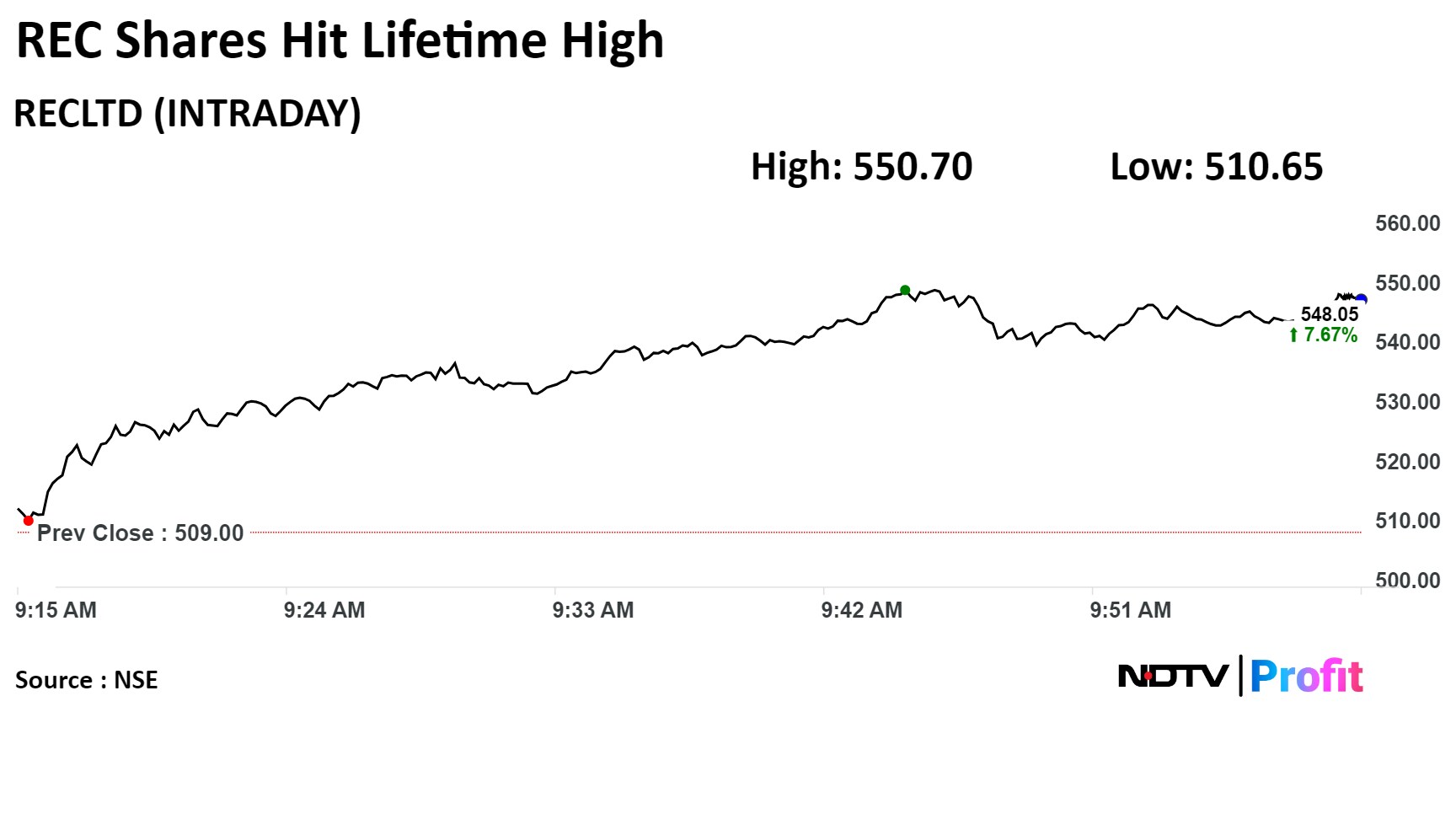

Consolidated total income at Rs 12,707 crore vs Rs 10,255 crore, up 24% YoY

Net profit at Rs 4,079 crore vs Rs 3,065 crore, up 33% YoY

Consolidated total income at Rs 12,707 crore vs Rs 10,255 crore, up 24% YoY

Net profit at Rs 4,079 crore vs Rs 3,065 crore, up 33% YoY

CLSA Reiterates BUY on REC, raises target to Rs 595 from Rs 560 previosuly

Management guides 15-18% AUM growth over next 3-4 years

View higher ROE, capex-led growth outlook as positive

Q4 credit cost of -0.6% a big positive

Company expects thermal capex to pick up, aims 50% market share in non-NTPC thermal projects

Does not expect write backs in FY25 due to more liquidation projects

Adjust loan growth, credit cost estimates, leading to 4% rise in FY25 EPS

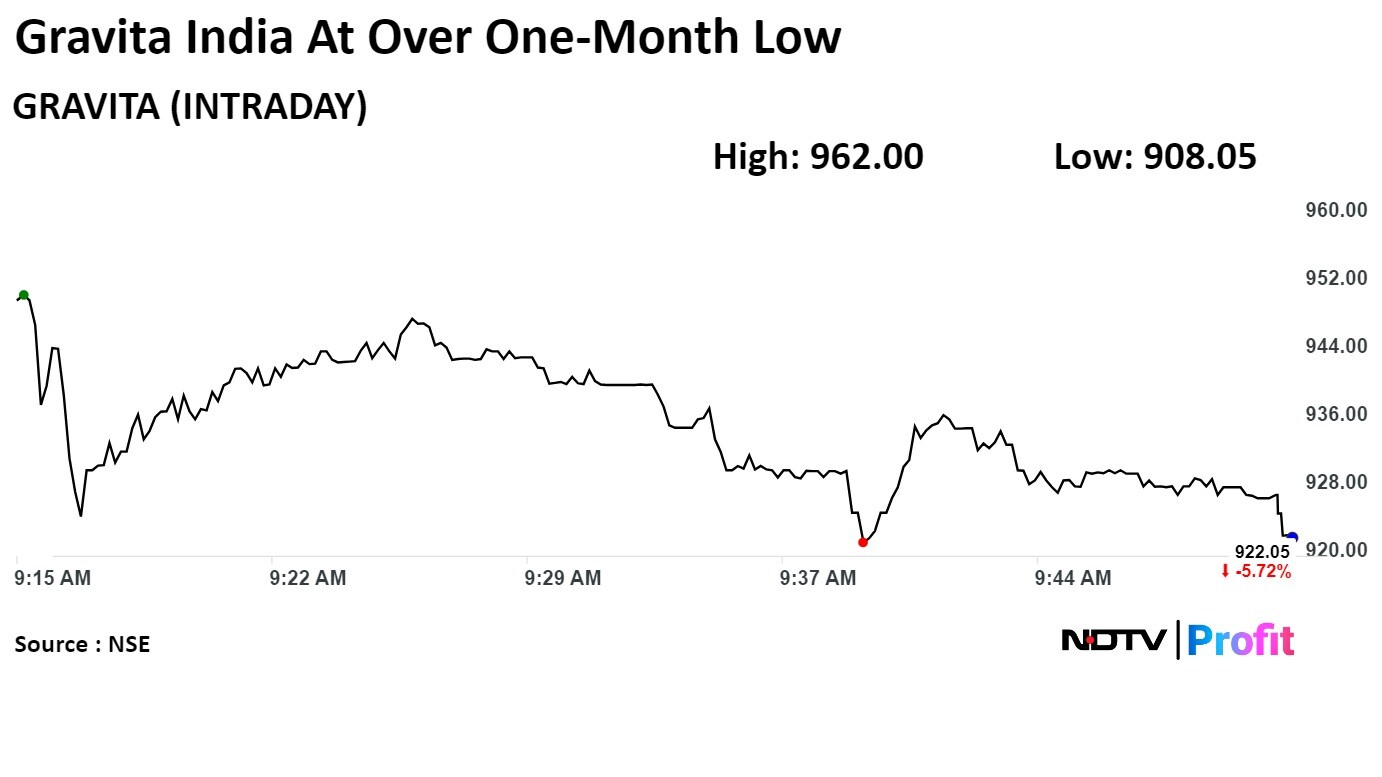

Shares of Gravita India Ltd. declined to the lowest level in over one month after the company's profit margin declined.

The recycling company's margin fell 11 bps to 8.35% in January-March, compared 8.46% in the corresponding period of previous financial year

Shares of Gravita India Ltd. declined to the lowest level in over one month after the company's profit margin declined.

The recycling company's margin fell 11 bps to 8.35% in January-March, compared 8.46% in the corresponding period of previous financial year

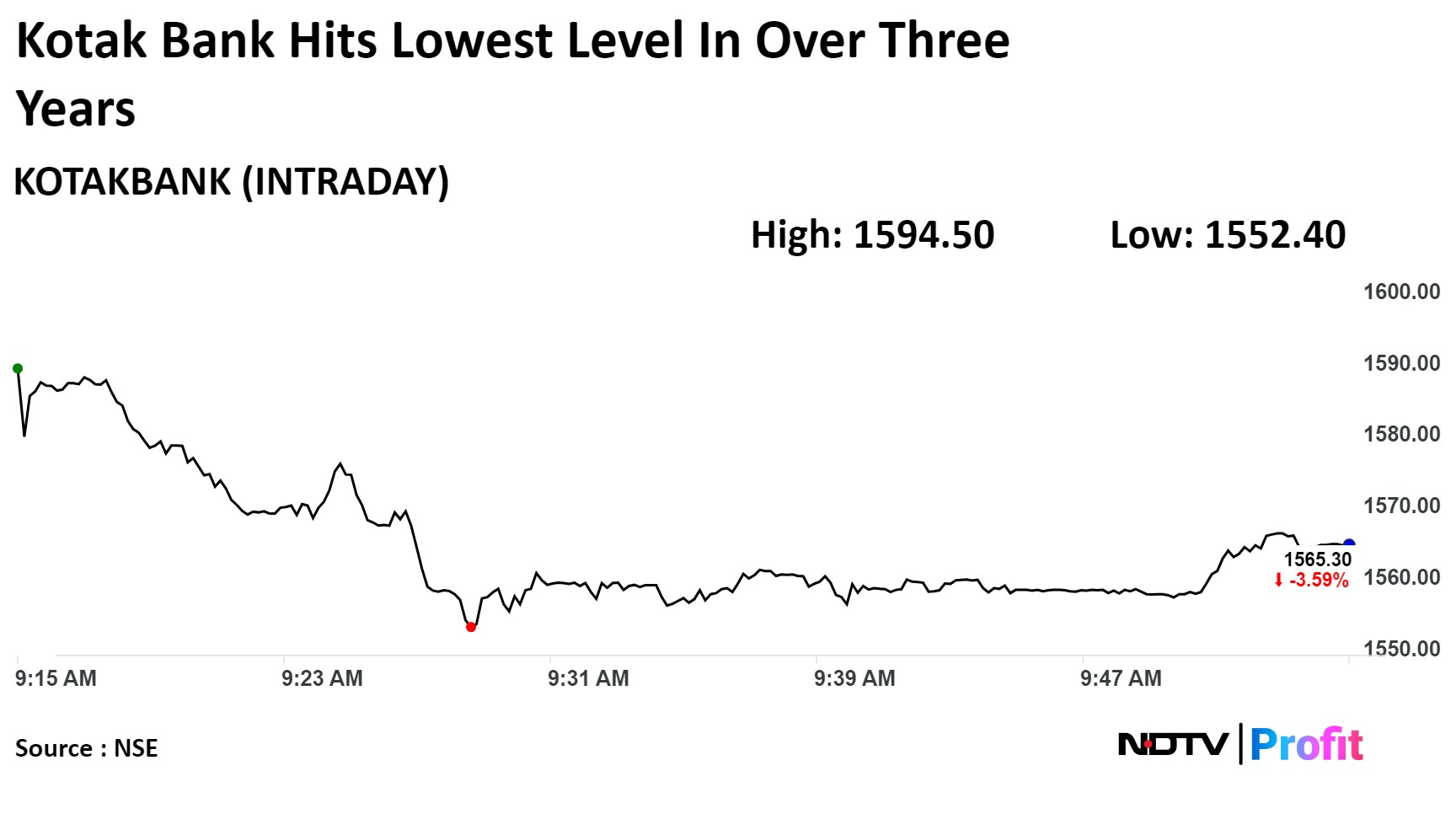

Kotak Mahindra Bank Ltd.'s Joint Managing Director, KVS Manian, has resigned from his post, which has analysts concerned that recent key managerial personnel changes would weigh on the private lender's growth outlook.

Kotak Mahindra Bank Ltd.'s Joint Managing Director, KVS Manian, has resigned from his post, which has analysts concerned that recent key managerial personnel changes would weigh on the private lender's growth outlook.

The scrip declined as much as 4.41% to Rs 1,552.40, the lowest level since Nov 20, 2024. It was trading 3.80% down at Rs 1,562.50 as of 10:49 a.m., as compared to 0.32% advance in the NSE Nifty 50 index.

The stock has declined 18.68% in 12 months, and on year-to-date basis, it has fallen 18.01%. Total traded volume so far in the day stood at 7.6 times its 30-day average. The relative strength index was at 28.94, which implied the stock is oversold.

Out of 43 analysts tracking the company, 22 maintain a 'buy' rating, 14 recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.3%.

The GIFT Nifty recorded a new milestone and achieved a record monthly turnover of 18,66,728 contracts worth $82.04 billion or Rs 6,85,187.4 crore. This surpasses its previous record of $78.09 billion set in February 2024.

