And it's a wrap on real-time market coverage for Tuesday. Thank you for joining us, today!

Nifty fell for third consecutive session

Nifty closed below 25900 mark

Nifty top losers include Trent and Infosys

Broader markets outperform benchmark

Nifty midcap 150 , top gainers include AB capital and Federal bank

Nifty smallcap 250 , top gainers include HEG and craftman automation

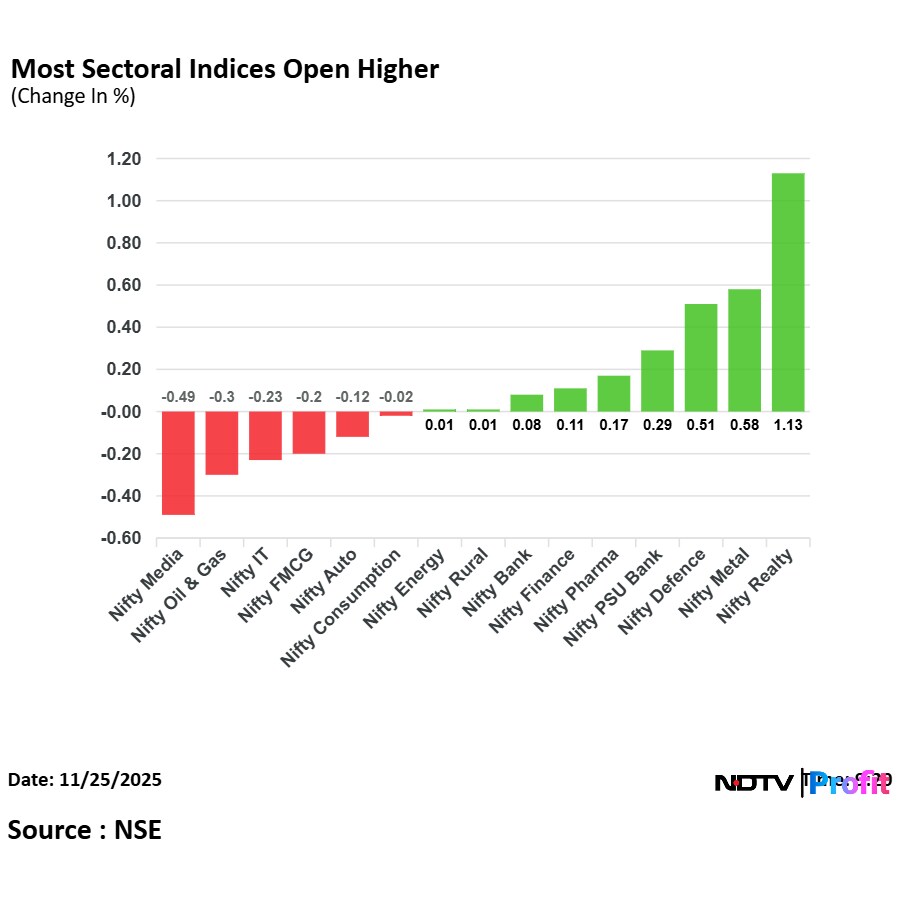

All sectoral indices closed on mixed note

NIfty realty and Nifty PSU bank gain the most

Nifty realty top gainers include Raymond and brigade enterprise

Nifty PSU bank top gainers include Bank of Maharashtra and Indian bank

Nifty media and Nifty IT fell the most

Nifty PSU bank , Nifty pharma snaps 3 day losing streak

Nifty oil and gas and Nifty auto fell for third consecutive session

Nifty realty snaps five day losing streak

Nifty bank and financials fell for third consecutive session

Nifty fell for third consecutive session

Nifty closed below 25900 mark

Nifty top losers include Trent and Infosys

