S&P 500: Down 0.04%

Dow Jones Industrial Average: Down 0.04%

Nasdaq: Down 0.02%

Rupee strengthened six paise to end at 86.38 against the US Dollar.

Source: Bloomberg

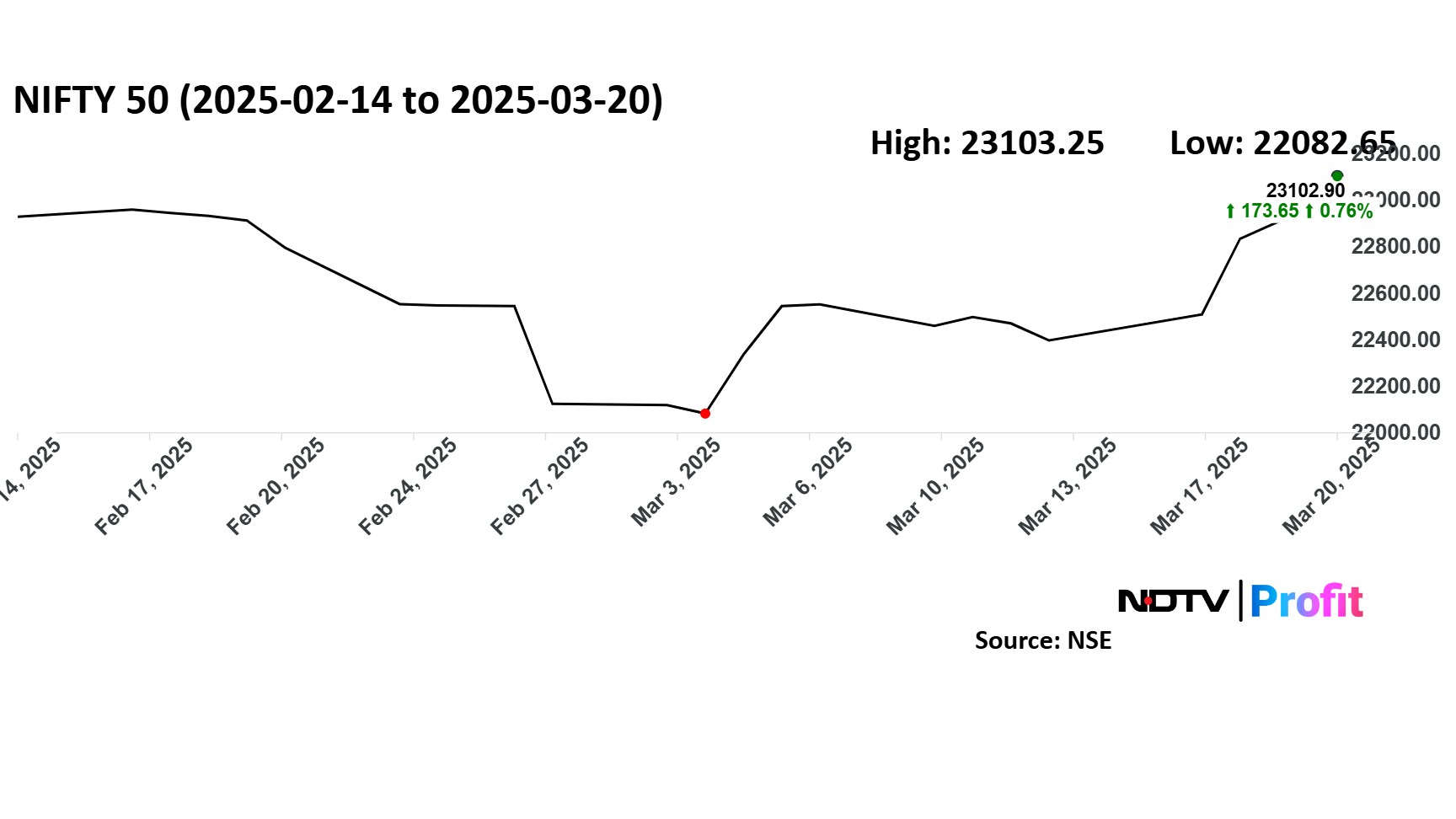

Indian equities posted their fourth consecutive day of gains on Thursday after the US Federal Reserve signaled more interest rate cutes later this year because any increase in inflation due to Trump's tariff policies will likely be brief.

The NSE Nifty 50 closed 1.24% or 283 points higher at 23,190.65, while BSE Sensex added nearly 900 points or 1.2% to end at 76,348.

Nifty close above 23,000 mark after 22 sessions

Last time Nifty closed above 23000 mark was on Feb. 14

Nifty ends higher for the 4th day in a row.

Nifty Smallcap 250 ends higher for the 4th day in a row.

Nifty ends higher by 1.2% for the day, led by Bharti Airtel, Titan and Britannia Industries.

Sensex ends up higher by 1.2% for the day.

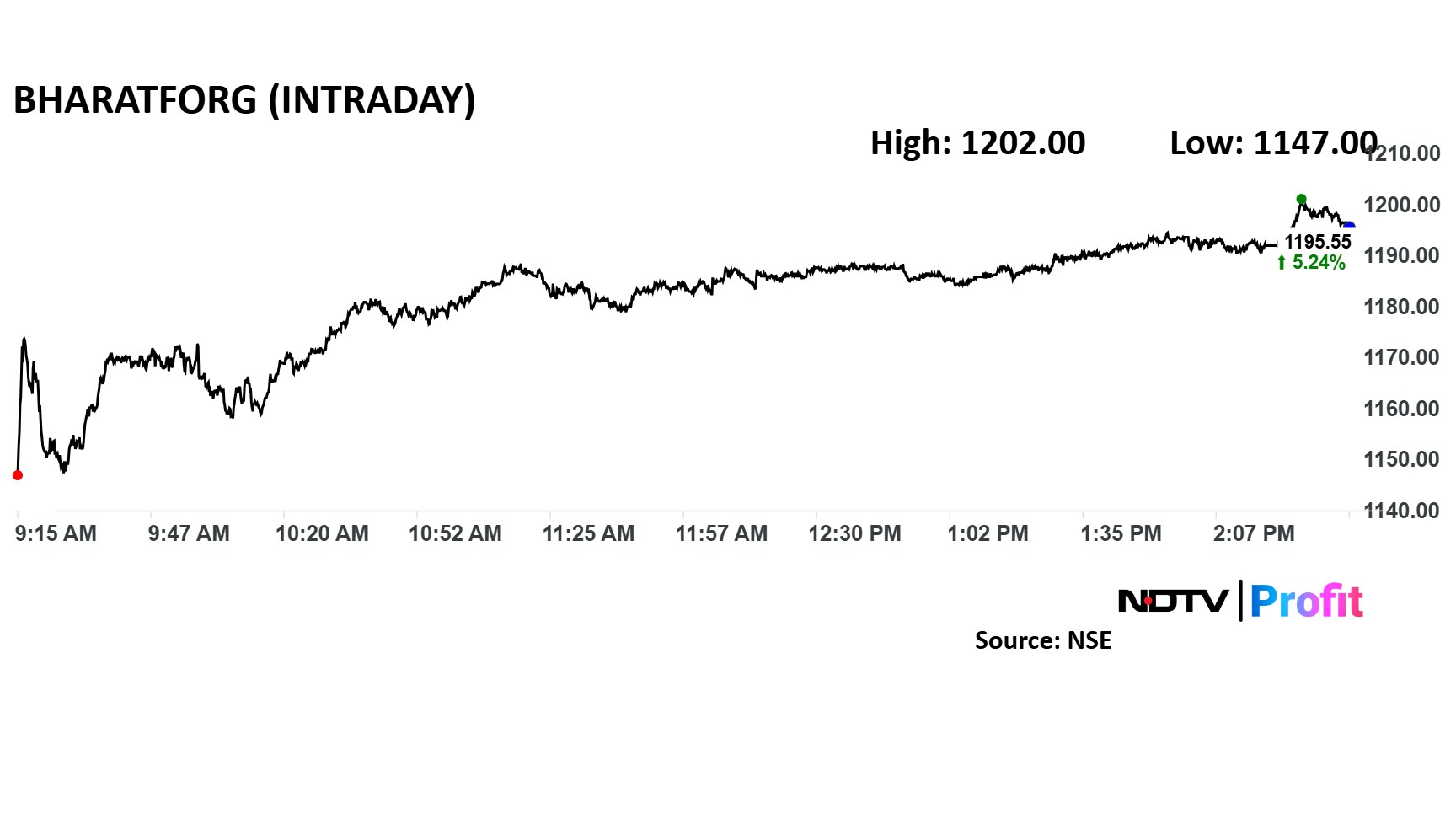

Nifty Midcap 150 ends higher 0.5% for the day, led by Bharat Forge, Max Healthcare, Phoeni Mills.

Nifty smallcap 250 ends higher 0.8% for the day, led by Rajesh Exports, SCI and SPARC.

Nifty Oil and Gas is the top sectoral gainer for the day, led by GSPL, MGL and HPCL.

Nifty Oil and Gas, Metal, Pharma, Financials ends higher for the 4th day in a row.

Nifty Auto, Realty, PSU Banks end higher for the third day in a row.

Nifty Bank ends higher for the sixth day in a row.

Indian equities posted their fourth consecutive day of gains on Thursday after the US Federal Reserve signaled more interest rate cutes later this year because any increase in inflation due to Trump's tariff policies will likely be brief.

The NSE Nifty 50 closed 1.24% or 283 points higher at 23,190.65, while BSE Sensex added nearly 900 points or 1.2% to end at 76,348.

Nifty close above 23,000 mark after 22 sessions

Last time Nifty closed above 23000 mark was on Feb. 14

Nifty ends higher for the 4th day in a row.

Nifty Smallcap 250 ends higher for the 4th day in a row.

Nifty ends higher by 1.2% for the day, led by Bharti Airtel, Titan and Britannia Industries.

Sensex ends up higher by 1.2% for the day.

Nifty Midcap 150 ends higher 0.5% for the day, led by Bharat Forge, Max Healthcare, Phoeni Mills.

Nifty smallcap 250 ends higher 0.8% for the day, led by Rajesh Exports, SCI and SPARC.

Nifty Oil and Gas is the top sectoral gainer for the day, led by GSPL, MGL and HPCL.

Nifty Oil and Gas, Metal, Pharma, Financials ends higher for the 4th day in a row.

Nifty Auto, Realty, PSU Banks end higher for the third day in a row.

Nifty Bank ends higher for the sixth day in a row.

Parag Thakkar of Fort Capital said he is positive on NBFCs given structural tailwinds.

"Cost of funds will ease out and liquidity will improve come April. Government has began spending since December and lending is going up," he said.

Maintain 'Outperform' with target price of Rs 260.

AB Capital is one of our top picks and on track to double in three years.

Recent underperformance offers a good opportunity.

Key catalysts - Rising margins driven by falling rates, growth in higher yielding unsecured loans, and falling credit costs leading to higher ROA.

Valuations a big support now.