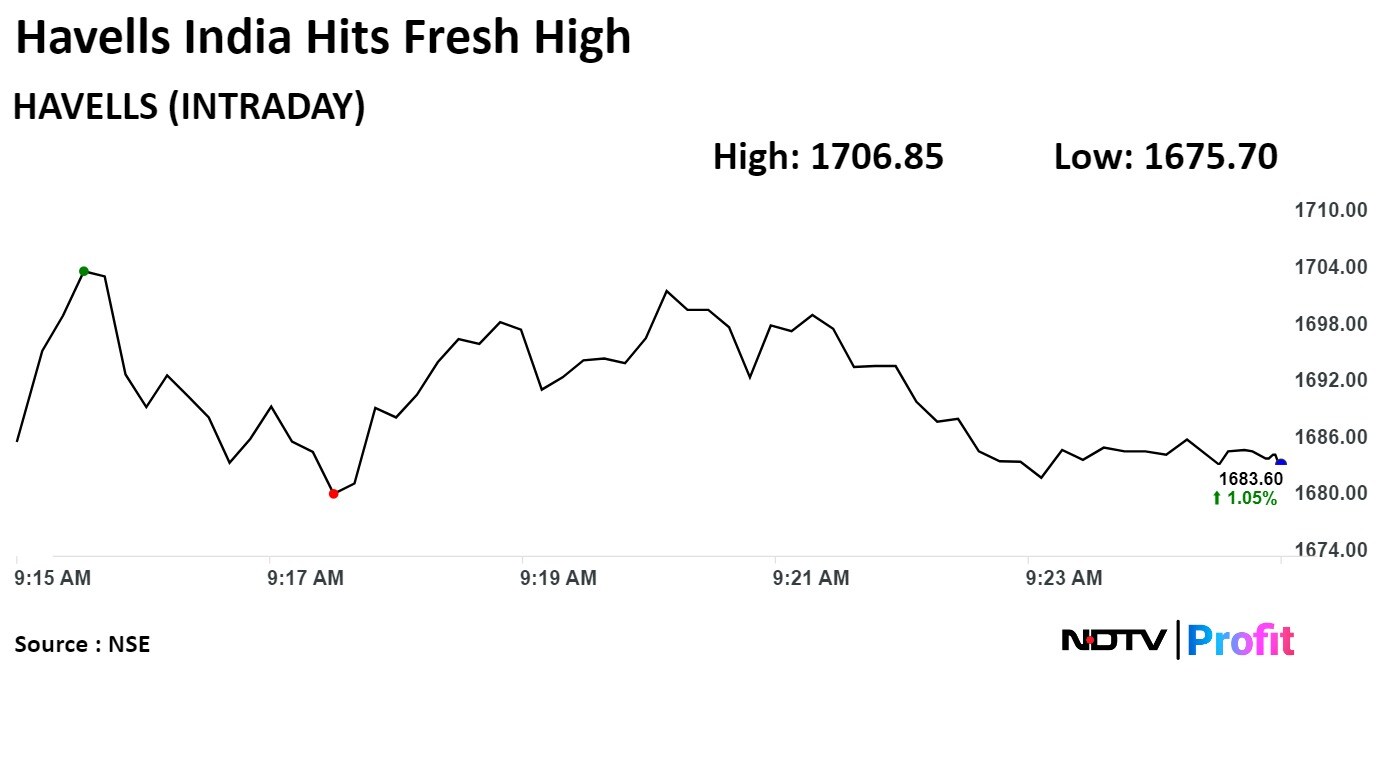

Havells India Ltd. rose to the highest level since its listing on Thursday after the company's net profit grew more than expectation during January-March. The scrip rose as much as 2.58% to Rs 1,706.85.

Havells India Ltd. rose to the highest level since its listing on Thursday after the company's net profit grew more than expectation during January-March. The scrip rose as much as 2.58% to Rs 1,706.85.

The index gained consecutively in the second session with shares of Mahindra & Mahindra and Tata Motors contributing the most.

The index gained consecutively in the second session with shares of Mahindra & Mahindra and Tata Motors contributing the most.

