The yield on the 10-year bond closed 4 bps higher at 7.10% on Monday.

Source: Bloomberg

-The local currency weakened 13 paise to close at Rs 83.06 against the U.S dollar.

-It closed at 82.93 on Friday

Source: Bloomberg

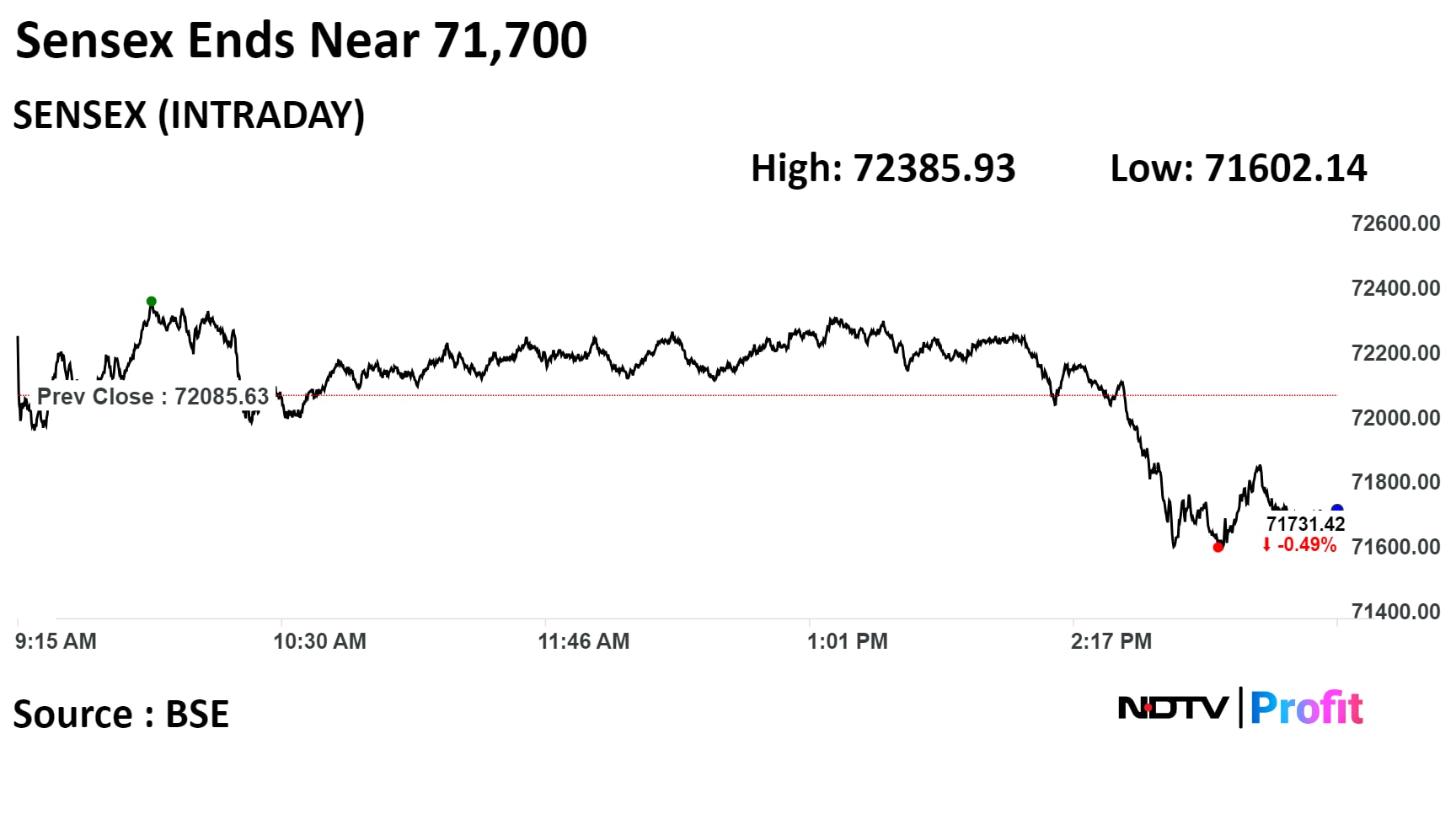

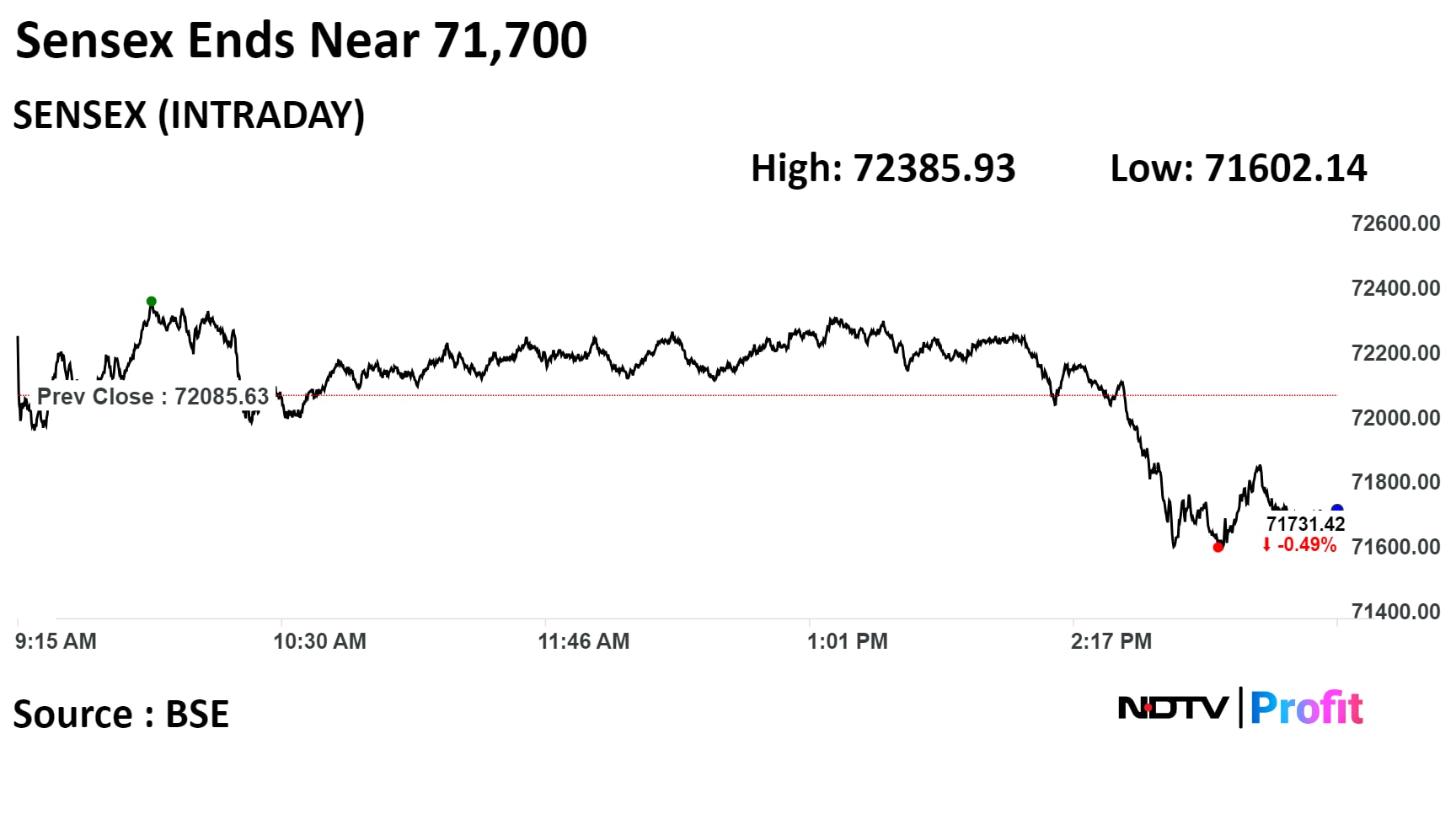

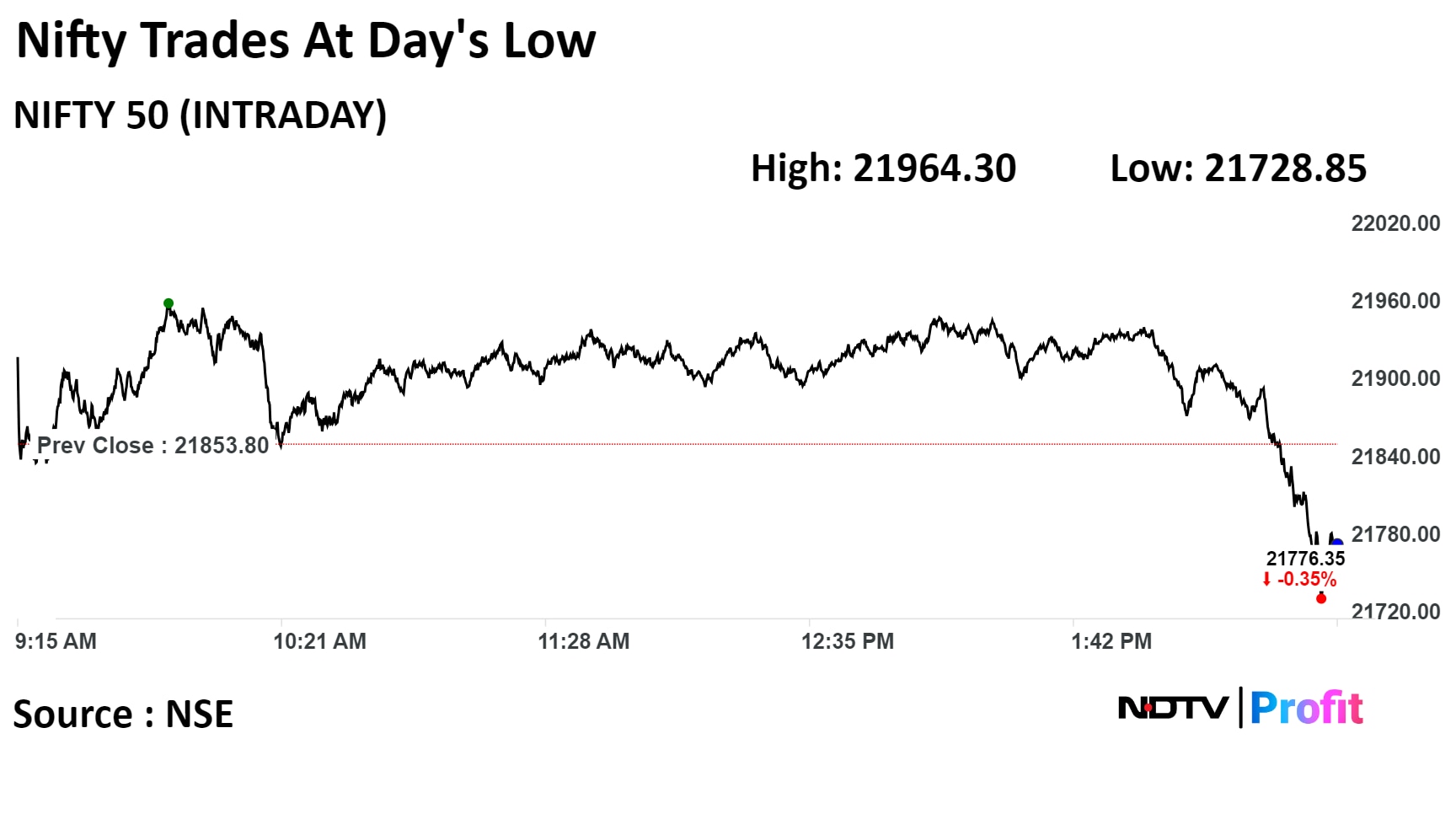

A sell-off in the last hour of Monday's trade made the equity benchmarks give up their gains and close lower. Shares of heavyweight Reliance contributed the most to today's fall in the 50-stock index.

The Nifty lost 0.38% or 82.10 points to end at 21,771.70 points while the Sensex ended 0.49% or 354.21points lower at 71,731.42 . Intraday, the Nifty gained as much as 0.51% and the Sensex gained 0.42%.

The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern, said Aditya Gaggar, director of Progressive Shares.

A sell-off in the last hour of Monday's trade made the equity benchmarks give up their gains and close lower. Shares of heavyweight Reliance contributed the most to today's fall in the 50-stock index.

The Nifty lost 0.38% or 82.10 points to end at 21,771.70 points while the Sensex ended 0.49% or 354.21points lower at 71,731.42 . Intraday, the Nifty gained as much as 0.51% and the Sensex gained 0.42%.

The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern, said Aditya Gaggar, director of Progressive Shares.

A sell-off in the last hour of Monday's trade made the equity benchmarks give up their gains and close lower. Shares of heavyweight Reliance contributed the most to today's fall in the 50-stock index.

The Nifty lost 0.38% or 82.10 points to end at 21,771.70 points while the Sensex ended 0.49% or 354.21points lower at 71,731.42 . Intraday, the Nifty gained as much as 0.51% and the Sensex gained 0.42%.

The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern, said Aditya Gaggar, director of Progressive Shares.

A sell-off in the last hour of Monday's trade made the equity benchmarks give up their gains and close lower. Shares of heavyweight Reliance contributed the most to today's fall in the 50-stock index.

The Nifty lost 0.38% or 82.10 points to end at 21,771.70 points while the Sensex ended 0.49% or 354.21points lower at 71,731.42 . Intraday, the Nifty gained as much as 0.51% and the Sensex gained 0.42%.

The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern, said Aditya Gaggar, director of Progressive Shares.

A sell-off in the last hour of Monday's trade made the equity benchmarks give up their gains and close lower. Shares of heavyweight Reliance contributed the most to today's fall in the 50-stock index.

The Nifty lost 0.38% or 82.10 points to end at 21,771.70 points while the Sensex ended 0.49% or 354.21points lower at 71,731.42 . Intraday, the Nifty gained as much as 0.51% and the Sensex gained 0.42%.

The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern, said Aditya Gaggar, director of Progressive Shares.

A sell-off in the last hour of Monday's trade made the equity benchmarks give up their gains and close lower. Shares of heavyweight Reliance contributed the most to today's fall in the 50-stock index.

The Nifty lost 0.38% or 82.10 points to end at 21,771.70 points while the Sensex ended 0.49% or 354.21points lower at 71,731.42 . Intraday, the Nifty gained as much as 0.51% and the Sensex gained 0.42%.

The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern, said Aditya Gaggar, director of Progressive Shares.

A sell-off in the last hour of Monday's trade made the equity benchmarks give up their gains and close lower. Shares of heavyweight Reliance contributed the most to today's fall in the 50-stock index.

The Nifty lost 0.38% or 82.10 points to end at 21,771.70 points while the Sensex ended 0.49% or 354.21points lower at 71,731.42 . Intraday, the Nifty gained as much as 0.51% and the Sensex gained 0.42%.

The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern, said Aditya Gaggar, director of Progressive Shares.

A sell-off in the last hour of Monday's trade made the equity benchmarks give up their gains and close lower. Shares of heavyweight Reliance contributed the most to today's fall in the 50-stock index.

The Nifty lost 0.38% or 82.10 points to end at 21,771.70 points while the Sensex ended 0.49% or 354.21points lower at 71,731.42 . Intraday, the Nifty gained as much as 0.51% and the Sensex gained 0.42%.

The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern, said Aditya Gaggar, director of Progressive Shares.

Shares of Reliance Industries Ltd., Bharti Airtel Ltd., Bajaj Finance Ltd., Larsen & Toubro Ltd., and UPL Ltd. dragged the Nifty 50 lower.

Meanwhile, those of Tata Motors Ltd., Sun Pharmaceutical Industries Ltd., Coal India Ltd., Mahindra & Mahindra Ltd., and Power Grid Corp. Of India Ltd. cushioned the fall.

Sectoral indices ended on a mixed note Nifty Energy, Nifty Auto, Nifty Oil & Gas, and Nifty Pharma gaining over 1%. Nifty FMCG fell the most.

Broader markets ended lower on Monday. The S&P BSE Midcap settled 0.20% lower, and S&P BSE Smallcap index fell 0.16%.

On BSE, 12 sectors out of 20 declined while eight rose. The S&P BSE Telecommunication declined the most among sectoral indices.

Market breadth was skewed in favour of sellers, Around 2,129 stocks fell, 1,820 stocks rose, and 148 remained unchanged on BSE.

Net profit rose 42.6% to Rs 1,027 crore from Rs 720.2 crore

Total income rose 43.2% to Rs 6,842 crore Rs 4,777 crore

Revenue rose 17.3% to Rs 132.7 crore from Rs 113.1 crore

Ebitda rose 18.2% to Rs 52.31 crore from Rs 44.26 crore

Margin rose 28 bps to 39.4% from 39.1%

Net profit rose 58% at Rs 26 crore from Rs 16.46 crore

Revenue rose 5.03% to Rs 1,918.7 crore from Rs 1,826.8 crore

Ebitda rose 24.8% to Rs 244 crore from Rs 195.51 crore

Margin rose 201 bps to 12.71% from 10.7%

Net profit rose 39.57% to Rs 152.1 crore from Rs 108.97 crore

Revenue rose 8.09% to Rs 736.7 crore from Rs 681.5 crore

Ebitda fell 8.63% Rs 94.37 crore from Rs 103.28 crore

Margin fell 234 bps to 12.8% from 15.15%

Net profit fell 72.25% to Rs 13.65 crore from Rs 49.2 crore

Revenue rose 43.6% to Rs 434.4 crore from Rs 302.5 crore

Ebitda was at Rs 38.11 crore from Ebitda loss of Rs 42.78 crore

Margin at 8.77%

Net profit rose 31.37% to Rs 83.99 crore from loss of Rs 63.93 crore

Revenue rose 8.05% to Rs 1,630.6 crore from Rs 1509 crore

Ebitda rose 7.15% to Rs 266.5 crore from Rs 248.7 crore

Margin fell 13 bps to 16.34% from 16.48%

Net profit rose 48.1% to Rs 180.5 crore from Rs 121.9 crore

Indian banks' strong credit growth may moderate to 12-14% in FY25, said S&P Global in a press release today.

