Benchmark fell 1% in intraday

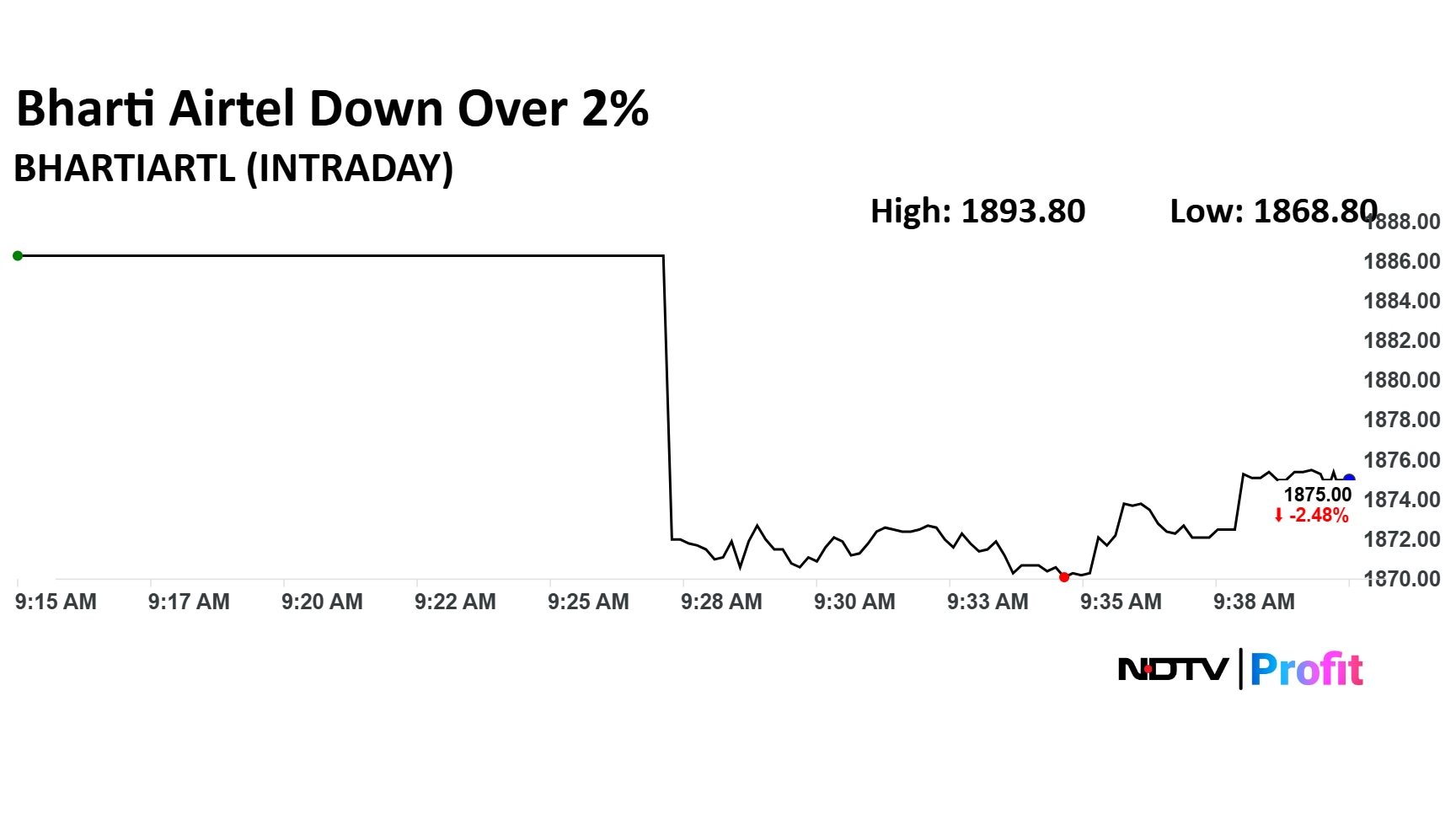

Bharti Airtel and IndusInd Bank among the top losers in Nifty

Benchmark indices outperform Broader Market indices

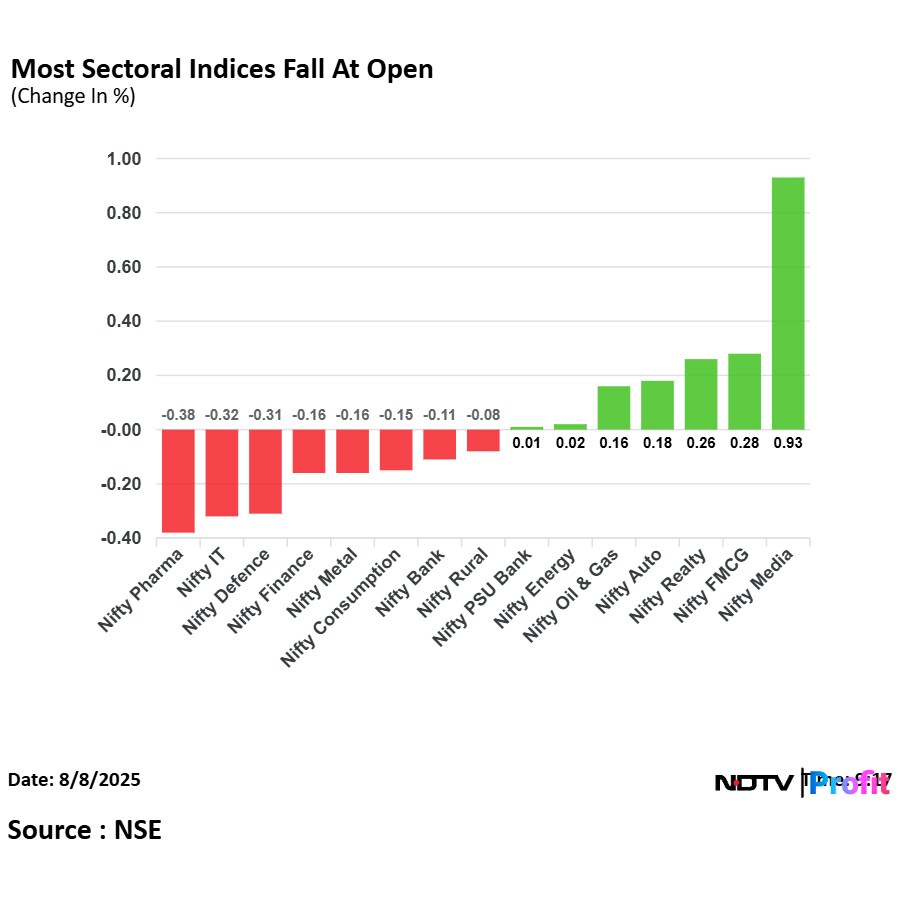

All sectoral indices ended in red

Nifty realty fell over 2% for the day , Worst performing sector

Godrej properties, Sobha and phoenix Mills fell the most in Nifty Realty

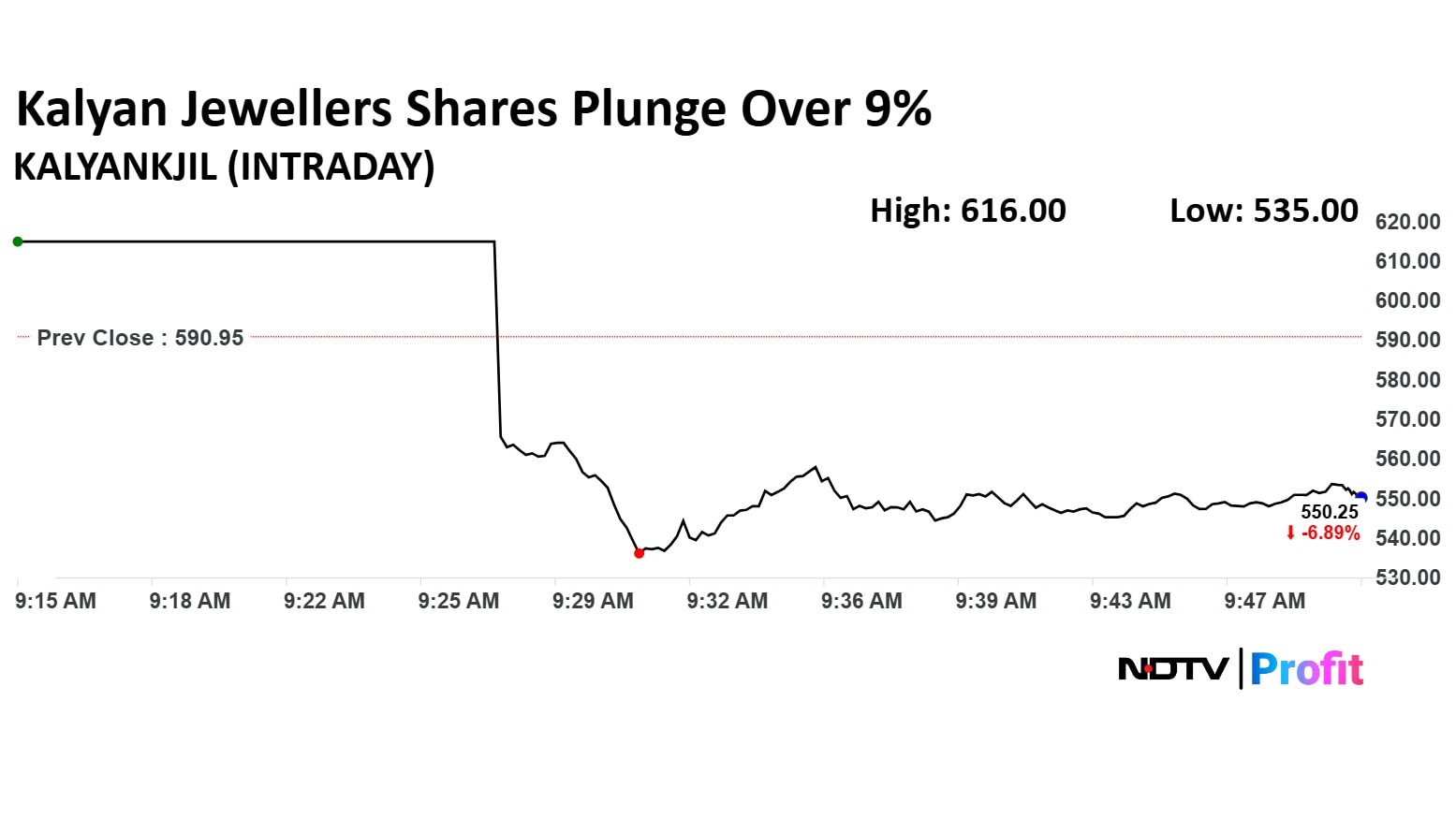

Kalyan jewelers fell 10% post Q1 results, Worst performer in Nifty midcap 150

Nifty oil and gas fell for fourth consecutive session

Nifty PSU snaps its two day gaining streak, dragged by Punjab&Sind Bank and Bank of baroda

Nifty Bank snaps its two day gaining streak

