Shares of Steel Authority of India Ltd. advanced over 3% on Wednesday even after its net profit slipped 62% in the quarter ended Dec. 31, 2024, thereby missing analysts' estimates.

The steel manufacturing company's standalone bottom line came in at Rs 126 crore in the third quarter, as compared to Rs 331 crore in the year-ago period, according to an exchange filing on Tuesday. The consensus estimate of analysts tracked by Bloomberg was Rs 175 crore.

Revenue increased by 4.9% year-on-year for the three months ended December, reaching Rs 24,489 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, fell 5.42% year-on-year to Rs 2,024 crore. The Ebitda margin contracted to 8.26% from 9.16% reported in the same period last year.

Morgan Stanley maintained an 'underweight' rating with a target price of Rs 115 per share. The brokerage said that the third quarter results were largely in line. Adjusted for higher volumes, realisations on reported numbers were in line, Morgan Stanley said.

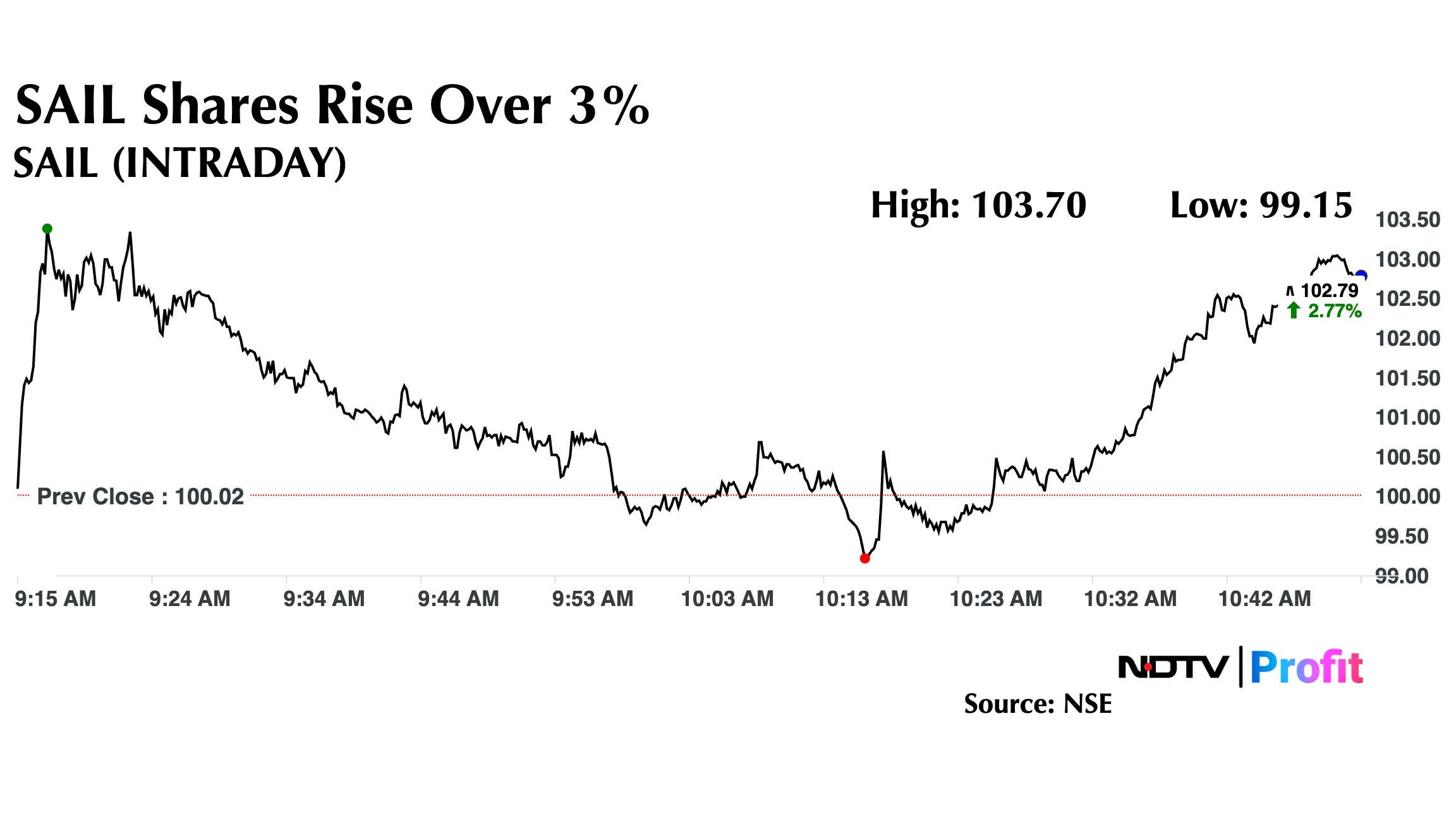

SAIL's share price rose as much as 3.68% to Rs 103.7 apiece, the highest level since May. 22, 2024. However, it pared gains to trade 2.8% higher at Rs 102.8 apiece, as of 10:49 a.m. This compares to a 0.55% decline in the NSE Nifty 50 Index.

It has fallen 16.11% in the last 12 months. Total traded volume so far in the day stood at 13.4 times its 30-day average. The relative strength index was at 44.3.

Three of 29 analysts tracking the company maintain a 'buy' rating, eight recommend a 'hold,' and 18 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.