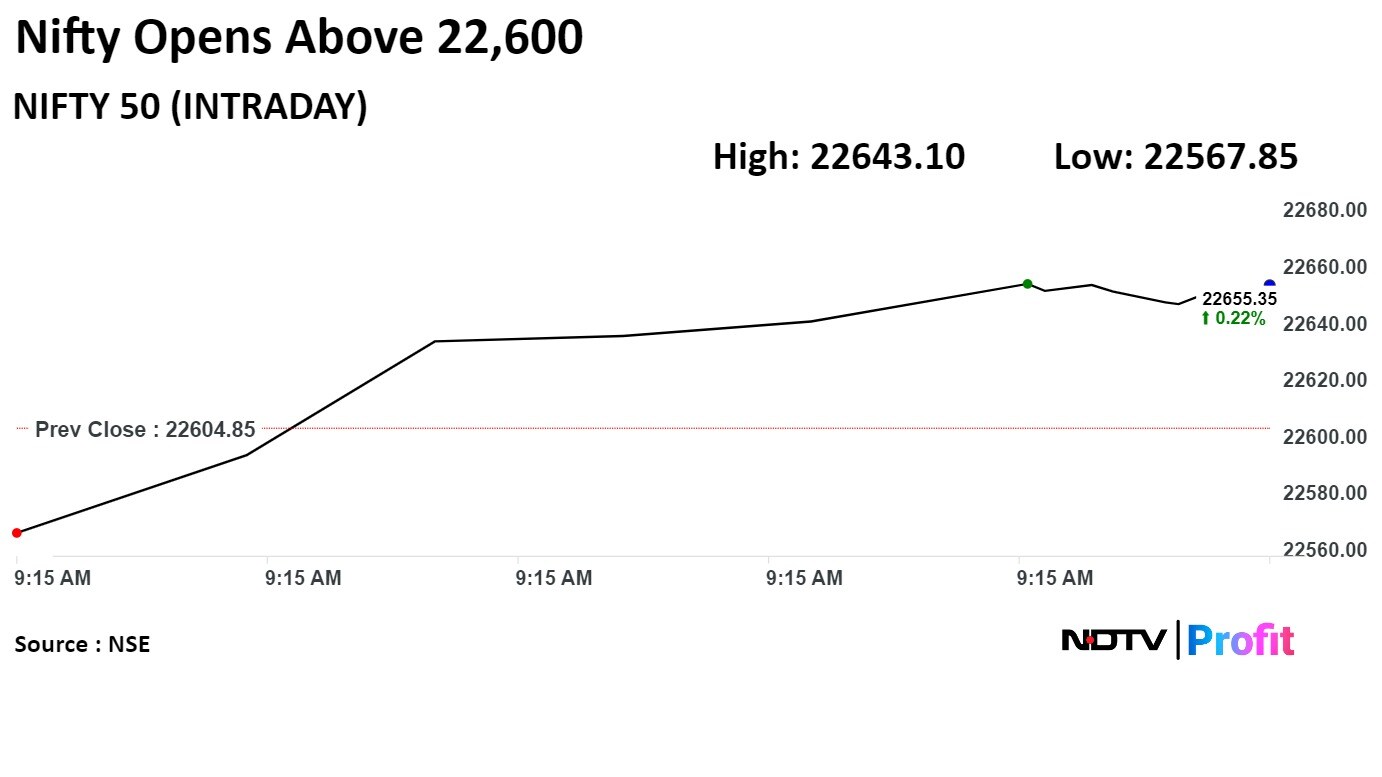

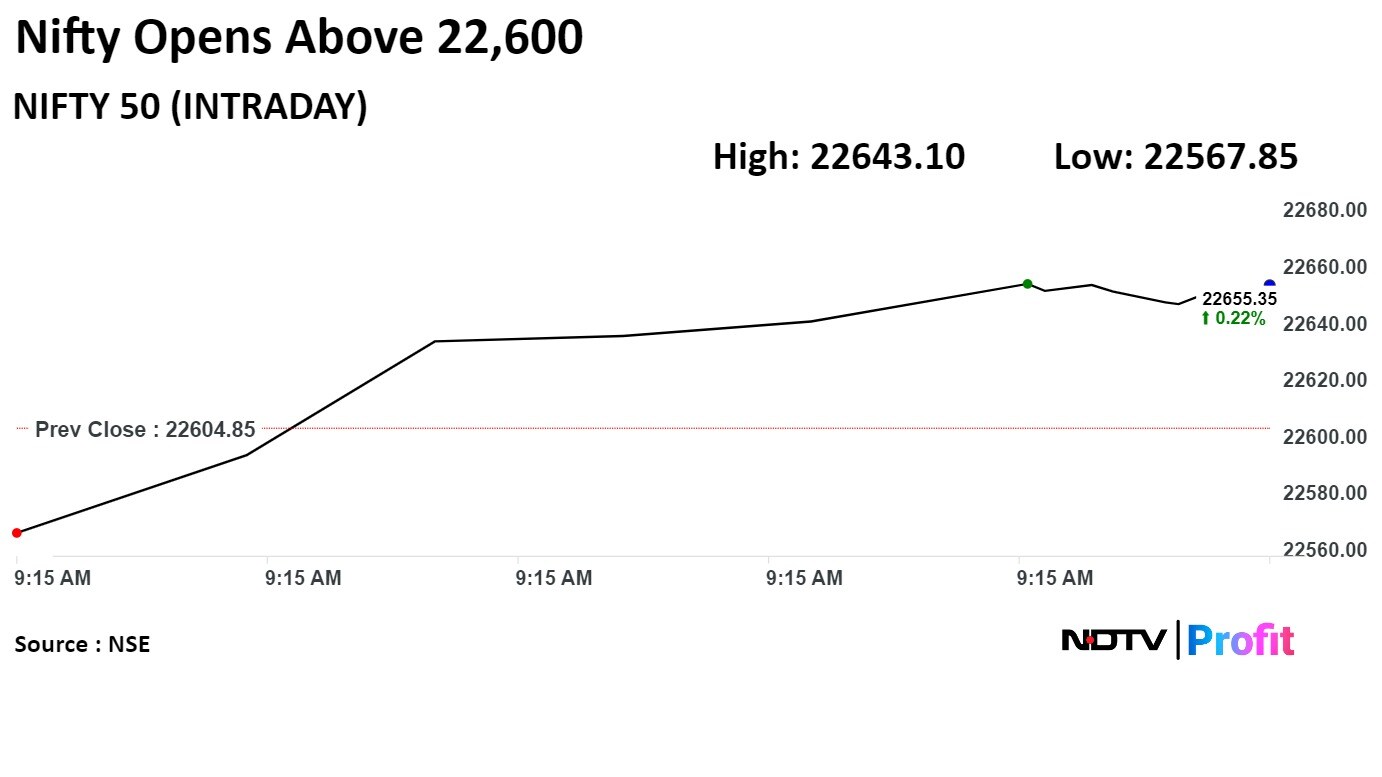

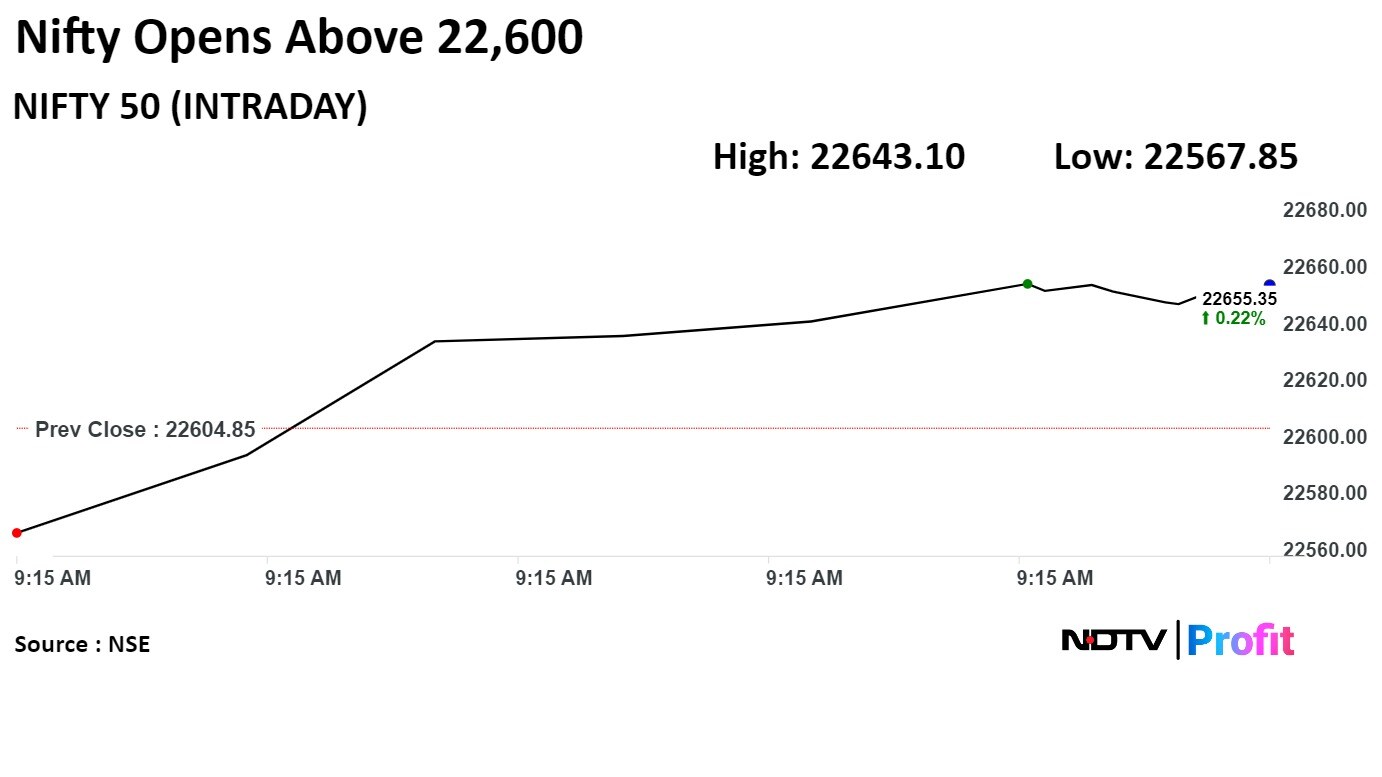

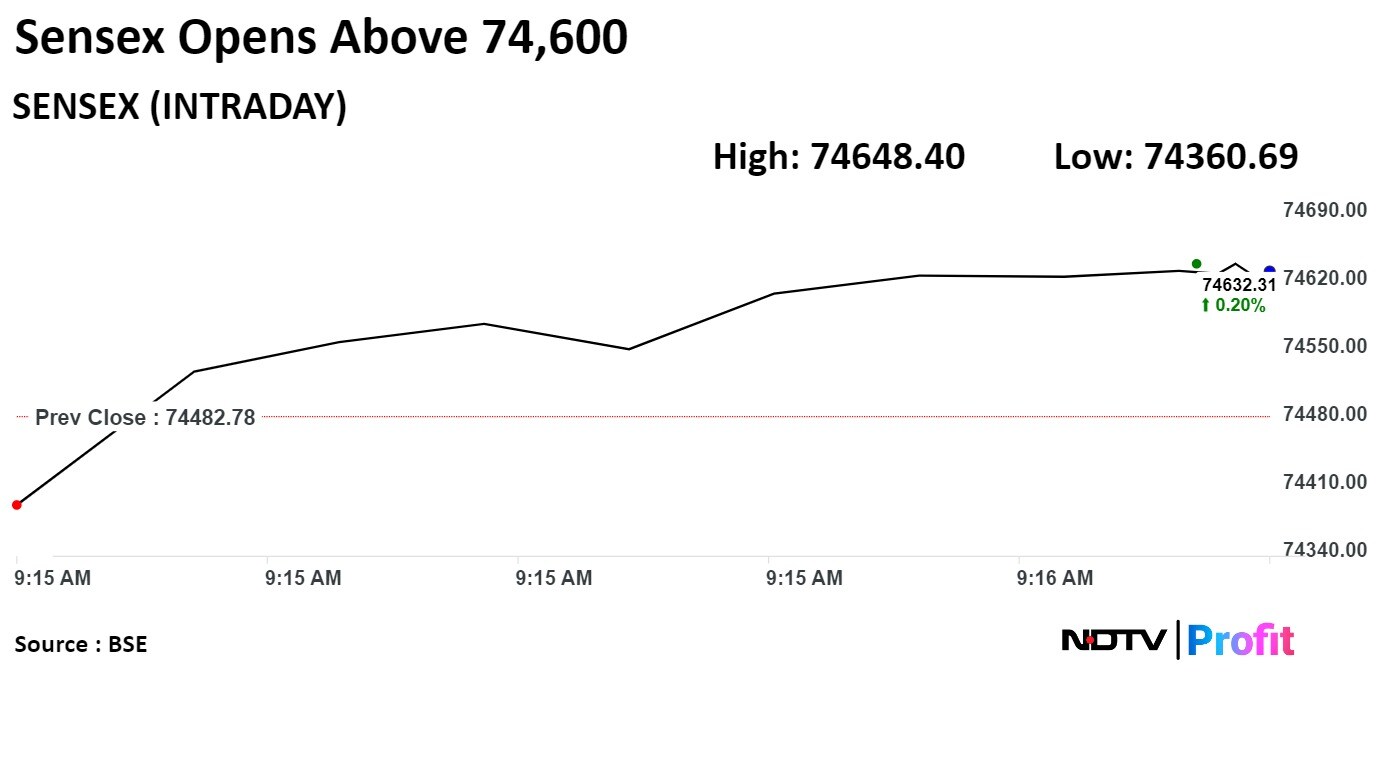

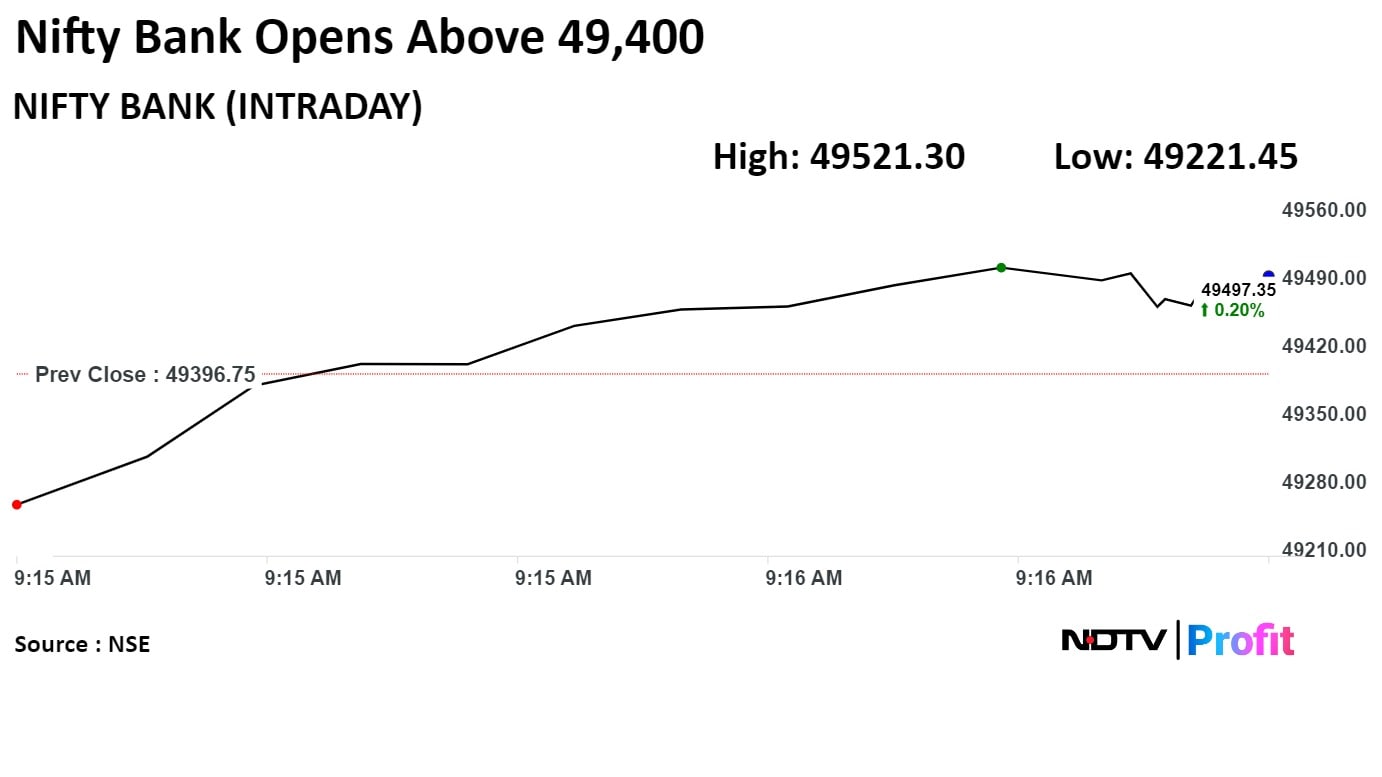

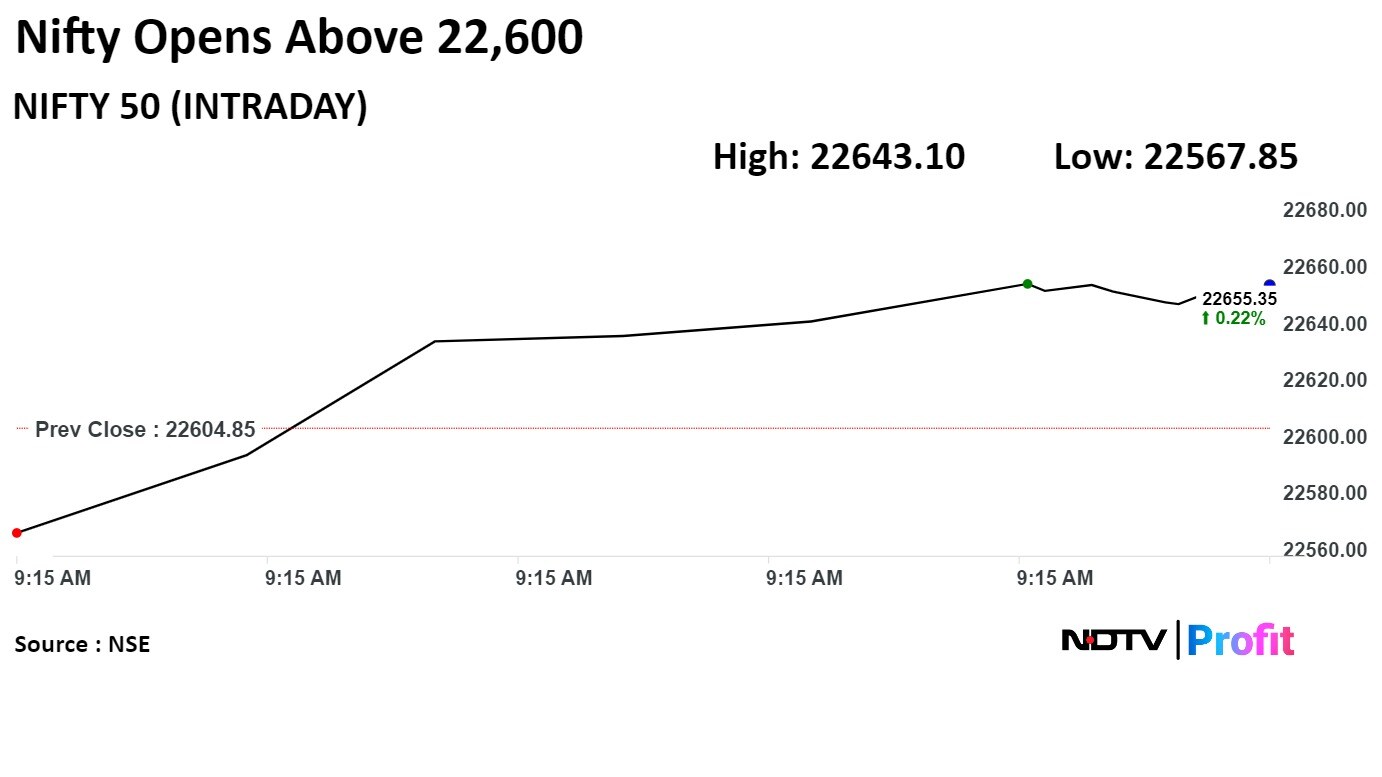

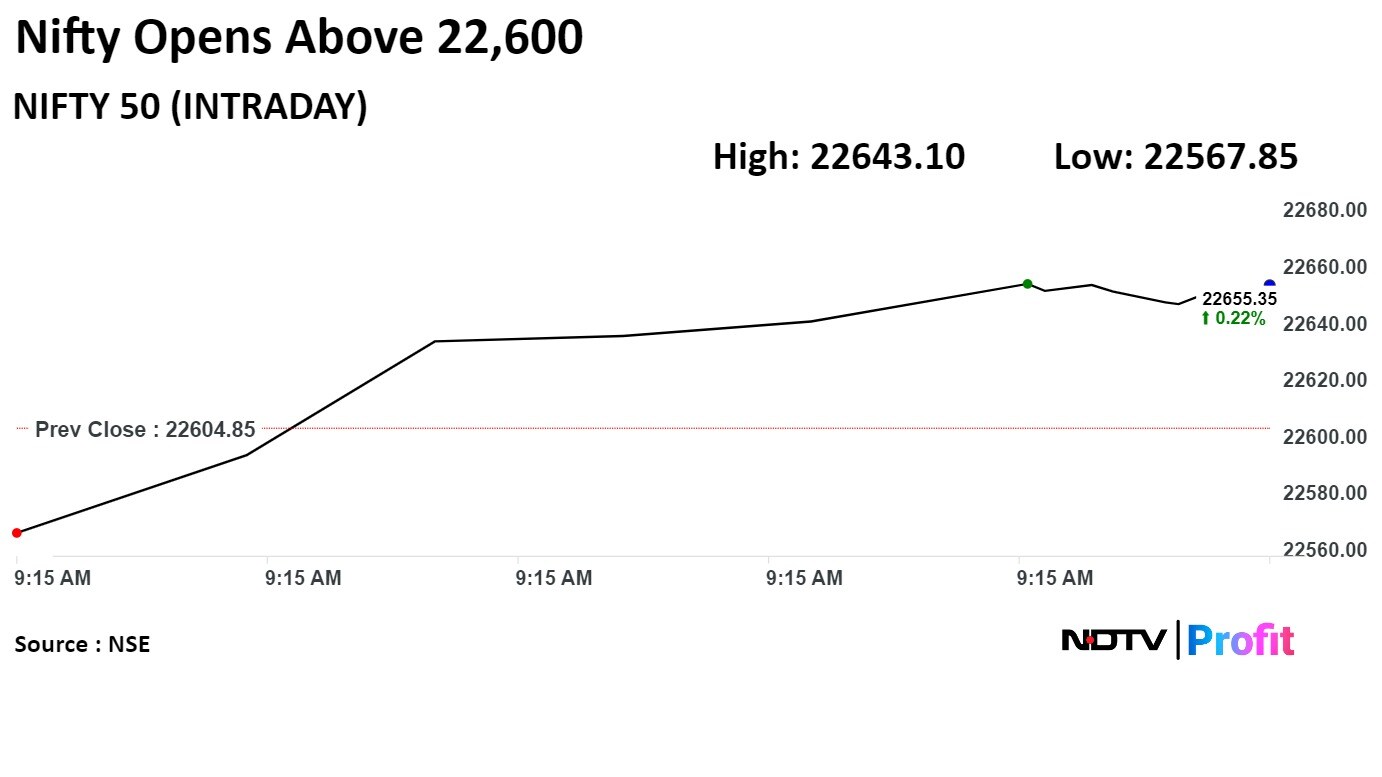

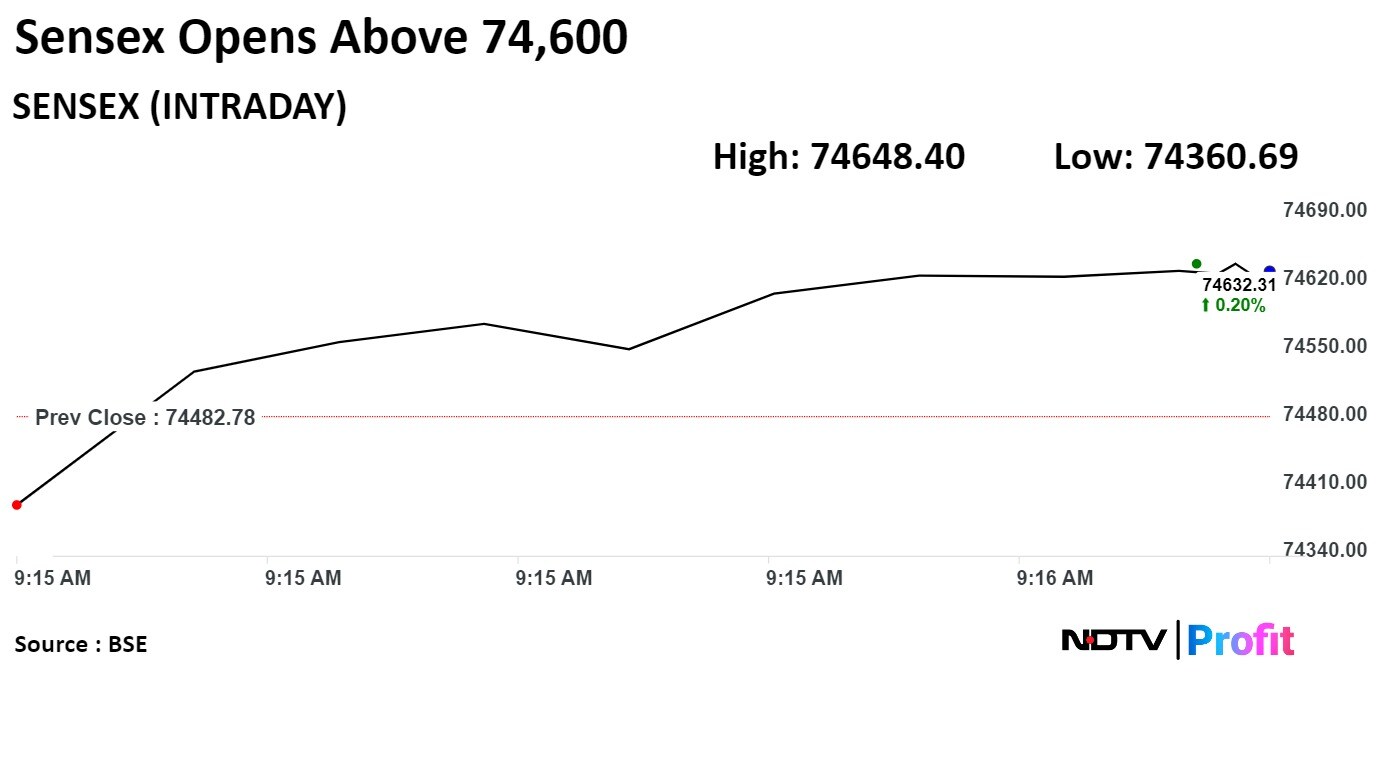

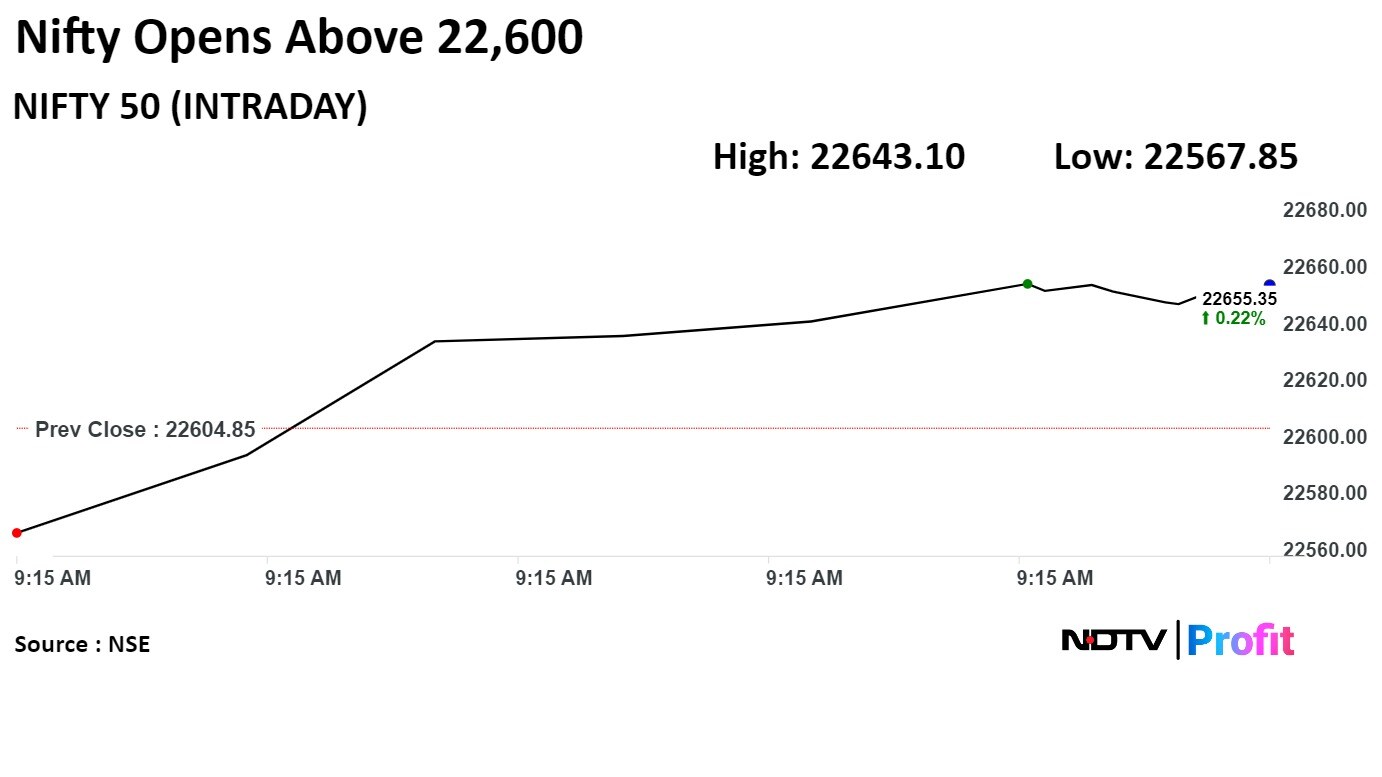

