- Nifty Bank traded 0.27% higher before RBI policy announcement

- RBI kept the repo rate unchanged at 5.5% during the policy meet

- The central bank maintained a neutral monetary policy stance

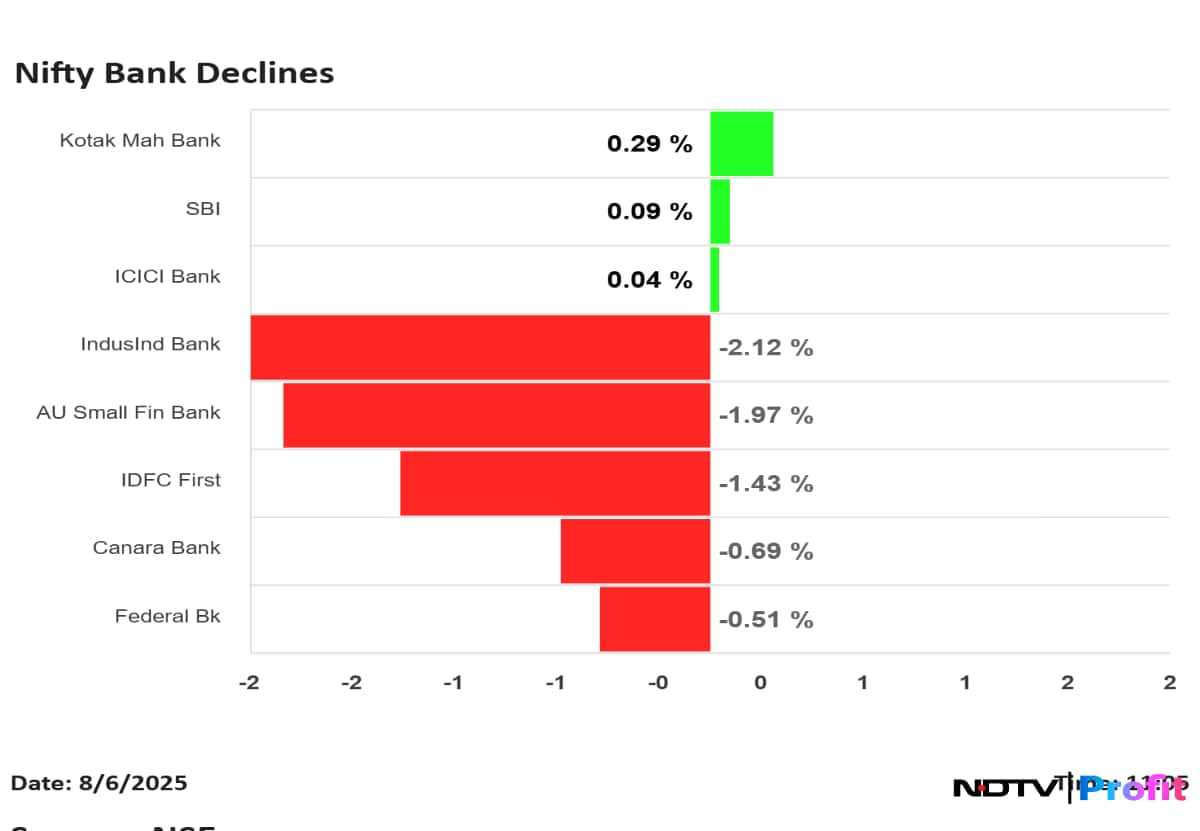

Nifty Bank, which was trading 0.27% higher ahead of the announcement of the Reserve Bank of India's policy meet outcome, gave up gains to trade 0.24% lower as the central bank decided to keep the repo rate unchanged at 5.5% and maintain the stance neutral.

Leading the decline, IndusInd Bank Ltd.'s share price fell 2.22% intraday to trade lower at Rs 800 per share. Shares of AU Small Finance Bank Ltd. were second biggest laggard as they fell 2.20% intraday to trade at Rs 726.30 apiece. Third on the list was IDFC First Bank Ltd. which fell 1.47% to trade at Rs 68.31 apiece.

"The RBI took decisive, forward looking measures to support growth. MPC voted unanimously to keep policy rate unchanged. Repo rate kept at 5.5%. MPC decided to continue with neutral stance," said RBI Governor Sanjay Malhotra.

At the policy meet address, the governor also said there is ample liquidity in the system. As of Aug 1 forex reserves stood at $688.9 billion, sufficient to cover more than 11 months of merchandise imports.

Malhotra also noted that bank credit grew at 12.1% in FY25 and it was higher than the average of the past 10 years.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.