S&P Global said, tight liquidity hurts Indian banks' robust credit growth.

Potential rate cuts, rising cost of funds in FY25 may hit India banks' NIM

Banks may be forced to look for wholesale funding, cutting margin

Tepid deposit growth may hit Indian banks' credit growth in FY25

More Indian banks may raise equity in 2024 as markets are favourable

Stable NPA, capital levels support banks' credit profiles

Higher risk weight not yet hindered banks' unsecured loan growth

See unsecured personal loans' share rising for India banks

Source: Press Release

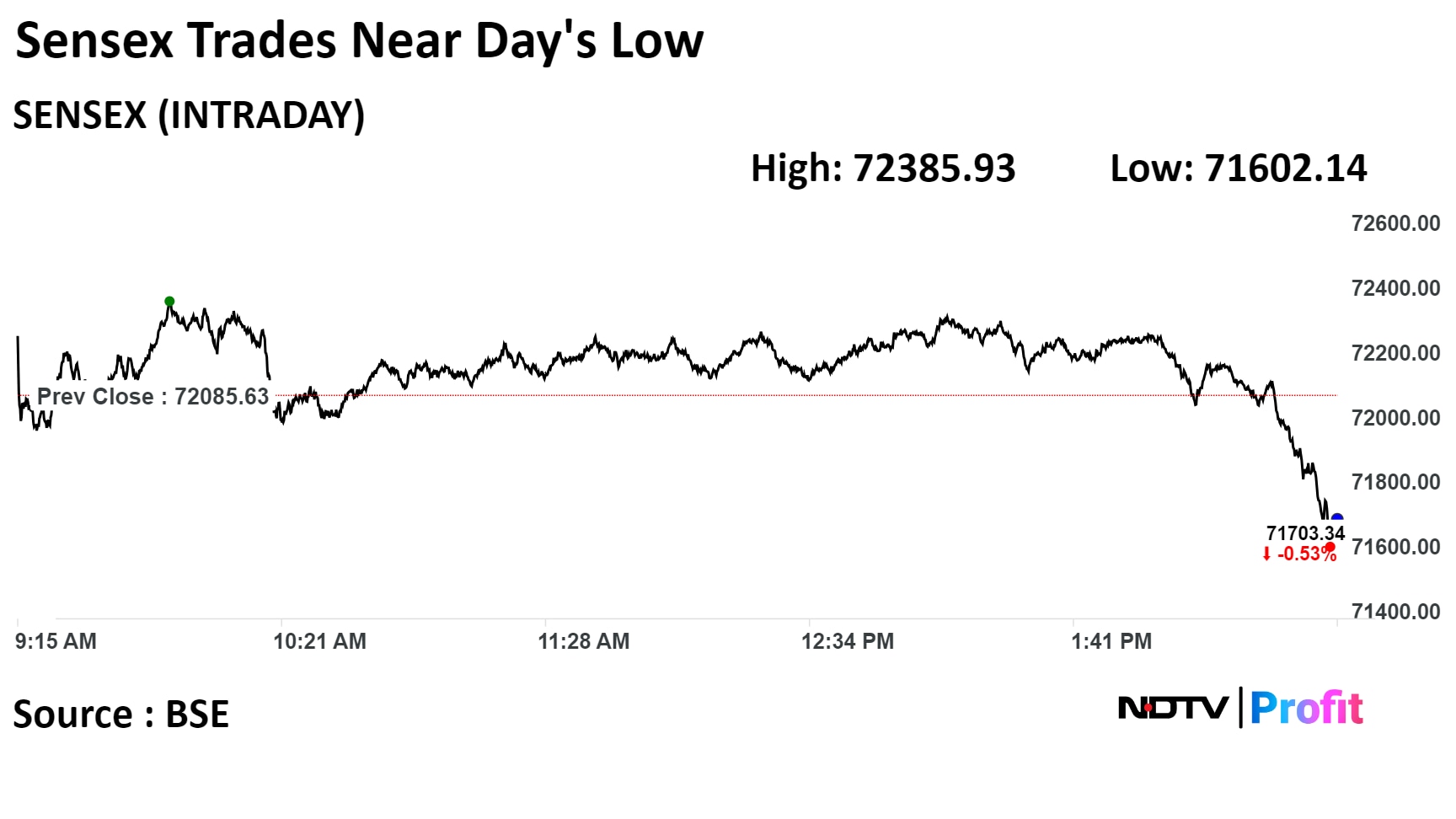

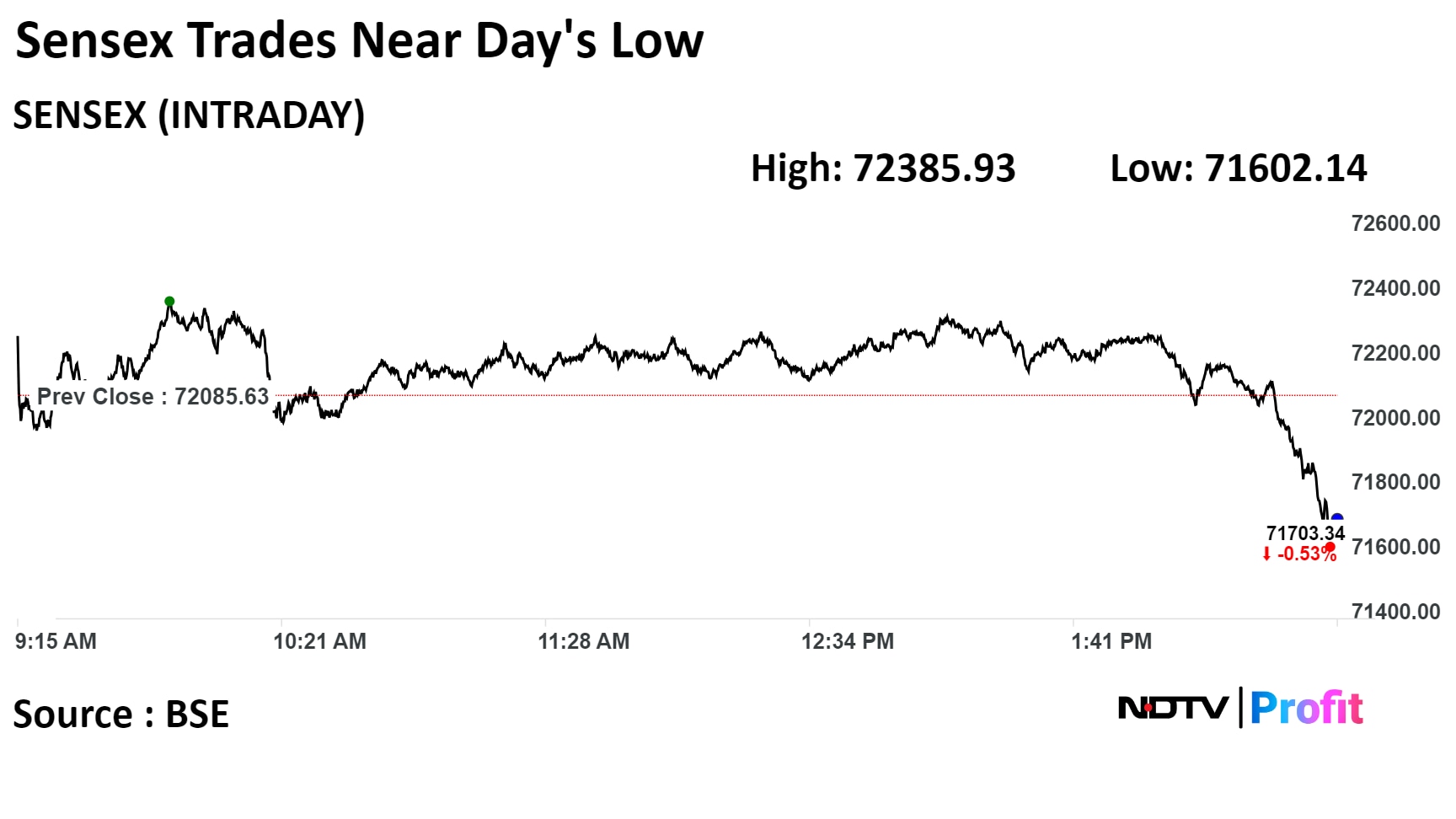

Indian benchmark stock indices were trading higher through midday on Monday, tracking gains in shares of Tata Motors Ltd., Coal India Ltd., and Power Grid Corp. of India.

As of 12:13 a.m., the NSE Nifty 50 was 63.95 points, or 0.29%, higher at 21,917.75, while the S&P BSE Sensex rose 114.82 points, or 0.16%, to 72,200.45.

The Nifty 50 hit an intraday high of 21,964.30, and the Sensex touched 72,385.93 so far on Monday.

"For positional traders, the support levels (for Nifty and Sensex) are 21,700/71,800. If the market remains at that level, then it can go up to 22,127/72,700-73,090, which may continue the uptrend further, leading the market to 22,300-22,400/73,800-74000 levels. On the other hand, the sentiment below 21,700/71,800 may change, and if it stays below that, then it may fall towards 21,600-21,500/71,500-71,200 levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

The strategy should be to reduce long positions between 21,950 and 22,050 levels, while buying is advisable only above the reversal patterns, he said.

Indian benchmark stock indices were trading higher through midday on Monday, tracking gains in shares of Tata Motors Ltd., Coal India Ltd., and Power Grid Corp. of India.

As of 12:13 a.m., the NSE Nifty 50 was 63.95 points, or 0.29%, higher at 21,917.75, while the S&P BSE Sensex rose 114.82 points, or 0.16%, to 72,200.45.

The Nifty 50 hit an intraday high of 21,964.30, and the Sensex touched 72,385.93 so far on Monday.

"For positional traders, the support levels (for Nifty and Sensex) are 21,700/71,800. If the market remains at that level, then it can go up to 22,127/72,700-73,090, which may continue the uptrend further, leading the market to 22,300-22,400/73,800-74000 levels. On the other hand, the sentiment below 21,700/71,800 may change, and if it stays below that, then it may fall towards 21,600-21,500/71,500-71,200 levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

The strategy should be to reduce long positions between 21,950 and 22,050 levels, while buying is advisable only above the reversal patterns, he said.

Indian benchmark stock indices were trading higher through midday on Monday, tracking gains in shares of Tata Motors Ltd., Coal India Ltd., and Power Grid Corp. of India.

As of 12:13 a.m., the NSE Nifty 50 was 63.95 points, or 0.29%, higher at 21,917.75, while the S&P BSE Sensex rose 114.82 points, or 0.16%, to 72,200.45.

The Nifty 50 hit an intraday high of 21,964.30, and the Sensex touched 72,385.93 so far on Monday.

"For positional traders, the support levels (for Nifty and Sensex) are 21,700/71,800. If the market remains at that level, then it can go up to 22,127/72,700-73,090, which may continue the uptrend further, leading the market to 22,300-22,400/73,800-74000 levels. On the other hand, the sentiment below 21,700/71,800 may change, and if it stays below that, then it may fall towards 21,600-21,500/71,500-71,200 levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

The strategy should be to reduce long positions between 21,950 and 22,050 levels, while buying is advisable only above the reversal patterns, he said.

Indian benchmark stock indices were trading higher through midday on Monday, tracking gains in shares of Tata Motors Ltd., Coal India Ltd., and Power Grid Corp. of India.

As of 12:13 a.m., the NSE Nifty 50 was 63.95 points, or 0.29%, higher at 21,917.75, while the S&P BSE Sensex rose 114.82 points, or 0.16%, to 72,200.45.

The Nifty 50 hit an intraday high of 21,964.30, and the Sensex touched 72,385.93 so far on Monday.

"For positional traders, the support levels (for Nifty and Sensex) are 21,700/71,800. If the market remains at that level, then it can go up to 22,127/72,700-73,090, which may continue the uptrend further, leading the market to 22,300-22,400/73,800-74000 levels. On the other hand, the sentiment below 21,700/71,800 may change, and if it stays below that, then it may fall towards 21,600-21,500/71,500-71,200 levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

The strategy should be to reduce long positions between 21,950 and 22,050 levels, while buying is advisable only above the reversal patterns, he said.

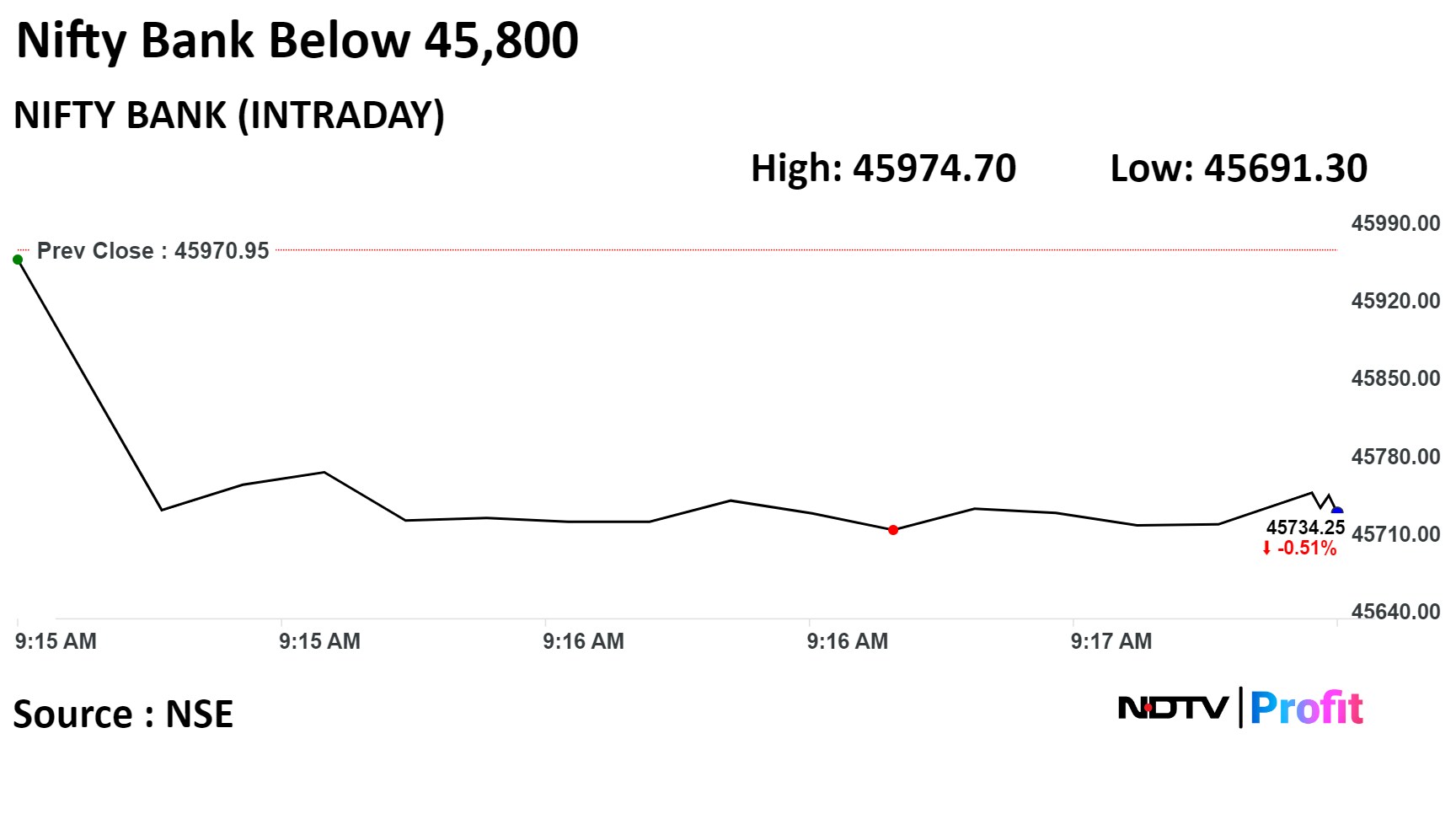

The Nifty Bank was trading in negative throughout midday, as shares of Kotak Mahindra Bank Ltd. and ICICI Bank Ltd. fell.

Intraday, the index declined 0.77% to 45,615.10.

Indian benchmark stock indices were trading higher through midday on Monday, tracking gains in shares of Tata Motors Ltd., Coal India Ltd., and Power Grid Corp. of India.

As of 12:13 a.m., the NSE Nifty 50 was 63.95 points, or 0.29%, higher at 21,917.75, while the S&P BSE Sensex rose 114.82 points, or 0.16%, to 72,200.45.

The Nifty 50 hit an intraday high of 21,964.30, and the Sensex touched 72,385.93 so far on Monday.