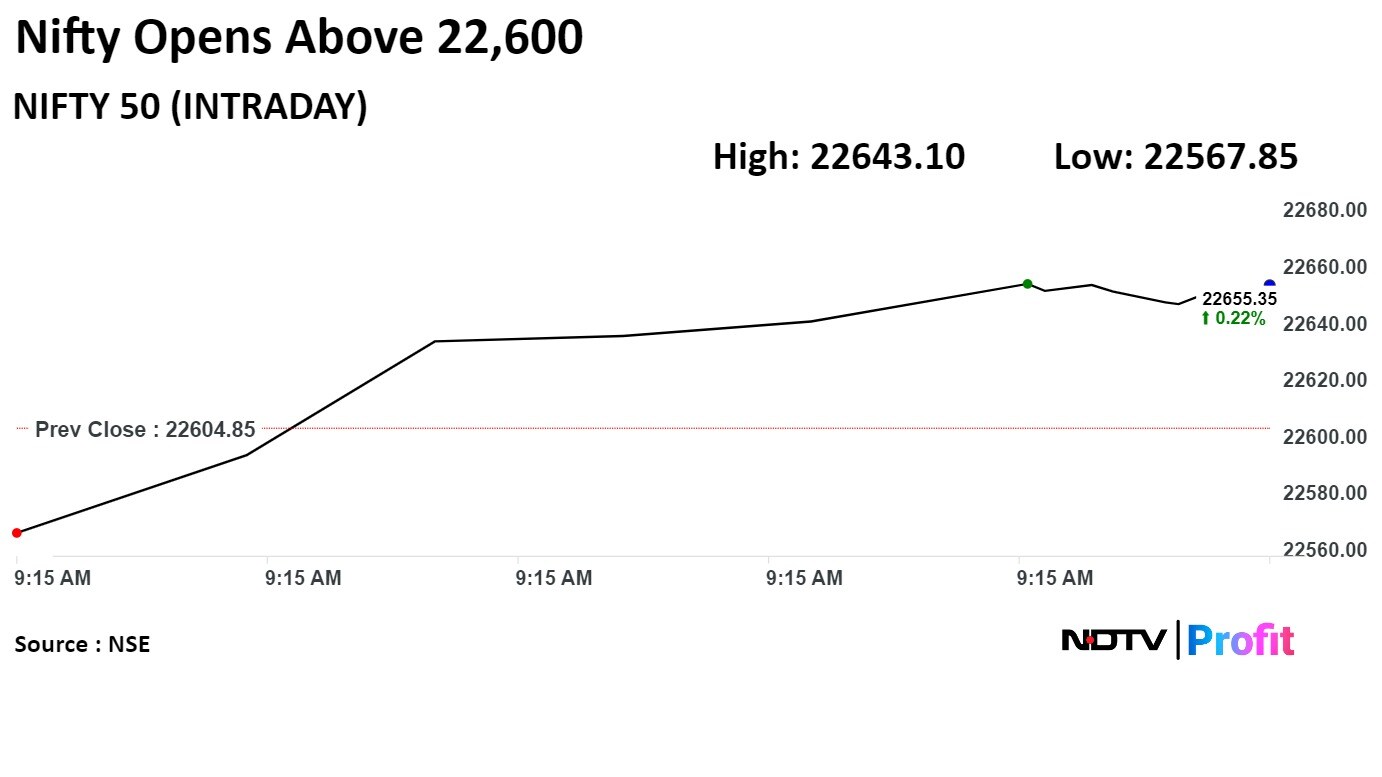

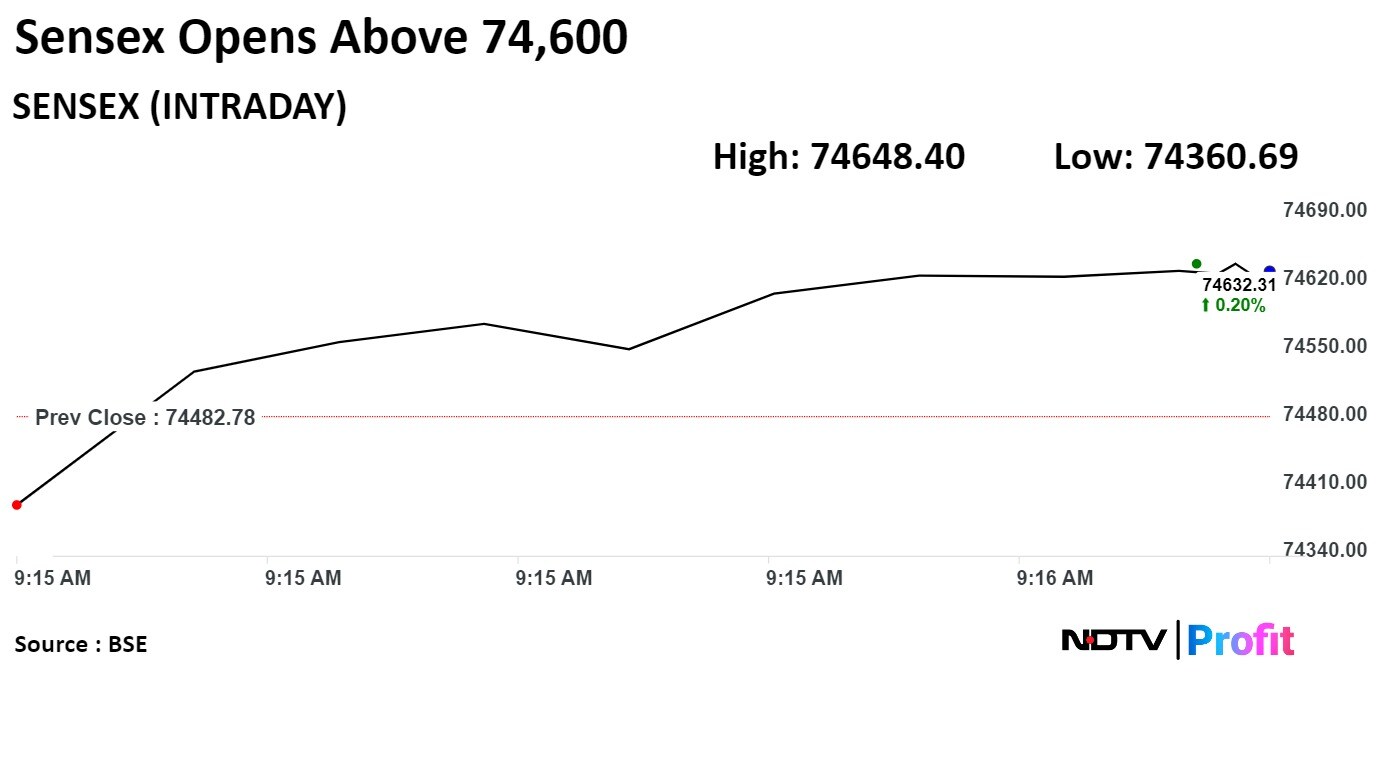

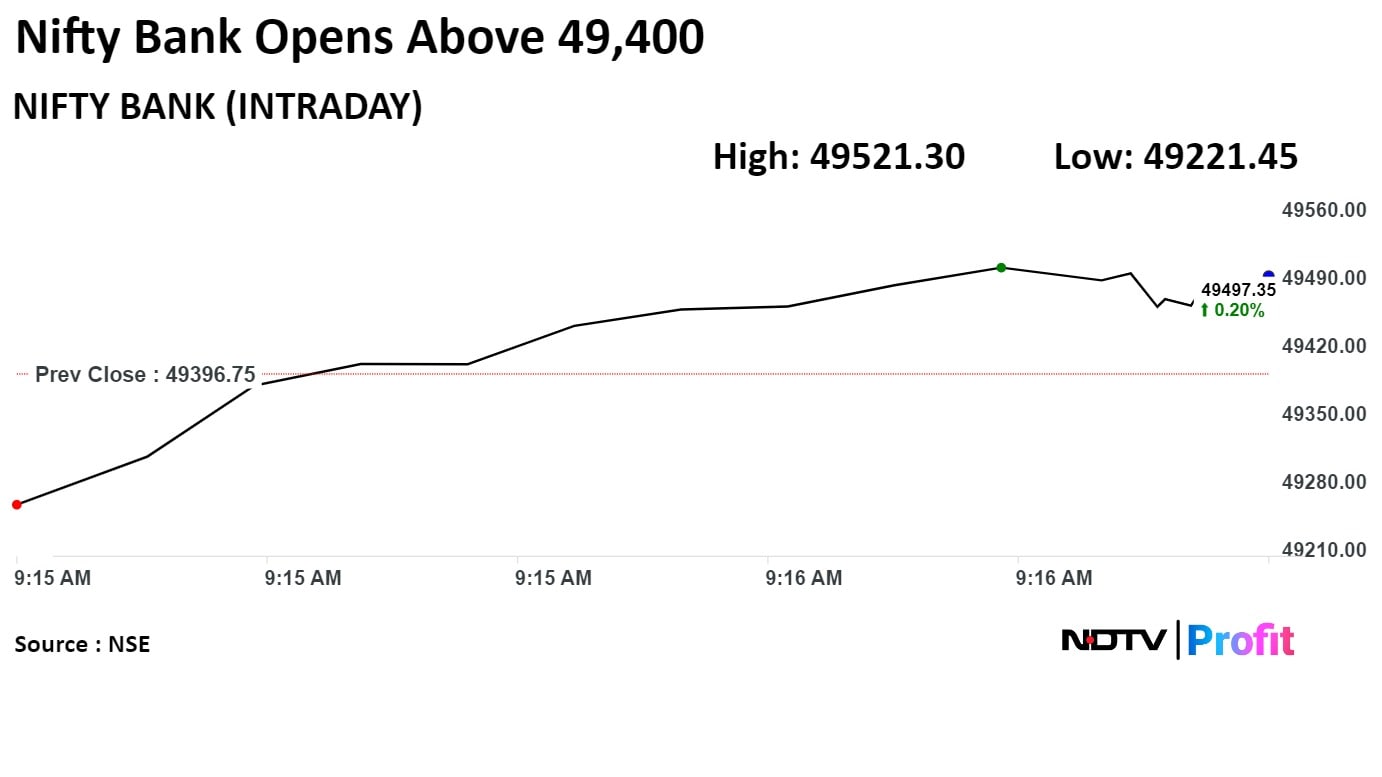

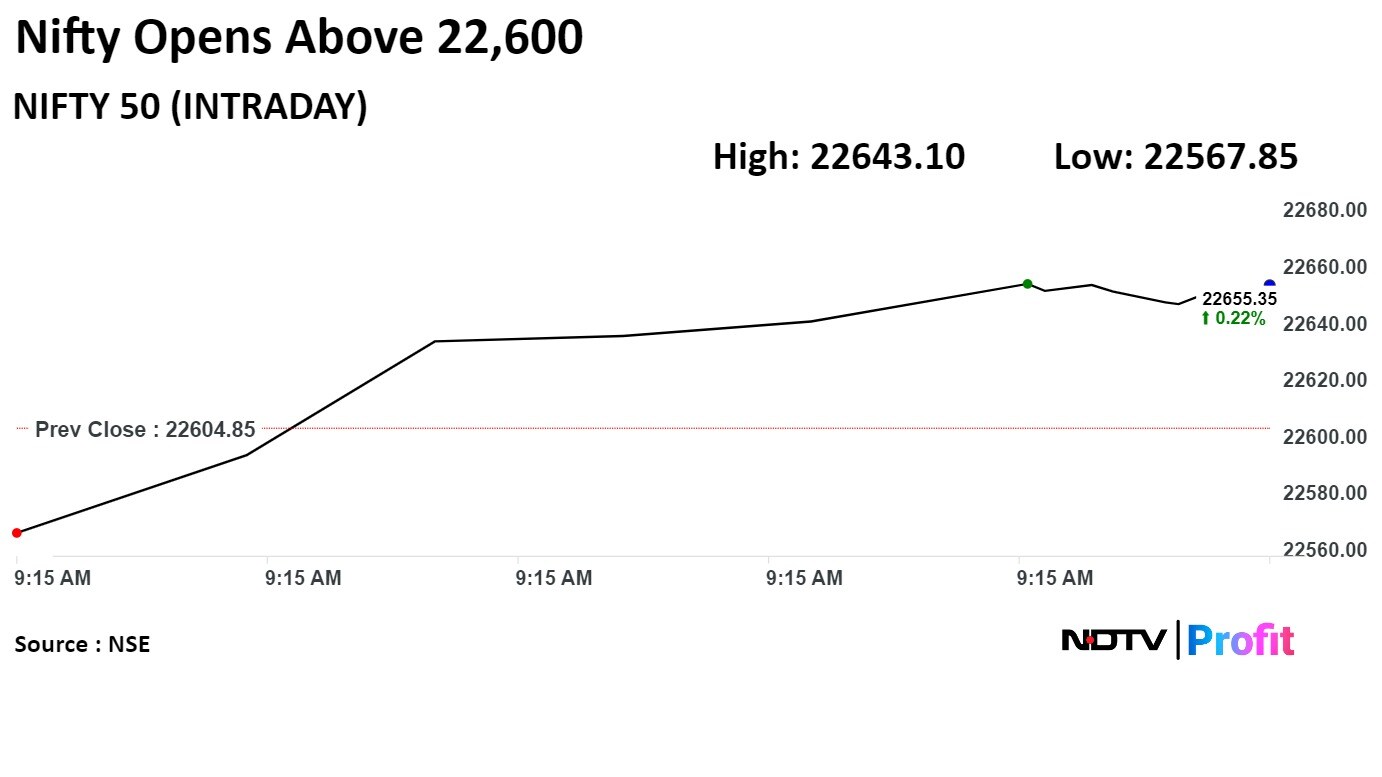

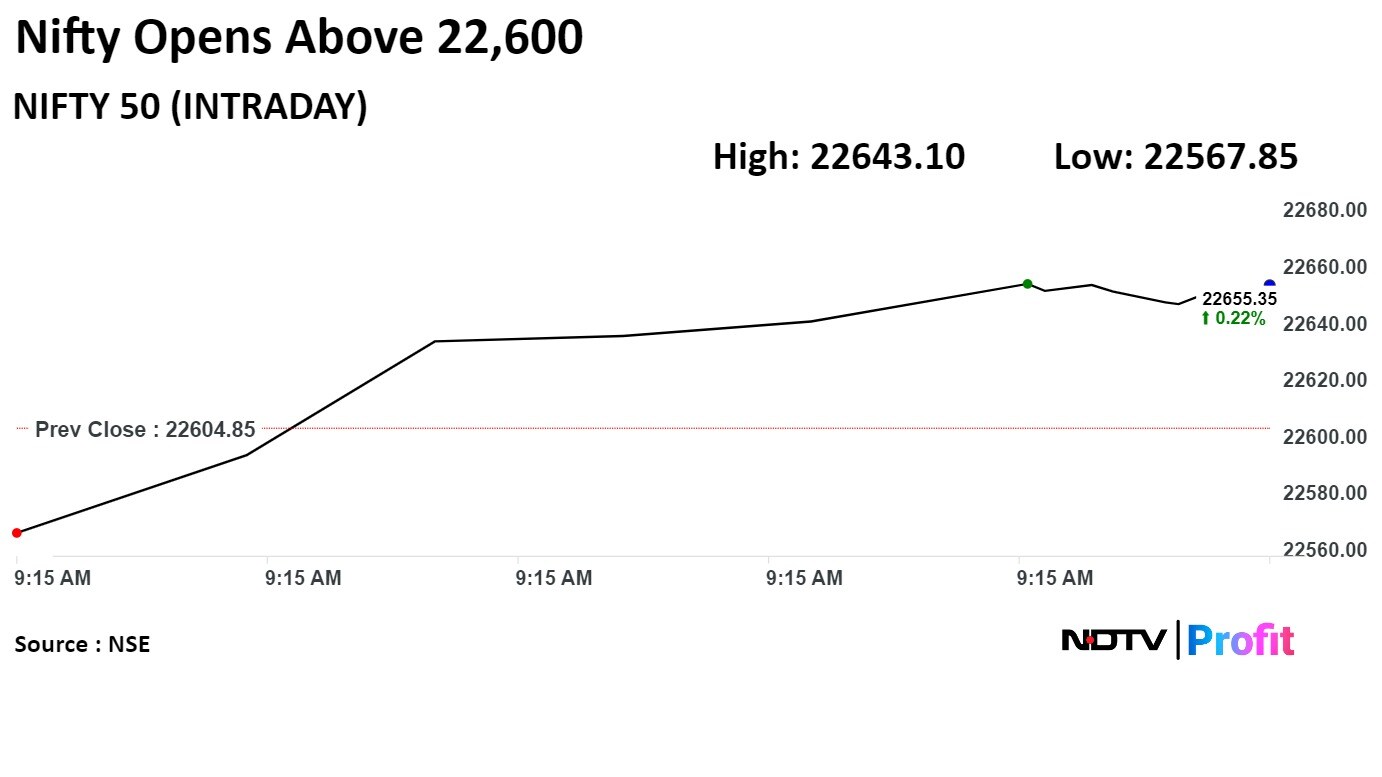

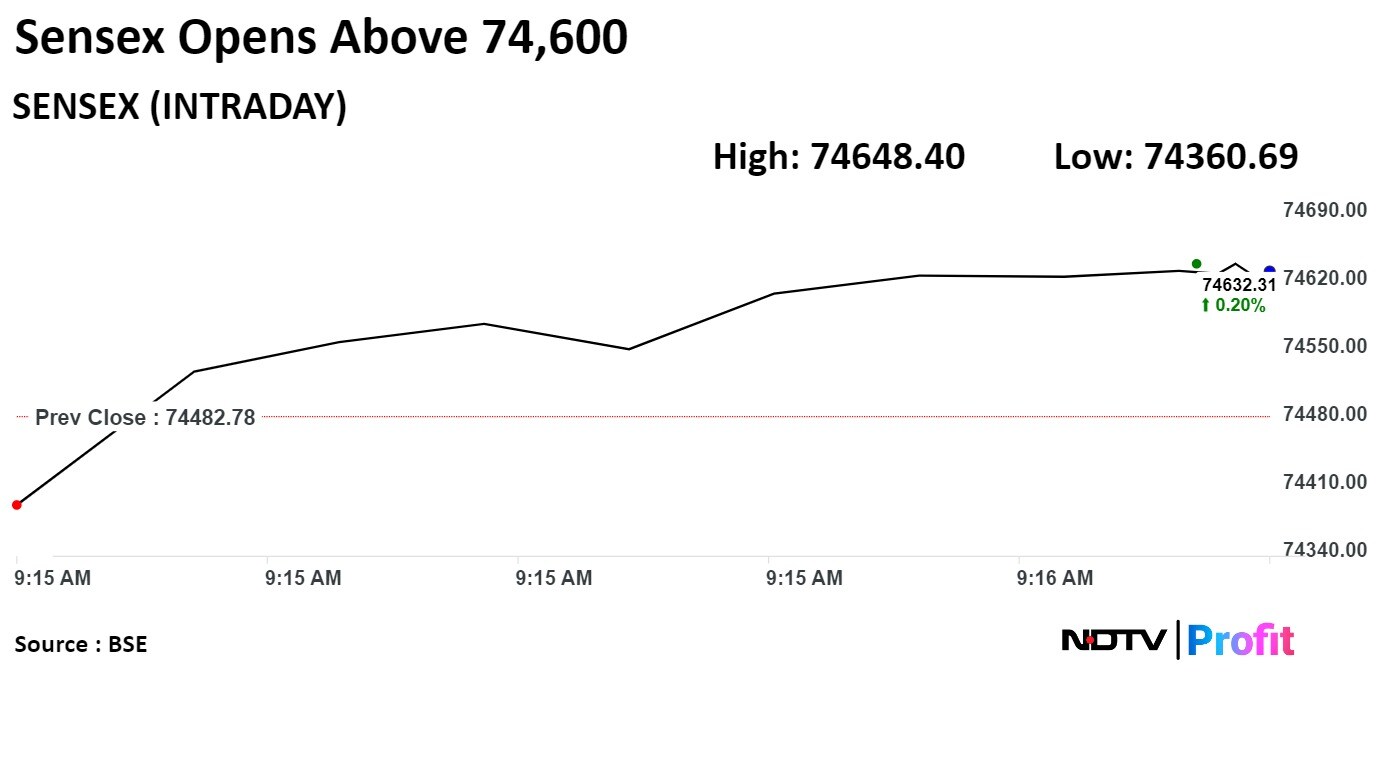

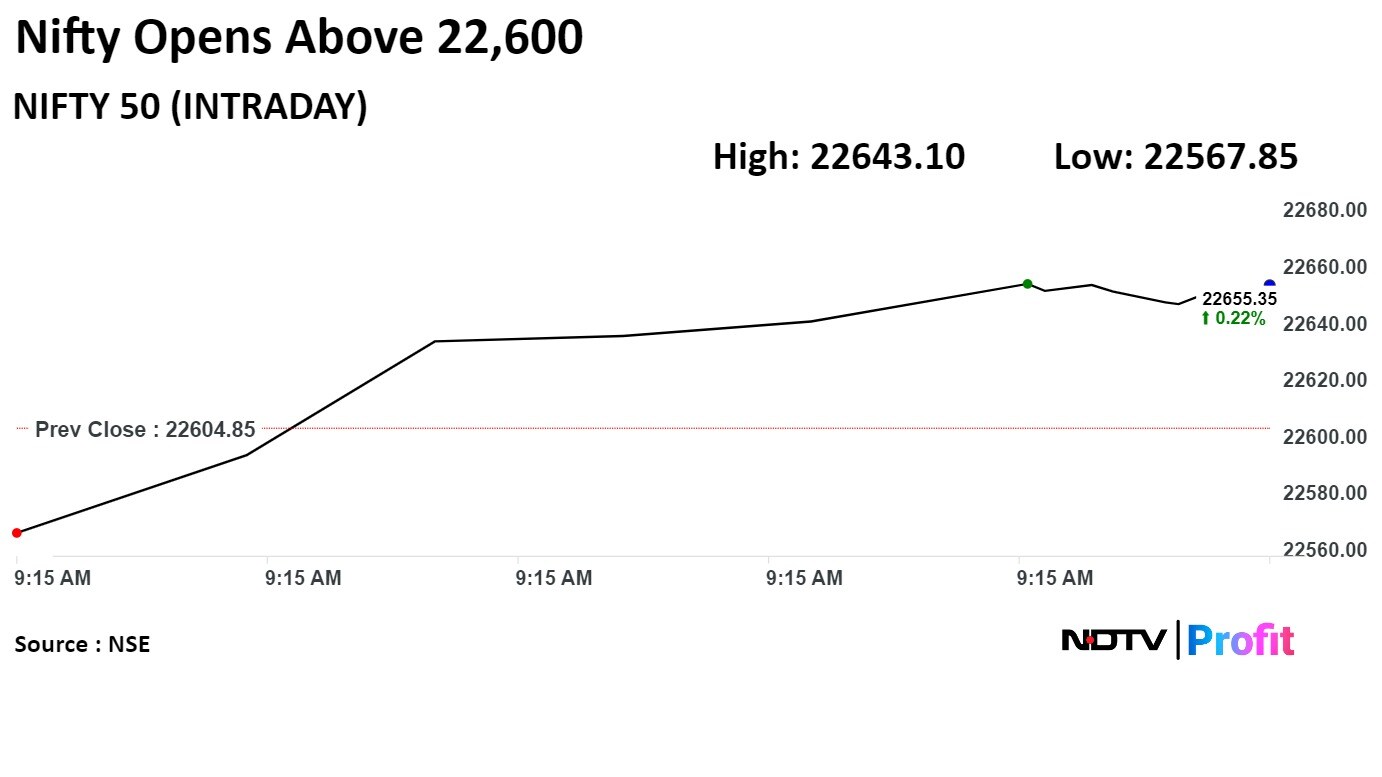

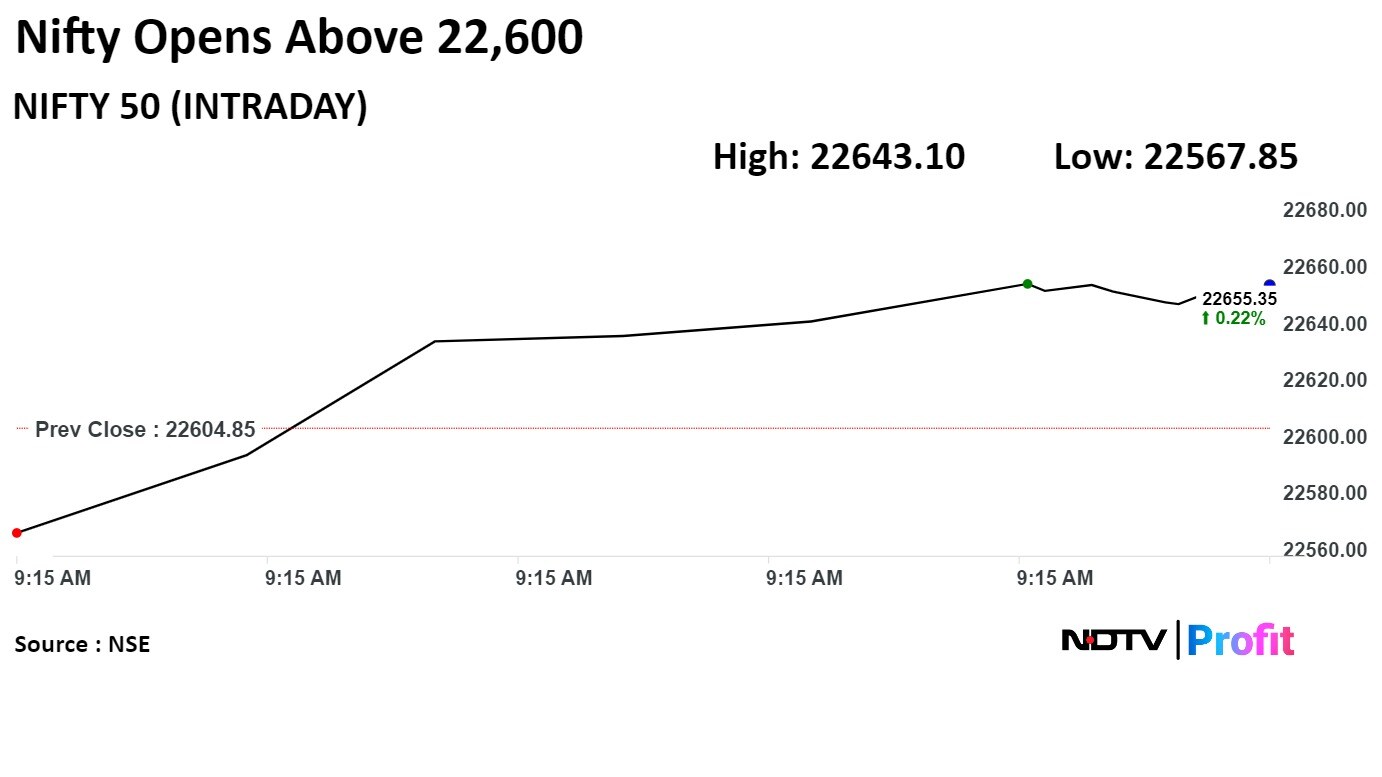

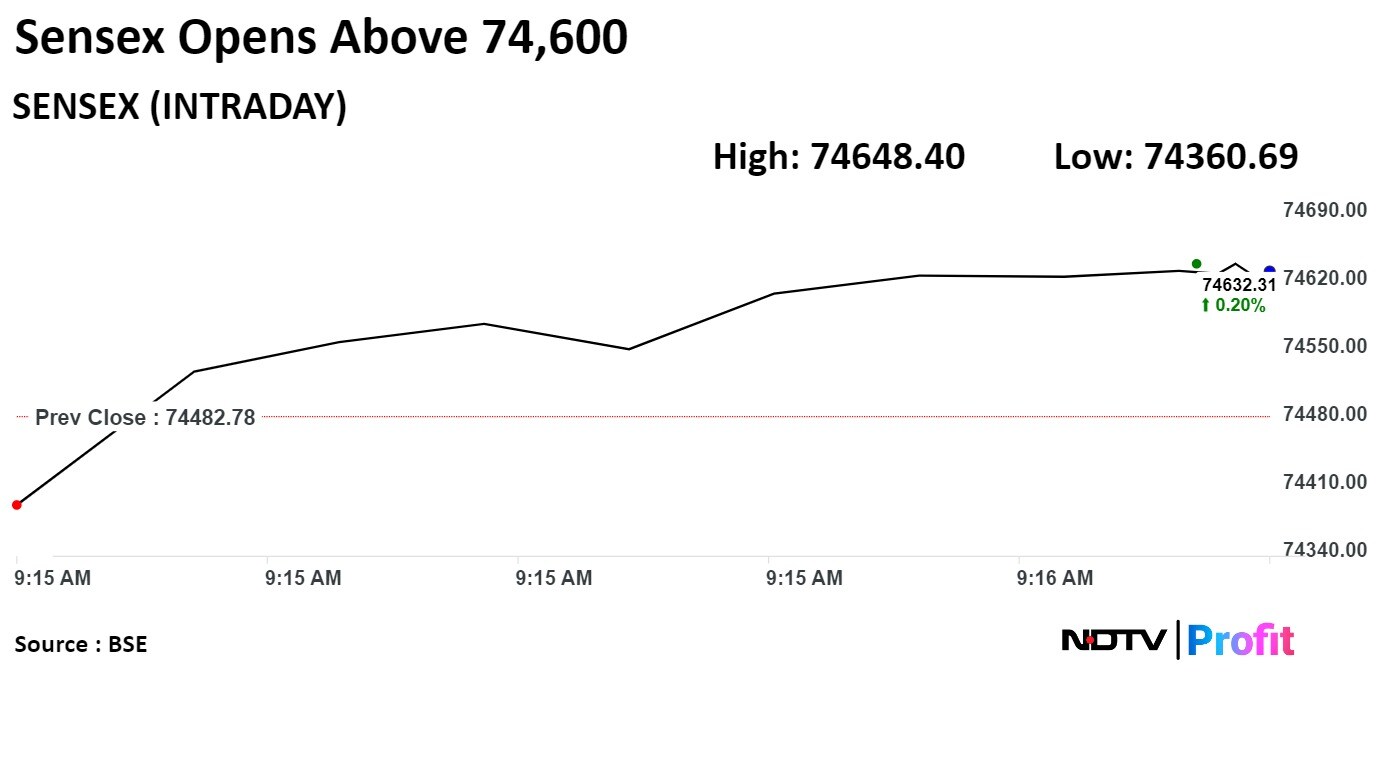

