The benchmark equity indices closed lower for the third consecutive session on Tuesday amid volatility in the domestic stock markets.

The NSE Nifty 50 closed 261.55 points or 1.05% lower at 24,683.9 and the BSE Sensex ended 872.98 points or 1.06% down at 81,186.44. During the day, the Nifty fell 1.11% to 24,669.7, while the Sensex declined 1.1% to 81,153.7.

"The index struggled to sustain higher levels and erased all its morning gains to trade lower," Aditya Gaggar, director of Progressive Share Brokers, said. "A sharp decline in the Midcap and SmallCap segments added pressure on the Index, which intensified during the second half of the trading session."

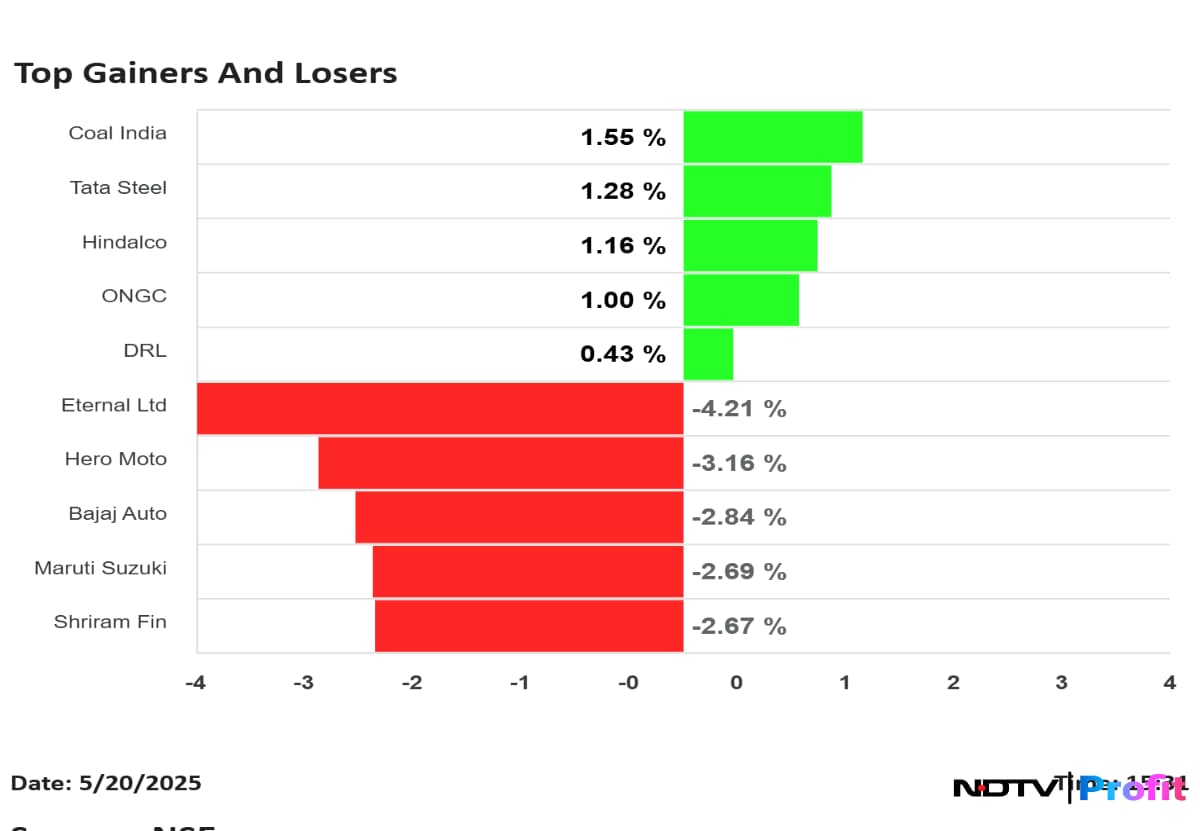

Shares of Coal India Ltd. and Tata Steel Ltd. were among the top gainers among the Nifty 50 stocks. Eternal Ltd. and Hero MotoCorp. were the among biggest laggards.