"For positional traders, the support levels (for Nifty and Sensex) are 21,700/71,800. If the market remains at that level, then it can go up to 22,127/72,700-73,090, which may continue the uptrend further, leading the market to 22,300-22,400/73,800-74000 levels. On the other hand, the sentiment below 21,700/71,800 may change, and if it stays below that, then it may fall towards 21,600-21,500/71,500-71,200 levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

The strategy should be to reduce long positions between 21,950 and 22,050 levels, while buying is advisable only above the reversal patterns, he said.

Indian benchmark stock indices were trading higher through midday on Monday, tracking gains in shares of Tata Motors Ltd., Coal India Ltd., and Power Grid Corp. of India.

As of 12:13 a.m., the NSE Nifty 50 was 63.95 points, or 0.29%, higher at 21,917.75, while the S&P BSE Sensex rose 114.82 points, or 0.16%, to 72,200.45.

The Nifty 50 hit an intraday high of 21,964.30, and the Sensex touched 72,385.93 so far on Monday.

"For positional traders, the support levels (for Nifty and Sensex) are 21,700/71,800. If the market remains at that level, then it can go up to 22,127/72,700-73,090, which may continue the uptrend further, leading the market to 22,300-22,400/73,800-74000 levels. On the other hand, the sentiment below 21,700/71,800 may change, and if it stays below that, then it may fall towards 21,600-21,500/71,500-71,200 levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

The strategy should be to reduce long positions between 21,950 and 22,050 levels, while buying is advisable only above the reversal patterns, he said.

Indian benchmark stock indices were trading higher through midday on Monday, tracking gains in shares of Tata Motors Ltd., Coal India Ltd., and Power Grid Corp. of India.

As of 12:13 a.m., the NSE Nifty 50 was 63.95 points, or 0.29%, higher at 21,917.75, while the S&P BSE Sensex rose 114.82 points, or 0.16%, to 72,200.45.

The Nifty 50 hit an intraday high of 21,964.30, and the Sensex touched 72,385.93 so far on Monday.

"For positional traders, the support levels (for Nifty and Sensex) are 21,700/71,800. If the market remains at that level, then it can go up to 22,127/72,700-73,090, which may continue the uptrend further, leading the market to 22,300-22,400/73,800-74000 levels. On the other hand, the sentiment below 21,700/71,800 may change, and if it stays below that, then it may fall towards 21,600-21,500/71,500-71,200 levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

The strategy should be to reduce long positions between 21,950 and 22,050 levels, while buying is advisable only above the reversal patterns, he said.

Indian benchmark stock indices were trading higher through midday on Monday, tracking gains in shares of Tata Motors Ltd., Coal India Ltd., and Power Grid Corp. of India.

As of 12:13 a.m., the NSE Nifty 50 was 63.95 points, or 0.29%, higher at 21,917.75, while the S&P BSE Sensex rose 114.82 points, or 0.16%, to 72,200.45.

The Nifty 50 hit an intraday high of 21,964.30, and the Sensex touched 72,385.93 so far on Monday.

"For positional traders, the support levels (for Nifty and Sensex) are 21,700/71,800. If the market remains at that level, then it can go up to 22,127/72,700-73,090, which may continue the uptrend further, leading the market to 22,300-22,400/73,800-74000 levels. On the other hand, the sentiment below 21,700/71,800 may change, and if it stays below that, then it may fall towards 21,600-21,500/71,500-71,200 levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

The strategy should be to reduce long positions between 21,950 and 22,050 levels, while buying is advisable only above the reversal patterns, he said.

The Nifty Bank was trading in negative throughout midday, as shares of Kotak Mahindra Bank Ltd. and ICICI Bank Ltd. fell.

Intraday, the index declined 0.77% to 45,615.10.

Shares of Coal India Ltd., Power Grid Corp. Of India, NTPC Ltd., Tata Motors Ltd. and Tata Consultancy Services Ltd. were positively contributing to the Nifty.

Bharti Airtel Ltd., ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd. and UPL Ltd. were weighing on the index.

Nine of the 12 sectors gained on NSE, while three declined. Nifty Oil & Gas surged 2.69% to become the top performer, while Nifty FMCG fell the most at 0.41%.

Broader markets outperformed benchmark indices; the S&P BSE Midcap gained 0.90% and the S&P BSE Smallcap rose 0.58%.

On BSE, 15 of the 20 sectors gained, while five declined. S&P BSE Oil & Gas gained the most.

The market breadth was skewed in the favour of buyers. Around 2,077 stocks gained, 1,750 shares fell, and 171 stocks remained unchanged on BSE.

Net profit at rose 23.6% to Rs 300.1 crore from Rs 242.7 crore

Total income rose 33.7% to Rs 1,351.7 crore from Rs 1,010.96 crore

Revenue rose 2.59% to Rs 751.3 crore from Rs 732.3 crore

Ebitda rose 27.7% to Rs 115.39 crore from Rs 90.34 crore

Margin rose 302 bps to 15.35% from 12.33%

Net profit rose 63.54% to Rs 44.99 crore from Rs 27.51 crore

Revenue fell to Rs 1,228.2 crore from Rs 1,309.5 crore

Ebitda declined 45.5% to Rs 57.6 crore from Rs 105.6 crore

Margin fell 337 bps to 4.68% from 8.06%

Net profit fell 38.8% to Rs 37.4 crore from Rs 61.1 crore

Revenue fell 89.43% to Rs13.86 crore from Rs 131.1 crore

Ebitda loss at Rs 102.62 crore from profit of Rs 16.19 crore

Net loss at Rs 99.65 crore from profit of Rs 10.15 crore

TCS gets multi-year contract from Europ Assistance for IT services

To provide Europ Assistance with AI and ML for its IT operating model

To provide end-to-end enterprise IT application services across all geographies where Europ Assistance operates

Partnership to focus on co-innovation on novel use cases leveraging gen-AI & other advanced technologies

Source: Exchange filing

Revenue up 9.28% at Rs 230.8 crore vs Rs 211.2 crore

Ebit up 11.38% at Rs 46 crore vs Rs 41.3 crore

Margin at 19.93% vs 19.55%

Net profit up 11.47% at Rs 37.9 crore vs Rs 34 crore

Source: Exchange Filing

Revenue down 13.29% at Rs 1,241.3 crore vs 1431.4 crore

Ebitda up 1.09% at Rs 271.55 crore vs Rs 268.62 crore

Margin at 21.87% vs 18.76%

Net profit up 7.15% at Rs 187.1 crore vs Rs 174.6 crore

Source: Exchange Filing

Revenue rose 7.5 at Rs 479.8 crore from Rs 446.5 crore

Ebitda rose 68.6% to Rs 95.6 crore from Rs 56.7 crore

Margin rose 722 bps to 19.92% from 12.69%

Net profit rose 67% to Rs 65.3 crore from Rs 39.1 crore

Revenue rose 7.5 at Rs 479.8 crore from Rs 446.5 crore

Ebitda rose 68.6% to Rs 95.6 crore from Rs 56.7 crore

Margin rose 722 bps to 19.92% from 12.69%

Net profit rose 67% to Rs 65.3 crore from Rs 39.1 crore

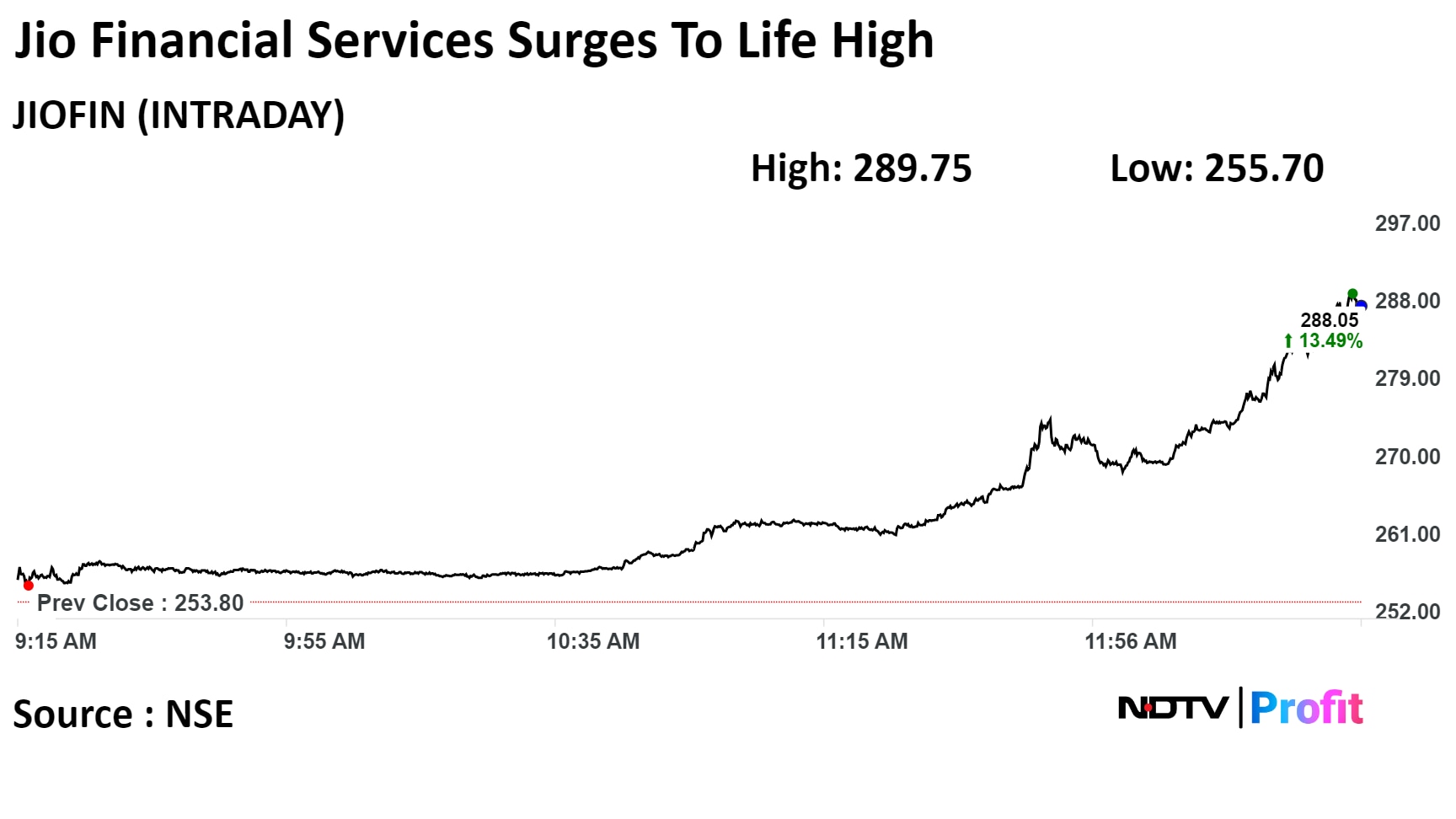

Scrips of Jio Financial Services Ltd rose as much as 14.16% to Rs 289.75 apiece, the highest level since its listing on Aug 21, 2023. It trading 13.49% higher at Rs 288.05 apiece, as of 12:47 p.m. This compares to a 0.30% advance in the NSE Nifty 50 Index.

It has risen 15.73% since its listing. Total traded volume so far in the day stood at 6.4 times its 30-day average. The relative strength index was at 74.95, which implied the stock is overbought.

Scrips of Jio Financial Services Ltd rose as much as 14.16% to Rs 289.75 apiece, the highest level since its listing on Aug 21, 2023. It trading 13.49% higher at Rs 288.05 apiece, as of 12:47 p.m. This compares to a 0.30% advance in the NSE Nifty 50 Index.

It has risen 15.73% since its listing. Total traded volume so far in the day stood at 6.4 times its 30-day average. The relative strength index was at 74.95, which implied the stock is overbought.

Revenue up 21% at Rs 2667.69 crore vs Rs 2214.3 crore

Ebitda up 36% at Rs 418.2 crore vs Rs 307.4 crore

Margin at 15.67% vs 13.88%

Net profit up 76.3% at Rs 143.7 crore vs Rs 81.5 crore

Revenue up 21% at Rs 2667.69 crore vs Rs 2214.3 crore

Ebitda up 36% at Rs 418.2 crore vs Rs 307.4 crore

Margin at 15.67% vs 13.88%

Net profit up 76.3% at Rs 143.7 crore vs Rs 81.5 crore

Re-appoints Varun Jaipuria as Whole-time Director for up to 5 years effective Nov 1

Re-appoints Raj Gandhi as Whole-time Director for up to 5 years effective Nov 1

Re-appoints of Rajinder Jeet Singh Bagga as Whole-time Director for up to 5 years effective May 2

Appoints of Naresh Trehan as Non-executive Director for up to 5 years effective April 21

Co not aware of any information, keeps evaluating alternatives for business development

Source: Exchange filing

Greaves Retail's AutoEVMart expands its range of electric three-wheeler brands with the inclusion of Zero21.

Source: Exchange Filing

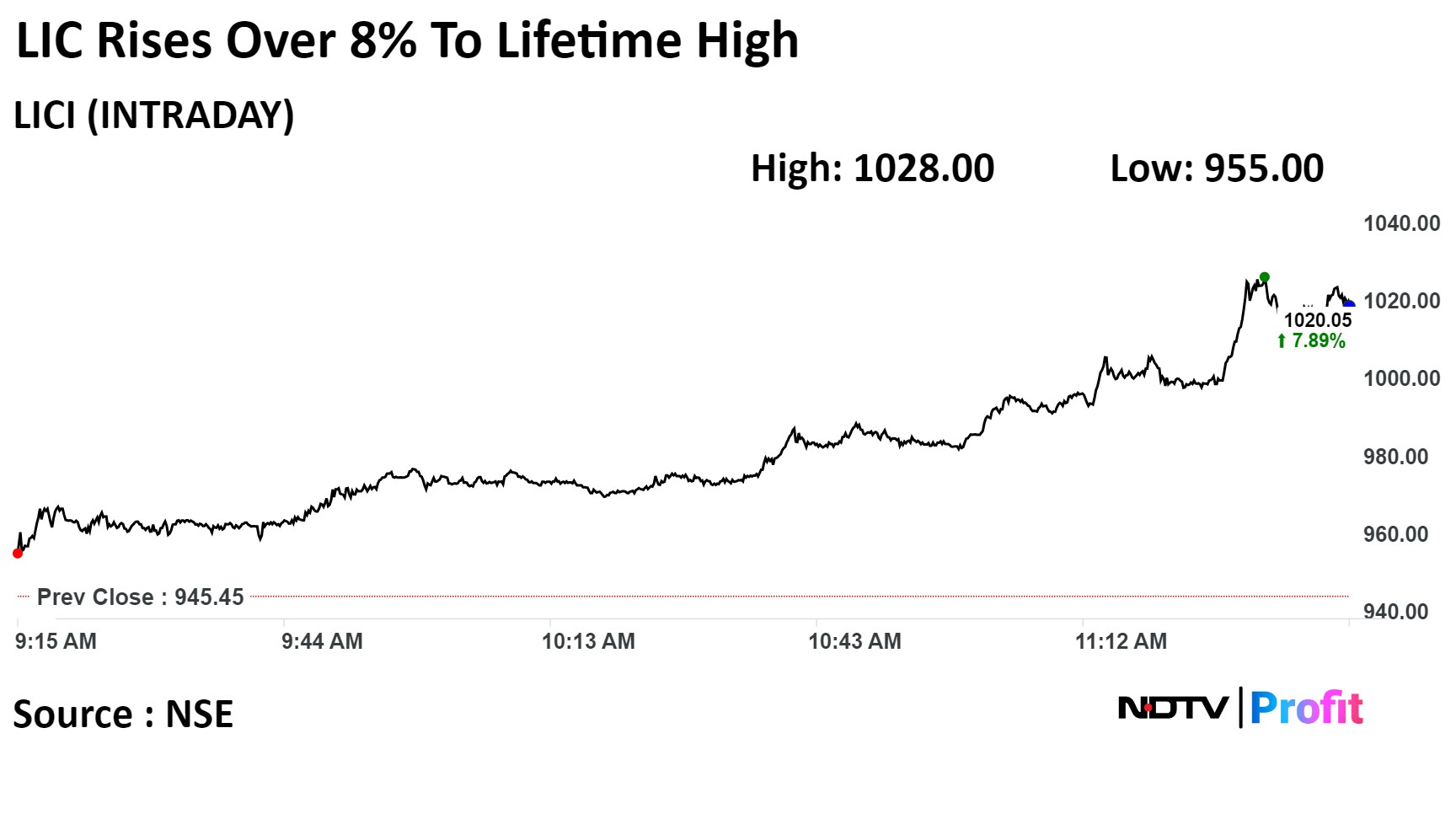

On NSE, scrips of Life Insurance Corp of India surged 8.69% to Rs 1,027.60, the highest level since its listing on May 17, 2022. It pared gains/losses trade 7.58% higher at Rs 1,017.10 apiece, as of 11:37 a.m. This compares to a 0.32% advance in the NSE Nifty 50 Index.

It has risen 69.77% in 12 months. Total traded volume so far in the day stood at 3.0 times its 30-day average. The relative strength index was at 75.1, which implied the stock is overbought.

Out of 19 analysts tracking the company, 13 maintain a 'buy' rating, five recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 10.7%.