Broader markets outperform benchmark

Nifty midcap 150 , top gainers include AB capital and Federal bank

Nifty smallcap 250 , top gainers include HEG and craftman automation

All sectoral indices closed on mixed note

NIfty realty and Nifty PSU bank gain the most

Nifty realty top gainers include Raymond and brigade enterprise

Nifty PSU bank top gainers include Bank of Maharashtra and Indian bank

Nifty media and Nifty IT fell the most

Nifty PSU bank , Nifty pharma snaps 3 day losing streak

Nifty oil and gas and Nifty auto fell for third consecutive session

Nifty realty snaps five day losing streak

Nifty bank and financials fell for third consecutive session

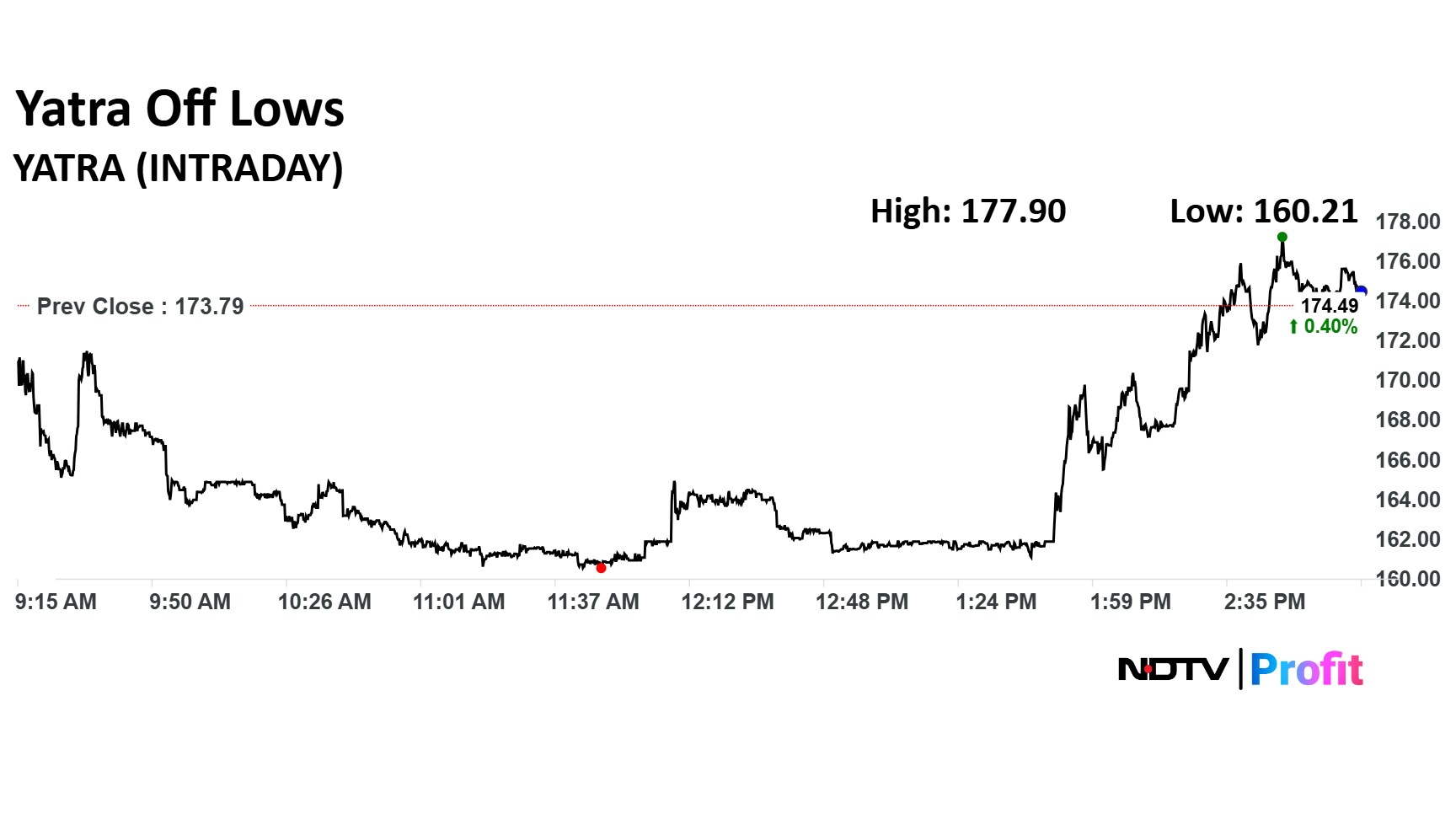

Yatra Online share price recovered after declining nearly 8%. The share price was trading 0.47% higher at Rs 174.6 apiece as of 3:12 p.m.

Most stocks of tourism companies were trading in red in Tuesday's session.

Yatra Online share price recovered after declining nearly 8%. The share price was trading 0.47% higher at Rs 174.6 apiece as of 3:12 p.m.