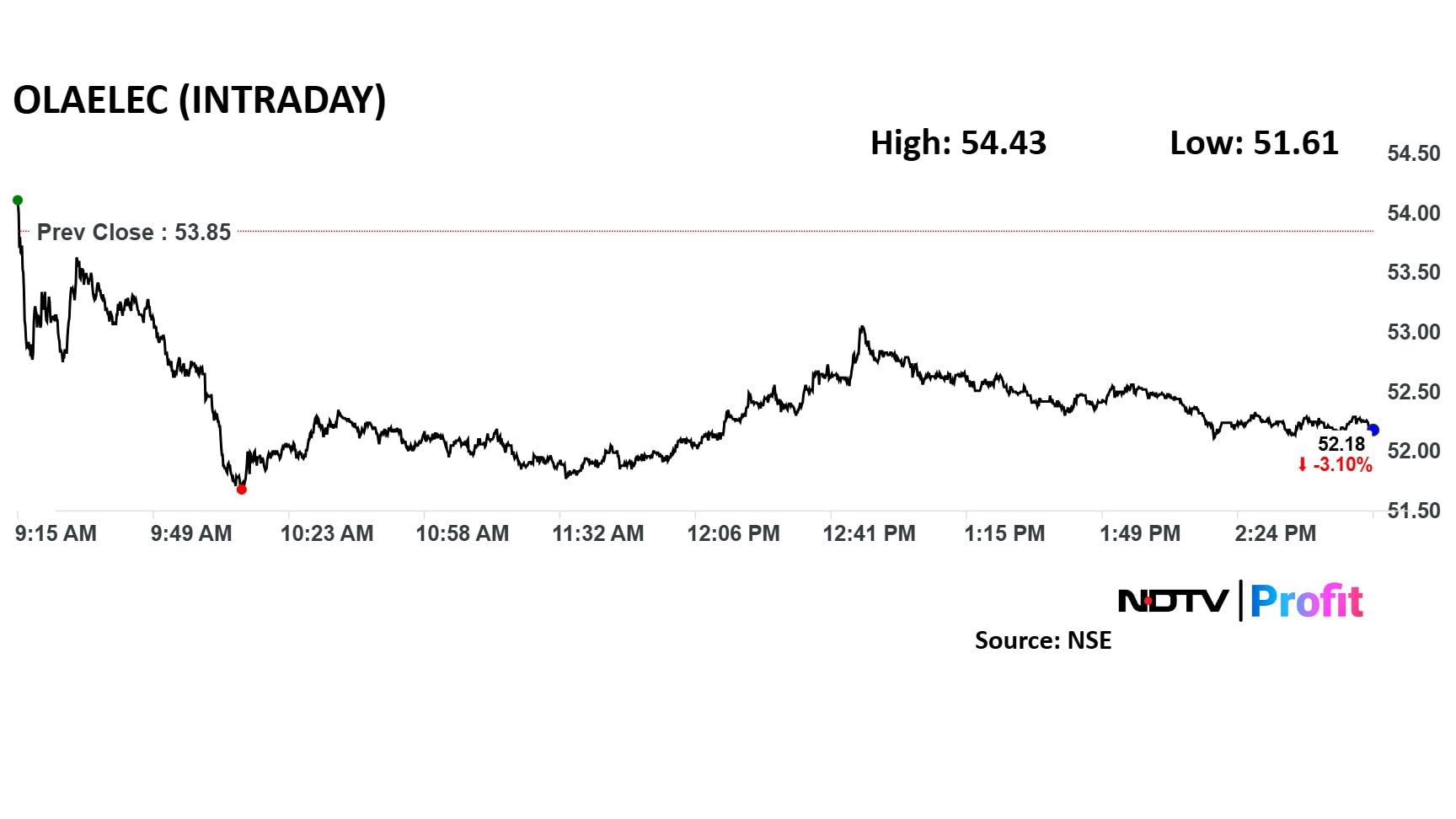

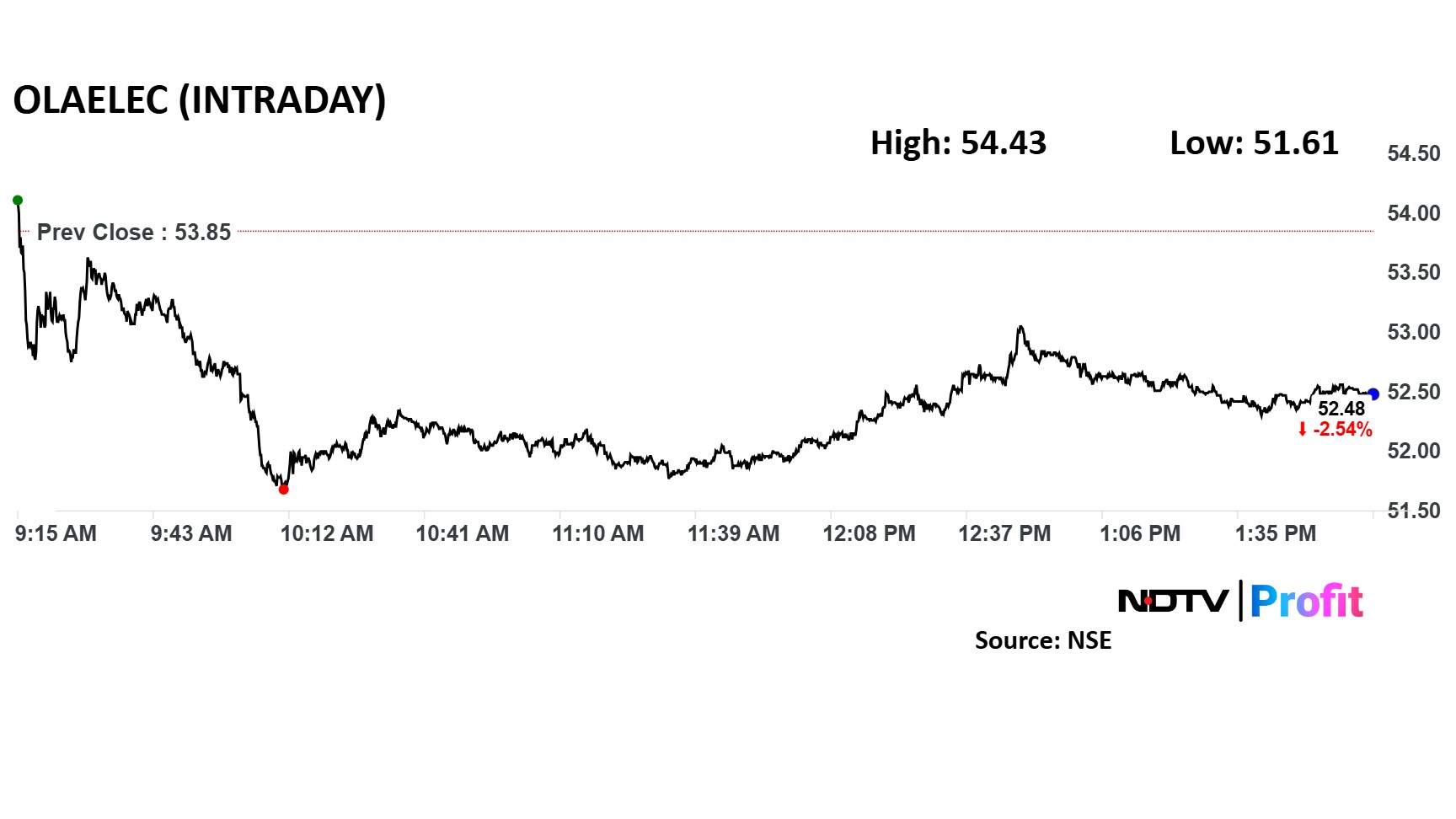

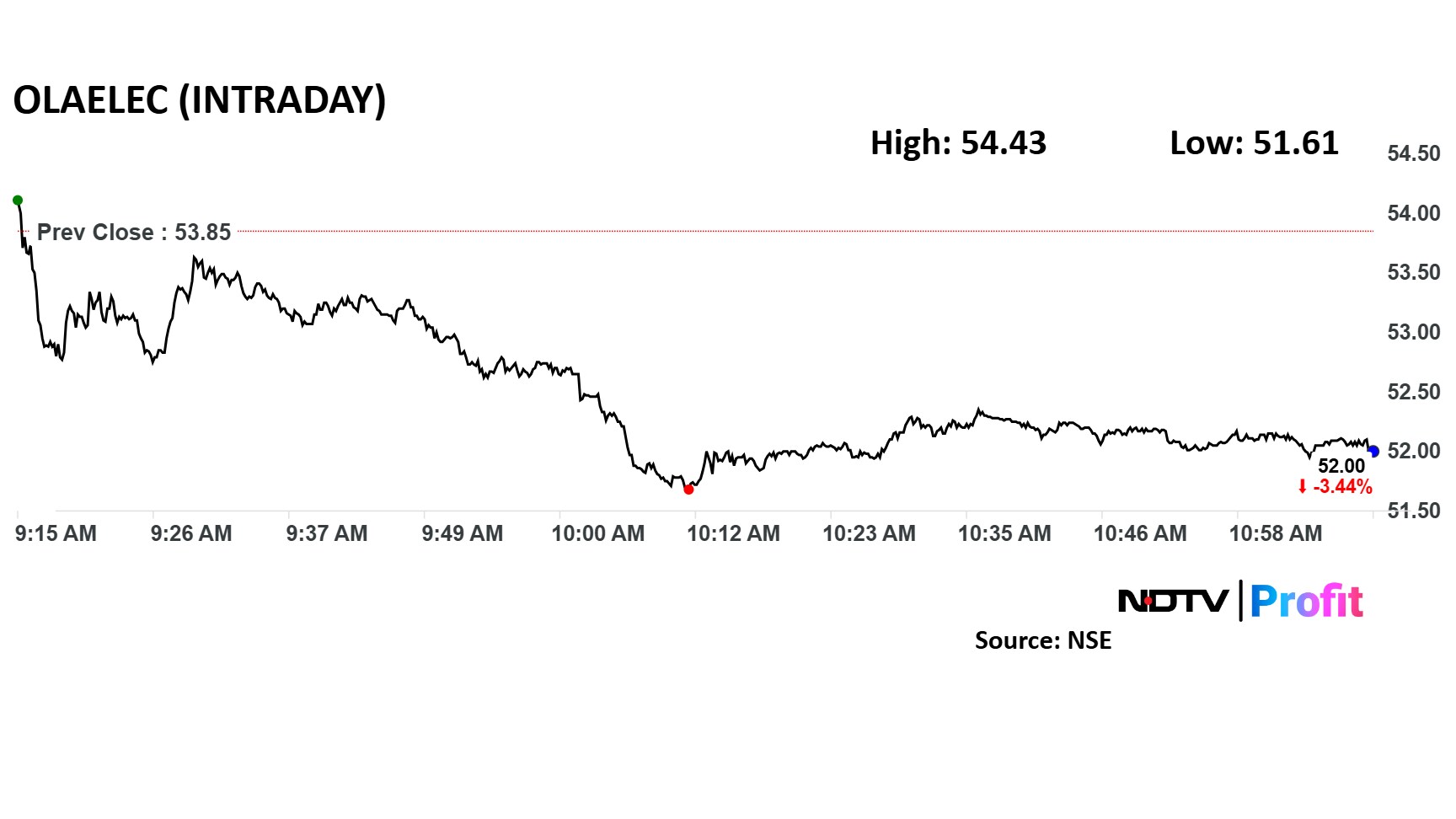

Ministry of Heavy Industries’ letter to Ola Electric highlights discrepancies in stating of sales in February.

On Feb. 28, Ola Electric claimed to have sold 25,000 units for 28% market share.

VAHAN data shows only 8,642 Ola electric scooters were registered in February.

A registration number is generated only after all vehicular data is uploaded on VAHAN portal.

Alert: Indian laws prohibit vehicle sales without a valid number plate.

Source: People in the know, Ola Electric’s stock exchange filing, VAHAN website, ‘The Motor Vehicles Act, 1988’ handbook

Ministry of Heavy Industries’ letter to Ola Electric highlights discrepancies in stating of sales in February.

On Feb. 28, Ola Electric claimed to have sold 25,000 units for 28% market share.

VAHAN data shows only 8,642 Ola electric scooters were registered in February.

A registration number is generated only after all vehicular data is uploaded on VAHAN portal.

Alert: Indian laws prohibit vehicle sales without a valid number plate.

Source: People in the know, Ola Electric’s stock exchange filing, VAHAN website, ‘The Motor Vehicles Act, 1988’ handbook

The Nifty reclaimed 23,200, rising 1.35% intraday. The Sensex advanced 1.33% to 76,456.25.

IT, oil and gas and auto stocks are powering the rally.

The Nifty Smallcap 250 is up 0.8% and Nifty Midcap 150 by 0.6%

Cabinet Committee on Security approved purchase of ATAGS gun worth Rs 7,000 crore.

ATAGS: Advanced Towed Artillery Gun System

ATAGS is first indigenously designed and manufactured 155 mm artillery gun.

Weapon to enhance operational capabilities of Indian Armed Forces.

Collaboration between DRDO & Indian private industry partners.