On NSE, scrips of Life Insurance Corp of India surged 8.69% to Rs 1,027.60, the highest level since its listing on May 17, 2022. It pared gains/losses trade 7.58% higher at Rs 1,017.10 apiece, as of 11:37 a.m. This compares to a 0.32% advance in the NSE Nifty 50 Index.

It has risen 69.77% in 12 months. Total traded volume so far in the day stood at 3.0 times its 30-day average. The relative strength index was at 75.1, which implied the stock is overbought.

Out of 19 analysts tracking the company, 13 maintain a 'buy' rating, five recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 10.7%.

Birlasoft Ltd has introduces Birlasoft Cogito, a generative AI platform to provide 'cutting-edge' solutions to businesses.

The generative AI platform is built strategically to revolutionise business with the power of artificial intelligence.

Source: Exchange Filing

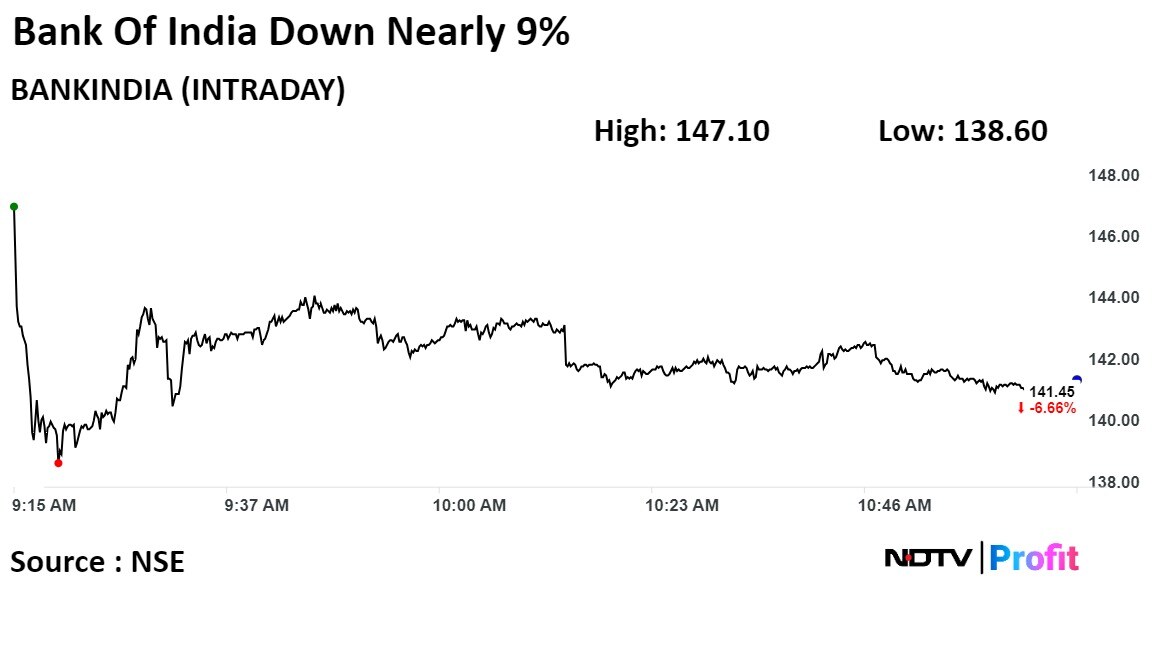

The shares of Bank Of India Ltd. slumped nearly 9% on Monday as the net interest income dips marginally.

Bank of India on Friday reported a 62% year-on-year jump in net profit to Rs 1,870 crore with the NII down 2% at Rs 5,463.5 crore. However, the net profit missed the Bloomberg estimate of Rs 2,183 crore.

The scrip fell as much as 8.55% to 138.60 apiece, the lowest level since Feb. 1. It pared losses to trade 6.73% lower at Rs 141.35 apiece, as of 11:00 a.m. This compares to a 0.25% advance in the NSE Nifty 50 Index.

It has risen 78.70% in the last 12 months. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 62.

Out of four analysts tracking the company, two maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.4%.

The shares of Bank Of India Ltd. slumped nearly 9% on Monday as the net interest income dips marginally.

Bank of India on Friday reported a 62% year-on-year jump in net profit to Rs 1,870 crore with the NII down 2% at Rs 5,463.5 crore. However, the net profit missed the Bloomberg estimate of Rs 2,183 crore.

The scrip fell as much as 8.55% to 138.60 apiece, the lowest level since Feb. 1. It pared losses to trade 6.73% lower at Rs 141.35 apiece, as of 11:00 a.m. This compares to a 0.25% advance in the NSE Nifty 50 Index.

It has risen 78.70% in the last 12 months. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 62.

Out of four analysts tracking the company, two maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.4%.

Ashok Leyland had 20.1 lakh shares changed hands in a large trade.

The company's 0.1% equity changed hands at Rs 173.5 apiece.

Buyers and sellers not known immediately.

Source: Bloomberg

Indian Overseas Bank had 11.9 lakh shares changed hands in a large trade.

The lender's had 0.01% equity changed hands at Rs 65.1 apiece.

Buyers and sellers are not known immediately.

Source: Bloomberg

Ahluwalia Contracts received an order worth Rs 394.36 crore from Emaar India.

The order is for construction of residential tower, club house works in Haryana.

Source: Exchange Filing

UCO Bank Ltd had 77.5 lakh shares changed hands in a large trade.

The lender's 0.1% equity changed hands at Rs 60.3 apiece.

Buyers and sellers not known immediately.

Source: Bloomberg

HDFC Bank's loan growth to slow to 11%/14% in FY25/26

Expect 10 bps margin improvement over FY25-26 on better loan mix

Monetising existing branches to help profitable growth

Expect credit costs to stay at 0.4% of loans over FY25-26

Trim FY25-26 estimates by 4-6%

IDBI Bank had 10.8 lakh shares changed hands in a large trade

The lender's 0.01% equity changed hands at Rs 93.65 apiece

Buyers and sellers are not known immediately

Source: Bloomberg

NHPC Ltd had 26.4 lakh shares changed hands in two large trades.

The company's 0.03% equity changed hands at price range of Rs 112.25 to Rs 113.1 apiece.

Buyers and sellers are not known immediately.

Source: Bloomberg

Larsen & Toubro Ltd bagged a contract worth Rs 2,500-5,000 crore from IndiaOil Adani Ventures.

Order is for onshore hydrocarbon business Lump Sum Turnkey basis.

Source: Exchange filing

Waaree Renewable Technologies Ltd received Rs 547.5 crore order for solar power plant.

Solar plant of 412 MWp /335 MWac capacity.

Source: Exchange filing

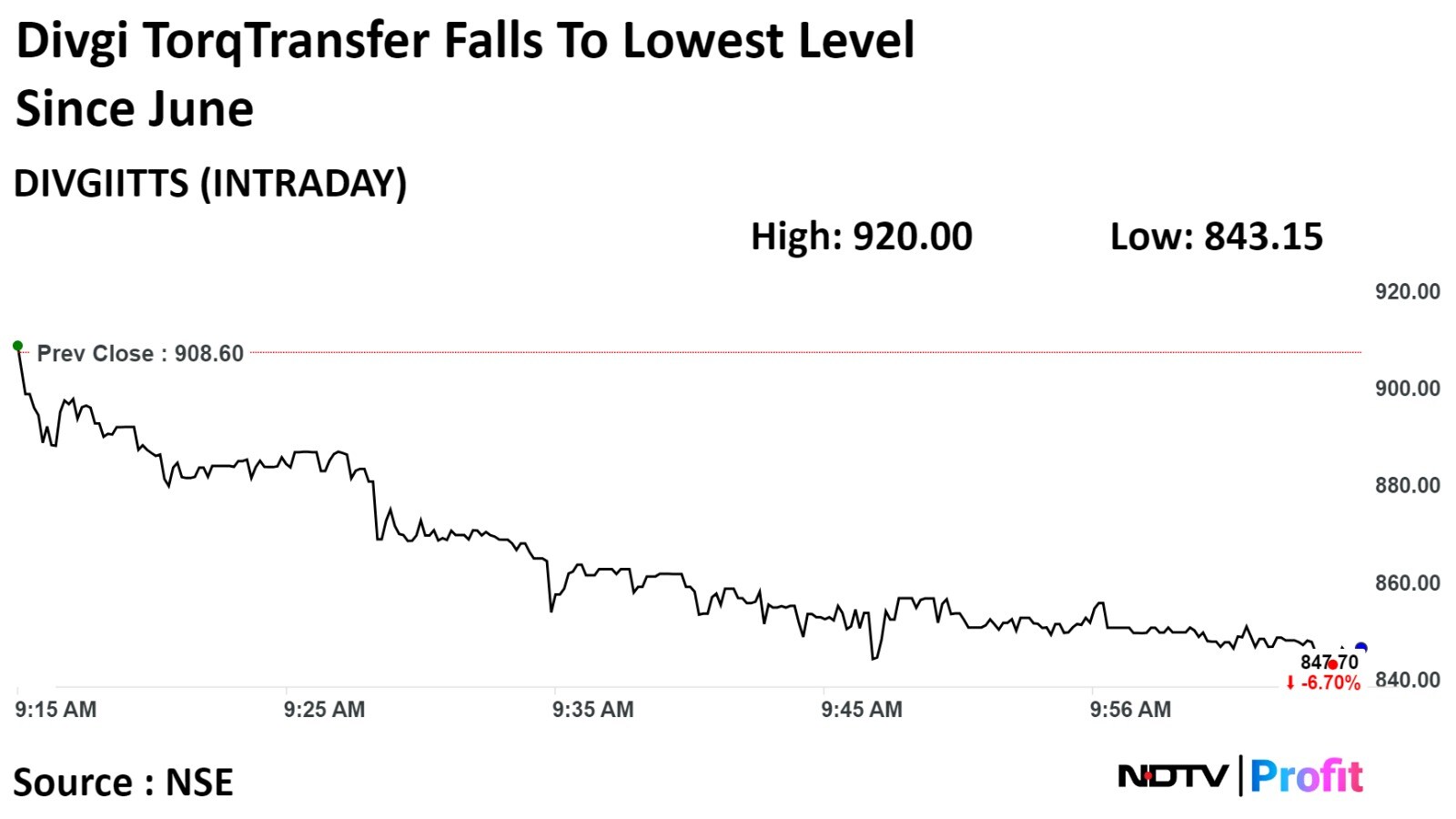

Shares of Divgi TorqTransfer Systems fell to hit its lowest level since June after the company reported a 22.2% year-on-year fall in its net profit for the quarter ended December to Rs 9.37 crore.

The scrip fell as much as 7.20% to Rs 843.15 piece, the lowest level since June 23, 2023. It pared gains to trade 6.78% lower at Rs 847 apiece, as of 10:11 a.m. This compares to a 0.40% advance in the NSE Nifty 50 Index.

It has risen 39.57% since listing. Total traded volume so far in the day stood at 8.2 times its 30-day average. The relative strength index was at 25.34, indicating that the stock might be oversold.

The two analysts tracking the company have a 'buy' rating for the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 50%.

Shares of Divgi TorqTransfer Systems fell to hit its lowest level since June after the company reported a 22.2% year-on-year fall in its net profit for the quarter ended December to Rs 9.37 crore.

The scrip fell as much as 7.20% to Rs 843.15 piece, the lowest level since June 23, 2023. It pared gains to trade 6.78% lower at Rs 847 apiece, as of 10:11 a.m. This compares to a 0.40% advance in the NSE Nifty 50 Index.

It has risen 39.57% since listing. Total traded volume so far in the day stood at 8.2 times its 30-day average. The relative strength index was at 25.34, indicating that the stock might be oversold.

The two analysts tracking the company have a 'buy' rating for the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 50%.

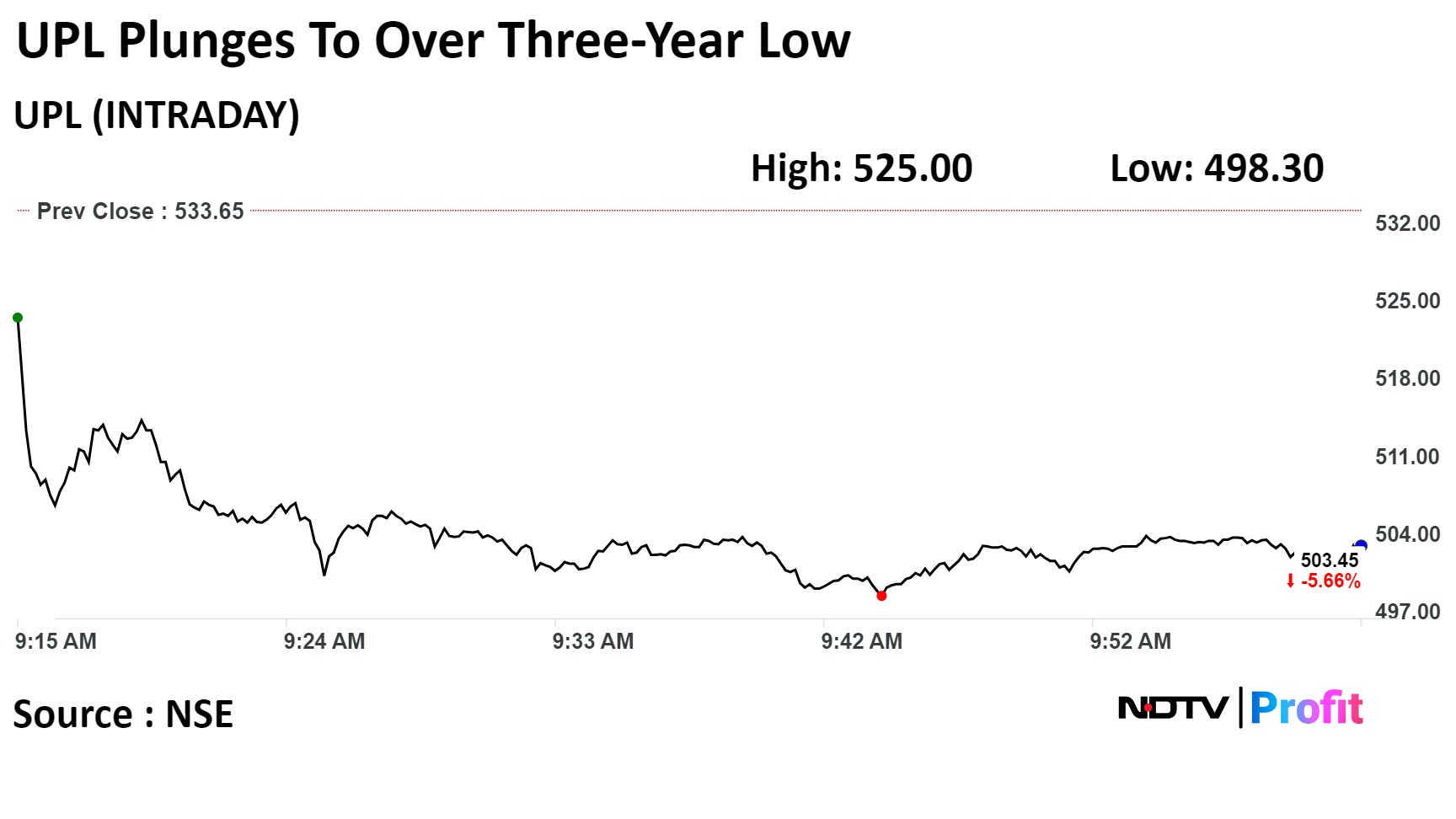

Shares of UPL Ltd plunged more than 6% to over a three-year low on Monday after the company reported net loss in contrast analysts' expectation low profit.

UPL Ltd recorded net loss of Rs 1,607 crore in October-December, compared Rs 5.2 crore net profit analysts projected in a Bloomberg's survey. The figure is sharply lower than Rs 1,360 crore net profit in the preceding quarter, due to a fall in its revenue.

The scrip fell as much as 6.62% to Rs 498.30 apiece, the lowest level since Jan 14, 2021. It trading 5.57% lower at Rs 503.90 apiece, as of 09:58 a.m. This compares to a 0.05% decline in the NSE Nifty 50 Index.

It has declined 29.54% in 12 months. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 26, which implied the stock is oversold.

Out of 32 analysts tracking the company, 21 maintain a 'buy' rating, six recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.1%.

Shares of UPL Ltd plunged more than 6% to over a three-year low on Monday after the company reported net loss in contrast analysts' expectation low profit.

UPL Ltd recorded net loss of Rs 1,607 crore in October-December, compared Rs 5.2 crore net profit analysts projected in a Bloomberg's survey. The figure is sharply lower than Rs 1,360 crore net profit in the preceding quarter, due to a fall in its revenue.

The scrip fell as much as 6.62% to Rs 498.30 apiece, the lowest level since Jan 14, 2021. It trading 5.57% lower at Rs 503.90 apiece, as of 09:58 a.m. This compares to a 0.05% decline in the NSE Nifty 50 Index.

It has declined 29.54% in 12 months. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 26, which implied the stock is oversold.

Out of 32 analysts tracking the company, 21 maintain a 'buy' rating, six recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.1%.