Most stocks of tourism companies were trading in red in Tuesday's session.

Oriental Rail Infra received Rs 2.9 crore order from Souther Railway to supply 826 Coupler Body with Shank Wear Plate, the company said in the exchange filing.

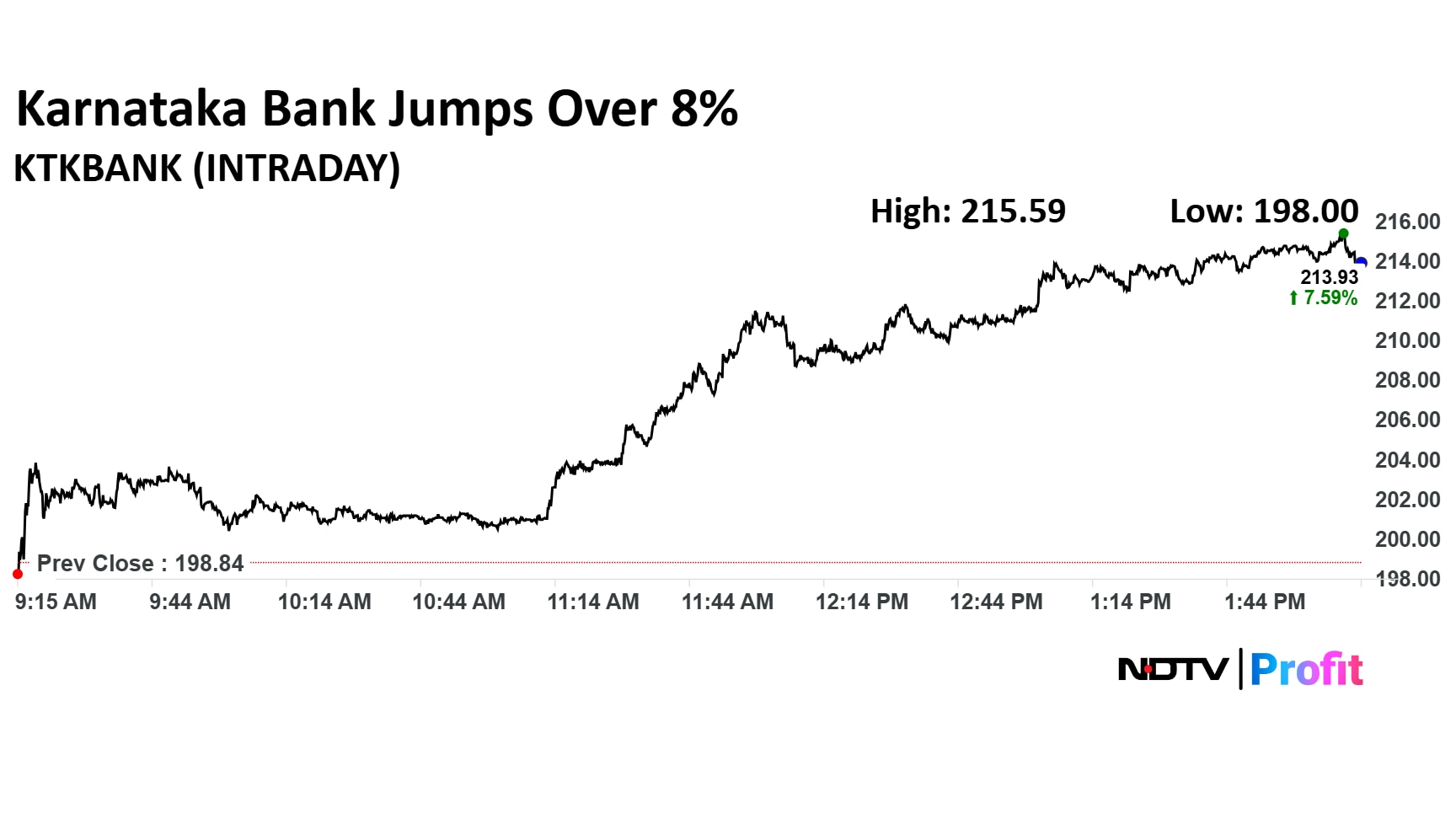

The Karnataka Bank Ltd. share price was trading shy of its yearly peak in Tuesday's price after Aditya Halwasiya bought shares in the Quant Mutual Fund-backed private lender.