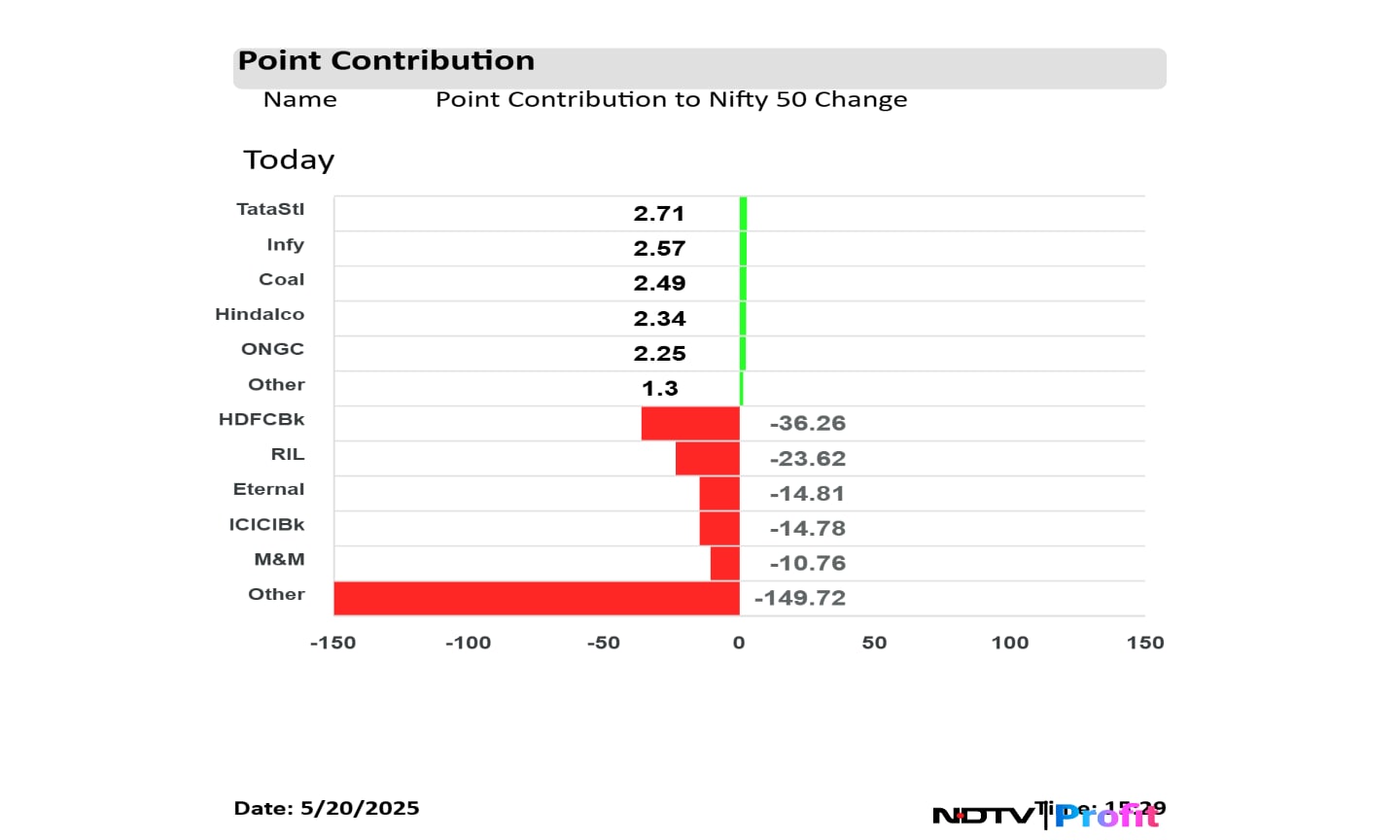

In terms of points contribution, Tata Steel Ltd., Infosys Ltd. and Coal India Ltd. led the gains in the index the most.

HDFC Bank Ltd. and Reliance Industries Ltd. dragged the index the most.