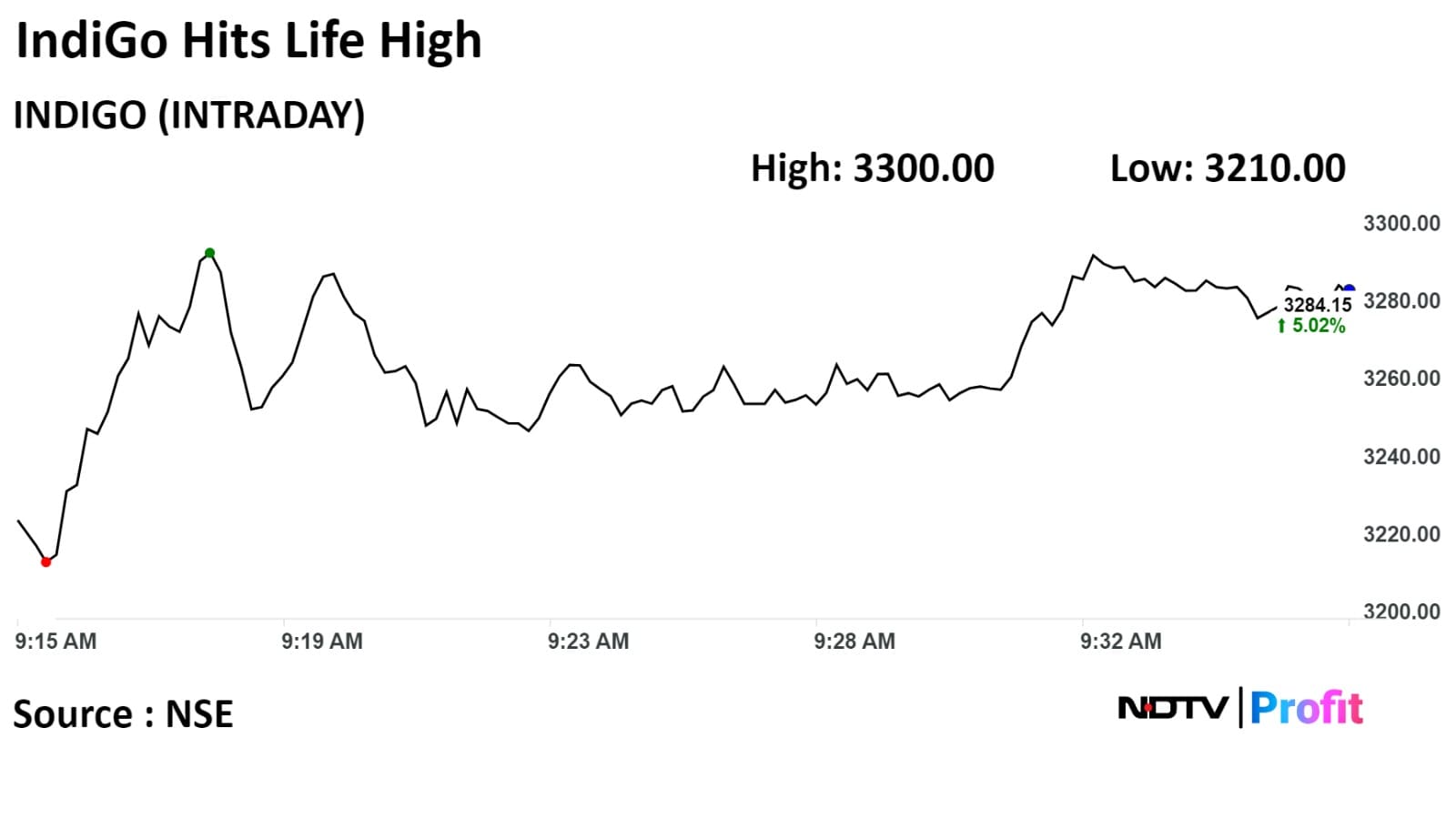

InterGlobe Aviation Ltd.'s shares rose over 5% to hit a record high after company's net profit more than doubled in the third quarter beating analysts' estimates, aided by the strong demand for travel during the festive season.

Shares of IndiGo rose as much as 5.53%, to the highest since May 03,2023, It is trading 4.16% higher at Rs 3,257.05 12:07 p.m. This compares to a 0.09% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 22 times its 30-day average. The relative strength index was at 72, implying the stock is overbought.

Of the 22 analysts tracking the company, 17 maintain a 'buy', two recommends a 'hold,' and three suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 3.5%

InterGlobe Aviation Ltd.'s shares rose over 5% to hit a record high after company's net profit more than doubled in the third quarter beating analysts' estimates, aided by the strong demand for travel during the festive season.

Shares of IndiGo rose as much as 5.53%, to the highest since May 03,2023, It is trading 4.16% higher at Rs 3,257.05 12:07 p.m. This compares to a 0.09% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 22 times its 30-day average. The relative strength index was at 72, implying the stock is overbought.

Of the 22 analysts tracking the company, 17 maintain a 'buy', two recommends a 'hold,' and three suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 3.5%

UCO Bank has 16.2 lakh shares change hands in a large trade

Buyers and sellers are not known immediately.

Source: Bloomberg

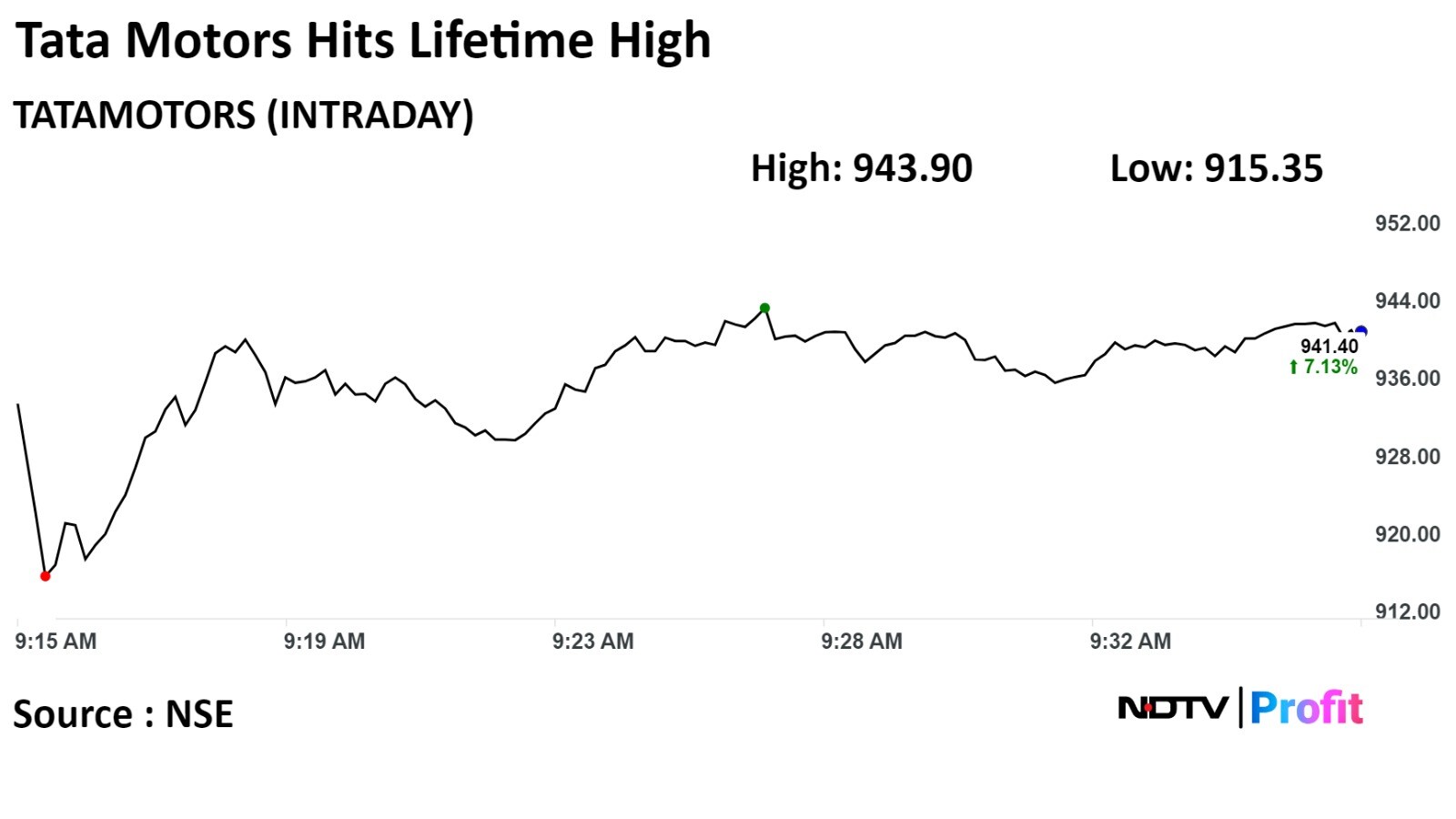

Shares of Tata Motors jumped to hit its lifetime high today after the company's net profit more than doubled on year in the third quarter and beat Bloomberg's estimates.

The company reported a 138% jump in its net profit to Rs 7,025 crore above Bloomberg's estimates of Rs 4,557 crore.

Shares of Tata Motors jumped to hit its lifetime high today after the company's net profit more than doubled on year in the third quarter and beat Bloomberg's estimates.

The company reported a 138% jump in its net profit to Rs 7,025 crore above Bloomberg's estimates of Rs 4,557 crore.

The scrip surged as much as 7.41% to Rs 943.90 piece, its highest level. It pared gains to trade 6.92% higher at Rs 939.55 apiece, as of 9:35 a.m. This compares to a 0.09% decline in the NSE Nifty 50 Index.

It has risen 112.78% in the last twelve months. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 83, indicating that the stock may be overbought.

Out of 34 analysts tracking the company, 27 maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 1.4%.

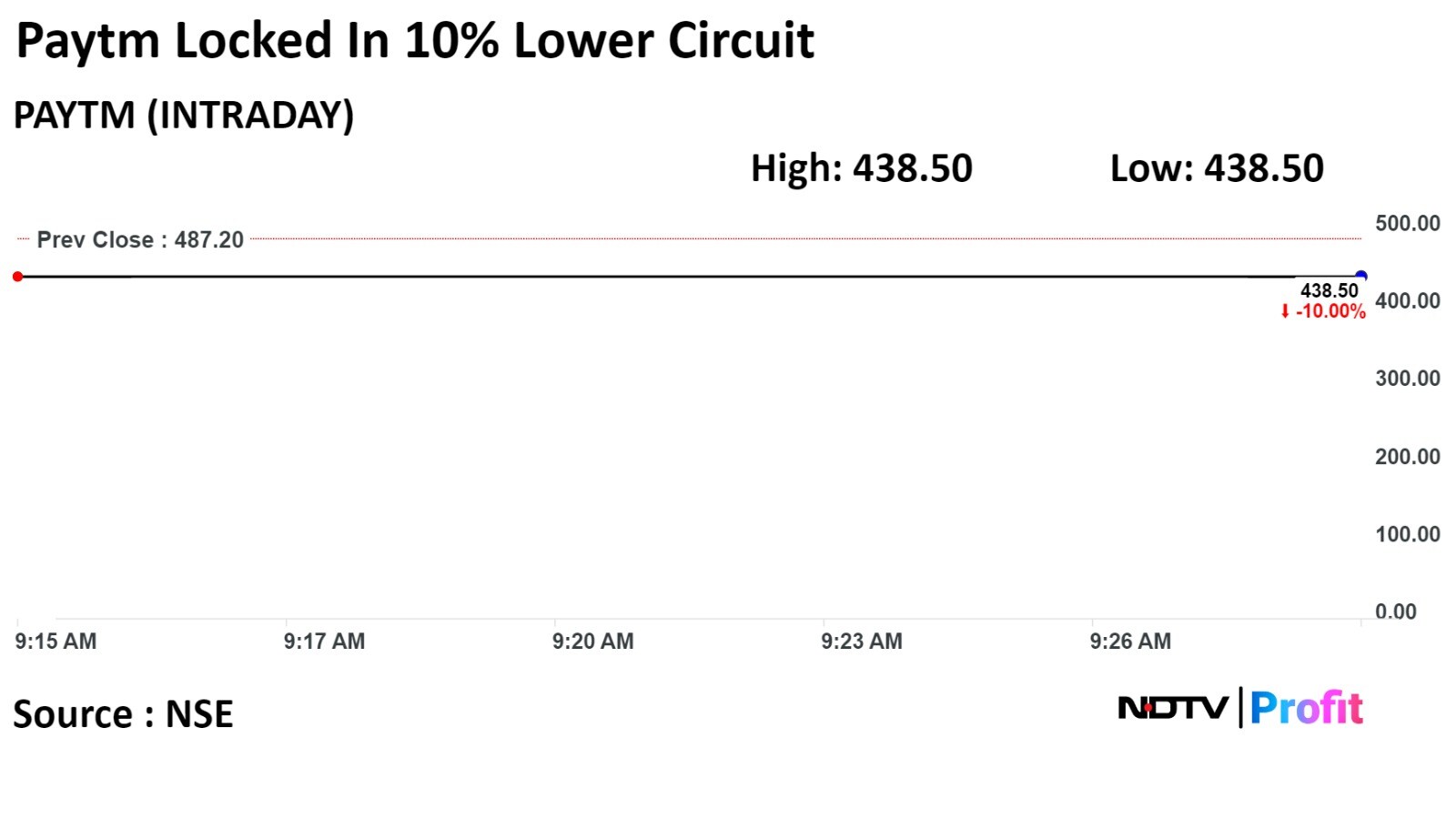

The shares of One97 Communications Ltd. were locked in lower circuit for the third day after RBI put restrictions on the Paytm Payments Bank.

The scrip fell as much as 10% to 438.50 apiece, to be locked in the lower circuit. This compares to a 0.13% advance in the NSE Nifty 50 Index as of 9:31 a.m.

It has fallen 21.46% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 19 indicating it was underbought.

Out of 15 analysts tracking the company, 6 maintain a 'buy' rating, 4 recommend a 'hold,' and 5 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 16.5%.

The shares of One97 Communications Ltd. were locked in lower circuit for the third day after RBI put restrictions on the Paytm Payments Bank.

The scrip fell as much as 10% to 438.50 apiece, to be locked in the lower circuit. This compares to a 0.13% advance in the NSE Nifty 50 Index as of 9:31 a.m.

It has fallen 21.46% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 19 indicating it was underbought.

Out of 15 analysts tracking the company, 6 maintain a 'buy' rating, 4 recommend a 'hold,' and 5 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 16.5%.