Halwasiya, chairman and managing director, Cupid Ltd. accumulated 83 lakh shares in last two sessions. His stakes in The Karnataka Bank stood at 2.19%.

CopperTech Metals Inc. an arm of Vedanta Resources Ltd. has filed confidential draft papers for a potential initial public offering, the company said in a press release on Monday.

The Karnataka Bank share price jumped 8.42% to Rs 215.59 apiece. It was trading 7.59% higher at Rs 214.13 apiece as of 2:14 p.m.

Cupid Chairman and Managing Director Aditya Kumar Halwasiya has bought additional shares in the company.

The Karnataka Bank share price jumped 8.42% to Rs 215.59 apiece. It was trading 7.59% higher at Rs 214.13 apiece as of 2:14 p.m.

Cupid Chairman and Managing Director Aditya Kumar Halwasiya has bought additional shares in the company.

The Tata Sierra is officially back! The company has relaunched the iconic model from the dawn of the century, but with a modern touch. Tata Motors are calling it the 'rebirth of a legend'.

Sierra was initially unveiled at the Bharat Mobility Expo, and after several design teasers, the company has finally launched the SUV, which takes inspiration from the 90s and sports a retro-inspired design, akin to the older Sierra model.

The Securities and Exchange Board of India (SEBI) has proposed a few changes in rules linked to Basic Services Demat Accounts (BSDAs). The draft circular issued by the market regulator on Monday proposes to exclude delisted securities and Zero Coupon Zero Principal (ZCZP) bonds issued under the social impact framework from portfolio value calculations to determine annual maintenance charges (AMC) for these special demat accounts.

Transformers and Rectifiers received orders worth Rs 390 crore from Gujarat Energy Transmission Corp to manufacture transformers, the company said in the exchange filing.

India's lack of correlation with the blistering rally in the US is being witnessed as an "anti-AI play," which Helios Capital's Samir Arora believes is an unjustified take.

Some investors view India as an "anti-AI" play because its stock market isn't dominated by AI-heavy companies the way the US, Taiwan, or South Korea are. Instead, India's growth is anchored in domestic demand like financials, consumer goods, manufacturing, rather than the global tech cycle.

