.jpg?downsize=773:435)

Shares of R R Kabel Ltd. hit a three-month high after the company posted a 63% advance in its consolidated net profit during the quarter ended March, according to the financial results declared by the wires and cables manufacturer on Friday.

The company's profit came in at Rs 129 crore during the quarter under review, as compared to Rs 78.7 crore in the year-ago period. This was above Bloomberg's estimates of Rs 90.1 crore.

Revenue from operations clocked by RR Kabel rose 26.39% to Rs 2,217 crore in the fourth quarter of the current financial year. In the corresponding period of the previous fiscal, the revenue stood at Rs 1,754 crore. This was above Bloomberg's estimates of Rs 2,065 crore.

While the company's wires and cables segment rose 28% to Rs 1,956 crore, its revenue in the fast-moving electrical goods segment was up 13% at Rs 261.6 crore.

Earnings before interest, taxes, depreciation and amortisation also rose in the quarter ended March. It came in at Rs 193.5 crore, up by 68.55% as compared to Rs 114.8 crore in the year-ago quarter. The Ebitda margin expanded by 218 basis points to 8.72% from 6.54% in the same period of the past fiscal.

R R Kabel board also recommended a final dividend of Rs 3.5 per share for the financial year ended March 2025. The final dividend, if approved, shall be paid within 30 days from the date of AGM, subject to deduction of tax at source, as applicable.

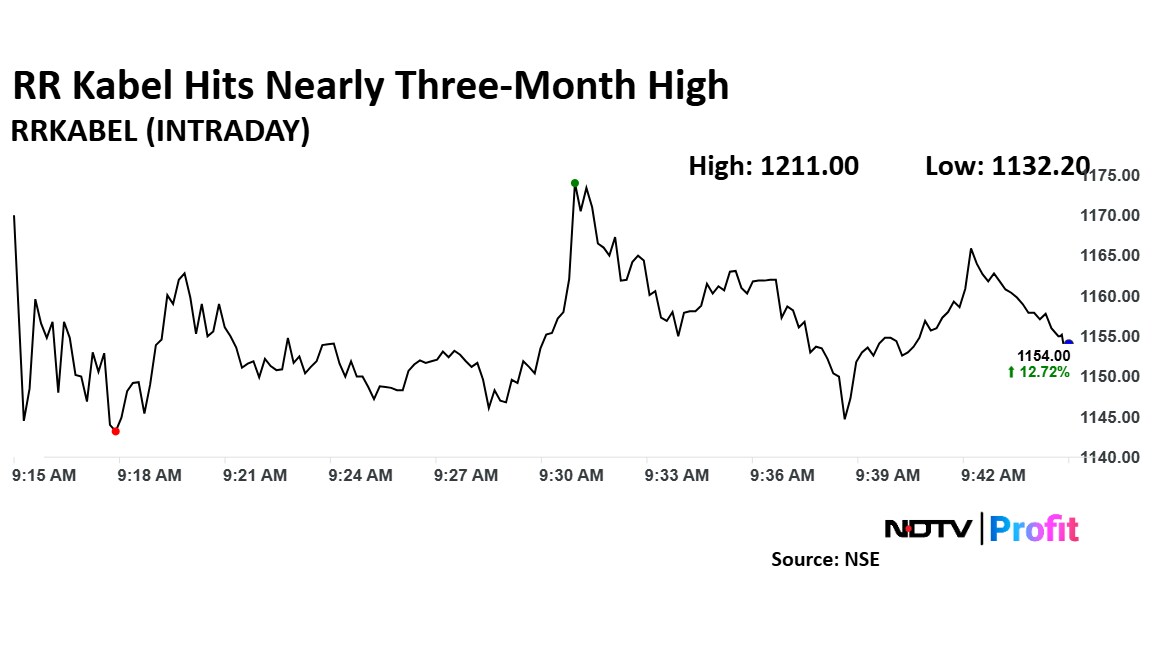

RR Kabel Share Price Rises

Shares of R R Kabel rose as much as 18.28% to Rs 1,211 apiece, the highest level since Feb. 7. It pared gains to trade 13.02% higher at Rs 1,157.10 apiece, as of 9:44 a.m. This compares to a 0.42% advance in the NSE Nifty 50.

It has fallen 31.79% in the last 12 months and 19.91% year-to-date. Total traded volume so far in the day stood at 51 times its 30-day average. Relative strength index was at 77, indicating it was overbought.

Out of nine analysts tracking the company, eight maintain a 'buy' rating and one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 24.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.