India's stock benchmarks snapped winning streak after advancing to record highs in intraday trade, as technology and metal stocks dragged.

The S&P BSE Sensex fell 0.37% to 57,338.21 and snapped a four-day winning streak. The 30-stock index had hit a record 57,918.71 in intraday trade. The NSE Nifty 50 declined by similar magnitude to 17,076.25, snapping a seven-day winning streak, joint longest in 2021. The 50-stock index hit a record 17,225.75 in intraday trade. Infosys Ltd. contributed the most to the index decline, decreasing 1.7%. Mahindra & Mahindra Ltd. had the largest drop, falling 3%. Today, 25 of 50 shares fell, while 25 rose.

India's stock benchmarks snapped winning streak after advancing to record highs in intraday trade, as technology and metal stocks dragged.

The S&P BSE Sensex fell 0.37% to 57,338.21 and snapped a four-day winning streak. The 30-stock index had hit a record 57,918.71 in intraday trade. The NSE Nifty 50 declined by similar magnitude to 17,076.25, snapping a seven-day winning streak, joint longest in 2021. The 50-stock index hit a record 17,225.75 in intraday trade. Infosys Ltd. contributed the most to the index decline, decreasing 1.7%. Mahindra & Mahindra Ltd. had the largest drop, falling 3%. Today, 25 of 50 shares fell, while 25 rose.

The broader indices outperformed their larger peers with the S&P BSE MidCap adding 0.9% and S&P BSE SmallCap gaining 0.2%. Thirteen of the 19 sectoral indices compiled by the BSE Ltd. advanced, with S&P BSE Realty adding 5.5%. On the flipside, S&P BSE Metal shed 1.8% and S&P BSE Information Technology index declined 1.35%.

The market breadth was skewed in favour of bears. About 1,509 stocks advanced, 1,668 declined and 153 remained unchanged.

“Heavy selling pressure in metals and I.T. was the prime reason for moderation in Nifty. real estate stocks were in focus today as ongoing traction in sales volume attracted investors towards this space”, Binod Modi wrote in a note. The Head – Strategy at Reliance Securities added that “while 1QFY22 GDP expanded 20.1% indicating a sharp recovery, there has been sharp contraction in sequential comparison due to second wave of COVID-19 and growth is still lagging from pre-pandemic level. Hence, economy still needs policy support from government and RBI, which is likely to persist".

NMDC Ltd. reported sales for Aug. of 2.91 million tonnes vs. 1.79 million tonnes YoY

August sales at 2.91 million tonnes, up 63% YoY

August production 3.06 million tonnes, up 89% YoY

TVS Motor Company Ltd. registered sales of 2,90,694 units in August vs 2,87,398 units YoY.

August total two-wheeler sales at 2,74,313 units vs 2,77,226 units YoY

Domestic two-wheeler sales at 1,79,999 units vs 2,18,338 units YoY

Expect retails to improve as Covid curbs are eased and festive season boost.

Motorcycle sales at 1,33,789 units vs 1,19,878 units YoY

Scooter sales at 87,059 units vs 87,044 units YoY

Production and sales of premium two-wheelers were severely affected due to semiconductor shortage.

Total exports at 1,09,927 units vs 68,347 units YoY

Three-wheeler sales at 16,381 units vs 10,172 units YoY

Shares of India’s consumer durables makers advanced after a Credit Suisse note which said that rapid changes in the sector provide scope for large companies to strengthen their presence.

Credit Suisse said that Indian electrical and consumer durables sectors represented a Rs 6 lakh crore opportunity, with 15% CAGR (FY20-25E).

Credit Suisse picked up Havells India Ltd. and Voltas Ltd. as the companies with highest potential due to the presence that they have already established in the market.

Shares of Equitas Small Finance Bank Ltd. added nearly 5% to Rs 62.45 apiece after the company launched a new initiative, enabling Google Pay users to book fixed deposits (FDs) on Google Pay in under 2 minutes.

There is no need to open a savings account with Equitas SFB to book FDs, according to an exchange filing by Equitas SFB.

Upon maturity, the principal and interest of the FD will go directly to the user’s existing Google Pay-linked bank account, which could be in any bank in India.