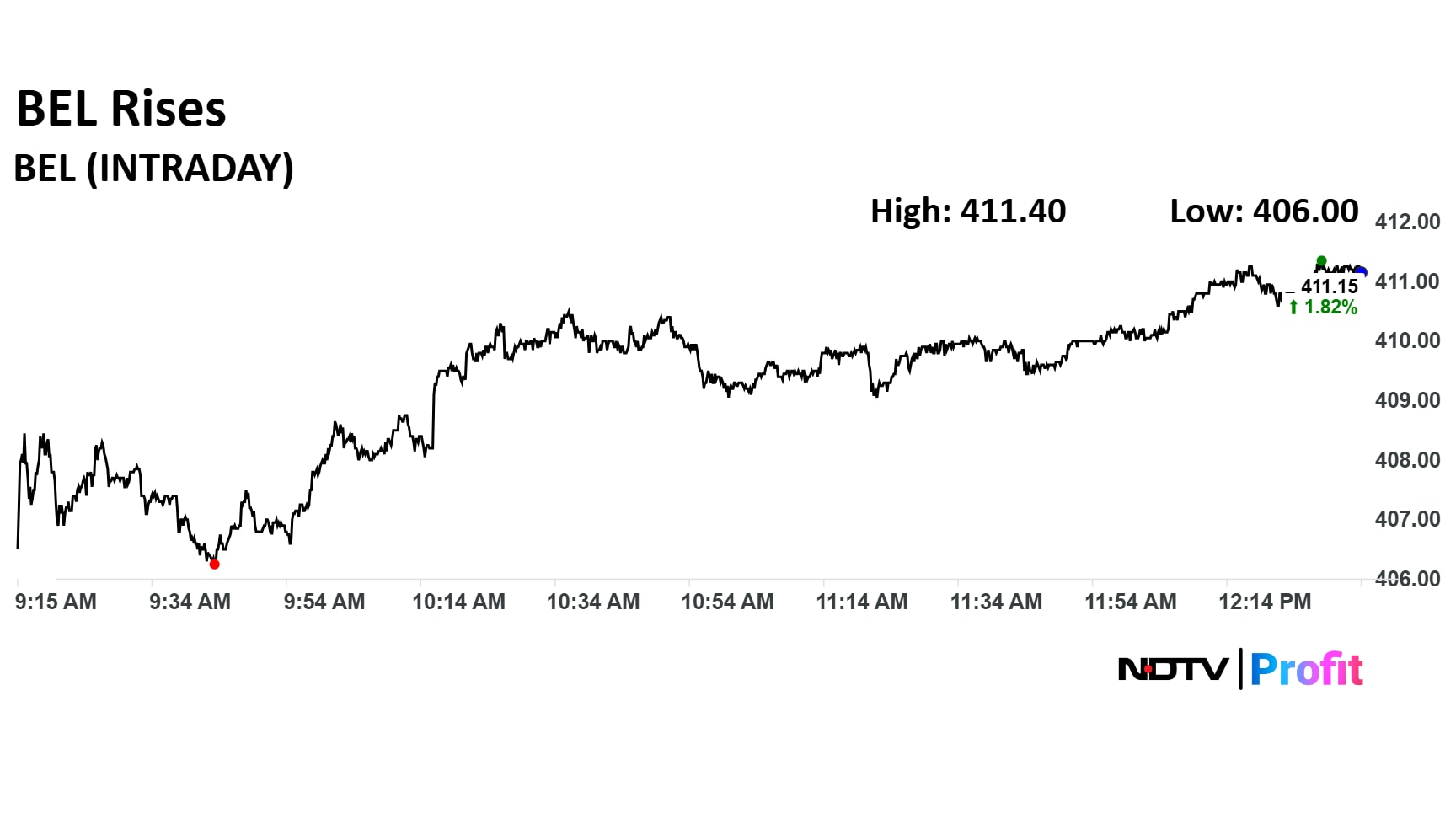

Bharat Electronics Ltd. share price snapped a three-day declining streak as the company signed an agreement with France-based Safran Electronics & Defense to manufacture a precision-guided weapon system.

The system is known HAMMER is designed for multiple platforms including Rafale Fighter Jet and Tejas Light-Combat aircraft.

Bharat Electronics Ltd. share price snapped a three-day declining streak as the company signed an agreement with France-based Safran Electronics & Defense to manufacture a precision-guided weapon system.

The system is known HAMMER is designed for multiple platforms including Rafale Fighter Jet and Tejas Light-Combat aircraft.

Groww’s parent Billionbrains Garage Ventures Ltd. reported a 24.6% rise in profit to Rs 471 crore for the September quarter, driven by strong revenue growth and operational efficiency.

In an exclusive conversation with NDTV Profit, Harsh Jain, Co-Founder and COO of Groww, addressed queries on margins, restructuring, and active user trends. Jain clarified that the Rs 160 crore management incentive reversal seen in filings relates to adjustments made in previous years during a major restructuring.

Avantel received purchase order worth Rs 17.6 crore from Bharat Electronics Ltd. for communication systems, the company said in the exchange filing.

Indostar Capital's board approved allotment of 1 crore shares at Rs 184 apiece on a preferential basis. The warrant holder Florintree Tecserv exercised the right for conversion of 1 crore, the company said in the exchange filing.

Ventura Recommended a Buy with a target price Rs 3,433, which implied 43% upside

Fundraise to ease balance sheet pressure & fuel growth

Fresh equity raise of Rs Rs 25,000 cr timely and strategic step to monetise stock’s strong recovery

Given the substantial growth headroom in current portfolio, view the rights issue offer price attractive

Over FY25–28E, revenue & EBITDA projected to grow at a CAGR of 17.4% and 18.7%

Growth in airports & ANIL with ramp-up in data centres & copper to be key growth drivers

Bank of America (BoFA)'s latest internet survey on India’s online consumers points to robust demand for quick commerce and food delivery apps

According to a survey of over 1,000 users conducted in early November, Blinkit is the preferred quick commerce platform for Indian consumers. The report also shows growth in the overall reliance on multiple delivery apps and quick-commerce for grocery needs.

Indore-based engineered steel castings manufacturer Gallard Steel Ltd. which concluded its initial public offering (IPO) on November 21, received a fantastic response from investors. The SME IPO was oversubscribed nearly 350 times.

According to BSE data, NIIs and RIIs led the demand, subscribing 463.85 and 351.58 times, respectively. The QIB portion was oversubscribed 228.48 times.