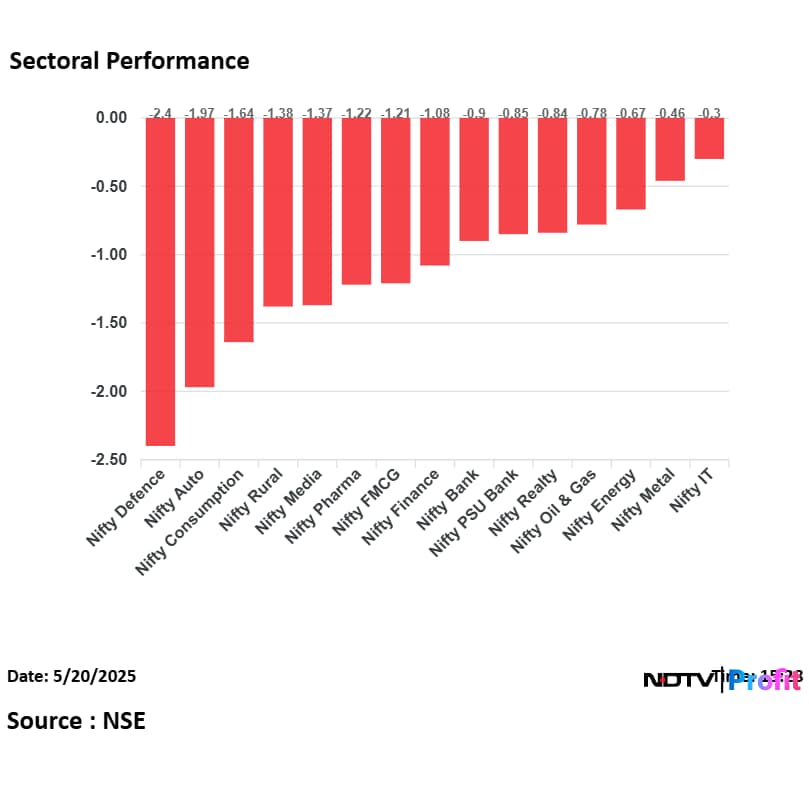

On the NSE, all sectoral indices closed the trading session in the red, with the Nifty Defence, Auto and Consumption being the biggest laggards.

In the broader market, the BSE MidCap underperformed the benchmark Sensex as it settled 1.64% lower, while the SmallCap outperformed the benchmark as it settled 0.95% lower.

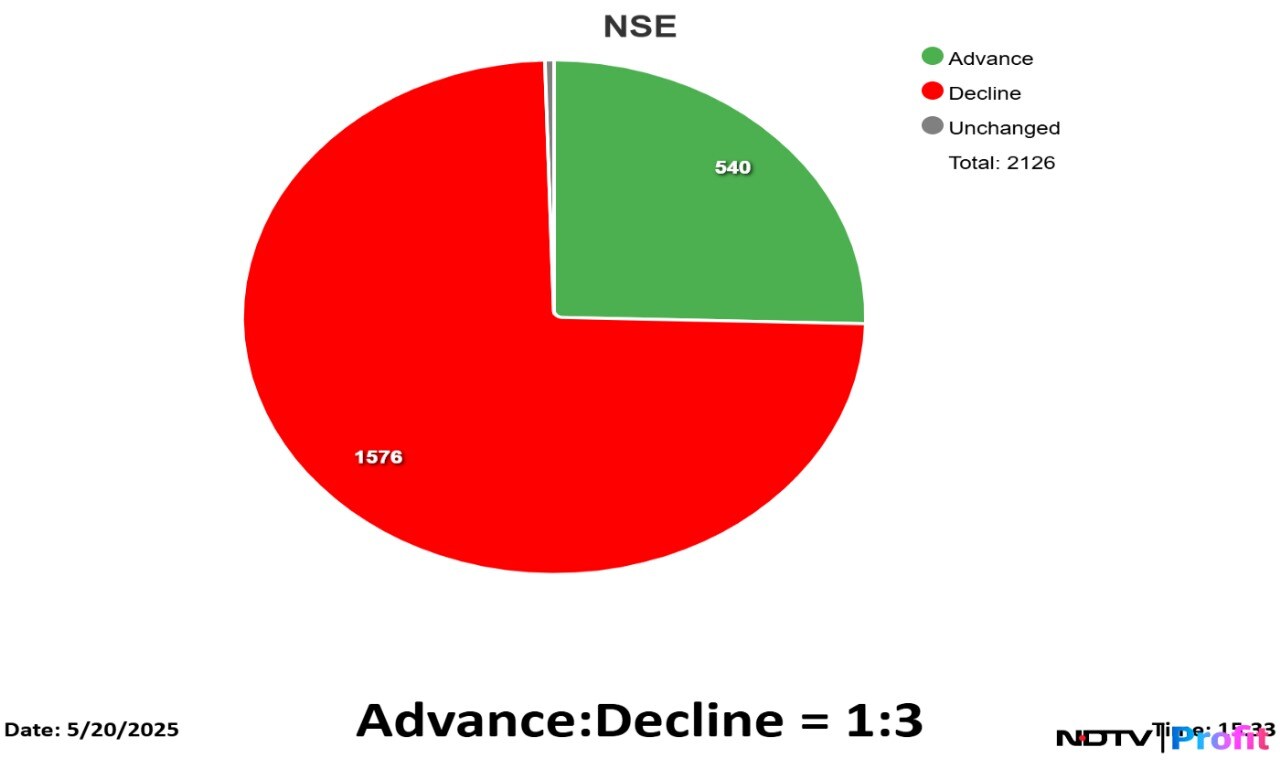

The market breadth was skewed in favour of the sellers as 1,374 stocks advanced, 2,586 declined and 139 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.