The offering was made possible APIs built by fintech infrastructure provider Setu for Equitas Bank. The functionality will be available initially for Google Pay users who access the app from Android.

Murali Vaidyanathan, Senior President and Country Head at the bank said the program will provide a true digital FD booking experience to users.

Of the 12 analysts tracking the company, 11 maintained ‘buy’ and 1 maintained ‘hold’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 19.5%.

Shares of Mahindra & Mahindra Financial Services Ltd. advanced 4.46% to Rs 167.30 apiece after the company appointed Raul Rebello as its new Chief Operating Officer (COO) with immediate effect.

In an exchange filing, the company said it is broad basing the management team to be able to handle all the new initiatives.

Raul Rebello replaces Rajnish Agrawal, who was shifted to Mahindra Rural Housing Finance Ltd, a subsidiary of Mahindra & Mahindra Financial Services.

Raul Rebello is a career banker with nearly two decades of experience in rural banking and financial inclusion domain.

Prior to joining Mahindra Finance, he was associated with Axis Bank Ltd. as EVP & Head – Rural Lending & Financial Inclusion.

Of the 37 analysts tracking the company, 19 maintained ‘buy’, 11 maintained ‘hold’ and 7 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside 4%.

Housing & Urban Development Corp. rose for the seventh straight day, on track for the longest winning streak since the period ended April 17, 2020.

HUDCO has gained a total of 9.4% during the streak while the Sensex index increased 3.6%. Today, the stock rose 0.3% to Rs 43.20.

India is likely to absolve bidders for its loss-making flag carrier from any liability arising out of a lawsuit filed by Cairn Energy Plc, which has claimed the state-run airline Air India Ltd.’s assets over a long-running tax dispute with the government.

Prime Minister Narendra Modi’s administration will offer so-called indemnity to the financial bidders of Air India, which the government has repeatedly tried to sell without success.

In the latest attempt, a group of bureaucrats cleared a final sale purchase agreement on Saturday, and that plan is likely to be approved by a group of ministers this week.

Source: People familiar with the matter.

A Finance Ministry spokesperson declined to comment.

Shares of Carborundum Universal Ltd. gained after Citi Research initiated coverage on the abrasives maker with a ‘buy’ rating, citing a “long growth runway”. Carborundum, a Murugappa Group company, is one of the two large Indian abrasives manufacturers, making the market structure favourable for it, the research firm said in a note. It has around 25% market share in the sector.

Gross GST Revenue collected in the month of August: Rs 1,12,020 crore

August CGST at Rs 20,522 crore

August SGST at Rs 26,605 crore

August IGST at Rs 56,427 crore

Government has settled Rs 23,043 crore to CGS and Rs 19,139 crore to SGST from IGST as regular settlement.

Revenue for the month of August 2021 is 30% higher than GST revenues in August 2020.

GST collection above Rs 1 lakh crore for the second successive month.

Source: PIB

Shares of AU Small Finance Bank Ltd. rose as much as 6.9% to Rs 1,208.60 apiece after the lender clarified that the recent resignations of high-level executives was for personal reasons.

The stock fell 13% Tuesday, the most since March 2020, after news that its Chief Risk Officer Alok Gupta and Head of Internal Audit Sumit Dhir had tendered their resignations

The bank is in discussions for possible retention of Sumit Dhir, who has expressed his desire to move back to his hometown, while Gupta has quit for personal reasons, the lender said in filings to the exchange

It has appointed Deepak Jain, formerly the chief operating officer of the bank, as CRO effective Wednesday.

Of the 26 analysts tracking the company, 13 maintained ‘buy’, 8 maintained ‘hold’ and 5 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 3.6%.