65% of components are sourced domestically

Bharat Forge has the capability to produce the artilerry; stock up 5%.

Cabinet Committee on Security approved purchase of ATAGS gun worth Rs 7,000 crore.

ATAGS: Advanced Towed Artillery Gun System

ATAGS is first indigenously designed and manufactured 155 mm artillery gun.

Weapon to enhance operational capabilities of Indian Armed Forces.

Collaboration between DRDO & Indian private industry partners.

65% of components are sourced domestically

Bharat Forge has the capability to produce the artilerry; stock up 5%.

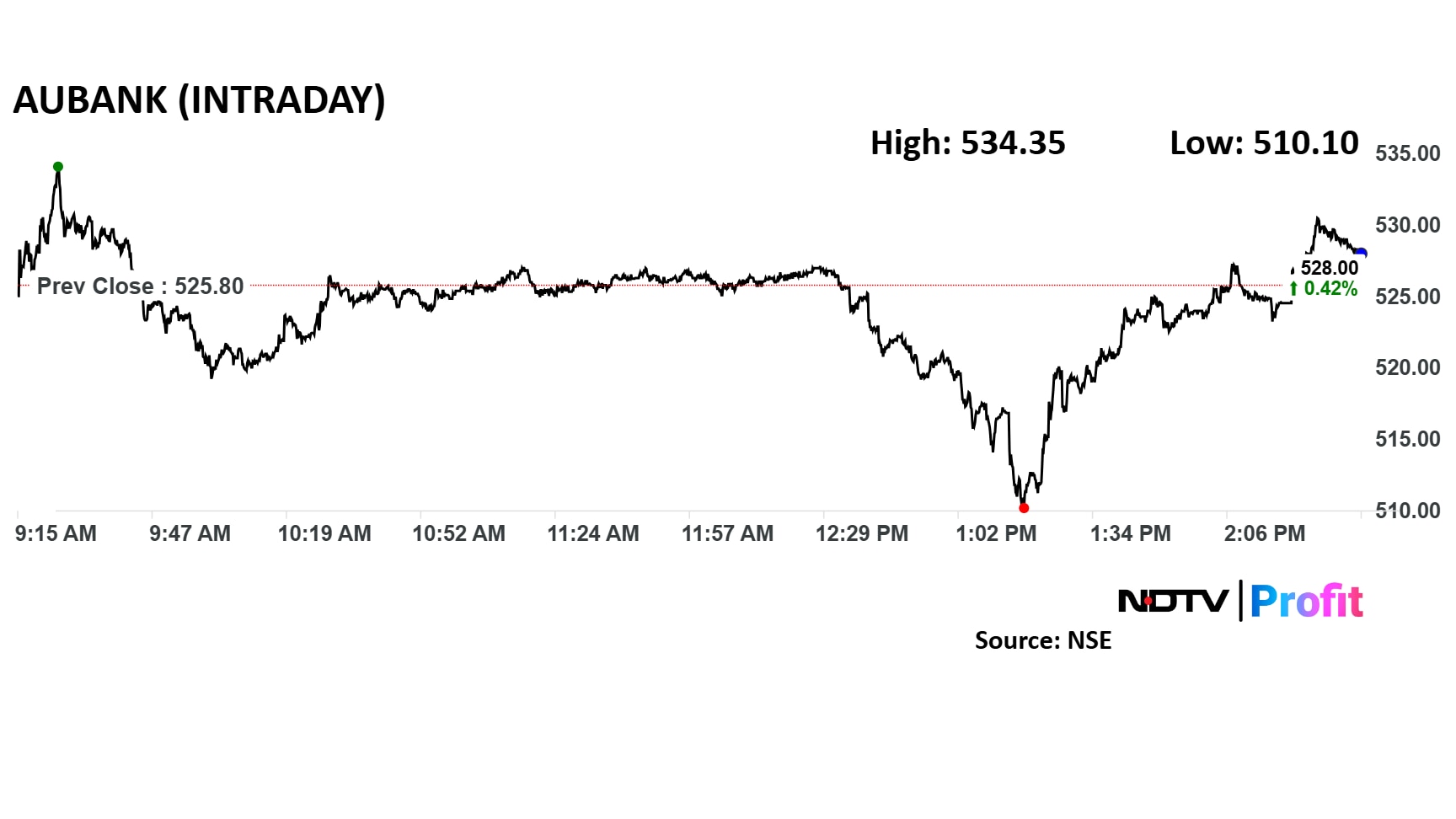

AU Small Finance Bank confirmed to NDTV Profit that CFO Vimal Jain has not resigned and called media reports "baseless rumour".

The stock rose after the clarification.

AU Small Finance Bank confirmed to NDTV Profit that CFO Vimal Jain has not resigned and called media reports "baseless rumour".

The stock rose after the clarification.

The US economy will be under pressure due to disruption caused by Trump's economic policy, Jim Walker said.

"Inflation in the US has been accelerating in certain metrics. Inflation expectations are as high as 4.7%. Central banks raise rates when its this high," he said.

Jim Walker, chief economist at Aletheia Capital, said it is a good time to invest in India given its fundamentals.

"Fiscal and monetary policy has never been looking better in India. The best profit cycle in Asia is unfolding in India, its a sprinboard for private investment," Walker, who foresaw 2008 market crash, told NDTV Profit.

He said te government should be easing regulations for doing business in India.

"Large domestic economy is the main reason for our focus on India and China. I don't see the masses will rush to China market. India can be the best performing market in EMs/Asia," he said.

While we are on gold, a new bullion future contract may be the next big thing for derivatives traders who have been snubbed by regulatory curbs on equity futures and options.

Amid record-high prices, the Multicommodity Exchange of India said it would launch gold 10 gram future contracts from April 1. The minimum price movement will be of Rs 1, and the contracts will have monthly expiries.

Read full story here.

The US Federal Reserve's latest policy guidance pushed gold rates to a record high, as the American monetary policy authority projected two likely rate cuts in the year ahead despite looming economic uncertainties.

"Gold prices are likely to trade higher as the Fed hinted at two possible interest rate cuts this year boosting bullion's appeal amid ongoing geopolitical and economic tensions," said Prathamesh Mallya, deputy vice president for research of non-agricultural commodities and currencies at Angel One Ltd.

Read full story here.

Troubles for Ola Electric Mobility Ltd. have deepened further with fresh raids on its stores in Madhya Pradesh.

At least six Ola Electric stores—two in Jabalpur and four in Indore—were raided on March 12 and March 18, respectively, according to inspection letters seen by NDTV Profit. All the so-called "experience centres" were found to be retailing electric scooters without trade certificates.

Read full story here.

Troubles for Ola Electric Mobility Ltd. have deepened further with fresh raids on its stores in Madhya Pradesh.

At least six Ola Electric stores—two in Jabalpur and four in Indore—were raided on March 12 and March 18, respectively, according to inspection letters seen by NDTV Profit. All the so-called "experience centres" were found to be retailing electric scooters without trade certificates.

Read full story here.

The Nifty and Sensex gained over 1% intraday. Both indices reclaimed levels last seen mid February.

The top sectoral gainer has been Nifty Oil and Gas, higher by 1.7%, followed by Nifty IT's 1.6% jump.

Proposes clarity on minimum holding period for OFS

Allow exemption for convertible securities from approved schemes.

Let founders keep ESOPs granted before DRHP filing.

Impose a one-year gap before IPO for such ESOP grants.

Public comments open until April 10, 2025.

Source: SEBI consultation paper

The Nifty 50 reclaimed the 23,100 mark for the first time since Feb. 14, 2025.

The Nifty 50 reclaimed the 23,100 mark for the first time since Feb. 14, 2025.

The cement sector space has been buzzing with mergers and acquisitions for some time now and there are no signs of slowing down.

NDTV Profit's last analysis in July 2024 on the potential merger-and-acquisition candidates in the cement space pinpointed a cluster of potential M&A contenders, including companies like India Cements Ltd., Sagar Cements Ltd., Orient Cement Ltd., HeidelbergCement India Ltd. and more.

HeidelbergCement, Mangalam Cement, Shree Digvijay and Saurashtra Cement are high-probability targets.

Read full report here.

Competitive intensity to increase in sector as Adani Enteprises announce Rs 10 lakh investment in new JV to enter cable & wires industry.

Polycab: Rs 6,800 crore

Havells India: Rs 4,100 crore

KEI Industries: Rs 4,000 crore

Siemens: Rs 3,300 crore

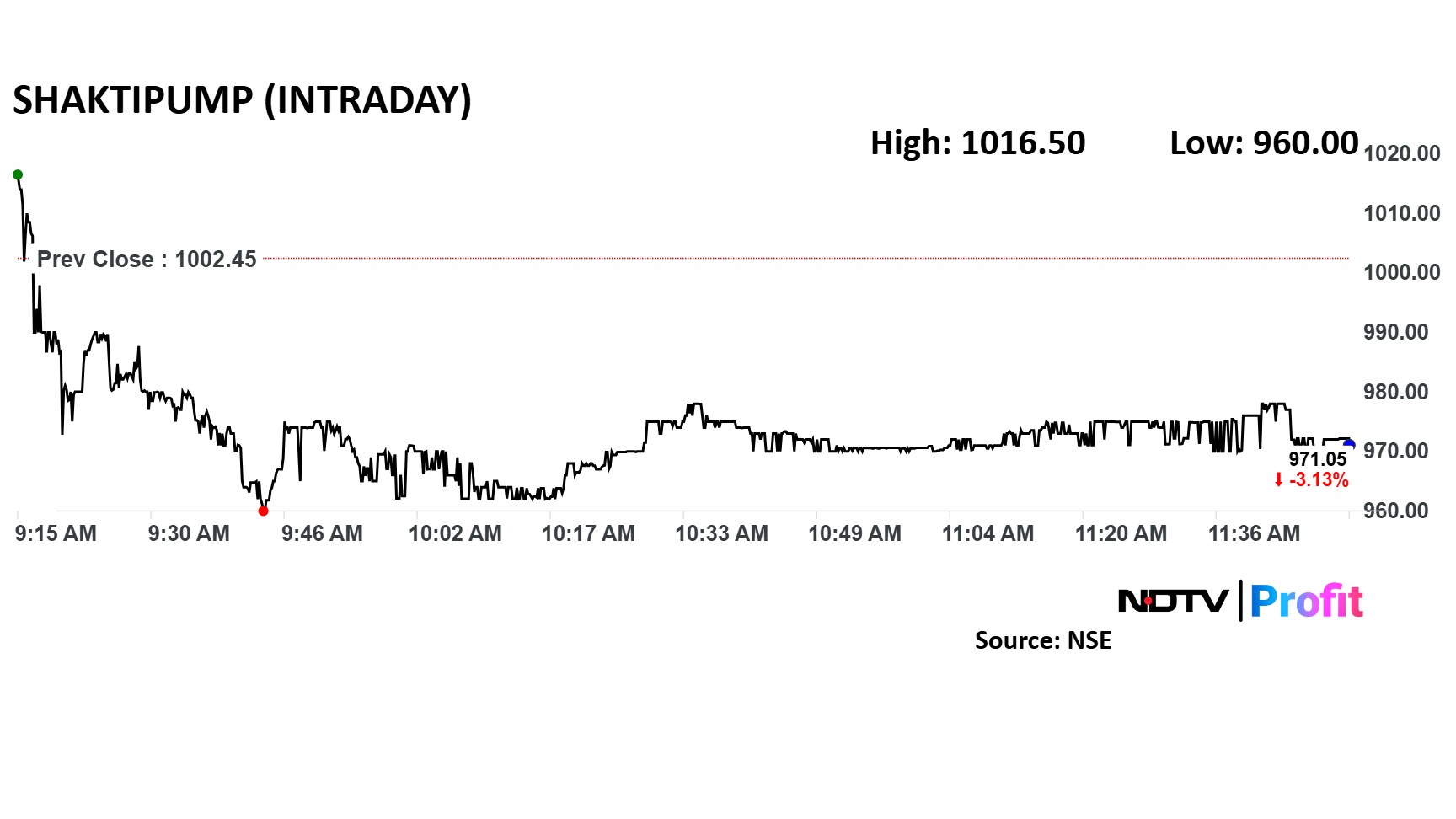

Shakti Pump board approved plan to borrow up to Rs 2,000 crore.