Benchmark fell 1% in intraday

Bharti Airtel and IndusInd Bank among the top losers in Nifty

Benchmark indices outperform Broader Market indices

All sectoral indices ended in red

Nifty realty fell over 2% for the day , Worst performing sector

Godrej properties, Sobha and phoenix Mills fell the most in Nifty Realty

Kalyan jewelers fell 10% post Q1 results, Worst performer in Nifty midcap 150

Nifty oil and gas fell for fourth consecutive session

Nifty PSU snaps its two day gaining streak, dragged by Punjab&Sind Bank and Bank of baroda

Nifty Bank snaps its two day gaining streak

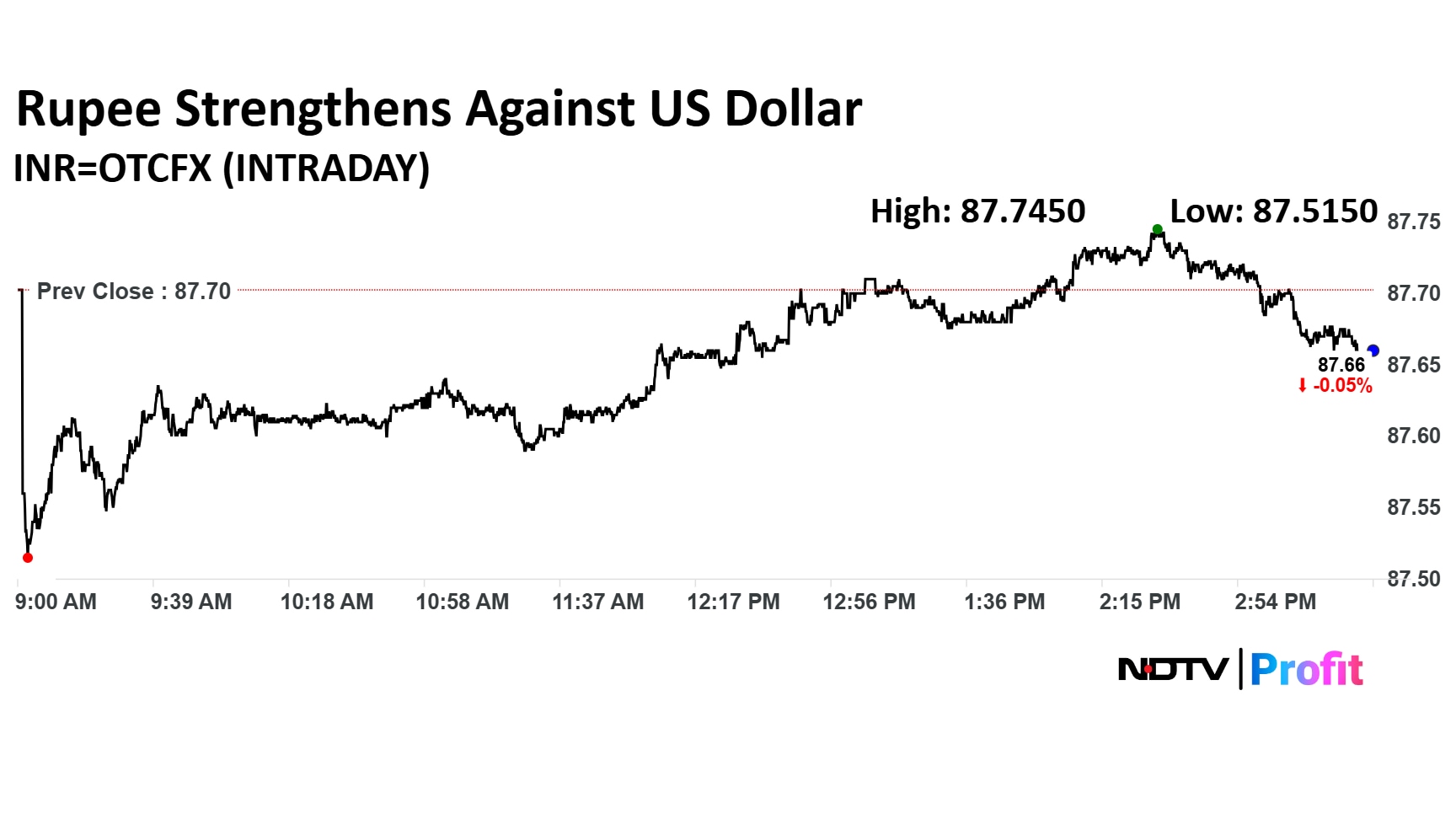

Rupee closed 4 paise stronger at 87.66 against US Dollar

It closed at 87.70 a dollar on Thursday.