Tata Motors reported local sales for Aug. of 54,190 units vs. 35,420 YoY

August passenger vehicle sales 28,018 units vs 18,583 units, up 51% YoY

August passenger vehicle sales 28,018 units vs 30,185 units in July, down 7% MoM

August commercial vehicle sales 29,781 units vs 17,889 units, up 66% YoY

August commercial vehicle sales 29,781 units vs 23, 848 units in July, up 25% MoM

Company says chip shortage continues to impact industry globally

Says lockdowns in East Asia have worsened supply situation

Forced to Moderate Production and Offtake Volumes

Company will be forced to moderate production and offtake volumes in the coming months

Company will have close engagement with extended supply chain partners, to procure chipsets from the open market and use alternate chips

Tata Motors also plans to manage model and trim mix

Shares of Tata Motors added 1.91% to Rs 292.80 apiece. Of the 33 analysts tracking the company, 20 maintained ‘buy’, 7 maintained ‘hold’ and 6 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 22.2%

Maruti Suzuki India Ltd. reported total sales for August of 1,30,699 units vs 1,24,624 units, up 4.9% YoY

August domestic sales 1,10,080 units vs 1,16,704 units, down 5.7% YoY

August exports at 20,619 units vs 7,920 units YoY

Maruti Suzuki says sales in August hit by electronic components shortage.

Maruti Suzuki says it took all measures to limit the adverse impact.

Shares of Maruti Suzuki shed 2.10% to Rs 6,702.35 apiece. Of the 48 analysts tracking the company, 29 maintained ‘buy’, 8 maintained ‘hold’ and 11 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 11%.

India's stock benchmarks fell after advancing to record highs in early trade, as technology and metal stocks dragged.

The S&P BSE Sensex fell 0.20% to 57,434.88. The 30-stock index had hit a record 57,918.71 in intraday trade. The NSE Nifty 50 declined by similar magnitude to 17,109.70. The 50-stock index hit a record 17,225.75 in intraday trade. Infosys Ltd. contributed the most to the index decline, decreasing 1.7%. Tata Steel Ltd. had the largest drop, falling 2.3%. In midday trading, 28 of 50 shares fell, while 22 rose.

India's stock benchmarks fell after advancing to record highs in early trade, as technology and metal stocks dragged.

The S&P BSE Sensex fell 0.20% to 57,434.88. The 30-stock index had hit a record 57,918.71 in intraday trade. The NSE Nifty 50 declined by similar magnitude to 17,109.70. The 50-stock index hit a record 17,225.75 in intraday trade. Infosys Ltd. contributed the most to the index decline, decreasing 1.7%. Tata Steel Ltd. had the largest drop, falling 2.3%. In midday trading, 28 of 50 shares fell, while 22 rose.

The broader indices outperformed their larger peers with the S&P BSE MidCap adding 0.72% and S&P BSE SmallCap gaining 0.2%. Fourteen of the 19 sectoral indices compiled by the BSE Ltd. advanced, with S&P BSE Realty adding 3.4%. On the flipside, S&P BSE Information Technology index declined 1.25%/

The market breadth was skewed in favour of bears. About 1,451 stocks advanced, 1,602 declined and 165 remained unchanged.

India's stock benchmarks fell after advancing to record highs in early trade, as technology and metal stocks dragged.

The S&P BSE Sensex fell 0.20% to 57,434.88. The 30-stock index had hit a record 57,918.71 in intraday trade. The NSE Nifty 50 declined by similar magnitude to 17,109.70. The 50-stock index hit a record 17,225.75 in intraday trade. Infosys Ltd. contributed the most to the index decline, decreasing 1.7%. Tata Steel Ltd. had the largest drop, falling 2.3%. In midday trading, 28 of 50 shares fell, while 22 rose.

India's stock benchmarks fell after advancing to record highs in early trade, as technology and metal stocks dragged.

The S&P BSE Sensex fell 0.20% to 57,434.88. The 30-stock index had hit a record 57,918.71 in intraday trade. The NSE Nifty 50 declined by similar magnitude to 17,109.70. The 50-stock index hit a record 17,225.75 in intraday trade. Infosys Ltd. contributed the most to the index decline, decreasing 1.7%. Tata Steel Ltd. had the largest drop, falling 2.3%. In midday trading, 28 of 50 shares fell, while 22 rose.

The broader indices outperformed their larger peers with the S&P BSE MidCap adding 0.72% and S&P BSE SmallCap gaining 0.2%. Fourteen of the 19 sectoral indices compiled by the BSE Ltd. advanced, with S&P BSE Realty adding 3.4%. On the flipside, S&P BSE Information Technology index declined 1.25%/

The market breadth was skewed in favour of bears. About 1,451 stocks advanced, 1,602 declined and 165 remained unchanged.

