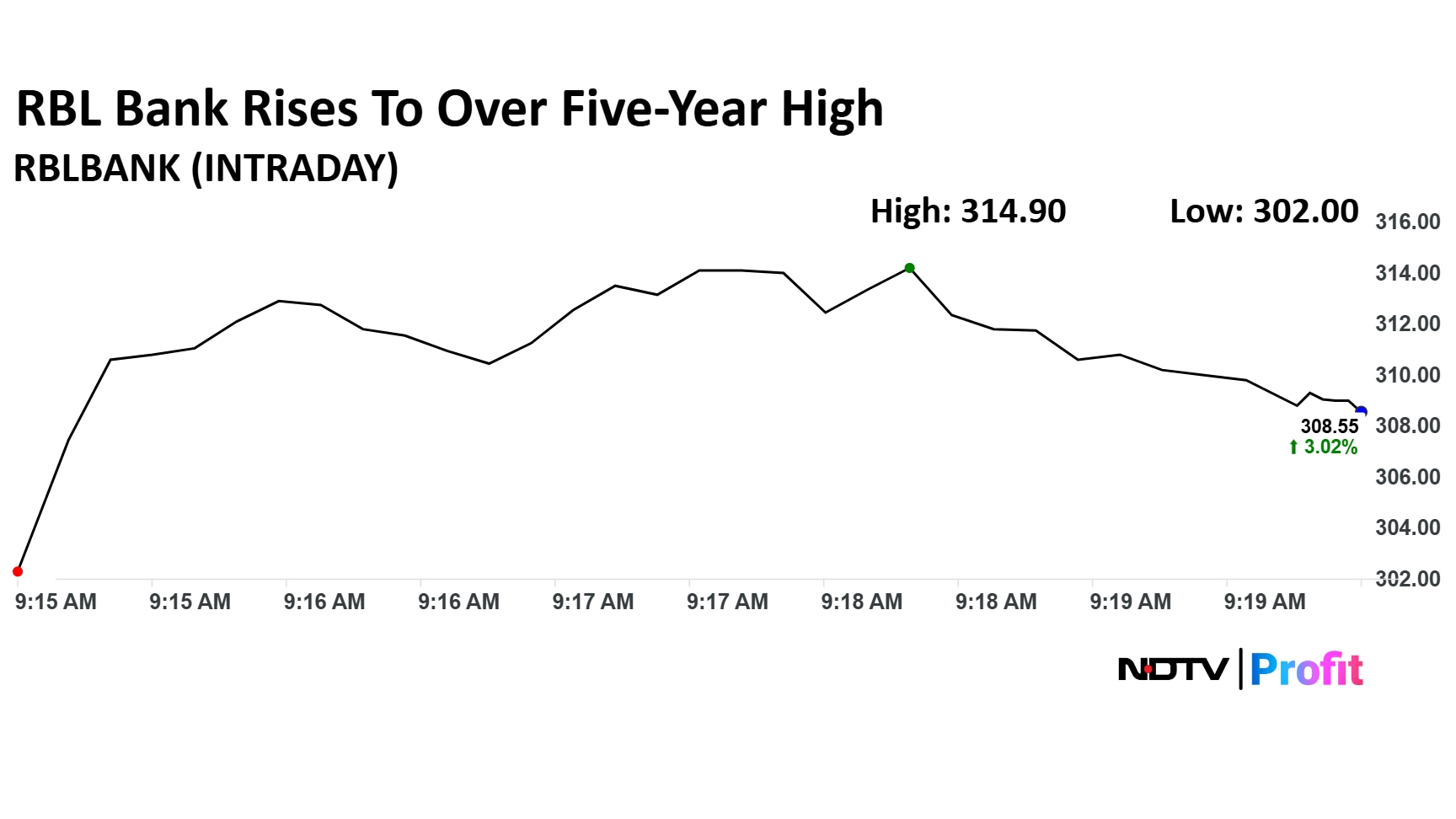

- RBL Bank share price hit highest level since February 2020 on Monday session

- Emirates NBD to acquire 60% stake in RBL Bank via preferential allotment

- Open offer will occur after regulatory approvals before preferential allotment

RBL Bank Ltd. share price rose to the highest level since February 2020 in Monday's session, despite disappointing results for the September quarter, as $3 billion-deal with Emirates NBD boosted sentiment for the stock.

The second largest bank of Dubai will buy a 60% stake in the Indian private bank through a preferential allotment. For the investment, up to 41.6 crore shares at Rs 280 apiece will get allotted to Emirates NBD on a preferential basis. An open offer is a consequence of preferential allotment, he said in the second-quarter conference call on Sunday.

The open offer will take place after all regulatory approvals. Preferential placement will be followed 15 days post open offer, Chief Executive Officer R Subramaniakumar said.

Post the investment, RBL Bank's net worth will increase to Rs 42,000 crore, Subramaniakumar said. The deal will conclude in April, and after that, RBL Bank will be a listed entity of Emirates NBD.

RBL Bank Q2 Earnings Key Highlights (YoY)

Net Profit down 20% at Rs 178 crore versus Rs 222 crore

Net interest income down 4% at Rs 1551 crore versus Rs 1615 crore

Other income up 1% at Rs 932 crore versus Rs 927 crore

Provisions down 19% at Rs 499 crore versus Rs 618 crore

Track live updates on stock market here.

RBL Bank share price rose 5.14% to Rs 314.90 apiece, the highest level since Feb 27, 2020. It was trading 2.5% higher at Rs 307.40 apiece as of 9:22 a.m., as compared to 0.78% advance in the NSE Nifty 50 index.

The stock advanced 74.9% in 12 months, and 95.73% on year-to-date basis.

Out of 23 analysts tracking the company, 13 maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.