Source: Cogencis

Rupee closed 4 paise stronger at 87.66 against US Dollar

It closed at 87.70 a dollar on Thursday.

Source: Cogencis

Indian markets are likely to remain range-bound going forward, as most market participants continue to stay on the sidelines, said Sandeep Tandon, founder and chief investment officer of Quant MF.

Sentiment is ultimately very important for a rally. Currently, overall excitement is missing, he said.

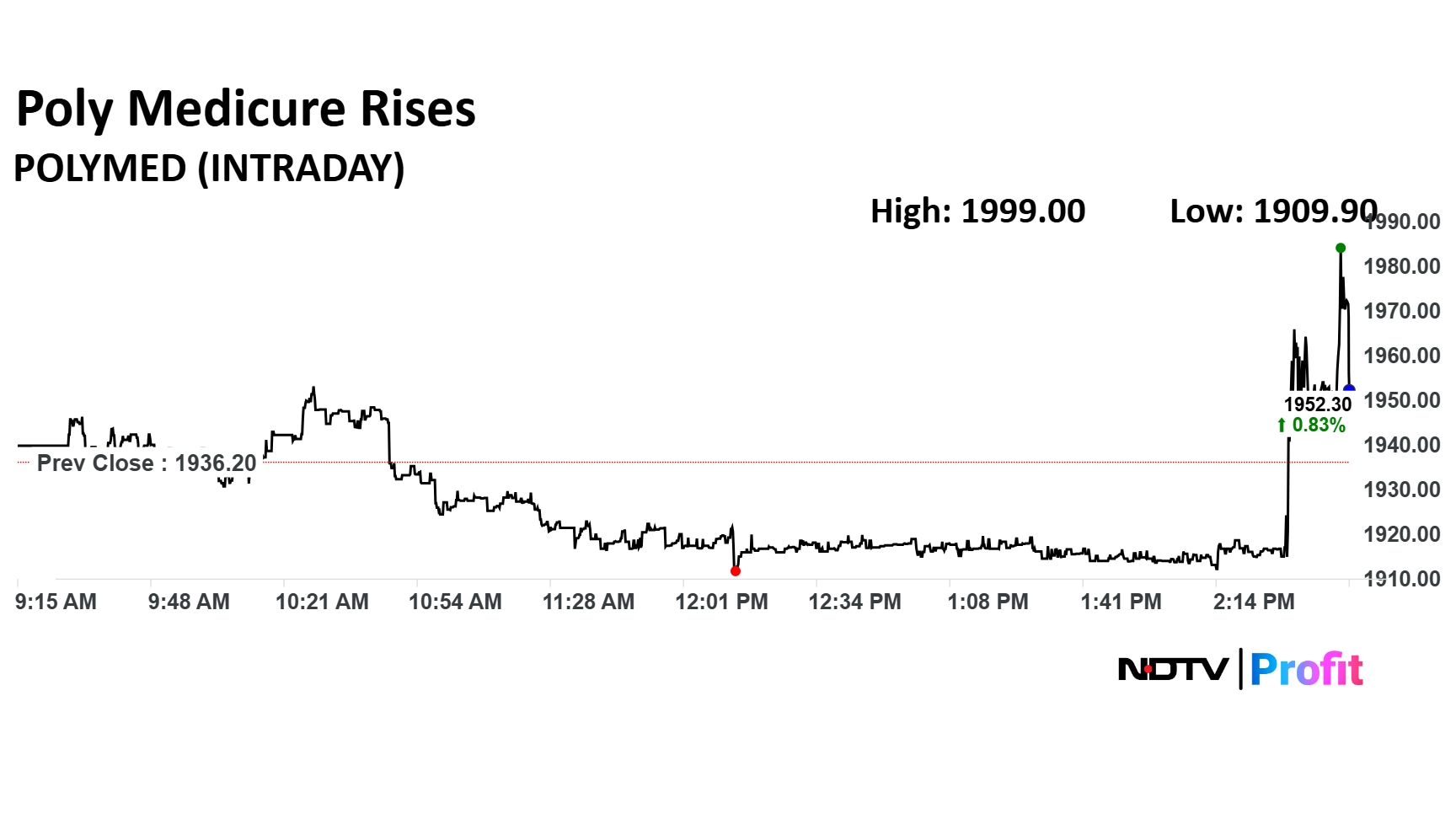

Poly Medicure Q1 Highlights (Cons, YoY)

Revenue up 4.8% to Rs 403 crore versus Rs 385 crore

Ebitda up 2.3% to Rs 106 crore versus Rs 104 crore

Margin at 26.3% versus 26.9%

Net Profit up 25.7% to Rs 93 crore versus Rs 74 crore

Poly Medicure Q1 Highlights (Cons, YoY)