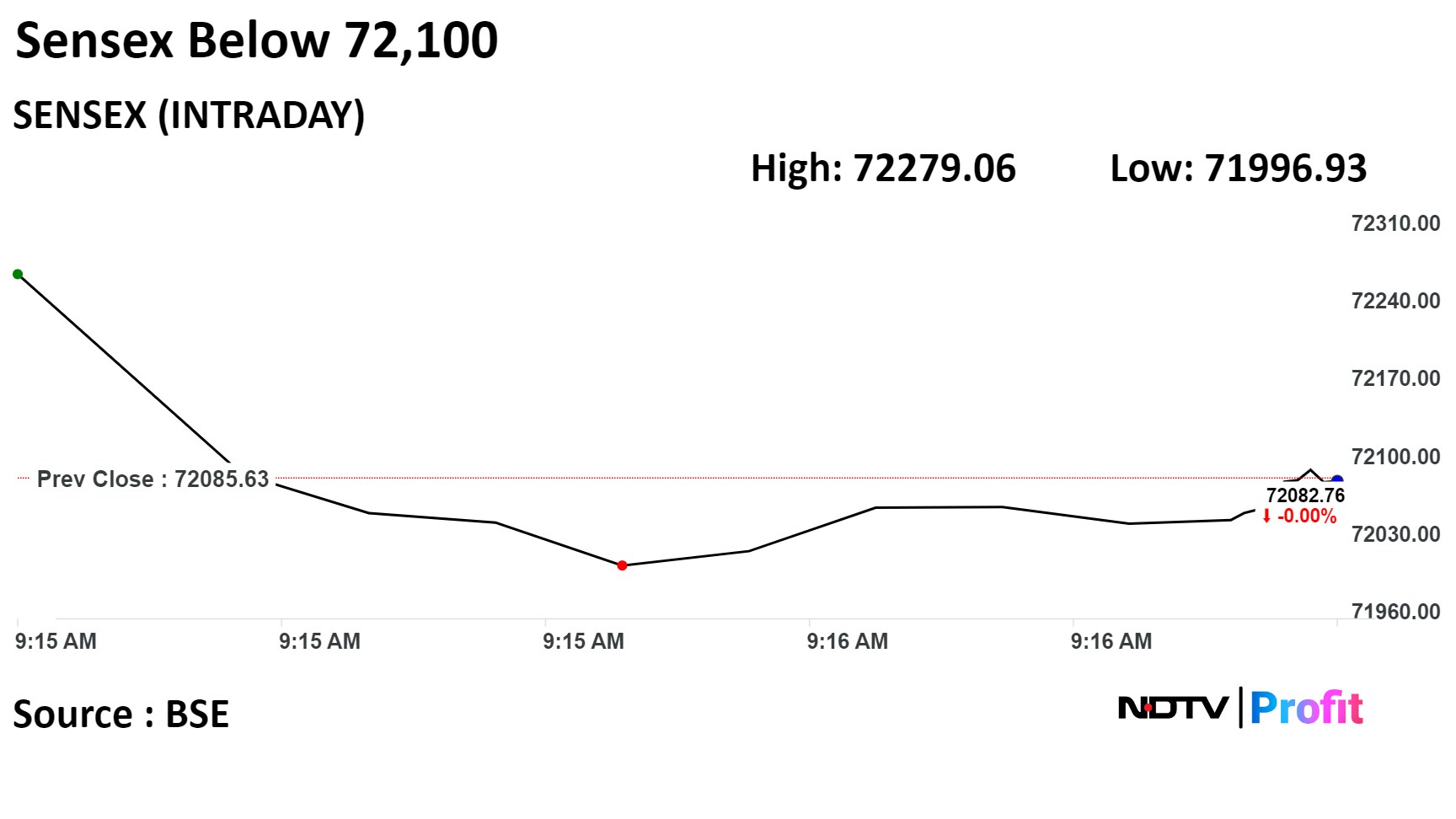

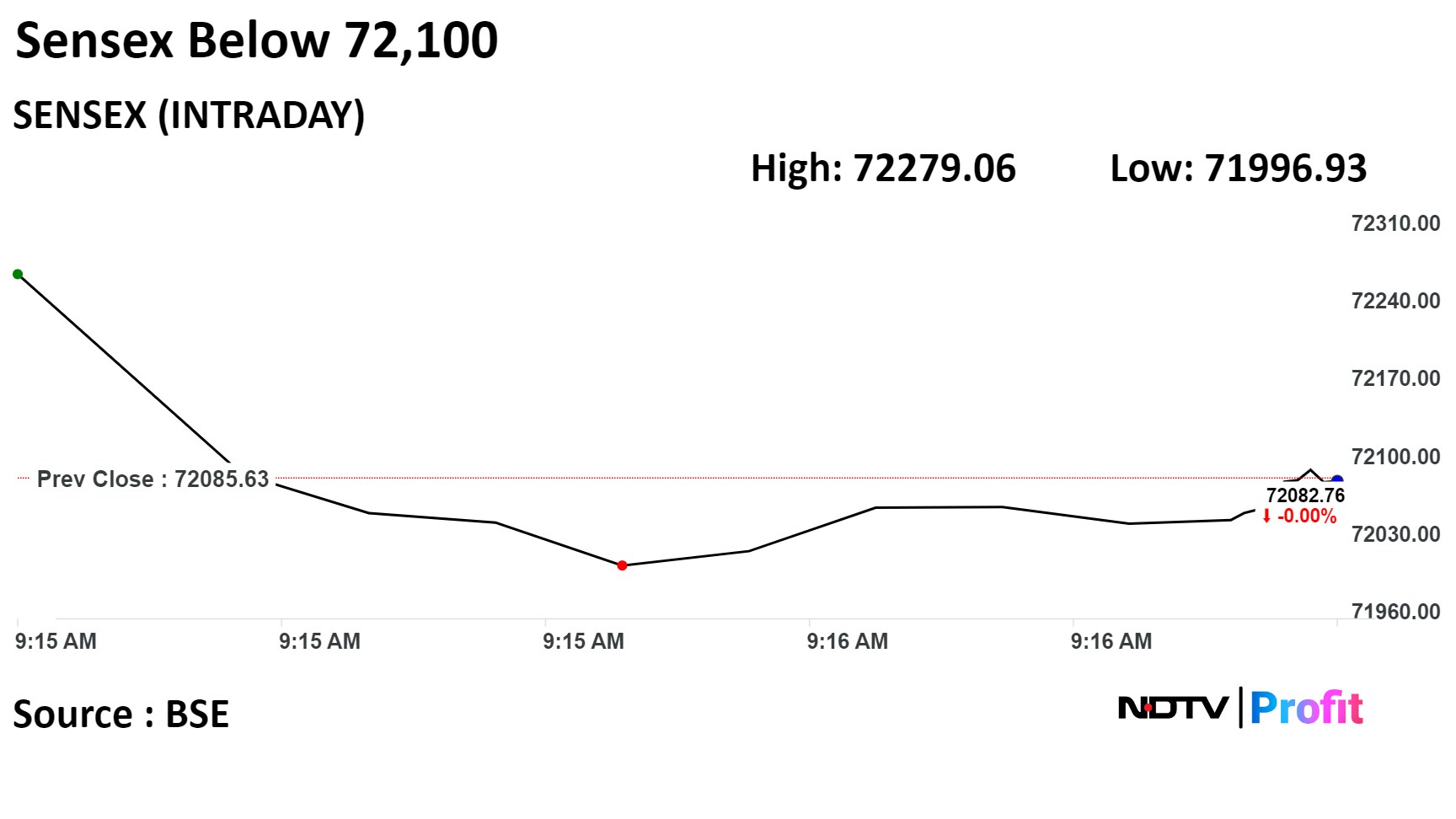

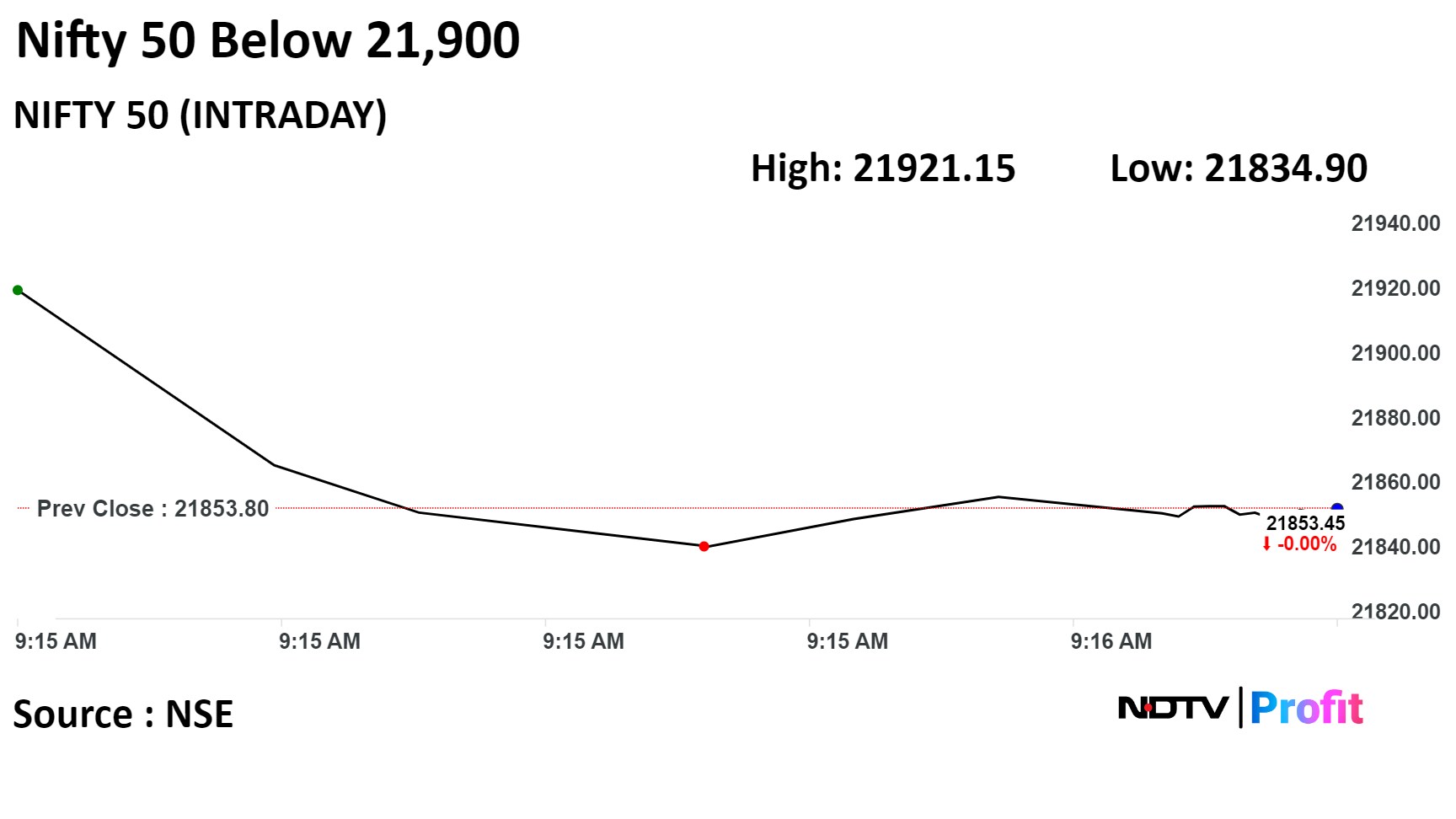

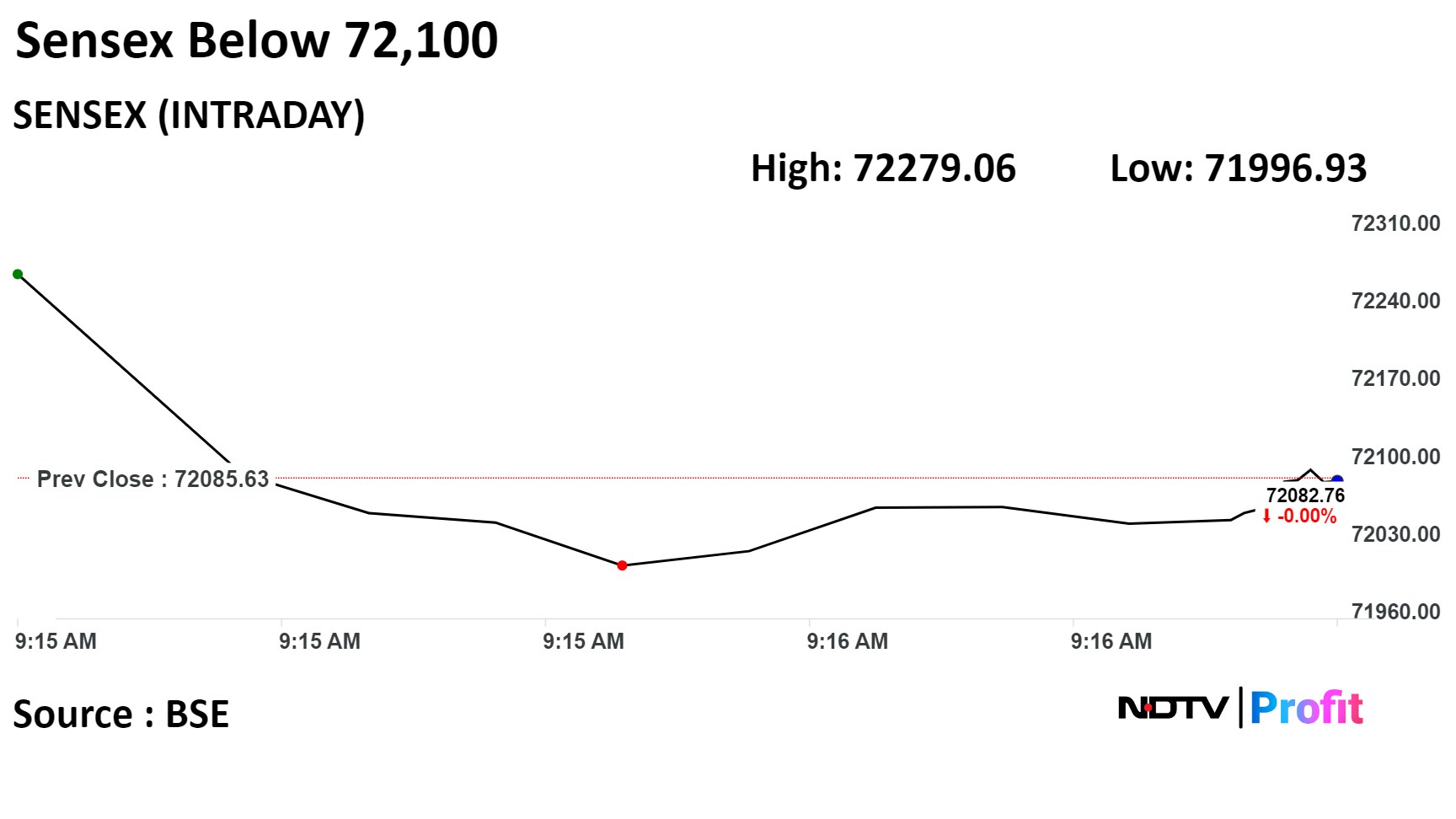

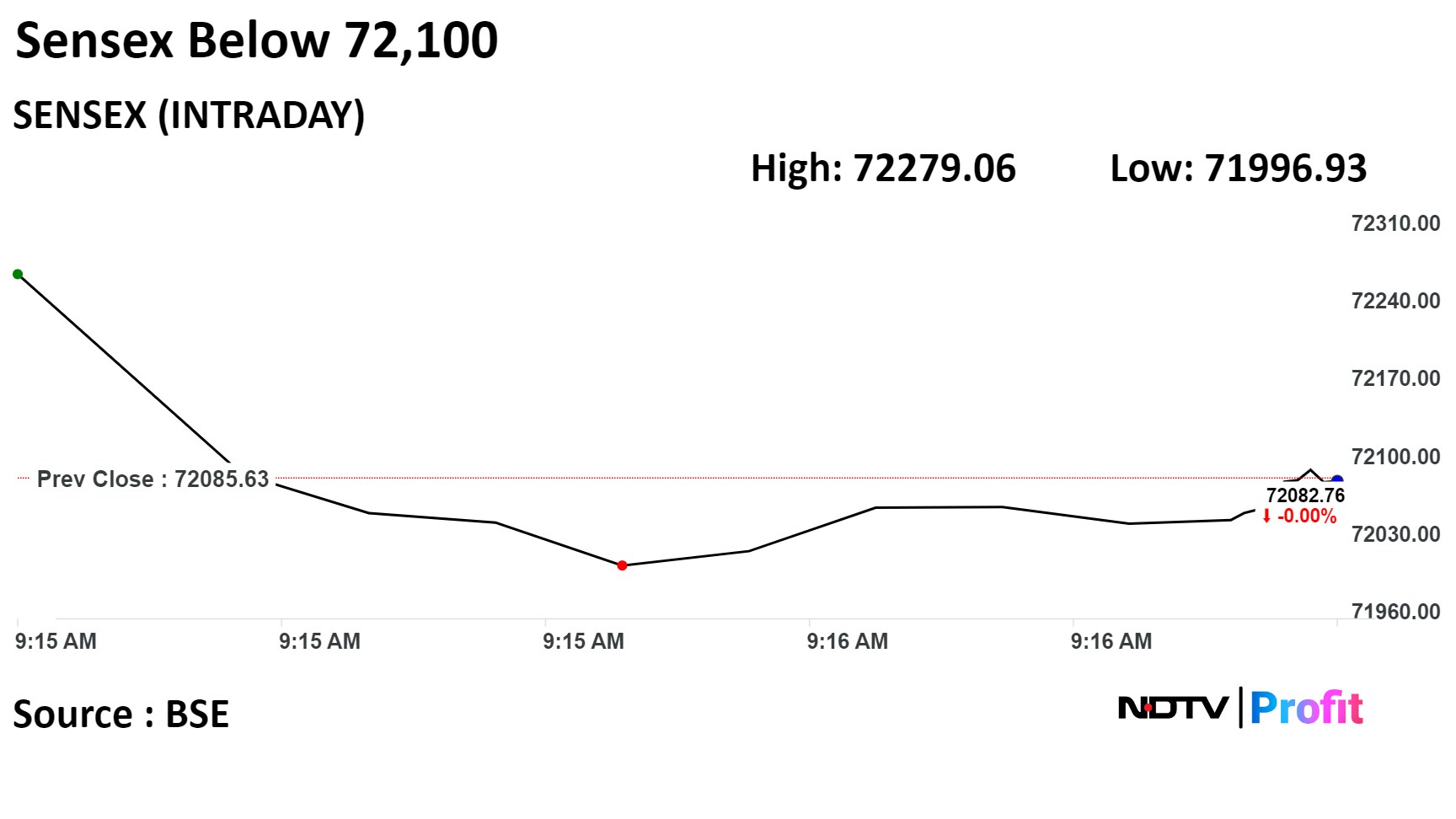

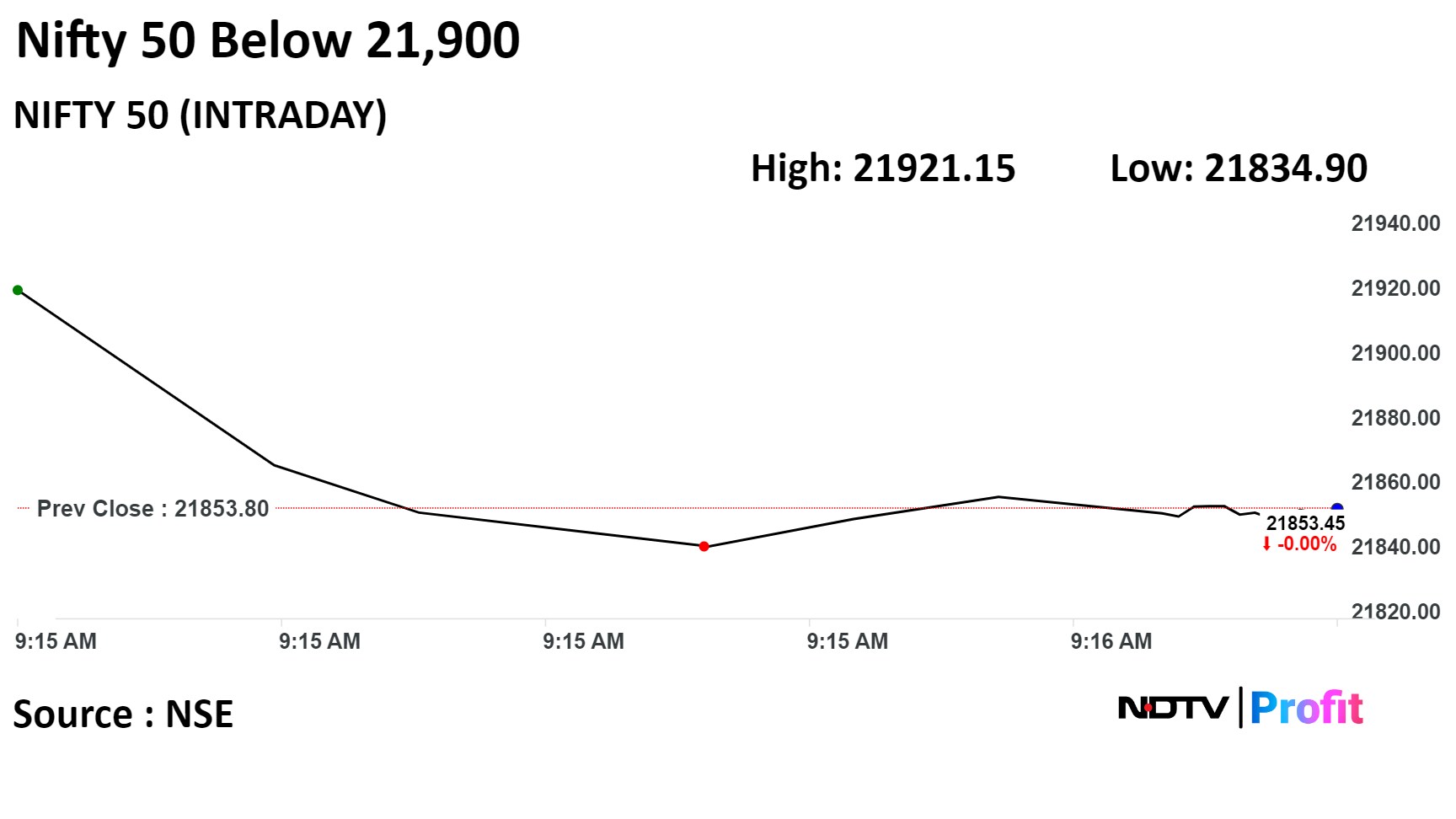

Indian benchmarks opened first trading session of the week on a muted note as Bajaj Finance Ltd, Tata Motors Ltd gained, while losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd weighed.

As of 09:21, the NSE Nifty 50 was trading 6.15 points or 0.03% higher at 21,859.95, and the S&P BSE Sensex was 81.02 points or 0.11% lower at 72,004.62.

"As per different time-frames, a mixed trend was seen where in the weekly chart, the Index has formed Above The Stomach (Bullish) candle while the daily chart denotes a reversal by forming a Shooting Star candle. Considering the larger picture; the trend is positive with the downside protected at 21,700-21,645 while on the higher side, a convincing close above 22,100 is a must," said Aditya Gaggar, director of Progressive Shares

Indian benchmarks opened first trading session of the week on a muted note as Bajaj Finance Ltd, Tata Motors Ltd gained, while losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd weighed.

As of 09:21, the NSE Nifty 50 was trading 6.15 points or 0.03% higher at 21,859.95, and the S&P BSE Sensex was 81.02 points or 0.11% lower at 72,004.62.

"As per different time-frames, a mixed trend was seen where in the weekly chart, the Index has formed Above The Stomach (Bullish) candle while the daily chart denotes a reversal by forming a Shooting Star candle. Considering the larger picture; the trend is positive with the downside protected at 21,700-21,645 while on the higher side, a convincing close above 22,100 is a must," said Aditya Gaggar, director of Progressive Shares

Indian benchmarks opened first trading session of the week on a muted note as Bajaj Finance Ltd, Tata Motors Ltd gained, while losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd weighed.

As of 09:21, the NSE Nifty 50 was trading 6.15 points or 0.03% higher at 21,859.95, and the S&P BSE Sensex was 81.02 points or 0.11% lower at 72,004.62.

"As per different time-frames, a mixed trend was seen where in the weekly chart, the Index has formed Above The Stomach (Bullish) candle while the daily chart denotes a reversal by forming a Shooting Star candle. Considering the larger picture; the trend is positive with the downside protected at 21,700-21,645 while on the higher side, a convincing close above 22,100 is a must," said Aditya Gaggar, director of Progressive Shares

Indian benchmarks opened first trading session of the week on a muted note as Bajaj Finance Ltd, Tata Motors Ltd gained, while losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd weighed.

As of 09:21, the NSE Nifty 50 was trading 6.15 points or 0.03% higher at 21,859.95, and the S&P BSE Sensex was 81.02 points or 0.11% lower at 72,004.62.

"As per different time-frames, a mixed trend was seen where in the weekly chart, the Index has formed Above The Stomach (Bullish) candle while the daily chart denotes a reversal by forming a Shooting Star candle. Considering the larger picture; the trend is positive with the downside protected at 21,700-21,645 while on the higher side, a convincing close above 22,100 is a must," said Aditya Gaggar, director of Progressive Shares

"In the case of Nifty Bank, a strong move above 46,600 is required to resume its uptrend; and on the flip side, 45,700 will act as a strong support," Gagger added.

Indian benchmarks opened first trading session of the week on a muted note as Bajaj Finance Ltd, Tata Motors Ltd gained, while losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd weighed.

As of 09:21, the NSE Nifty 50 was trading 6.15 points or 0.03% higher at 21,859.95, and the S&P BSE Sensex was 81.02 points or 0.11% lower at 72,004.62.

"As per different time-frames, a mixed trend was seen where in the weekly chart, the Index has formed Above The Stomach (Bullish) candle while the daily chart denotes a reversal by forming a Shooting Star candle. Considering the larger picture; the trend is positive with the downside protected at 21,700-21,645 while on the higher side, a convincing close above 22,100 is a must," said Aditya Gaggar, director of Progressive Shares

Indian benchmarks opened first trading session of the week on a muted note as Bajaj Finance Ltd, Tata Motors Ltd gained, while losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd weighed.

As of 09:21, the NSE Nifty 50 was trading 6.15 points or 0.03% higher at 21,859.95, and the S&P BSE Sensex was 81.02 points or 0.11% lower at 72,004.62.

"As per different time-frames, a mixed trend was seen where in the weekly chart, the Index has formed Above The Stomach (Bullish) candle while the daily chart denotes a reversal by forming a Shooting Star candle. Considering the larger picture; the trend is positive with the downside protected at 21,700-21,645 while on the higher side, a convincing close above 22,100 is a must," said Aditya Gaggar, director of Progressive Shares

Indian benchmarks opened first trading session of the week on a muted note as Bajaj Finance Ltd, Tata Motors Ltd gained, while losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd weighed.

As of 09:21, the NSE Nifty 50 was trading 6.15 points or 0.03% higher at 21,859.95, and the S&P BSE Sensex was 81.02 points or 0.11% lower at 72,004.62.

"As per different time-frames, a mixed trend was seen where in the weekly chart, the Index has formed Above The Stomach (Bullish) candle while the daily chart denotes a reversal by forming a Shooting Star candle. Considering the larger picture; the trend is positive with the downside protected at 21,700-21,645 while on the higher side, a convincing close above 22,100 is a must," said Aditya Gaggar, director of Progressive Shares

Indian benchmarks opened first trading session of the week on a muted note as Bajaj Finance Ltd, Tata Motors Ltd gained, while losses in shares of Reliance Industries Ltd., Tata Consultancy Services Ltd weighed.

As of 09:21, the NSE Nifty 50 was trading 6.15 points or 0.03% higher at 21,859.95, and the S&P BSE Sensex was 81.02 points or 0.11% lower at 72,004.62.

"As per different time-frames, a mixed trend was seen where in the weekly chart, the Index has formed Above The Stomach (Bullish) candle while the daily chart denotes a reversal by forming a Shooting Star candle. Considering the larger picture; the trend is positive with the downside protected at 21,700-21,645 while on the higher side, a convincing close above 22,100 is a must," said Aditya Gaggar, director of Progressive Shares

"In the case of Nifty Bank, a strong move above 46,600 is required to resume its uptrend; and on the flip side, 45,700 will act as a strong support," Gagger added.

Tata Motors Ltd, Tata Consultancy Services Ltd, ITC Ltd, Sun Pharmaceutical Industries Ltd, Mahindra and Mahindra Ltd contributed positively to the index.

Reliance Industries Ltd, ICICI Bank Ltd, HDFC Bank Ltd, State Bank of India, and Kotak Mahindra Bank weighed on the index.

Around eight sectors on NSE were trading in positive, while three traded in negative, and one remained flat. The Nifty media gained 1.11% to become the top performer among sectoral indices.

Broader markets outperformed benchmark indices. The S&P BSE Midcap gained 0.70%, and Smallcap gained 0.61%.

On BSE, 17 sectors out of 20 rose, and three declined. The BSE Auto index gained most among sectoral indices.