Servotech Renewable Power Systems received patent for CCS2 to GB/T electric vehicle charging conversion technology, the company said in the exchange filing.

Adani Ports And Special Economic Zone Ltd. is poised for robust growth as a comfortable balance sheet position, strong cash-flow generation support, Antique said. The brokerage started the coverage with a 'Buy' rating and a target price of Rs 1,773 apiece, which implies 20% upside from the current level.

Wall Street's artificial intelligence (AI) bellwether, Nvidia, reported strong third quarter earnings last week, posting a double beat with revenue of $57 billion and an EPS at $1.30. The AI chip giant commands a market cap of $4.3 trillion after having hit the coveted $5-trillion mark earlier this year.

Nvidia shares, up 38% year-to-date, have retreated 10% since hitting a record high in late October. The Q3 results helped restore a tentative sense of calm after weeks of heavy selling in tech stocks, as investors grew uneasy about stretched valuations and fading prospects for near-term rate cuts.

Shares of Siemens Energy Ltd. is buzzing in trade on Tuesday, gaining more than 4% on the back of a stellar fourth-quarter earnings in the financial year ending March 2025.

The stock reached an intraday high of Rs 3,294, compared to Monday's closing price of Rs 3,162. Shares of Siemens Energy have since retreated, currently trading at Rs 3,186, which accounts for gains of more than 0.7%.

On National Stock Exchange, seven sectoral indices advanced, five declined, and three remained flat out of 15.

On National Stock Exchange, seven sectoral indices advanced, five declined, and three remained flat out of 15.