Revenue up 4.8% to Rs 403 crore versus Rs 385 crore

Ebitda up 2.3% to Rs 106 crore versus Rs 104 crore

Margin at 26.3% versus 26.9%

Net Profit up 25.7% to Rs 93 crore versus Rs 74 crore

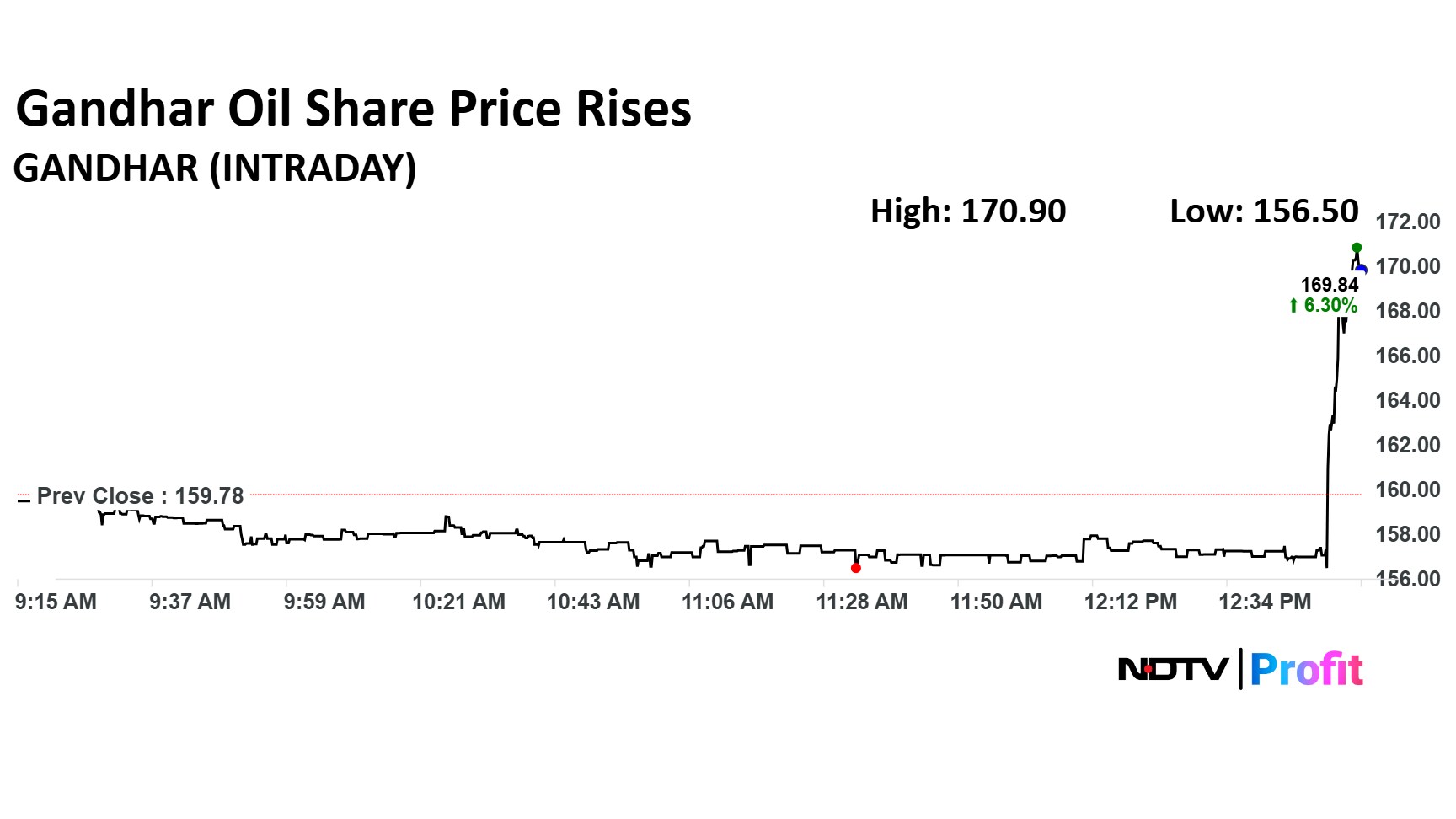

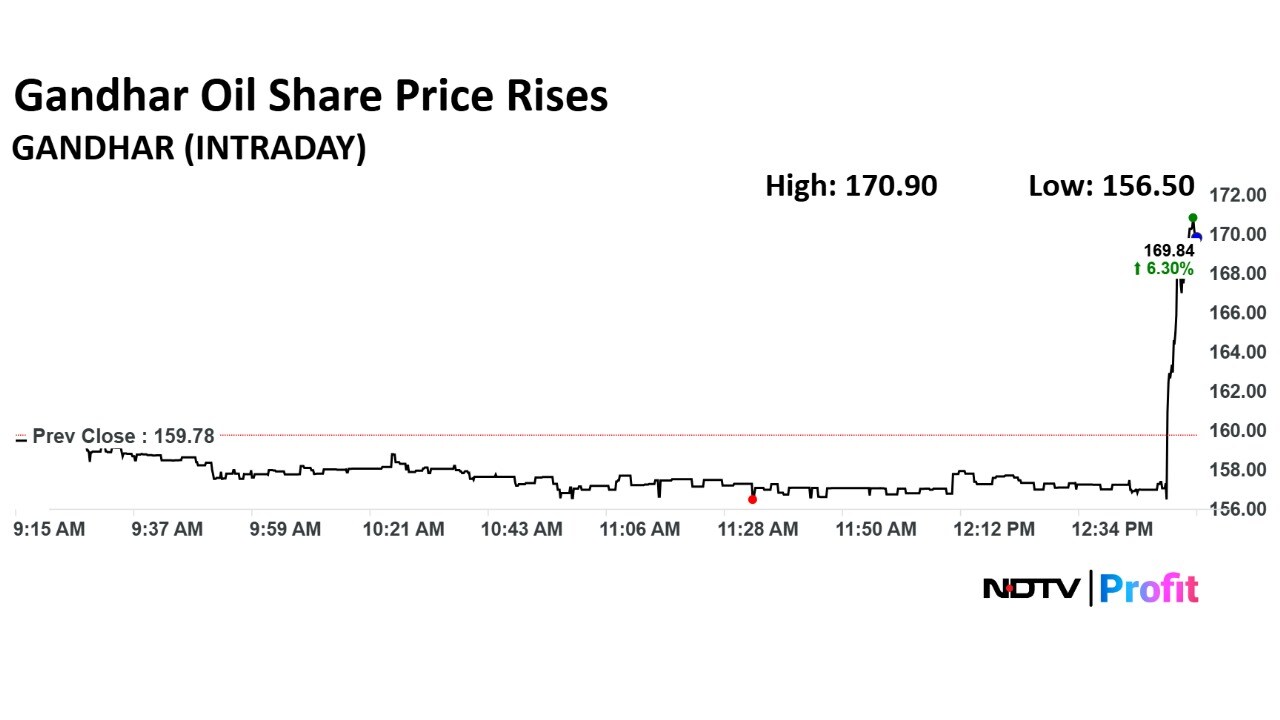

Gandhar Oil Refinery Ltd.'s share price jumped 7% in Friday's session despite the company posting bleak numbers for the first quarter. Its consolidated net profit declined 15% on the year to Rs 26.2 crore from Rs 30.8 crore.

Gandhar Oil Refinery Ltd.'s share price jumped 7% in Friday's session despite the company posting bleak numbers for the first quarter. Its consolidated net profit declined 15% on the year to Rs 26.2 crore from Rs 30.8 crore.