Mahindra & Mahindra Ltd. reported automotive sales for Aug. of 30,585 units.

August automotive sales 30,585 units.

August exports 3,180 units vs. 1,169 units, up 172% YoY.

August tractor sales 19,997 units, down 15% YoY.

August passenger vehicle sales 15,973 units vs 13,651 units, up 17% YoY.

August commercial vehicle sales 2,591 units vs 307 units, up 744% YoY.

M&M Says Semiconductors Supply Continues to Be A Global Issue.

M&M Says Semiconductors Supply 'Major Area of Focus' for the company.

Mahindra & Mahindra Overall Auto Sales Fall 29% in August MoM (30,585 units in August vs 42, 983 units in July)

Shares of Mahindra & Mahindra shed 2% to Rs 777 apiece after reporting the August sales numbers.

Of the 41 analysts tracking the company, 36 maintained ‘buy’ and 5 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 21%.

NCC Ltd. informed exchanges that it received a new order worth Rs 877 crore (exclusive of GST) in the month of August. The order pertained to building division and is received from the state government agency, the company said in an exchange filing.

Of the 18 analysts tracking the company, 16 maintained ‘buy’ and 2 maintained ‘hold’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 46.5%

Ashok Leyland reported vehicle sales for Aug. of 9,360 units vs 6,325 YoY.

August vehicle sales up 48% YoY

August local sales 8,400 units, up 44% YoY

August Total M&HCV sales at 4,632 units vs 2,589 units YoY

August Total M&HCV sales up 79% YoY

Shares of Ashok Leyland added 1.22% to Rs 124.25 apiece before paring the gains

Of the 44 analysts tracking the company, 34 maintained ‘buy’, 6 maintained ‘hold’ and 4 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 16.1%.

Shares of Ramco Systems Ltd. advanced 7% to Rs 484.25 apiece after the company announced that it will implement its Aviation M&E MRO Suite V5.9 at Draken International, for contract adversary air services (ADAIR) to the defense industry.

Ramco Aviation software will help in managing Draken’s global operations and support the expansion plans, according to an exchange filing by Ramco Systems.

Draken International is the world’s largest defense adversary air operator with a fleet of 150 tactical fighter aircraft. The company operates the world’s largest commercial fleet of tactical ex-military aircraft.

Both the analysts tracking Ramco Systems maintained ‘buy’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 65.9%

IMD forecasts rainfall to be around lower end of normal during June-September 2021.

Rainfall, averaged over the country as a whole during September 2021, is most likely to be above normal.

Considering expected above normal rainfall activity during September, current deficiency of 9% in seasonal rainfall during June-August likely to reduce.

Accumulated rainfall during June-September is likely to be around lower end of normal.

Source: IMD

Eicher Motors Ltd. reported August commercial vehicle sales of 4,793 units vs 2,477 units YoY, a 93.5% growth.

Total Eicher Trucks & Buses at 4,667 units vs 2,440 units YoY

Total domestic sales at 3,864 units vs 2,190 units YoY

Total exports at 803 units vs 250 units YoY

Shares of Eicher Motors gained 3.28% to Rs 2,767 apiece. Of the 44 analysts tracking the company, 20 maintained ‘buy’, 10 maintained ‘hold’ and 14 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied a downside of 1.1%.

Shares of Axis Bank Ltd. advanced over 4% to 52-week high of Rs 819 apiece, extending the winning streak for the fifth consecutive session.

On Monday, the company said it initiated the process of issuing debt instruments in the form of Additional Tier 1 notes in foreign currency. The board of directors had earlier authorized the lender to borrow/raise funds in Indian currency/ foreign currency. The bank announced a partnership with BharatPe to expand its PoS business on Tuesday

Of the 52 analysts tracking the company, 45 maintained ‘buy’ and 7 maintained ‘hold’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 10%.

The relative strength index on the stock was 70, suggesting it may be overbought.

Shares of Axis Bank advanced 30% in 2021 so far compared to 17% gains for NSE Nifty Bank index.

Bharti Airtel’s planned $2.8 billion equity issuance will improve its FFO net leverage to nearly 2.0x and provide funds to strength its market position, said Fitch Ratings in a note.