Source: Exchange Filing

Shakti Pump board approved plan to borrow up to Rs 2,000 crore.

Source: Exchange Filing

Kotak Mahindra Asset Management Co. became the latest to announce the launch of the 'Choti SIP' facility. The Systematic Investment Plan will be available for all eligible schemes of Kotak Mahindra Mutual Fund, it stated in a press release on Thursday.

The Securities and Exchange Board of India and Association of Mutual Funds in India recently introduced the Choti SIP or small ticket SIPs, in a bid to introduce more Indians to mutual funds. “Only about 5.4 crore unique investors of India’s population are mutual fund investors, leaving a massive, untapped opportunity for penetration and bringing the Indian saver closer to financial freedom," said Nilesh Shah, managing director of Kotak Mahindra AMC. "SIPs have been an excellent way to bring new investors and kickstart their mutual fund journey."

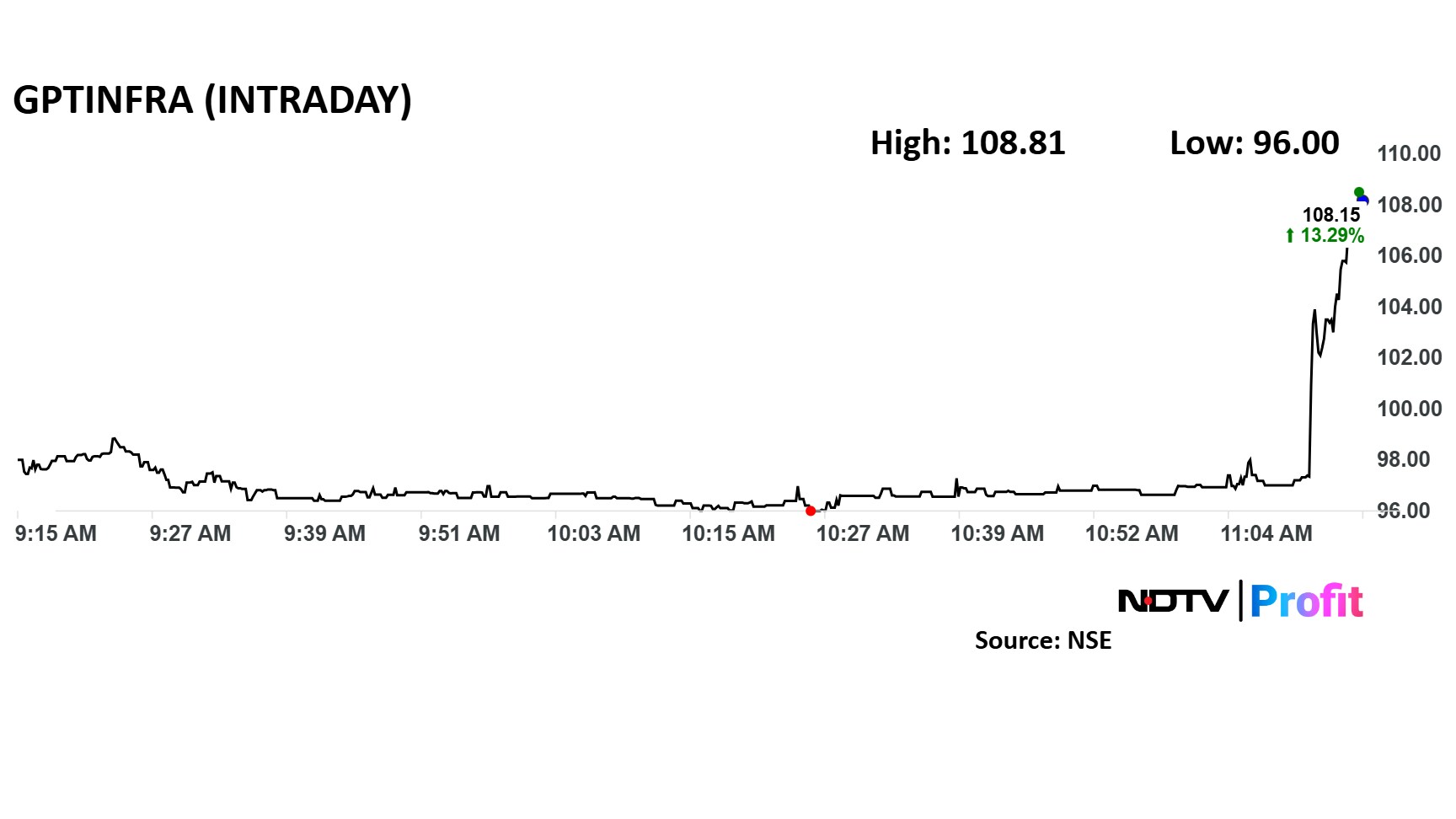

GPT Infra emerges as lowest bidder for railway project worth Rs 481 crore.

Source: Exchange Filing

GPT Infra emerges as lowest bidder for railway project worth Rs 481 crore.

Source: Exchange Filing

The Maharashtra government has expanded its inspection of Ola Electric stores, mounting troubles for the EV maker led by founder-billionaire Bhavish Aggarwal.

Officials from five regional transport offices inspected as many as 26 Ola Electric stores in Mumbai and then Pune to check for trade certificates, people aware of the development said late night Wednesday. A total of 36 Ola Electric scooters were confiscated.

Until Tuesday, 10 Ola Electric stores in Mumbai were inspected and 10 scooters impounded, the people said.

The stock is down 3%.

Read full story here.

The Maharashtra government has expanded its inspection of Ola Electric stores, mounting troubles for the EV maker led by founder-billionaire Bhavish Aggarwal.

Officials from five regional transport offices inspected as many as 26 Ola Electric stores in Mumbai and then Pune to check for trade certificates, people aware of the development said late night Wednesday. A total of 36 Ola Electric scooters were confiscated.

Until Tuesday, 10 Ola Electric stores in Mumbai were inspected and 10 scooters impounded, the people said.

The stock is down 3%.

Read full story here.

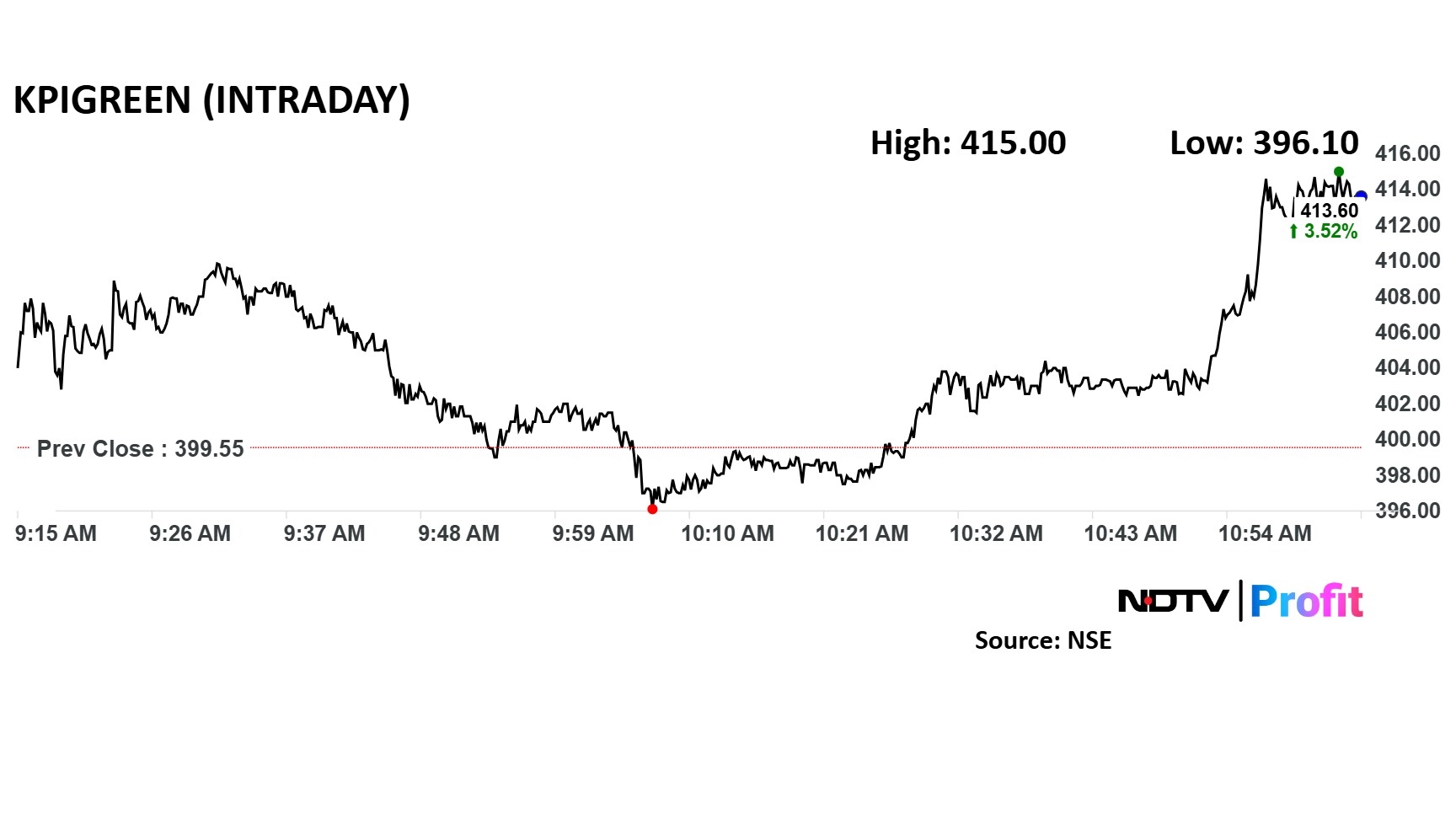

KPI Green Energy received a letter of award for 14.9 MW solar power projects from various clients.

Source: Exchange filing

KPI Green Energy received a letter of award for 14.9 MW solar power projects from various clients.

Source: Exchange filing

According to S&P Global, India's limited exposure to the US market reduces its risk to tariff-related disruptions. However, the country's steel and chemical sectors may still face indirect effects from US tariffs. Nevertheless, Indian companies are shielded by robust economic growth and improved credit quality, enabling most rated firms to weather temporary earnings downturns.