The market breadth was skewed in favour of buyers. Around 2,075 stocks rose, and 1,075 stocks declined, and 125 stocks remained unchanged.

At pre-open, the NSE Nifty 50 was trading 67.25 points or 0.31% higher at 21,921.05, while the S&P BSE Sensex was 183.48 points or 0.25% higher at 72,269.12.

The yield on the 10-year bond opened 3 bps higher at 7.08%.

It closed at 7.05% on Friday.

Source: Bloomberg

The local currency weakened 10 paise to open at Rs 83.03 against the U.S dollar.

It closed at 82.93 on Friday.

Source: Bloomberg

Aurobindo Pharma Ltd's U.S .unit Eugia U.S. inked a pact with Empower Clinic Services for asset disposal

Asset disposal is a part of business restructuring as a going concern with related assets.

Cash of $52 million to be received from the disposal.

$58 million in lease payments to also be paid over 20 years to Eugia US as a part of disposal.

Source: Exchange filing

VA Tech Wabag received $33.5 million order for wastewater plant in Kingdom of Saudi Arabia.

Source: Exchange Filing

Railtel Corporation of India Ltd received an order worth Rs 125 crore from Western Railways.

The order is for unified communication infrastructure.

Source: Exchange Filing

U.S. Dollar Index at 104.10

U.S. 10-year bond yield at 4.07%

Brent crude up 0.12% at $77.42 per barrel

Nymex crude down flat at $72.27 per barrel

Bitcoin was down 0.76% at $42,434.82

Nuvama downgrades Tata Motors to 'hold', and raised target price to Rs 960 apiece from Rs 910 apiece.

Ebitda outperformance primarily due to better JLR margins

Raising FY24–26E Ebitda by 7–8%

JLR mix should turn adverse

FY25 volume growth outlook is subdued for JLR/India CV at only 4%/3%

Limited upside potential & moderating volume; downgrading to ‘HOLD’

Emkay maintains 'add' on Tata Motors, and raised target price to Rs 925 apiece from 900 apiece

Healthy margin expansion across operations in Q3

Consolidated automotive FCF stood at Rs6400cr (equivalent to Rs6400cr achieved in H1)

Net automotive debt reduced further to Rs29200cr

Domestic CV volume to peak in FY24

Raise FY24E/25E/26E EPS by 3%/5%/8%

Jefferies raises price target to Rs 1,100 apiece from Rs 950 apiece.

Remains preferred 'buy' among 4W OEMs

See industry demand concerns in India in CY24, but like strong PV launch pipeline

Raise FY24-26 EPS by 7-11% on lower India CV volumes but highest estimate for JLR

Expect FY26 Ebitda to be 2.3x of FY23, EPS to rise to a new high of Rs 82

Balance sheet to turn net cash by FY25

Nuvama maintains ‘buy’ on SBI, with the target price increased to Rs 745 apiece from Rs 705 apiece.

Mixed Q3FY24, 32% PAT miss due to a one-time exceptional item.

Strong growth and low loan to deposit ratio

Lower net interest income and fees, higher wage provisions

Cut for FY24 and FY25 by 21% and 9%, respectively, on higher provisions.

Values SBI at 1.3x PBV on a 12-month forward basis

Emkay maintains 'buy' on SBI and raised target price by 7.1% to Rs 750 apiece.

Reported near in-line PPoP, but higher staff cost, including one-off retirement provision

Higher slippages QoQ due to one account but NPAs continue to trend down

Staff cost could remain elevated in Q4 due to staff cost and provisions of 5400 crore

Has now indicated to raise capital soon

Trim FY24 estimates by 6%, hike FY25/26 estimates by 3%/9%

Bernstein retains ‘buy’ on SBI; target price remains at Rs 710 apiece.

Deposit repricing leads to 5% YoY Net Interest Income growth

RoA impacted by exceptional item

Values SBI at 1.3x PBV on a 12-month forward basis.

Elara Securities maintained 'buy' on State Bank of India and raised price target to Rs 758 apiece from Rs 717 apiece.

SBI's Q3 PAT lower than estimates on higher opex, exceptional items

Strong liability franchise to guard bank from NIM headwinds

Expects SBIN to sustain momentum on asset quality trends

Capital position an overhang for company

Tega Industries: To meet analysts and investors on Feb. 9.

PB Fintech: To meet analysts and investors on Feb. 5, 6 and 21.

IndusInd Bank: To meet analysts and investors on Feb. 7 and 12.

Indian Energy Exchange: To meet analysts and investors on Feb. 6.

Price band revised from 20% to 10%: BEML Land Assets, Man Industries, NBCC, One 97 Communication.

Price band revised from 10% to 5%: FCS Software Solutions, Gallant ISPAT, Pakka, PTC India Financial Services.

Price band revised from 5% to 10%: Prakash Industries.

Ex/record date dividend: Apcotex Industries, Sona BLW Precision Forgings, Coforge, Mahanagar Gas, Tanla Platforms, CG Power, and Industrial Solutions.

Moved into short-term ASM framework: South Indian Bank.

Moved out of short-term ASM framework: Zee Entertainment Enterprises, Bondada Engineering, Network 18 Media & Investments.

Infibeam Avenues: Abhishek Mayur Desai sold 30 lakh shares (0.11%) at Rs 34.9 apiece and Sonal Desai bought 30 lakh shares (0.11%) at Rs 34.9 apiece.

One 97 Communication: Morgan Stanley Asia bought 50 lakh shares (0.78%) at Rs 487.2 apiece.

HMA Agro Industries: Radiant Global Fund sold 70 lakh shares (13.97%) at Rs 72.5 apiece.

Indiabulls Housing Finance: Vibgyor Investors Developers sold 25 lakh shares (0.52%) at Rs 189.12 apiece.

Pricol: Phi Capital Solutions LLP sold 20 lakh shares (1.64%) at Rs 408.08 apiece, while Societe Generale bought 8.24 lakh shares (0.67%) at Rs 408.05 apiece.

Salasar Techno Engineering: BLB sold 39.83 lakh shares (1.26%) at Rs 29.4 apiece.

Skipper: SK Bansal Family Trust sold 6.25 lakh shares (0.6%) at Rs 99.31 apiece, SK Bansal Heritage Trust sold 4.62 lakh shares (0.45%) at Rs 91.49 apiece, and SK Bansal Unity Trust sold 4.5 lakh shares (0.43%) at Rs 102 apiece.

Swan Energy: 2I Capital PCC sold 25 lakh shares (0.94%) at Rs 657.27 apiece.

Tourism Finance Corp: Quant Mutual Fund bought 6 lakh shares (0.66%) at Rs 208.57 apiece.

PB Fintech: PI Opportunities Fund sold 46.43 lakh shares (1.03%) at Rs 985.07 apiece.

Bajaj Finance: The non-banking financial company will acquire a 7% stake on a fully diluted basis in RMBS Development Co. for an undisclosed amount.

Aurobindo Pharma: The U.S. FDA inspected the company’s unit in Telangana and closed with nine inspections. The company temporarily stopped manufacturing on certain lines.

India Cements: The Enforcement Directorate searched the company's Chennai office and was looking into certain forex transactions done by associate company India Cements Capital.

H.G. Infra Engineering: The company received a letter of acceptance from the Central Railway for a Rs 716 crore construction project.

Mahindra and Mahindra Financial Services: The company reported disbursement at Rs 4,440 crore, up 11% YoY, and collection efficiency at 95%.

Cochin Shipyard: The company received a contract worth Rs 150 crore from the Indian Navy for medium refits of two vessels.

Torrent Pharmaceuticals: Sudhir Mehta will step down as director and continue to be the chairman emeritus, effective April 1.

Atul: The company completed capacity expansion at the DCDPS plant and approved an investment of Rs 99.5 crore for expansion.

Torrent Power: The company will set up 150 MW of solar power projects at four of Shapoorji's desalination plants.

India Glycols: The company expanded the capacity of the grain-based distillery plant in Gorakhpur to 290 KLPD from 110 KLPD.

Apeejay Surrendra Park Hotels: The hotel chains operator will offer its shares for bidding on Monday. The issue price is set at Rs 147-155 apiece. The Rs 920-crore IPO consists of a fresh issue of Rs 600 crore and an offer for sale of Rs 320 crore. The company has raised Rs 409.5 crore from anchor investors.