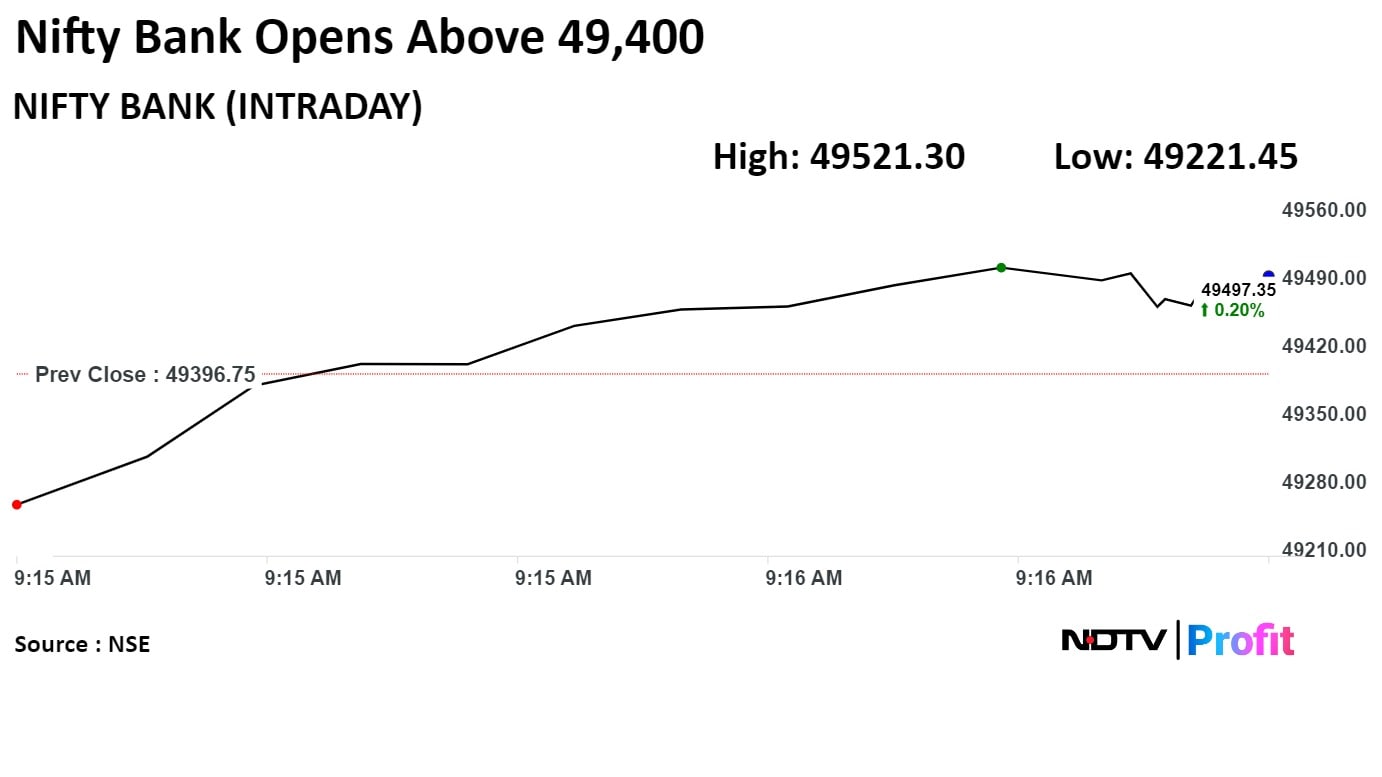

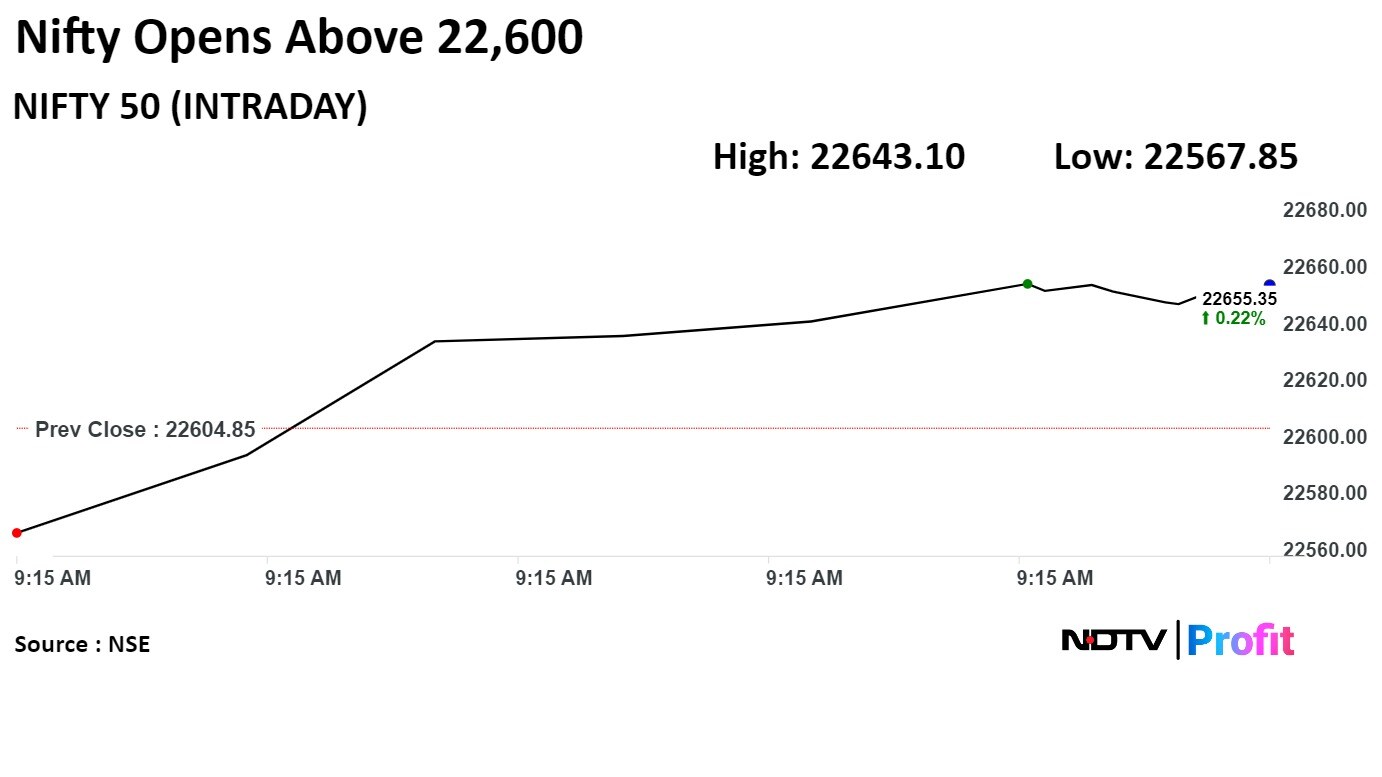

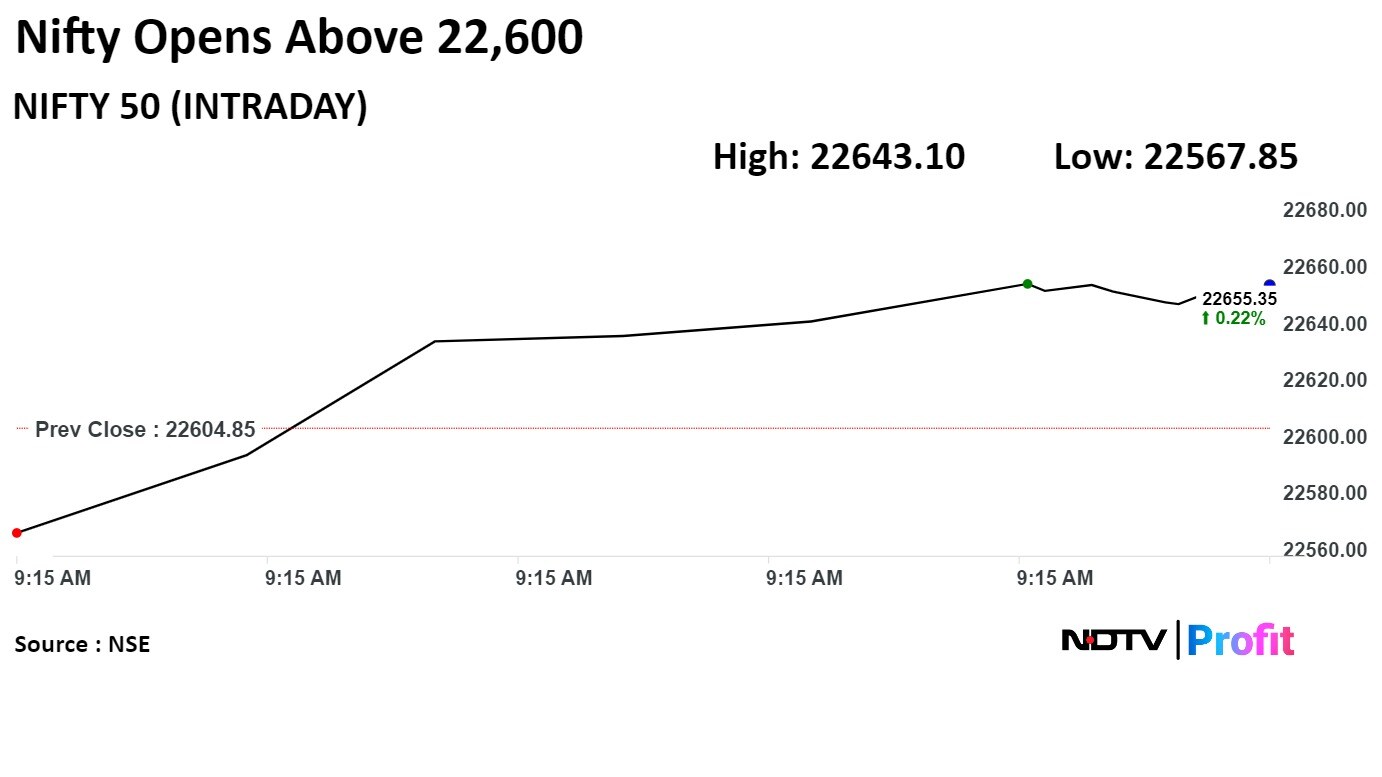

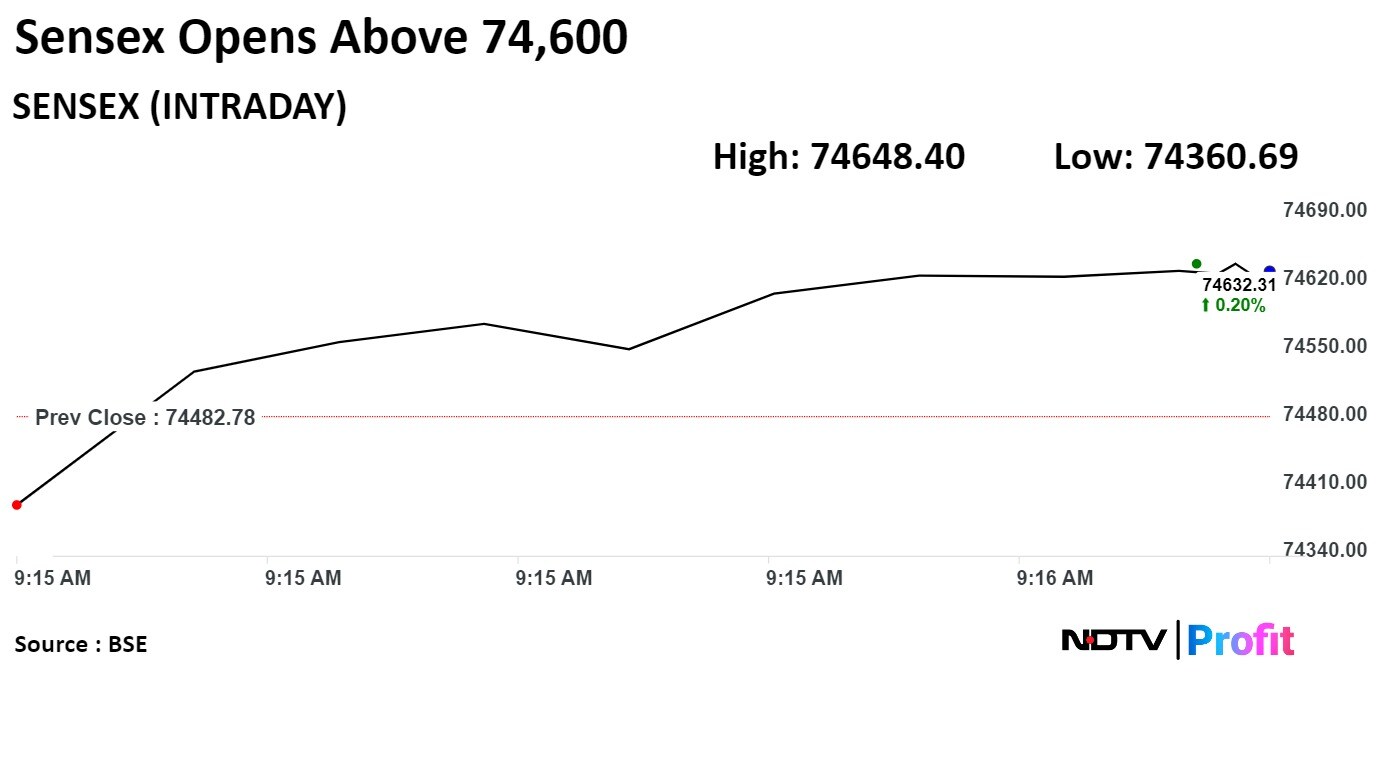

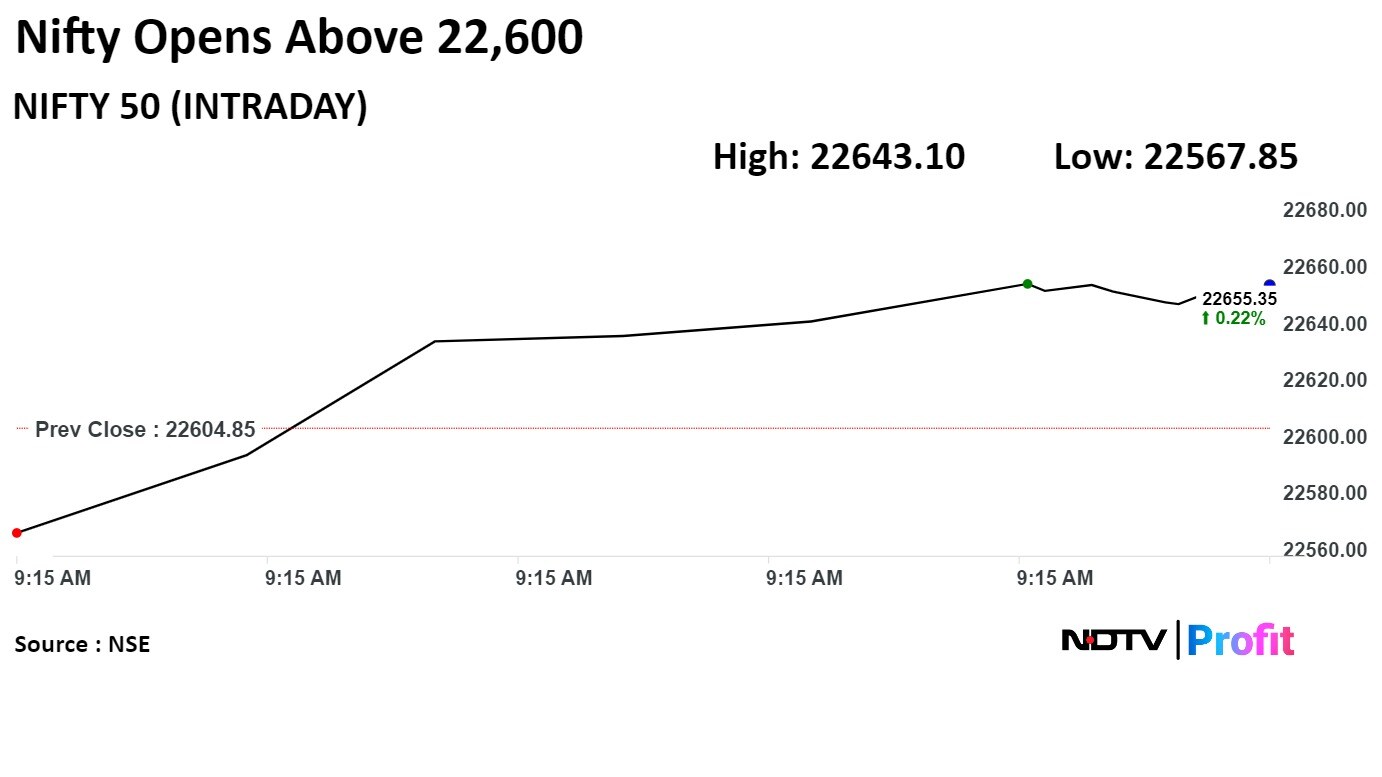

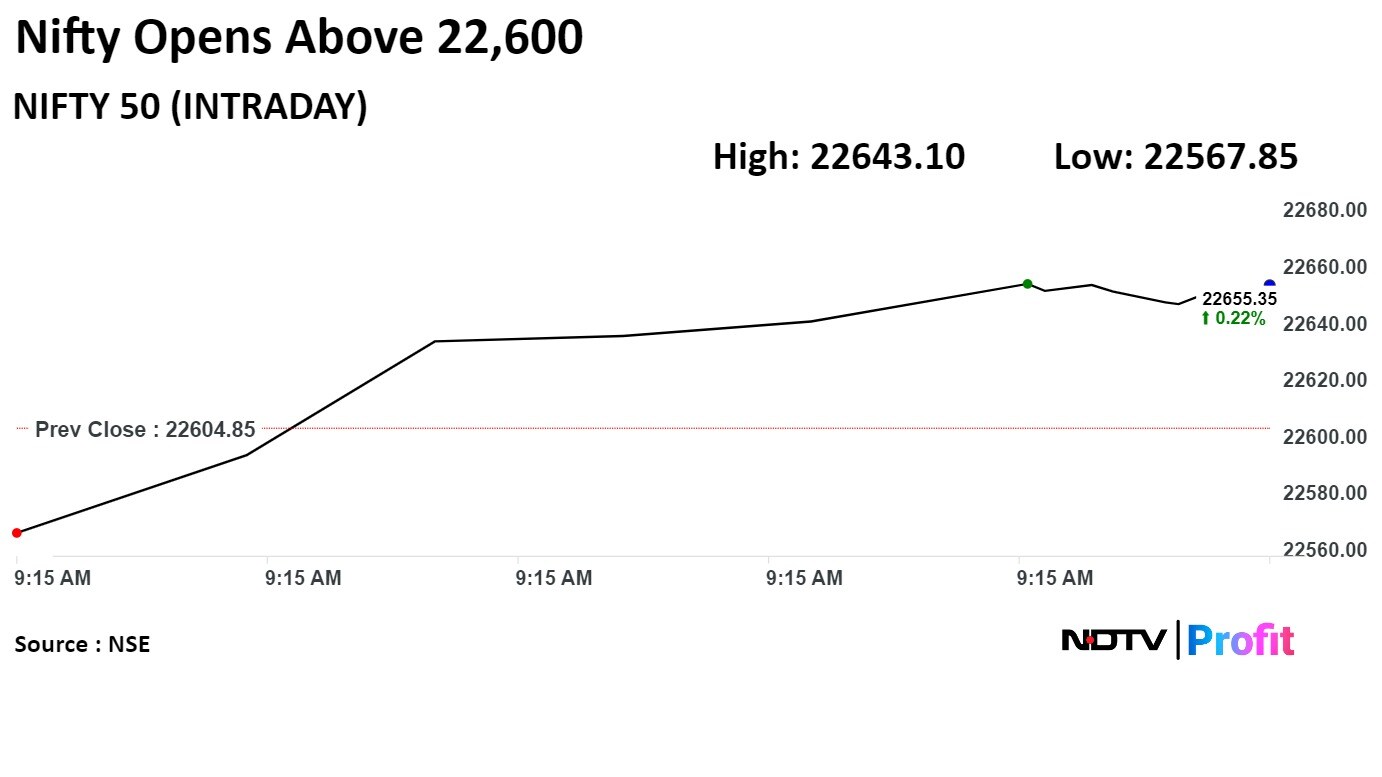

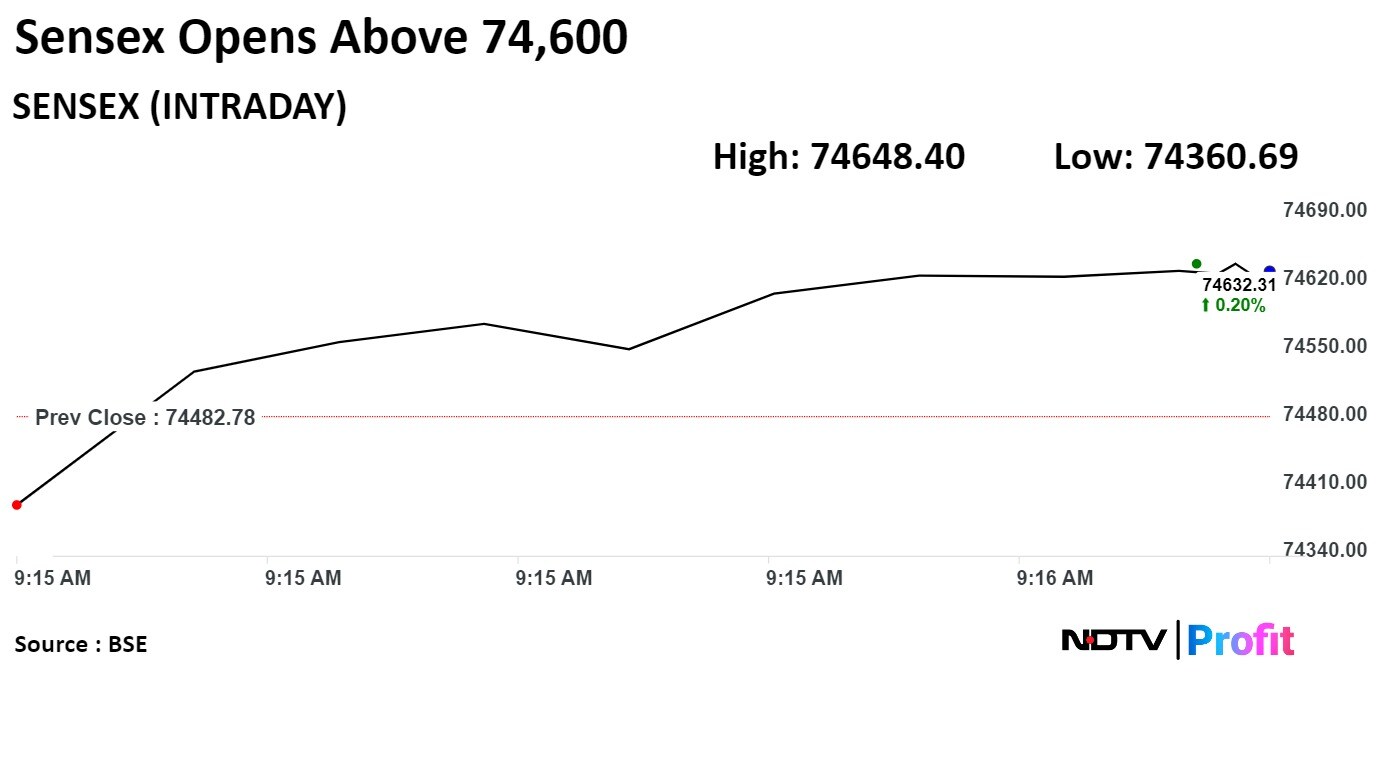

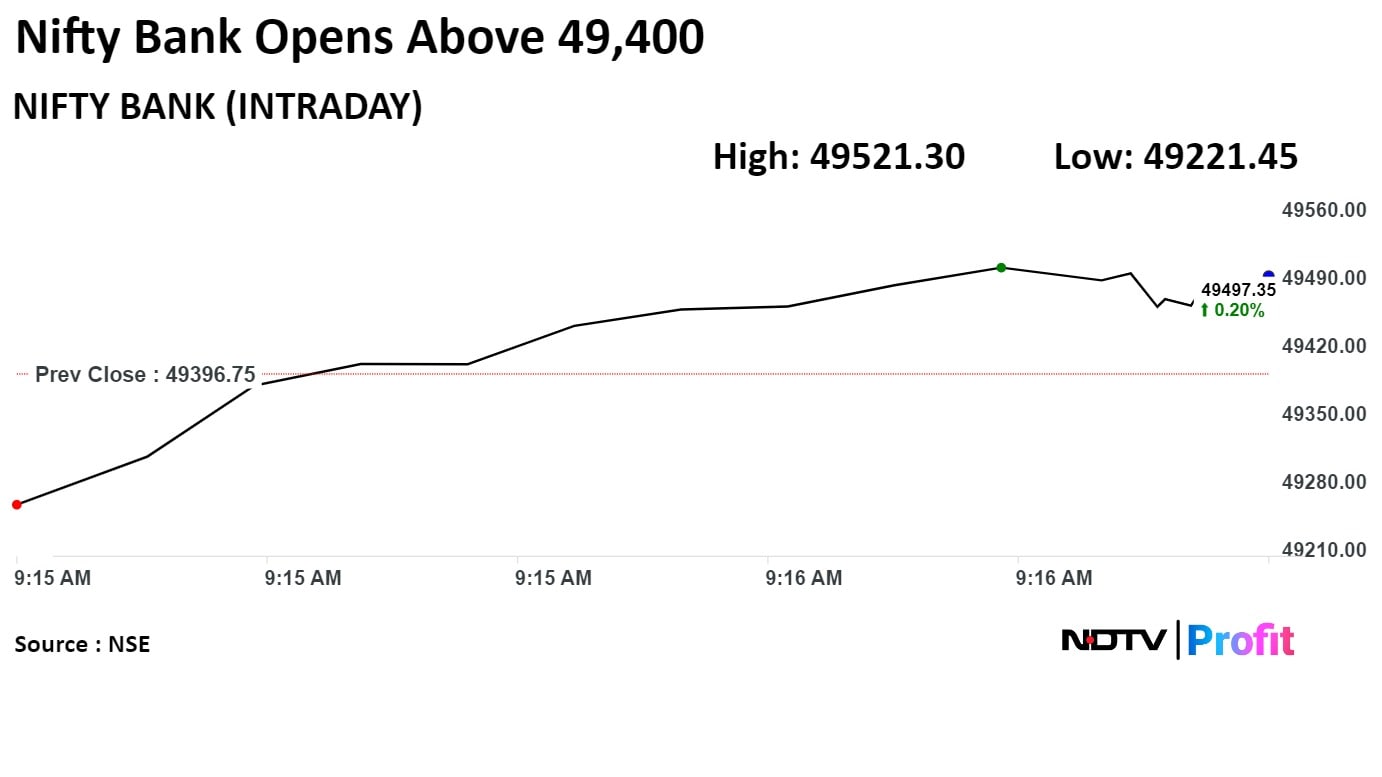