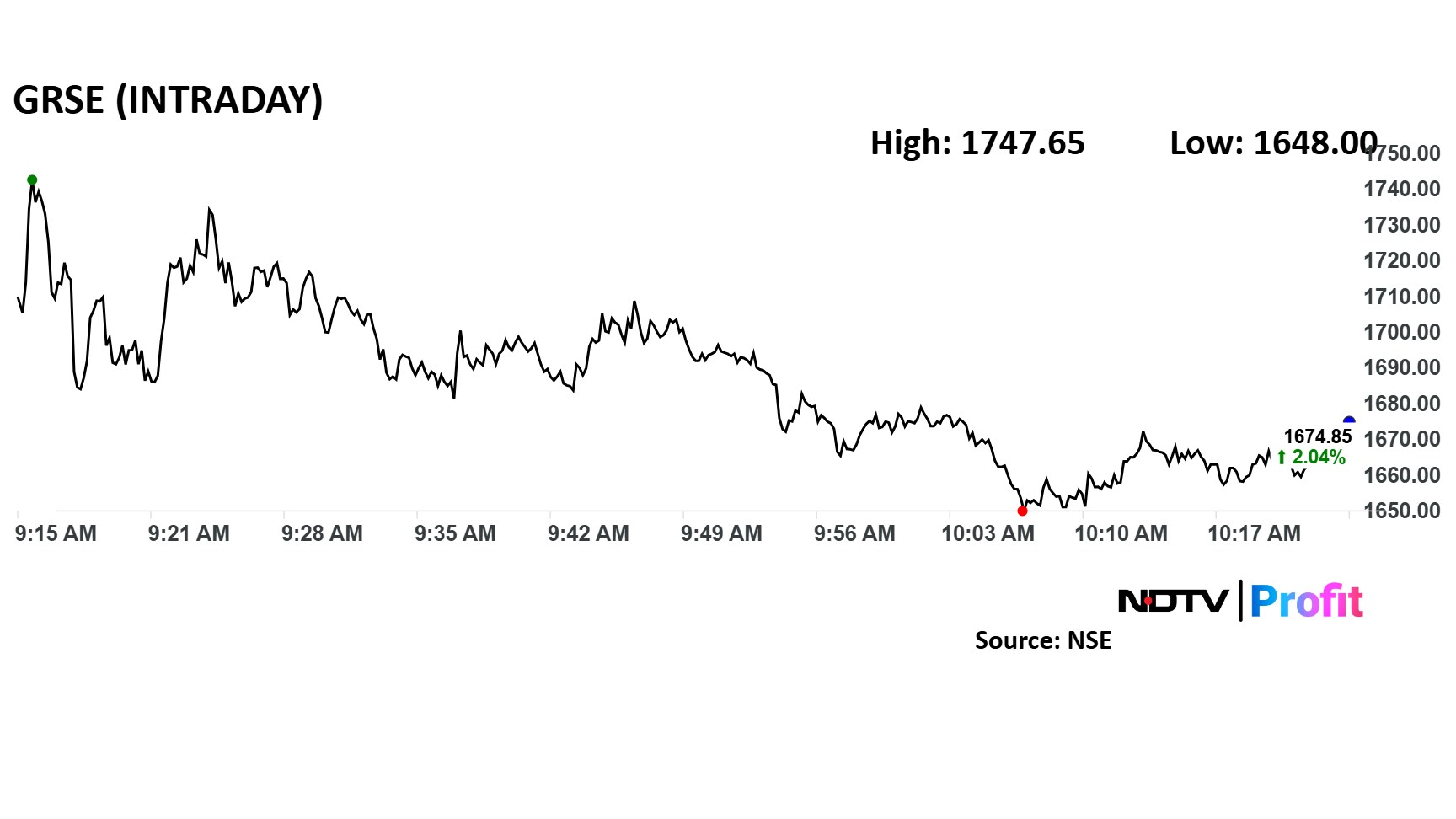

Garden Reach Shipbuilders & Engineers share price rose 6.48% after the company announced a Memorandum of Understanding with the Public Works Department of Nagaland. This MoU is the first agreement between GRSE and a North Eastern state, the company said in an exchange filing.

The MoU, signed on March 19, 2025, in Kohima, involves the supply of eight sets of Double Lane Modular Steel Bridges to Nagaland.

Garden Reach Shipbuilders & Engineers share price rose 6.48% after the company announced a Memorandum of Understanding with the Public Works Department of Nagaland. This MoU is the first agreement between GRSE and a North Eastern state, the company said in an exchange filing.

The MoU, signed on March 19, 2025, in Kohima, involves the supply of eight sets of Double Lane Modular Steel Bridges to Nagaland.

The Nifty Midcap 150 and Nifty Smallcap 250 gave up early gains to trade lower.

The midcap gauge was down 0.07% and smallcap down 0.03%.

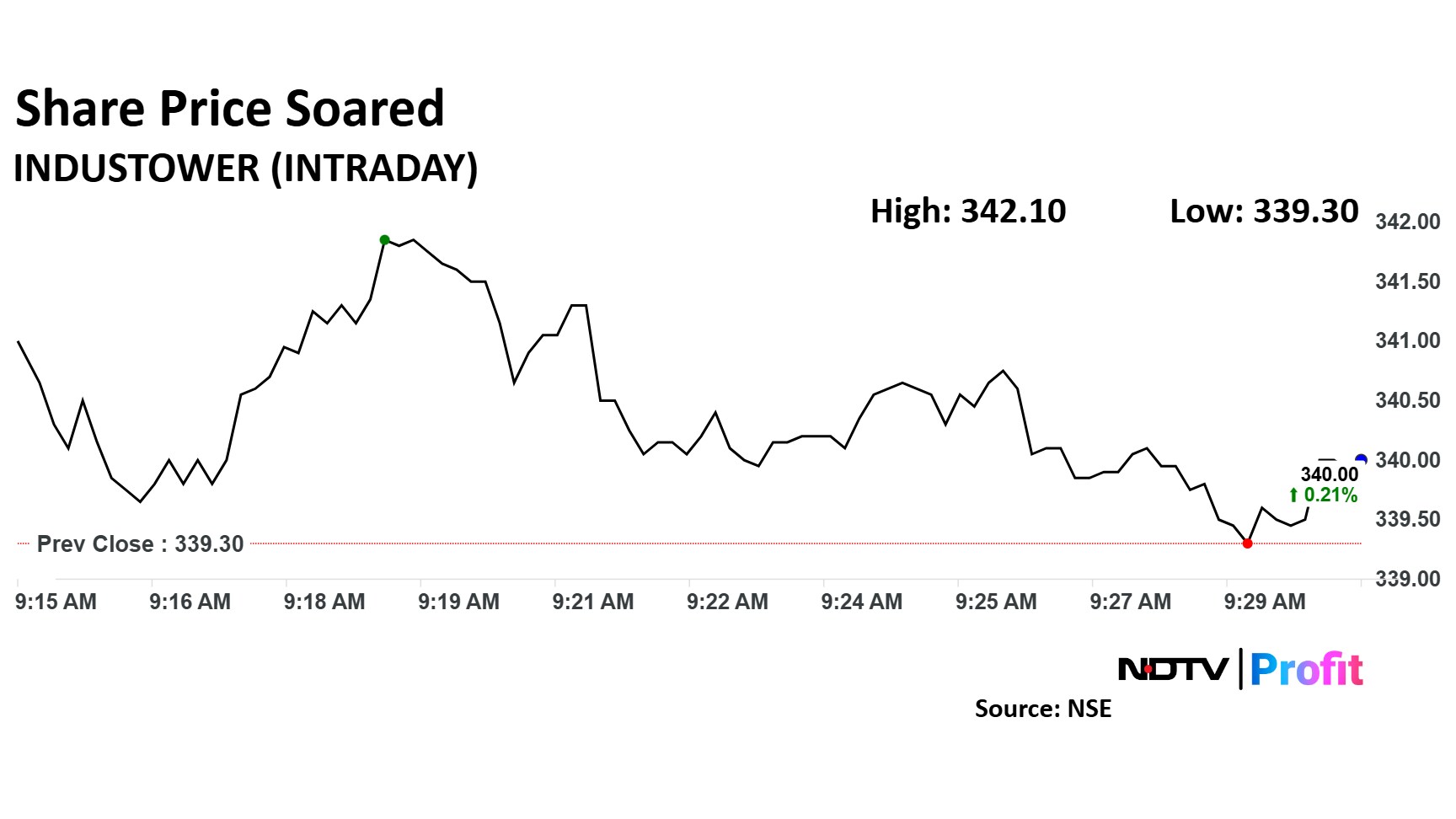

Indus Towers' share price continued its upward trajectory for the second consecutive day, rising nearly 1% on Thursday, following a 1.78% increase on Wednesday. The surge comes after Citi elevated Indus Towers to its top telecom pick, citing positive growth prospects and strategic acquisitions.

Citi's report highlighted that Indus Towers has received shareholder approval for the acquisition of 16,100 towers from Bharti Airtel and Hexacom for up to Rs 3,300 crore. This acquisition is expected to be earnings accretive, leading to a 3-5% increase in the company's FY26-27 Ebitda and a 1-2% rise in EPS forecasts.

Read story here.

Indus Towers' share price continued its upward trajectory for the second consecutive day, rising nearly 1% on Thursday, following a 1.78% increase on Wednesday. The surge comes after Citi elevated Indus Towers to its top telecom pick, citing positive growth prospects and strategic acquisitions.

Citi's report highlighted that Indus Towers has received shareholder approval for the acquisition of 16,100 towers from Bharti Airtel and Hexacom for up to Rs 3,300 crore. This acquisition is expected to be earnings accretive, leading to a 3-5% increase in the company's FY26-27 Ebitda and a 1-2% rise in EPS forecasts.

Read story here.

The Maharashtra government has expanded its inspection of Ola Electric stores, mounting troubles for the EV maker led by founder-billionaire Bhavish Aggarwal.

Officials from five regional transport offices inspected as many as 26 Ola Electric stores in Mumbai and then Pune to check for trade certificates, people aware of the development said late night Wednesday. A total of 36 Ola Electric scooters were confiscated.

Until Tuesday, 10 Ola Electric stores in Mumbai were inspected and 10 scooters impounded, the people said.

Read full story here.

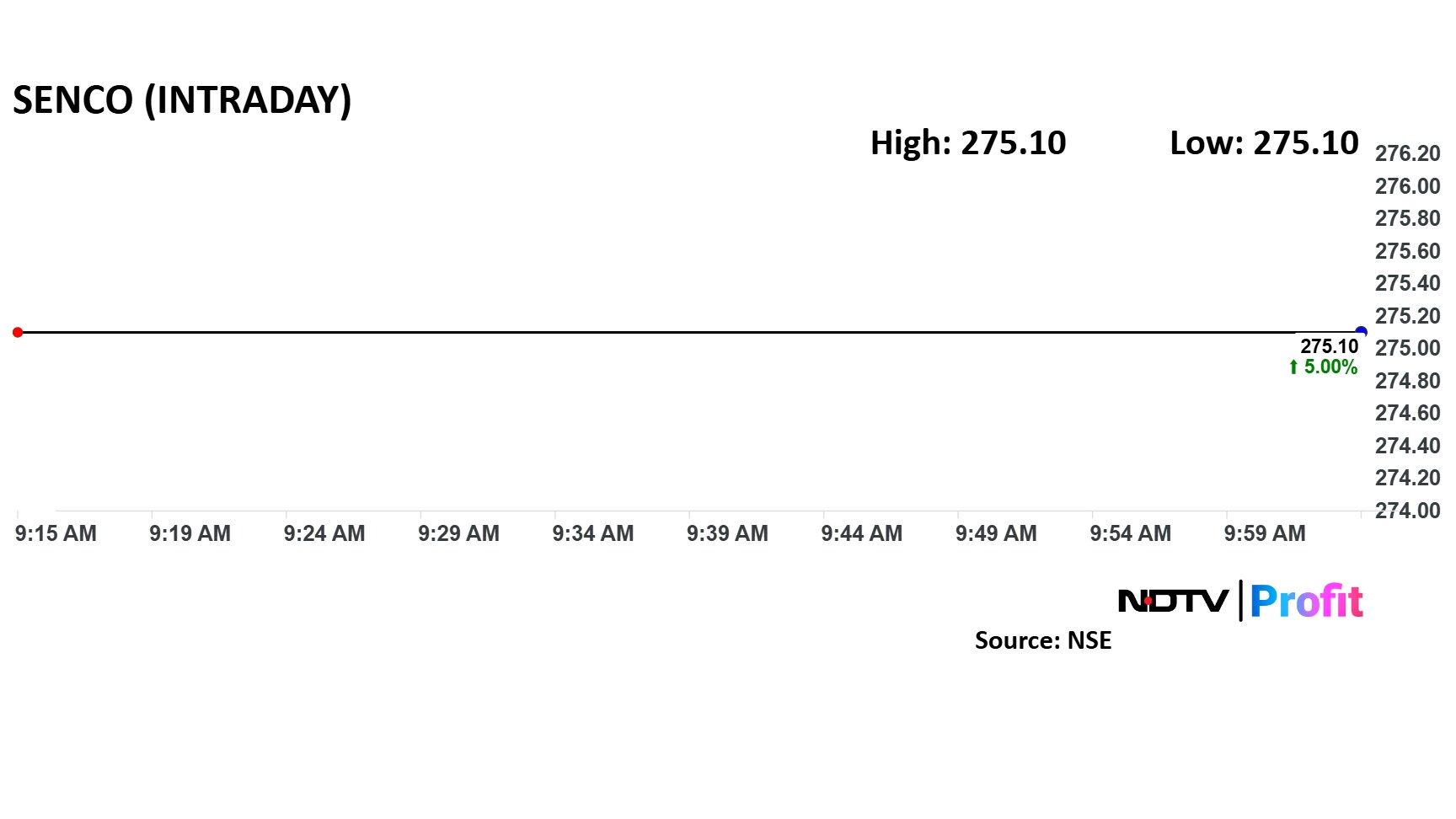

The Senco Gold share price is locked in upper circuit of 5%. The promoter group bought 80,400 shares, which accounts for 0.1% of total equity.