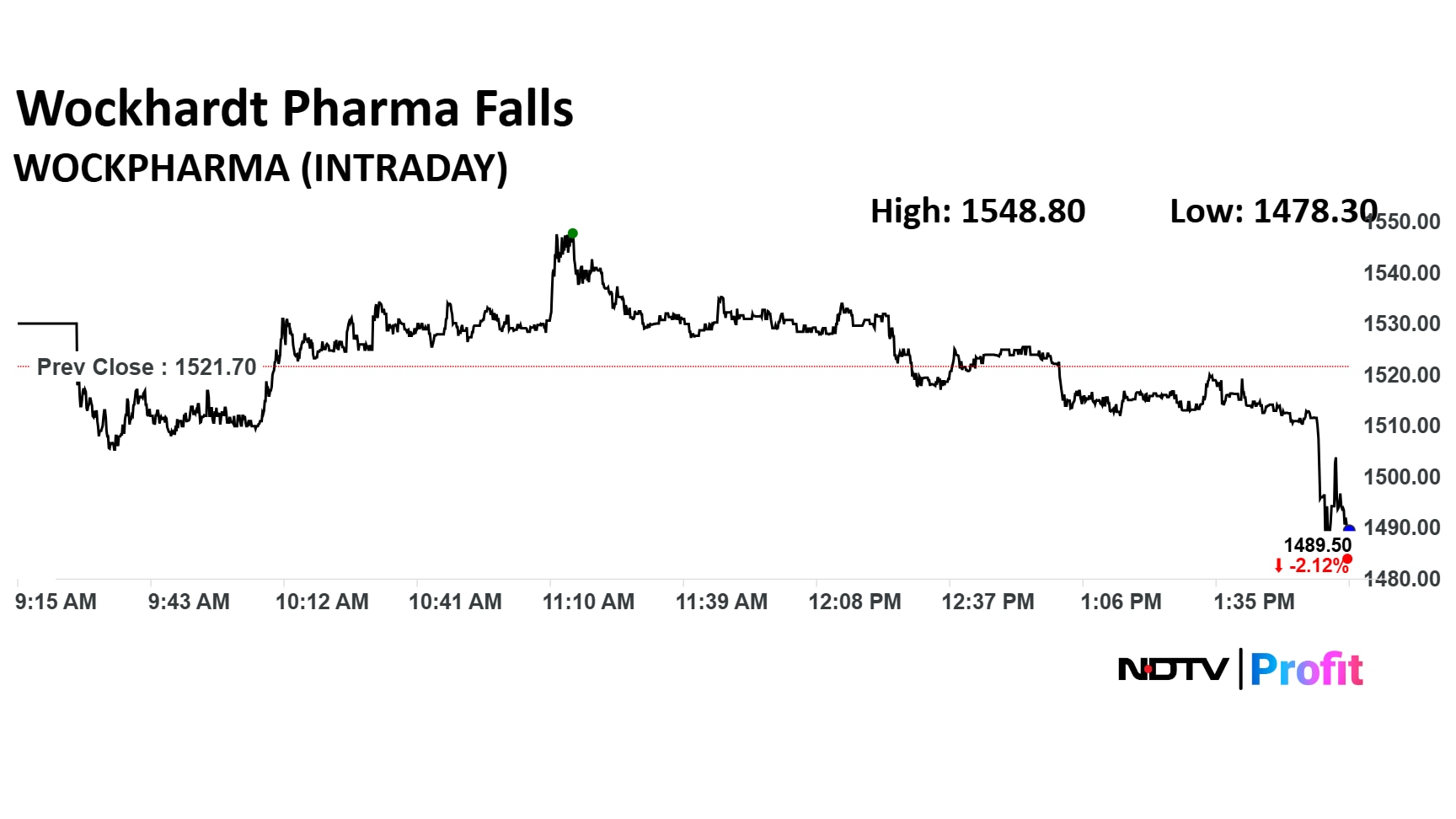

Wockhardt Q1FY26 Highlights (Consolidated, YoY)

Revenue down 0.14% at Rs 738 crore versus Rs 739 crore

EBITDA down 20.9% at Rs 72 crore versus Rs 91 crore

Margin at 9.8% versus 12.3%

Net loss of Rs 90 crore versus loss of Rs 14 crore

Wockhardt Q1FY26 Highlights (Consolidated, YoY)

Revenue down 0.14% at Rs 738 crore versus Rs 739 crore

EBITDA down 20.9% at Rs 72 crore versus Rs 91 crore

Margin at 9.8% versus 12.3%

Net loss of Rs 90 crore versus loss of Rs 14 crore

SBI Q1 Highlights (Standalone, YoY)

Net Interest Income largely flat at Rs 41,072 crore.

Provisions up 38% to Rs 4,759 crore versus Rs 3,449 crore.

Operating Profit up 15.5% to Rs 30,544 crore versus Rs 26,449 crore.

Net Profit up 12.5% to Rs 19,160 crore versus Rs 17,035 crore. (Bloomberg estimate: Rs 16,964 crore)

Net NPA Flat at 0.47%.

Gross NPA at 1.83% versus 1.82%.

Slippage ratio at 0.75% versus 0.42%.

Gandhar Oil Q1 Highlights (Cons, YoY)

Revenue down 9.2% to Rs 903 crore versus Rs 995 crore

Ebitda down 23.8% to Rs 46 crore versus Rs 60.3 crore

Margin at 5% versus 6%

Net Profit down 15% to Rs 26.2 crore versus Rs 30.8 crore

Gandhar Oil Q1 Highlights (Cons, YoY)

Revenue down 9.2% to Rs 903 crore versus Rs 995 crore

Ebitda down 23.8% to Rs 46 crore versus Rs 60.3 crore

Margin at 5% versus 6%

Net Profit down 15% to Rs 26.2 crore versus Rs 30.8 crore

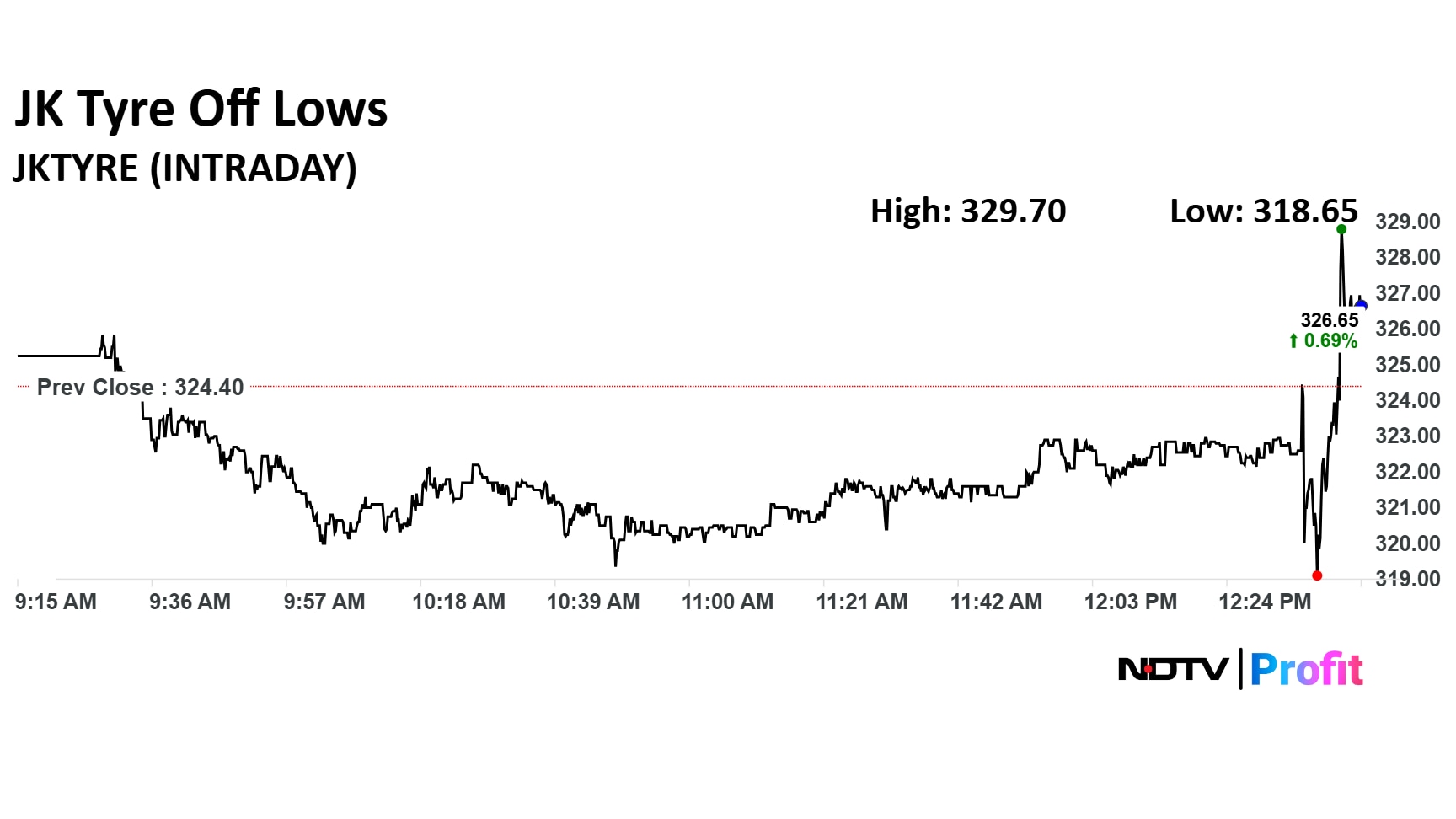

JK Tyre Q1 Highlights (Cons, YoY)

Revenue up 6.3% to Rs 3,869 crore versus Rs 3,639 crore

Ebitda down 19.6% to Rs 402 crore versus Rs 500 crore

Margin at 10.4% versus 13.7%

Net Profit down 21.8% to Rs 165 crore versus Rs 211 crore

JK Tyre Q1 Highlights (Cons, YoY)

Revenue up 6.3% to Rs 3,869 crore versus Rs 3,639 crore

Ebitda down 19.6% to Rs 402 crore versus Rs 500 crore

Margin at 10.4% versus 13.7%

Net Profit down 21.8% to Rs 165 crore versus Rs 211 crore

Shares of National Securities Depository Ltd. extended their post-listing rally to a third session, generating a return of 66% over its IPO price. The stock gained as much as 19% intraday at Rs 1,339 on Friday, close to the upper band on the BSE.