Fitch expects Bharti’s capex to rise to $5 billion in FY22, of which $1.5 billion is likely to be paid upfront to acquire 5G spectrum assets.

Fitch also expects Reliance Jio and Bharti Airtel to increase combined revenue market share among private telecom companies to 80-82% at the expense of third-place Vodafone Idea.

Fitch sees Vodafone Idea losing 50-70 million subscribers in the next 12 months.

Shares of Atul Ltd. added 4.65%, the steepest rise in nearly two months, to Rs 9,552.90 apiece.

Trading volume was 6,937 shares, double the 20-day average of 2,828 shares for this time of day.

Atul trades at 37 times its estimated earnings per share for the coming year.

Analysts have 4 'buy', 3 'hold' and 3 'sell' recommendations on the stock.

The overall consensus price of analysts tracked by Bloomberg implied a downside of 0.9%.

Yields fell across the India sovereign yield curve in Wednesday morning trading.

The 4-year yield fell 3.9bps to 5.229%

The 10-year yield was little changed at 6.214%

The 30-year yield fell 1.9bps to 7.07%

The 4-year-10-year yield spread was 98.5bps, vs previous close 94.8bps

Ami Organics

Ami Organics Ltd. launched its Rs 570-crore IPO. The specialty chemicals maker is selling shares at Rs 603-610 apiece, seeking a market value of Rs 1,934.8 crore at the upper end of the price band. The three day offer will close on Sept. 3.

The IPO was subscribed 1.58 times as of 3 p.m. on Sept. 1.

Institutional investors: 1.39 times

Non-institutional investors: 0.32 times

Retail investors: 2.24 times

Vijaya Diagnostic Centre

Vijaya Diagnostic Centre Ltd. launched its three-day IPO as existing shareholders look to pare stake in the company. The diagnostic services provider is selling shares at Rs 522-531 apiece, seeking a market value of Rs 5,414.4 crore at the upper end of the price band.

The IPO was subscribed 0.20 times as of 3 p.m. on September 1.

Institutional investors: 0.01 times

Non-institutional investors: 0.01 times

Retail investors: 0.38 times

Employees: 0.04 times

Follow the live subscription updates here:

Shares of Steel Strips Wheels Ltd. added 2% to Rs 1,940 apiece in intraday trade before reversing gains. The company informed exchanges that it achieved highest ever net turnover of Rs 308.09 crore in August 2021 vs Rs 126.79 crore in August 2020, a growth of 142.68% YoY.

The gross turnover for August grew 144% YoY to Rs 373.03 crore vs Rs 152.69 crore in August 2020.

Exports segment volume rose by 113% YoY

Commercial vehicles segment volume rose by 103% YoY

Tractor volume rose 33% YoY

PV segment volume grew by 28% YoY

2 & 3 Wheelers segment volume rose by 13% YoY

Shares of Bharat Heavy Electricals Ltd. added nearly 4.5% to Rs 54.85 apiece after the company bagged an order worth Rs 10,800 crore from NPCIL. In an exchange filing post market hours Tuesday, BHEL said this is the largest ever order secured by the firm. The order from NPCIL is for EPC of Turbine Island for 6 units of 700 MWe (setting up of 4 units at Gorakhpur, Haryana and 2 units at Kaiga, Karnataka) .

Of the 27 analysts tracking the company, 1 maintained ‘buy’, 4 maintained ‘hold’ and 22 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied a downside of 28.9%.

A gauge of activity across India’s manufacturing sector dropped from the previous month, indicating expansion but at a softer rate of growth.

IHS Markit releases India’s August manufacturing purchasing managers’ index.

Index falls to 52.3 from 55.3 in July; Year ago 52

Second consecutive month of expansion

Output falls to 52.5 vs 57.6 in July

Second consecutive month of expansion

New orders fall vs prior month

Reading above 50 signals expansion, less than 50 a contraction

Shares of Shoppers Stop Ltd advanced 6% to Rs 254.90 apiece after the company announced exit from non-core business. In an exchange filing post market hours Tuesday, Shoppers Stop said it closed the sale of a controlling stake of its 100% subsidiary, Crossword Bookstores Ltd to Dinesh Gupta, Aakash Gupta and Family (Owners of Agarwal Business House, Pune) on Tuesday.