The promoter holding as of December was 41.94%.

The stock has been hitting upper circuit since past three days.

The Senco Gold share price is locked in upper circuit of 5%. The promoter group bought 80,400 shares, which accounts for 0.1% of total equity.

The promoter holding as of December was 41.94%.

The stock has been hitting upper circuit since past three days.

According to Stephen Davies, Founder and CEO of Javelin Wealth Management, expectations are that Europe will outperform the US in terms of managing inflation and potentially cutting interest rates. India is also seen as having the capacity to reduce rates.

Davies told NDTV Profit that other markets are stepping in to fill the gap left by the US, with European markets performing particularly well due to supportive government policies. European markets that were previously lagging behind are now showing notable improvement.

According to Peter Cardillo, Chief Market Economist at Spartan Capital Securities, the key takeaway from the Federal Reserve meeting was the downward revision of forecasts.

He noted that bond yields may decline even if Fed fund rates remain stable, which could lead to short-term stabilization in stock prices.

However, Cardillo cautioned that the current stock market correction is not yet over and expressed uncertainty about potential further Fed rate hikes in June or the fourth quarter. He attributed the surge in gold prices to concerns about stagflation, a scenario in which the economy experiences stagnant growth and high inflation.

Despite expecting corporate earnings to be less robust than before, Cardillo believes they will not deteriorate, and the stock market will likely navigate the stagflation environment for now.

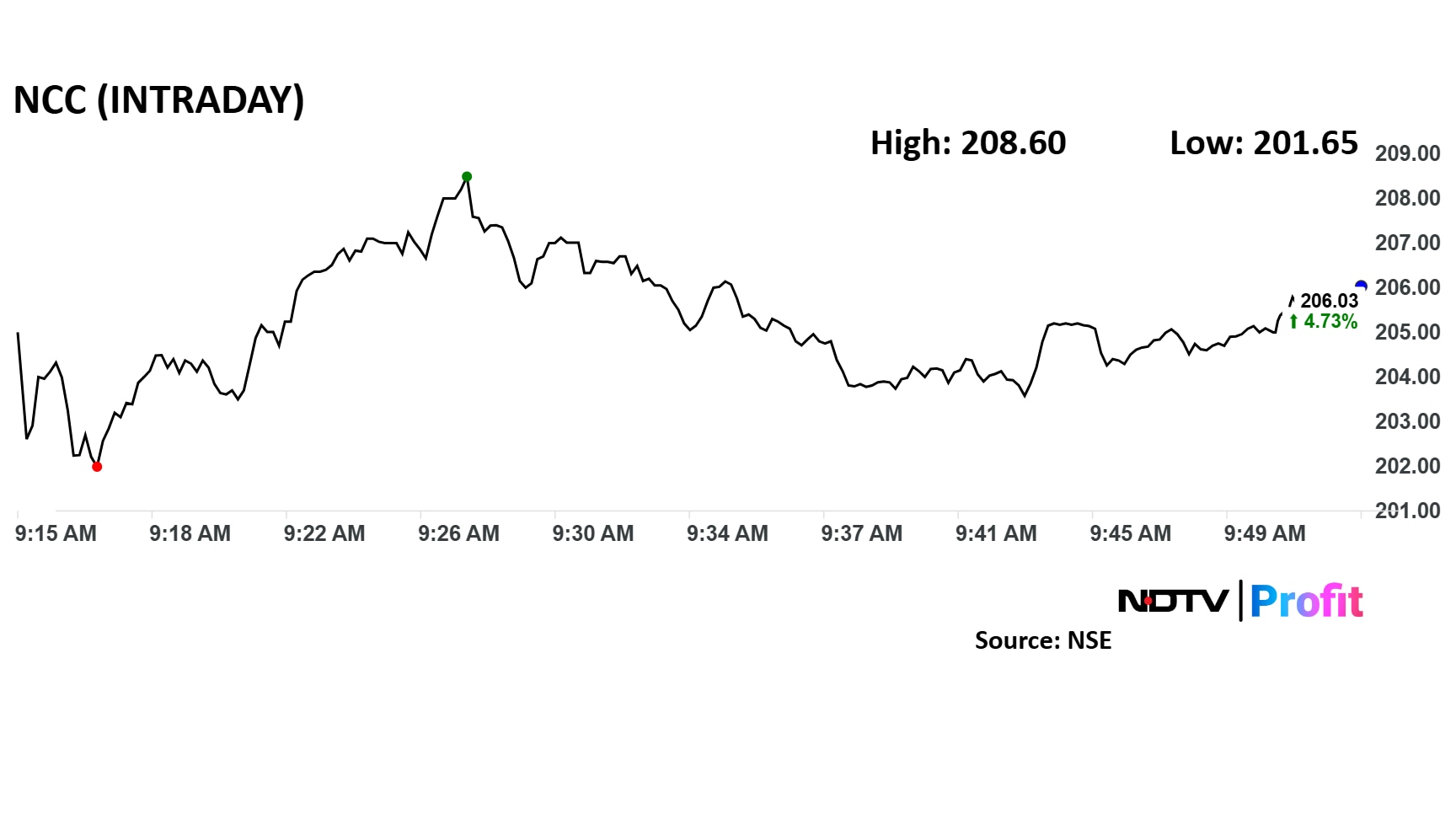

NCC share price rose 6% after receiving contract worth Rs 2,130 crore for construction work in Amaravati.

NCC share price rose 6% after receiving contract worth Rs 2,130 crore for construction work in Amaravati.

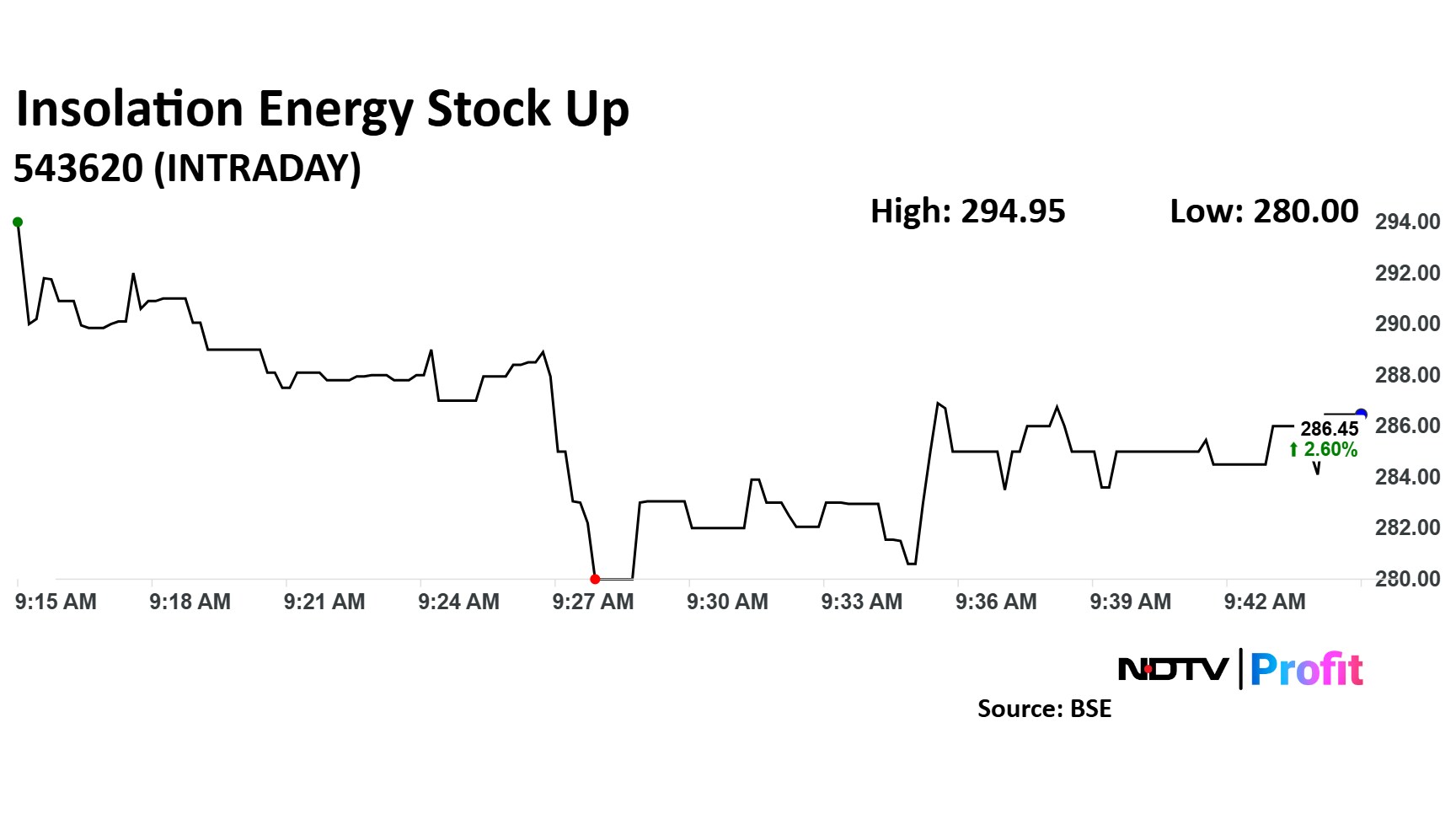

Insolation Energy has secured a 38.43 MW solar power project, with plans to invest Rs 134 crore during FY26. The project boasts a final levelised tariff of Rs 2.88 per unit for seven sites and Rs 3.02 per unit for 21 sites.

Source: Exchange filing

Insolation Energy has secured a 38.43 MW solar power project, with plans to invest Rs 134 crore during FY26. The project boasts a final levelised tariff of Rs 2.88 per unit for seven sites and Rs 3.02 per unit for 21 sites.

Source: Exchange filing

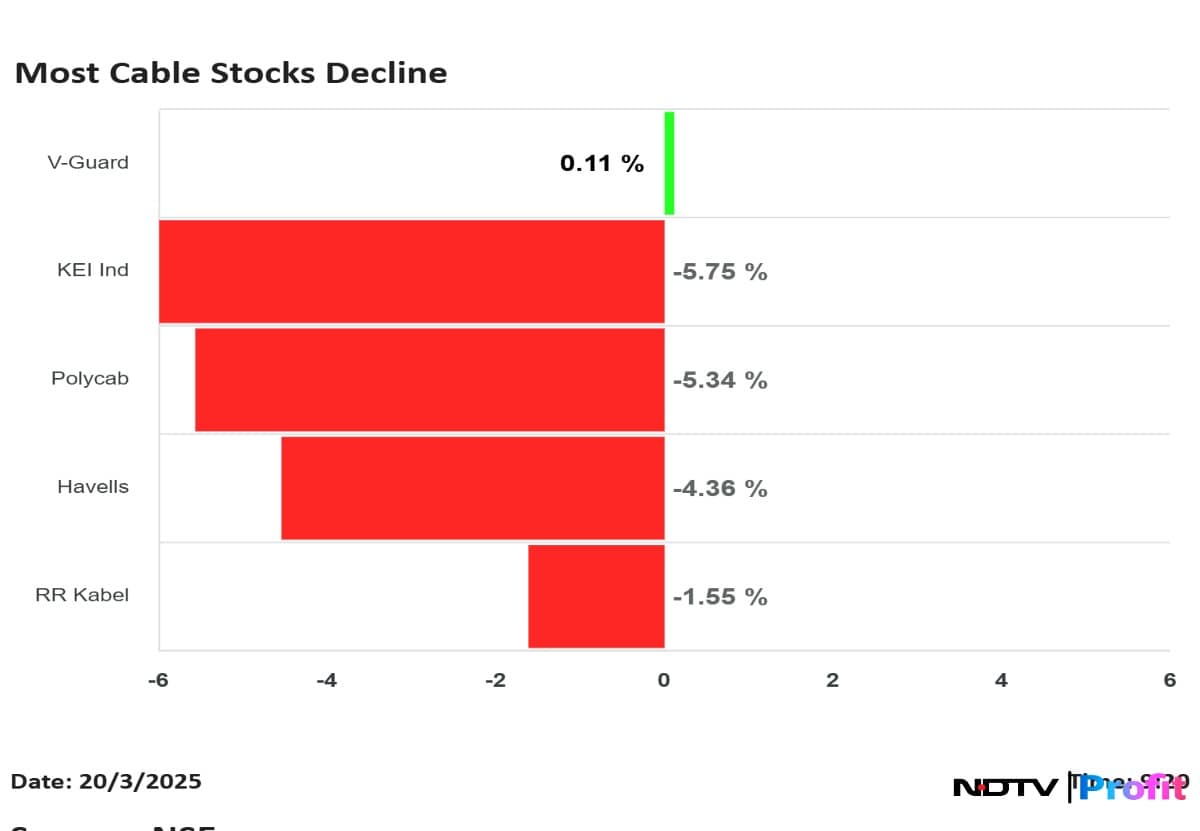

The shares of Havells, Polycab India and KEI Industries fell on Thursday after UBS in a note said that the competition as a negative for the companies. While Havells fell nearly 6%, the shares of KEI Industries and Polycab fell nearly 9% and 8% respectively.