The NSDL share price ended 17% higher on Wednesday and 20% on Thursday. The IPO price was Rs 800 and the scrip listed at Rs 880.

BlueStone Jewellery and Lifestyle Ltd. is set to launch its initial public offering (IPO) next week to raise over Rs 1,500 crore from the primary market.

The company manufactures and sells jewellery under the brand name BlueStone. Ahead of the launch, the grey market premium (GMP) for the IPO indicates a potential listing gain of over 3% per share.

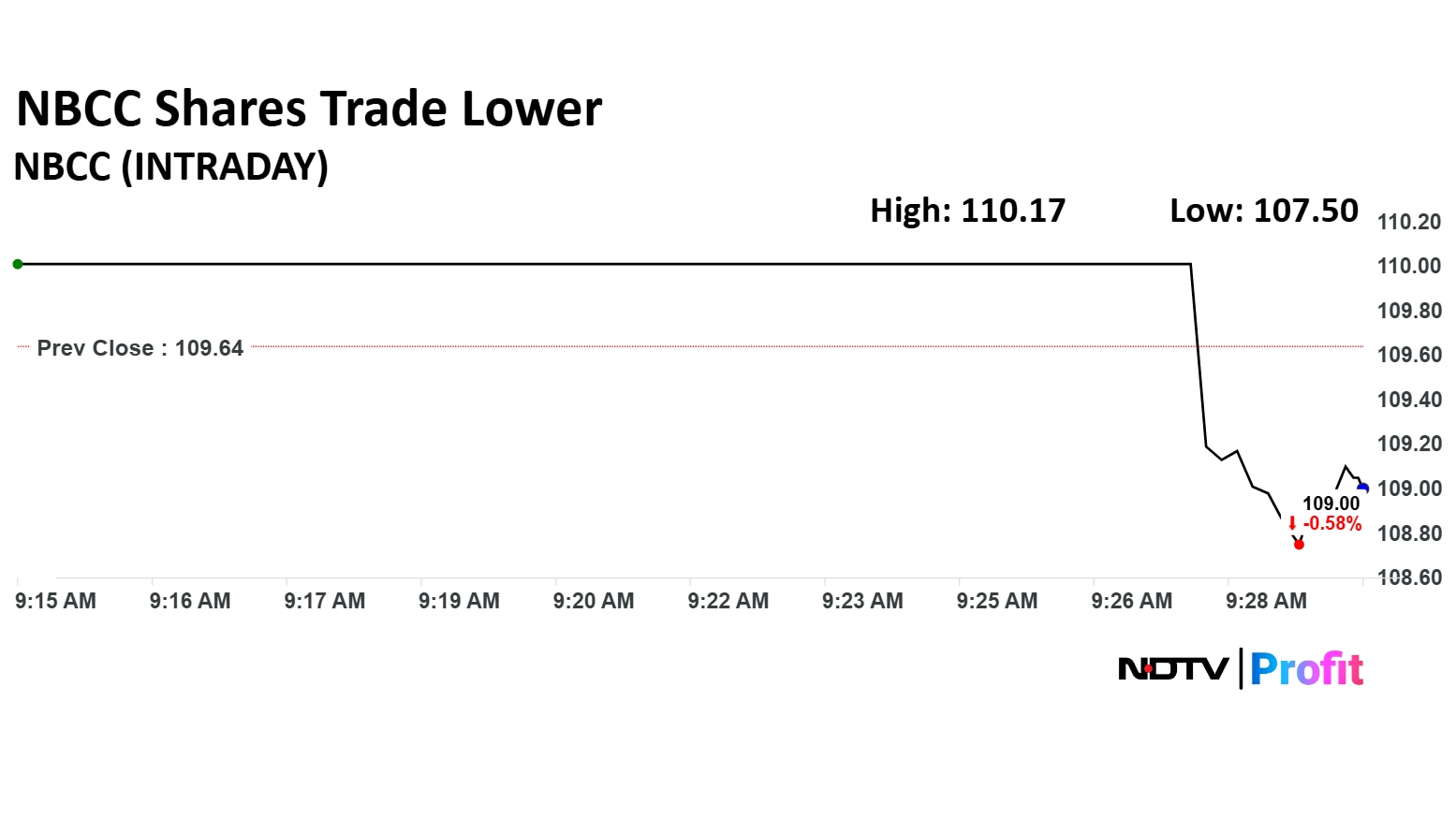

NBCC Q1 Results: Public sector construction company NBCC (India) Ltd. on Thursday announced its financial results for the first quarter of FY 2025-26.

The company reported a 26% year-on-year rise in net profit for the first quarter of FY26, with earnings increasing to Rs 132.13 crore for the April-June 2025 period from Rs 104.62 crore in the same period a year ago.

Top US buyers such as Amazon, Walmart, Target, and Gap Inc have suddenly halted consignments and have become cautious about placing fresh orders with leading Indian exporters like Gokaldas Exports, following the shocking raise in tariff announced by US President Donald Trump on Aug. 6.

Shares of NBCC (India) Ltd.'s rose declined nearly 2% after the company posted its first-quarter results on Thursday. The Navratna Public Sector Enterprise's net profit surged 26% during the quarter ended June 30, 2025.

The company's bottom line grew to Rs 132.13 crore during the April-June period, compared to Rs 104.62 crore for the same period last year.

Shares of NBCC (India) Ltd.'s rose declined nearly 2% after the company posted its first-quarter results on Thursday. The Navratna Public Sector Enterprise's net profit surged 26% during the quarter ended June 30, 2025.

The company's bottom line grew to Rs 132.13 crore during the April-June period, compared to Rs 104.62 crore for the same period last year.

State Bank of India, Tata Motors Ltd., and Voltas Ltd. are among the top names that will announce their earnings for the first quarter on Friday.

The country’s largest lender is expected to post a standalone net profit of Rs 16,964 crore, down 0.4% on year, according to a poll by Bloomberg. During the quarter ended March, the bank’s bottom line was at Rs 18,643 crore.

Track live updates on first-quarter earnings here.

Bharti Airtel Ltd.'s share price slipped by over 2% after its promoter, Indian Continent Investment, offloaded a stake worth Rs 9,310 crore in a block deal in the pre-open session.

Airtel stock fell as much as 2.80% during the day to Rs 1,868 apiece on the NSE.

Bharti Airtel Ltd.'s share price slipped by over 2% after its promoter, Indian Continent Investment, offloaded a stake worth Rs 9,310 crore in a block deal in the pre-open session.

Airtel stock fell as much as 2.80% during the day to Rs 1,868 apiece on the NSE.

Marksans Pharma Ltd.'s arm received US Food and Drug Administration for Omeprazole delayed-release tablets. The drug is used to treat heart burn and other conditions, the exchange filing said.

Shares of Titan Co. rose over 1% on Friday as brokerages Citi and Jefferies hiked the target price for the stock after the announcement of the first-quarter earnings.

Citi maintained a 'buy' rating for Titan with the target price hiked to Rs 3,900 from Rs 3,800, as growth and profitability were in-line. Meanwhile, Jefferies maintained a 'hold' rating for Titan with the target price hiked to Rs 3,800 from Rs 3,600.

