Shares of Saregama India Ltd. rose over 6% on Friday after the company announced acquisition of popular Haryanvi music catalogue of NAV Records to strengthen its regional portfolio on Thursday.

The acquisition for an undisclosed sum comprises over 6,500 tracks across Haryanvi, Punjabi, ghazals, devotional and Indie pop genres.

The deal also includes NAV's YouTube channels, including NAV Haryanvi and Nupur Audio, which together have over 24 million subscribers, the company said in a statement.

With this acquisition, the company strengthened its digital footprint and cemented the leadership position across Indian languages, including Haryanvi, where it was previously under-represented, the statement said.

Saregama India, a part of the Kolkata-based RPSG Group, and NAV will also collaborate on creating fresh Haryanvi and Punjabi content, it said.

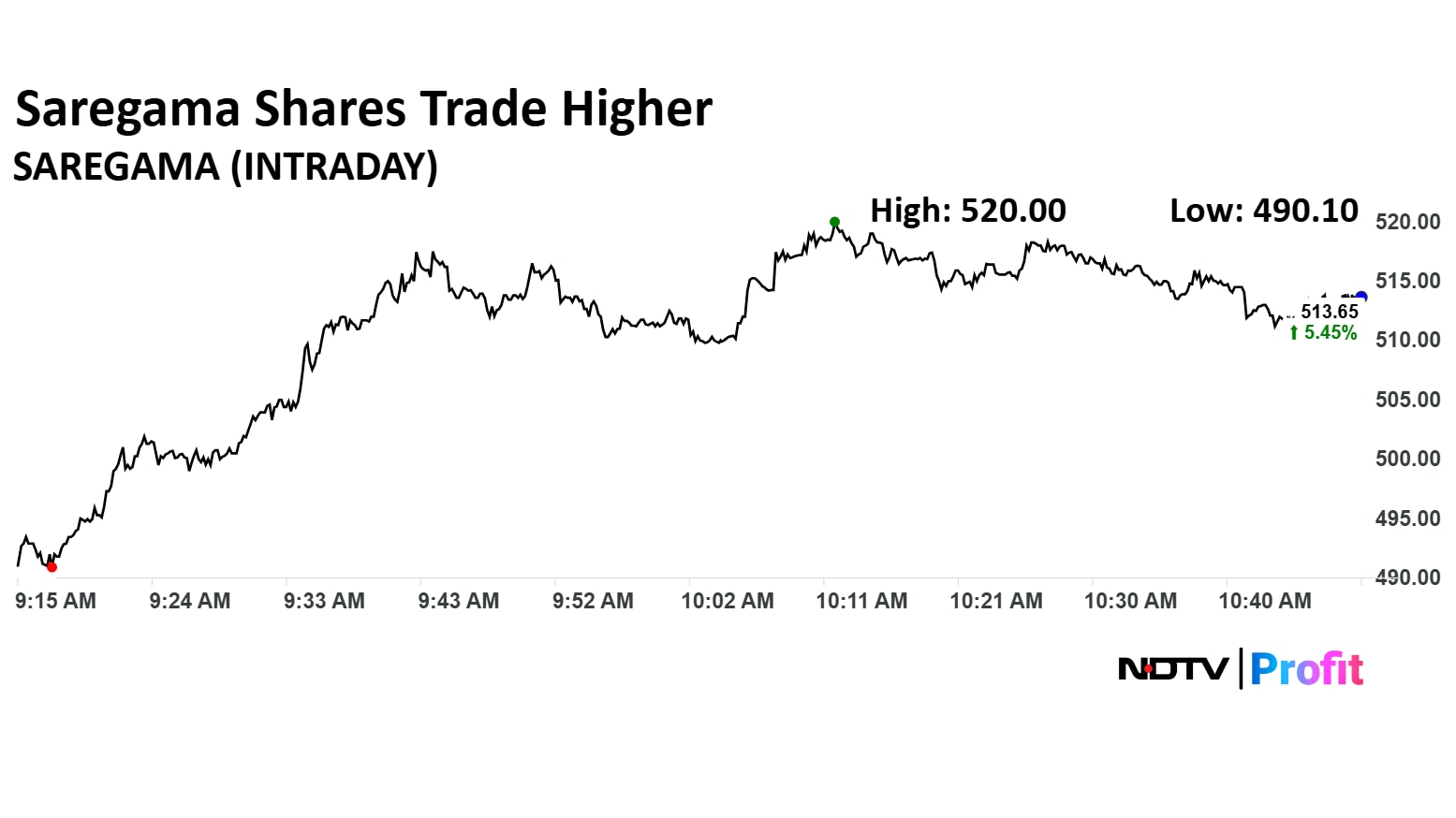

Saregama Share Price

Shares of Saregama rose as much as 6.75% to Rs 520 apiece. They pared gains to trade 5.45% higher at Rs 513.65 apiece, as of 10:45 a.m. This compares to a 0.66% decline in the NSE Nifty 50.

The stock has fallen 5.46% in the last 12 months and risen 10.76% year-to-date. Total traded volume so far in the day stood at 0.28 times its 30-day average. The relative strength index was at 60.96.

Out of seven analysts tracking the company, five maintain a 'buy' rating, and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.