This comes after Adani Enterprises through its subsidiary entered metal products, cables and wires segment. UBS in its note said that competitive intensity in the segment continues to rise as "second large serious player" enters the segment.

Read story here.

The shares of Havells, Polycab India and KEI Industries fell on Thursday after UBS in a note said that the competition as a negative for the companies. While Havells fell nearly 6%, the shares of KEI Industries and Polycab fell nearly 9% and 8% respectively.

This comes after Adani Enterprises through its subsidiary entered metal products, cables and wires segment. UBS in its note said that competitive intensity in the segment continues to rise as "second large serious player" enters the segment.

Read story here.

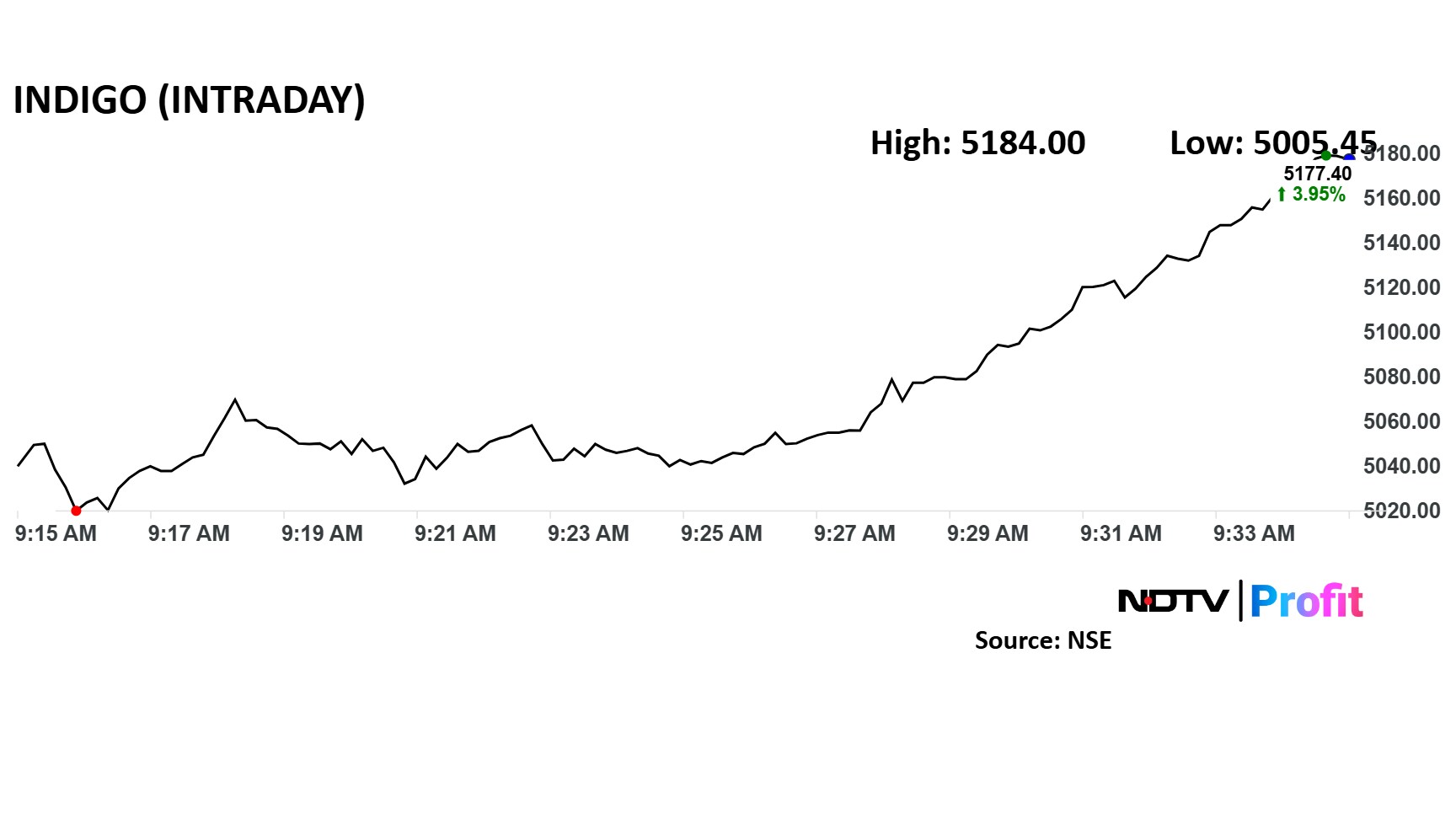

IndiGo operator InterGlobe Aviation stok rose 3% after positive analyst reviews.

BofA raised IndiGo's three-year earnings estimates with near-term pricing power surprising to the upside on strong demand. "We lift our FY25-27 operating profit estimates by an average of +7% to factor IndiGo's revised 4Q unit revenue outlook and FY26 capacity growth guide," the note said. The analysts are also confident on the FY30 growth strategy.

Read story here.

IndiGo operator InterGlobe Aviation stok rose 3% after positive analyst reviews.

BofA raised IndiGo's three-year earnings estimates with near-term pricing power surprising to the upside on strong demand. "We lift our FY25-27 operating profit estimates by an average of +7% to factor IndiGo's revised 4Q unit revenue outlook and FY26 capacity growth guide," the note said. The analysts are also confident on the FY30 growth strategy.

Read story here.

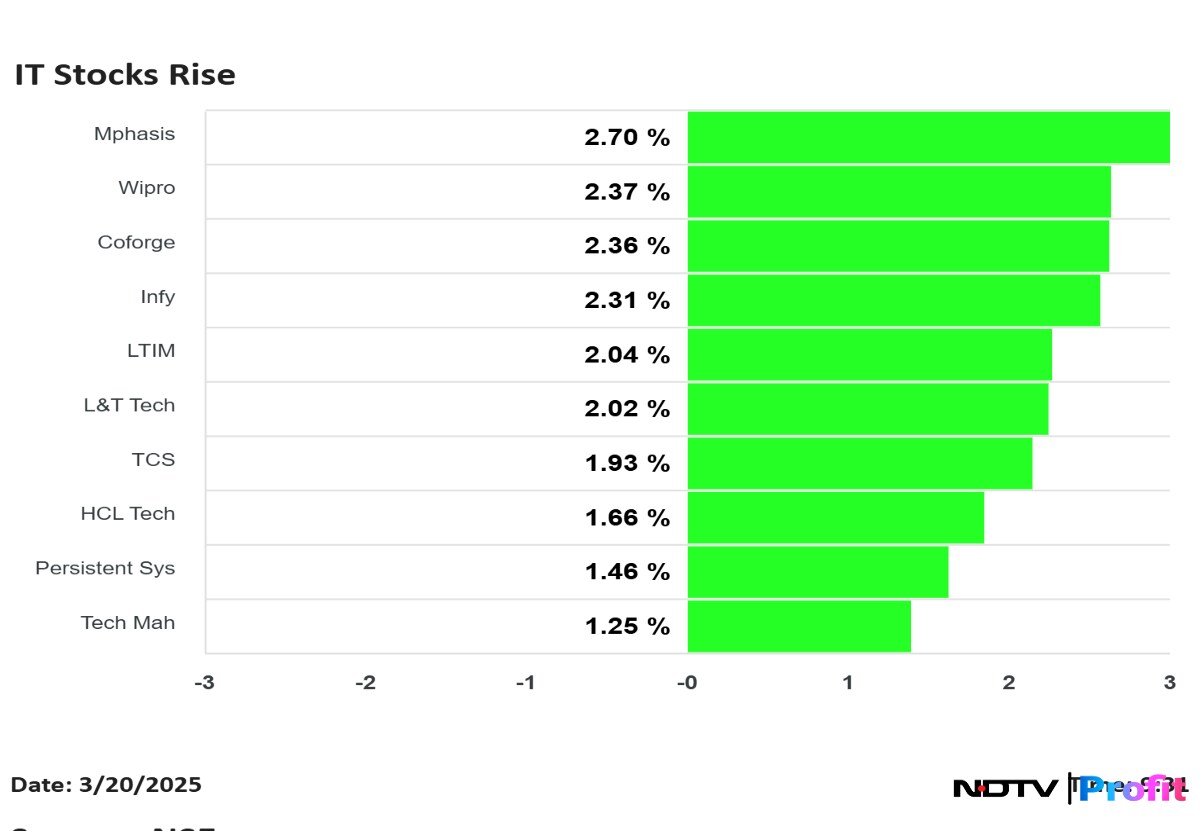

All IT stocks rose after the US Federal Rreserve indicated at least 50 basis points rate cut this year and eased worries about recessionary risks in the world's largest economy.

All IT stocks rose after the US Federal Rreserve indicated at least 50 basis points rate cut this year and eased worries about recessionary risks in the world's largest economy.

The broader markets are performing better. The Nifty Midcap 150 is up 0.68%, while Nifty Smallcap 250 added 1.3%. The Nifty 500 is trading 0.75% higher.