Schneider Electric Infrastructure Ltd.'s share price hit the lower circuit in Friday's session as the company's net profit declined in the first quarter. During April–June, Schneider Electric Infrastructure's consolidated net profit declined 15% on the year to Rs 41.24 crore from Rs 48.48 crore.

Schneider Electric Infrastructure reported a 4.8% on the year rise in revenue. It revenue for the first quarter stood at Rs 621.63 crore compared to Rs 592.91 crore.

Silver Consumer Electricals Ltd. filed offer documents with the market regulator SEBI to sell shares worth Rs 1,400 crore via an initial public offering.

The IPO consists of a fresh issue of Rs 1,000 crore to be used for repaying debt in the current financial year. As of June 30, 2025, consolidated outstanding borrowings stood at Rs 1,103 crore.

Shares of Kalyan Jewellers Ltd. dropped over 9% on Friday after the company announced the first-quarter results for the fiscal year 2026. The company's net profit rose 49% during the first quarter.

The jewellery retailer's bottom line surged to Rs 264.08 crore during the April-June period, against Rs 177.77 crore for the same period last year, according to an exchange filing on Thursday.

Shares of Kalyan Jewellers Ltd. dropped over 9% on Friday after the company announced the first-quarter results for the fiscal year 2026. The company's net profit rose 49% during the first quarter.

The jewellery retailer's bottom line surged to Rs 264.08 crore during the April-June period, against Rs 177.77 crore for the same period last year, according to an exchange filing on Thursday.

Reliance Infrastructure's arm BSES Yamuna and BSES Rajdhani Power to recover nearly Rs 21,413 crore of regulatory assets. Its arm to recover regulatory assets over four years, the company said in the exchange filing.

Made strong start to FY26, Biosimilars to build on momentum

Balance sheet is stronger post QIP

All three businesses seeing accelerated growth

Multiple launches in generics segment planned in financial year 2026

JSW Steel Ltd.'s July crude steel production rose 19% to Rs 26.24 lakh tonnes

Its July India capacity utilisation is at at 92.5%

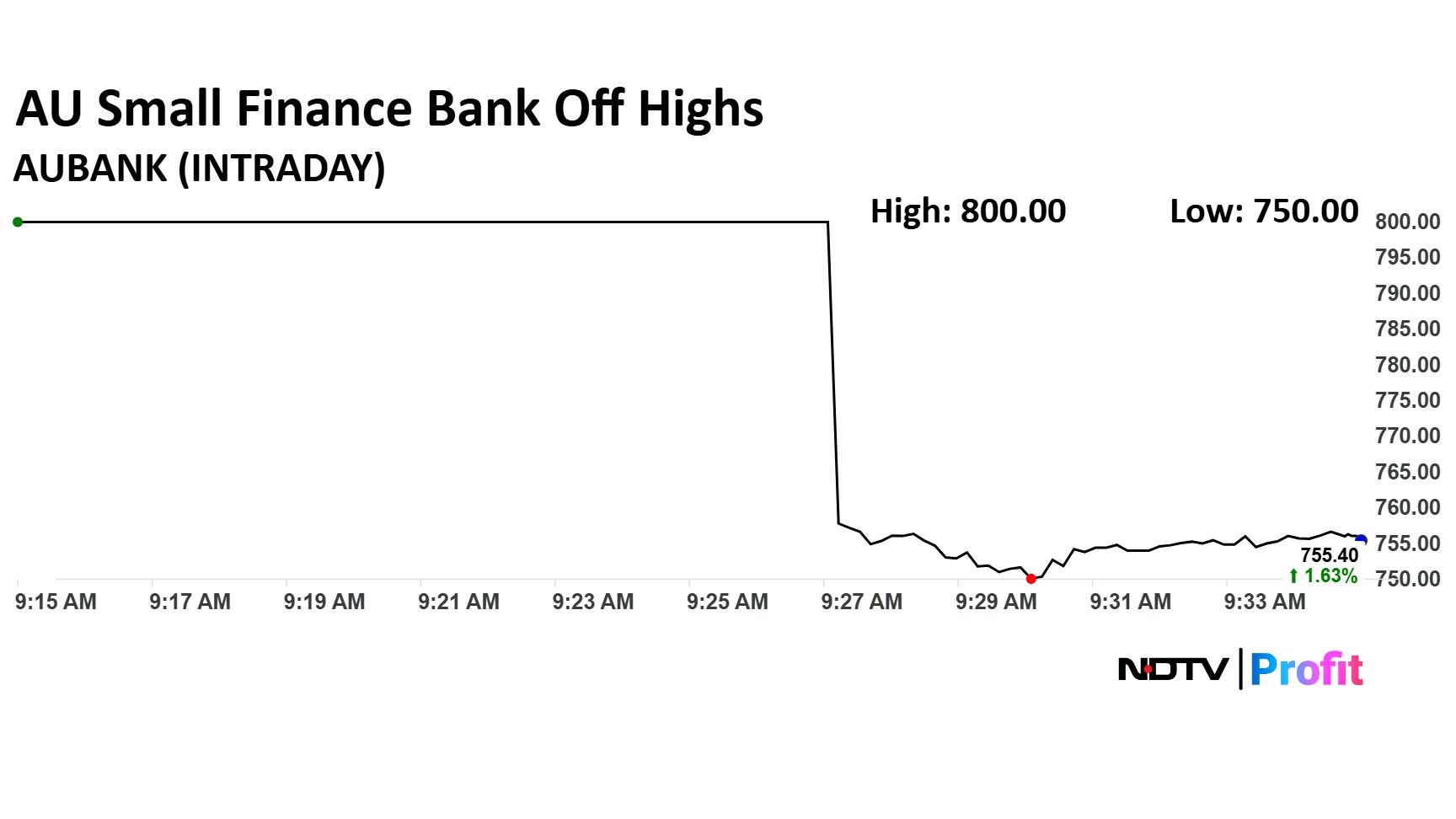

AU Small Finance Bank Ltd. share price jumped over 7% in Friday's session after it received permission for becoming an universal bank from the Reserve Bank of India. An universal bank can offer a wide range of financial services including banking, investment banking, and asset management.

AU Small Finance Bank Ltd. share price jumped over 7% in Friday's session after it received permission for becoming an universal bank from the Reserve Bank of India. An universal bank can offer a wide range of financial services including banking, investment banking, and asset management.

"We are of the view that 24,500-24450/80300-80000 would act as a key support zone for day traders. As long as the market stays above this level, the pullback formation is likely to continue. On the higher side, the market could move up to 24,800/81000 with a minor resistance at 24650/80700," said Shrikant Chouhan, head, equity research, Kotak Securities

The NSE Nifty Midcap 150 and NSE Nifty Smallcap 250 fell in line with the benchmark indices. The indices were trading 0.23% and 0.01% down, respectively as of 9:27 a.m.

The NSE Nifty Midcap 150 and NSE Nifty Smallcap 250 fell in line with the benchmark indices. The indices were trading 0.23% and 0.01% down, respectively as of 9:27 a.m.

On National Stock Exchange, eight sectoral indices declined, five advanced, and two remained flat out of 15.

On National Stock Exchange, eight sectoral indices declined, five advanced, and two remained flat out of 15.