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

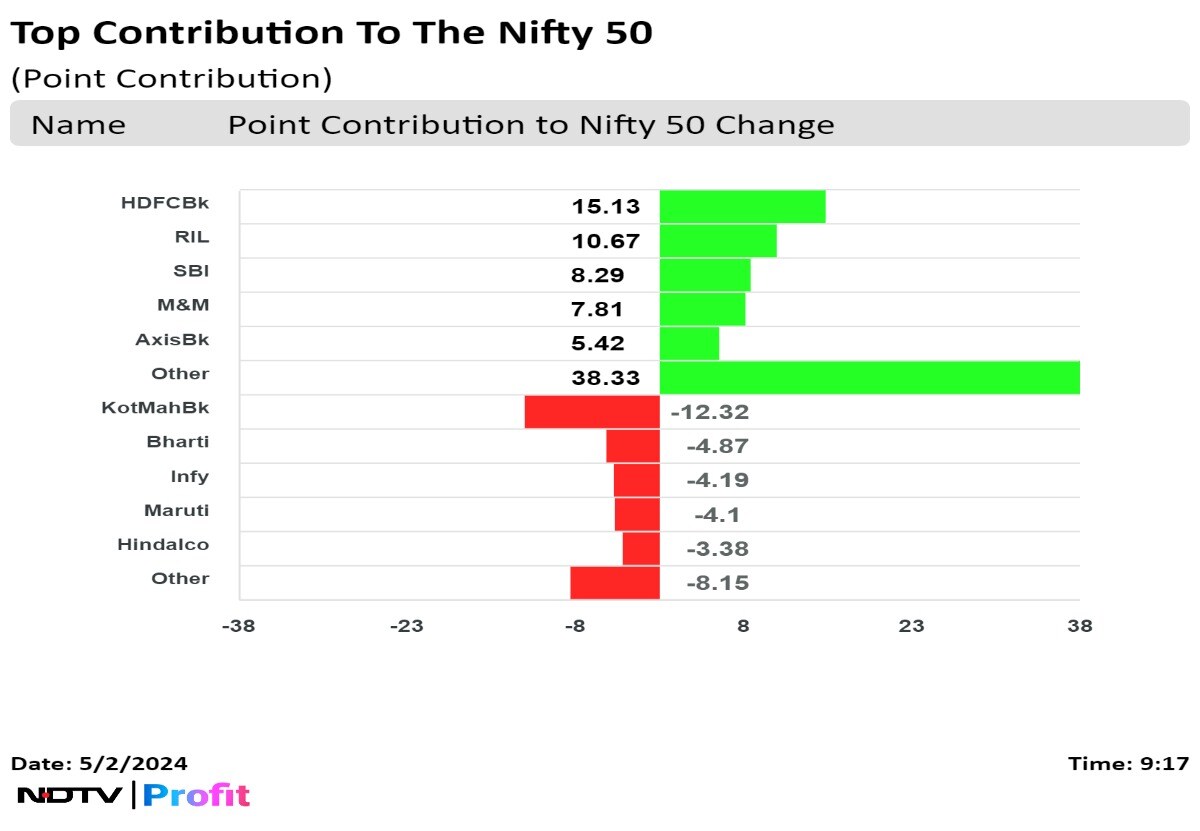

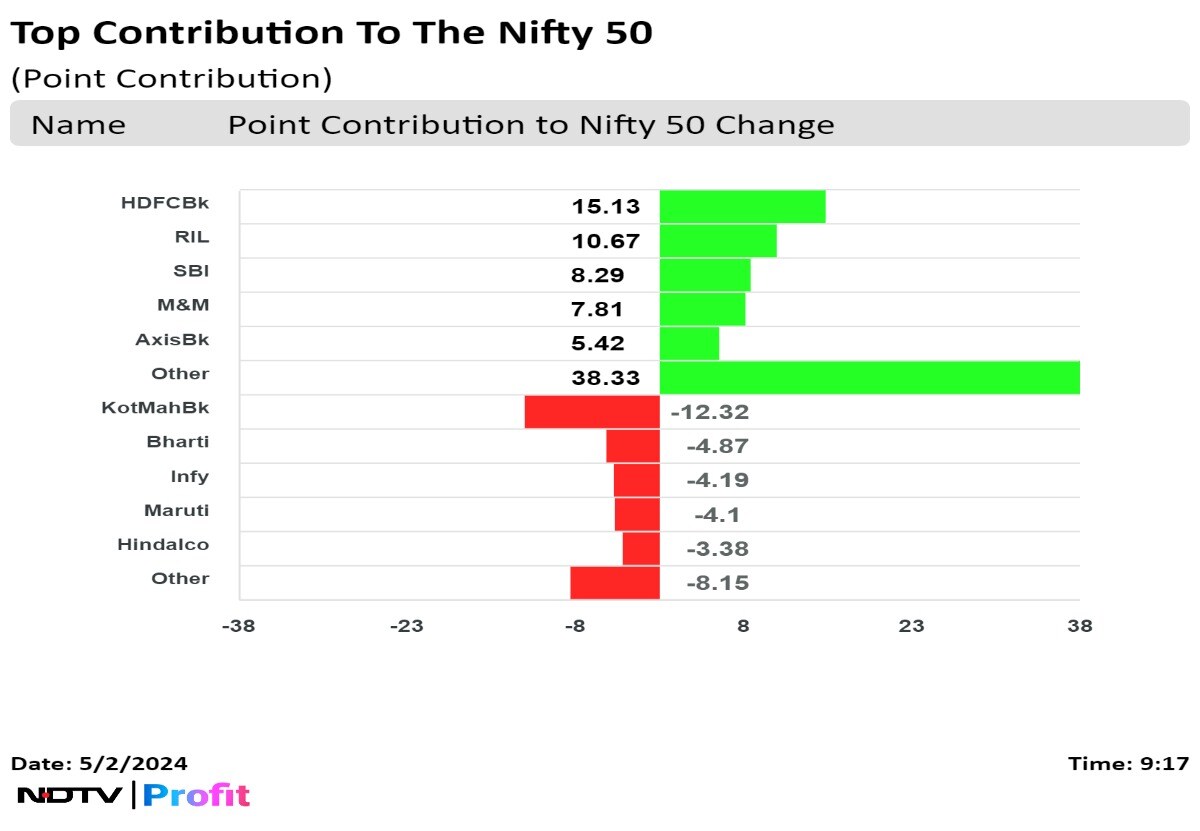

Shares of HDFC Bank Ltd., Reliance Industries Ltd., State Bank Of India, Mahindra & Mahindra Ltd., and Axis Bank Ltd. contributed the most to the gains.

While those of Kotak Mahindra Bank Ltd., Bharti Airtel Ltd., Infosys Ltd., Maruti Suzuki Ltd., and Hindalco Industries Ltd. capped the upside.

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.

At pre-open, the Nifty 50 was at 22,567.85, down 37.00 points or 0.16% and Sensex was at 74,402.44, lower by 91.05 points or 0.12%.

Given the market dynamics, traders and investors are advised to seize buying opportunities during Nifty dips while implementing effective stop-loss strategies below the mentioned support levels, said Mandar Bhojane, research analyst at Choice Broking. "This cautious approach can help mitigate risks and capitalize on potential gains in today's trading session."

Benchmark equity indices recovered from Tuesday's fall and opened higher on gains in heavyweights Reliance Industries and HDFC Bank.