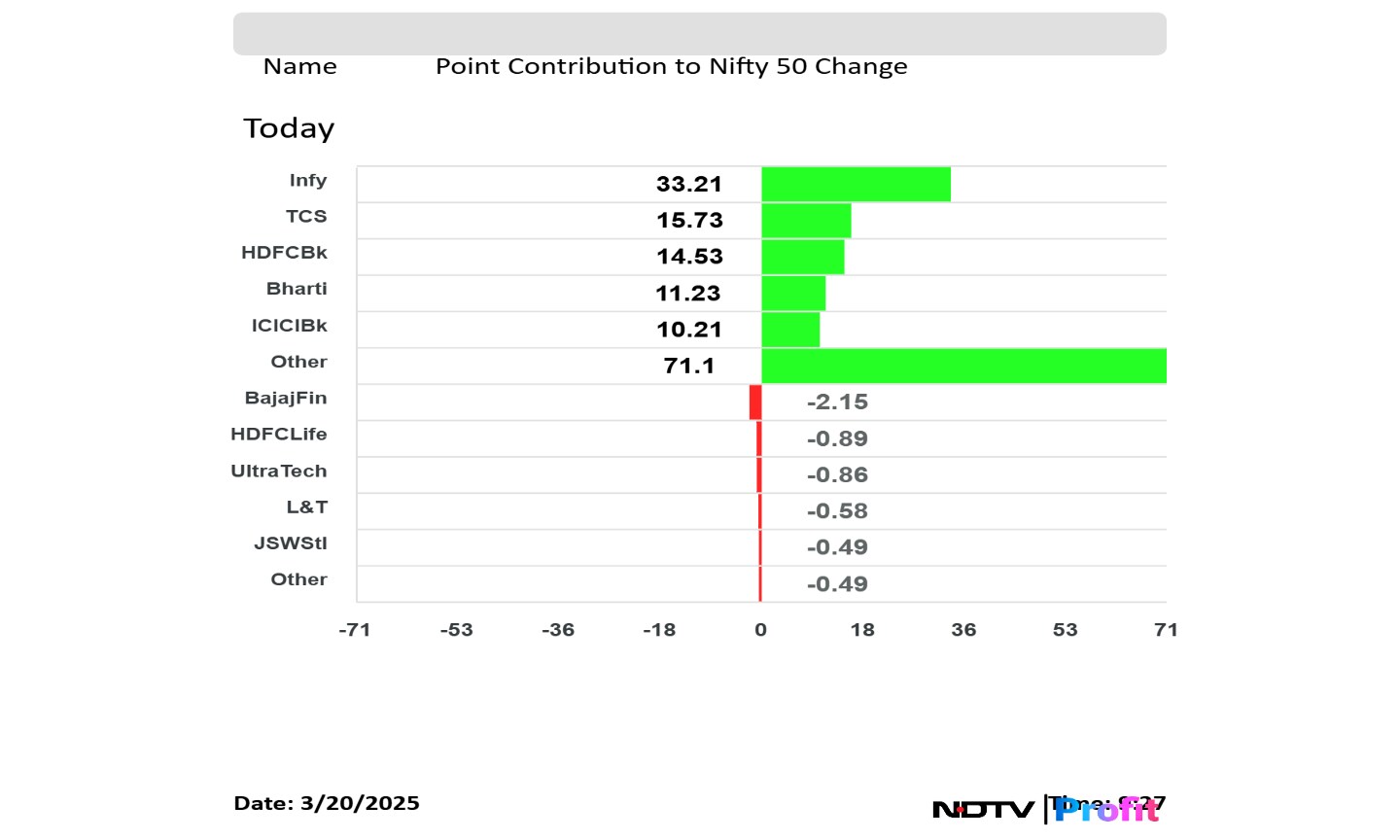

Infosys, TCS and HDFC Bank are the top contributers in the Nifty 50's rise. Bharti Airtel and ICICI Bank are also lending support.

Infosys, TCS and HDFC Bank are the top contributers in the Nifty 50's rise. Bharti Airtel and ICICI Bank are also lending support.

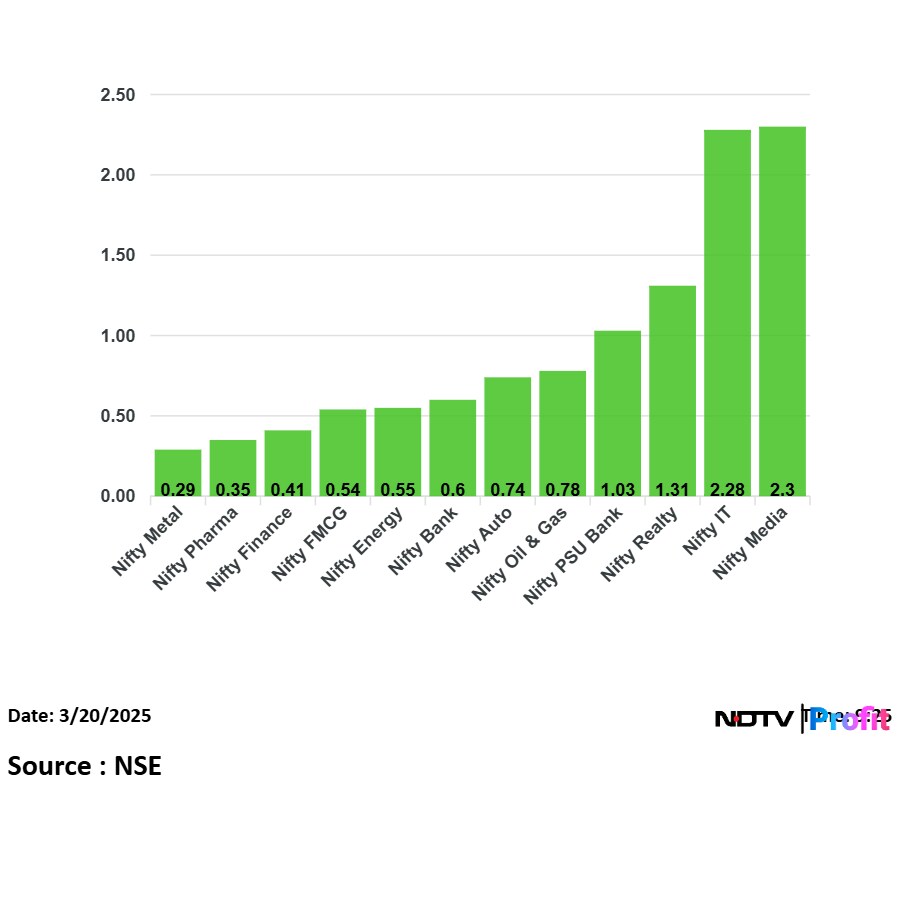

All 12 sectoral indices on the NSE are in green. The Nifty Media and Nifty IT have risen the most.

All 12 sectoral indices on the NSE are in green. The Nifty Media and Nifty IT have risen the most.

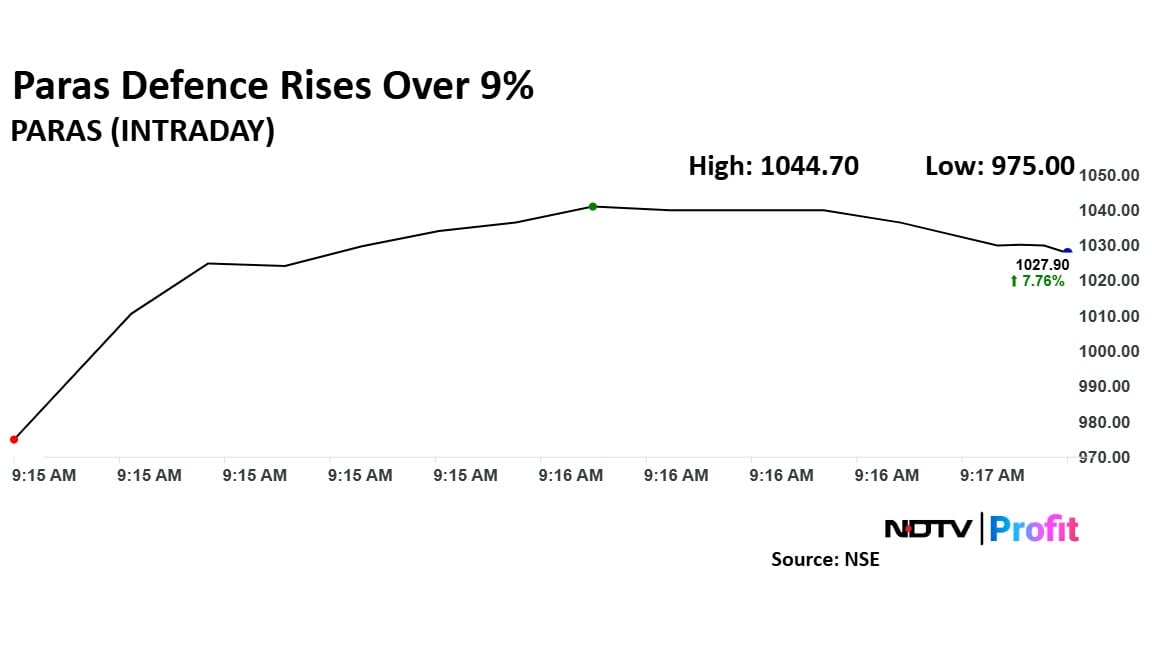

Paras Defence received orders worth Rs 142 crore from DRDO for laser solar module and beam control system.

The stock rose over 9%.

Paras Defence received orders worth Rs 142 crore from DRDO for laser solar module and beam control system.

The stock rose over 9%.

India's benchmark stock indices rose, tracking global markets. The Nifty 50 opened 0.59% higher to 23,042, while BSE Sensex rose 0.63% to 75,927.

The Bank Nifty started 0.67% higher.

India's benchmark stock indices rose, tracking global markets. The Nifty 50 opened 0.59% higher to 23,042, while BSE Sensex rose 0.63% to 75,927.

The Bank Nifty started 0.67% higher.

The yield on the benchmark 10-year government bond opened flat at 6.65%. It opened at 6.66% on Wednesday

Source: Bloomberg

IndiGo airline operator InterGlobe Aviation Ltd. received positive views from analysts on earnings projection, given demand visibility, domestic position, and competitive strategy.

Demand momentum for air travel in India remains robust and IndiGo, with its large fleet and orderbook, is well positioned to benefit from this air traffic demand growth, analysts at Citi said in a note.

Induction of wide-body aircraft from Airbus over the next few years will enable the budget airline to offer long haul international routes as well.

BofA raised IndiGo's three-year earnings estimates with near-term pricing power surprising to the upside on strong demand. "We lift our FY25-27 operating profit estimates by an average of +7% to factor IndiGo's revised 4Q unit revenue outlook and FY26 capacity growth guide," the note said.

The analysts are also confident on the FY30 growth strategy.

Read full report here.

Rupee strengthened 24 paise to open at 86.40 against US Dollar. It opened at 86.64 a dollar on Wednesday.

Source: Bloomberg

The three consecutive days of climb in the Indian markets has raised the support and hurdle levels for NSE Nifty 50. The frontline equity market index faces fresh resistance at 23,000-23,100 levels, analysts said post market hours on Wednesday.

The short-term texture of the Indian market is still on the positive side, but due to temporary overbought conditions, "we could see range-bound activity in the near future", said Shrikant Chouhan, head equity research at Kotak Securities.

Chouhan noted that for day traders, the key support zones are 22,800-22,720, while 23,000-23,100 could act as crucial resistance areas for the bulls. "A fall below 22,720 would make the uptrend vulnerable," he said.

Indian Overseas Bank: The board of directors of the company considered and approved issue of Long Term Infra Bonds to the tune of Rs 10,000 crore.

NHPC: Following their previous announcement on 12th march 2025 , the company's board of directors, in a meeting held on March 19, 2025, approved a borrowing plan to raise up to Rs 6,300 crore in FY 2025-26.

Hyundai Motors: The company announces up to 3% price hike for its vehicles effective April 2025 due to rising input cost, increased commodity prices and higher operational expenses.

Nifty March futures went up by 0.32% to 22,969 at a premium of 61 points. The Nifty March futures open interest down by 1.91%.

Nifty Options March 20 expiry: Maximum call open interest at 23,300 and maximum put open interest at 22,500.

Securities in ban period: Hindustan Copper, IndusInd Bank, SAIL.

Nifty March futures went up by 0.32% to 22,969 at a premium of 61 points. The Nifty March futures open interest down by 1.91%.

Nifty Options March 20 expiry: Maximum call open interest at 23,300 and maximum put open interest at 22,500.

Securities in ban period: Hindustan Copper, IndusInd Bank, SAIL.

US futures were trading in green, after stocks ended higher in the last session.

S&P 500: Up 0.37%

Dow Jones Industrial Average: Up 0.22%

Nasdaq 100: Up 0.51%

The US Federal Reserve's decision to hold interest rates and future trajectory of monetary policy and economic outlook lifted Asian stocks, following a rally on Wall Street.

Australian and South Korean shares gained. The Kospi rose by 0.4% and S&P/ASX 200 by 0.8%. However, Hang Seng was down 0.93%.

Japanese markets are closed for a public holiday.

The GIFT Nifty was trading flat but remained above 23,000. The futures contract based on the Nifty 50 index was up 4 points or 0.02% at 23,069 by 7:30 a.m., indicating a marginally higher open for the benchmark.

The frontline stock market indices ended higher for the third consecutive day on Wednesday, ahead of the US Federal Reserve's monetary policy decision.

The NSE Nifty 50 ended 73.30 points, or 0.32% higher at 22,907.60, while the BSE Sensex closed 147.79 points, or 0.2% up at 75,449.05.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.