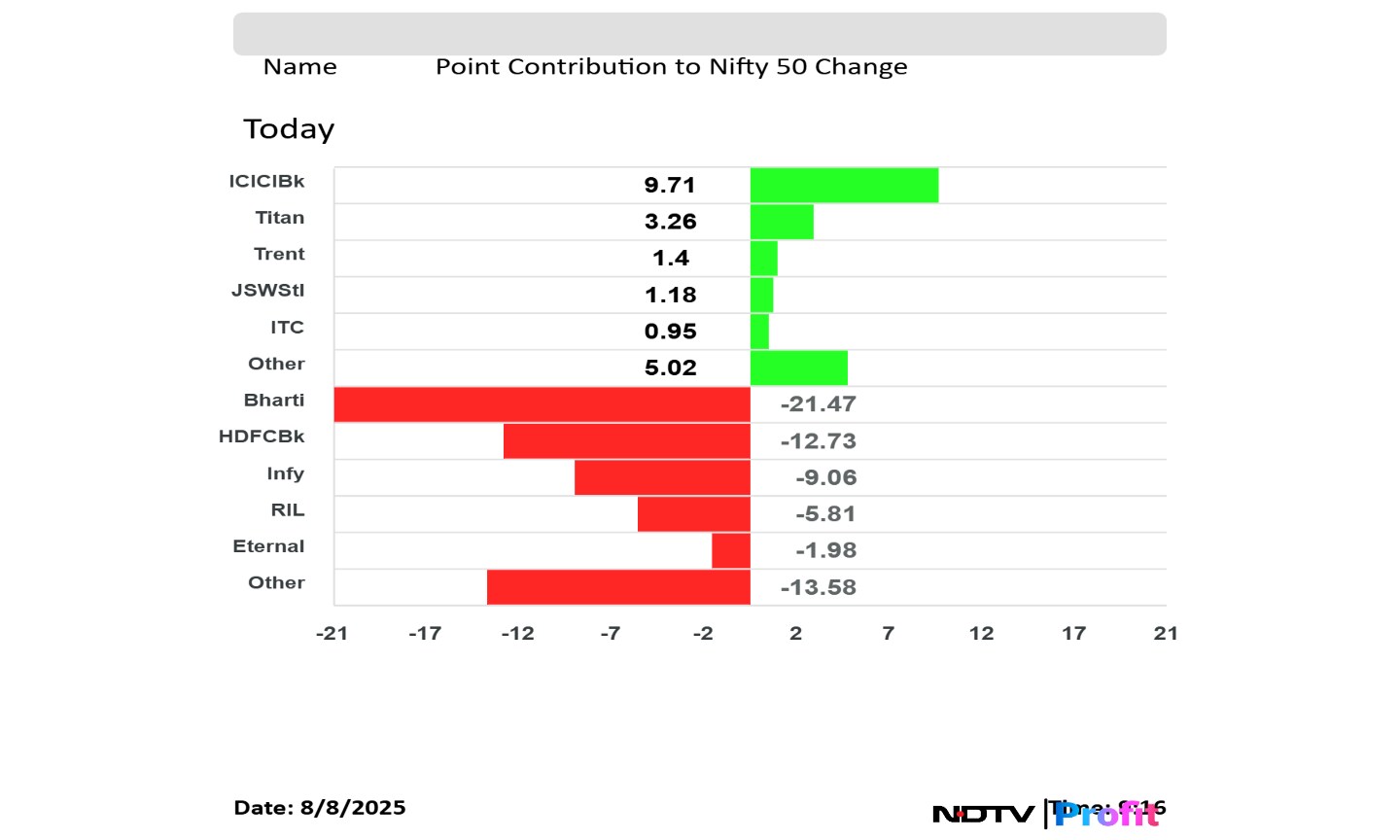

Bharti Airtel Ltd., HDFC Bank Ltd., Infosys Ltd., Reliance Industries Ltd., and Eternal Ltd. shares weighed on the NSE Nifty 50 index.

ICICI Bank Ltd., Titan Co. Ltd., Trent Ltd., JSW Steel Ltd., and ITC Ltd. shares limited losses in the index.

Bharti Airtel Ltd., HDFC Bank Ltd., Infosys Ltd., Reliance Industries Ltd., and Eternal Ltd. shares weighed on the NSE Nifty 50 index.

ICICI Bank Ltd., Titan Co. Ltd., Trent Ltd., JSW Steel Ltd., and ITC Ltd. shares limited losses in the index.

The NSE Nifty 50 and BSE Sensex erased all gains from previous session as heavyweight HDFC Bank Ltd. share weighed. The indices were trading 0.16% and 0.20% down, respectively as of 9:22 a.m.

The NSE Nifty 50 and BSE Sensex erased all gains from previous session as heavyweight HDFC Bank Ltd. share weighed. The indices were trading 0.16% and 0.20% down, respectively as of 9:22 a.m.

The yield on the 10-year bond opened flat at 6.39%

Source: Cogencis

Rupee opened 14 paise stronger at 87.56 against US Dollar

It closed at 87.70 a dollar on Thursday

Source: Cogencis

Adani Green Energy Ltd.'s arm has commissioned a solar-wind hybrid power project of 50 megawatt at Khavda. Total operational renewable generation capacity increased to 15,865.5 megawatt, the company said in the exchange filing.

Brokerages remain bullish in their views on Titan Co. post first quarter of fiscal 2025-26. Citi and Jefferies have hiked target price for the stock, while Morgan Stanley and Macquarie kept target price unchanged.

Titan Co.'s consolidated net profit rose 52.6% in the first quarter of financial year 2026, beating analysts' estimates. The luxury products manufacturer's bottom line increased to Rs 1,091 crore in the April-June period, according to an exchange filing on Thursday.

Shares of Akzo Nobel India Ltd., Jio Financial Services Ltd., KPI Green Energy Ltd., Castrol India Ltd. and eight other companies will be of interest on Friday, as it marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

For a dividend, investors should note the record date that determines shareholder eligibility.

Syrma SGS Technology Ltd. is raising Rs 1,000 crore through qualified institutional placement. In case the total issue gets subscribed, the equity dilution will be 7.43% of the post-issue outstanding equity paid-up capital.

The QIP opened on Thursday and will close on Friday. Dam Capital is the book-running lead manager for the issue.

Oil prices continued to consolidate on Friday as hopes rose that the war between Russia and Ukraine may finally come to an end. US President and Russian President Vladimir Putin are set to meet in coming days, as confirmed by Kremlin.

Oil futures were trading 0.05% higher at $66.45 a barrel as of 7:52 a.m.

Japan's benchmark index TOPIX index hit a record high on Friday as technology stocks led. Nihon Chouzai Co, Toyo Engineering Corp were top gainer in the index.

The TOPIX and Nikkei 225 were trading 2.05% and 1.41% higher, respectively as of 7:45 a.m.

Meanwhile, markets in China, South Kora, and Australia were trading in loss as they assessed multiple factors. US President Donald Trump has chosen Council of Economic Advisers Stephen Miran for the post of Federal Reserve Chair.

Trump and Putin are set to meet, Kremlin confirmed. The meet will be focused to end the war in Ukraine as reported by news agencies.

US futures were trading higher on Friday in Asia-Pacific trade session after stocks ended near record high in the previous session. According to experts as reported by Bloomberg, it's a rally before the plunge as economic data so far has been disappointing in the world's largest economy while valuations remained high.

The Dow Jones Industrial Average and S&P 500 futures were trading0.23% and 0.26% higher, respectively as of 7:36 a.m.

The GIFT Nifty was trading 0.10% or 24.50 points higher at 24,657.50 as of 6:39 a.m. It implied that the NSE Nifty 50 may open over 61 points lower than Thursday's close.

Titan Co., Life Insurance Corp, Hindustan Petroleum Corp Ltd., India Glycols Ltd., C.E. Info Systems Ltd. shares will likely be in focus in Thursday's session.

The Indian equity benchmarks closed in the green, recovering sharply during the last hour of trade, to snap its two-day decline. The NSE Nifty 50 benchmark ended 21 points, or 0.09% higher at 24,596 and the 30-stock BSE Sensex ended 79 points, or 0.10% lower at 80,623.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.