The business of Crosswork Bookstores is valued at Rs 41.6 crore. The sale of Crossword Bookstores is in-line with the company’s strategic plans to focus on the core business and rapidly growing omnichannel business.

Venu Nair, Managing Director and Chief Executive Officer of Shoppers Stop said it represented another step in the company’s plans to become a customer focused, omnichannel retailer and a win-win situation for both his company and ABH.

Of the 14 analysts tracking the company, 8 maintained ‘buy’, 4 maintained ‘hold’ and 2 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 12.2%.

Shares of Mastek Ltd. gained nearly 8% to Rs 2,782 apiece after the company announced partnership with fulfillmentttools to enable D2X (Direct to Stakeholder) transformation for their joint clients.

In an exchange filing post market hours Tuesday, Mastek said that the unified D2X process would enable clients to improve customer experience.

fulfillmenttools offers integrated end-to-end platform solution for efficient omnichannel fulfillment through three modules. The company combines cloud-based order management system with app-based in-store fulfillment solutions and an array of omnichannel services

Of the 5 analysts tracking the company, 4 maintained ‘buy’ and 1 maintained ‘hold’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 5.6%.

Shares of Maruti Suzuki India Ltd. shed nearly 2% to Rs 6,726 apiece after the company said it expects an adverse impact on vehicle production in the month of September. In an exchange filing post market hours Tuesday, Maruti Suzuki said that production will be hurt in both Haryana and its contract manufacturing company in Gujarat due to supply constraint of electronic components due to semiconductor shortage.

The company estimated the total vehicle production volume across both the locations to 40% of normal production levels, but noted that the situation is quite dynamic.

Of the 48 analysts tracking the company, 29 maintained ‘buy’, 8 maintained ‘hold’ and 11 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 11.4%.

Shares of Tourism Finance Corporation of India Ltd. advanced 3.69% to Rs 67.40 apiece informed exchanged post market hours Tuesday that it will consider and approve the proposal for raising funds in the board meeting on Friday. The fund raise is planned by way of issue of one or more instruments, including equity shares, convertible/non-convertible preference share, convertible securities of any description or warrants or debt securities.

Shares of Tourism Finance Corp gained 40% in 2021 so far compared to 22% for S&P BSE Sensex. The company’s strategic activity in the past 3 months included 4 M&A deals and 2 investments.

Shares of Likhitha Infrastructure Ltd. climbed over 8% to Rs 407.40 apiece after the company won an order worth Rs 145.86 crore from Indradhanush Gas Grid Ltd. for laying and construction of steel gas pipeline and terminals for sections of North East Gas Grid (NEGG) project.

In an exchange filing post market hours Tuesday, Likhitha Infrastructure said that it received various orders worth Rs 80 crore from oil & gas distribution companies between June 2021 and now, for city gas distribution pipeline and related works. As such, the value of total outstanding order is approximately Rs 1,020 crore, excluding GST.

Share price crossed above the 50-day simple moving average, indicating potential upward positive momentum.

Escorts Ltd. reported vehicle sales for August at 5,693 units vs 7,268 units YoY

August vehicle sales down 21.7% YoY

August local sales at 4,970 units vs 6,750 units YoY

August local sales down 27.1% YoY

August exports at 773 units vs 518 units YoY

August exports up 49.2% YoY

August domestic tractor sales at 4,920 units vs 6,750 units YoY

Of the 25 analysts tracking the company, 17 maintained ‘buy’, 5 maintained ‘hold’ and 3 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 1.2%.

Shares of Bajaj Auto Ltd. added 2.2% to Rs 3,810 apiece after the company reported vehicle sales for August.

August vehicle sales at 3,73,270 units vs 3,56,199 units YoY

August sales up 5% YoY

August motorcycle sales at 3,38,310 units vs 3,21,058 units YoY

August motorcycle sales at 5% YoY

August exports at 2,00,675 units vs 1,70,320 units YoY

August exports up 18% YoY

August commercial vehicles sales at 34,960 units vs 35,141 units YoY

August commercial vehicles sales down 1% YoY

Of the 48 analysts tracking the company, 30 maintained ‘buy’, 12 maintained ‘hold’ and 6 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 13.1%.