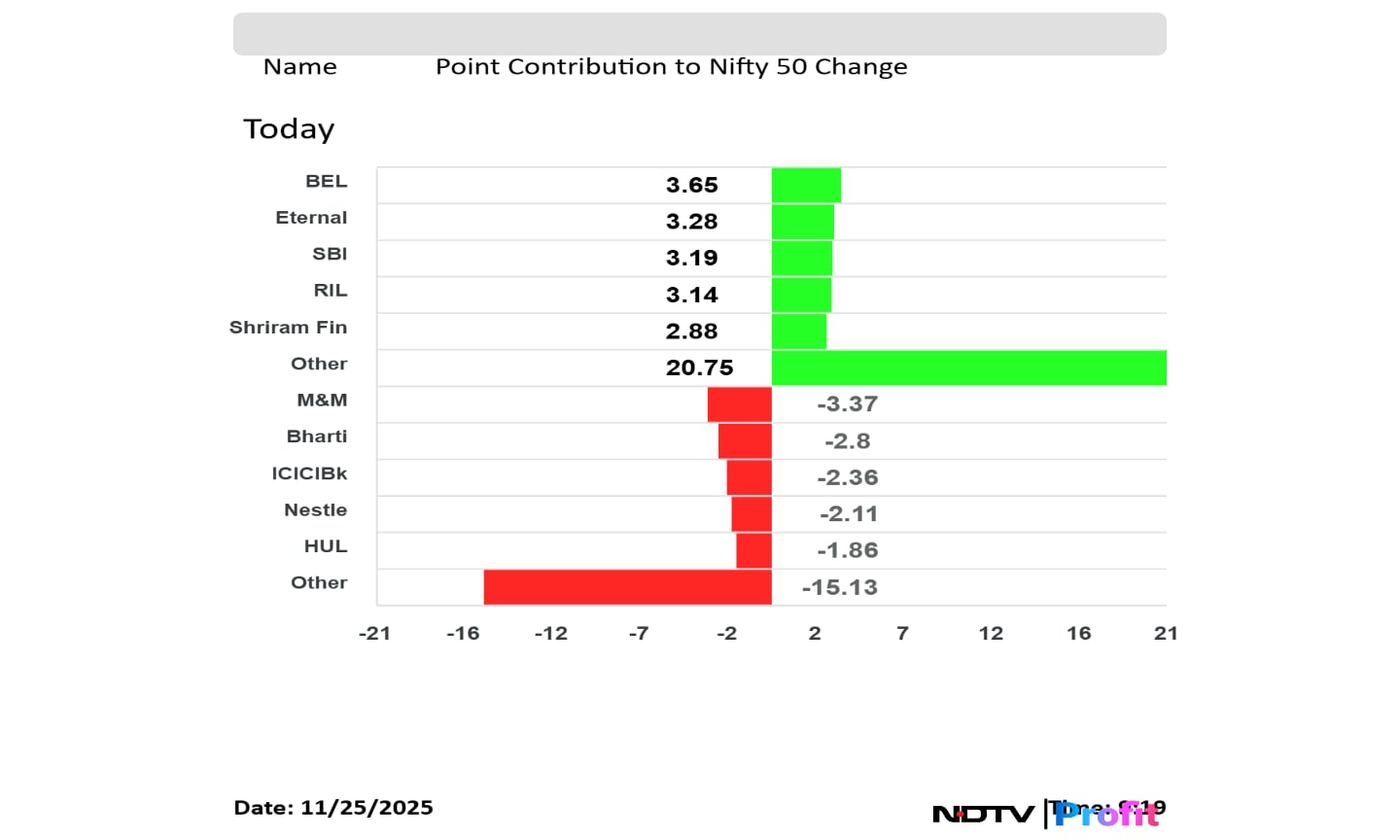

Mahindra & Mahindra Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Nestle India Ltd., and Hindustan Unilever Ltd. shares weighed.

Bharat Electronics Ltd., Eternal Ltd., State Bank of India, Reliance Industries Ltd., and Shriram Finance Ltd. shares limited losses in the Nifty 50 index.

Mahindra & Mahindra Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Nestle India Ltd., and Hindustan Unilever Ltd. shares weighed.

Bharat Electronics Ltd., Eternal Ltd., State Bank of India, Reliance Industries Ltd., and Shriram Finance Ltd. shares limited losses in the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex declined after a positive open. The indices were trading 0.03% and 0.04% down, respectively as of 9:22 a.m.

The NSE Nifty 50 and BSE Sensex declined after a positive open. The indices were trading 0.03% and 0.04% down, respectively as of 9:22 a.m.

The yield on the 10-year bond opened flat at 6.47%

Source: Bloomberg

Rupee opened 18 paise stronger at 89.06 against US Dollar

It closed at 89.24 a dollar on Monday

Source: Bloomberg

HSBC has come out with a cautious note on Tata Motors Passenger Vehicles Ltd, pointing out that all stars appear to be 'misaligned' for the company's Jaguar Land Rover business.

CLSA projected a 16% upside potential for Indian equities as multiple factors come together to form a base-case profitability for 2026.

The brokerage prefers Bajaj Auto Ltd., DLF Ltd., Eternal Ltd., ICICI Bank Ltd., Infosys Ltd., ITC Ltd., Oil and Natural Gas Ltd., NTPC Ltd., State Bank of India, Tech Mahindra Ltd., Tata Motors Ltd., and UltraTech Cement Ltd.

Oil steadied as investors tracked a risk-on mood in wider financial markets, which countered the impact of progress in peace talks over Ukraine that could pave the way for increased crude supplies.

West Texas Intermediate held near $59 a barrel after rising by more than 1% on Monday, while Brent closed above $63.

Read the Bloomberg article here.

Reliance Industries Ltd. has already delivered a strong year, rising 27% year-to-date and comfortably beating the Nifty’s 17% gain. Yet analysts remain upbeat heading into 2026, citing more room for valuation re-rating, a turnaround in the company’s refining cycle, and a series of catalysts expected next year.

Brokerage firm JPMorgan has revised the stock’s price target to Rs 1,727, with an 'overweight' call maintained.

Markets in most regions in Asia advanced as hopes for a rate cut in December increased after US Federal Reserve's positive remarks.

The UD Fed Governor Christopher Waller said that a rate cut is due in December because of a softer labour market. The US Fed New York President John Willian said that he also sees room for a near-term rate cut.

Japan's Nikkei 225 and South Korea's KOSPI were trading 0.61% and 0.83% higher, respectively as of 7:30 a.m.

The GIFT Nifty was trading 0.02% or 5 points higher at 25,992 as of 6:43 a.m., which implied a flat-to-positive open for the NSE Nifty 50 index.

Tata Power Ltd., Natco Pharma Ltd., Power Finance Corp Ltd., Rail Vikas Nigam Ltd. shares are in focus for Tuesday's trade session.

India's benchmark stock indices ended lower on Friday. The BSE Sensex settled 400.76 points or 0.47% lower at 85,231.92, and the Nifty 50 dropped 124 points or 0.47% at 26,068.15.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.