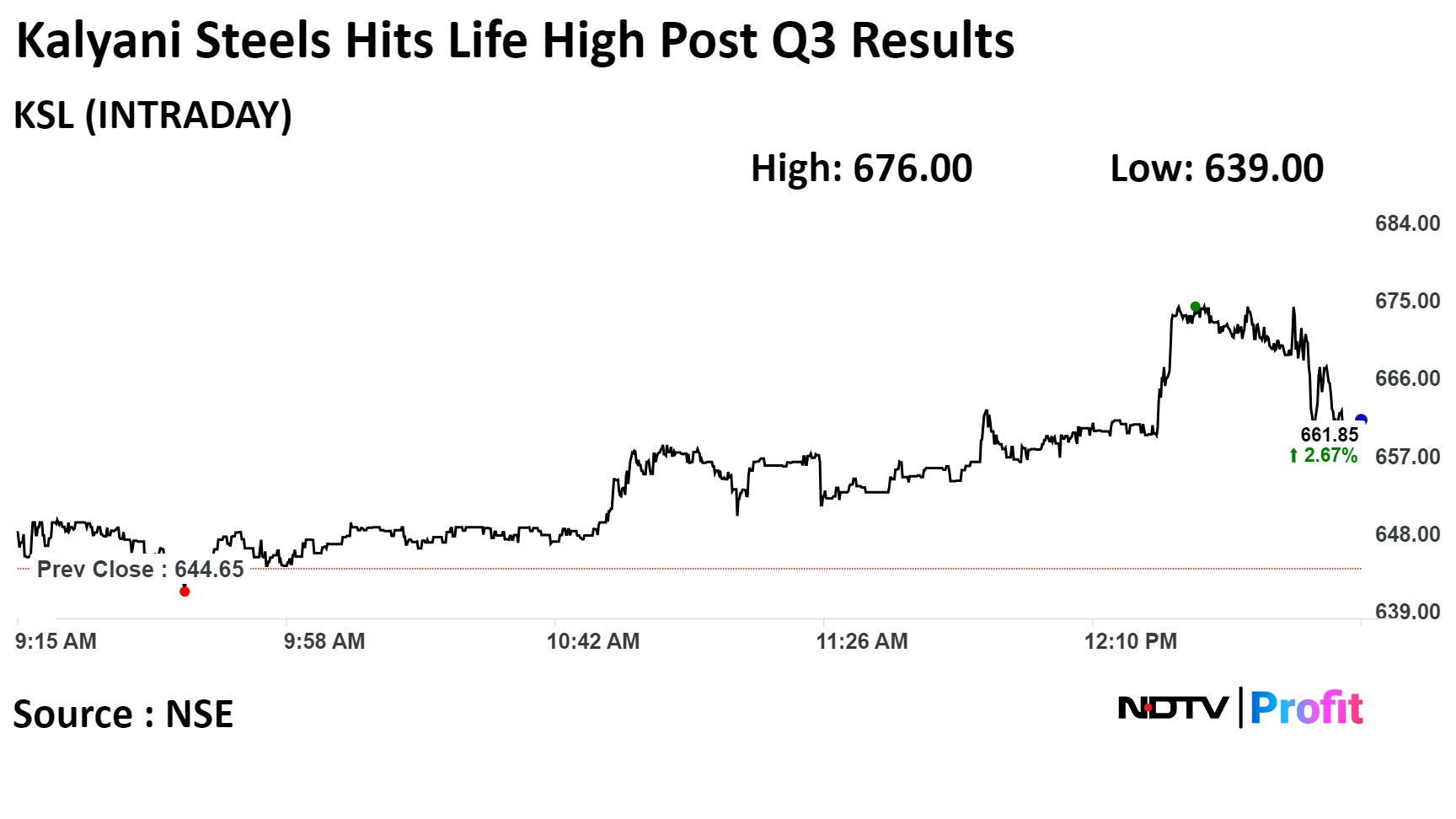

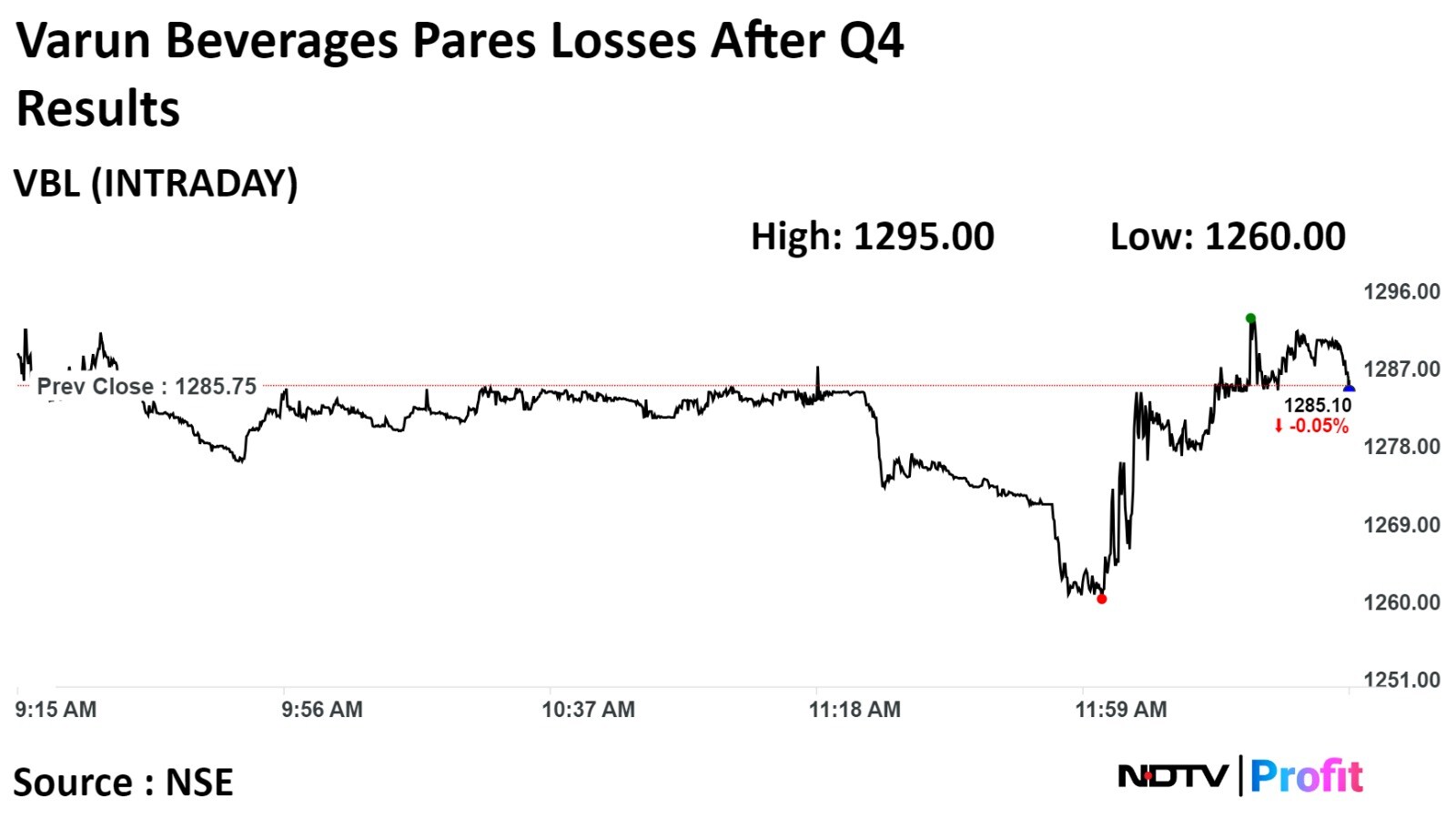

Alembic Pharmaceuticals, Artemis Medicare Services, Ashok Leyland, Aurionpro Solutions. Avanti Feeds, Bajaj Consumer Care, Bajaj Electricals, Banco Products (India), Bharti Airtel, CCL Products, Cholamandalam Financial Holdings, eMudhra, Fusion Micro Finance, GE T&D India, Gulf Oil Lubricants India, Ideaforge Technology, Kansai Nerolac Paints, K.P.R. Mill, Kalyani Steels, Linde India, Man Infraconstruction, Orient Cement, Paradeep Phosphates, Prince Pipes and Fittings, Responsive Industries. Shilchar Technologies, Sun Pharma Advanced Research, Suven Pharmaceuticals, Tata Chemicals, Triveni Turbine, TVS Supply Chain Solutions, Unichem Laboratories, Varun Beverages, Vijaya Diagnostic Centre, and VRL Logistics.

Tata Motors Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 25% to Rs 1.11 lakh crore vs Rs 88,489 crore (Bloomberg estimate: Rs 1,08,517 crore).

Ebitda up 59% to Rs 15,333 crore vs Rs 9,643 crore (Bloomberg estimate: Rs 14,778 crore).;

Margin at 13.86% vs 10.89% (Bloomberg estimate: 13.6%).

Net profit up 138% to Rs 7,025 crore vs Rs 3,043 crore (Bloomberg estimate: Rs 4,557 crore).

Bank Of India Q3 Earnings (Standalone, YoY)

NII down 2% at Rs 5,463.5 crore vs Rs 5,595 crore.

Net profit up 62.4% at Rs 1,869.5 crore vs Rs 1,151 crore (Bloomberg estimate: Rs 2,183 crore).

Gross NPA at 5.35% vs 5.84% (QoQ).

Net NPA at 1.41% vs 1.54% (QoQ).

InterGlobe Aviation Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 30.3% at Rs 19,452 crore vs Rs 14,933 crore (Bloomberg estimate: Rs 18,266 crore).

Ebitdar up 40.4% at Rs 5,499.2 crore vs Rs 3,774.2 crore.

Margin at 28% vs 25%.

Net profit at Rs 2,998 crore vs Rs 1,422.6 crore (Bloomberg estimate: Rs 2,518.6 crore).

Divgi TorqTransfer Systems Q3 Earnings (Consolidated, YoY)

Revenue down 1.5% at Rs 63.05 crore vs Rs 63.98 crore.

Ebitda down 29% at Rs 12.9 crore vs Rs 18.14 crore.

Margin at 20.5% vs 28.4%.

Net profit down 22.2% at Rs 9.37 crore vs Rs 12.05 crore.

UPL Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 27.7% at Rs 9,887 crore vs Rs 13,679 crore (Bloomberg estimate: Rs 11,060.4 crore).

Ebitda down 86% at Rs 416 crore vs Rs 2,964 crore (Bloomberg estimate: Rs 1,635.8 crore).

Margin at 4.2% vs 21.7% (Bloomberg estimate: 14.8 crore).

Net loss of Rs 1,607 crore vs profit of Rs 1,360 crore (Bloomberg estimate: Rs 5.2 crore).

Delhivery Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 20.3% at Rs 2,194.5 crore vs Rs 1,823.8 crore.

Ebitda at Rs 109.3 crore vs Ebitda loss of Rs 73.4 crore.

Margin at 4.98%

Net profit at Rs 11.7 crore vs loss of Rs 195.7 crore.

Titagarh Rail Systems Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 24.6% at Rs 954.7 crore vs Rs 766.4 crore.

Ebitda up 52.3% at Rs 110.68 crore vs Rs 72.65 crore.

Margin at 11.59% vs 9.47%

Net profit up 129.8% at Rs 74.8 crore vs Rs 32.6 crore.

Medplus Health Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 21.1% at Rs 1,441.5 crore vs Rs 1,190.3 crore (Bloomberg estimate: Rs 1,462.6 crore).

Ebitda up 28.1% at Rs 91.8 crore vs Rs 71.7 crore (Bloomberg estimate: Rs 71.7 crore).

Margin at 6.36% vs 6.02% (Bloomberg estimate: 4.9%).

Net profit up 2.4% at Rs 13.7 crore vs Rs 13.4 crore (Bloomberg estimate: Rs 12.9 crore).

Fine Organics Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 35.7% at Rs 488.4 crore vs Rs 759.5 crore (Bloomberg estimate: Rs 508.9 crore).

Ebitda down 26.1% at Rs 118.24 crore vs Rs 160.08 crore (Bloomberg estimate: Rs 121 crore).

Margin at 24.2% vs 21.07% (Bloomberg estimate: 23.8%).

Net profit down 11.3% at Rs 94.2 crore vs Rs 106.2 crore (Bloomberg estimate: Rs 89.1 crore).

Mahindra Lifespace Developers Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 56.1% at Rs 82 crore vs Rs 186.9 crore (Bloomberg estimate: Rs 62.1 crore).

Ebitda loss of Rs 39 crore vs Ebitda loss of Rs 11.4 crore (Bloomberg estimate: Rs -47.8 crore).

Net profit up 46.6% at Rs 50 crore vs Rs 34.1 crore (Bloomberg estimate: Rs 2.3 crore).

Dalmia Bharat Sugar Q3 Earnings (Consolidated, YoY)

Revenue down 2.7% at Rs 583.6 crore vs Rs 600 crore.

Ebitda down 2.8% at Rs 109.3 crore vs Rs 112.5 crore.

Margin at 18.72% vs 18.75%.

Net profit at Rs 64.9 crore vs Rs 64.9 crore.

Metropolis Health Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 2% at Rs 291.1 crore vs Rs 285.5 crore.

Ebitda down 8.1% at Rs 64.8 crore vs Rs 70.5 crore.

Margin at 22.26% vs 24.69%.

Net profit down 24% at Rs 27.3 crore vs Rs 35.9 crore.

LIC Housing Finance Q3 Earnings FY24 (Standalone, YoY)

Revenue up 15.7% at Rs 6,792.5 crore vs Rs 5,871 crore.

Net profit at Rs 1,162.9 crore vs Rs 480.3 crore (Bloomberg estimate: Rs 1,131.9 crore).

Markets in Australia were trading in red as investors awaited a policy decision from the Reserve Bank of Australia on Tuesday.

The S&P ASX 200 was 0.96% lower at 7,625.30. The KOSPI was 1.79% down at 2,568.48. However, the share index in Japan was trading higher, with the Nikkei 225 trading 0.20% higher at 36,229.95.

The U.S. stock market extended the week’s gains amid a rally in big tech, and a solid jobs report bolstered the outlook for corporate America.

Equities continued to show resilience near their all-time highs, with the S&P 500 topping 4,900. The tech-heavy Nasdaq 100 climbed 1% thanks to a bullish outlook from two megacaps: Meta and Amazon.

Brent crude was trading 0.17% up at $77.46 a barrel. Gold also traded 0.16% lower at $2,037.57 an ounce.

The GIFT Nifty was trading 30.5 points, or 0.14%, lower at 21,929.00 as of 8:50 a.m.

India's benchmark stock indices ended the budget week higher on Friday, led by gains in IT companies and index heavyweight Reliance Industries Ltd. The Nifty breached 22,000 for the first time since Jan. 16 to hit a fresh record high but was unable to hold on to a bout of profit booking. The Sensex increased by as much as 2.02%, coming close to its all-time high, but it fell in late trade due to losses at Axis Bank Ltd. and HDFC Bank Ltd.

The Nifty closed 156.35 points, or 0.72%, higher at 21,853.80, while the Sensex gained 440.34 points, or 0.6%, to end at 72,085.63.

Overseas investors became net buyers of Indian equities after a day. Foreign portfolio investors mopped up stocks worth Rs 70.7 crore, while domestic institutional investors remained net buyers and purchased equities worth Rs 2,463.2 crore, the NSE data showed.

The Indian rupee strengthened 5 paise to close at Rs 82.93 against the U.S. dollar.

Markets in Australia were trading in red as investors awaited a policy decision from the Reserve Bank of Australia on Tuesday.

The S&P ASX 200 was 0.96% lower at 7,625.30. The KOSPI was 1.79% down at 2,568.48. However, the share index in Japan was trading higher, with the Nikkei 225 trading 0.20% higher at 36,229.95.

The U.S. stock market extended the week’s gains amid a rally in big tech, and a solid jobs report bolstered the outlook for corporate America.

Equities continued to show resilience near their all-time highs, with the S&P 500 topping 4,900. The tech-heavy Nasdaq 100 climbed 1% thanks to a bullish outlook from two megacaps: Meta and Amazon.

Brent crude was trading 0.17% up at $77.46 a barrel. Gold also traded 0.16% lower at $2,037.57 an ounce.

The GIFT Nifty was trading 30.5 points, or 0.14%, lower at 21,929.00 as of 8:50 a.m.

India's benchmark stock indices ended the budget week higher on Friday, led by gains in IT companies and index heavyweight Reliance Industries Ltd. The Nifty breached 22,000 for the first time since Jan. 16 to hit a fresh record high but was unable to hold on to a bout of profit booking. The Sensex increased by as much as 2.02%, coming close to its all-time high, but it fell in late trade due to losses at Axis Bank Ltd. and HDFC Bank Ltd.

The Nifty closed 156.35 points, or 0.72%, higher at 21,853.80, while the Sensex gained 440.34 points, or 0.6%, to end at 72,085.63.

Overseas investors became net buyers of Indian equities after a day. Foreign portfolio investors mopped up stocks worth Rs 70.7 crore, while domestic institutional investors remained net buyers and purchased equities worth Rs 2,463.2 crore, the NSE data showed.

The Indian rupee strengthened 5 paise to close at Rs 82.93 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.