India's stock benchmarks opened higher and hit record highs, aided by gains in tech stocks, amid positive macroeconomic data as Indian economy grew at a record pace of 20.1% in the June quarter due to low base effect.

The S&P BSE Sensex rose 0.15% to a 57,640.19 The NSE Nifty 50 advanced by similar magnitude to 17,161.15. Axis Bank Ltd. contributed the most to the index gain and had the largest move, increasing 3.2%. In early trading, 33 of 50 shares rose, while 17 fell.

India's stock benchmarks opened higher and hit record highs, aided by gains in tech stocks, amid positive macroeconomic data as Indian economy grew at a record pace of 20.1% in the June quarter due to low base effect.

The S&P BSE Sensex rose 0.15% to a 57,640.19 The NSE Nifty 50 advanced by similar magnitude to 17,161.15. Axis Bank Ltd. contributed the most to the index gain and had the largest move, increasing 3.2%. In early trading, 33 of 50 shares rose, while 17 fell.

The broader indices outperformed their larger peers with the S&P BSE MidCap and S&P BSE SmallCap gaining 0.6%. Barring S&P BSE Telecom and S&P BSE Metal indices, all the other 17 sectoral indices compiled by the BSE Ltd. advanced, with S&P BSE Realty and S&P BSE Telecom adding 1.5%

The market breadth was skewed in favour of bulls. About 1,553 stocks advanced, 631 declined and 96 remained unchanged.

India’s economy expanded at 20.1% in 2Q YoY, keeping the nation on track for the world’s fastest growth in 2021. That should help stocks extend their records and keep the rupee rally going. As a backdrop, the Fed’s reluctance to start tapering means U.S. bond rates will stay low, a source of continued demand for higher-yielding emerging assets.

India’s Nifty 50 surpassed 17,000 for the first time ever Tuesday. By points, this was quicker than it took to cross the last two 1,000-points milestones each.

Indian bond traders will parse central bank chief Das’s comments late Tuesday on more steps to manage any surge in banking cash due to unanticipated inflows, and RBI measures after the currency posted its biggest monthly gain in three months.

India’s central bank plans to conduct more operations to manage any unanticipated surge in banking-system cash due to inflows, Governor Shaktikanta Das said, as the monetary authority grapples with a surfeit of liquidity.

While the RBI has started draining liquidity using the so-called variable rate reverse repo auctions, the central bank “will also conduct fine-tuning operations from time to time as needed to manage unanticipated and one-off liquidity flows so that liquid conditions in the system evolve in a balanced and evenly distributed manner,” Das said in a speech at a conference of bond dealers on Tuesday.

USD/INR fell 0.4% to 73.0063 on Tuesday; rupee rose 1.9% in August, the most since May, and was among EM Asia’s best performing currencies for the month

The economic toll from a deadly second wave of Covid-19 outbreak in India last quarter wasn’t as bad as feared, with the nation still very much on track to achieving the world’s fastest growth this year.

Early signs of it appeared in the economy’s fiscal first-quarter numbers published by the Statistics Ministry Tuesday, which showed gross domestic product advancing 20.1% in the three months to June from a year ago. That was in line with the median forecast for a 21% expansion in a Bloomberg survey of 45 economists.

10-year yields little changed at 6.22% on Tuesday

Global Funds Buy Net Rs 3,880 crore of India Stocks Tuesday: NSE

They bought Rs 85 crore of sovereign bonds under limits available to foreign investors, and added Rs 71 crore of corporate debt

State-run banks bought Rs 984 crore of sovereign bonds on Aug. 31: CCIL data. Foreign banks sold Rs 950 crore of bonds.

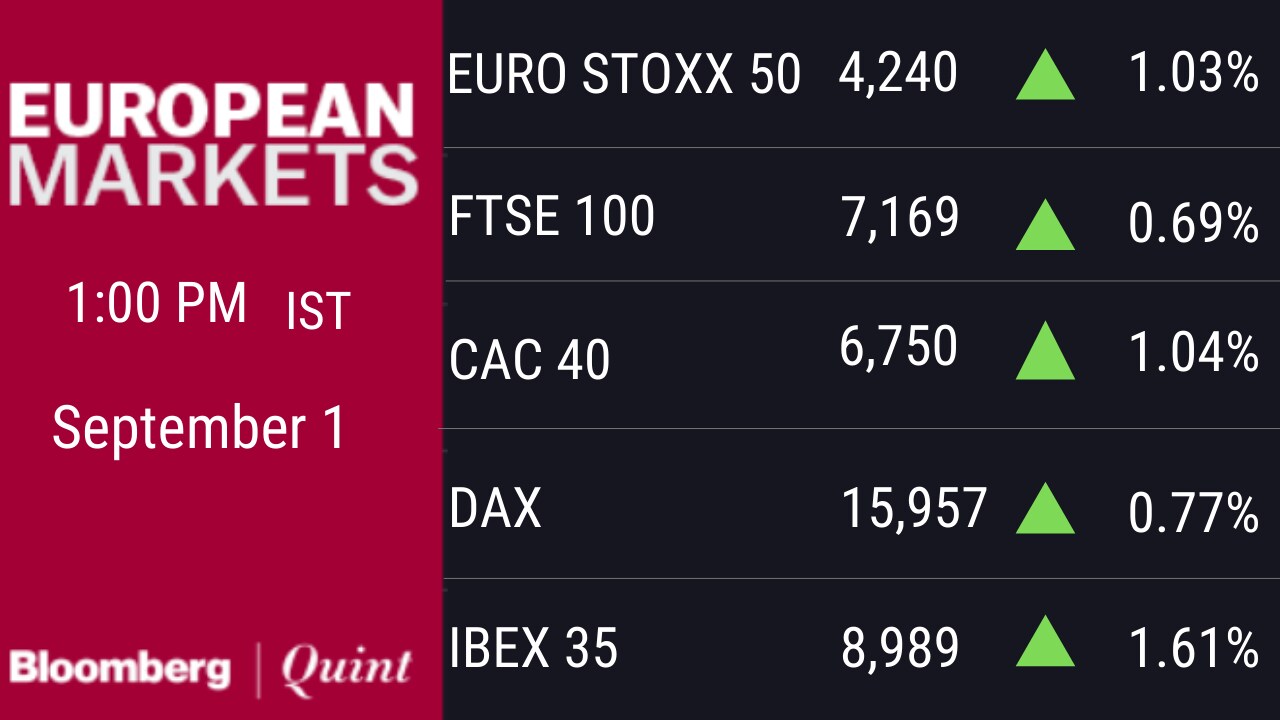

Asian stocks were mixed on Wednesday as traders evaluated the outlook for central bank stimulus and the global recovery’s resilience to the delta virus variant. A gauge of the dollar ticked up.

Shares rose in Japan but slipped in Hong Kong and wavered in China. S&P 500 futures were modestly higher after the U.S. stocks edged back from a record amid mixed data, including weaker consumer confidence and a jump in home prices.

Hawkish comments from some European Central Bank officials highlighted the prospect of a reduction in the monetary-policy support that has helped financial markets. Treasury yields advanced following losses in European sovereign debt. Australian and New Zealand government bond yields rose.

India’s SGX Nifty 50 Index futures for September delivery rose 0.1% to 17,143.00, while MSCI Asia Pacific Index remained little changed. The NSE Nifty 50 gained 1.2% on Tuesday to 17,132.20.

In China, President Xi Jinping chaired a meeting that backed a range of steps, particularly fighting monopolies, a push that is weighing on the nation’s technology stocks. Meanwhile, China Evergrande Group warned it could default on borrowings, rattling bond investors in the world’s most indebted developer.

Global stocks continue to hover around record levels, illustrating faith in the durability of the recovery from the pandemic. But one question is whether the pace of that rebound is peaking due to the prospect of less expansive stimulus and the spread of the delta strain. The latest Asian purchasing managers’ indexes signaled either a contraction or moderation in manufacturing.

Elsewhere, oil was steady above $68 a barrel ahead of an OPEC+ meeting that could result in a rise in output.

Back home, automakers will release sales data for August; Markit India manufacturing PMI data for August will also be released. Foreign investors bought net Rs 1,710 crore of stocks on Monday, according to NSDL.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.